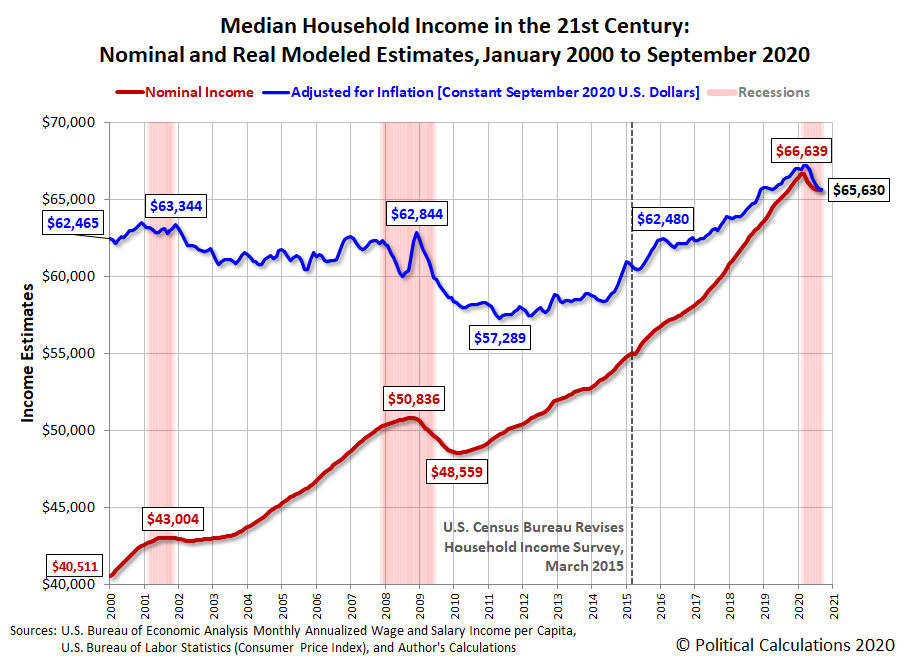

Political Calculations' initial estimate of median household income of in September 2020 is $65,630, rising above the initial estimate of $65,602 recorded for August 2020. This change marks the first positive month-over-month growth in median household income since the start of the Coronavirus Recession, with August 2020 marking its bottom, as expected.

The following chart shows the nominal (red) and inflation-adjusted (blue) trends for median household income in the United States from January 2000 through September 2020. The inflation-adjusted figures are presented in terms of constant September 2020 U.S. dollars.

September 2020's estimate of median household income is 1.5% below February 2020's peak of $66,639.

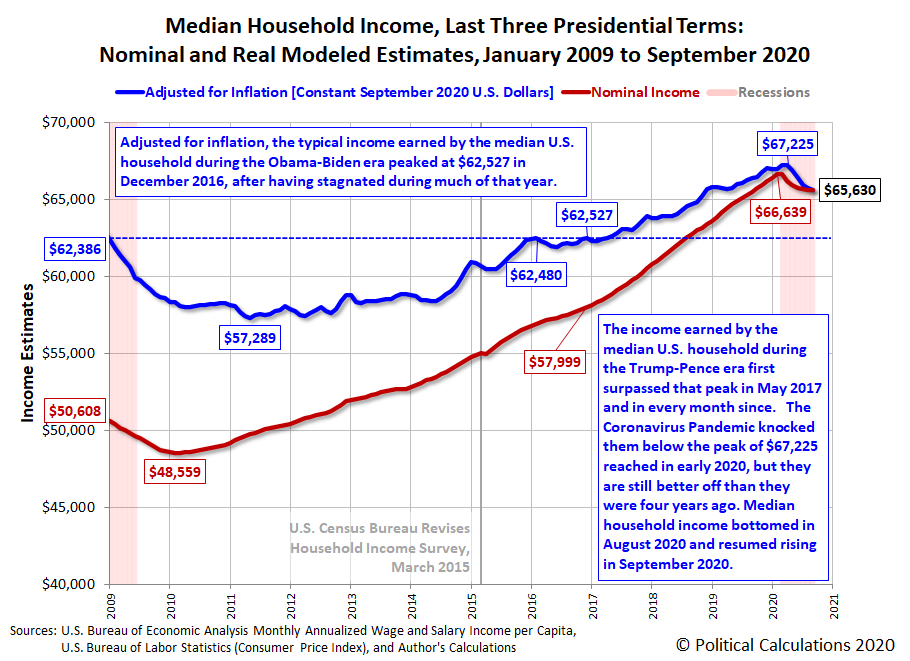

The next chart zooms in on the period of the last three presidential terms to update the answer to the question "Is the typical American household better off than four years ago?"

The main differences between this chart and the previous version we introduced within the last two weeks are the inflation-adjusted figures representing the purchasing power of the median household income from January 2009 through September 2020, which are now expressed in terms of constant September 2020 U.S. dollars. We've also updated the commentary to reflect the resumption of growth in median household income in September 2020.

Analyst's Notes

In the 30 October 2020 data release, minor revisions were made to the aggregate personal wage and salary income data we use to generate our estimates of median household income, which affects the estimates for July 2020 through August 2020.

The U.S. Census Bureau issued its Household Income report for 2019 in September 2020, giving $68,703 as its estimate of median household income for the 2019 calendar year. At first glance, that figure would suggest our monthly median household estimates are understating the growth of median household income by a considerable margin, however the Census confirms the arrival of the coronavirus pandemic in the U.S. impacted its data collection in March 2020, increasing the non-response rate to its Current Population Survey's Annual Social and Economic Supplement and skewing its reported results upward because of the disruption of the pandemic.

The Census Bureau's analysts indicate the survey's resulting estimate overstates median household income by 2.8%, also indicating they believe that if they had been able to collect a more complete sample, the figure would have only increased to $66,790. That figure is within $151 of Political Calculations' median household income estimate for February 2020 and represents one of the stronger year-over-year gains observed in the annual data since it began to be reported in 1967.

Other Analyst's Notes

Sentier Research suspended reporting its monthly Current Population Survey-based estimates of median household income, concluding their series with data for December 2019. Sentier Research ceased operating in 2020, as its principals would appear to have permanently retired after a 19 year run. In their absence, we are providing the estimates from our alternate methodology for estimating median household income on a monthly basis. Our data sources are presented in the following section.

