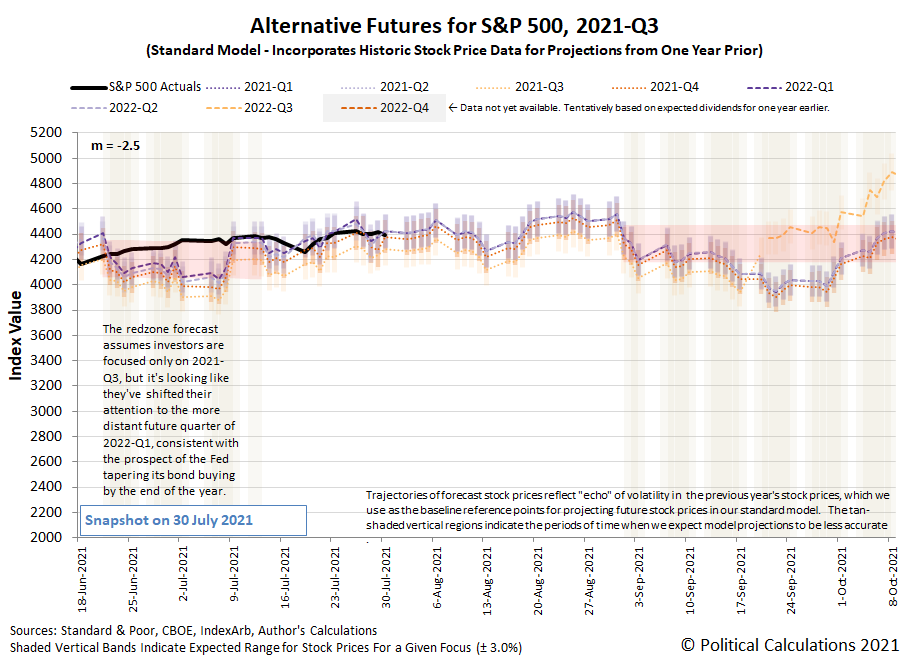

We've officially hit the doldrums of summer for the S&P 500 (Index: SPX). Not much happened in the last week to affect the expections investors have for the future. Consequently, not much happened with stock prices, which traded within a narrow range during the week.

The index continues to generally follow the trajectory associated with investors focusing on 2022-Q1 in setting current day stock prices. Beyond that, even though the Federal Reserve's Federal Open Market Committee met during the week, nothing they said after their meeting was unexpected. What little news there was to move markets in the week ending July 2021 follows below....

- Monday, 26 July 2021

- Signs and portents for the U.S. economy:

- U.S. air travel passengers jumped 19% in May over prior month

- U.S. new home sales hit 14-month low amid supply constraints

- Fed minions have problems to deal with:

- Fed now facing twin inflation, growth risks as virus jumps and supply chains falter

- Fed meeting may test low U.S. Treasury yields

- Take Five: The great Fed conundrum

- Bigger inflation developing all over:

- Brazil interest rates to hit 7.00% this year -cenbank survey

- Inflation and the Bank of England: what its rate-setters are saying

- S&P 500 edges up as investors eye key earnings, Fed meeting

- Tuesday, 27 July 2021

- Signs and portents for the U.S. economy:

- Asian export-driven economies expect slowing:

- South Korea's second-quarter GDP growth hits decade high but risks loom

- Taiwan seen growing at slower pace in second quarter; strong exports support: Reuters poll

- Bigger inflation developing all over:

- China's industrial profit growth slows in June on high raw material prices

- Inflation could pour cold water on Bank of Canada's hot-economy strategy

- Australian CPI blows hot in second quarter, core inflation far cooler

- BOJ minion claims success in creating 2% inflation in Japan after decade of trying:

- U.S. stocks, real U.S. bond yields slip as Fed meets; China tremors

- Wednesday, 28 July 2021

- Signs and portents for the U.S. economy:

- Fed minions to keep stimulus flowing, chief minion says focus is on jobs and not inflation

- U.S. economic recovery intact despite COVID-19 surge, Fed says

- Stocks Blast Off Once Powell Defines "Substantial Further Progress" As Just Jobs, Not Inflation

- Fed establishes standing repo facilities to support money markets

- ECB minions to spend time focusing on side hustle:

- S&P 500 ends off day's lows; Powell says Fed still a ways away from rate hikes

- Thursday, 29 July 2021

- Signs and portents for the U.S. economy:

- Fed minions expected to talk taper of stimulus bond buys:

- Bigger inflation developing all over:

- ECB minions officially okay with inflation running hot:

- Wall St gains with upbeat earnings and forecasts

- Friday, 30 July 2021

- Signs and portents for the U.S. economy:

- U.S. labor costs increase solidly in second quarter

- U.S. consumer sentiment declines in July as inflation remains concern

- Services buoy U.S. consumer spending; inflation pushes higher

- Fed minion expects "Delta" wave feared by Biden won't derail U.S. economy, minions do a booming repo business:

- Fed's Powell bets economy will navigate new coronavirus surge

- U.S. Fed reverse repo volume hits record $1 trillion as debt ceiling looms

- Recovery signs in Eurozone and Mexico, bigger stimulus developing in Japan:

- Euro zone pulls more strongly than expected from recession

- Mexican economy grows strongly on U.S. demand, services

- Japan eyes fresh stimulus package as new curbs weigh on growth

- Wall Street falls with Amazon; S&P 500 posts sixth straight month of gains

We’ll be taking a closer look at U.S. stock market dividends tomorrow, but if you want to see one of our main sources for dividend declaration news, check out Seeking Alpha’s Market Currents filtered for dividends.