For a week that had more negative than positive headlines, the S&P 500 (Index: SPX) perhaps surprisingly turned in a pretty good week. The index rose 1.8% to 4,783.83.

That puts the S&P 500 less than 13 points away from breaking it's all-time high closing value of 4,796.56, which is set on 3 January 2022.

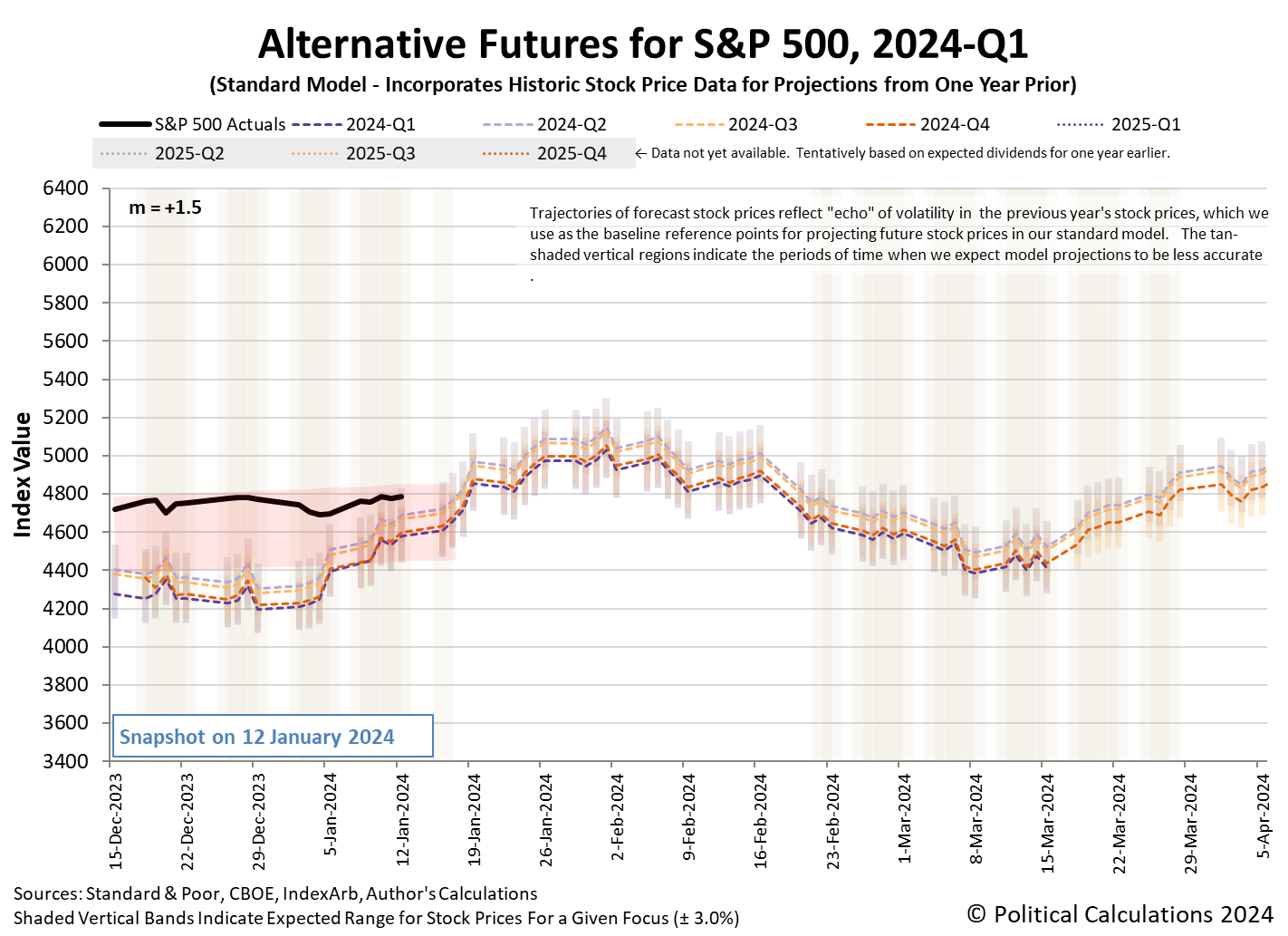

We say "perhaps surprisingly" because in the current market environment, negative headlines focus investors on the very near term, in which the outlook for dividend growth is positive. The newest update to the dividend futures-based model's alternative futures chart indicates the trajectory of the S&P 500 is consistent with investors focusing their forward-looking attention on 2024-Q1 as we come to the end of the current redzone forecast range.

