After last week's failed breakout attempt, the second week of February 2019 saw the level of the S&P 500 (Index: SPX) broke out above our redzone forecast range on Friday, 15 February 2019, boosted by the speculation of improved prospects for a trade deal being reached between the U.S. and China.

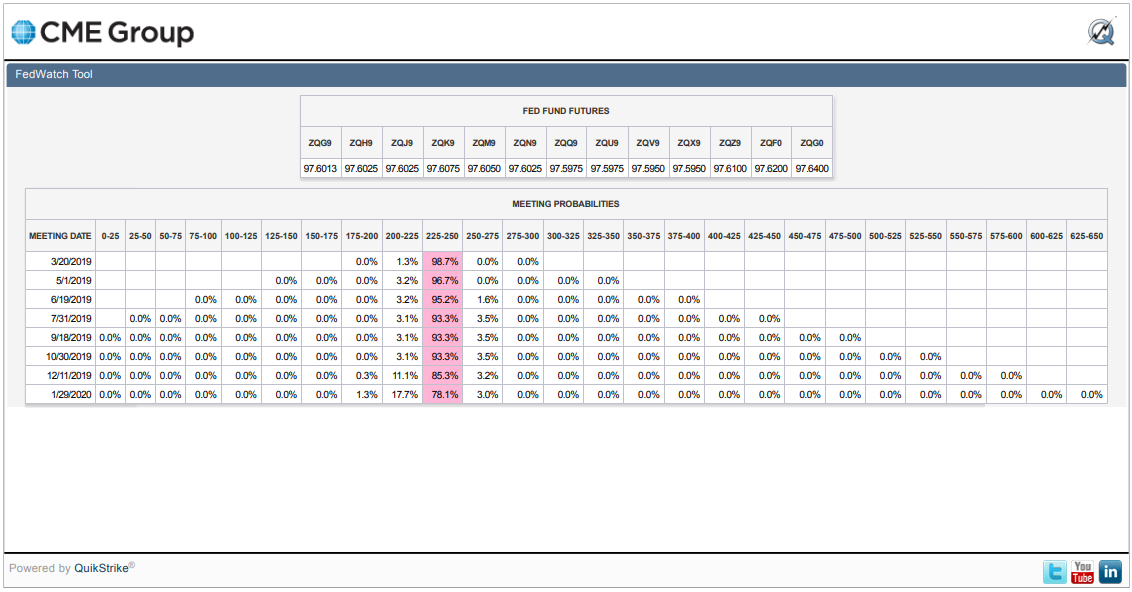

The other big news of the week is that there seems to be a growing consensus at the Fed for no further rate hikes in 2019. In fact, the CME Group's FedWatch Tool is suggesting that investors are giving small, but increased odds of a rate cut in December 2019, though the much greater probability at this point of time is for rates to be held steady at today's Federal Funds Rate target range of 2.25% to 2.50%.

Here's the other headlines of the week that stood apart from the regular noise from the news cycle....

- Monday, 11 February 2019

- Tuesday, 12 February 2019

- Oil gains 1 percent after Saudi Arabia pledges more output cuts

- Bigger trouble developing in China: Debt guarantee tangle: China's private firms hit by default contagion

- Fed to finalize plans to end balance sheet runoff 'at coming meetings': Mester

- Wall Street advances on trade hopes, deal to avert government shutdown

- Wednesday, 13 February 2019

- Oil gains on Saudi output cuts; rally limited by U.S. output

- Despite falling rates, U.S. mortgage applications fall again

- Fed's Mester sees limited inflation risk from rising wages

- Trump: China trade talks going 'very well' before high-level parley

- Wall Street advances on trade hopes, tame inflation data

- Thursday, 14 February 2019

- Friday, 15 February 2019

- Oil rises over 2 percent to 2019 highs on tightening supplies

- Bigger trouble developing in China:

- China's producer prices slow for seventh straight month, raising deflation fears

- Bigger stimulus developing in China: China's banks throw open spigots in January, lend record 3.23 trillion yuan

- Trump says may extend March 1 deadline for China trade deal

- Sputtering auto production sinks U.S. manufacturing output

- Fed policymakers see one U.S. rate hike, or none, as growth slows

- Fed's Bostic: Soft data doesn't change view of above-trend U.S. growth

- Fed's Daly sees no case for rate hike this year: WSJ interview

- Progress in U.S.-China trade talks sparks world stock rally

Elsewhere, Barry Ritholtz scanned the week's markets and economy-related news to identify the positives and negatives, finding six of each, though we wonder if one of the positives (flat inflation) is really a negative....