For the S&P 500 (Index: SPX), there may as well have been only one event taking place during the past week.

That event was the Federal Reserve's annual getaway meeting at Jackson Hole, Wyoming, at which Fed Chair Jerome Powell addressed inflation and the Fed's path ahead in charting a course to deal with it on Friday, 25 August 2023. Compared to the speech Powell gave last year, this year's speech was more positive for investors. The S&P 500 (Index: SPX) rose after Powell's speech, ultimately ending the week at 4405.71, a 0.8% increase over the prior week's close.

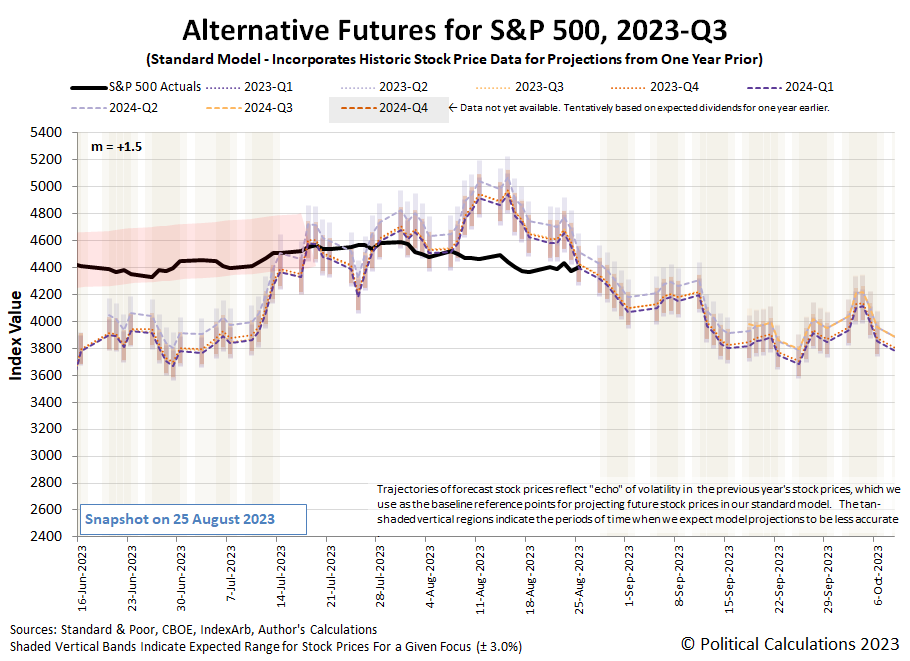

For us, because of intense interest investors have for the direction for the Federal Reserve's monetary policies, Powell's speech serves as a calibration point for setting the value of the multiplier in the dividend futures-based model. The event allowed us to confirm our current estimate of the multiplier's current value of +1.5 is still valid, with investors closely focused on the upcoming fourth quarter of 2023, which coincides with the expected timing of the Fed's next actions to change interest rates.

Here's what that looks like on the latest update for the alternative futures chart:

Speaking of charting courses, that brings us to our next challenge. The chart indicates the accuracy of the dividend futures-based model's projections of the future for the S&P 500 will soon be impacted by the echo effect. This is a consequence of using historic stock prices as the base reference points from which the model's projections of the future are made, where the past volatility of stock prices affects the model's projections of the future.

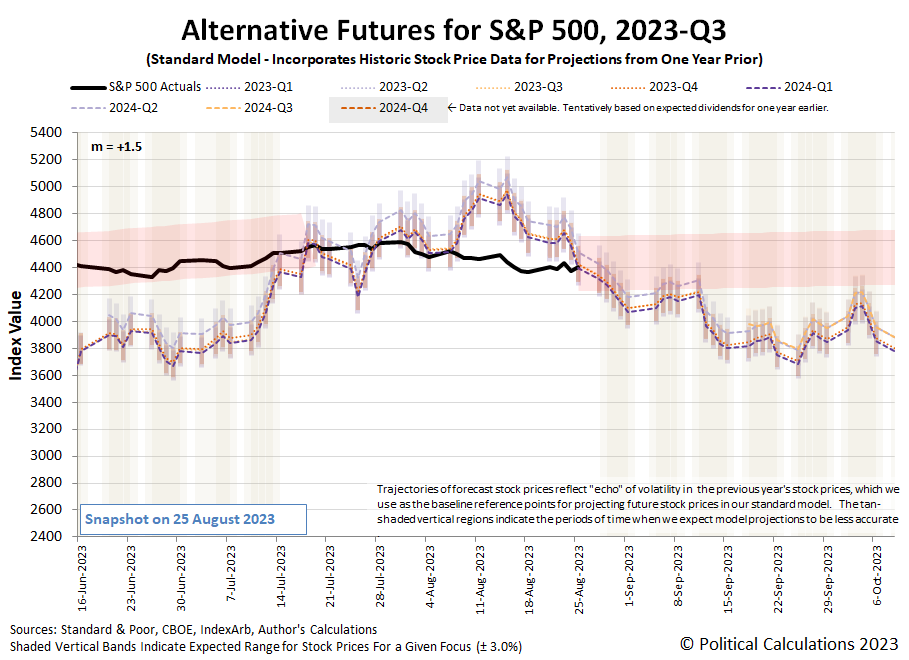

To compensate for that effect, we've added a new redzone forecast range to the chart, which we've anchored at the level of the S&P 500 on Friday, 25 August 2023. The opposite end of the forecast range is anchored to the projections associated with investors focusing on 2023-Q4 on 7 November 2023, after the echoes of past stock price volatility have dissipated.

