Getting the results of coronavirus tests has been a chronic problem throughout much of the 2020 pandemic.

Early on, simply getting things like an adequate supply of nasal swabs to collect samples for all those seeking COVID tests was a huge problem. Later, testing labs entrusted with determining whether a person either tested positive for the SARS-CoV-2 coronavirus infection or not became a problem when many couldn't keep up with the demand for tests.

The answer to the first challenge was to increase the supply of the test kit components that were in short supply. Engineers deployed 3-D printing technology to make the nasopharyngeal swabs used in COVID test kits. Earlier this month, a study found that one of the more widely used 3-D printed swabs that was developed to cope with the shortage "work as well, and safely, as the standard synthetic flocked nasal swabs".

The answer to the second challenge has been more difficult. The standard answer for the testing labs has been to add more testing equipment to process test results. Unlike nasal swabs however, this equipment cannot be easily produced using 3-D printers, and the supply of qualified equipment and related testing supplies has also come to be in short supply.

That shortage can be seen in the experience of testing labs in states coping with surges in coronavirus infections. Many have had to wait weeks to get new equipment they ordered, only to then face further delays as they needed more time to clear the huge backlogs of past test results after it arrived.

These delays have made it difficult for testing labs to get caught up enough to make testing an effective way to monitor and control the rate of spread of coronavirus infections as envisioned by public health officials. In the absense of sufficient testing capacity, many politicians have stepped in to impose restrictions on commerce and other activities in a bid to slow the spread of infections, but their reactionary policies have wrought considerable damage.

Damage that might be avoided if only COVID-19 testing can be done in a much more timely manner.

That's where the idea of pooling test samples makes a lot of sense. Take a portion of the individual test samples that have been collected and combine them together to perform a single test. If the test on the combined sample comes back negative, then all the individuals whose samples were pooled together this way can be cleared in the time it takes to perform a single test. If the combined test samples comes back positive, then individual tests might be performed to identify the individuals who are infected.

The following diagram provides an example of how pooled testing works in the case of testing for HIV infections in multiple individuals using collected blood samples.

In this example, we can see how pooling test samples can reduce the number of required tests from 20, one for each individual sample, down to as few as 9 tests, a 55% reduction. Applied to COVID-19, pooled testing could greatly amplify the capacity of testing labs while reducing their immediate needs to add expensive equipment.

That's the promise of pooled testing, but the reality hinges on a number of factors. How prevalent are coronavirus infections among the population being tested? How many people's tests can be batched and usefully processed and tracked together using this testing method? What's the optimal size of a testing subgroup?

Fortunately, if you have an idea of what the answer for the first two of these questions might be, there's math to answer the third question! Math that we've deployed in the following tool. If you're accessing this article on a site that republishes our RSS news feed, please click through to our site to access a working version.

Without pooled testing, the number of tests that would otherwise need to be performed would be equal to the total number of individual samples.

For the default scenario in the tool, that would be 20 tests. With pooled testing, and assuming that 10% of the population would test positive, the required number of tests to identify all those with positive results would drop to 9, a 55% reduction. That was to be expected, seeing as the default scenario presented in the tool matched the example in the diagram.

But how might the results change if you increased the number of individual samples? What would happen if the expected test positivity rate was 5% instead of 10%? Being able to answer questions like those is why we built this tool!

For what it's worth, the Food and Drug Administration first approved pooled testing for a COVID-19 test developed by Quest Diagnostics that would group four individuals at a time back on 19 July 2020. On Monday, 28 September 2020, the FDA granted an emergency use authorization to Hologic for a new COVID-19 test that would increase the number of individuals in a pooled test group to five.

That's the size of pooled COVID-19 saliva testing now being conducted at the University of Tennessee. Starting with 574 individual samples, divided into 115 pools for testing (114 pools made from 5 individual samples and 1 pool made from the remainder), university researchers found 21 pooled samples with positive results, with individual tests to be conducted on 105 to identify students actually testing positive. Adding 115 tests to the 105 tests to be conducted, pooled testing will have reduced the amount of needed testing to find students testing positve by over 61% from what would have been needed if each student had to have their samples tested individually.

Pooled testing for COVID-19 is looking to be super beneficial indeed.

References

Horemheb-Rubio, Gibran & Ramos-Cervantes, Pilar & Arroyo Figueroa, Hugo & Ávila-Ríos, Santiago & García Morales, Claudia & Reyes-Teran, Gustavo & Escobedo, Galileo & Estrada, Gloria & García-Iglesias, Trinidad & Muñoz-Saucedo, Claudia & Kershenobich, David & Ostrosky-Wegman, Patricia & Ruiz-Palacios, Guillermo. (2017). High HPgV replication is associated with improved surrogate markers of HIV progression. PLoS ONE. 12. e0184494. DOI: 10.1371/journal.pone.0184494.

