The U.S. stock market is nothing if not the most incredible information absorption tool ever developed, continually responding almost instantaneously to the random onset of new information.

But which new information are investors weighting the most in setting their expectations for the future?

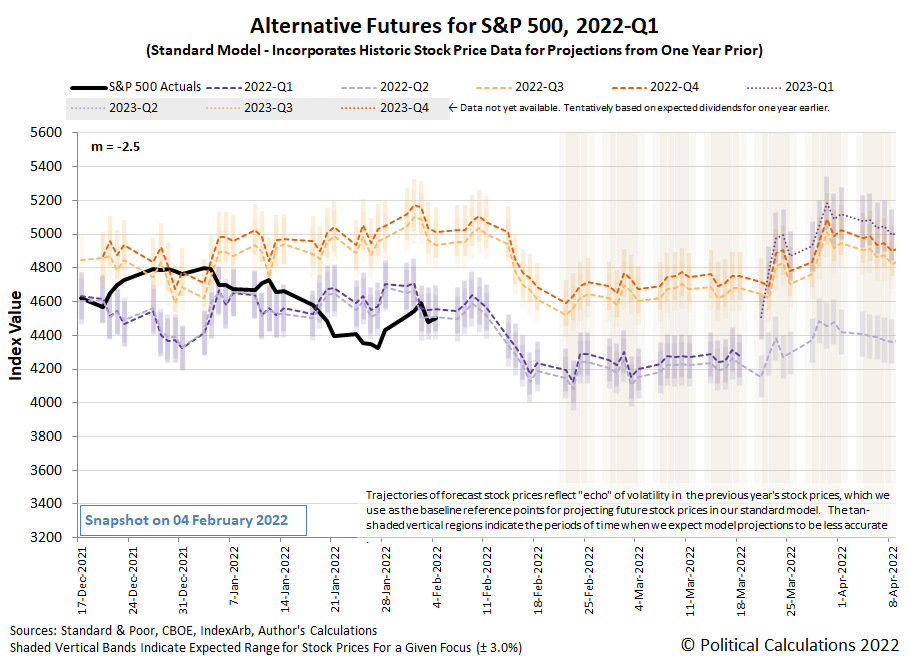

That question arises because we've developed two different scenarios based simply on how investors are factoring the prospects for the Fed's expected rate hikes in 2022. In the first scenario we're presenting in this article, we're assuming that the Fed's recent 26 January 2022 meeting played an outsized role influencing the future expectations of investors, where we find the level of the S&P 500 (Index: SPX) is elevated above where we would expect it to be for investors focusing in on how the Fed will act during the current quarter of 2022-Q1:

In our second scenario, we're treating the Fed's 26 January 2022 meeting as if it were just a noisy outlier temporarily affecting a well established trend, with investors continuing to treat the S&P 500 as they have since 16 June 2021:

In this past week, this second scenario would appear to be the stronger one in terms of explaining the evolution of U.S. stock prices.

Regardless, we expect the S&P 500 to eventually settle according to the assumptions investors are developing for the future, which means we get to keep paying close attention to the one thing that's affecting those assumptions more any any other factor right now. The random onset of new information.

Speaking of which, here's a sampling of what investor had to digest during the first week of February 2022.

- Monday, 31 January 2022

- Signs and portents for the U.S. economy:

- U.S. Treasury yield curve to flatten, possibly invert this year - Standard Chartered

- Oil posts biggest monthly gain in a year on tight supply, political tensions

- Fed minion floats half point rate hike, then tries to walk it back; other minions try being noncommital:

- Fed rate hike could be half-point if needed, says Raphael Bostic - FT

- Fed's George: aggressive balance sheet reduction may allow for fewer rate hikes

- Fed's Barkin says pace of U.S. rate hikes depends on inflation

- Fed sees March rate hike, but no roadmap after that

- Bigger trouble developing in China, Japan, Eurozone:

- China Jan factory activity growth slows, demand wanes as COVID surges

- Japan's factory output dips more than expected as risks emerge

- Euro zone growth slowed in Q4 as Omicron COVID wave hit

- Nasdaq narrowly misses worst January ever as Wall Street gains

- Tuesday, 1 February 2022

- Signs and portents for the U.S. economy:

- U.S. construction spending misses expectations in December

- U.S. job openings increase in December; quits decline

- Oil dips on potential for faster supply OPEC+ boost

- U.S. trade official says China failed to meet 'Phase 1' commitments

- Fed minions try to dial back expectations of more than four rate hikes or a half point rate hike in 2022:

