The S&P 500 (Index: SPX) pulled back from last week's record high close. The index ended the first trading week of April 2024 at 5,204.34, a little under one percent below where it ended up the week before.

Two factors combined to produce that outcome. On Monday, 1 April 2024, signs that oil prices are likely to rise in the months ahead pushed up inflation expectations. Later in the week, several Fed officials responded by trying to dial back expectations for when they will start cutting interest rates. After the preceding weeks, when Fed officials had all but committed to cutting rates several times in 2024, the effect was to reverse the momentum for rate hikes.

The CME Group's FedWatch Tool still projects the Fed will hold the Federal Funds Rate steady in a target range of 5.25-5.50% until 12 June 2024 (2024-Q2), but that's now looking very shaky. After last week's news, the tool indicates investors are now giving a little over a 50% chance of a rate cut taking place at that date.

Not unsurprisingly, investors responded by shifting their time horizon from 2024-Q2, where they had previously fixed it in anticipation the Fed would announce rate cuts after its meeting in June 2024, toward the more distant future quarter of 2024-Q4.

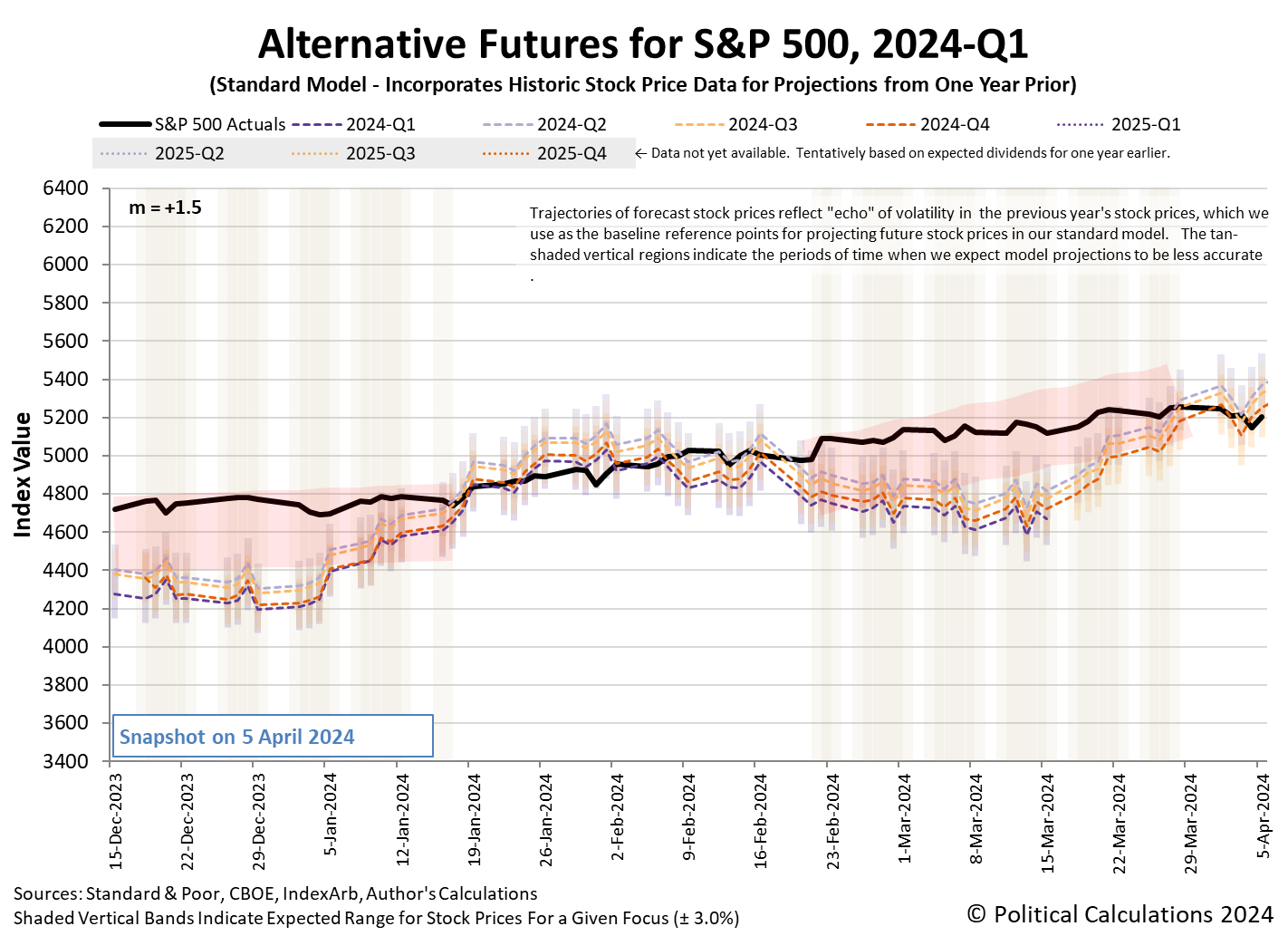

That change can be seen in the latest update of the alternative futures chart, where the trajectory of the S&P 500 has shifted from the trajectory associated with investors focusing on 2024-Q2 toward the alterate trajectory associated with investors fixing their attention on 2024-Q4.

Assuming that change holds, it represents a new Lévy flight event for stock prices, which occur whenever investors are prompted by the random onset of new information to shift their investing time horizon.

As for the new information that prompted the change, you'll find the market-moving headlines captured in the following summary of the past week's newstream.