Summer J Decker et al, 3D Printed Alternative to the Standard Synthetic Flocked Nasopharyngeal Swabs Used for COVID-19 testing, Clinical Infectious Diseases (2020). DOI: 10.1093/cid/ciaa1366.

Image Credit: Photo by Mufid Majnun on Unsplash

Labels: coronavirus, health, math, tool

The market for new homes in the U.S. is continuing its recent torrid pace. Based on the latest sales data reported by the U.S. Census Bureau, the preliminary nominal estimate of the market capitalization for new homes was $30.6 billion in August 2020.

Taking the trailing twelve month average of the market cap for new homes to factor out seasonality in the data while factoring in data revisions in previous months, we estimate August 2020's adjusted market cap to be $25.76 billion. In nominal terms, this is the highest this figure has been since August 2006, which can be seen in a chart showing the historical market cap data going back to January 1976.

Perhaps more remarkably, the median sale price of new homes sold in the U.S. fell to an initial estimate of $312,700 in August 2020. The initial estimate of the average sale price of a new home sold in the U.S. in August 2020 is $369,000. Overall, new home sale price data have been slowly trending downward since peaking in January 2018, as shown in the following chart presenting median and average new home sale prices since Janaury 2000.

With the trend for the sale prices of new homes generally flat to slightly falling over the last two years, the only way the market cap of new homes could increase is because of rising sales volumes. That fact may be confirmed in the next chart showing the trailing twelve month average of the annualized number of new home sales in the U.S. from January 1976 through August 2020.

The preliminary data for the months from April 2020 through August 2020 suggest the number of new home sales is rising at one of the fastest paces on record. Since the data for the last few months of this period may be subject to revision during the next several months ahead, we won't be able to confirm if its the fastest until later this year.

Labels: market cap, real estate

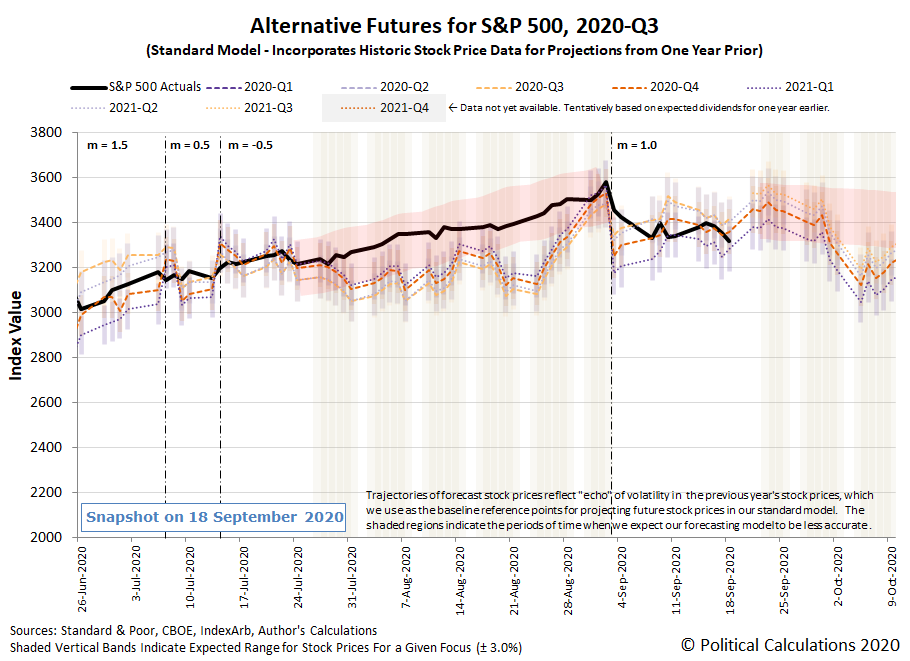

The S&P 500 (Index: SPX) has come to revolve as much around the miscellaneous pronouncements of various minions of the Federal Reserve as it does about their expectations for the fundamental future business prospects of the 500 largest publicly-traded U.S. companies.

The latest sign of how deeply dependent investors have become on those pronouncements on Tuesday, 22 February 2020. Speaking to a virtual forum of Official Monetary and Financial Institutions, Chicago Fed President Charles Evans 'accidentally' set a new expectation the Fed's future monetary policy would be less expansionary than it previously communicated it would be in announcing its new average inflation target policy.

