Earlier this year, the U.S. Sentencing Commission released its study on the recidivism of violent offenders released from federal prisons in 2010. The study tracked some 13,883 individuals to find out how many might go on to be arrested for new crimes within nine years after they completed serving their original sentences. How many of these violent offenders would you predict returned to crime after their release from federal prisons?

We won't keep you in suspense. Within nine years of their release, 63.8% of this sample cohort of violent offenders were subsequently arrested for committing new crimes. No fewer than 26% of this criminal cohort were arrested for new crimes within the first year after they were released, while over half had done so within four years.

The following chart visualizes the Sentencing Commission's data for the number of violent offenders who were arrested for newly committed crimes within one to nine years after they were released from prison in 2010.

We opted to present this data using a Sankey diagram to illustrate both the relative share of total offenders that went on to be arrested for committing new crimes and how many were added to that total within each year following their release from prison. 76.4% of these individuals had been sentenced for their original crimes after 12 January 2005, when the Supreme Court issued a ruling that affected U.S. federal sentencing guidelines, so the vast majority of these former prisoners had served fewer than five years in federal prisons before their release in 2010.

Reference

U.S. Sentencing Commission. Recidivism of Federal Violent Offenders Released in 2010. [PDF Document]. February 2022.

Labels: crime

What does the future hold for the dividends of the S&P 500 (Index: SPX)?

We're now in the gap between when the index' dividend futures contracts for 2022-Q2 have expired and the actual end of the calendar quarter, which makes it a good time to see what investors expect for the rest of the year. The good news is the outlook for the quarterly dividends per share of the S&P 500 has continued improving since we last checked them at the midpoint of 2022-Q2. Better yet, the futures data extends through 2023-Q2 so we can peer into the first half of 2023.

The following chart reveals those expectations as of Monday, 27 June 2022:

Here's how the dividend futures have changed since our previous snapshot:

- 2022-Q2: Up $0.07 per share.

- 2022-Q3: Up $0.35 per share.

- 2022-Q4: Up $0.50 per share.

These increases indicate an improved outlook for the S&P 500's dividends has developed over the last six weeks, which you would think would have boosted stock prices during this time. If you've been watching the stock market, you know they've fallen significantly instead and if you've been following our S&P 500 chaos series, you already know why the index has behaved as it has despite its improving outlook.

But this improving outlook may be in jeopardy. With recessionary risks now rising in the U.S., expectations for future dividends will take a greater role in shaping how stock prices behave. That's why we're increasing the cadence for presenting and analyzing future dividend data, which we'll now do at roughly six week intervals. Our next update will arrive in mid-August 2022 and will present the Summer 2022 snapshot of the future for S&P 500 dividends.

About Dividend Futures

Dividend futures indicate the amount of dividends per share to be paid out over the period covered by each quarters dividend futures contracts, which start on the day after the preceding quarter's dividend futures contracts expire and end on the third Friday of the month ending the indicated quarter. So for example, as determined by dividend futures contracts, the "current" quarter of 2022-Q3 began on Saturday, 18 March 2022 and will end on Friday, 16 September 2022.

That makes these figures different from the quarterly dividends per share figures reported by Standard and Poor, who reports the amount of dividends per share paid out during regular calendar quarters after the end of each quarter. This term mismatch accounts for the differences in dividends reported by both sources, with the biggest differences between the two typically seen in the first and fourth quarters of each year.

Reference

The past and projected data shown in this chart is from the CME Group's S&P 500 quarterly dividend index futures. The past data reflects the values reported by CME Group on the date the associated dividend futures contract expired, while the projected data reflects the values reported on 27 June 2022.