- Monday, 1 April 2024

-

- Signs and portents for the U.S. economy:

- Relentless US credit demand seen driving second-quarter rally

- Oil up 1%, US WTI at 5-month closing high, market seen tight

- US manufacturing on the mend; rising raw material prices pose obstacle

- US construction spending falls for second straight month in February

- Fed minions say they saw inflation fall in February 2024, are all over the map on rate cuts:

- NY Fed inflation gauge sees cooler price pressures in February

- Fed hawks and doves: U.S. central bankers in their own words

- Recovery signs developing in China, trouble elsewhere in Asia:

- Asia factory activity slumps, brighter signs emerge in China

- China's forecast-beating data buys officials time to figure out fix

- China's new home prices rise at fastest pace in over 2-1/2 years, survey shows

- China's factory activity expands at fastest clip in 13 months, Caixin PMI shows

- China's March factory activity expands for first time in six months

- Japan's March factory activity shrinks at slower pace, PMI shows

- South Korea factory activity contracts in March as weak domestic demand drags, PMI shows

- ECB minions gearing up for rate cuts before Fed starts cutting:

- Dow, S&P, and Nasdaq ended mixed while Treasury yields pushed higher

- Tuesday, 2 April 2024

-

- Signs and portents for the U.S. economy:

- OPEC+ unlikely to change output policy at April 3 meeting

- US new vehicle sales likely rose in Q1, to extend recent streak

- Tesla quarterly deliveries decline for the first time in nearly four years

- GM's first-quarter US auto sales slip 1.5%

- Toyota reports 20% jump in first-quarter US auto sales

- GM's first-quarter US sales dip on lower commercial deliveries but beats Toyota

- US factory orders increase solidly in February

- US, Canadian companies kick off 2024 with layoffs

- Fed minions say to expect three rate cuts in 2024, possibly starting in June:

- Fed's Daly says 3 rate cuts this year 'reasonable'

- Fed's Mester says it's possible data may support June rate cut

- Really positive growth signs in India:

- BOJ minions told to keep never-ending stimulus unalive:

- Japan panel calls for shift away from stimulus-driven economy

- Japan's money printing slows as BOJ moves away from radical stimulus

- ECB minions get green light to start cutting rates:

- Slow start to second quarter continues, though Nasdaq, S&P, Dow end off session lows

- Wednesday, 3 April 2024

-

- Signs and portents for the U.S. economy:

- Brent oil futures rise towards $90 as supply risks intensify

- Crude oil pushes higher on global tensions, signs of strong U.S. gasoline demand

- OPEC+ ministers keep oil output policy steady, sources say

- Exxon Mobil signals weaker oil and gas prices to hit first-quarter profit

- US services sector cooling; input price increase slows considerably

- Fed minions start flashing brake lights on road to rate cuts:

- Powell sticks with Fed's cautious rate-cut strategy

- Fed's Adriana Kugler sees 'some lowering' of benchmark rate this year

- Fed's Kugler says disinflation "to continue"

- Stimulus getting traction in China:

- China's services activity growth speeds up in March, Caixin PMI shows

- China eases car loan policy for first time since 2018 to boost demand

- Global central bank rate cuts get underway:

- Former JapanGov officials set expectations for what will happen if yen needs to be bailed out:

- Japan likely to intervene if yen falls well below 152 vs dlr, says ex-FX diplomat Yamazaki

- Japan won't intervene unless yen slides below 155, says ex-FX diplomat Watanabe

- ECB minions keep looking to Fed for direction on rate cuts, getting tired of Eurozone bank bailouts:

- ECB's Holzmann warming to June rate cut but keeping an eye on Fed

- Euro zone inflation unexpectedly eases, boosting rate cut case

- ECB's central scenario points to interest rate cut in June, De Cos says

- Nasdaq, S&P, Dow end mixed as Intel, Disney drag offsets Powell's wait-and-see message

- Thursday, 4 April 2024

-

- Signs and portents for the U.S. economy:

- US labor market still tight; trade seen subtracting from Q1 growth

- US employment boom leaves factory workers behind

- OPEC+ gets oil price to its sweet spot, the trick is keeping it there

- Fed minions spell out what they want to see in inflation data before starting rate cuts:

- Exclusive: Fed's Barkin: Confidence to cut rates requires breadth of inflation to narrow

- Fed's Goolsbee says housing price pressures pose biggest inflation risk

- Fed's Kashkari says 2024 rate cuts under threat if inflation continues to stall

- BOJ minions to act to bail out yen if needed:

- ECB minions getting excited about cutting rates in June 2024:

- Nasdaq, S&P, Dow shed over 1% each as investors brace for nonfarm payrolls report

- Friday, 5 April 2024

-

- Signs and portents for the U.S. economy:

- March US payrolls beat expectations; wages increase steadily

- Oil prices climb more than $1 per barrel on supply risk

- 'Upside' inflation risks keep Fed officials wary of turn to rate cuts

- Fed's Bowman says time hasn't arrived for cutting rates

- Fed's Logan says 'much too soon' to think about interest rate cuts

- Fed's Barkin: "That's a quite strong jobs report"

- BOJ minions getting excited to hike interest rates higher into positive territory:

- Bank of Japan hints at near-term rate hike, pushing yields higher

- Japan's coincident index slumps in sign of weakening economic momentum

- S&P 500 sees worst week of 2024 as strong labor market data dents rate cut hopes

The Atlanta Fed's GDPNow tool's latest estimate of real GDP growth for the first quarter of 2024 (2024-Q1) increased to +2.5% from the +2.3% level anticipated last week.

Image credit: Microsoft Copilot Designer. Prompt: "An editorial cartoon of a bull driving a car that has had to stop because a Federal Reserve official stepped out in front of it, with the Federal Reserve official looking at a map but appearing lost". That prompt is pretty different from the image we got, but we were able to make it work. Just pretend the prompt we gave was "An editorial cartoon of a Federal Reserve official getting lost while driving on the road to rate cuts as a bull looks on."