2023 has come to an end, leaving behind a mixed legacy.

For dividend-paying stocks, December 2023 was representative of 2023 as a whole. There was good news in that the number of unfavorable changes were down, month-over-month, quarter-over-quarter, and year-over-year. But there was also bad and mixed news. The number of dividend increases was also down month-over-month and year-over-year, representing a negative development for investors. However, that situation was mitigated by the number of dividend increases rising quarter-over-quarter in 2023-Q4.

Let's get straight to the numbers. The following table presents Standard and Poor's dividend metadata for December 2023. It summarizes how the month's dividend data compares in both Month-over-Month (MoM) and Year-Over-Year (YoY) terms with previously reported data:

| Dividend Changes in December 2023 | |||||

|---|---|---|---|---|---|

| Dec-2023 | Nov-2023 | MoM | Dec-2022 | YoY | |

| Total Declarations | 5,405 | 3,822 | 1,583 ▲ | 5,528 | -123 ▼ |

| Favorable | 239 | 264 | -25 ▼ | 281 | -42 ▼ |

| - Increases | 121 | 161 | -40 ▼ | 144 | -23 ▼ |

| - Special/Extra | 118 | 103 | 15 ▲ | 135 | -17 ▼ |

| - Resumed | 0 | 0 | 0 ◀▶ | 2 | -2 ▼ |

| Unfavorable | 8 | 15 | -7 ▼ | 31 | -23 ▼ |

| - Decreases | 8 | 15 | -7 ▼ | 31 | -23 ▼ |

| - Omitted/Passed | 0 | 0 | 0 ◀▶ | 0 | 0 ◀▶ |

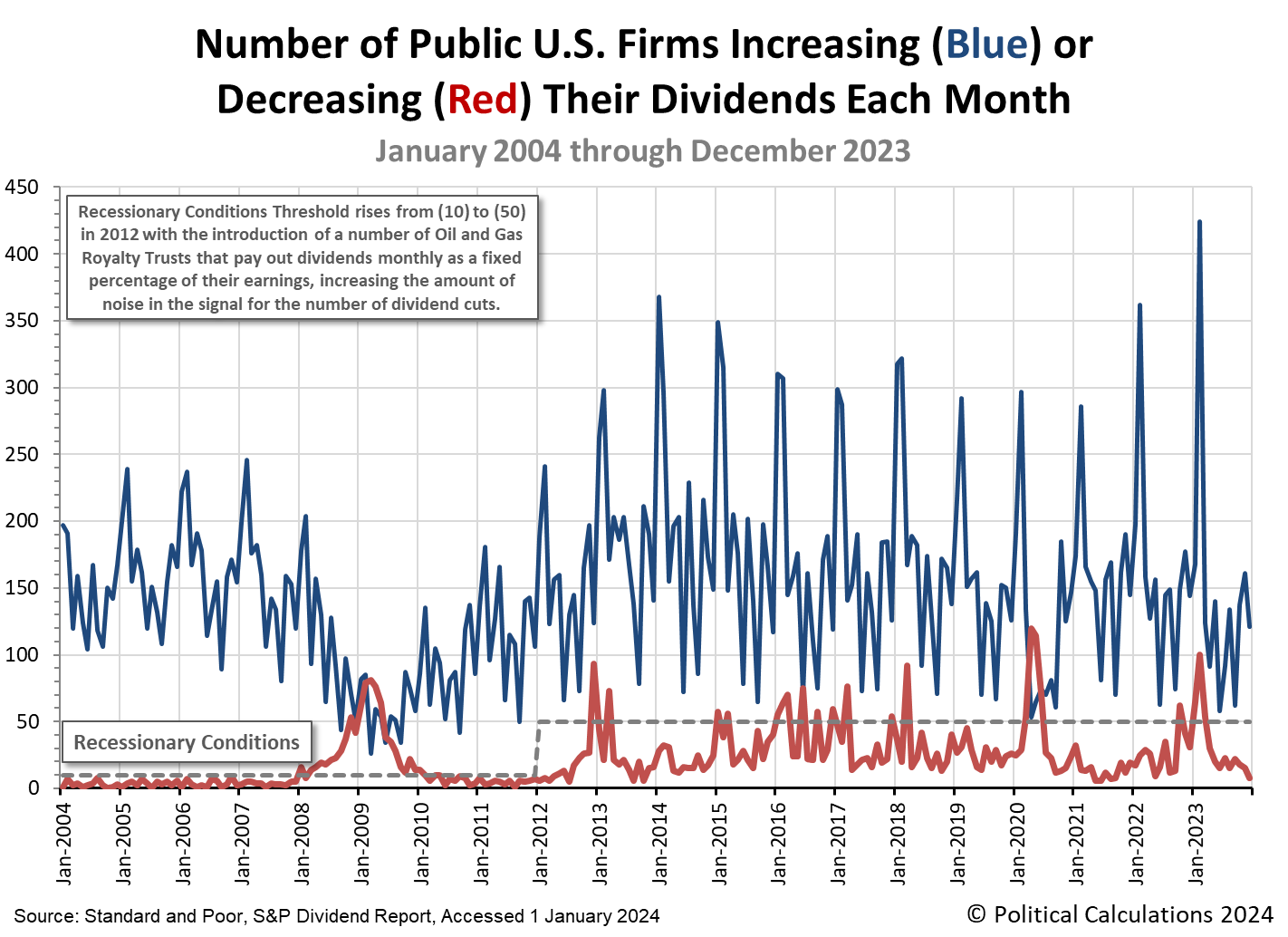

Now, let's visualize that data, starting with the number of dividend rises and decreases reported each month over the last 20 years to put these numbers into their long term context.

The next chart focuses on just the last five quarters, spanning from 2022-Q4 through 2023-Q4. This presentation makes it easier to see the downward trends in the year-over-year figures for dividend increases and also the improving trend for dividend decreases.