For the dividend futures-based model we use to project the future potential levels of the S&P 500, that kind of change alters the model's amplification factor, which we think shifted from +1.0 to +1.5 as a direct consequence of Evans' statement. We've visually indicated that shift in the latest update of the alternative futures chart indicating the model's future projections.

That change also occurs as investors would seem to have shifted their forward-looking focus from 2020-Q4 toward the more distant quarter of 2021-Q1, which began last week. We think that shift can be best understood as the market starting to pay much closer attention to the 2020 election, whose outcome will have considerable impact on the future for the U.S. government's fiscal policies. We anticipate investors may switch their focus back and forth between 2020-Q4 and 2021-Q1 severval times before the end of the 2020 calendar year.

We've described Evans' rate hike statement as 'accidental' since he attempted to walk it back on the next day, though the level of the S&P 500 indicates his effort, combined with the statements of other Fed officials, was unsuccessful.

Speaking of which, there was quite a lot of noise coming from the Fed's minions in the trading week ending on 25 September 2020, mostly calling for the U.S. government to step up its fiscal stimulus efforts. There was other stuff too, but that's what stood out to us in reviewing what we consider to be market-moving headlines from the week's newstream.

- Monday, 21 September 2020

- Daily signs and portents for the U.S. economy:

- Oil falls 5% as economic outlook dims with rising virus cases

- Oil refiners worldwide struggle with weak demand, inventory glut

- Government aid, stock gains push U.S. wealth to pre-pandemic levels, Fed says

- Bigger trouble developing in Eurozone:

- Europe lockdown fears trigger worst stocks sell-off in three months

- S&P Global warns of new European sovereign-bank 'doom loop'

- Bigger stimulus still developing in China:

- China's cabinet unveils steps to spur new forms of consumption

- China's property developers seek to dodge new rules with shift of debt off balance sheets

- Fed minions see rates at near-zero for years:

- Fed's Powell says central bank committed to using all tools to help recovery

- Fed's Kaplan says low rates may be needed for two-and-a-half to three years

- Wall St ends lower on lockdown fears, likely delay of stimulus

- Tuesday, 22 September 2020

- Daily signs and portents for the U.S. economy:

- Oil edges up a day after selloff; rangebound ahead of U.S. crude stocks data

- U.S. existing home sales approach 14-year high; prices scale record peak

- Surge in U.S. pork exports to China led by Brazil's JBS, China's WH Group

- Bigger trouble continuing in China, growing in Brazil and Argentina, as 'clouds gather' in Eurozone:

- China's consumption will take time to return to normal growth: Premier Li

- Brazil's rates curve a 'warning' spending must be tamed: treasury secretary

- Argentina economy plunges record 19.1% in second quarter on pandemic impact

- Euro zone rebounds from recession but clouds gather

- Bigger stimulus expected in Eurozone:

- ECB should err in doing too much rather than too little: Panetta

- EU may allow more state aid to boost green projects

- Fed minions want U.S. government to spend more to 'stimulate' U.S. economy:

- Fed's Evans sees 'recessionary dynamics' without fiscal aid

- Fed's Barkin says recent labor market improvements will slow

- Fed, Treasury chiefs back more aid for small business but leave details fuzzy

- Wall Street closes higher on Amazon boost, despite economic worries

- Wednesday, 23 September 2020

- Daily signs and portents for the U.S. economy:

- Oil edges higher after U.S. crude, fuel stockpiles draw down

- U.S. oil inventories fall across the board last week: EIA

- U.S. business activity slows, house price inflation accelerates

- U.S. House passes stopgap funding bill to avoid government shutdown

- Bigger trouble developing in Japan, Germany, United Kingdom, global trade hub Singapore:

- Nearly 36,000 Japan firms shut down business due to COVID-19 - think tank

- German manufacturers benefit from foreign demand, but services lose steam: PMI

- UK's post-lockdown recovery loses steam as household demand weakens

- Singapore's deflation extends to seventh month in core gauge

- Fed policymakers vow to keep interest rates near zero, call for more fiscal help

- Fed not planning 'major' changes to Main Street program, Powell says

- Cleveland Fed's Mester does not comment on U.S. economic, policy outlook

- Fed's Rosengren says increased COVID infections, lack of fiscal support could slow recovery

- Fed's Rosengren says more targeted fiscal aid needed

- Fed's Rosengren says U.S. could face a credit crunch by year end if virus worsens