Labels: dividends, forecasting, SP 500

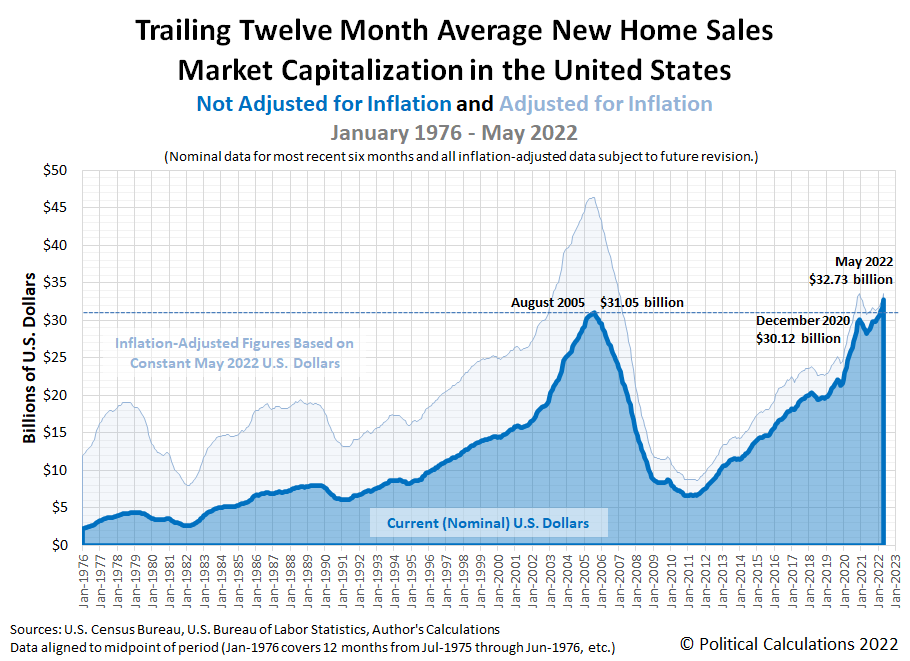

May 2022's new home sales in the United States were stronger than expected. Political Calculations' initial estimate of the market cap for new homes sold in the U.S. during May 2022 is $32.73 billion, an increase of 3.1% from April 2022's revised estimate of $31.75 billion.

The latest update of our chart shows the surging market capitalization of new homes in the U.S.

While rising new home sale prices continued to boost the new home market cap, May 2022's data also benefited from an unexpected increase in the number of sales that came despite surging mortgage rates. Both these factors are illustrated in the next two charts.

Because new home sales are counted toward GDP when their sales contracts are signed, a rising trend in the market cap for new homes boosts the U.S. economy. The National Association of Home Builders estimates new home sales contribute 3% to 5% of the nation's Gross Domestic Product.

That may not sound like much, but new home sales are providing a tailwind for an economy slowing under the growing weight of President Biden's inflation. How long that might continue in the economic climate the Biden administration has fostered is an open question.

Labels: real estate

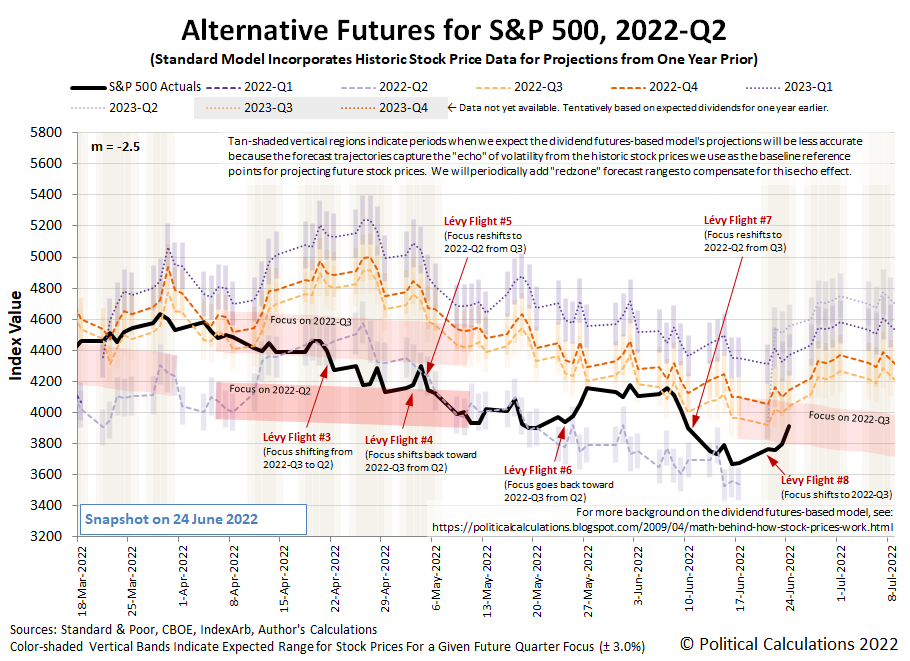

The trading week ending on Friday, 24 June 2022 ended with a bang for the S&P 500 (Index: SPX), which experienced its eighth Lévy flight event of the year. The index closed the week at 3,911.74, rising 3.06% just on Friday, 24 June 2022 alone and gaining 6.45% from the previous week's close. The index is now 18.4% below its 3 January 2022 record peak, rising back above the 20% decline threshold that defines a bear market.