References

Sentier Research. Household Income Trends: January 2000 through December 2019. [Excel Spreadsheet with Nominal Median Household Incomes for January 2000 through January 2013 courtesy of Doug Short]. [PDF Document]. Accessed 6 February 2020. [Note: We've converted all data to be in terms of current (nominal) U.S. dollars.]

U.S. Department of Labor Bureau of Labor Statistics. Consumer Price Index, All Urban Consumers - (CPI-U), U.S. City Average, All Items, 1982-84=100. [Online Database (via Federal Reserve Economic Data)]. Last Updated: 10 September 2020. Accessed: 13 October 2020.

U.S. Bureau of Economic Analysis. Table 2.6. Personal Income and Its Disposition, Monthly, Personal Income and Outlays, Not Seasonally Adjusted, Monthly, Middle of Month. Population. [Online Database (via Federal Reserve Economic Data)]. Last Updated: 30 October 2020. Accessed: 30 October 2020.

U.S. Bureau of Economic Analysis. Table 2.6. Personal Income and Its Disposition, Monthly, Personal Income and Outlays, Not Seasonally Adjusted, Monthly, Middle of Month. Compensation of Employees, Received: Wage and Salary Disbursements. [Online Database (via Federal Reserve Economic Data)]. Last Updated: 30 October 2020. Accessed: 30 October 2020.

Labels: median household income

We're experimenting with using the relationship between a company's market capitalization and its aggregate dividends as a tool for assessing the Goldilocks quality of its stock price. By Goldilocks quality, we mean whether the value of a company's stock price is too low, too high, or just right, which would correspond to an investing decision to buy, sell or hold.

Why use market cap and aggregate dividends for assessing the value of a stock? We've already established that there's a useful relationship between price per share and dividends per share when dealing with stock indices, but the increase of stock buybacks over time makes that direct approach a dicier method for evaluating individual stocks. Using market cap and aggregate dividends can eliminate the potential for a company's management to artificially dress up its "per share" financial metrics with buybacks, letting us use the next closest thing to share prices and dividends per share in determining whether it makes sense to buy, sell or hold its shares.

We've developed the basic method for evaluating an individual firm's stock valuation using General Electric (NYSE: GE) as our experimental guinea pig, but we have been seeking another publicly traded company to evaluate.

We've found a candidate: Iron Mountain (NYSE: IRM). IRM is a documents management company that is set up as a Real Estate Investment Trust (REIT), which is perhaps best known for archiving the paper records of hundreds of large corporations, but which has been expanding into digital records management.

That's a boring, but lucrative business, where the company is currently paying an annual dividend of $2.47 per share. With a closing share price of $26.33 on 29 October 2020, that's a dividend yield of nearly 9.4%.

By contrast, the dividend yield of the S&P 500 was 1.75% back on 30 September 2020.

That large difference makes IRM an interesting stock to consider. An relatively outsized dividend yield can be both an attractive stock for investors seeking dividend income and a potential harbinger of future dividend cuts, which is the kind of stock investors would generally seek to either sell or avoid.

Which is IRM? Here's a chart showing the relationship between IRM's market cap and aggregate dividends from 2010 up to 29 October 2020, where we've focused on the periods approximately coinciding with Iron Mountain's dividend declaration dates.

Overall, we find there's a moderately strong relationship between IRM's market capitalization and its aggregate annual dividend payout, which currently sits at $0.71 billion with a market cap of roughly $7.59 billion.

In considering how investors have historical valued the stock at dividend declaration dates from 25 February 2010 through 5 August 2020, we find the current valuation is below the typical range we would expect given its history, which means one of two things: it's either a serious candidate for a dividend cut, or its shares are currently on sale for investors looking to pick up relatively easy money.

In August 2020, Action Biased made the case that the stock is due for a dividend cut, which our method suggests could be on the order of a 33% reduction from its current $2.74 annual dividend per share. The argument supporting a significant dividend cut recognizes the dividends the REIT paid in 2019 exceeded its Funds From Operations (FFO) by a significant margin, which is a consequence of the company having loaded up on debt to expand its digital records management operations. Cutting its dividend to cope with its debt could be advisable if it remains elevated.

Since then, presentations the company has made to investors have focused on the steps it has taken to restructure its debt at today's lower interest rates, which would make its current dividend level more sustainable. Analyst Mark Roussin picked up on that strategy in his argument that the company's stock is currently undervalued, which our analytical method suggests could provide up to a 20% gain given its current dividend payout and how investors have historically valued the firm.

So which is it? If you're looking for ideas of where to invest, you'll ultimately have to make that call for yourself, but you won't have long to wait to find out which potential view of the future will prevail. Iron Mountain will announce its 2020-Q3 financial results early on 5 November 2020 and will host a conference call for investors later that day.

According to analyst Rida Morwa, Iron Mountain may also announce a change in its dividend at that time. He's betting on it being a dividend increase, which for our method, would suggest the potential for a greater than 20% gain.

See? Interesting! Who knew a company in the record storage business could present so many possibilities for investors to weigh?

Labels: dividends, investing, market cap, stock market

Johns Hopkins has maintained one of the go-to data sites for the global coronavirus pandemic, where their time series data stretches back to 22 January 2020.

Since the data shows weekly 'seasonality', where daily statistics tend to be underreported on weekends, the common trick most analysts have adopted to work around the regular noise that creates in the data is to track the seven day moving average of the daily count of newly confirmed COVID-19 cases and reported deaths. We now have nine months worth of those seven month moving averages, and with coronavirus cases surging in Europe and on the rise in the U.S., we thought it was a good time to focus just on those two regions.

