The World Trade Organization is finally catching on that global trade isn't growing like they thought it would.

That's the big takeaway from the WTO's just-released report on their updated forecast for the growth of global trade in 2023. They're still forecasting positive growth for the year but they are now expecting it will be less than half as much as they were just six months ago. They're also describing the decline in trade as "broad-based".

Here is how the WTO's report describes the change in their forecast for 2023:

The 0.8% forecast for world trade in 2023 represents a downward revision of 0.9 percentage points from the previous forecast of last April, which predicts a 1.7% increase in merchandise trade. Reasons for the downgrade include a 1.1 percentage point reduction in the 2023 forecast for North America and a 3.0 percentage point reduction in the forecast for Asia. While the revision of European imports was smaller (0.1 percentage points), contraction was already expected for the region. These three regions account for the vast majority of global demand for imported goods, 88% of the total in 2022.

We've been tracking the United States' trade with the world and China, which happens to make up a big part of the reduction the WTO is reporting. The following chart shows the combined value of goods imported and exported between the U.S. and the world, both with and without China.

The WTO's report indicates global trade growth began slowing in the fourth quarter of 2022, which coincides with the timing of when trade between the U.S. and China began dropping off. Since February 2023 however, trade between the U.S. and the rest of the world has also been dropping off.

Using a simple linear projection of how trade between the U.S. and the rest of the world (minus China) grew between October 2022 and February 2023, we can estimate how big those declines have become during the time the United States' trade with the rest of the world has been in decline. The gap between the U.S. and the world not including China has grown to $21.5 billion in August 2023 and the net cumulative gap through that time is $76 billion. Applying the same linear trade growth projection to total U.S. trade with the world, including China, we estimate the gap for August 2023 is $31.5 billion with a net cumulative gap of almost $123 billion.

The next chart focuses on the trade in goods between just the U.S. and China, which illustrates the deviation between a counterfactual based on the recovery in trade between the two countries after the Great Recession since October 2022:

Here, the gap between the counterfactual of how trade would have grown if its post-pandemic recovery not been altered since October 2022 has grown to $13.1 billion in August 2023. Since October 2022, we estimate almost a cumulative $69 billion in trade has been lost just between the U.S. and China. We estimate about $56 billion of that total loss has occurred since February 2023.

References

U.S. Census Bureau. Trade in Goods with China. Last updated: 5 October 2023.

U.S. Census Bureau. Trade in Goods with World, Not Seasonally Adjusted. Last updated: 8 August 2023.

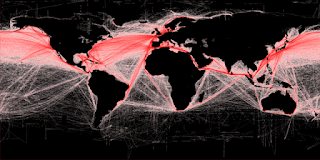

Image credit: Commercial shipping density image by B.S. Halpern (T. Hengl; D. Groll) via Wikimedia Commons. Creative Commons. CC BY-SA 3.0 DEED.