Every three months, we take a snapshot of the expectations for future earnings in the S&P 500 (Index: SPX) at approximately the midpoint of the current quarter, shortly after most U.S. firms have announced their previous quarter's earnings.

Since our last update three months ago, expectations for the S&P 500's earnings have improved. The S&P 500's earnings per share had been expected to return to their March 2022 peak of $197.91 after June 2024, but now looks like it will hit that mark before the end of 2024-Q2.

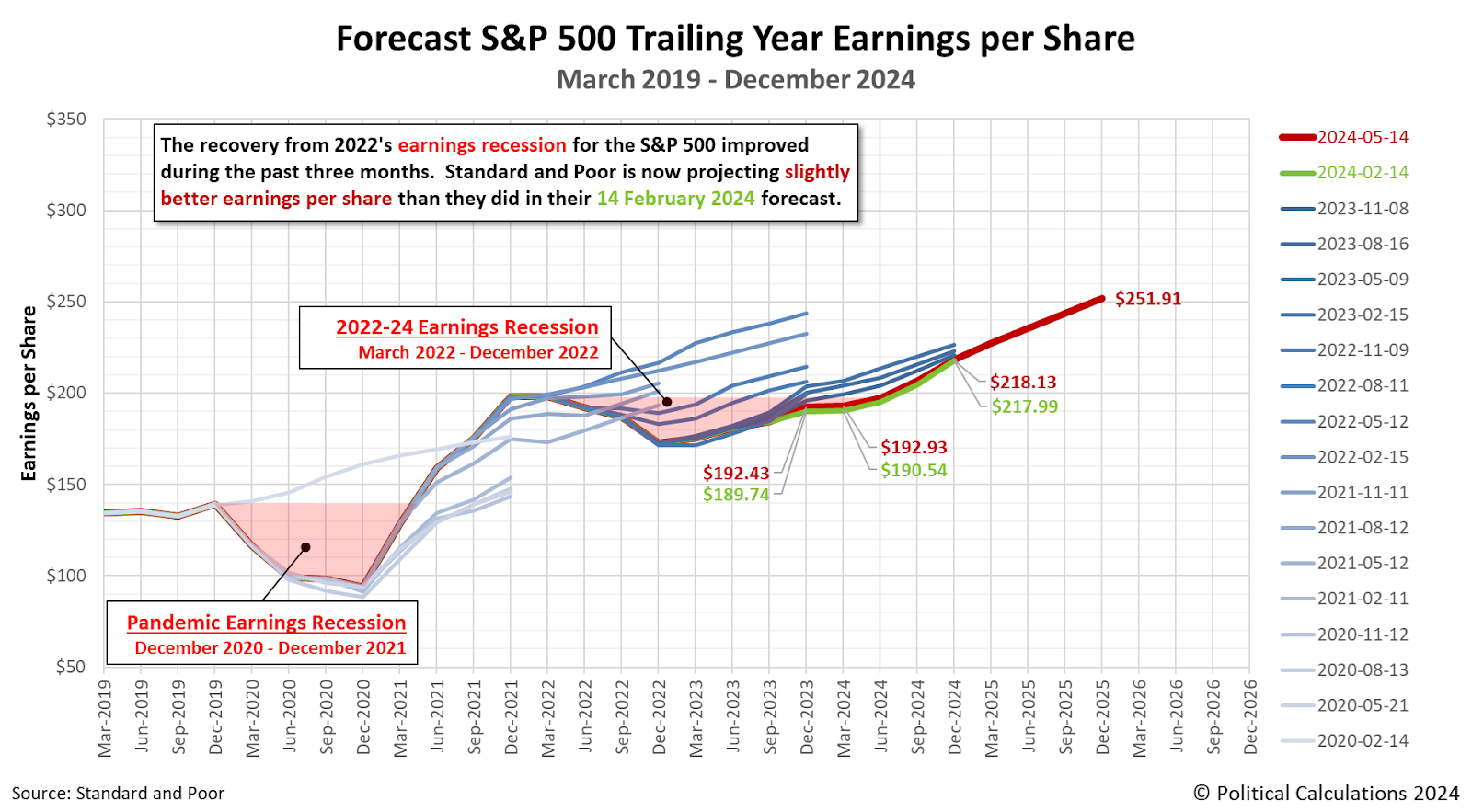

Here is a summary of the major observations that may be seen in the changes of Standard & Poor's earnings projections from 14 February 2024 to 14 May 2024:

- Earnings per share for 2023-Q4 increased from a projection of $189.74 to a finalized figure of $192.43.

- Projected earnings for 2024-Q1 improved from $190.54 to $192.93 per share.

- S&P projects faster earnings growth during the second half of 2024, improving from $217.99 to $218.13 per share by the end of the year.

- The first projection of where the S&P 500's earnings per share will be at the end of 2025 is $251.91.

The following chart reveals how the latest earnings outlook has changed with respect to previous snapshots:

If you look at the historic earnings expectations shown on the chart, particularly the period since 2021, you'll notice a negative pattern in which later projections for earnings are less optimistic than the projections that preceeded them. This is the 'typical' pattern we see in these earnings projections.

About Earnings Recessions

Depending on who you talk to, an earnings recession has one of two definitions. An earnings recession exists if either earnings decline over at least two consecutive quarters or if there is a year-over-year decline over at least two quarters. The chart identifies the periods in which the quarter-on-quarter decline in earnings definition for an earnings recession is confirmed for both the Pandemic Earnings Recession (December 2020-December 2021) and the new earnings recession (March 2022-December 2022) according to the first definition. The regions of the graph shaded in light-red correspond to the full period in which the S&P 500's earnings per share remained below (or are projected to remain below) its pre-earnings recession levels.

Let's define what a "double-dip" earnings recession would be in case that becomes relevant at the time of our next update. This term describes the situation where after having begun to recover, the S&P 500's earnings per share stops rising and falls without having recovered to its pre-earnings recession level.

Our next snapshot of the index' expected future earnings will be in three months. With the improvement in the earnings outlook over the past three months, we should be able to confirm the full recovery from 2022's earnings recession. Then again, at the end of 2023, we didn't expect that recovery would stretch out as it has, so there is the possibility things will turn to be more negative.

Reference

Silverblatt, Howard. Standard & Poor. S&P 500 Earnings and Estimates. [Excel Spreadsheet]. 14 May 2024. Accessed 15 May 2024.

Image Credit: Microsoft Copilot Designer. Prompt: "A crystal ball with the word 'SP 500' written inside it". And 'Earnings' written above it, which we added.