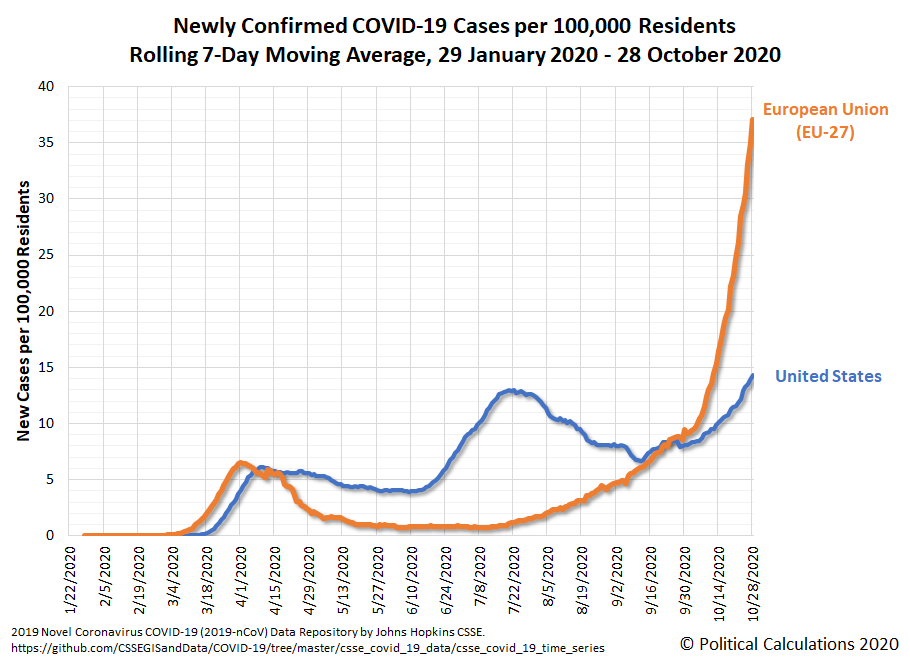

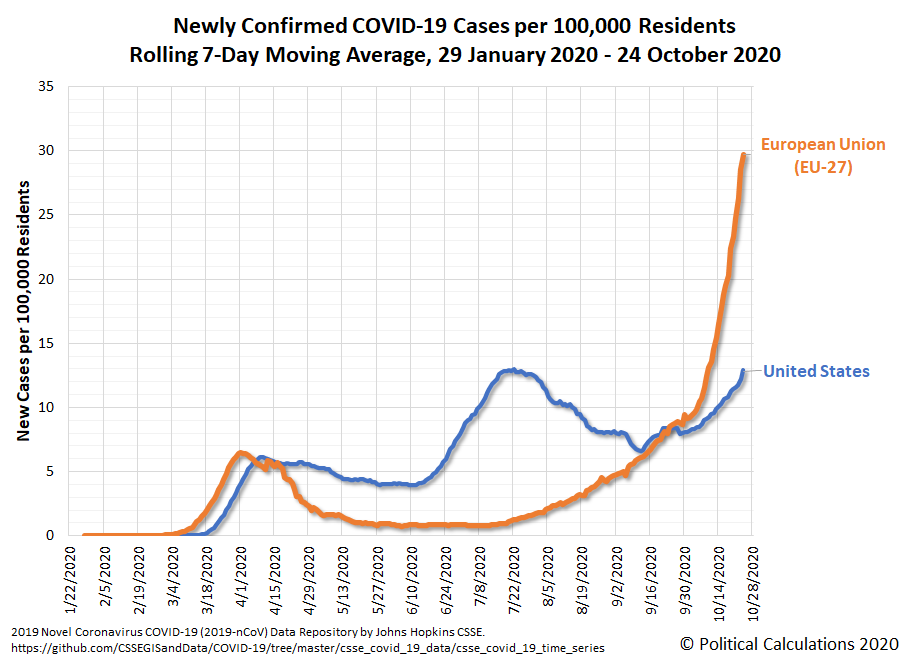

Here's a chart showing the rolling seven day moving averages for the number of newly confirmed COVID-19 cases per 100,000 residents in both the United States and the 27 nations of the European Union. It shows that the EU has become the new global epicenter for the spread of SARS-CoV-2 coronavirus infections, with an average rate of spread among its residents that has skyrocketed to be more than double that in the U.S.

We have a second chart tracking the rolling seven day moving averages for the number of newly reported COVID-19 deaths per 100,000 residents in both the U.S. and the EU-27.

This second chart shows a significant difference in the experience of the EU-27 and the U.S. The rate of deaths in the European Union is rising rapidly, following the basic pattern that the spread of newly confirmed cases has in the region, where it is nearing double the rate occurring in the U.S. as of 28 October 2020. What stands out here however is that the relative rate of COVID-19 deaths in the U.S. has fallen within a relatively narrow range over the last two months, even though the number of cases in the U.S. has been rising over nearly that entire period of time.

This difference between the two regions helps explain why much of Europe is retreating into lockdown mode, despite knowing the economic damage that will be caused by doing so, while the U.S. appears better positioned to weather its latest regional wave of cases.

Speaking of which, we'll close by linking to the changing map for COVID-19 deaths per 100,000 in the U.S. created by sdbernard, which is as well done as any COVID-19 data visualization we've seen:

[OC] Animation showing the number of Covid-19 deaths per 100k, by county in the US since the start of the pandemic from r/dataisbeautiful

Most of the U.S.' excess number of COVID-19 deaths can be attributed to just four states that sustained a particularly disastrous policy in the early months of the pandemic.

Labels: coronavirus, data visualization

We've followed the state of Arizona's experience with the coronavirus pandemic since we first recognized the state had become a national hotspot for COVID-19 earlier this summer.

Early on, we employed an analytical method called 'back calculation' to trace changes in trends for the state's COVID data back to significant changes in the incidence of exposure to the SARS-CoV-2 coronavirus. The idea behind back calculation is pretty straightforward. If you know what the median time is from the initial onset of symptom to when someone who has become infected with a serious case is hospitalized, you use any significant changes you see in the trends for new hospital admissions to identify when something changed to affect the rate at which people are being exposed to the virus. Ideally, you can identify a very narrow window of time in which that happens.

This kind of analysis also works for data on positive COVID test results and deaths, but the data for hospital admissions works best because it is independent of the factors that affect when test kits are processed or when deaths are reported. It also provides the narrowest potential window of time to consider, the the median time between initial virus exposure and hospitalization falling somewhere between 11 and 13 days, according to the CDC's COVID-19 Pandemic Planning Scenarios.