- Fed's Evans says he doesn't fear 2.5% inflation, or even above

- Fed's Daly says inflation will be guide on U.S. full employment

- Fed's Quarles sees long recovery, says he'll be 'more patient' on inflation

- Wall Street closes lower on fears of a slowing economy

- Thursday, 24 September 2020

- Daily signs and portents for the U.S. economy:

- Crude steady as rising European COVID-19 cases offset U.S. oil stock draw

- U.S. new home sales vault to near 14-year high in August

- Bigger trouble evident in China, Canada:

- China's slow consumption recovery upset by wary low-income households

- Trudeau says Canada is in second wave of pandemic, urges renewed caution

- Bigger stimulus rolling out in Canada, signs of traction in China:

- Canada 'bets the farm' on big spending as second wave threatens economic recovery

- Global steel output edges up in August, buoyed by strong China

- ECB minion demonstrates firm grasp of obvious, Fed minions step on soapboxes:

- ECB's Lane says containing virus is priority

- Fed's Williams says structural inequality stifles economic growth

- Fed's Bullard: Not reasonable to make second virus wave a baseline outlook for U.S. economy

- Fed's Evans says U.S. taking unnecessary risks with lack of more fiscal aid

- Fed's Barkin sees low risk of inflation escalating in near future

- Fed's Powell says Main Street may use up to $30 billion by year end

- Wall Street closes up on tech rally despite mixed signs on economic rebound

- Friday, 25 September 2020

- Daily signs and portents for the U.S. economy:

- Oil falls on mounting COVID-19 cases, supply concerns

- U.S. business spending digging out of deep hole; outlook uncertain

- U.S. imports surge as pandemic worries have retailers stockpiling

- Mnuchin, Powell say some $380 billion in unused aid could help U.S. economy

- Bigger stimulus in the Eurozone comes with a price:

- Euro zone firms continue to load up on credit as economy reopens: ECB data

- Rise of the zombies? Europe faces insolvency balancing act

- Wall Street ends higher as tech rally squashes virus fears, but S&P down for week

Barry Ritholtz presents the positives and negatives he found in the past week's economics and markets news over at The Big Picture.

Finally, for those looking for a primer of how the outcome of an election can alter the future expectations of investors, be sure to review the history of 2012's Great Dividend Raid, which we had the pleasure of documenting in real time as it happened!

Update 1 October 2020: Following the close of trading on 30 September 2020, we've tweaked the alternative futures chart to refine the start of the next redzone forecast range, which we're now showing as beginning on 1 October 2020. Here's the updated chart:

On Monday, 28 September 2020, investors shifted their forward-looking focus from 2020-Q1 back toward 2020-Q4. The new redzone forecast range assumes investors will hold their attention on 2020-Q4 through 28 October 2020. We anticipate investors may continue to shift their investing time horizon between these two quarters in the weeks ahead. While a strong focus on 2020-Q4 would see the trajectory of the S&500 run within the forecast range, we would see shifts toward 2020-Q1 would coincide with the trajectory of the S&P 500 running toward the low end of the forecast range, if not falling below it.

How much do you need to set aside each payday to save up for a big ticket item you will need to buy a few years from now?

Sure, you could do what a lot of people do and just pull out your credit card when it is time for you to buy that big ticket item, then spend the next several years paying for it and the interest your credit card company will charge you. But what if you would rather only pay once for what you know well in advance that you're going to be buying?

Better still, what if you set aside money every payday and earned a little bit of interest on it from that savings account at your bank? You wouldn't need to set aside quite so much, but all the money you would need would be ready when you're ready to pull the trigger on your planned purchase.

That's where our latest tool might be really helpful for you. Just enter the indicated data for your future purchase in the input fields below, and it will work out how much you will need to set aside from each of your paychecks until you have saved enough! [If you're reading this article on a site that republishes our RSS news feed, please click here to access a working version of the tool at our site.]

For our default calculation, if you placed $126.69 out of every paycheck in your savings account and earned 0.8% interest on it, you would have $10,000 saved up after 3 years. If you change the interest rate to 0%, you'll find that you'll have reduced the amount you need to save by $1.52 per paycheck, which doesn't sound like much, but that's a $118.56 savings for you over three years.

If you can get a higher interest rate on your savings account, then the savings math may become more compelling. Alternatively, if you can find a way to get a discount on what you're looking to buy and are willing to adjust the timing of when you plan to buy, that will work in your favor too.

If you're wondering about the math behind the tool, it the same that big corporations use when they plan to set aside funds to pay dividends to their shareholding owners or to pay back money they've borrowed. They call these special purpose savings accounts "sinking funds", although we have yet to find a compelling explanation for why they're called that.

