It was a good week for the S&P 500 (Index: SPX) jumped almost 2.7% over the previous week. The index closed the fourth week of April 2024 at 5,099.96.

There were three main drivers behind the positive change from the preceding week:

- The world's biggest publicly-traded company Microsoft (NASDAQ: MSFT) experienced what one analyst called a "drop the mic moment", as its cloud computing division and especially its artificial intelligence (AI) initiatives boosted its bottom line.

- Alphabet (NASDAQ: GOOG and GOOGL) also reported booming earnings and announced it would initiate a dividend to shareholders of its stocks. The company's market cap surged above $2 trillion on that news.

- The expected timing for when the Fed will cut interest rates stopped slipping. The CME Group's FedWatch Tool held steady in anticipating the Fed will hold the Federal Funds Rate steady in a target range of 5.25-5.50% until 18 September (2024-Q3), the same as expected a week earlier, but now looking much less shaky. The tool projects the Fed will cut the rate by 0.25% on that date, which is now expected to hold at its new level for the next six months.

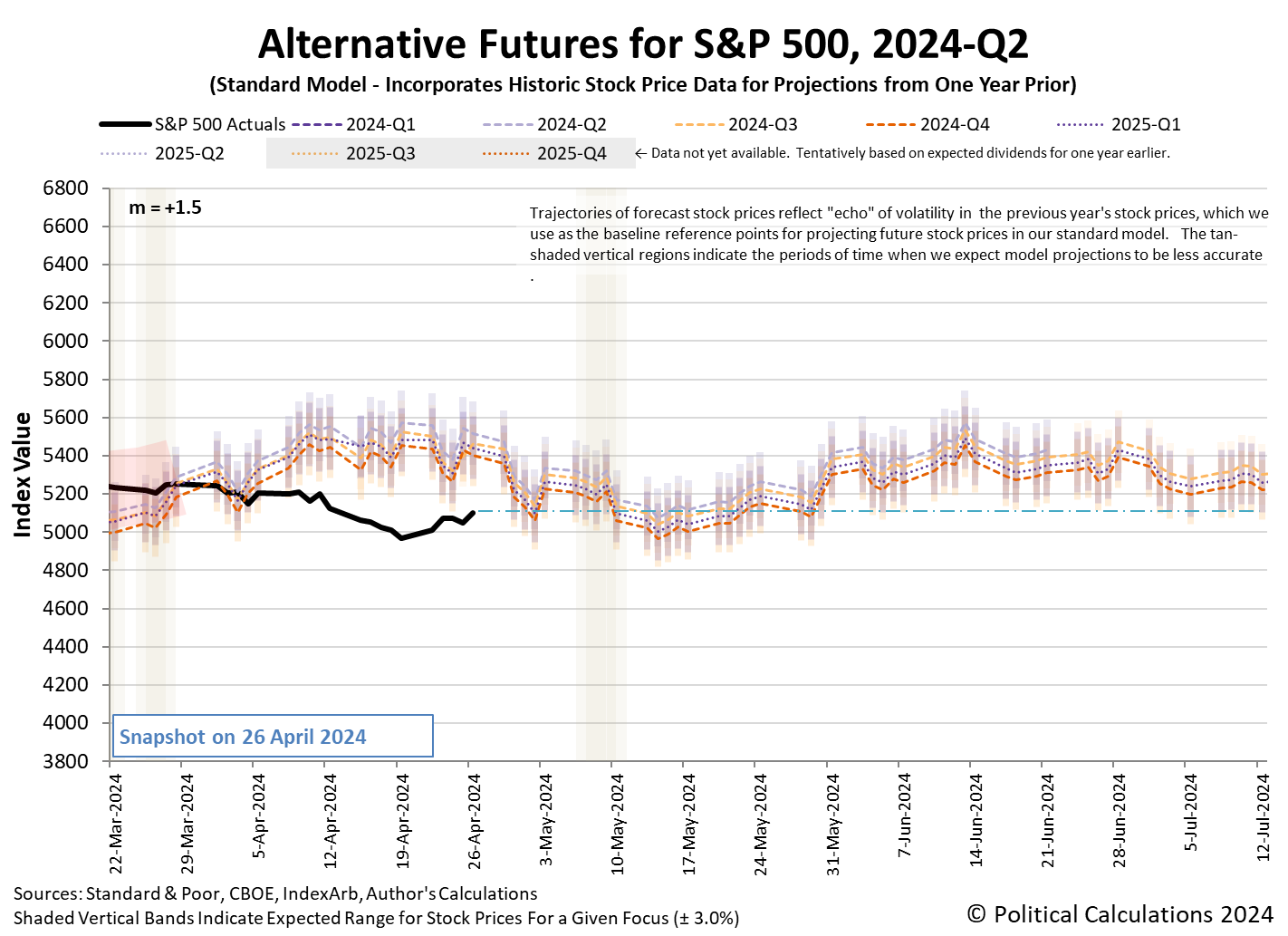

We think that last development to prompted investors to shift their forward investment horizon from 2024-Q4 back toward 2024-Q3. Here's the latest update of the alternate futures chart.

