Welcome to the Friday, July 31, 2009 edition of On the Moneyed Midways! Each week, we seek out the best and most entertaining posts we can find among the contributions to the week's business and money-related blog carnivals, which we then extract and present to provide the best weekend entertainment you'll find on these topics anywhere!

Welcome to the Friday, July 31, 2009 edition of On the Moneyed Midways! Each week, we seek out the best and most entertaining posts we can find among the contributions to the week's business and money-related blog carnivals, which we then extract and present to provide the best weekend entertainment you'll find on these topics anywhere!

Each of the posts we've listed ranked at the top of the blog carnival in which they appeared, but some take it to the next level. We've identified these posts as Absolutely essential reading! And one post has earned the title of being The Best Post of the Week, Anywhere!

So why wait any longer? The best posts of the week that was are waiting for you below....

| On the Moneyed Midways for July 31, 2009 | |||

|---|---|---|---|

| Carnival | Post | Blog | Comments |

| Carnival of Debt Reduction | A Big Victory for Those in Debt Collections | Prudent Money | Bob Brooks reports on a secret deal the National Arbitration Forum had with a large debt collection firm, which put the consumers going through arbitration at a severe disadvantage, as the firm was forced to exit the business thanks to a lawsuit. |

| Carnival of Personal Finance | When to Start Collecting Social Security | Bad Money Advice | Frank Curmudgeon runs the numbers to work out that if you have a choice, it's better to hold off on applying for Social Security benefits for as long as you can. |

| Carnival of Real Estate | Marketing Home Listings Using Social Media & Twitter | Arch City Homes | Karen Goodman talks about what she's learned as she's begun to take advantage of Twitter to help her real estate business. Absolutely essential reading! |

| Consumer Focused Carnival of Real Estate | How to Protect Yourself from Someone Else's Unpaid Water Bill When Buying a Home… | Team Reba Real Estate | Reba Haas sends up a warning flag for agents representing property buyers to be sure they're not stuck with the previous owner's unpaid utility bills! |

| Consumer Focused Carnival of Real Estate | Consumer Focused Carnival of Real Estate | Searchlight Crusade | Carnival host Dan Melson has a special place to review the this week's off-topic or just-plain-awful posts submitted for consideration to the blog carnival. Absolutely essential reading! |

| Festival of Frugality | Make a Trashcycled Hermes Birkin Bag | Dollar Store Crafts | The world's most expensive handbag is made by Hermes Birkin and costs $200,000. A Craftster forum member, brainybee, took on the challenge of creating a "decent copy out of garbage," saving as much as $199,998. You'll need to follow the links, but brainybee's forum post is The Best Post of the Week, Anywhere! |

| Carnival of Money Stories | Famous Musician Bankruptcies: From Millions to Broke | Bible Money Matters | Peter Anderson identifies the lessons to be learned from the great failures following the great successes of some of the music industry's top talent. |

Previous Editions

- OMM's Running Index for 2008

- OMM's Running Index for 2007

- The Best Blogs Found in 2006 (and our full 2006 index)!

Labels: carnival

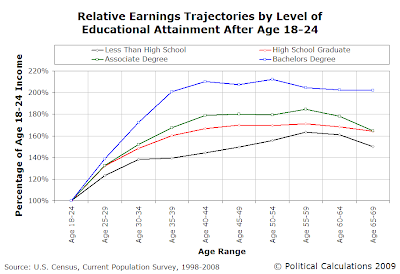

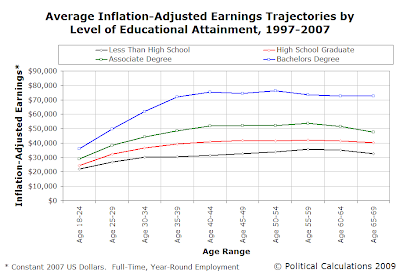

We previously explored the relationship between age, education and inflation-adjusted earnings for another project, but we limited that study to just the first 25 years of a typical bachelor degree holder's life after they graduated from college. Today, we're widening our net to examine how the average individual's income changes over time, depending upon whether they have less than a high school education, have graduated from high school, have earned an Associates degree or have earned a Bachelor's degree as they progress in life from Age 18-24 through Age 65-69.

Building on what we did previously, our first step was to calculate the percentage of Age 18-24 earnings to determine the basic trajectory that each educational peer group took from 1997 through 2007 with respect to this "starting" income using data from the U.S. Census' Current Population Survey covering each of those years, for those working full-time year-round. After calculating the earnings trajectory for each of these years, we averaged the basic trajectories to produce our first chart.

Next, we converted the mean earnings of the Age 18-24 educational peer group for each year to be in constant 2007 U.S. dollars, then found the average and standard deviation, which we've presented in our second chart in this post.

If we omit the annual earnings reported for 2002 for those with less than a high school education and bachelor degree holders, we find the the standard deviation declines from $1,977 to $1,293 for those without high school diplomas or GEDs and from $3,091 to $1,417 for the college graduates. The mean incomes for each group declines from $21,834 to $21,366 for those with less than a high school education and from $35,902 to $35,063 for those holding bachelor degrees. We opted to retain the data for 2002 in producing the charts in this post.

One pattern we note is that income generally rises up through Age 50-54 for each of the educational peer groups. However, we see a significant drop-off in income earned after this age band. This outcome is most likely the result of more successful, higher income-earning individuals opting to retire earlier than their lower income earning peers.

That likelihood is also suggested by the steeper drop-off in annual earnings that we see for the higher income earning educational peer groups after Age 50-54, especially the highest earning bachelor degree holders and associate degree holders as compared to the lower earning high school graduates and those with less than a high school education. In the case of the highest earning bachelor degree holders, we see the maximum earning point reached roughly five years before the same peak earnings point for the other educational peer groups.