Working with Arizona's COVID hospital admissions data has been challenging. Mainly that's because the data the state's Department of Health Services makes available is subject to human failings.

As an example, in the latter part of July 2020, Arizona began requiring non-hospital medical facilities to begin reporting their COVID data to the state, which was then incorporated in the statewide data. It shouldn't have been a big deal, but the new reporting suggested Arizona's COVID hospital admissions were far greater than previously released data had indicated. It also suggested that factors affecting changes in trends for hospitalizations were very different from what we were seeing for newly confirmed cases and deaths in the state.

Several weeks ago, Arizona's public health officials found and fixed the problem. It turned out that the number of positive test results collected at urgent care centers in the state were being counted as new hospital admissions, even though in nearly all these cases, the positive-testing patients were never hospitalized in any way. In between, back calculation using Arizona's hospitalization data was highly suspect because of the data corruption. Fortunately, we recognized the issue and worked around it to the greatest extent we could. But it was like not having access to the sharpest scalpel in a doctor's medical bag when you're trying to perform fine surgery.

We wondered if there was any hospital-related data that we could substitute for it, which would have been unaffected by the positive-test contamination issue. And then it struck us! Arizona's COVID data for ICU beds in use falls in an entirely separate category, so it had never been corrupted by the urgent care positive test result data. Here's that data in graphical form (please click here for a full-size version):

So we took Arizona's COVID-19 ICU Bed Usage data for a test drive, adapting our original method for new hospital admissions, and found that it worked nearly as well. The results of that test drive are shown in the following chart showing Arizona's daily COVID ICU admissions chart.

The ICU back calculation chart comes very close to delivering the accuracy we're really after. We think there's a slightly longer lag between initial exposure and ICU admission than there is to just hospital admission, so the predicted timing of changes in trend shown as the purple and green shaded vertical shaded bands in the chart following a significant event are slightly too early. We haven't yet found peer-reviewed data to quantify what that additional lag is, but the changes in trend

In this chart, we're showing two new events we haven't previously discussed that seem to correspond to changes in the overall trajectory for Arizona's COVID ICU admissions. The first, marked with the letter G, corresponds to the Labor Day holiday weekend, which followed the initial reopening of high-risk businesses (like bars and indoor gyms) in most Arizona counties a week earlier.

In this case, we think the impact of social mixing during the holiday weekend itself is responsible for causing the change from a falling to a flat trend. If it had just been the bars reopening, we would have seen the change in trend start a week earlier (we've ruled out other large scale events like the timing of school reopenings or political rallies in the state for similar reasons). We think that while the reopened bars may be tangentally involved as places where social mixing took place during the holiday weekend, they are not the primary contributor to the change in trend that occurred in ICU bed usage in mid-September.

The second change, marked with the letter H, may be partially related to reopened high exposure risk businesses in counties that have seen higher rates of infection within their populations in the weeks since. In this case, we think the delayed reopening of high exposure-risk businesses in Yuma and Greenlee counties on 17 September 2020 may have provided enough additional exposure events to change the trend in ICU hospitalizations from flat to a slowly rising, but steady trend.

Since it is not rising at an exponential rate, we consider the current overall trend to be managable. We think relatively minor steps short of shuttering the just reopened high exposure-risk businesses could be taken to modify the trend in a desirable direction. Those minor steps may include things like contact tracing and continued local ordinance-directed mask usage at public venues and events.

The worst case scenario however would be a repeat of the BLM/anti-police protests from late May and early June 2020, a true superspreader event that made contact tracing useless within the state. The protests took a very managable situation and instead made Arizona a national epicenter for coronavirus infections, amplifying the state's number of positive cases, hospital admissions, ICU bed usage, and deaths until the state implemented its decentralized approach to correct the adverse COVID-19 trend.

Welcome to the world of back calculation. It's easier when you have good data!

Previously on Political Calculations

Here's our previous Arizona coronavirus coverage, with a sampling of some of our other COVID analysis!

- Arizona's Decentralized Approach to Beating COVID

- Going Back to School with COVID-19

- Arizona Turns Second Corner Toward Crushing Coronavirus

- Arizona's Coronavirus Crest in Rear View Mirror

- The Coronavirus Turns a Corner in Arizona

- A Delayed First Wave Crests in the U.S. and a Second COVID-19 Wave Arrives

- The Coronavirus in Arizona

- A Closer Look at COVID-19 Deaths in Arizona

- The New Epicenter of COVID-19 in the U.S.

- How Long Does a Serious COVID Infection Typically Last?

- How Deadly is the COVID-19 Coronavirus?

- Governor Cuomo and the Coronavirus Models

- How Do False Test Outcomes Affect Estimates of the True Incidence of Coronavirus Infections?

- How Fast Could China's Coronavirus Spread?

References

Arizona Department of Health Services. COVID-19 Data Dashboard. [Online Application/Database].

Maricopa County Coronavirus Disease (COVID-19). COVID-19 Data Archive. Maricopa County Daily Data Reports. [PDF Document Directory, Daily Dashboard].

Stephen A. Lauer, Kyra H. Grantz, Qifang Bi, Forrest K. Jones, Qulu Zheng, Hannah R. Meredith, Andrew S. Azman, Nicholas G. Reich, Justin Lessler. The Incubation Period of Coronavirus Disease 2019 (COVID-19) From Publicly Reported Confirmed Cases: Estimation and Application. Annals of Internal Medicine, 5 May 2020. https://doi.org/10.7326/M20-0504.

U.S. Centers for Disease Control and Prevention. COVID-19 Pandemic Planning Scenarios. [PDF Document]. Updated 10 September 2020.

COVID Tracking Project. Most Recent Data. [Online Database]. Accessed 16 October 2020.

More or Less: Behind the Stats. Ethnic minority deaths, climate change and lockdown. Interview with Kit Yates discussing back calculation. BBC Radio 4. [Podcast: 8:18 to 14:07]. 29 April 2020.

Labels: coronavirus, data visualization

The market for new homes in the U.S continued to surge in September 2020, with the trailing twelve month market cap reaching levels not seen since the days of the first housing bubble.