But you have to admit, they're an excellent way to ensure you have the money you will need when it is time to buy that costly, not-so-everyday item. Not to mention being easier to manage than three years worth of loose change tossed in a jar!

Image credit: Photo by Michael Longmire on Unsplash

Labels: debt management, personal finance, tool

How has the cumulative distribution of income in the United States changed over the last six years?

Since the U.S. Census Bureau published its income distribution data for American individuals, households, and families for the 2019 calendar year on 15 September 2020, we thought it would be interesting to show how the distributions for each of these subgroups of the nation's population has changed over time. To do that, we've put together several animated charts to show the evolution of the distribution of income in the U.S. from 2014 through 2019.

If you're reading this article on a site that republishes our RSS news feed, you may want to click through to the original version of this article at our site to see the animations in action.

Here is the animated chart showing the shifting distribution of total money income for individual Americans:

Next, let's look at the animated chart for the total money income distribution of American households:

Finally, here is the animated chart showing the ongoing development of total money income for American families:

The U.S. Census Bureau distinguishes families from households by recognizing that families are made up of individuals who live together that are related to each other by birth, marriage, or adoption. Households may consist of people who either are related or that are not related as a family.

Each of the animated charts show the distribution of nominal cumulative total money income for American individuals, households, or families, which have not been adjusted for inflation. For each of these groupings, the animations show the distribution of income in the U.S. shifting toward the right, with Americans' incomes rising over time. The rate of increase has accelerated considerably in the most recent years, although we should note that the data for 2019 was collected in early March 2020, before any negative impacts from the Coronavirus Recession would be observed.

The animations also show the shifting distribution of income in the U.S. resulting in a falling percentage of Americans with the lowest incomes during these years, while the percentage of Americans at the upper end of the nation's income spectrum has been rising.

If you would like to keep track of the latest trends for median household income, we estimate that vital statistic each month. Our next update will come on 1 October 2020, when we'll present the latest updates through August 2020. Until then, our estimate of median household income for July 2020 is the latest entry in the series.

Labels: data visualization, income distribution, median household income

From time to time, we test drive new forecasting methods for stock prices to see how they perform.

Back in early November 2018, we presented a prediction for what would happen with the share price of General Electric (NYSE: GE) based on a relationship between its expected future dividends and its market cap. Let's quickly recap that old forecast:

Now that General Electric (NYSE: GE) has slashed its quarterly dividend by 91%, from $0.12 to $0.01 per share, which we estimate is about 50% more than what investors had already priced in to the stock, what can they expect next for the company's share price?

Based on the historic relationship that investors have set between the company's market capitalization and its aggregate forward year dividends since 12 June 2009, we would anticipate GE's share price falling to somewhere within a range of $3 to $7.

Almost two years later, we can see how well the forecasting method we were testing worked, updating that original chart to show how history played out. The new chart catches the data up through 3 September 2020 to coincide with the date of GE's most recent dividend declaration:

It didn't take long for GE to prove that prediction right, with its market cap dropping within the top end of our target range in a month's time.

But that outcome didn't last very long. Soon, GE's stock price rose above the range we had projected using nine years worth of historical data, staying well above it for a prolonged period of time. It took the onset of today's Coronavirus Recession to drop GE's market cap back within that target range. Even so, GE's market cap hasn't fallen below the midpoint of that range during any of that time, which means the method we used set the target too low.

Being able to connect a company's expected forward year aggregate dividends to its market capitalization to forecast its stock price could be a valuable way of determining whether its current share price presents a buying or a selling opportunity. Doing a better job in setting the target would better indicate which kind of investing opportunity might exist at any given time.

We have an idea for how to improve our result, which we'll explore more in upcoming weeks. To test it out though, we'd like to look at some other stock than GE, since we don't expect the company will be changing its dividend payouts anytime soon. If you have a candidate for us to consider, please drop us a line!

References

Dividend.com. General Electric Dividend Payout History. [Online Database]. Accessed 22 September 2020.

Ycharts. General Electric Market Cap. [Online Database]. Accessed 22 September 2020.

Yahoo! Finance. General Electric Company Historical Prices. [Online Database]. Accessed Accessed 22 September 2020.

Labels: dividends, investing, market cap

What effect does going back to school have on the spread of COVID-19 coronavirus infections?

The possible answers to that question have greatly concerned many parents and policymakers around the world. To find out the possible effect, we've turned to data from the state of Arizona where a combination of demographic data from the state's Department of Health Services and its three major public universities provides a window into seeing what that effect might be.