Update 12 March 2010: We've developed a tool you can use to project an individual's income at different ages (assuming their income trajectory parallels the average level for an individuals with a similar level of education.) And if you're someone who is conducting demographic research for the Boston Beer Company, or others, we're available for consulting. Just see the "About Political Calculations" in the right hand sidebar at the top for our contact information!...

Labels: data visualization, economics, education, income, income distribution

Writing in Foreign Policy, Vitaliy Katsenelson argues that China is defying economic reality and compares China's current economic fortunes with those Lucent Technology in the days of the Dot-Com Bubble in the late 1990s:

Despite everything, the Chinese economy has shown incredible resilience recently. Although its biggest customers -- the United States and Europe -- are struggling (to say the least) and its exports are down more than 20 percent, China is still spitting out economic growth numbers as if there weren't a worry in the world. The most recent estimate put annual growth at nearly 8 percent.

[...]

China's fortunes over the past decade are reminiscent of Lucent Technologies in the 1990s. Lucent sold computer equipment to dot-coms. At first, its growth was natural, the result of selling goods to traditional, cash-generating companies. After opportunities with cash-generating customers dried out, it moved to start-ups -- and its growth became slightly artificial. These dot-coms were able to buy Lucent's equipment only by raising money through private equity and equity markets, since their business models didn't factor in the necessity of cash-flow generation.

Funds to buy Lucent's equipment quickly dried up, and its growth should have decelerated or declined. Instead, Lucent offered its own financing to dot-coms by borrowing and lending money on the cheap to finance the purchase of its own equipment. This worked well enough, until it came time to pay back the loans.

The United States, of course, isn't a dot-com. But a great portion of its growth came from borrowing Chinese money to buy Chinese goods, which means that Chinese growth was dependent on that very same borrowing.

Now the United States and the rest of the world is retrenching, corporations are slashing their spending, and consumers are closing their pocket books. This means that the consumption of Chinese goods is on the decline. And this is where the dot-com analogy breaks down.

It's a provocative argument, but is Katsenelson right? How healthy is China's economy with respect to that of the United States? Is China's reported economic growth rate real? Is there a way to find out?

The chart above reveals that the rate of growth of U.S. exports to China and Chinese exports to the U.S. have both fallen into negative territory with respect to where they were in the previous year. Significantly, we find that U.S. exports to China have been consistently falling at a faster rate than Chinese exports to the United States since December 2008, reversing the trend we observed in the period beginning in July 2003, which was driven largely by China's much faster rate of economic growth than the U.S.

We also see that at the moment, the rates at which the year-over-year change in export growth between the two nations are changing are such that the rate of U.S. export growth to China is falling more steeply than that of China's exports to the U.S. This difference suggests that China's economy is less well off than that of the U.S. That, in turn, indicates that China's reported GDP growth figure of 8% is an illusory figure, as a truly growing economy would steadily demand greater resources from all available sources, which would be reflected in international trade data.

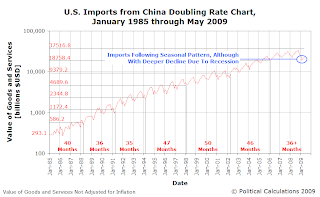

We confirm that outlook by examining our doubling rate charts showing the level of exports from the U.S. to China, and the level of imports to the U.S. from China below:

|  |

|---|

In the charts above, we see that U.S. demand for Chinese export is following its well-established seasonal pattern, although with a greater seasonal decline due to the worsening of the current recession in late 2008. Meanwhile, we see that while U.S. exports to China have rebounded from the level they plunged to early in 2009, there is not yet sufficient evidence to indicate that genuinely sustainable economic growth in China is driving the change. Katsenelson explains why China's leaders are acting as they are to stimulate their economy as they are, as well as the different risks they're trading off in doing so:

Why is China doing this? It doesn't have the kind of social safety net one sees in the developed world, so it needs to keep its economy going at any cost. Millions of people have migrated to its cities, and now they're hungry and unemployed. People without food or work tend to riot. To keep that from happening, the government is more than willing to artificially stimulate the economy, in the hopes of buying time until the global system stabilizes. It's literally forcing banks to lend -- which will create a huge pile of horrible loans on top of the ones they've originated over the last decade.

But don't confuse fast growth with sustainable growth. Much of China's growth over the past decade has come from lending to the United States. The country suffers from real overcapacity. And now growth comes from borrowing -- and hundreds of billion-dollar decisions made on the fly don't inspire a lot of confidence. For example, a nearly completed, 13-story building in Shanghai collapsed in June due to the poor quality of its construction.

Time will tell if that Shanghai building collapse will become a metaphor for the Chinese economy at large.

Labels: economics, risk, trade

Are you a DC policy wonk looking to work out how much economic growth you might be able to squeeze out of that next economic stimulus package? Or maybe you're playing along at home and you'd like to work out why the last one would not seem to be working very well at all.

Are you a DC policy wonk looking to work out how much economic growth you might be able to squeeze out of that next economic stimulus package? Or maybe you're playing along at home and you'd like to work out why the last one would not seem to be working very well at all.

If either of these describe you, we can help! Our latest tool adapts math developed by the University of Chicago's Kevin Murphy, which may be used to determine the likely effectiveness of that economic stimulus package you might be considering!

Or rather, it could figure out what the net gain from an economic stimulus package might be, if only you could work out what values you should use for all the different parts of it. But then, we're putting those factors in your hands with this tool. Just use it responsibly with reasonable assumptions (not like this guy did). As you play with the tool, you'll find that your outcome will hinge on the assumptions you enter, including:

- How inefficient you believe the government is in generating new economic activity. In other words, how much of the new government spending will go to current productive activity or to redirecting current productive activity instead of generating genuinely new economic activity.