Our initial estimate of the trailing twelve month average of the market capitalization of new homes sold throughout the U.S. in September 2020 is $26.87 billion. In nominal terms, only the period between July 2004 and June 2006 saw higher value for the market cap of new homes sold in the U.S.

The story is similar after adjusting for inflation, although here the first bubble period with higher national new home market caps stretches between December 2002 and April 2007.

Much of today's demand is being fueled by American families seeking to escape corrupt cities that permitted sustained breakdowns in public order during the summer of 2020, sparking sharply increased demand in the U.S. market for new homes. That demand has combined with the lowest mortgages rates on record, which enabled American households to afford significantly higher priced homes.

The result of this combination of factors has produced a surging market for new homes in the U.S. in 2020. That market is providing a tailwind for the nation's economy and its recovery from the worst of the coronavirus recession.

Labels: coronavirus, real estate, recession

The S&P 500 (Index: SPX) continued to mostly move sideways during the third week of October 2020. Overall, it closed the trading week some 18.42 points (0.5%) lower than in the previous week, which is to say most of what happened during the week was day-to-day noise.

If investors are primarily focusing on 2020-Q4 in setting stock prices, we can expect more of the same next week. That assessment is based on coming toward the end of the redzone forecast range in this week's alternative futures chart.

The mostly-noise driven action during the past week continues to be mostly influenced by the changing prospects of the U.S. government's next major stimulus bill. Perhaps a more serious fundamental issue is developing in Europe with its surge in coronavirus cases and corresponding lapse back into lockdown mode in several countries, which adds its own element of noise to the U.S. market. Here's a chart showing the rolling 7-day moving average trends in newly confirmed cases per 100,000 residents in both the European Union and the United States, where we find that Europe's rate of new cases is more than double than in the U.S.

Here's a second chart showing the rolling 7-day moving average trends in newly reported deaths per 100,000 residents in the E.U. and U.S., where we see the E.U.'s COVID-19 death rate has likewise surpassed the United States.

While the U.S. is doing far better than the E.U., we expect the increasing number and relative severity of lockdowns being imposed in various EU countries will negatively affect commodity markets and prices, which will put a damper on the business outlook for U.S. firms.

Overall, the general tone of the news during the past week was mixed, with several stories referencing the U.S. economy's stronger than expected performance in recent weeks, which perhaps helps explain why stock prices mostly moved noisily sideways rather than decidedly downward.

- Monday, 19 October 2020

-

- Signs and portents for the U.S. economy:

- Oil dips after OPEC+ meeting as Libyan supply boost weighs

- Worried about weak oil demand, OPEC pledges action

- Trump's payments to farmers hit all-time high ahead of election

- Fed minions learning to love higher inflation, chief Fed minion learning to love digital currencies:

- Fed's Harker: Tolerating higher inflation 'worth it' to help achieve employment goals

- Fed's Clarida says rates will stay near zero until inflation reaches 2%

- Fed's Powell: More important for U.S. to get digital currency right than be first

- Bigger trouble developing in Brazil:

- China shows signs of recovery:

- Chief ECM minion wants more stimulus, lower level minions wants no more, another sends up red flag on data quality, and yet another wants big bank mergers:

- Lagarde says ECB to maintain accommodative policy in response to coronavirus crisis

- ECB's Mersch warns against double counting as decision looms

- ECB's De Guindos says mergers can improve banks' profitability

- Wall Street closes lower as stimulus deadline nears without deal

- Tuesday, 20 October 2020

-

- Signs and portents for the U.S. economy:

- Oil up on U.S. stimulus hopes, rising virus cases keep prices in check

- U.S. single-family homebuilding, permits surge to more than 13-year high

- Trump pushes for major COVID-19 deal over Senate Republican objections

- U.S. coronavirus aid talks moving closer to deal-Pelosi aide

- Fed minions optimistic, pessimistic, worried about non-banks, but still believe they are all powerful:

- Fed's Evans sees less economic drag from new COVID-19 wave

- Fed's Quarles says pandemic stresses highlighted fragility in nonbanks

- NY Fed's Singh says central bank can ramp up, slow down, corporate bond purchases as needed

- Bigger trouble developing in Japan, Britain, Latin America:

- Exclusive: Bank of Japan to cut growth, inflation forecasts as pandemic pain persists - sources

- Britain's economic recovery faltering, Bank of England to step up spending: Reuters poll

- Latin America's recovery in doubt as fiscal worries mount, confidence wanes: Reuters poll

- Wall Street shares end higher on stimulus optimism

- Wednesday, 21 October 2020

-

- Signs and portents for the U.S. economy:

- Oil prices fall as inventory report reflects demand weakness

- U.S. economy recovering slowly, but some sectors struggling: Fed survey

- Where's the floor? Investors left guessing as U.S., Europe money market rates sink

- Fed minions pessimistic, uncertain, and want more U.S. government spending:

- Fed's Kaplan says U.S. economy will live with virus well into next year

- Fed's Mester says further study needed of monetary policy's affect on financial stability

- Fed's Brainard calls for more fiscal aid for economy

- Bigger trouble developing in Japan, Britain, Latin America:

- China shows signs of recovery:

- China's fiscal revenues rise 4.7% in third-quarter as economy gains steam

- China to balance stable growth and risk prevention: central bank

- China's 2020 auto production and sales could return to 2019 levels: government official

- Chief ECB minion goes on listening tour ahead of monetary policy revamp:

- S&P edges down in choppy session as U.S. stimulus talks drag on

- Thursday, 22 October 2020

-

- Daily signs and portents for stronger than expected U.S. economy:

- Oil ends higher, boosted by U.S. stimulus hopes

- U.S. weekly jobless claims fall; many unemployed losing benefits

- U.S. existing home sales blow past expectations in September

- U.S. economy's rebound sets up test of Fed's new pledge

- Wall Street closes higher, trade choppy as U.S. stimulus talks eyed

- Friday, 23 October 2020

- Daily signs and portents for the U.S. economy:

- Oil falls about 2% on Libyan output, COVID-19 demand concerns

- Exclusive: China eyes more corn imports as shipments surge, set to become top buyer

- Trump, Mnuchin say Pelosi must compromise to reach COVID-19 deal

- Fed minions worry about liquidity, think coronavirus has legs:

- Threats to U.S. Treasury market liquidity still exist, Fed says

- Fed's Kaplan says U.S. economy will live with virus well into next year

- Bigger trouble developing in the Eurozone:

- Euro zone economy at risk of double-dip recession: PMIs

- German factories hum, services shrink in two-speed economy: PMI

- Japan seeing signs of recovery:

- S&P, Nasdaq close higher as stimulus talks in spotlight

The Big Picture's Barry Ritholtz has outlined the positives and negatives he found in the past week's economics and markets news.