Our sampling of December 2023's unfavorable dividend actions found 14 firms announcing decreases in dividend payments to their shareholding owners. Six firms announcing dividend decreases in December 2023 represent the real estate industry, the largest share of any industrial sector, which makes sense given that sector has been hammered throughout 2023 by rising interest rates in the U.S. The oil and gas industry contributed the second-highest share of any industrial sector for the month. However, at five firms, the number of dividend decreases for this sector falls well within the background noise range we expect for the oil and gas industry given that most of these firms pay variable dividends that are directly affected by how the price of oil has changed in recent months.

The remaining three firms in the sampling hail from the manufacturing, packaging (consumer cyclical), and banking industries.

- SL Green Realty (REIT-Office) (Fixed) (NYSE: SLG)

- Danaher (Fixed) (NYSE: DHR)

- Vornado Realty Trust (REIT-Office) (Fixed) (NYSE: VNO)

- Greif (Class B) (Fixed) (NYSE: GEF.B)

- W.P. Carey (REIT-Diversified) (Fixed) (NYSE: WPC)

- Armour Residential (REIT-Mortgage) (Fixed) (NYSE: ARR)

- New York Mortgage Trust (REIT-Mortgage) (Fixed) (NASDAQ: NYMT)

- Ready Capital (REIT-Mortgage) (Fixed) (NYSE: RC)

- Cross Timbers Royalty Trust (Variable) (NYSE: CRT)

- San Juan Basin Royalty Trust (Variable) (NYSE: SJT)

- PermRock Royalty Trust (Variable) (NYSE: PRT)

- Permian Basin Royalty Trust (Variable) (NYSE: PBT)

- Mesa Royalty Trust (Variable) (NYSE: MTR)

- Finward Bancorp (Fixed) (NASDAQ: FNWD)