- Fed's Harker says four rate hikes are appropriate for this year

- Bostic: Fed needs to act "soon" to be sure inflation expectations stay controlled

- Fed's Bullard does not think a half-point rate hike 'really helps us' -Reuters interview

- Bigger trouble developing in Japan:

- Mixed economic signs in the Eurozone:

- Euro zone factory growth accelerated in Jan as bottlenecks eased -PMI

- Euro zone jobless rate falls to record low in Dec 2021

- Inflation to cancel out German retail sales growth in 2022 - HDE

- Central banks looking to avoid rate hikes:

- Australia's central bank ends bond buying, but in no hurry to hike

- BOJ under less pressure to shift yield target than market thinks - sources

- Wall St flat in choppy trading after two-day surge

- Wednesday, 2 February 2022

- Signs and portents for the U.S. economy:

- Omicron depresses U.S. private payrolls in temporary setback to labor market

- Oil edges higher after OPEC+ keeps to steady supply bump, U.S. stockpiles draw

- Prospective Fed minions not well matched to appointed tasks?

- ECB minions surprised to find higher inflation than expected in the Eurozone:

- Record euro zone inflation piles pressure on ECB

- Euro zone inflation unexpectedly hits new record high

- Inflation rise hurts growth, euro zone ministers concerned

- Euro zone fiscal support for economy to shrink in 2023 - Eurogroup head

- Stocks extend gains on strong U.S. earnings, weak economic reports

- Thursday, 3 February 2022

- Signs and portents for the U.S. economy:

- U.S. job market faces reshuffling as workers quit at near record rates

- U.S. worker productivity rebounds in fourth quarter; labor costs tepid

- U.S. service sector slows in January; input prices remain elevated - ISM survey

- Oil prices take a breather, OPEC+ sticks to output plans

- U.S. factory orders fall in December; shipments rise further

- Biden's prospective Fed minions say they fear inflation, current Fed minions wants higher rates:

- Fed nominees say inflation is 'grave threat,' vow to fight

- Fed's Barkin says rates should move to pre-pandemic levels, then assess next steps

- Bigger trouble developing in Japan, positive growth signs in S. Korea:

- Japan's service sector shrinks at fastest pace in 5 months - PMI

- S.Korea Jan factory activity grows at fastest pace in 6 months- PMI

- ECB minions thinking about doing something about inflation; BOJ minion thinking about passing on doing something about inflation; Bank of England acts to deal with inflation:

- Inflation risks tilted to upside, ECB's Lagarde says

- Lagarde comments at ECB press conference

- Statement from the ECB following policy meeting

- ECB hawks pushed for dialling back stimulus at Thursday meeting

- ECB opens door to 2022 rate hike in policy turnaround

- BOJ deputy governor Wakatabe says premature to tighten monetary policy now

- BoE hikes rates to fight inflation, but not by enough for 4 officials

- Wall St snaps winning run as Facebook forecast disrupts tech-led recovery

- Friday, 4 February 2022

- Signs and portents for the U.S. economy:

- U.S. heating oil, diesel stocks dwindle as demand rises

- U.S. labor market shrugs off Omicron surge, economy strong ahead of rate hikes

- Oil hits seven-year highs as rally extends to a 7th week

- Fed minions will hike rates by quarter point in March (no half point rate hike):

- Recovery signs in Japan and the Eurozone:

- Japan's economy likely rebounded in Q4 on solid consumption: Reuters poll

- Strong domestic demand boosts German industrial orders in December

- BOJ minion determined to keep stimulus going; ECB minions starting to notice inflation, are expected to raise rates to 0%:

- BOJ Kuroda vows to keep ultra-easy policy in wake of ECB's hawkish shift

- Euro zone firms see wages rising by 3% or more, ECB says

- Nasdaq ends choppy week higher, as Amazon earnings stall tech rout

As of the close of trading on 4 February 2022, the CME Group's FedWatch Tool projects rate hikes in March 2022 (2022-Q1), May 2022 (2022-Q2), July (2022-Q3), and December (2022-Q4). Although we should point out the tool's results look a little haywire right now, in that it forecasts a quarter point rate cut in September, followed by a half point rate hike in December 2022. Based on Reuters' reporting on Friday, 4 February 2022, the Fed is seeking to set expectations for quarter point rate hikes, of which there will be four hikes in 2022 with no cuts if all goes according to plan. (Unless, of course, something really goes wrong with the economy.)

Finally, checking on the Atlanta Fed’s GDPNow tool, it is still forecasting a 0.1% real GDP growth rate for the U.S. economy in the first quarter of 2022.