- How much new economic activity is generated for every dollar of new government spending. Many supporting the current Obama administration's spending initiatives believe this figure is as high as 157%. Others, drawing upon new research findings, would place it somewhere between 50 and 60%.

- The percentage of currently idle resources that will be drawn into new, productive economic activity as a result of the stimulus. This is a factor that might be hampered by such things as the need to relocate the resources or the ability to adequately match the requirements of the new economic activity with the capabilities of those available idle resources. Generally speaking, the more idle resources you can get to work, the bigger the bang for your buck. For the sake of the tool though, you'll enter the percentage of those idle resources that will remain idle - who won't be drawn into productive activity as a result of the government's stimulus spending, and where a smaller value would represent the more desirable, but perhaps not achievable, outcome.

- As we've indicated elsewhere, if U.S. politicians act as their predecessors have in the past, since the new spending is generating large deficits, we can reasonably expect that higher taxes will be needed to support the government's borrowing. That creates a deadweight loss, in that people will act to limit their exposure to the new taxes in a way that reduces economic activity. Martin Feldstein, the former head of the National Bureau of Economic Research, estimates this effect to be $0.76 for every additional dollar of personal income tax revenue the government collects. Update 30 July 2009: Meanwhile, the non-partisan Tax Foundation puts the deadweight loss of additional tax collection at $0.40, estimating that it will cost the federal government $1.40 for every $1.00 it collects in new taxes. (HT: King Banaian.)

Got all that? Then you're ready! We've entered Kevin Murphy's assumed values and set the stimulus value for $787 billion dollars:

The goal, of course, is for the proposed economic stimulus to realize a positive net gain. If you can't do that with realistic assumptions, the nation will be better off without the stimulus spending.

Labels: economics, politics, taxes, tool

If you click the chart for a larger version, you'll see that we've had a fairly good performance in anticipating where the S&P 500 would go for the full months for which we've made predictions, indicated by the green rectangles. The exception is May 2009, where we revised our original forecast downward, as indicated by the orange rectangle.

We may need to do that again, or at least apply the lesson learned and also calculate the range of stock prices using an older base value from which to project their value forward, but for now, we're really more interested in evaluating this method of visualizing the forecast data.

Keep in mind too - that preliminary forecast range runs from 991 to 1007. The S&P 500 closed today at 982.18 - it's not like we're not far off from that range right now.

Labels: data visualization

Welcome to the Friday, July 24, 2009 edition of On the Moneyed Midways, where we've rounded up the best of the past week's business and money-related blog carnivals for your weekend entertainment!

Welcome to the Friday, July 24, 2009 edition of On the Moneyed Midways, where we've rounded up the best of the past week's business and money-related blog carnivals for your weekend entertainment!

This week's blog carnivals provided a study in contrast. On one side, we had this week's Carnival of Personal Finance, which was above and away one of the best constructed carnivals we've seen in a very long time. This week's host, Stephanie of Poorer Than You, really went the extra mile in assembling the carnival around the theme of the U.S. Presidents. Not an easy, or even a desirable thing to do, yet she made it work.

At the other extreme, this week's Carnival of Real Estate was a completely forgettable affair. Completely automated, the host barely managed to note that they were just throwing up the week's contributions in the order they were received. We reacted as we always do to that level of visible effort: we completely ignored the carnival except to offer this obsevation: If you're not going to make the effort to make the blog carnival you host worth reading, we're not going to review it. It's just not worth our time.

For the best posts we found in the best of the past week's business and money-related blog carnivals, just scroll down....

| On the Moneyed Midways for July 24, 2009 | |||

|---|---|---|---|

| Carnival | Post | Blog | Comments |

| Carnival of Debt Reduction | Debt: Invest in Yours | Don't Quit Your Day Job | Which is smarter: paying off your 5% interest debt with extra money or investing it to get a 7% return? PKAMP3 says that before you answer that question, you need to take taxes into account! |

| Carnival of Personal Finance | Median vs Mean: Know the Difference or Risk Being Manipulated | Darwin's Finance | Darwin describes the three different ways of finding an "average" value and explains how politicians and other shady types use them to manipulate the truth. Absolutely essential reading! |

| Carnival of HR | You Get What You Pay For | i4CP | Eric Davis challenges the HR notion that what employees value more than money is recognition programs. By far and away, The Best Post of the Week, Anywhere! |

| Festival of Frugality | How to Clean a Dirty Oven | Miss Thrifty | Miss Thrifty describes how you can do away with those really caustic chemical oven cleaners and their cost! |

| Festival of Frugality | Downsizing Appliances to Save Money | pocketmint | Karawynn inherited a large chest freezer with the purchase of a house and only recently unplugged it in favor of a smaller unit - the energy savings were pretty shocking! Absolutely essential reading! |

| Festival of Stocks | Somebody Stop Me Before I Buy Again: Boeing Update | Bootstrap Investing | Boeing (BA) has a lot of problems right now, including the continuing slide of the first flight for its new 787 flagship to the right (that's internal Boeingese for "undesirable delay"!) Still, Bootstrap looks at the company's strategic position and argues that it's worth investing in. |

| Money Hacks Carnival | Just Buy It Already! Fighting Indecision on Big Purchases | The Happy Rock | The Weakonomist guest posts an argument in favor of spending now on big ticket items that you know you need instead of waiting to try to score a perfect deal. |

| Carnival of Money Stories | The Automatic Poorhouse | My Dollar Plan | Amanda Grossman guest posts about how she lives paycheck to paycheck. Not because she's poor, but because she's following David Bach's advice on how to become an Automatic Millionaire, whereby she automatically invests a very large portion of her paycheck. |

Previous Editions

- OMM's Running Index for 2008

- OMM's Running Index for 2007

- The Best Blogs Found in 2006 (and our full 2006 index)!

