We found an interesting correlation between how Brent crude oil prices have changed and the value of the S&P 500 since the beginning of 2015:

If one were to consider Brent crude oil prices as a significant driver of the stock market, the two large deviations in stock prices with respect to the trajectory of oil prices might be described as speculative rallies that didn't pan out - they weren't supported by fundamentals.

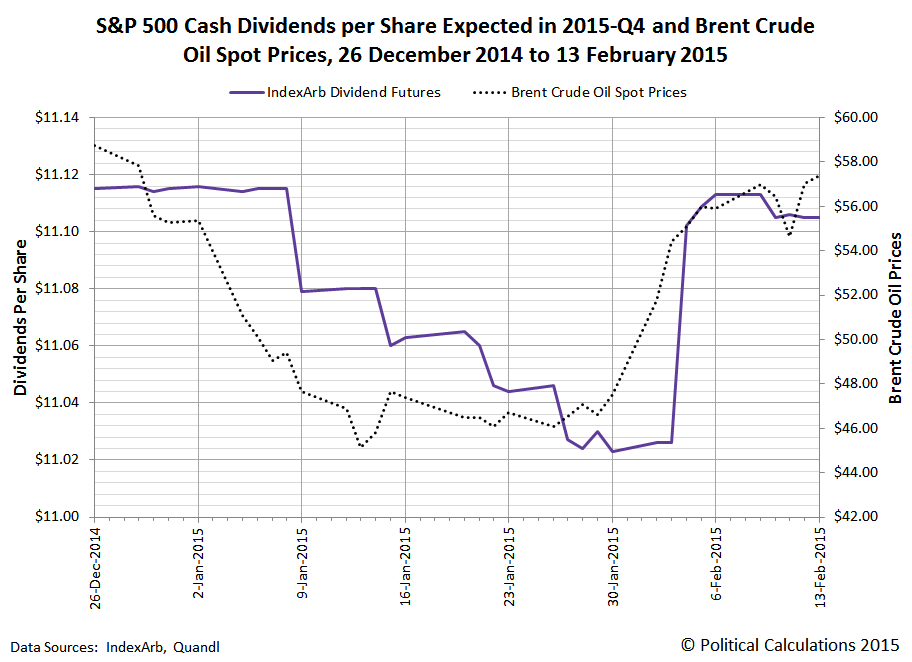

And perhaps the best evidence for that hypothesis to to see how the expectations for future dividends per share evolved with respect to the trajectory of Brent crude oil prices:

Hope this helps clarify the third comeback rally for stock prices in 2015 would seem to have some legs!