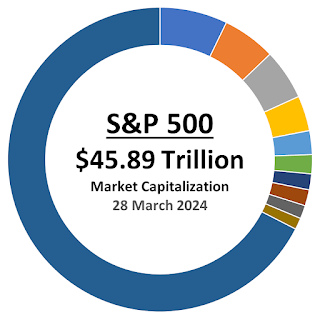

The first quarter of 2024 has come and gone. Before it did, the S&P 500 (Index: SPX) clocked a new record high of 5,254.35 The index ended 2024-Q1 with a market cap of $45.89 trillion according to Standard and Poor.

The Top 10 stocks within the market cap-weighted index together accounted for 32.5% of its total valuation. That's up from the 30.9% share that the S&P 500's Top 10 stocks held at the end of 2023.

It would be a mistake however to assume that all the biggest stocks just got bigger over the past three months. At the end of December 2023, Apple (NASDAQ: AAPL) was the biggest company in the S&P 500 with a market cap of $2.81 trillion. At the end of March 2024, Apple's valuation shrank to just under $2.6 trillion, falling to second place in the index.

Microsoft (NASDAQ: MSFT) has become the biggest company in the S&P 500 with a market cap of nearly $3.3 trillion as of 28 March 2024, rising from a $2.79 trillion figure we reported three months ago.

But that's not the only change for the top ten companies of the S&P 500 in the last three months. The following chart shows the relative shares of the top 10 stocks in the S&P 500 at the end of the first quarter of 2024.

Three months ago, both Tesla (NASDAQ: TSLA) and JP Morgan Chase (NYSE: JPM) were members of the S&P 500's Top 10 stocks. They've been replaced by Eli Lilly (NYSE: LLY) and Broadcom (NASDAQ: AVGO). Meanwhile, Nvidia (NASDAQ: NVDA) rocketed upward to become the third largest company in the S&P 500, passing several long-running members of the index' top ten on its rapid ascent.

Here are the market capitalizations of each of the S&P 500's top ten component firms:

- Microsoft (NASDAQ: MSFT) $3,294,823,648,250 (7.18%)

- Apple (NASDAQ: AAPL) $2,597,312,235,250 (5.66%)

- Nvidia (NASDAQ: NVDA) $2,459,645,509,000 (5.36%)

- Amazon (NASDAQ: AMZN) $1,720,834,078,125 (3.75%)

- Meta Platforms (A) (NASDAQ: META) $1,160,989,391,375 (2.53%)

- Alphabet (A) (NASDAQ: GOOGL) $926,955,956,750 (2.02%)

- Alphabet (C) (NASDAQ: GOOG) $780,111,448,750 (1.70%)

- Berkshire Hathaway (B) (NYSE: BRK.B) $780,111,448,750 (1.70%)

- Eli Lilly & Co. (NYSE: LLY) $647,033,613,375 (1.41%)

- Broadcom (NASDAQ: AVGO) $563,615,416,881 (1.23%)

The remaining 495 firms of the S&P 500 index account for 67.5% of its total market valuation.

References

Standard and Poor. S&P Market Attributes. [Excel Spreadsheet]. 28 March 2024. Accessed 29 March 2024.