The highest year-over-year inflation since 1982 has resolved a question we had about investor expectations for the S&P 500 (Index: SPX).

We had been debating whether the sharp decline in U.S. stock prices after Federal Reserve Chair Jerome Powell spoke marked a significant shift in how investors weight the future or if it was a noisy outlier event in a longer established trend. The news of the past week however has resolved the question by giving us enough additional data points: it was a noisy outlier event.

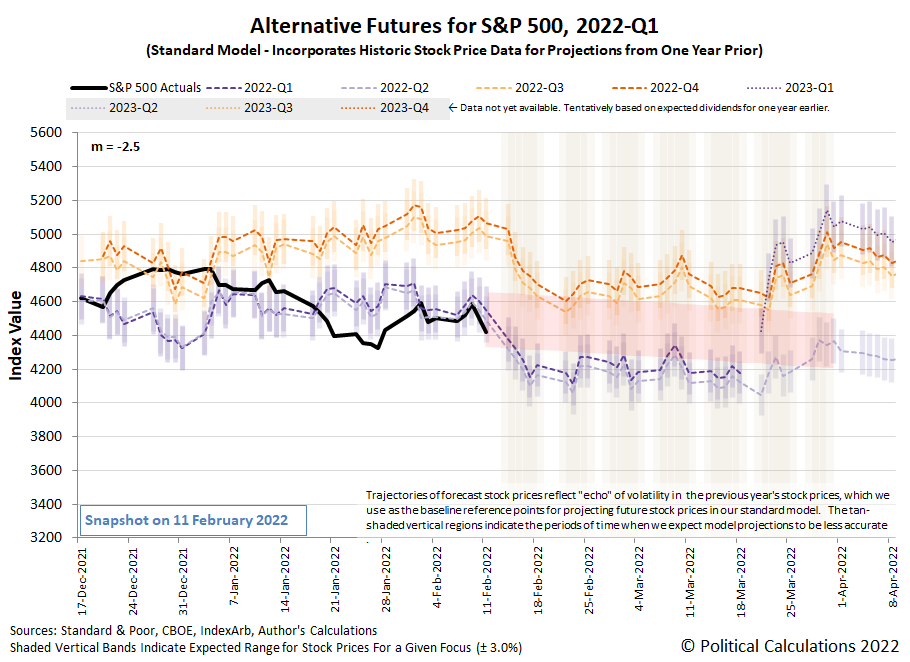

We're able to make that determination because the trajectory of the S&P 500 during the past week has closely tracked the alternate trajectories associated with investors focusing on either 2022-Q1 or 2022-Q2 according to how they would be set if the trend established since 16 June 2021 has remained intact. The following chart reveals the close correlation that has developed:

As you can see however, we've now reached a point where we have a very different challenge to sort out. Since the dividend futures-based model behind these trajectories uses historic stock prices as the base reference points from which its projections of the future are made, its accuracy is affected by the "echoes" of past volatility in stock prices. We've added the redzone forecast range to this chart to compensate for that effect, which assumes investors will continue focusing on the upcoming two quarters of 2022-Q1 and Q2 through the end of March 2022, which makes sense given the likely timing and uncertainty associated with the Fed's upcoming rate hikes to deal with President Biden's inflation.

Here's our wrap-up of the past week's market moving headlines:

- Monday, 7 February 2022

-

- Signs and portents for the U.S. economy:

- U.S. stock market liquidity 'abysmal,' adding to volatility risk

- Exclusive: U.S. calls for 'concrete action' from China on trade deal

- Bigger trouble developing in the Eurozone:

- ECB minion predicts Eurozone rate hike in 2022-Q4:

- Wall Street ends lower as Meta weighs

- Tuesday, 8 February 2022

-

- Signs and portents for the U.S. economy:

- U.S. small business sentiment drops to 11-month low -NFIB

- U.S. banks outlook positive with loan growth and rate hikes in view

- As oil nears $100 a barrel, U.S. drillers get busy in costly shale basins

- Wall Street ends higher; bank stocks rise with Treasury yields

- Wednesday, 9 February 2022

-

- Signs and portents for the U.S. economy:

- U.S. crude stockpiles drop unexpectedly, demand hits record high - EIA

- U.S. 4-week oil product supplied rises to record high - EIA

- Column-Diesel is the U.S. economy’s inflation canary: Kemp

- U.S. and Canada fear economic damage from border crossing protest

- Fed minions hope inflation will go away, confidently predict 2%+ inflation through 2023, open to digital dollar, not talking about personal trading:

- Fed hopes economy is on cusp of inflation slowdown as rate hikes loom

- Fed's Mester says she doesn't see compelling case to start with 50 bps rate hike

- Fed's Bowman: keeping 'open mind' on central bank digital currency

- Fed denies release of correspondence on pandemic trades made by policymakers

- BOJ minion says China's COVID policies are harming the global economy:

- ECB minions stricken with panic:

- Wall Street ends sharply higher, lifted by Big Tech

- Thursday, 10 February 2022

-

- Signs and portents for the U.S. economy:

- Ford, Toyota halt some output as U.S., Canada warn on trucker protests

- Jan US CPI shows biggest yearly rise in 4 decades

- U.S. rate futures lift chances of 50 bps hike in March after strong CPI data

- Biden says consumer inflation report shows budgets of Americans are 'being stretched'

- U.S. mortgage rates jump to two-year high, further squeezing buyers

- Explainer-The U.S. yield curve has been flattening: Why you should care

- Fed minions put more, bigger rate hikes on the table to fight inflation, sends a signal about what trouble they expect banks to have to deal with:

- Hot inflation jump-starts case for 'big-bang' Fed rate hike in March

- Fed to stress test banks against commercial real estate, corporate debt troubles in 2022

- Bigger trouble developing in the Eurozone:

- EU exec cuts 2022 euro zone growth forecast, sharply raises inflation view

- Germany's industrial order backlog the highest since 1969 - Ifo

- BOJ minions not wanting to stop endless stimulus policies:

- ECB minions want to go slow to quelch inflation, worry about hackers:

- Better to normalise monetary policy step-by-step, ECB's Rehn says

- Euro zone inflation doesn't require significant policy tightening, ECB's Lane says

- ECB tells banks to step up defences against hacks

- Wall Street ends down sharply on fears of aggressive Fed rate hikes

- Friday, 11 February 2022

-

- Signs and portents for the U.S. economy:

- Goldman ups Fed hike forecast to 7 rate increases in 2022 after CPI data

- Russia now has enough forces for Ukraine invasion, says White House

- Oil soars 3% to 7-yr highs on Ukraine jitters, tight supplies

- ANALYSIS-Truckers at Ambassador Bridge in perfect spot to threaten U.S.- Canada trade

- Fed minions made stock market bets while setting monetary policy in 2020:

- Bigger stimulus rolling out in China:

- Wall Street drops, oil prices jump on Ukraine conflict worries

As of the close of trading on 11 February 2022, the CME Group's FedWatch Tool projects a half-point rate hike in March 2022 (2022-Q1), followed by quarter point rate hikes in May 2022 (2022-Q2), June 2022 (2022-Q2), July 2022 (2022-Q3), September 2022 (2022-Q3) and December (2022-Q4). If you weren't counting, that's six rate hikes in 2022.

On a more positive note, the Atlanta Fed's GDPNow tool shows real GDP growth of 0.7% for the current first quarter of 2022 (as of 9 February 2022), thanks largely to updated wholesale trade data.