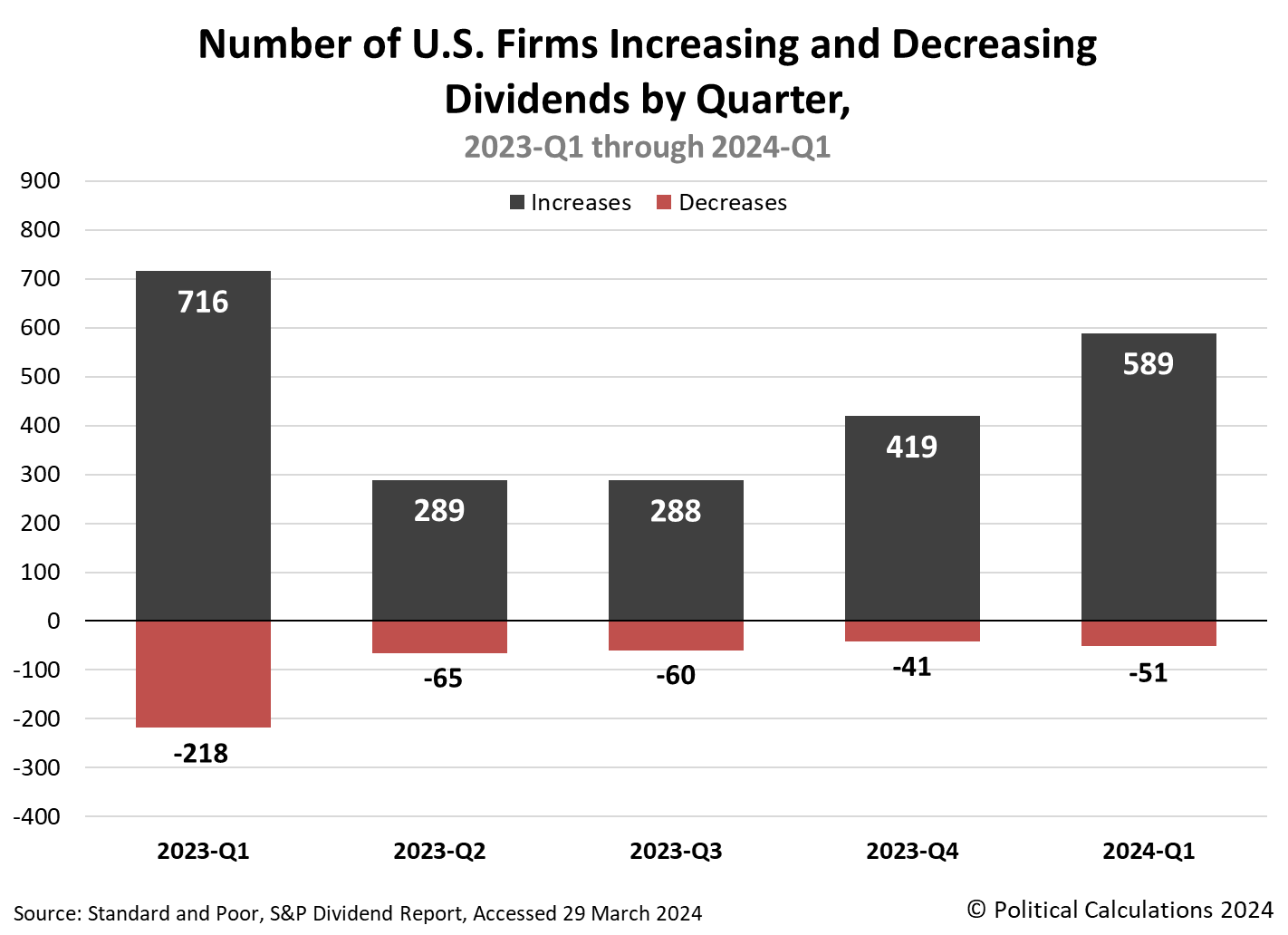

The first quarter of 2024 continued following the template set during 2023 for dividend paying stocks in the U.S. stock market.

That template has some defining characteristics, measured year-over-year:

- Fewer firms announced dividend cuts, a favorable change.

- Fewer firms announced dividend rises, an unfavorable change.

Together, these two characteristics set the stage for a mixed outcome for dividend paying firms during 2024-Q1, at least as measured year over year, where the point of comparison is 2023-Q1.

Quarter-over-quarter, the situation also appears mixed. But this time that's because:

- More firms announced dividend cuts, an unfavorable change.

- More firms announced dividend rises, a favorable change.

Both these mixed outcomes can be seen in the chart tallying the number of U.S. firms either increasing or decreasing their dividends by quarter, covering the five quarters from 2023-Q1 through 2024-Q1.