Labels: carnival

We subscribe to very few magazines, but Air & Space/Smithsonian has long been one of our favorites.

The August 2009 issue of the magazine illustrates why. Not only does this issue provide highly entertaining, history-drenched articles covering things like the newly developing technology behind airplanes that can heal themselves, the challenges of powering aircraft with electric batteries, secret space shuttle flights and how the Apache helicopter is currently being used in Afghanistan, it sprinkles some amazing economics lessons throughout the magazine, all from quarters you might never expect.

The August 2009 issue of the magazine illustrates why. Not only does this issue provide highly entertaining, history-drenched articles covering things like the newly developing technology behind airplanes that can heal themselves, the challenges of powering aircraft with electric batteries, secret space shuttle flights and how the Apache helicopter is currently being used in Afghanistan, it sprinkles some amazing economics lessons throughout the magazine, all from quarters you might never expect.

Let's start with a sidebar to that feature about creating an electric-powered airplane. You could spend weeks, if not months, reviewing media coverage bemoaning Americans use of oil, or worse, foreign oil, for powering all sorts of vehicles, and you could spend an equal amount of time listening to those demanding a switch to other, eco-friendly fuel sources, like re-usable electric batteries, or fuel cells, or solar cells, et cetera.

What you'll never find in all that noise is the compelling reason why we don't: compared to how much energy output we might get from a given volume and mass of oil we might burn to make and move things, you can't get anywhere near the same amount of power out of an electric battery of similar volume and weight. It's not even close:

... the problem for electric airplanes boils down to something called energy density: the amount of energy a pound of "fuel" can hold. In this sense, gasoline is wonderful stuff. A pound of it contains 5.75 kilowatt-hours' worth of pure energy. Batteries, in comparison, are pitiful. The best practical batteries today store, per pound, perhaps 1/80 of the energy of gasoline. It takes 15 pound of batteries to store one kilowatt-hour of energy. Cow dung, a popular cooking fuel in many parts of the world, far outshines any battery.

The main article explains how the current economics significantly favors gasoline power with the established order of technology:

Conventionally powered airplanes with the performance of electric ones use only one or two gallons of fuel an hour, so the difference in direct operation cost is negligible in comparison to the difference in initial outlay: for an airworthy gasoline engine, $100 per horsepower; for an electric powerplant, $400 or more per kilowatt.

We note that 1 horsepower is equivalent to roughly 3/4 of a kilowatt. By our math, to produce the same 1 horsepower of energy, the electric powerplant would then cost $300 per horsepower. That's still a very deep bucket out of which the cost of electric powerplants will need to climb to become genuinely competitive.

For another example of economics at work in the world of aviation, there's the story of a brand new airport in Branson, Missouri, which is distinguished by being the "first and only privately developed and operated commercial service airport in the United States."

No government money was used to build the airport and no government funds are used to operate the airport. Despite years of efforts to follow the traditional public sector approach to the solving the problem of bringing an airport to Branson, it ultimately took private investors to take up the slack created by the failure of multiple government initiatives to act.

Today, aside from a minimal number of federal government-mandated air traffic controllers and Transportation Security Administration personnel, the airport functions without any government employees. It may also be the only airport in the country where its administrators wave goodbye to the passengers from the tarmac as they depart. The reward for the people of Branson is substantially better access to the nation's airways at substantially lower prices than what was available before.

Two pages later finds a short article about U.S. mail service in the remote regions of Cascade, Idaho. Here, the U.S. Postal Service had sought to cut $46,000 from its annual budget by suspending the mail delivery contract of Arnold Aviation, the only outfit in the lower 48 states who delivers mail by air to backcountry residents, who are too remote to have any sort of regular mail service otherwise. While the story mainly focuses upon the nature of this kind of mail service and the reaction by residents, who enlisted Idaho's U.S. senators to get the post office to back down from its plan, the real gem is an insight by Ray Arnold, the owner and pilot who delivers the mail, regarding the condition and ownership of the airfields he has to use:

"We got 22 places we go, and only three places are accessible by road, and they're not open in the winter."

Some of his patrons have pretty sweet airstrips: 1,000 feet long, grades around 20 percent, elevations up to 7,000 feet. "People who have private runways maintain them better than the forestry service," Arnold says.

Who would have guessed that the people living in this very remote area of the United States would be so willing to invest so much of their own effort and limited resources into ensuring that they're able to obtain the kind of mail service they want rather than what the officials of the U.S. Forestry service and U.S. Post Office would seem to believe they should have?

Come to think of it, where else do we see these same dynamics at play in America today?

Labels: economics

You see them everywhere, from the tiny ones securing the battery compartments of childrens' toys to the most exotic varieties imaginable designed to only be able to be turned with equally exotic tools, usually for the purpose of ensuring that bathroom partitions aren't dismantled by drunken party-goers, but did you know that the humble screw first came into common use nearly 2000 years ago?

You see them everywhere, from the tiny ones securing the battery compartments of childrens' toys to the most exotic varieties imaginable designed to only be able to be turned with equally exotic tools, usually for the purpose of ensuring that bathroom partitions aren't dismantled by drunken party-goers, but did you know that the humble screw first came into common use nearly 2000 years ago?

We didn't either, but according to arcticpenguin, a community member at Instructables, screw-shaped tools made from wood first began to be incorporated in wine and olive presses sometime in the first century. Unlike today's screws however, the earliest versions had a hole in their shaft, which allowed a rod to be inserted for turning.

