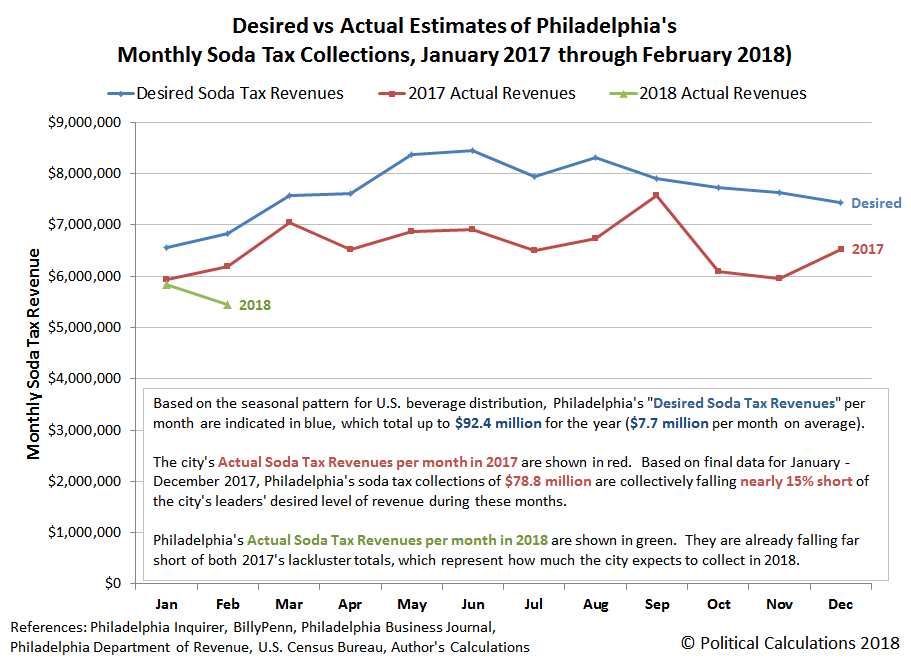

In 2017, the revenue that the city of Philadelphia saw from its controversial soda tax fell far short of city leaders' expectation that it would bring in $92.4 million in its first year. So much so that the city's mayor, Jim Kenney, scaled back his ambitions for how much money the city would collect in the future to match the city's actual soda tax revenue of $78.8 million.

Now in its second year, the city's tax revenues from the Philadelphia Beverage Tax are falling short of those reduced expectations, where the city has just recorded its lowest ever monthly total since the tax went into effect in January 2017.

The money from the city's soda tax was intended to fund a universal pre-K school program, community schools, as well as improvements to public parks in the city. However, because the constitutionality of the tax is being challenged in Pennsylvania's state courts, at least $62 million that has been collected from the tax has instead been kept, unspent, in the city's general fund.

Unfortunately, the city now has an additional fiscal management problem, in that millions of dollars in the Philadelphia's general fund may have gone missing from the city's main bank account.

The City of Philadelphia isn’t sure where $33.3 million went from its largest cash account.

City Controller Rebecca Rhynhart called it “unacceptable.”

“It could be the money was mistakenly deposited in the wrong city account,” she said. “It could be worse. It could be that a portion of it is actually missing or it could be theft.”

While the initial total of unaccounted money was over $33 million, that figure has been reduced to $27 million of tax revenue that has gone missing over the last several weeks. As yet, Philadelphia city officials have no good explanation for where that money has gone.

Previously on Political Calculations

We've been covering the story of Philadelphia's flawed soda tax on roughly a monthly basis from almost the very beginning, where our coverage began as something of a natural extension from one of the stories we featured as part of our Examples of Junk Science Series. The linked list below will take you through all our in-near-real-time analysis of the impact of the tax, which at this writing, has still to reach its end.

- Examples of Junk Science: Taxing Treats

- Philadelphia Soda Tax Crushes Soft Drink Sales

- The Tax Incidence and Deadweight Loss of Philadelphia's Soda Tax

- Philadelphia's Soda Tax Collections Are Falling Short

- Philly's Soda Tax Collections Continue to Fall Short of Goals

- Jobs Gained and Lost from Philadelphia's Soda Tax

- Philadelphia Soda Sales Volume Down 34% Since Tax

- Philadelphia Soda Tax to Shrink City's Economy by $20 Million

- Big Miss for Philadelphia's Beverage Tax

- Odds and Ends for Philadelphia's Soda Tax

- Legal Jeopardy for Philadelphia's Soda Tax

- Soda Tax Driving Philadelphians To Drink?

- Philadelphia Soda Tax Collections Start Fiscal Year in Deep Hole

- Philadelphia Soda Tax Collections Continues Falling Flat

- A Natural Experiment for Philadelphia's Soda Tax

- Philadelphia Soda Tax $20 Million Short with One Month to Go in First Year

- Philadelphia Soda Tax Falls 15% Short of Target

- Philadelphia Mayor Scales Back Soda Tax Ambitions

- Philadelphia Soda Tax Boosts City's Alcohol Sales