The S&P 500 (Index: SPX) continued its upward trajectory in trading week ending 21 July 2023. The index closed the week at 4536.34 with a week-over-week gain of 0.7%.

The main factors lifting the market during the week were positive bank earnings reports and additional data indicating tamer-than-previously expected inflation. Of these, the positive news for banks, particularly regional banks that reports earnings during the week, boosted the market because it indicates the negative factors that sunk Silicon Valley Bank, Signature Bank, and First Republic Bank earlier in the year are now relatively contained.

The news pointing to tamer-than-expected inflation was also positive, because it reduced the probability of another rate hike beyond the quarter point increase in the Federal Funds Rate expected to be announced at the end of the Fed's two-day meeting next week on Wednesday, 26 July 2023. In the previous edition of the S&P 500 chaos series, investors were giving a greater-than-50% probability of one more rate hike that would take place during 2023-Q4, which now appears off the table.

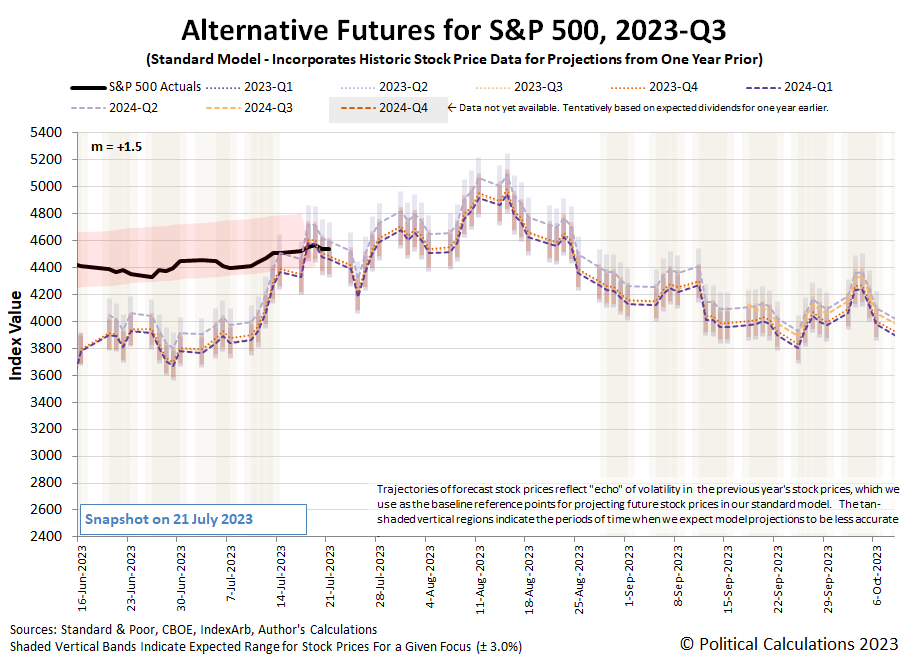

Investors however remain focused on 2023-Q4 after having set their forward-looking attention on that quarter in the previous week. The following update to the dividend futures-based model's alternative futures chart shows the level of the S&P 500 at the end of the third week of July 2023 is consistent with that forward time horizon.

The chart also shows we've fully exited the period of the redzone forecast range we first added to the chart in early April 2023. Longtime readers know we add these ranges to the alternative futures chart when we recognize the past volatility of stock prices, which the dividend futures model uses as the base reference points for projecting the future for the S&P 500 index, will affect the accuracy of its projections for a sustained period of time by more than a few percent.

Because this latest redzone forecast range spans such a long period of time and breaks across regular calendar quarters, we thought it might be interesting to show it all in one chart. The following chart covers the period from 30 March 2023, or shortly before the last redzone forecast range was first added to the alternative futures chart, through 21 July 2023, which extends several days past the end of the added forecast range. We've also animated the chart to show how the forecast range changed between the snapshot dates of 6 April 2023 and 21 July 2023.