But wait, that's not all! The venerable arcticpenguin has gone far beyond simply outlining the history of the screw - he's also gone to the trouble of explaining the advantages and disadvantages of each of the various types of screw head drive designs in use throughout much of the world today! (HT: Core77) Here's a quick sampling for several of the most common designs in use today, which we've either quoted or paraphrased from arcticpenguin's original commentary:

| Advantages and Disadvantages of Different Screw Drive Designs | |||

|---|---|---|---|

| Screw Head | Name | Advantages | Disadvantages |

| Cut Slot Drive |

|

|

| Phillips Drive |

|

|

| Robertson Drive |

|

|

| Pozidriv |

|

|

Labels: none really, technology

Once upon a time, baseball's All Star Game was a competitive event. Joe Sheehan describes the "good old days":

Baseball’s All-Star Game was once a cutthroat battle between two distinct and competitive entities, one of just two times all season that the leagues interacted. The game was played largely by the very best players in baseball, and those players often went the distance. If you wanted to see Babe Ruth face Carl Hubbell, or Bob Feller take on Stan Musial, or Warren Spahn pitch to Ted Williams, the All-Star Game was just about your only hope.

In the modern era, the All-Star Game has been reduced to the final act of a three-day festival, in recent seasons often overshadowed by the previous night’s Home Run Derby. Rather than a grudge match between rivals, it’s an interconference game like the NFL, NBA, and NHL events. The individual matchups, once unique, have been diluted by interleague play.

But that's not the worse part. Sheehan goes on to describe how players and managers used to approach the game, comparing the past to how things are done today:

In the first All-Star Game back in 1933, the starting lineups went the distance. The AL made just one position-player substitition, getting legs in for Babe Ruth late in the game. In the NL, the top six hitters in the lineup took all their at-bats. Each team used three pitchers. A quarter-century later, this was still the general idea: seven of the eight NL position-player starters in the 1958 game went the distance, five AL hitters did, and the teams used just four pitchers each. The best players in baseball showed up trying to win to prove their league’s superiority.

Then it all went awry. Before interleague play or 32-man rosters or All-Star Monday, there were the years of two All-Star Games. From 1959 through 1962, the AL and NL met twice each summer as a means of raising revenues for the players’ fledgling pension fund. In '58, 32 players played in the All-Star Game, 12 of them staying for the entire game. In 1963, the first year after the experiment, 41 players played and just five went the distance. The 1979 game, one of the all-time best contests, saw 49 players used and had just three starters who were around at the end. Fast-forward to 2007—the last nine-inning All-Star Game—and you find 55 players in, 17 pitchers used to get 54 outs, and not a single starter left in the game at its conclusion.

The All-Star Game has lost its luster because the game isn’t taken seriously by the people in uniform. Don’t read what they say—watch what they do. That’s the damning evidence that the participants care less about winning than they do about showing up.

So what to do? In recent years, Major League Baseball has tried to incentivize the players and managers of the teams representing the National League and American League by awarding home field advantage in the World Series to the team from the winning league in the All Star Game. But is that really working?

So what to do? In recent years, Major League Baseball has tried to incentivize the players and managers of the teams representing the National League and American League by awarding home field advantage in the World Series to the team from the winning league in the All Star Game. But is that really working?

Given that the managers of each league's all-stars are the managers of the teams that went to the previous year's World Series, who most often by the All-Star Game know that their own teams are unlikely to repeat, what's the point? If they're not in the running by that point of the season, why manage their All-Star team to win for an advantage they themselves won't realize? The same fact holds especially true for the players, with maybe as many as a half-dozen on each side playing for teams with a realistic shot at making it to the World Series in the fall.

Bob Ryan describes how history has played out since league home-field advantage has been made the purpose of the All-Star Game:

Sadly, Bud Selig and his marketing minions don’t get it.

Bud is haunted by the tie game in his own hometown seven years ago. It was second only to the cancellation of the 1994 World Series as the worst event of his tenure as baseball commissioner, and he is determined it will not happen again. He thinks the solution is to expand the rosters for Tuesday night’s game into the absurdly bloated 33 players apiece, 13 of whom will be pitchers. As is almost invariably the case in these matters, more is less.

In order to restore so-called “meaning’’ into the game, Bud declared that, beginning with the 2003 game, the teams would be playing for home-field advantage in the World Series. That hasn’t prevented the American League from winning the first six games played under this policy, nor has it prevented the National League from winning the World Series despite lack of said home-field advantage in 2006 and 2008.

But neither of those are the point. The truth is that Bud wants it both ways. He wants the game to be played for a proper prize, and yet he has allowed the game to evolve into something far less than a real baseball contest.

Ryan argues that the way to make the All-Star Game more meaningful would be to shrink each team's roster back to 25 players and tell the managers to focus on winning, but still, they're having to go out of their way to play a game that offers nothing of real value to either the players or the managers.

If you're a player, why risk injury by playing your heart out? If you're a manager, why not coach by the same rules that apply to T-ball, where everybody getting a turn is more important than winning the game?

Here's our idea: put a real world championship at stake in the All-Star Game. Create two potential teams to represent the United States in the World Baseball Classic, Olympics or other international competition that might apply, one from the National League, the other from the American League. Players for the team that wins the All-Star Game would then be the ones that would literally get to go for the gold for the next year.

That might create a problem in selecting players, given the increasing internationalization of baseball in the United States. Here, at least 25 of the players selected for each team, covering each needed position for international play, would have to be selected to satisfy the eligibility rules to represent the U.S. Additional players, who might not be eligible to represent the United States, could then fill out the remaining slots on each team's roster to bring the total up to 33.

That might create a problem in selecting players, given the increasing internationalization of baseball in the United States. Here, at least 25 of the players selected for each team, covering each needed position for international play, would have to be selected to satisfy the eligibility rules to represent the U.S. Additional players, who might not be eligible to represent the United States, could then fill out the remaining slots on each team's roster to bring the total up to 33.

With the opportunity to coach the team in international play, that might make for a real challenge for managers, who would be compelled to put the best players possible out on the field in the All-Star Game, regardless of eligibility, who might then have to face those same additional players on other teams in international play.

