As expected, stock prices gapped up to start the fourth week of May 2018 thanks to a deal between the U.S. and China to not impose new tariffs on each other's goods, but beyond that move, didn't do very much else during the rest of the week.

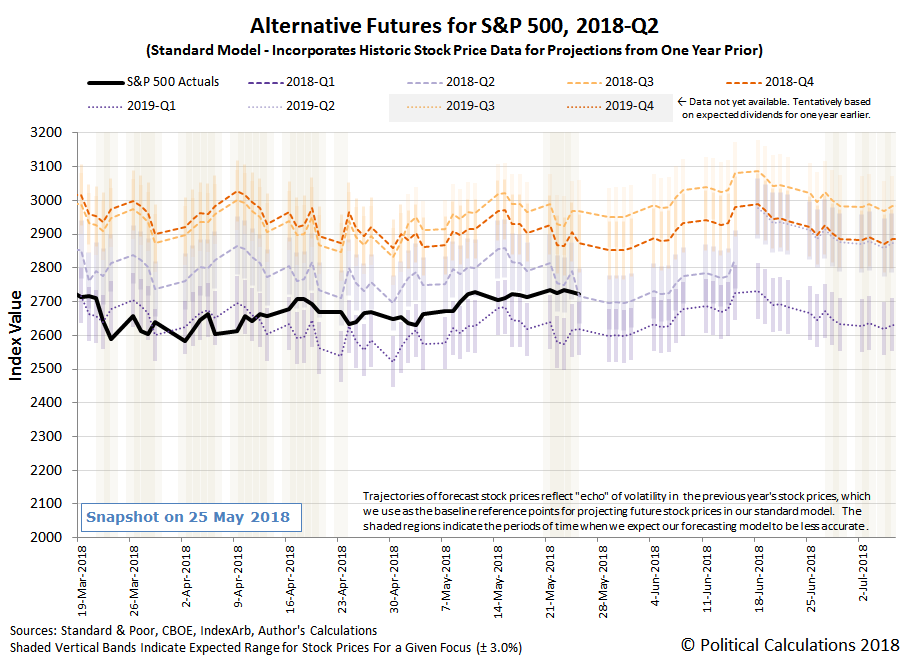

Update 29 May 2018: We missed a change in 2018-Q2's dividend futures that occurred last Friday. We've corrected the chart above, the original version of the chart may be found here.

Then again, that might have been expected too for a week preceding a long holiday weekend in the U.S., which not uncoincidentally, made for a pretty slow news week.

- Monday, 21 May 2018

- Oil rallies to multi-year highs on Venezuela worries

- Fed's Bostic repeats U.S. close to Fed's inflation, employment goals

- Fed's Harker looking for sustained U.S. inflation near target

- Harker could back 3 more Fed rate hikes in face of U.S. inflation

- Wall St. rises on trade war truce; industrials lead

- Tuesday, 22 May 2018

- Wednesday, 23 May 2018

- Oil falls on shock U.S. stock builds, OPEC supply worries

- Trump calls for new 'structure' for U.S.-China trade deal

- China's Sinopec to boost U.S. crude imports to all-time high: sources

- U.S.-China trade row sows confusion in farmer planting plans

- Trump blasts Mexico, Canada over NAFTA talks

- U.S. new home sales fall in April, housing market treading water

- Wall St. ends up as Fed seen keeping gradual approach to rate hikes

- Thursday, 24 May 2018

- Fed could end tightening cycle in 2019: Harker on CNBC

- Tight supply weighs on U.S. home sales; job market strengthening

- China plans to cut import tariffs on some consumer goods from July 1: Bloomberg

- Wall Street dips after Trump cancels North Korea summit; Netflix gains

- Wall St. ends down slightly on trade, oil price concerns

- Friday, 25 May 2018

Elsewhere, Barry Ritholtz identified the week's positives and negatives for the U.S. economy and markets.

Welcome back from the holiday!