Update 28 October 2020: The S&P 500 dropped 3.5% today, with the die cast long before the market opened thanks to France's and Germany's decision to impose new nationwide COVID lockdowns, which will negatively impact the European and global economy. From our perspective, that news appears to have triggered investors to suddenly shift their forward-looking focus from 2020-Q4 toward 2021-Q1 in a new Lévy flight. The change comes just as we're reaching the end of the redzone forecast range:

This new shift is consistent with our nearly one month old observation that investors "may switch their focus back and forth between 2020-Q4 and 2021-Q1 severval times before the end of the 2020 calendar year". It's important to note that while we can anticipate the effect and the relative magnitude of the shifts when they do occur, they are not predictable because the timing of these shifts is essentially random. That is because they are prompted by the random onset of new market-moving information, like today's before-the-bell news of the Eurozone's new coronavirus lockdowns. At the same time, what makes the content of the news that drives these events so important is how it affects the time horizon for investors, or rather, how far forward in time they are looking when making their current day investing decisions.

What events might refocus investors back upon 2020-Q4? That answer may come sooner than you might think, but once again, it all hinges on the random onset of new information.

Labels: chaos, coronavirus, SP 500

Halloween is coming, and with it, a new problem in 2020. How can you hand out candy to your neighborhood's trick-or-treating children while keeping them far enough away to avoid the risk of catching the coronavirus from them?

A number of crafty-minded treat dispensers across America have seemingly simultaneously come up with a do-it-yourself invention to solve that problem: the COVID candy chute. All you need is some PVC pipe, some creative Halloween decorative skills, and you too can deliver candy to a costumed child from an safe distance.

It's not a new idea by any stretch, but it is one whose time would appear to have finally arrived! We came across dozens of local news clips telling essentially the same story of how an inventive parent crafted their own candy chute device, but we found the following video report from NBC-affiliate KRIS in Corpus Christi, Texas to be especially entertaining.

We could spent a lot of time unpacking everything that managed to get compressed into that two-minute long video package, but since we're focused on the invention at work here, let's simply describe it as a long tube, with one end rigged up higher than the other, designed for candy to be dropped in at the upper end and dispensed to an awaiting trick-or-treater at the lower end.

There's no patent, because its basic form is one of the oldest and simplest types of machines in existence: an inclined plane.

We'll close this edition of IIE with the words of KRIS' Corderro McMurry, who advises "If you do plan to trick or treat this Halloween, please be safe and to wear a mask." If you need guidance, here's Randall Munroe's helpful diagram revealing which Halloween masks are most effective at preventing respiratory virus transmission:

Labels: technology

"Are you better off today than you were four years ago?"

That question first became famous when asked in 1980 by then-presidential candidate Ronald Reagan. Every four years since, polling firm Gallup has asked that question whenever a presidential election is held in the U.S.

In 2020, the year of the coronavirus pandemic and a deep recession, they received a surprising response when asking that question of registered voters:

Gallup's most recent survey found a clear majority of registered voters (56%) saying they are better off now than they were four years ago, while 32% said they are worse off.

Gallup provides a chart showing the graphical results of their polling in the fourth year of the first terms of Presidents Ronald Reagan (1984), George H.W. Bush (1992), George H.W. Bush (2004), Barack Obama (2012), and Donald Trump (2020).

How could that possibly be? Thanks to state and local government lockdown orders that shuttered businesses and required Americans to stay-at-home in late March 2020, the U.S. economy has been experiencing one of the sharpest, deepest recessions in its history, from which it has only begun recovering in recent months as those lockdowns have been lifted. And yet, when asked during the two week period from 14 September through 28 September 2020, a clear majority of Americans stated they and their families were better off than four years ago.

We have unique data that explains that outcome, at least as it applies to the typical American household. Median Household Income is the measure of total money income earned by the American household at the exact middle of the nation's income earning spectrum. 50% of American households have higher incomes, 50% of American households have lower incomes.

Tracking how median household income changes over time can tell us a lot about the state of the typical American household. Not only can it tell us whether nominal incomes are rising or falling with economic conditions, if we adjust it for consumer price inflation, it can tell us a lot about the buying power of the incomes Americans earn.

We've visualized that information in a single chart that shows median household income measured in both these ways.

The chart covers the period from January 2009 through August 2020, which captures the eight years of President Obama's tenure in office and most of President Trump's. With the 2020 presidential election a race between Joe Biden, who served as Vice President during President Obama's terms in office, and Donald Trump, who is running for reelection, it seems most appropriate to focus on this period to evaluate the effect of their respective policies on the welfare of the typical American household.

We see that nominal median household income, shown as the red data series in the chart, declined from $50,608 in January 2009 to $48,559 in early 2010, which then rose at a steady rate through 2016, before accelerating after January 2017. It ultimately peaked at $66,639 in February 2020 as the U.S. economy peaked before the onset of the coronavirus recession in March 2020. Through August 2020, median household income has fallen to $65,602.

The inflation adjusted data, shown as the blue data series, tells a similar story but with meaningful differences. In terms of constant August 2020 U.S. dollars, the Obama-Biden era began with median household income at $62,299, which then fell to $57,209 in early 2011. The buying power of the median income-earning U.S. household then stayed flat until mid-2014, when it finally began recovering.

Inflation-adjusted median household income would go on to slightly surpass its January 2009 level in early 2016, and then largely stagnated for the rest of the year before peaking in December 2016 at $62,440. A few months after President Trump assumed office in January 2017, the stagnation ended and the buying power of the typical American household rose above the levels recorded throughout the Obama-Biden era. The inflation adjusted median household income ultimately peaked at $67,131 in early 2020, but has since fallen with the coronavirus recession to its current level of $65,602.