If you're new to the concept of Lévy flights and how they apply to stock prices, here's a quick primer. They are perhaps most easily understood as the outsized changes in stock prices that occur more frequently than would be predicted assuming the day-to-day variation in stock prices is described by a normal distribution from conventional statistics. Their variation is better described by the math for Lévy stable distributions, which have "fatter tails" than what you'll see in the normal distribution's bell curve.

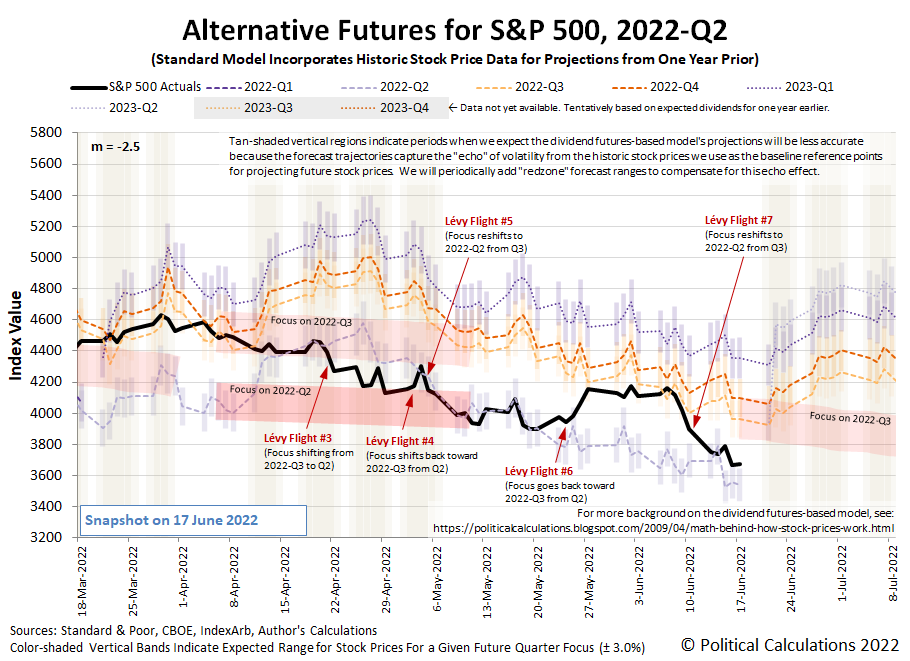

In the dividend futures-based model we use to project the potential future trajectories of stock prices, these events can be seen occurring whenever investors shift their forward-looking time focus from one point of time in the future to another. In past week, the alternative futures chart confirms investors fully shifted their forward time horizon to 2022-Q3 after having fully focused it on 2022-Q2 in the previous week.

Not that they had any choice. The expiration of 2022-Q2's dividend futures contracts on 17 June 2022 represented the clock running out on the future of 2022-Q2. Its end meant investors had no choice but to shift their focus to a different point of time in the future, where they've fixed it on 2022-Q3. Again. For now.

From our perspective, the first half of 2022 has proven to be an exciting time. That's because of the large difference between the potential trajectories of the S&P 500 for the alternative trajectories for 2022-Q2 and 2022-Q3, which are set by the expectations for changes in the rate of dividend growth for these two quarters. The cluster of volatility the stock market has experienced in the year to date has seen investors repeatedly shifting their forward-looking attention between these two quarters, producing an unusually high number of atypically large Lévy flight events in the process.

Those shifts have come as investors absorbed and responded to the random onset of new information throughout this period. We've tracked the market-moving news that has prompted those shifts throughout our S&P 500 chaos series during 2022. Here are the market-moving headlines we noted during the latest week that was.

