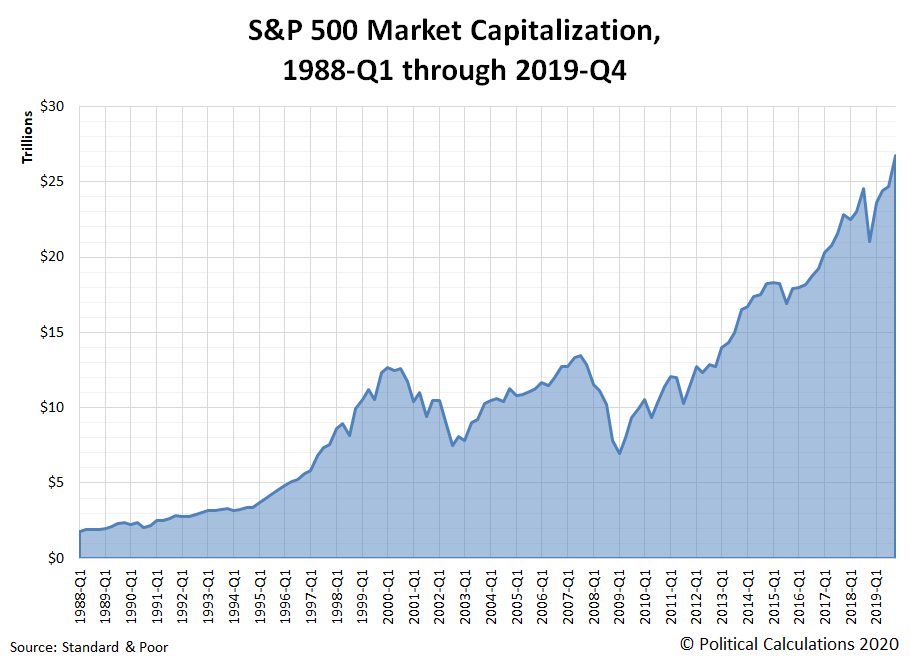

As of the end of 2019, the total market capitalization of the S&P 500 was $26,759,686,786,884. Or if you prefer, approximately $26.76 trillion!

That's 14.8 times the value of the S&P 500's market capitalization at the end of 1988-Q1, when the index' market cap stood at $1.81 trillion. From 1988-Q1 to 2019-Q4, the S&P 500's total market capitalization has doubled three times, completing its first doubling period in 7 years from 1988-Q1 to 1995-Q1, taking another 2.5 years to double again by 1997-Q3, and then another 16 years to double a third time in 2013-Q3.

Measured a little differently, the market cap of the S&P 500 as a percentage of the U.S. Gross Domestic Product at the end of 2019-Q3, the most recent quarter for which we have a somewhat finalized estimate, was 114.7%. That's close to the highest the S&P 500's total market cap has been since the days of the Dot-Com Bubble, when that figure peaked at 126.8% in the first quarter of 2000.

We won't know until the end of March 2020 how the S&P 500's market cap compares to the size of the U.S. economy through the end of 2019, when the estimate for the United States' GDP in 2019-Q4 is somewhat finalized.

References

Silverblatt, Howard. Standard & Poor Index Earnings and Estimates. [Excel Spreadsheet]. 16 January 2020. Accessed 23 January 2020.

U.S. Bureau of Economic Analysis. GDP and Personal Income Interactive Data. National Income and Product Accounts. Table 1.1.5. Gross Domestic Product. [Online Database]. Accessed 23 January 2020.