These outcomes help explain the difference in Gallup's polling results for both 2012 and 2020. For 2020, a clear majority of Americans are answering that they are better off than four years ago because they are better off, even with the negative impact of the coronavirus recession.

Speaking of which, we see indications the recessionary trend for median household income in the U.S. reached a bottom in August 2020. We anticipate September 2020's data will show the first increase in this measure since the coronavirus recession began, as the economic recovery gains traction. The data for September 2020 will become available on 30 October 2020.

Analyst's Notes

Sentier Research suspended reporting its monthly Current Population Survey-based estimates of median household income, concluding their series with data for December 2019. In its absence, we are providing monthly estimates of median household income based upon our alternate methodology. Our references and data sources are presented in the following section.

References

Sentier Research. Household Income Trends: January 2000 through December 2019. [Excel Spreadsheet with Nominal Median Household Incomes for January 2000 through January 2013 courtesy of Doug Short]. [PDF Document]. Accessed 6 February 2020. [Note: We've converted all data to be in terms of current (nominal) U.S. dollars.]

U.S. Department of Labor Bureau of Labor Statistics. Consumer Price Index, All Urban Consumers - (CPI-U), U.S. City Average, All Items, 1982-84=100. [Online Database (via Federal Reserve Economic Data)]. Last Updated: 10 September 2020. Accessed: 10 September 2020.

U.S. Bureau of Economic Analysis. Table 2.6. Personal Income and Its Disposition, Monthly, Personal Income and Outlays, Not Seasonally Adjusted, Monthly, Middle of Month. Population. [Online Database (via Federal Reserve Economic Data)]. Last Updated: 1 October 2020. Accessed: 1 October 2020.

U.S. Bureau of Economic Analysis. Table 2.6. Personal Income and Its Disposition, Monthly, Personal Income and Outlays, Not Seasonally Adjusted, Monthly, Middle of Month. Compensation of Employees, Received: Wage and Salary Disbursements. [Online Database (via Federal Reserve Economic Data)]. Last Updated: 1 October 2020. Accessed: 1 October 2020.

Labels: coronavirus, election, median household income, recession

The rate at which COVID-19 is spreading in the 27 nations of the European Union has reached nearly double the rate coronavirus infections are spreading within the United States. Here's a chart showing the sudden, runaway growth of newly confirmed COVID-19 cases in the EU compared with the US.

The EU has been experiencing true exponential growth since late July 2020. Starting from the very low level of a rolling 7-day moving average of less than one new case for every 100,000 residents, the EU is now recording over 20 new cases per 100,000 residents per day. If the United Kingdom were still included as part of the EU, the rate at which new cases are being recorded would exceed 32 cases per day per 100,000 residents, which points to how hard the UK is currently being impacted.

Officials in the EU point to the role of August travel and outbreaks in holiday destinations in generating the continent's second wave of coronavirus infections:

With new COVID-19 cases ebbing, many European nations started reopening their borders in mid-June. Travelers began to fly south for vacation like they would on any nonpandemic-ravaged year.

But outbreaks bloomed in summer holiday destinations, such as the French Riviera, Greece, and Croatia.

And then those travelers flew back to their home countries, where the outbreaks had been relatively contained.

In August, Italian officials said 30 percent of new cases were due to people who contracted the virus abroad. In Germany, officials put the figure at nearly 40 percent.

Unlike the United States, many nations in the European Union have long established national health care systems, which may have given their residents a false sense of confidence in their situation. Combined with extraordinarily strict lockdown measures that had been adopted to keep their health care systems from becoming overwhelmed earlier in 2020, that false sense of safety may have contributed to the moral hazard of engaging in social mixing while on holiday after the measures were lifted in the summer, fueling Europe's new surge in coronavirus infections.

Since one of the defining characteristics of such national health care systems is chronic underinvestment in health care technology and treatment facilities as compared to market-based systems, many of these nations are once again at risk of exceeding their health care systems' available capacity to care for infected patients unless they re-impose lockdown orders on their populations. Highly restrictive measures are already being imposed in the United Kingdom, while other European nations adopt partial lockdown measures at their national level with considerably stricter restrictions in large cities. Generally speaking, the new attempt to contain the spread of COVID infections is a repeat performance of what they did earlier in 2020.

References

2019 Novel Coronavirus COVID-19 (2019-nCoV) Data Repository by Johns Hopkins CSSE. Confirmed Global Time Series Data. [Online Database]. Accessed 19 October 2020.

Labels: coronavirus

As of the end of its 2020 fiscal year on 30 September 2020, U.S. government's total public debt outstanding stood at $27,026,921,935,432.41 ($27.027 trillion). One year earlier, it stood at $22,622,684,674,364.43 ($22.623 trillion). During the year in between, the total U.S. national debt rose by $4.404 trillion.

Earlier this year, we found the U.S. Federal Reserve had become the U.S. government's new sugar daddy. As of 30 September 2020, we find that the Federal Reserve directly holds over $4.445 trillion in U.S. Treasury securities, up $2.338 trillion from the $2.108 trillion it held a year earlier. Uncle Sam's new friendly neighborhood loan shark lent 47% of all the dollars the government borrowed during its 2020 fiscal year.

As a result, the Fed's share of all the money borrowed by the U.S. government increased from 1 out of every 8 dollars the government has borrowed to 1 out of every 6 dollars. If we just focused on the publicly-held portion of the national debt, the Fed's share would increase to 1 out of every 5 dollars borrowed.

In becoming the U.S. government's primary creditor, the Fed has widened its margin over Uncle Sam's former top lender, Social Security's Old Age and Survivors Insurance Trust Fund, which has only loaned the U.S. government 1 out every 10 dollars it has borrowed.

The following chart tallies the shares of money the U.S. government has borrowed from its major worldwide creditors. Please click here to access the full size version of the chart.

With the Fed having taken such a dominant lender role in financing the U.S. government's spending, the relative share of money borrowed from foreign entities has decreased. That share has fallen from 30% of the total public debt outstanding in 2019 to 26% in 2020. Japan has become the largest foreign creditor to the U.S. government, as China seeks to reduce its holdings of U.S. government-issued debt.