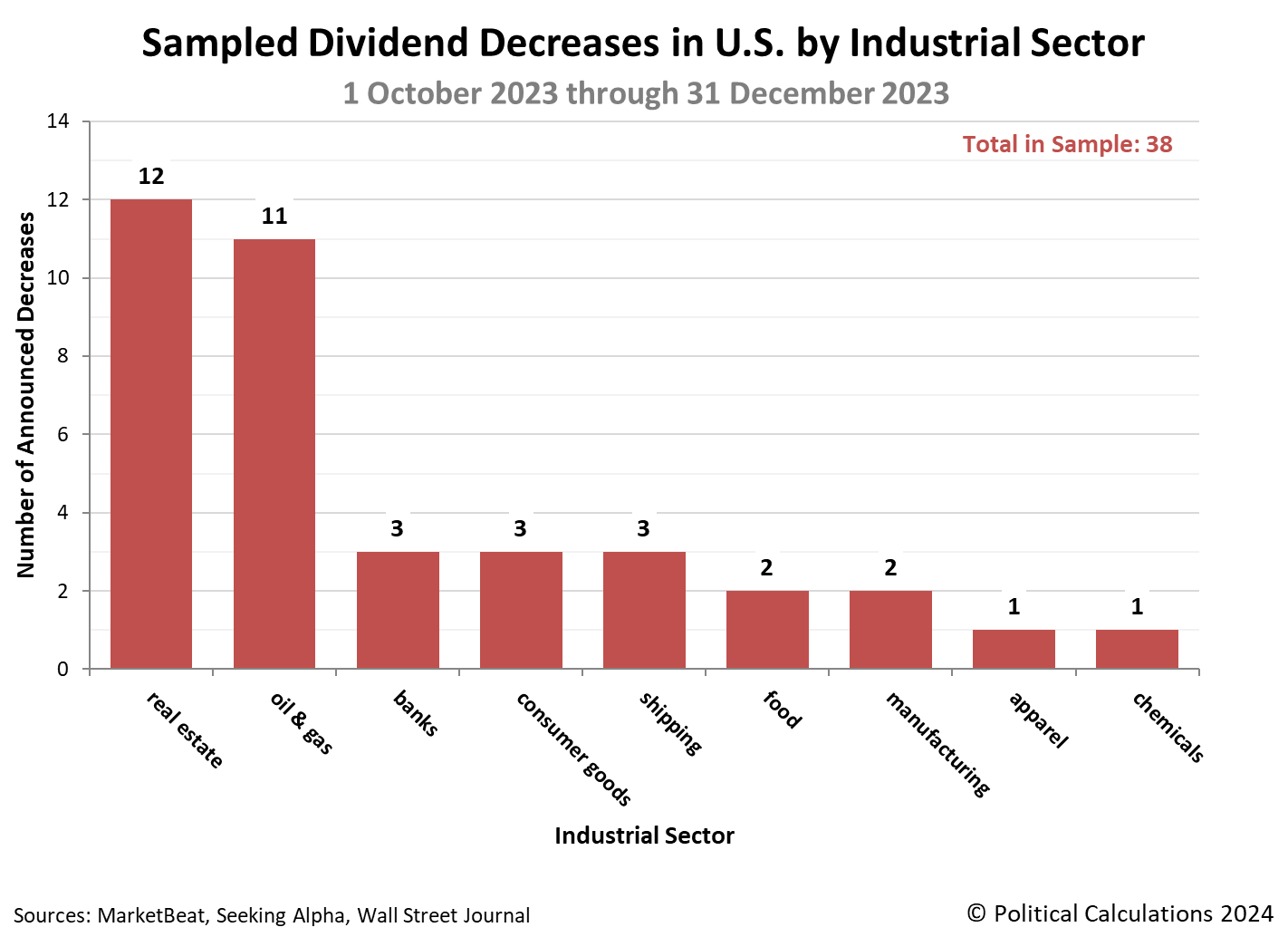

We've tallied up the number of dividend cuts by industrial sector from our monthly sampling over the fourth quarter of 2023 in the next chart:

Dividend reductions in the real estate sector outnumbered those in the oil and gas industry. That's remarkable because many of the firms that saw decreased dividend payments for shareholders in oil and gas industry pay variable dividends on a monthly basis. Never-the-less, the concentration of dividend decreases in the real estate sector points to the outsize effect the Federal Reserve's series of interest rate hikes from March 2022 through July 2023 in negatively impacting the sector, which we should note also negatively affected the banking industry.

2024 promises to see the Federal Reserve swing into reverse and cut interest rates instead, which bodes better for banks and the real estate industry. That anticipated change has the potential to improve the outlook for firms in these sectors and return them to the ranks of firms increasing their dividends.

References

Standard and Poor. S&P Market Attributes Web File. [Excel Spreadsheet]. Accessed 1 January 2024.

Image credit: SyedaAfreen1810443, CC BY-SA 4.0, via Wikimedia Commons.

Labels: dividends

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.