- Tuesday, 21 June 2022

-

- Signs and portents for the U.S. economy:

- Yellen says gasoline tax holiday worth considering as anti-inflation tool

- U.S. home sales slide as prices break above $400,000 for first time

- Fed minions engage in wishful thinking, want bigger rate hike in July:

- Fed's Bullard: I hope U.S. economy repeats outcome of 1994's soft landing

- Demand issues account for one-third of U.S. inflation spike - SF Fed

- Fed's Barkin backs 50 or 75 bps rate hike in July

- China makes Russia its top oil supplier:

- BOJ minions in cahoots with government to prop up yen while keeping never-ending stimulus going:

- BOJ and govt closely coordinating on FX, Kuroda says after meeting PM

- Japan Finance Minister says to respond to FX moves appropriately if necessary

- Japan PM Kishida backs BOJ ultra-easy policy while yen worries mount

- ECB minions worrying about what Europeans are feeling, think they should support the Euro, fear fragmentation, say there's no free ECB lunch plan:

- Euro zone at risk of "inflation psychology", ECB's Lane says

- New ECB tool must backstop commitment to euro - Villeroy

- ECB's moves to fight fragmentation are positive, Spain says

- Euro zone governments shouldn't expect free lunch from ECB, governors say

- Wall Street gains over 2% in broad rebound

- Wednesday, 22 June 2022

-

- Signs and portents for the U.S. economy:

- U.S. tech companies yank job offers, leaving college grads scrambling

- Probability of Global Recession Nearing 50%: Citigroup Economists

- Fed minions "strongly committed" to hiking interest rates to combat inflation:

- Powell says Fed 'strongly committed' to bringing down inflation 'expeditiously'

- Instant view: Fed 'strongly committed' to bring down inflation 'expeditiously,' Powell says

- Fed's Powell: committed to inflation fight, not trying to trigger recession

- Fed to lift rates by 75 basis points in July, 50 bps in September - Reuters poll

- Inflation Was High Before Ukraine': Powell Tosses Biden Back Under The Bus

- Fed's Evans: will need to raise rates 'a good deal more'

- Fed's Harker says interest rates should reach above 3%, then reassess

- Bigger trouble developing in Canada, U.K.:

- Canada inflation up near 40-year high; calls mount for 75-bps rate hike

- UK food price inflation set to hit 20%, Citi forecasts

- Germany Finance Minister wants ECB minions to stop thinking and start doing something about inflation:

- Wall Street ends little changed after Powell remarks

- Thursday, 23 June 2022

-

- Signs and portents for the U.S. economy:

- U.S. labor market remains tight; business activity slowing

- OPEC+ to stick to oil supply rise plan as Biden heads to Saudi - sources

- U.S. recession fears darken outlook for global growth

- Fed minions claim fight against inflation won't stop for recession, want bigger rate hikes:

- Fed's inflation fight is 'unconditional,' Powell says

- Fed's Bowman calls for steep rate hikes to fight inflation

- Bigger trouble developing in the Eurozone, U.K.:

- Euro zone business growth slumped in June as price hikes bite

- UK economy 'running on empty' as recession signals mount - PMI

- Other central banks acting to hike interest rates to combat inflation:

- Norway central bank makes largest rate hike in two decades

- Hike in Thai policy interest rate to be gradual - central bank

- Mexico central bank makes record rate increase, flags more hikes

- S&P 500 ends higher, boosted by defensives, tech

- Friday, 24 June 2022

-

- Signs and portents for the U.S. economy:

- Oil settles up but posts weekly decline on recession fears

- U.S. new home sales unexpectedly rise in May

- U.S. consumer sentiment falls to record low, inflation outlook improves

- Fed minions really determined to convince people they'll do what it takes to break inflation, several decide to dump investments:

- Fed must act 'forthrightly and aggressively' to rein in inflation, Bullard says

- Fed's Barkin, Daly dump stocks, bonds after ethics scandal

- BOJ minions becoming like deer in headlights for commitment to never-ending stimulus policies:

- Japan's inflation tops BOJ target for 2nd month in test of monetary stance

- Japan govt spokesperson says caution needed on inflation's downside risks

- Japan May factory output seen dipping for 2nd month on China lockdown- Reuters poll

- BOJ deputy governor repeats vigilance of FX impact on economy

- ECB minions say they're not worried about EU-member bond yield spreads:

- Wall Street posts big gains to end strong week

Data suggesting the U.S. economy is slowing more than expected is altering investor expectations for how the Federal Reserve will be setting interest rates to fight inflation. While the CME Group's FedWatch Tool still projects half point rate hikes for both July and September 2022 (2022-Q3), it now projects quarter point rate hikes at six-week intervals after that through 2022-Q4 and 2023-Q1, topping out in a range between 3.50 and 3.75% in February 2023. More remarkably, the FedWatch tool is now projecting a quarter point rate cut in June 2023 (2023-Q2), which is to say a response to a developing recession is now built into tool's projections.

