We're becoming increasingly concerned by the media's repetitive use of the word "unexpected" with respect to the number of new claims being filed and reported each week for unemployment insurance. It's as if the "professional" media just doesn't have a collective clue as to what kind of numbers they ought to expect!

We can help! Taking advantage of the work we've already done in identifying the major turning points for the U.S. job market in recent years, we can identify the range of seasonally adjusted first-time unemployment insurance claim filings that we ought to expect.

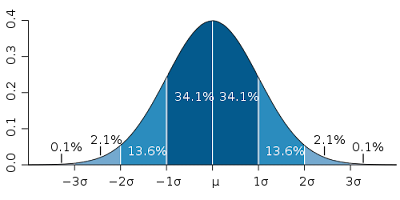

Here, we assume that the mean trend line since that starting point represents the center line of a statistically normal distribution. The standard deviation of the individual data points with respect to that mean trend line then may be used to define the full range of values we should expect if the variation in the data is due to common causes or natural volatility.

The upper and lower boundaries of that range are defined as being plus or minus three standard deviations from the mean trend line. Provided that our assumption that the individual data points defining the trend may be described by a normal distribution holds, we would then expect that any individual data point will fall within this range some 99.7% of the time.

Missouri Unemployment Line Incorporating the most recently announced new jobless claims data, we should expect that next week's number (to be announced on 12 August 2010) will fall between 412,000 and 500,000. If we want to narrow that range down more, if we define the upper and lower limits of our expected range as being within one standard deviation of the current mean trend line, we can expect that there is a 68.2% probability that next week's new jobless claims number will fall between 441,000 and 470,000.

Missouri Unemployment Line Incorporating the most recently announced new jobless claims data, we should expect that next week's number (to be announced on 12 August 2010) will fall between 412,000 and 500,000. If we want to narrow that range down more, if we define the upper and lower limits of our expected range as being within one standard deviation of the current mean trend line, we can expect that there is a 68.2% probability that next week's new jobless claims number will fall between 441,000 and 470,000.

If the next data point falls within our full plus-or-minus three standard deviations of the mean trend line range, we should expect it (after all, there's a 99.7% chance that it will.) It's only when a value falls outside of that defined full range that we could then could truly classify the new unemployment data as "unexpected."

Most often, a point falling outside our expected range of values would be an indication that a new trend may be developing. Or it may be what's called an "outlier," which we would expect to see just 0.3% of the time.

The way we find out which situation applies is to continue observing the data. If the newest data stays outside the old expected range, then it's very probable that a new trend has begun. If there's only one data point that pops outside our expected range of values, then it's what's called an "outlier."

The way we find out which situation applies is to continue observing the data. If the newest data stays outside the old expected range, then it's very probable that a new trend has begun. If there's only one data point that pops outside our expected range of values, then it's what's called an "outlier."

By way of example, the "Cash for Clunkers" program of July 2009 demonstrates how to recognize an outlier in the data. Here, for just one observation, new jobless claims fell outside our expected range of values, before new data resumed following the trend that had been established back on 28 March 2009.

Likewise, we see a similar kind of phenomenon with the trend in new jobless claims in late December of 2008, corresponding to the auto industry bailout, only here, we find that the short-term reduction in the number of jobless claims related to the automotive industry bailout wasn't sufficient to break out of the typical range of volatility that applies for the established trend of that period.

Here, we confirm that the auto industry bailout was indeed the driving factor behind the short-term plunge in new unemployment insurance claim filings in late December 2008 by confirming the typical two-to-three week long lag that we've previously observed takes place between when a change in the economic situation for the U.S. occurs to when it affects new unemployment insurance claim filings. In this case, we identify the establishment of a credible expectation that such a bailout of the automotive industry would occur took hold two to three weeks before new jobless claims were affected, becoming fact just a week later.

Here, we confirm that the auto industry bailout was indeed the driving factor behind the short-term plunge in new unemployment insurance claim filings in late December 2008 by confirming the typical two-to-three week long lag that we've previously observed takes place between when a change in the economic situation for the U.S. occurs to when it affects new unemployment insurance claim filings. In this case, we identify the establishment of a credible expectation that such a bailout of the automotive industry would occur took hold two to three weeks before new jobless claims were affected, becoming fact just a week later.

And as we see in the data for the weeks that immediately followed, that bailout failed to affect the trend in new jobless claims. Meaning that the auto industry bailout failed to save any jobs in the U.S. economy - it really only affected which jobs were lost in the U.S. economy and when they were lost. Which is contrary to what at least one politician has claimed.

As for what finally did alter that trend, let's just say that we've been developing a pretty intriguing hypothesis....

Labels: forecasting, jobs

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.