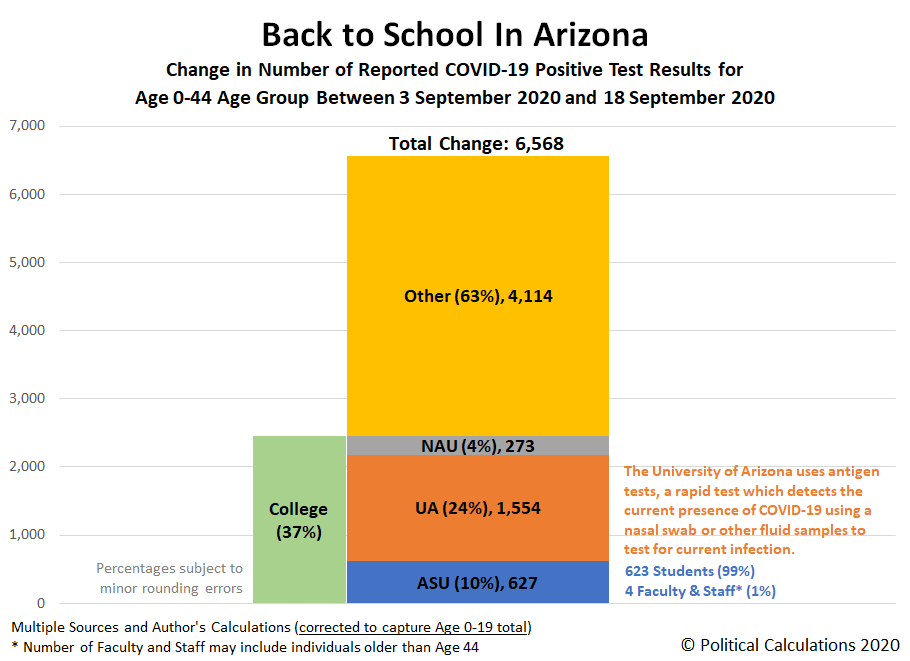

Arizona's universities started their Fall 2020 sessions by delivering course content online in August, but began providing either hybrid or traditional classroom instruction at their campuses in late-August or early September. Since we're mainly interested in how returning to the classroom might affect the spread of COVID-19 among the student age population, we looked at the total number of positive coronavirus tests reported for the Age 0 to 44 population across the state and just by Arizona State University (ASU), the University of Arizona (UA), and Northern Arizona University (NAU) at two points in time: 3 September 2020 and 18 September 2020.

We've presented the results of that exercise in the following chart showing the change in the number of coronavirus cases in the between these two points in time, where we find a mixed picture. Please click here to access a full-size version of the chart. [Update 26 September 2020: We identified an error in our original presentation that undercounted the number of cases in the Age 0-19 portion of the population. The original chart we presented is here, the following chart has been corrected. corrections in our analysis below are indicated with boldface font.]

Between 3 September 2020 and 18 September 2020, the total number of positive test results reported by Arizona's Department of Health Services increased by 6,568. Of this figure, 37% of the reported increase in cases originated at Arizona's three major public universities. The other 63% represents the total increase in cases reported in the state for its entire Age 0 to 44 population.

Here is the breakdown for the three public universities:

- Arizona State University: 627 cases (10%)

- Univerisity of Arizona: 1,554 cases (24%)

- Northern Arizona University: 273 cases (4%)

The University of Arizona's high case count stands out because it is utilizing rapid antigen tests, which differ from the established COVID-19 tests performed at the other universities and at testing sites across the state. After long excluding results from these tests in its daily reported case counts, Arizona's DHS began including results from antigen tests in its statewide tallies on 17 September 2020. UA's antigen test results have had issues with false positives.

The reported data is limited because it is silent about where an individual with a positive COVID-19 test result may have been exposed to the SARS-CoV-2 coronavirus. For example, a student's exposure to the viral infection may have taken place in a classroom, a campus facility, a dorm, or even off campus. We should also note that the positive COVID-19 results for university students, faculty and staff members may also include individuals older than Age 44.

That's why breaking out data for a university's faculty and staff may be valuable, since the incidence of cases would come primarily through contact in classroom and on-campus facilities. Here, data from ASU indicates that students account for 99% of the reported cases, while faculty and staff account for just 1% of the new cases reported in our period of interest. Data going back to 1 August 2020 indicates 2% of all ASU's reported cases have been among faculty and staff members.

All these institutions are operating with classes set up to minimize the potential spread of coronavirus infections. The exceptionally low number of new positive test results among faculty and staff suggest those approaches are effective at protecting the health of older individuals who are much more at risk of health complications from COVID-19 than the student-age population, who make up the vast majority of infections on campus.