The Atlanta Fed's GDPNow tool continued to forecast real GDP growth of 0.0% for the current quarter of 2022-Q2, unchanged from last week's running assessment. In remarks delivered on 21 June 2022, current U.S. Treasury Secretary and former Chair of the Federal Reserve Janet Yellen indicated she uses "two quarters of negative growth as a good rule of thumb to indicate a recession". Given the Atlanta Fed's GDPNow tool's projections, the U.S. economy may be on course to qualify as being in recession during the first two quarters of 2022 according to that rule of thumb. Not that there aren't some positive developments that may help forestall such an outcome, which we'll cover later this week.

Let's start with two parametric equations, x(t) and y(t), as given by the following formulations:

If you plot the results of these equations for values of t from 0 through 40π, using an online application like Wolfram Alpha, you'll get the following surprising output:

This, of course, is just another unique intersection between maths and The Simpsons, which runs very deep throughout the animated show's 31+ year run.

Labels: math

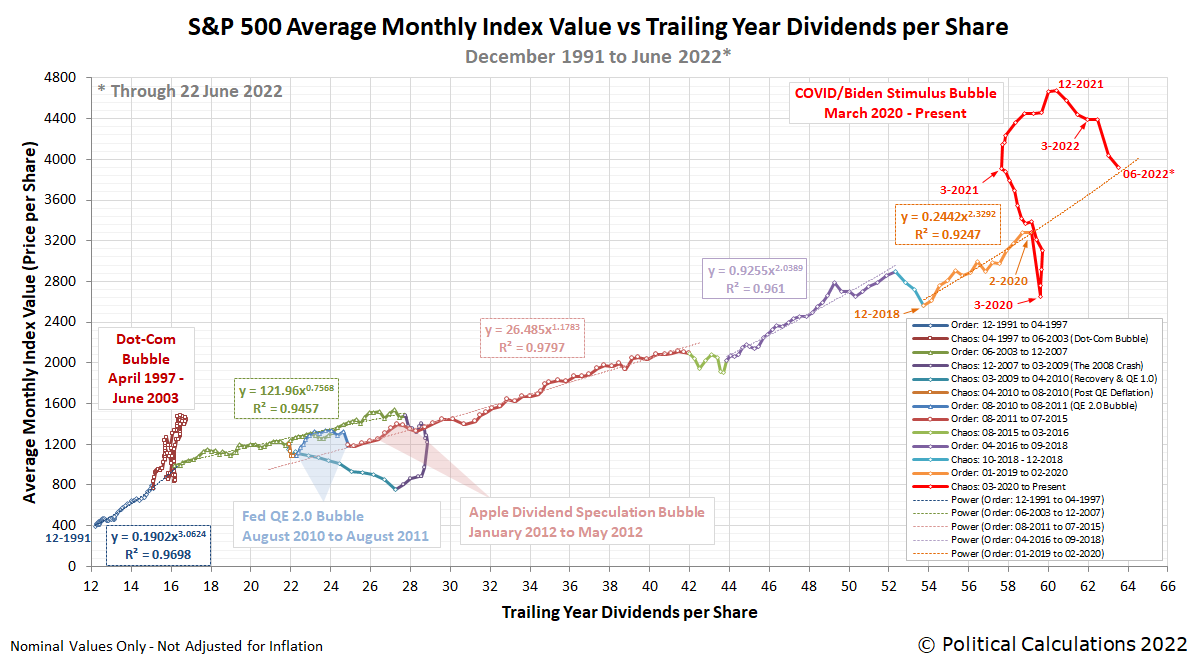

The S&P 500 (Index: SPX) closed at a peak of 4,796.56 on 3 January 2022. In the six and half months since, the index has dropped by as much as 23.4% as measured by its daily closing values.