Here's that version of the chart, which we'll be updating and presenting in the weeks ahead.

Since we discussed how we generate redzone forecast ranges in previous editions of the S&P 500 chaos series, we won't repeat that description here. Let's get to the handful of market-moving headlines that appeared in the newstreams of the past week.

- Monday, 21 August 2023

-

- Signs and portents for the U.S. economy:

- Crude oil settles lower as hope fades for Chinese demand

- Majority of small businesses believe US is in recession

- Fed minions think future economic growth will be weak:

- Bigger trouble and stimulus developing in China, government-run banks "mopping up" weak yuan:

- China's fiscal revenue slows as economy struggles

- China surprises with modest rate cut amid growing yuan risks

- China state banks seen mopping up offshore yuan to stem currency weakness

- Bigger trouble developing in the Eurozone; ECB minions getting results they wanted:

- Downturn in German housing construction worsens in July - Ifo

- German producer prices post first fall since late 2020

- Nasdaq rallies with Nvidia, tech shares; investors look toward Jackson Hole

- Tuesday, 22 August 2023

-

- Signs and portents for the U.S. economy:

- Oil prices settle lower on nagging worries about Chinese demand

- US existing home sales slide again, but prices up from a year earlier

- Fed minions claim they're worried about return of higher inflation, among other things:

- Strong US data makes 'reacceleration scenario' possible, Fed's Barkin says

- Fed doves, Fed hawks: US central bankers in their words

- BOJ minions claim they're not talking about propping up yen, ex-BOJ minion describes when they will:

- BOJ's Ueda meets premier, says didn't discuss recent yen volatility

- Ex-BOJ official predicts no yen intervention until breach of 150 threshold

- Dow, S&P 500 end down as US interest-rate worries mount, bank shares slip

- Wednesday, 23 August 2023

-

- Signs and portents for the U.S. economy:

- US bond yields surge despite muted inflation as investors look beyond Fed

- US 30-year mortgage rate soars to highest since 2000

- Oil slides on grim manufacturing data

- US job growth in year through March was less than estimated

- US economy near stalling point as consumer demand weakens, survey says

- Bigger trouble developing in China:

- Japanese economy shrinks more slowly:

- Much bigger trouble developing in the Eurozone, ECB minions expected to pause rate hikes:

- German business activity suffers steepest decline since May 2020-flash PMI

- Investors expect ECB rate-hike pause in September after dismal PMIs

- Indexes end sharply higher; AI chip maker Nvidia jumps again after the bell

- Thursday, 24 August 2023

-

- Signs and portents for the U.S. economy:

- Oil settles up, rebounds from lows after European storage report

- US economic activity picked up in July - Chicago Fed

- US department stores see higher credit delinquencies amid strained spending

- Fed minions like interest rates rising without them having to hike them, don't like "spend-happy" Americans:

- Two Fed officials tentatively embrace bond yield jump

- Fed's Collins: May be at a place where Fed can hold steady - Yahoo Finance

- Fed's Harker expects no more rate hikes needed this year, in CNBC interview

- Fed struggles to gain traction in battle with spend-happy consumers

- Wall St ends down sharply, focus shifts to upcoming Powell speech

- Friday, 25 August 2023

-

- Signs and portents for the U.S. economy:

- Oil futures up 1% to one-week high on soaring US diesel prices

- Large US homebuilders raise prices as existing home supply remains tight

- Expectations before Fed minion's Jackson Hole speech:

- Powell Talks At Jackson Hole, Says Nothing

- Fed's Powell: higher rates may be needed, will move 'carefully'

- Factbox-Highlights of Fed Chair Powell's Jackson Hole speech

- Rate hike chances rise after remarks by Fed's Powell

- Bigger trouble developing in China, currency bailout taking shape:

- Analysis-China has no pain-free solutions for its slowing economy

- Exclusive-China steps up yuan defence with bond limit guidance - sources

- BOJ minions expected to keep never-ending stimulus alive for another year despite inflation:

- BOJ will keep current policy until at least July 2024, most economists say: Reuters poll

- Inflation in Japan's capital slows in August, stays above BOJ target

- Bigger trouble developing in the Eurozone, expectations grow ECB minions will pause rate hikes:

- Gloomy Ifo fuels fears of second German recession in a year

- Euro zone inflation to remain "too high for too long" - Bank of Spain deputy chief

- Momentum growing for ECB rate hike pause as growth falters -sources

- Nasdaq, S&P 500 snap three-week losing streak, Dow ends slightly lower

The CME Group's FedWatch Tool continues to show no rate hike in September (2023-Q3), though it gives a greater than 50% probability the Fed will hike rates by a quarter point when it meets on 1 November (2023-Q4), which is now expected to stick nearly all the way through January 2024. However, on 31 January (2024-Q1), investors now expect the Fed to start a series of quarter point rate cuts that will continue at six-to-twelve-week intervals through the end of 2024.

The Atlanta Fed's GDPNow tool now predicts an annualized real growth rate of +5.9% during 2023-Q3 which is up a tick from the previous week's estimate of +5.8%.

Image credit: Photo by orbtal media on Unsplash.