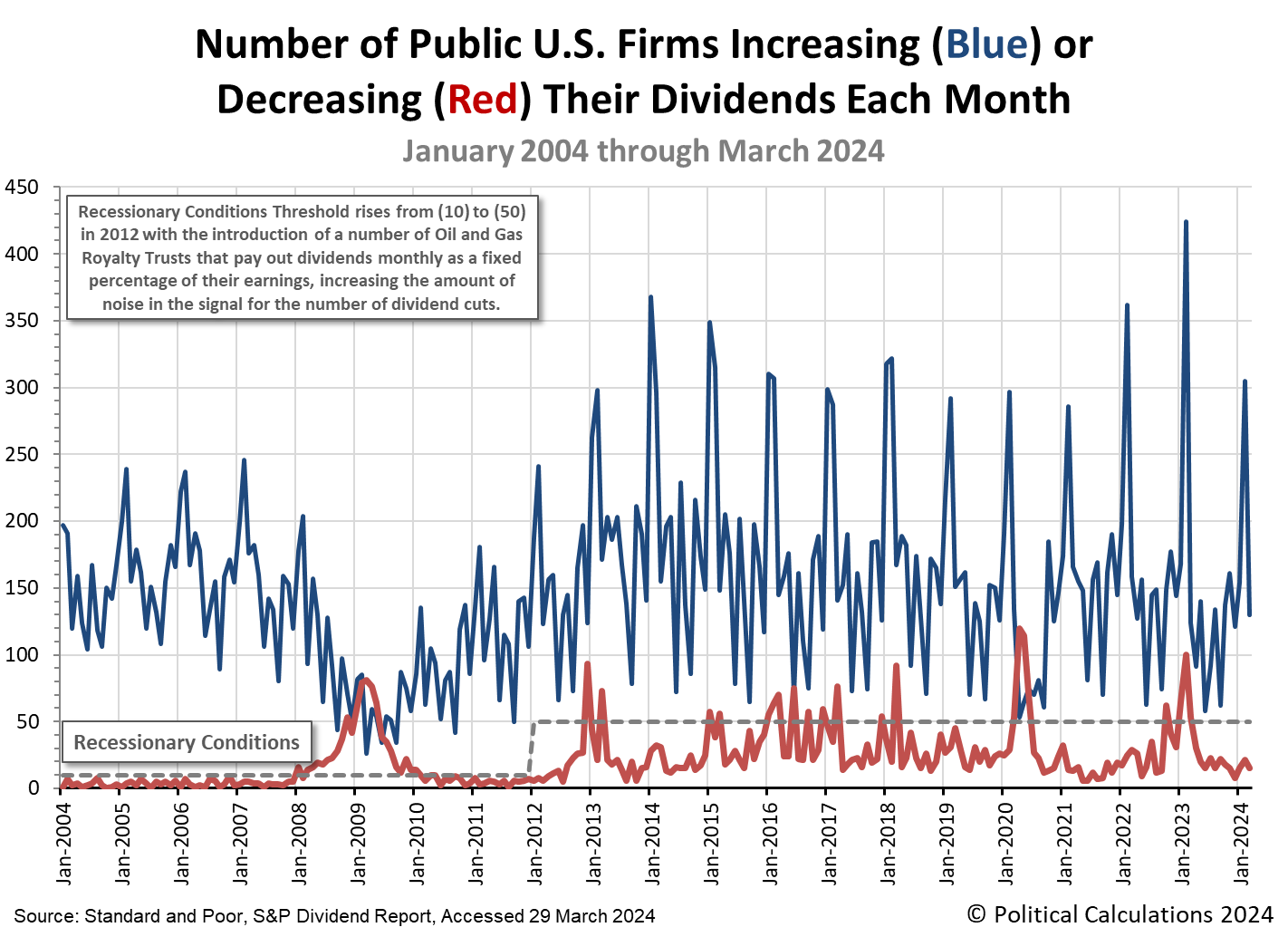

We have to go to the monthly changes to find data that suggests a more favorable situation may be starting to develop in the U.S. stock market. Here, when we compare March 2024 to the year-ago month of March 2023, we find that year-over-year:

- Fewer firms announced dividend cuts, a favorable change.

- More firms announced dividend rises, also a favorable change.

The numbers aren't big, but we'll take our silver lining where we can find it! The number of dividend rises and decreases reported each month over the last 20 years to put these numbers into their long term context.

The following table provides the numbers that back our observations. It summarizes Standard and Poor's dividend metadata for March 2024, showing how it compares in both Month-over-Month (MoM) and Year-Over-Year (YoY) terms with previously reported data:

| Dividend Changes in March 2024 | |||||

|---|---|---|---|---|---|

| Mar-2024 | Feb-2024 | MoM | Mar-2023 | YoY | |

| Total Declarations | 5,306 | 5,386 | -80 ▼ | 4,654 | 652 ▲ |

| Favorable | 200 | 396 | -196 ▼ | 173 | 27 ▲ |

| - Increases | 130 | 305 | -175 ▼ | 124 | 6 ▲ |

| - Special/Extra | 67 | 90 | -23 ▼ | 44 | 23 ▲ |

| - Resumed | 3 | 1 | 2 ▲ | 5 | -2 ▼ |

| Unfavorable | 15 | 21 | -6 ▼ | 53 | -38 ▼ |

| - Decreases | 15 | 21 | -6 ▼ | 53 | -38 ▼ |

| - Omitted/Passed | 0 | 0 | 0 ◀▶ | 0 | 0 ◀▶ |

Our sampling of January 2024's unfavorable dividend actions found just six firms announcing decreases in dividend payments to their shareholding owners. Here's the very short list:

- Great Ajax (REIT-Mortgage) (Variable) (NYSE: AJX)

- Mesa Royalty Trust (Fixed) (NYSE: MTR)

- Big 5 Sporting Goods (Retail) (Fixed) (NASDAQ: BGFV)

- B. Riley Financial (Fixed) (NASDAQ: RILY)

- Sabine Royalty Trust (Variable) (NYSE: SBR)

- NY Community Bancorp (Fixed) (NYSE: NYCB)

We'll close on that positive note and will hope April 2024 builds on that positive momentum for the U.S. stock market's dividend paying firms!

References

Standard and Poor. S&P Market Attributes Web File. [Excel Spreadsheet]. Accessed 29 March 2024.

Image credit: Cash Dividend by Nick Youngson on Picpedia. Creative Commons CC by SA 3.0 Deed.