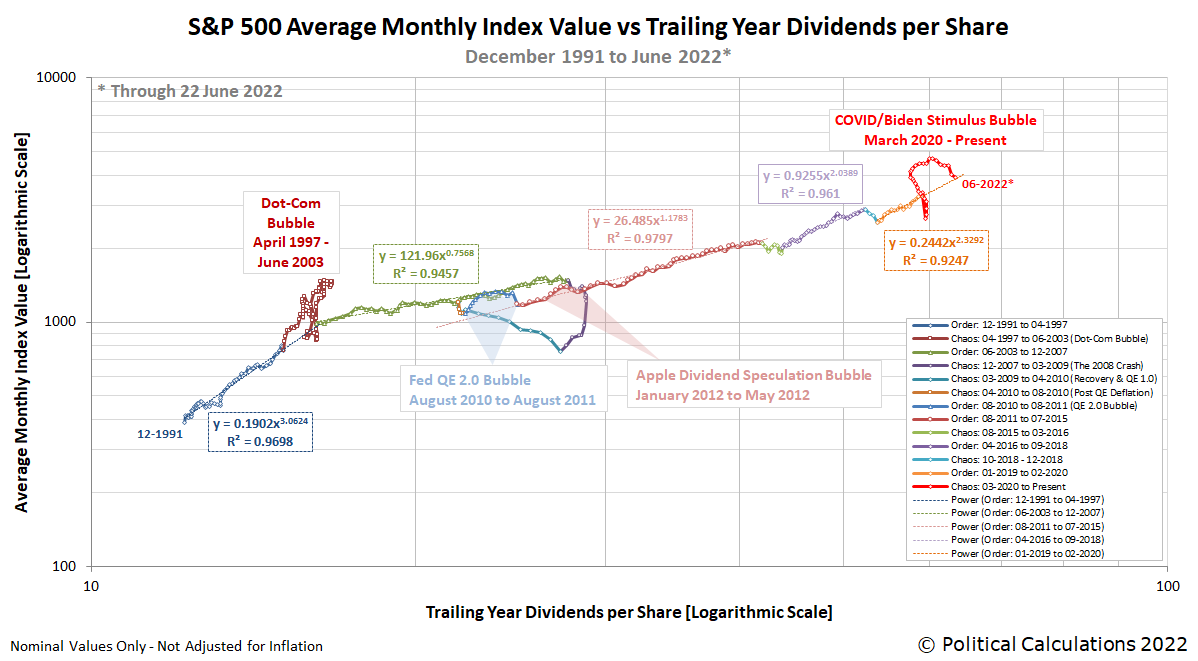

That sharp decline has reached a point where we can say the asset bubble the Federal Reserve began inflating in March 2020 and which President Biden's American Rescue Plan Act stimulus blew up even bigger through December 2021 is reaching a significant milestone. Based on the available data through 22 June 2022, the average monthly index value for the index is on track to intersect the projected trajectory the S&P 500 was on with respect to its trailing year dividends per share prior to the arrival of the coronavirus pandemic.

That means the COVID/Biden Stimulus Bubble, shown in red on the following chart tracking the relationship between the average monthly value of the S&P 500 and the index' trailing twelve month dividends per share, has almost fully deflated with respect to that last relative period of order over the last six months. Here's the chart:

The following tool, updated from the version we introduced last month with a projection of June 2022's projected dividend data, reveals what the level of the S&P 500 would be if that period of order has continued to the present. If you're accessing this article on a site that republishes our RSS news feed, you may need to click through to our site to access a working version of the tool.

Using the default selection of the most recent period of order that lasted from December 2018 through February 2020, we find that with June 2022's estimated $63.51 trailing year dividends per share, the corresponding value of the S&P 500 would be $3,863. Or rather, had that relative period of order continued to the present, that's what the math suggests would be a reasonable monthly average for the S&P 500 to go along with this amount of dividends per share.

But that period of order hasn't existed since February 2020. In the current chaotic state of the market, stock prices can and have ranged well above and below this mean trend line. Until a new relative period of order is established, there is as yet no new mean to which stock prices could revert.

We'll close by presenting a version of the first chart showing its vertical and horizontal axes using logarithmic scale to provide sense of the relative magnitude of the stock market events shown on the chart.