Why would negative headlines prompt investors to focus on the current quarter? It has everything to do with the expected timing of when the Federal Reserve will be forced to begin cutting interest rates to address a slowing U.S. economy. After the week's headlines, the CME Group's FedWatch Tool projects the Fed will hold the Federal Funds Rate steady in a target range of 5.25-5.50% until 20 March 2023 (2024-Q1), when investors anticipate it will launch a series of quarter point rate cuts at six-to-twelve-week intervals through the end of 2024 are anticipated.

In the current market environment, that leads to rising stock prices. At least until fading economic conditions might reduce the expectations for dividend growth in future quarters and investors shift their attention accordingly. When that happens, bad news will become bad news for the trajectory of stock prices.

Speaking of which, here are the past week's market-moving headlines:

- Monday, 8 January 2024

-

- Signs and portents for the U.S. economy:

- Oil falls over 3% as Saudi price cuts add to demand doubts

- US regional bank profits to be squeezed by pressure to pay for deposits

- Fed minion says rate hikes are done:

- Fed policy rate appears 'sufficiently restrictive': Bowman

- Atlanta Fed's Bostic says bias remains for policy to stay tight

- Nasdaq adds +2%, S&P, Dow also gain as tech stocks offset a slide in Boeing

- Tuesday, 9 January 2024

-

- Signs and portents for the U.S. economy:

- Oil climbs 2% on Mideast conflict and Libya outage

- Biggest U.S. grid operator triples annual load growth forecast for next decade

- BOJ minions get reason to keep never-endng stimulus alive as inflation continues biting:

- Inflation in Japan's capital keeps slowing, takes pressure off BOJ

- Japan's Nov real wages down for 20th straight month

- Bigger trouble developing in the Eurozone:

- German industrial output drops unexpectedly in November

- Euro zone's services sector may slow further, ECB says

- ECB minions thinking about cutting rates sooner:

- ECB's Centeno sees rate cut coming sooner than recently thought

- ECB to cut rates once inflation outlook settles at target- Villeroy

- Dow, S&P 500 retreat as yields edge up ahead of data, earnings

- Wednesday, 10 January 2024

-

- Signs and portents for the U.S. economy:

- Fed minions say they're not sure they're not done fighting inflation:

- Questions raised and some positive signs developing in China:

- China's policy dilemma: is boosting credit deflationary?

- POLL China's exports seen improving in December as global trade picks up

- Bigger trouble developing in the Eurozone:

- Stocks climb as megacaps lead; inflation data, earnings on deck

- Thursday, 11 January 2024

-

- Signs and portents for the U.S. economy:

- Rising shelter, healthcare costs lift US consumer inflation in December

- US power prices soar ahead of extreme cold and record natgas demand

- Oil up 1% as Middle East tensions offset US inflation worries

- US startup funding drops 30% in 2023 despite AI frenzy

- Fed minions say higher-than-expected inflation report no biggie for them:

- BOJ minions solve inflation:

- ECB minions dangle interest rate cuts if inflation falls lower:

- ECB's Lagarde: rate cuts to occur if it is clear inflation has fallen to 2%

- ECB can move early on rates if inflation falls quickly: Vujcic

- Nasdaq, S&P, Dow end little changed after inflation data sparks volatile trading session

- Friday, 12 January 2024

-

- Signs and portents for the U.S. economy:

- US producer prices unexpectedly fall; goods deflation seen persisting

- US power and natgas prices soar as extreme freeze hits natgas supplies

- Oil soars as US, UK strike on Houthis stirs up geopolitical worries

- Oil jumps 4% as tankers avoid Red Sea after strikes

- 'Remarkable' surge in auto insurance costs fans US inflation

- Flagging loan margins, one-off charges drag down profit at major US banks

- Citi to cut 20,000 jobs, posts $1.8 billion loss in 'disappointing' quarter

- Wells Fargo warns of lower interest income in 2024, shares drop

- Bank of America profit falls on one-off charges, shares slide

- Fed minions are losing money:

- Mixed economic signs developing in China:

- China's economy faces growing deflationary pressures as prices extend fall

- China's exports rise, but deflation persists as economy enters 2024 on shaky footing

- China's 2023 bank lending at record high, but economy still struggling

- ECB minions claim they're not cutting interest rates anytime soon:

- Stocks end little changed as earnings offset inflation data

The Atlanta Fed's GDPNow tool's estimate of real GDP growth for 2023-Q4 declined to +2.2% from the +2.5% it projected last week. The Atlanta Fed's projections for GDP growth in 2023-Q4 will continue through 19 January 2024; it will be replaced by the BEA's initial estimate of that growth in the following week. The Atlanta Fed's nowcast of the GDP growth rate for now current 2024-Q1 will begin on 26 January 2024.

Image credit: Microsoft Bing Image Creator. Prompt: "editorial cartoon of a bull running away from a boy who is selling newspapers, with the boy running behind the bull, both running up a hill". The AI didn't quite get it, but we rather liked this image of the bull running after the boy shouting bad headlines.