For all the testing the universities are doing, two of the three are reporting comparatively low test positivity rates, consistent with levels indicating the spread of coronavirus infections is manageable. Both ASU and NAU report their cases are below a 5% threshold.

By contrast, UA reports a 15.5% rate from its antigen tests, prompting the university to tell students on 14 September 2020 to "shelter-in-place" for two weeks. The action is expected to bring the spread of infections back down to manageable levels.

Meanwhile, falling rates of COVID-19 hospitalizations are continuing to be reported for the state. The Age 0-44 demographic is also the least likely to experience health complications from the viral infection requiring admission to hospitals, which may account for why these numbers have not been rising.

Perhaps the most significant factor behind the pattern we see in the incidence of COVID-19 infections at Arizona's major college campuses is whether or not its local community has already had significant numbers of cases. Arizona became a hotbed for infections during June 2020 and peaked in July 2020, with over 60% of its reported concentrated in the Phoenix metropolitan area (where ASU is located). Meanwhile, the Tucson metro area (the home of UA) had a moderate number of cases and greater Flagstaff (home to NAU) had has relatively low numbers.

As we've previously observed, COVID is very much a geographic phenomenon, tending to spread most where it hasn't previously been in great numbers, where local herd immunity hasn't developed. We suspect that dynamic lies behind the high number of cases at UA in Tucson now being recorded, and we fear NAU in Flagstaff may have a surge in cases in its future.

The patterns we've described for Arizona would seem to have direct bearing on the "going back to school" season for college students in other states. Dave Tufte describes what he's observing with a marked surge in COVID-19 cases now taking place in Utah. Looking over the state's data, we think the sharp increase in number of new coronavirus infections in the state may be tied to an initial exposure event coinciding with the late start of classes at Brigham Young University, which was then amplified and spread to students' home towns during the Labor Day holiday weekend a week later. Like Arizona's UA outbreak, it seems to be spreading in areas that haven't previously seen high levels of infections.

That still leaves us with one big question needing more information to be answered. Do high numbers of cases among college students take place in places that have already experienced high epidemic numbers? Arizona's data hints the answer is no, but the sample size of universities running in-person classes across the country is still pretty small.

References

We've used contemporary news reports to compile the COVID-19 data for the universities, and Arizona's DHS COVID-data dashboard for the state's overall figures for the Age 0-44 population.

Arizona Department of Health Services. COVID-19 Data Dashboard. [Online Application/Database]. Accessed 19 September 2020.

Eltohamy, Farah. University of Arizona reports new daily high for positive COVID-19 tests. AZCentral. [Online Article]. 3 September 2020.

Hansen, Piper J and Myscow, Wyatt. There are 983 positive coronavirus cases within the ASU community. State Press. [Online Article]. 3 September 2020.

Ackley, Madeline. ASU has 112 new COVID-19 cases in past 3 days, whil UA has 678. AZCentral. [Online Article]. 18 September 2020.

Northern Arizona University. Coronavirus updates and resources. [Online Article]. Accessed 18 September 2020.

Labels: coronavirus, education, risk

The dividend futures-based model we use to project the future for the S&P 500 (Index: SPX) presents some unique challenges from time to time.

In 2020, one of those challenges has been coping with changes in the model's amplification factor (m) which, after more than a decade of holding a virtually constant value, suddenly became a variable. Add to that a bubble in stock prices inflated by a Japanese investment bank, and we've had our hands full in keeping up with the changes that have driven stock prices.

The unwinding of the one-sided trades launched by the Japanese investment bank's "NASDAQ whale" combined with statements by Federal Reserve officials on Wednesday and Thursday in the past week however provided us with an opportunity to calibrate the model and empirically determine the amplification factor. Assuming investors are continuing to focus on 2020-Q4 in setting current day stock prices, it seems to have settled at a positive value of 1.0.

That's less than the value of 1.5 that held in the period prior to the NASDAQ whale's influence, where the reduction from this level is consistent with the Fed adopting a more expansionary monetary policy. Since nobody outside of Japan's SoftBank had visibility on its role in the summer stock price rally, we had previously attributed the runup in the S&P 500 to investors responding the Fed's signaling its increasing willingness to adopt a more 'dovish' policy. Now that the NASDAQ whale is out of the picture, so to speak, we can now better quantify the contribution of the Fed's signaled policy change to the summer rally, where it would appear to account for 25% of the change in the amplification factor.