At this point, both the Dot-Com Bubble (April 1997-June 2003) and the 2008 Crash represent bigger stock market events than the COVID/Biden Stimulus Bubble. We'll find out soon enough how much more momentum there still is in the deflation phase of the current bubble event to see how much bigger this disruptive event for the market might become.

Previously on Political Calculations

Labels: chaos, data visualization, SP 500, tool

On 7 December 2022, we documented the birth of the Martian economy and estimated the planet's GDP. Six Earth months and just over one Martian quarter later, we're ready to revisit the Red Planet to find how things have changed.

And change they have, because in between then and now, Mars' economy experienced its first recession-like event. After collecting its sixth cored rock sample on 29 December 2022 and putting it into inventory, the Perseverance rover ran into a technical problem that prevented it from collecting more samples, effectively suspending economic activity on the planet. Here's the story from NASA's press release:

On Wednesday, Dec. 29 (sol 306) Perseverance successfully cored and extracted a sample from a Mars rock. Data downlinked after the sampling indicates that coring of the rock the science team nicknamed Issole went smoothly. However, during the transfer of the bit that contains the sample into the rover’s bit carousel (which stores bits and passes tubes to the tube processing hardware inside the rover), our sensors indicated an anomaly. The rover did as it was designed to do - halting the caching procedure and calling home for further instructions.

NASA subsequently determined that rocky debris from its latest core sample blocked the rover's drilling equipment from seating properly, taking it out of action until it might be cleared. Here's a photo of the debris, which you can see at the bottom of the rover's drilling bit carousel:

It took almost a full Earth month to do it, but NASA's engineers succeeded in ejecting the debris from the bit carousel, allowing the rover to continue its rock core sample collecting mission. The rover would proceed to collect its seventh rock core sample on 8 March 2022 after traveling to its location in Mars' Jezero Crater. One week later, the rover collected its eighth sample that will someday be exported to Earth.

Since then, NASA engineers directed the Perseverance rover to travel to a new location in an ancient river delta within the crater to scout where it might collect additional rock samples. It has not collected more as of the end of the Martian quarter.

That brings us to the first revision of Mars GDP for its first quarter and the first estimate of its GDP in its second economic quarter.

We find our first estimate of Mars' quarterly GDP missed the collection of the fourth sample on 24 November 2021, so we need to adjust the estimate to account for it. We find Mars' GDP in its first economic quarter would fall in a range between $88,624 and $702,464. That range is up from the previously estimated range of $66,468 to $526,848.

Having added four samples to those original four in Mars' second quarter, we estimate the red planet's GDP will likewise fall between $88,624 and $702,464. With NASA engineers making a concerted effort to be more discriminating in selecting rock samples to core and store for future export to Earth, we think Mars' GDP will run to the higher end of that range.

We should also point out that had the debris issue not arisen and required a month to resolve, the Perseverance rover might have already collected its ninth rock sample. Martian GDP has fallen below its potential GDP for the first time.

If you're curious how Mars' future export economy will work, the following video explains what planetary scientists have in mind:

Back on Earth, NASA selected Lockheed Martin to develop the rockets that will be sent to Mars to collect the rock samples currently held in inventory by the Perseverance rover on the planet's surface on 7 February 2022.

Previously on Political Calculations

Postscript

Just because it's cool, here's video of a solar eclipse as seen from the surface of Mars involving its moon Phobos!

Truly fascinating. I zoomed in with my Mastcam-Z camera on a Phobos solar eclipse. This detailed video can help scientists on my team better understand the Martian moon’s orbit and how its gravity affects the interior of Mars, including its crust & mantle. https://t.co/jVdJ4UwhDx pic.twitter.com/q45HwKwLIS

— NASA's Perseverance Mars Rover (@NASAPersevere) April 20, 2022

Labels: economics, gdp, technology

The story of what happened to the S&P 500 (Index: SPX) in the past is a simple one. After running into President Biden's wall of inflation the previous week, the index plunged into bear market territory. Through the end of the trading week ending 17 June 2022, the index was 23.4% below its 3 January 2022 record high peak.