Here are the week's other market-moving news headlines:

- Monday, 22 April 2024

-

- Signs and portents for the U.S. economy:

- IMF's Gopinath says high U.S. deficits fueling growth, higher interest rates

- US consumers on lower incomes face loan stress while banks pull back

- Fed minions feel "no urgency" going into pre-FOMC meeting blackout period:

- Bigger trouble developing in China as tax cut stimulus takes effect:

- Souring China dreams force Western financial firms to cut costs

- China's state planner warns intensified EV price war on oversupply

- China's Q1 fiscal revenue falls as tax cut policies weigh

- BOJ minions thinking about hiking rates, propping up yen:

- ECB minions excited about cutting rates in June 2024, getting tired of following Fed's lead:

- Middle East tensions should not delay ECB's June rate cut, Villeroy says

- ECB governors fear political pressure over Fed-style 'dot plot'

- Nasdaq, S&P, and Dow closed on top as earnings season rolls on

- Tuesday, 23 April 2024

-

- Signs and portents for the U.S. economy:

- US business activity cools in April; inflation measures mixed

- Oil falls back after robust EU data as Mideast tensions linger

- Shortages key to copper's upward price trajectory to new peaks

- US new home sales rebound to six-month high; rising mortgage rates a concern

- BOJ minions say they'll hike interest rates if inflation rises above their target, preparing to prop up yen:

- BOJ will hike rates if trend inflation accelerates, gov Ueda says

- Yen's slide toward 160 level could trigger action, says senior ruling party official

- Japan may intervene to support yen any time, says senior ruling party official

- Japan issues strongest warning yet on readiness to intervene in currency market

- ECB minions thinking about cutting rates to prop up Eurozone economy:

- ECB governors stick to plan for multiple rate cuts despite global headwinds

- June ECB rate cut firmly in play; but slower easing now expected

- Nasdaq, S&P, Dow rise as Wall Street rebounds for a second straight day; Tesla reports

- Wednesday, 24 April 2024

-

- Signs and portents for the U.S. economy:

- Slow, but solid US economic growth anticipated in Q1; inflation likely heats up

- Oil settles lower as U.S. business activity cools, concerns over Middle East ease

- Bigger bailouts developing in China:

- Country Garden allowed to postpone first payments on three onshore bonds

- Exclusive: China turns the heat up on cross-border investments in local govt debt, sources say

- BOJ minions thinking more about how and when to prop up yen:

- ECB minions thinking about what to do after they start cutting rates:

- Nasdaq, S&P, Dow end little changed amid Tesla surge, industrials slump & rise in yields

- Thursday, 25 April 2024

-

- Signs and portents for the U.S. economy:

- Q1 US GDP shows surprise slowing and uncomfortable inflation

- Oil eases as US demand concerns outweigh Middle East fears

- Fed minions whinging over mixed signals sent by U.S. economic data:

- Confounding US economic, inflation data muddy Fed's rate path

- Weak GDP, strong prices, highlight Fed dilemma

- BOJ minions getting more worried about falling yen, thinking they may have to do something about it:

- ECB minions worry about inflation, Eurozone government officials want to make ECB minions worry about more than that:

- ECB most concerned about wages, services, Schnabel says

- ECB should not only target inflation, Macron says

- Nasdaq, S&P, Dow dip after GDP print fans stagflation worries; Meta plunges post earnings

- Friday, 26 April 2024

-

- Signs and portents for the U.S. economy:

- Fed minions still expected to deliver rate cut in September 2024:

- BOJ minions do nothing to change interest rates to combat inflation or to prop up Japan's currency:

- BOJ keeps low rates, hints of future rate hikes fail to stem yen fall

- Japan frets over relentless yen slide as BOJ keeps ultra-low rates

- Microsoft, Alphabet gains propel Nasdaq to best day since Feb; S&P, Dow also rise

The U.S. Bureau of Economic Analysis' first estimate of the real GDP growth rate in 2024-Q1 is +1.6%, well below the +2.9% growth rate forecast by the Atlanta Fed's GDPNow toola week ago. The BEA will revise its GDP growth rate estimate twice during the next two months. In the meantime, the Atlanta Fed's GDPNow tool has turned its forward-looking focus to how fast real GDP will grow during 2024-Q2 with an initial forecast of +3.9% growth for the quarter.

Image credit: Microsoft Copilot Designer. Prompt: "An editorial cartoon of a jumping bull wearing a sign"