The market capitalization of the U.S. new home market dipped in January 2024. At an initial estimate of $26.63 billion, it was down about 1% from December 2023's revised estimate of $26.98 billion. The valuation of new homes sold in the U.S. has been trending downward since September 2023, when it recorded a value of $28.30 billion.

The new home market cap also remains some 11.6% below its post-housing bubble peak of $30.12 billion, which was recorded in December 2020. That month represents the high water mark for the recovery of U.S. new home builders following the deflation of the early 2000's housing bubble.

The U.S. Census Bureau's initial estimate of the average price for a new home sold in January 2024 is $534,300, which is up significantly from December 2023's revised estimate of $493,400. The seasonally-adjusted and annualized number of new homes sold in January 2024 is 661,000, which was an increase from the preceding month's 651,000. These upward changes were not enough to alter the downward trend for the U.S. new home market cap however.

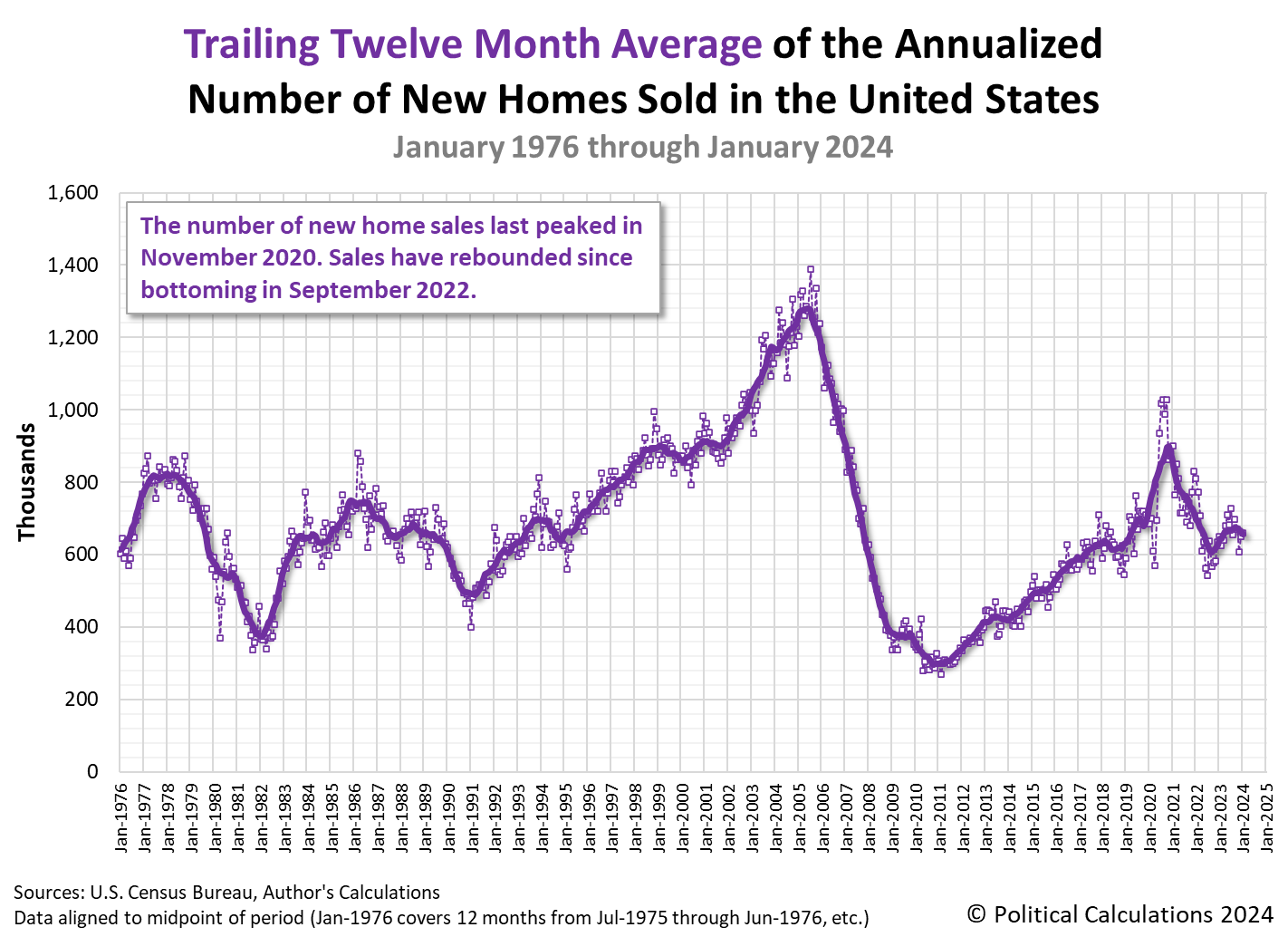

The following charts track the trends for the U.S. new home market capitalization, number of new home sales and new home sale prices as measured by their time-shifted, trailing twelve month averages from January 1976 through January 2024.

Considering the state of the market, the same "golden handcuffs" phenomemon that has hamstrung the existing home sales market in 2022 and 2023 is both very real and has continued into 2024. The phenomenon is boosting new home sales, which could have even higher in January 2024 if not for unusually cold weather, particularly in the southern region of the United States.

Both these factors are prominently mentioned in news reports on January 2024's new home sales figures.

Sales of new U.S. single-family homes rose less than expected in January amid a sharp decline in the South region, but demand for new construction remains underpinned by a persistent shortage of previously owned homes.

New home sales increased 1.5% to a seasonally adjusted annual rate of 661,000 units last month, the Commerce Department's Census Bureau said on Monday. The sales pace for December was revised lower to 651,000 units from the previously reported 664,000 units.

"The new side of the housing market continues to greatly outperform when measured against the market for existing homes," said Daniel Vielhaber, an economist at Nationwide. "As the existing home inventory shortage persists, buyers continue to be pushed into the market for new homes."

Economists polled by Reuters had forecast new home sales, which account for about 14.2% of U.S. home sales, would rise to a rate of 680,000 units. Large parts of the country experienced freezing temperatures in January, which could have kept some potential buyers home. The frigid weather weighed on retail sales, homebuilding and factory production in January.

To see what they mean about unseasonably cold weather in much of the U.S. Census Bureau's "South" region, we pulled the NOAA's climate data for January 2024. Here are maps showing what average temeratures are in the lower 48 contiguous states and where temperatures were either unseasonably warm or cold.

The number of sales were up in the Northeast, Midwest, and West, significant portions of which were unseasonably warm. That sales were down in the South with unseasonably cold weather is consistent with the hypothesis new home sales were affected by January 2024's weather.

The same article also indicates U.S. mortgage rates also crept back up toward the 7.0% threshold during the month. We'll check out the effect of that on the affordability of new homes in the very near future.

References

U.S. Census Bureau. New Residential Sales Historical Data. Houses Sold. [Excel Spreadsheet]. Accessed 26 February 2024.

U.S. Census Bureau. New Residential Sales Historical Data. Median and Average Sale Price of Houses Sold. [Excel Spreadsheet]. Accessed 26 February 2024.

Image credit: Stable Diffusion DreamStudio Beta. Prompt: "A photograph of a new home that is under construction."