And wouldn't that, just by itself, be a lot more interesting than how the All-Star Game is played today.

Labels: sports

is now available for sale through Amazon.com at prices ranging from $114.98 (used) to $123.85 (new) to $158.73 (new from Amazon), the latter price representing a 25% discount from the book's hefty $210.95 list price.

We wondered just how many textbooks would it take, at today's Amazon sale price, for Mankiw to make the same amount of money today.

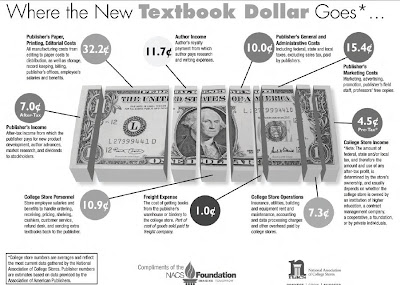

The key to this puzzle was provided by the National Association of College Stores, which provided the crucial information that textbook authors receive, on average, 11.7 cents of every dollar college students spend on textbooks.

Let's say that this percentage is exactly what Mankiw sees from each sale of his "Number 1 best-selling economics textbook". At a price of $158.73, that would mean that Mankiw personally pockets $18.57 for each textbook sold. [Note to students: It's unlikely that you could get a discount on the text by sending this portion of the money for the textbook directly to Mankiw. Or a better grade....]

Let's say that this percentage is exactly what Mankiw sees from each sale of his "Number 1 best-selling economics textbook". At a price of $158.73, that would mean that Mankiw personally pockets $18.57 for each textbook sold. [Note to students: It's unlikely that you could get a discount on the text by sending this portion of the money for the textbook directly to Mankiw. Or a better grade....]

Now for the big numbers! To justify an advance of $1.4 million dollars with today's prices, that would mean that college students would need to purchase over 75,390 new copies of the text over the publishing life of each edition. For the sake of comparison, in 1998, sales of 50,000 would represent the typical point of breaking even for textbook publishers under normal circumstances.

There's no question then that sales of Mankiw's Principles of Economics then are much higher than these figures, otherwise the publisher would not consider creating new editions. Consequently, while the total sales volume exceeds this figure, look for Mankiw to continue churning out slightly modified new editions of his text.

Which in turn explains the title of James Yu's post at IvyGate: Prof. Releases New Textbook, Poor Students Cower in Fear!

Labels: none really

Welcome to the Friday, July 17, 2009 edition of On the Moneyed Midways! Once again, we've scanned the best of the past week's money and business-related blog carnivals to bring the you the best of each!

Welcome to the Friday, July 17, 2009 edition of On the Moneyed Midways! Once again, we've scanned the best of the past week's money and business-related blog carnivals to bring the you the best of each!

We have a lot of high-quality posts to trumpet this week, but the two we'll highlight involve things learned from the bloggers' fathers: one on the importance of ethical conduct in business, even at the sacrifice of tangible benefits today, the other on three big lessons learned about money, investing and the value of work. Both posts are Absolutely essential reading!

But neither are The Best Post of the Week, Anywhere! For that, as well as another excellent post that's absolutely essential reading and the rest of the best posts of the week that was, you'll have to scroll down....

| On the Moneyed Midways for July 17, 2009 | |||

|---|---|---|---|

| Carnival | Post | Blog | Comments |

| Carnival of the Capitalists | What Is Management and What Do Managers Do? | Andrew Rondeau | You might think that what managers do is "manage." Andrew Rondeau discusses what that really involves! |

| Cavalcade of Risk | Trust as Risk Mitigation Strategy | Trusted Advisor | Charles H. Green makes the provocative argument that building trust is really a much more effective and efficient method for mitigating risks in dealing with others. Absolutely essential reading! |

| Carnival of Debt Reduction | Credit Score - Good? Or Good Enough? | Five Cent Nickel | Bargaineering's Jim Wang provides a guest post that looks into what's considered good and what's considered good enough where credit scores are concerned. He finds that timing makes all the difference between the two. |

| Carnival of Personal Finance | How to Guess a Social Security Number and Get Famous on the Internet | Bad Money Advice | Frank looks at the recent news that it's possible to guess someone's Social Security number by knowing just a few details about them and how the numbers are assigned, and really isn't very impressed. He runs the numbers to find the actual odds that you'll have your identity stolen based on how it's done. |

| Carnival of Personal Finance | 29 Reasons Why Being a Part Time Entrepreneur Sucks | The Happy Rock | The Happy Rock lists the real life obstacles you will face as a part-time entrepreneur. The Best Post of the Week, Anywhere! |

| Carnival of Real Estate | Real Estate Tax Deduction - Soon to Be History? | San Diego Real Estate Market | Bob Schwartz looks at the steps the Obama administration is taking today and projects that they'll lead to the near elimination of the mortgage interest tax deduction in an Obama second term. |

| Carnival of Trust | Why You Must Focus on Creating Trust More Than Anything Else | Next Level Blogger | Christian Russell makes the case that rather than drive high volumes of traffic to your site, you can gain greater success by instead focusing on building trust with a core group of frequent guests (or rather, potential customers.) |

| Festival of Frugality | Update: Programmable Thermostat vs. Electric Bill | Funny About Money | 110-degree daily temperatures. A freezer running in an uninsulated garage. A programmable thermostat that may not be working or set right. Funny About Money works through these issues to lower their electric bill. |

| Festival of Stocks | A Green Shoot That Is Not Less Bad But Actually Good | Disciplined Approach to Investing | David Templeton recognizes that a lot of what have been called "green shoots" in the current economy have really been situations where things are becoming "less bad." Here though, he looks at New Orders Minus Inventories and finds that this measure may indeed be a true "green shoot" for an improving economy. |

| Money Hacks Carnival | What to Do When Money Conflicts with Ethics | MoneyNing | Ning tells the story of her father, who passed up easy money by refusing to take payola while working at a Hong Kong television broadcaster. Absolutely essential reading! |

| Carnival of Money Stories | The Three Most Influential Lessons from My Childhood | My Life ROI | MLR learned three big lessons about the value of work, saving and money from his Dad. Absolutely essential reading! |

Previous Editions

- OMM's Running Index for 2008

- OMM's Running Index for 2007

- The Best Blogs Found in 2006 (and our full 2006 index)!