This past week is when that signal was set more definitively, although as you'll see in the headlines we plucked from the week's major market-moving newstream, the Fed is still really shaky on what that new policy means.

- Monday, 14 September 2020

- Daily signs and portents for the U.S. economy:

- Oil edges lower, shrugging off Gulf of Mexico shut-ins

- Mnuchin says he will continue to work on COVID-19 deal: CNBC

- Economic rebound taking shape in Eurozone, but ECB minion sees disinflation developing in Eurozone:

- German economic recovery to continue in second-half, third-quarter to show strong growth: ministry

- ECB's Makhlouf sees continued fall in prices during pandemic

- Wall Street closes broadly higher on deal news, vaccine hopes

- Tuesday, 15 September 2020

- Daily signs and portents for the U.S. economy:

- Oil gains as hurricane shuts U.S. output, stockpiles fall

- Bipartisan U.S. lawmakers to unveil $1.5 trln COVID-19 aid bill

- White House open to 'Problem Solvers' compromise in coronavirus aid fight

- Leading U.S. House Democrats say coronavirus relief plan from moderates 'falls short'

- U.S. median income hit record in 2019, Census data shows

- U.S. manufacturing production increases in August

- Bigger stimulus still rolling out in China:

- ECB minions having second thoughts on policies:

- S&P 500 ends higher on growing hopes Fed will stay accommodative

- Wednesday, 16 September 2020

- Daily signs and portents for the U.S. economy:

- Oil up more than 4% as U.S. stockpiles fall, hurricane hits output

- Fading fiscal stimulus restraining U.S. consumer spending

- Fed minions say no rate hikes:

- Fed touts economic recovery, vows to keep interest rates low

- Fed defends 'pedal to the metal' policy and is not fearful of asset bubbles ahead

- Fed vows to keep interest rates near zero until inflation rises

- ECB minions argue negative, low interest rates are bad:

- 'Don't do it': studies flash sub-zero rate warnings to central banks

- ECB's Holzmann says low rates harmful in long term

- Bigger trouble developing in China:

- Surprising news:

- S&P 500 ends down after late reversal despite Fed's low-rate stance

- Thursday, 17 September 2020

- Daily signs and portents for the U.S. economy:

- Oil rises 2%, reverses loses as OPEC+ addresses market weakness

- U.S. labor market recovery stalling; housing market presses ahead

- Bigger trouble developing in Eurozone:

- Resurging coronavirus biggest threat to euro zone economy: economists

- Euro zone August price fall confirmed, core inflation slows

- Fed minion seeks to lower expectations, ECB minions want to devalue Euro and bail out banks:

- Fed's Powell sees a long road to 'maximum employment'

- ECB's de Guindos says exchange rate is fundamental for inflation

- Euro zone banks get 73 billion euro ECB relief to withstand pandemic

- Wall Street falls as tech sells off again, jobless claims still high

- Friday, 18 September 2020

- Daily signs and portents for the U.S. economy:

- Oil flat as Libya developments counter OPEC+ boost

- U.S. details up to $14 billion in new aid for farmers

- Fed says household finances improving, but low-income ones face tougher road

- Fed minions don't understand their new policy, worry about inflation, admit pandemic aid aimed at bailing out banks, looking to bail out Main Street and fix effects of decades-old racist policies:

- Fed officials tussle over practical meaning of new inflation policy

- What are the Fed's new hurdles for rate hikes? Only the Fed knows

- Bostic: Inflation up to 2.3% 'would be fine' as long as it is stable

- Fed's Kashkari wanted stronger commitment to delay rate hikes

- Bullard: Loose central banks, big deficits could produce inflation

- Fed's Kashkari says pandemic aid was also 'banking bailout'

- Fed, regulators take step to encourage more Main Street loans

- Bostic: 'Fundamental' effort needed to address racial wealth, economic gaps

- ECB minion wants more stimulus:

- Wall Street posts third week of declines as tech slide drags on

Meanwhile, Barry Ritholtz succinctly summarized each of the positives and negatives he found in the past week's economics and markets news.

More or Less presenter Tim Harford talks about deliberately misleading statistical analysis in the following Numberphile video. If you have nine minutes, you'll find why its essential to maintain a healthy skepticism of both claims and counterclaims based on statistical analysis.

If you're anywhere but the U.S. or Canada today, Tim's newest book, How to Make the World Add Up, is now available for sale. If you're in the U.S. or Canada, you'll have to wait until February 2021 to get a copy that will carry a different title: The Data Detective: Ten Easy Rules to Make Sense of Statistics, which can be pre-ordered at Amazon today.

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.