Bankruptcies are on the rise in the U.S., which is driving a surge of interest in the news media. Here's a series of recent headlines:

- Corporate bankruptcies climb year-to-date, tracking toward more normal levels

- Corporate bankruptcies are on the rise — and the pain won’t end for a while

- Corporate bankruptcies are creeping up as pressures in the economy grow

- The credit crunch is driving more bankruptcies and could spark a domino effect of defaults at larger firms, investment manager says

- FirstFT: Corporate bankruptcies rise as US credit squeeze tightens

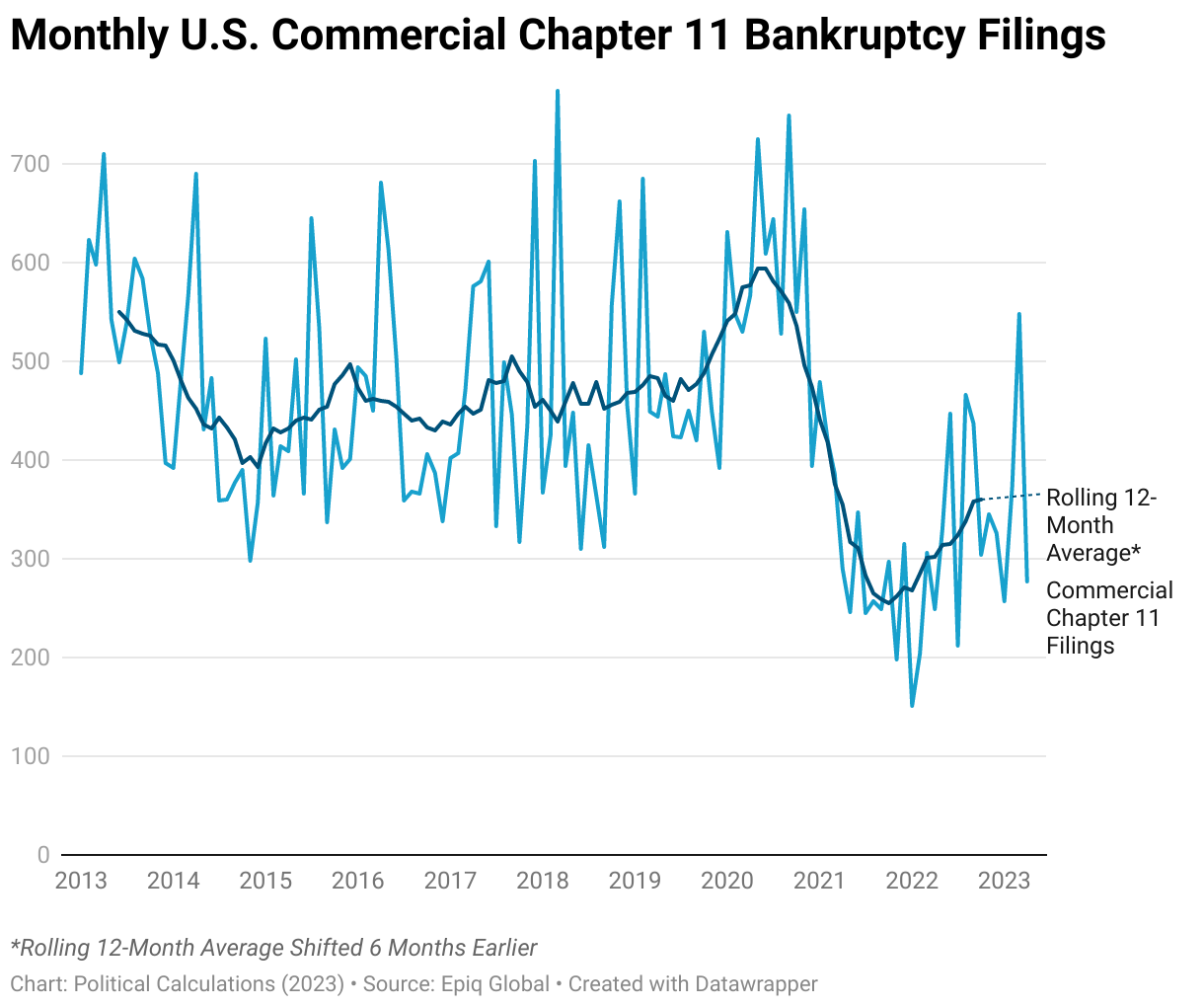

Most of the reports either don't do much to communicate what kind of numbers are being talked about, or in the case of the FT article, focus on a subset of commercial bankruptcy data so it presents an incomplete picutre. We threw together the following chart using data from Epiq Global/Epiq Bankruptcy to track the monthly number of commercial Chapter 11 bankruptcy filings over the past 10 years to provide some longer term context.

Based on what we see in the chart, the first headline provides the best description of where things stand today. The rest are looking forward to a future that's still developing. The big, unanswered questions are when will the current rising tide of commercial Chapter 11 bankruptcies peak before beginning to recede, and how high will the number of filings get before it does?

Image credit: Photo by Melinda Gimpel on Unsplash.