Labels: carnival

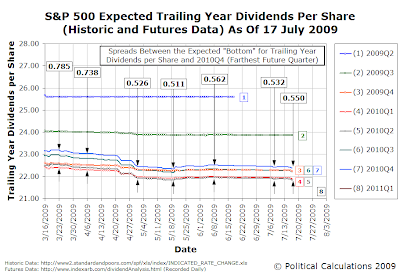

The sudden dip at the end may ultimately turn out to be a short-lived data anomaly that may be corrected as early as next Monday, or perhaps represents a more serious deterioration in market conditions that would appear to be as yet flying under the radar - as we indicated, there's no news to confirm which may be the case. In the absence of any news, it will be interesting to see how stock prices might react to this change. Our guess is "not well," but we'll be happy to be wrong.

Update 9:34 PM PDT: Did we say no news? We forgot to mention this particular speculation, which Felix Salmon has also considered. Hey, it's late and so far, it's the only news that fits!

Update 17 July 2009 8:30 AM PDT: Here are the drops we see for the projected trailing year dividends per share:

2009Q4 ... -0.032 2010Q1 ... -0.059 2010Q2 ... -0.058 2010Q3 ... -0.059 2010Q4 ... -0.045

We still don't see any news to indicate what's changed, so we dug deeper into the data to compare the individual dividends listed for each quarter for each stock in the S&P from what IndexArb lists today (17 July 2009), and what Google's cache shows for last Monday (13 July 2009), which we'll assume mostly holds through 16 July 2009. Here are the companies that have seen their expected future dividend payments drop during that period, at least not as a result of paying them during the past week!:

CSX ............... (-0.01 per quarter) Cummins ........... (~-0.01 per quarter) JPMorgan Chase .... (-0.06 per quarter, next two quarters)

There was one increase:

Ryder Systems (+0.02 per quarter)

What it looks like to us is that the change we observe is largely the result of JPMorgan Chase reducing what they expect to deliver for their end-of-year dividends per share. We find it interesting that there isn't a lot of news on it.

With this apparent one-time adjustment, stock prices may not be as negatively affected as might otherwise be expected if the reductions were going to be distributed among all quarters going forward. We would however still expect some downward movement in stock prices as a result of this change in investor expectations for the future income stream from dividends through the end of this year.

Update 17 July 2009 3:00 PM PDT: Once we worked out what drove the actual change, today's market action makes a lot more sense - we would expect this reduction in future dividends per share paid to only shave a few points off the level of stock prices, and sure enough, that's about the most that happened today, with the S&P 500 generally ranging between 3 and 5 points below it's previous close before closing just 0.04% below that level at 940.38.

Still, we kept digging and managed to turn up that the reason there wasn't a big news story about JPMorgan Chase announcing they were planning to further cut their dividend for just the next two quarters: they're not. Instead, we found that they instead have no plans to increase their dividend until early next year.

It would then appear that the dividend future dropped as they did purely because investors had been expecting JPMorgan Chase to increase their dividend sooner on the basis of their strong performance in recent months. The announcement by CEO Jamie Dimon that the company would not increase dividends until 2010 on 16 July 2009 put the kibosh on that expectation, and the dividend futures adjusted appropriately. They now reflect the expectation that JPMorgan Chase will begin increasing their dividend per share in early 2010.

Case solved!

To do that, we adapted the plus-minus statistic from hockey and basketball for our own purposes. If we make a correct prediction, meaning what we predicted comes to pass, we score it as +1. A prediction that turns out to be wrong is scored as a -1. And if the outcome for the prediction in question is uncertain, for whatever reason, we score it as a zero (+0). We obtain our plus-minus score by adding up these results.

What we like about this approach is that if our predictive ability is no better than the random outcome determined by a coin toss, our plus-minus score will drift toward a value of zero over time. If we're better at making predictions than a simple randomness would suggest, then our plus-minus score will grow higher in value over time. If we're wrong, then our plus-minus score will fall in value. If we're really bad, then our plus-minus score will plunge into deep negative territory!

The last time we did this exercise, we found that for the 25 occasions where we made predictions spanning the period from 1 January 2008 through 16 April 2009, we had earned a plus-minus score of +8, which really covered some 28 predictions, of which 16 were correct, 8 were incorrect, 1 was scored as "uncertain" and 3 were no decisions, meaning that we were still waiting to determine their associated outcome. We also noted that our plus-minus score since February 2008 is +11, as we found and corrected an error in our interpretation of stock market dividend futures data, which had resulted in three "misses" in Feburary 2008.