Perhaps the most remarkable thing illustrated by the chart is how little the projected future level of the forecast range changed from the "before" to the "after" snapshot. Stock prices largely behaved as expected, within the range expected, over the 15 weeks covered by the redzone forecast range.

Let's wrap up both these charts with our summary of the past week's market moving headlines:

- Monday, 17 July 2023

-

- Signs and portents for the U.S. economy:

- US bank mergers frozen by capital rules, regulatory uncertainty

- Oil dips over 1.5% on demand fears after weak Chinese data

- Bigger trouble, stimulus developing in China:

- Bigger trouble developing in the Eurozone:

- S&P, Dow kick off busy earnings week with small gains, Nasdaq rises nearly 1%

- Tuesday, 18 July 2023

-

- Signs and portents for the U.S. economy:

- US retail sales rise moderately; economy plodding along

- US manufacturing output falls in June; rebounds in second quarter

- Bigger stimulus developing in China:

- BOJ minions say they'll keep never-ending stimulus alive:

- Other central bank minions changing direction:

- Australia central bank hit pause as policy clearly restrictive, risking growth

- Two Polish central bankers say rate cut could come this year

- ECB minions thinking about looking at inflation data in the future:

- Bank results lift stocks; Dow up for seventh straight session

- Wednesday, 19 July 2023

-

- Signs and portents for the U.S. economy:

- Economists see July 2023 end to Fed minions' rate hikes:

- Bigger trouble, stimulus developing in China:

- China's sagging economy looms over quarterly results around the world

- China to increase support for private companies to bolster economy

- Changing inflation winds for central banks:

- Nasdaq, S&P, Dow end higher as earnings season heats up; eyes on Tesla, Netflix results

- Thursday, 20 July 2023

-

- Signs and portents for the U.S. economy:

- Oil settles higher amid low crude stocks, cautious economic outlook

- US labor market still tight; housing market slump persists

- US existing home sales fall; annual house price decline slows

- Fed minions get into instant payments game:

- Bigger trouble developing in China:

- Chinese professor says youth jobless rate might have hit 46.5%

- Exclusive-China's state banks seen selling dollars offshore to slow yuan declines - sources

- JapanGov minions say BOJ minions can expect to see more inflation, slow economy:

- Japan's govt sees inflation sharply exceeding BOJ target

- Japan exports underwhelm in June, global weakness drags on economy

- Economists expect ECB minions to deliver at least two more rate hikes:

- Tesla, Netflix pull Nasdaq and S&P lower, Dow ends higher

- Friday, 21 July 2023

-

- Signs and portents for the U.S. economy:

- Oil rallies higher for fourth straight week on tightening supply

- U.S. banks warn of interest income weakness after upbeat quarter

- Bigger stimulus developing in China:

- China seeks to boost demand by pushing urban development - state media

- China's steps to boost sales of cars, electronics disappoint market

- BOJ minions get mixed message on whether to tweak never-ending stimulus:

- Japan's inflation may have peaked, no imminent change seen to BOJ policy

- Japan's govt sees inflation sharply exceeding BOJ target

- ECB minions expected to deliver quarter point rate hike next week:

- S&P, Dow post solid weekly gains while Nasdaq retreats as tech takes a break

The CME Group's FedWatch Tool continues to project the Federal Reserve will hike the Federal Funds Rate by just a quarter point to a target range of 5.25-5.50% after it meets next week on 26 July (2023-Q3). Looking beyond that, the FedWatch Tool now says that's the peak for the Fed's series of rate hikes that began back in March 2022, where rates will hold at that level through January 2024. The tool then anticipates the Fed will swing into reverse and start cutting rates by a quarter point at six-to-twelve week intervals during 2024.

The Atlanta Fed's GDPNow tool estimate of the real GDP growth rate for current quarter of 2023-Q2 ticked up to +2.4% from the +2.3% growth rate projected a week earlier.

Image credit: Charging Bull Statue by Petr Kratochvil via PublicDomainPictures.net.