We had to wait until the U.S. Treasury Department issued its September 2020 monthly treasury statement some four days late on 16 October 2020 to get the latest debt holdings for Social Security and other trust funds operated by the U.S. government. The data for major foreign holders of U.S. government-issued debt is preliminary (or rather, only up-to-date through August 2020) and will be subject to revision over many months ahead.

Labels: national debt

The S&P 500 (Index: SPX) stayed in its redzone lane during the past week, not having much reason to do anything but that during the week that was.

It has been a while since we last featured the expected future for the S&P 500's quarterly dividends per share here in the S&P 500 chaos series. We've had complete futures data through the fourth quarter of 2021 since 21 September 2020, where we've created the following animated chart to show the day-to-day changes in the four weeks since. If you're accessing this article on a site that republishes our RSS news feed and you don't see the changing future, please click through to our site to access the animation.

You may have to watch through the cycle a couple of times to fully catch it, but the biggest change has been in the more distant future quarters of 2021, where the outlook has improved in recent weeks.

We'll keep this edition short and sweet by jumping next into the more significant news headlines we pulled out of the newstream in the past week.

- Monday, 12 October 2020

- Signs and portents for the U.S. economy:

- Bigger trouble developing in UK, France, China, Japan:

- Explainer: What is England's new COVID-19 lockdown system?

- Number of COVID patients in French intensive care units highest in nearly five months

- China's premier says 'arduous efforts' needed to achieve economic goals: state media

- Japan September wholesale prices slump, heightening deflation risk

- Bigger stimulus developing in Japan, EU using stimulus to force fiscal union:

- Kuroda says BOJ ready to ease more, has tools to cushion pandemic pain

- EU moving towards fiscal union with pandemic recovery plan: German FinMin

- ECB minions worry over stalling Eurozone economy, not certain copying Fed's new inflation targeting is a good policy:

- Euro zone economy losing momentum, ECB's de Guindos says

- Exclusive: ECB policymakers wary of following Fed's route on inflation target, sources say

- Apple and Amazon drive rally on Wall Street

- Tuesday, 13 October 2020

- Signs and portents for the U.S. economy:

- Oil rises nearly 2% as robust China trade data offsets returning supply

- McConnell sets Senate vote on coronavirus aid, Pelosi spurns White House bid

- U.S. small business confidence at highest since February

- Used vehicles lift U.S. consumer prices, but inflation slowing

- EU dishing out trade tariffs on U.S., China:

- EU wins tariff clearance on $4 billion of U.S. imports in Boeing case

- EU imposes tariffs on aluminium products from China

- Bigger stimulus to be doled out in Eurozone, signs of stimulus getting traction in China:

- How and when will EU countries get their recovery money?

- China auto sales jump in 'Golden September' as shoppers return to showrooms

- ECB minion thinks new COVID wave won't completely shut down EU economies again:

- Wall Street closes lower on vaccine delay, dampened stimulus hopes

- Wednesday, 14 October 2020

- Signs and portents for the U.S. economy:

- Oil rises 2% as OPEC complies with production cuts

- Mnuchin says coronavirus relief deal unlikely before U.S. election

- Fed minion holds huge contradictions within own head, another wants U.S. government to spend more:

- Fed's Clarida says U.S. data 'surprisingly strong,' but deep hole remains

- Fed's Daly says U.S. economy needs more fiscal support: CNBC

- Bigger stimulus being developed for third world, economic growth guaranteed in China:

- World Bank to propose $25 billion in extra funding for poorest countries

- China's third quarter GDP growth expected to improve: PBOC official

- ECB minions have some things to think over, Bank of Canada minions think they should get into digital currency:

- ECB policymakers set out wish list for strategic rethink

- ECB should look at broadening out its monetary analysis: Villeroy

- ECB's Mersch unconvinced of need for new strategy

- New virus containment measures would require more ECB stimulus, Holzmann says

- Pandemic accelerates need to consider digital currency: Bank of Canada

- Wall Street ends down after Mnuchin dims stimulus hopes

- Thursday, 15 October 2020

- Signs and portents for the U.S. economy:

- Oil eases as new lockdowns raise concern about fuel demand

- Trump calls for big COVID-19 stimulus but McConnell disagrees

- Trump threatens to 'strike back' if EU imposes tariffs over Boeing

- Fed minions say more needs to be done for jobs, look to fiscal over monetary stimulus:

- Fed's Barkin says hiring could recover slowly as companies streamline

- Fed's Kaplan says disadvantaged Americans need help getting back to work

- Fed's Daly: Monetary policy is in a good place, more fiscal help needed

- Bigger trouble developing in Canada, Central America:

- Canada sheds jobs for seventh straight month in September: ADP

- Central Americans edge north as pandemic spurs economic collapse

- Bigger stimulus to be doled out in Eurozone:

- EU parliament chief asks leaders for more money to unlock EU recovery package

- EU to use bond auctions to sell debt for 800-billion-euro recovery fund

- ECB minion thinks new COVID wave won't completely shut EU economies down again:

- S&P 500 ends lower as investors eye stimulus impasse

- Friday, 16 October 2020

- Daily signs and portents for the U.S. economy:

- Oil dips on COVID-19 resurgence, fears of more supply

- U.S. retail sales beat expectations; outlook murky

- U.S. manufacturing production unexpectedly drops in September

- Fed minions want more fiscal stimulus, think their monetary stimulus is fine, but still worry about economy:

- Fed's Kashkari: Recovery will be grinding and slow without more stimulus

- Current Fed bond purchases 'appropriate': St. Louis Fed's Bullard

- NY Fed's Williams says challenging period ahead for some sectors of economy

- Bigger stimulus developing in France, Japan:

- France plans $23 billion state-backed scheme to avert company failures

- BOJ has many tools to ramp up stimulus: deputy governor Wakatabe

- Dovish ECB minions don't want to stop stimulus:

- ECB's Villeroy says mistake to set end date now for pandemic response

- ECB's Visco says important for policies to remain accommodating

- Dow advances, S&P ekes out gain as vaccine timeline comes into focus

Looking for more news? Barry Ritholtz lists the positives and negatives he found in the past week's economics and markets news over at The Big Picture!

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.