Since then, we've been able to move two of the three "no decisions" out of that status and we've added several new predictions and recorded their outcomes. The table below provides the updated results.

| Political Calculations' Plus-Minus Score Update, 16 July 2009 | |||

|---|---|---|---|

| Date | Prediction | Outcome | +/- Score |

| 13 February 2009 | We predict that significant changes in the U.S. income tax are in the works given the kinds of questions that members of the U.S. Senate (or their staffs) are asking us through Google. | +0 | |

| 17 February 2009 | We present a prediction that GM is heading toward bankruptcy that we had originally put forward back on 2 October 2008 at Econbrowser. | +1 | |

| 2 April 2009 | We up our forecast for the S&P 500 to hit values between 860 through 890. | Although we didn't specify it on our own site, this prediction applies through the end of June 2009. Right now, there's been a very small bit of erosion in the dividend futures we use to create our forecasts, so if we made this prediction today, our methods would have us put the S&P 500 between 855 and 885 from now through June 2009. For now though, we're going to count this prediction as neutral. Update 16 July 2009: It can't be counted as neutral any more - we called it! | +1 |

| 20 April 2009 | We jumped all over an unexpected plunge in the value of stocks on this day, recognizing it as an unexpected "noise" event. We put all the money we had on the sidelines into the S&P 500. | Oh, yes! It turned out to be a one-day plunge, with stock prices quickly returning to the level we had forecast back on 2 April 2009. | +1 |

| 28 April 2009 | Barry Ritholtz was awfully pessimistic on the morning of 28 April 2009, anticipating the beginning of a significant correction. We didn't see things that way…. | Ironman 1, Ritholtz 0. But only for the day. Let's face it - Barry's too good an analyst to not pick up on a building trend, and he saw it developing before we did (we should also point out that while we framed the market bottom on 9 March 2009, Barry hit the bottom call just about dead center.) | +1 |

| 30 April 2009 | We saw a short-term selling opportunity developing in the stock market. | Very short term - just one day! The S&P 500 had risen to 886 at the time we posted that comment early that morning. Afterward, stock prices dropped to close at 872.81. | +1 |

| 4 May 2009 | We anticipated that the S&P 500 would rise to average between 935 and 955 during the month of May 2009. | Stock prices came within 5 points of hitting the bottom level of our range on 8 May 2009, but then backtracked as investors appeared to shift the base from which they were projecting the future level of stock price. | -1 |

| 12 May 2009 | We lowered our forecast from 4 May 2009 for the S&P 500 from 925 to 945 to account for the erosion of the future expected level of dividends per share we observed. We also indicated that any significant drop below these levels would have to be considered a strong buying opportunity. | Mixed. We still hadn't caught on to the backward shift in the base for investor expectations, but we were correct in identifying stock prices below this level as representing a buying opportunity. | +0 |

| 18 May 2009 | We finally recognized that stock prices were being based from an older, lower level of stock prices, which would anticipate a level for the S&P 500 of 909 to 927. | No prediction here, just finally catching up to reality! | +0 |

| 26 May 2009 | We pick up on an unlikely correlation between the timing of plunges in the stock market and the results of our preferred method for determining the probabilty of recession in the U.S. We predict stocks will dive in value around 16-23 June 2009 and 10-16 September 2009. | One down, one to go. The timing for the June drop actually coincided with the work week, beginning on Monday, 15 June 2009 and ending a week later. We'll have to see where things stand in September to see if we scored a two-fer here! | +1 |

| 8 June 2009 | We forecast that stock prices will range between 935 and 955 for the month, as measured by the S&P 500. Not counting the dive we anticipated for stock prices on or around 16 June 2009 through 23 June 2009, which we suggested would lead us to sell our investment in the S&P 500 later in the month "until the smoke clears." | We have to score this prediction as a zero, or mixed, even though we were on track with it until that turmoil we forecasted arrived nearly on schedule later in the month. Since we didn't take the drop in values of that event into account, that portion of our prediction is incorrect. | +0 |

| 9 June 2009 | We created a new tool for predicting the direction and level of both 30 year conventional mortgage rates and 10-Year constant maturity U.S. Treasury yields. | Using the tool, we anticipated that either mortgage rates would rise or U.S. Treasury rates would fall. Of these, we thought higher mortgages rates were more likely, but as it happened, both outcomes came to pass within a week. | +1 |

| 15 June 2009 | Once again, we put real money at stake. This time, by anticipating falling stock prices and selling our entire stake in the S&P 500. | We missed the top before stocks began dropping significantly by one day and 2.5 points. Even though we were nearly right about the timing, we're not really market timers. | +1 |

| 22 June 2009 | We went back "all-in" to the S&P 500, figuring there was very little downside to doing so. | It turned out there was no downside - stocks continued rising through the end of the month. | +1 |

| 25 June 2009 | We forecast that the average of the S&P 500 for the month of June 2009 would close with an average value between 926 and 944. | Coming as close to the end of the month as it was, this prediction was like shooting fish in a barrel, even with the turmoil in the previous week and the possibility it was only taking a breather. We're not counting it. | +0 |

| 1 July 2009 | We forecast a range for the S&P 500 in July 2009 between 925 and 945. | The month's not over, so the jury's still out - to hit the bottom end of our target though, stock prices will need to run at the high end of our range through the end of the month. It's likely that the average for the month will fall a bit below our predicted range. | +0 |

| 2 July 2009 | Stocks fell off the edge, once again unexpectedly. We found no fundamental reason why they should have done so, identifying the action as being the result of noise as opposed to a response to a signal. We suggest that if stock prices stay depressed in the next week, it represents a buying opportunity. | Noise off! At this writing, stocks have fully rebounded into the range we forecast for 1 July 2009. One of the nice things about our methods is that they help separate the signal from the noise, so we can have a decent idea of what's a significant event we need to respond to, versus one we can sit and wait out. Here, patience paid off. | +1 |

For our previous no-decisions, two have now been added to our positive total while one is still pending, but looking more and more likely. By our count, we've added some 16 predictions over the last three months, including several we've "bet" our entire retirement portfolio upon. Of these new predictions, we scored 9 hits, 3 misses (we guess two of these could be counted as near misses, but let's face it, they're still misses!), 1 uncertain outcome, 1 "right, but too easy, so scored it as a zero", and we have two "no decisions as yet" pending.

The net effect of all these changes is to increase our plus-minus score from +8 to +17. Not too shabby when you consider that most of what we predict is where the stock market is heading next. We wonder what Burton Malkiel might make of all this!

Labels: forecasting, track record

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.