Unsurprisingly, for those of us who pay attention to the number of companies acting to cut their dividends each month in the U.S. stock market as a real-time indicator of the relative health of the U.S. economy, the first estimate of GDP in the first quarter of 2014-Q1 is consistent with recessionary conditions being present in the economy.

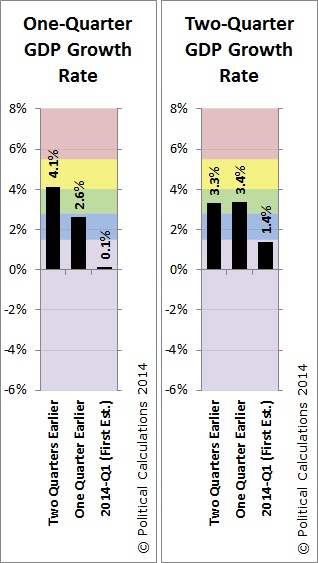

The first estimate of real GDP for 2014-Q1 came in at $15,946.6 billion, up just an annualized 0.1% for the single quarter from 2013-Q4's finalized value of $15,942.3 billion. Averaged over the preceding two quarters, that puts the 2Q growth rate at 1.4%.

These values are shown against the backdrop of typical economic growth recorded since 1980 in our GDP temperature gauge charts. In both, we see that the GDP growth rate initially reported for the first quarter of 2014 puts the U.S.' economic growth rate into the recessionary "cold" range.

Going back to our observation about dividends, what we observe is that the apparent recessionary distress in the U.S. economy began to arrive well in advance of the extreme winter weather that other observers are mistakenly attributing as the sole cause of the economy's poor performance in the first quarter of 2014. While winter weather disrupted a portion of the nation's economy for a short period during 2014-Q1, primarily in the northeast and upper midwest regions of the country, the real primary cause of the low economic growth recorded in the first quarter of 2014 is the outcome of the Fed's decision to begin tapering its Quantitative Easing program and its effect in driving up long-term interest rates from their historic lows.

That increase in interest rates negatively impacted U.S. businesses that are especially sensitive to such changes because it increases their costs for borrowing.

Looking forward, our chart below shows what our modified limo forecasting method predicted for 2014-Q1 and also what it now projects for 2014-Q2:

We'll take a more detailed look at the effect of the Fed's QE tapering on U.S. GDP in upcoming posts.