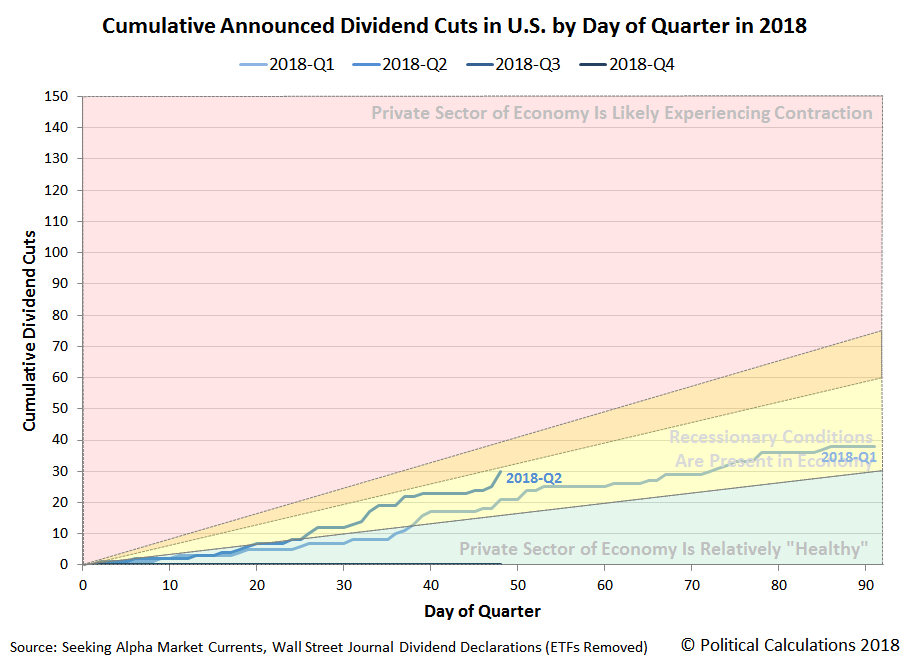

Earnings reporting season for 2018-Q2 is now mostly in the rear view mirror, which makes now a good time to review the state of dividend cuts for the quarter, which are the early warning system of whether any major industrial sectors are experiencing financial distress. Our first chart of two today reveals that compared to the first quarter of 2018, dividend cuts in the second quarter of 2018 have been announced at a faster pace through the current quarter to date.

However, compared to the second quarter of 2017 (2017-Q2), the current quarter of 2018-Q2 is nearly on exactly the same pace.

As for which industrial sectors are being hammered in 2018-Q2, the following sample of firms that have announced dividend cuts in the current quarter offers some insight. The list is presented in chronological order:

- Paradise (OTC: PARF)

- Franklin Street Properties (NYSE: FSP)

- Mesabi Trust (NYSE: MSB)

- Alliant Energy (NYSE: LNT)

- Mesa Royalty Trust (NYSE: MTR)

- Blackstone Group (NYSE: BX)

- Permian Basin Royalty Trust (NYSE: PBT)

- Dynagas LNG Partners LP (NYSE: DLNG)

- SandRidge Mississippian Trust II (NYSE: SDR)

- SunCoke Energy Partners (NYSE: SXCP)

- NuSTAR Energy (NYSE: NS)

- NuSTAR GP (NYSE: NSH)

- Carlyle Group (NASDAQ: CG)

- Och-Ziff Capital Management (NYSE: OZM)

- Aceto (NASDAQ: ACET)

- Apollo Global Management (NYSE: APO)

- AllianceBernstein (NYSE: ABDC)

- Chesapeake Granite Wash Trust (NYSE: CHKR)

- Salient Midstream & MLP Fund (NYSE: SMM)

- ECA Marcellus Trust I (NYSE: ECT)

- TC PipeLines (NYSE: TCP)

- Medley Capital (NYSE: MCC)

- Computer Programs and Systems (NASDAQ: CPSI)

- National Bankshares (NASDAQ: NKSH)

- PermRock Royalty Trust (NYSE: PRT)

- Cross Timbers Royalty Trust (NYSE: CRT)

- San Juan Basin Royalty Trust (NYSE: SJT)

- Enduro Royalty Trust (NYSE: NDRO)

Of the 28 dividend cutting firms in our sample, 16 are in the oil and gas production sector, where we note that 6 of the listings represent firms whose businesses are structured as Master Limited Partnerships (MLP) or Limited Partnerships (LP), which were negatively impacted by a tax rule change that was announced by the U.S. Federal Energy Regulatory Commission in March 2018, which would reduce their earnings and thereby prompt them to cut their dividends. In the oil and gas sector, these are firms that predominantly operate pipelines.

The majority of the remaining 10 dividend cutting oil and gas firms are those that pay monthly distributions of dividends to their shareholders, which fluctuate with their earnings from month-to-month. Here, we suspect that a dip in West Texas Intermediate crude oil prices in the first quarter is showing up as negative noise in the second quarter where these firms dividend announcements are concerned.

The second biggest cutters of dividend payments to their shareholders in 2018-Q2 are to be found in the financial sector, which includes a number of Real Estate Investment Trusts (REIT). Many firms in this sector are sensitive to interest rate hikes, where the Fed has been steadily raising short term rates in the U.S. since December 2016.

The remaining four dividend cutting firms represent the food, healthcare, technology and utility industries respectively.

On the whole, if not for the FERC's tax rule change, we believed that 2018-Q2 would appear stronger than is suggested by our charts above!

Data Sources

Seeking Alpha Market Currents. Filtered for Dividends. [Online Database]. Accessed 18 May 2018.

Wall Street Journal. Dividend Declarations. [Online Database]. Accessed Accessed 18 May 2018.