From our perspective, after the May 2022 inflation report came in higher than expected, investors sent the S&P 500 lower in a new Lévy flight event, the seventh of 2022, as investors scrambled to shift their attention back toward 2022-Q2 from 2022-Q3. But with the expiration of 2022-Q2's dividend futures contracts on Friday, 17 June 2022, the market has effectively entered 2022-Q3, even though the calendar quarter won't click over for another two weeks.

We think investors will, once again, shift their forward-looking attention toward 2022-Q3, because what actions the Fed will take next as it scrambles to get ahead of inflation will hold the focus of investors on this quarter. We've updated the alternative futures chart to add a new redzone forecast range to indicate where stock prices will likely go during the next several weeks, also assuming no deterioration of expected dividends or outbreaks of noise in the market.

In the very short term, that redzone forecast range suggests a higher level for the index, but one that could be relatively short-lived. We peeked ahead at the dividend futures-based model's projections for 2022-Q3, and see that the redzone range continues to drop to roughly where stock prices are today.

We can also confirm the bubble the Federal Reserve inflated for the S&P 500 through its coronavirus pandemic response has now fully deflated. We'll explore the data supporting that assessment later this week.

Here are the market-moving headlines in the week the Federal Reserve was forced to hike the Federal Funds rate by 0.75%, its largest rate hike since 1994.

- Monday, 13 June 2022

- Signs and portents for the U.S. economy:

- Oil rises on tight supplies; trade choppy on demand worries

- Huge sell-off rocks Treasury markets, yield curve inverts

- Morgan Stanley CEO sees 50% chance of U. S. recession

- Fed minions starting to admit they won't achieve "soft landing", banks signaling they expect bigger rate hikes:

- Fed tries to thread the needle in forecasting a 'softish' landing

- 'Compelled by circumstances': some banks forecast 75bp Fed hike

- BOJ minions trying to keep never-ending stimulus alive:

- BOJ to remain dovish outlier, keep rates low as its yen dilemma deepens

- BOJ's Kuroda repeats vow to continue ultra-easy policy

- ECB, EU minions getting on board with bigger rate hikes:

- ECB's Kazimir: we need to raise rates by 50 bps in September

- German economy minister welcomes move to higher interest rates

- ECB hikes are wrong way to curb inflation, says Draghi's right-hand man

- S&P 500 confirms bear market as recession worry grows

- Tuesday, 14 June 2022

- Signs and portents for the U.S. economy:

- U.S. fuel and trucking costs power producer inflation

- Oil prices settle down on fears of Fed and oil profit tax

- Fed minions expected to hike rates by three-quarter points:

- Bigger trouble developing in Eurozone, China:

- French central bank sees second quarter growth of 0.25%

- China attack on Taiwan would hit global trade more than Ukraine war, says Taiwan

- BOJ minions putting Japanese government's borrowing/spending interests ahead of Japan's businesses:

- BOJ ramps up bond buying to defend yield cap, undermining jawboning

- Nearly half of Japan firms see weak yen as bad for business - survey

- Confused ECB minion lacks effective communication skills:

- How will the ECB contain fragmentation risk in euro area bond markets?

- No limits in ECB's fight against fragmentation -Schnabel

- S&P 500 dips with Fed policy announcement on tap

- Wednesday, 15 June 2022

- Signs and portents for the U.S. economy:

- Analysis-How it came to this: The Fed and White House's slow inflation awakening

- U.S. mortgage interest rates jump to highest level since 2008

- U.S. import prices increase solidly in May

- U.S. business inventories rise strongly; sales slow

- U.S. retail sales stumble as inflation bites

- Oil prices fall over 2% as Fed hikes interest rates

- Fed minions got a fever. The only prescription is bigger rate hike cowbell:

- Signs of recovery, but still bigger stimulus developing in China:

- China's factories perk up, but frail consumption points to weak economic recovery

- China to ramp up support for economy, avoid excessive stimulus

- ECB minions count on being clever to solve congenital problem, claim they're not out to prop up EU countries with outsize debts:

- How will the ECB contain fragmentation risk in euro area bond markets?

- ECB to devise new tool to help indebted euro zone members

- Analysis-Markets suspect new ECB tool to address bond stress could mimic old tools

- ECB bond-buying scheme likely to have loose conditions -sources

- ECB will not be dominated by fiscal considerations -Lagarde

- Wall Street rallies to close higher after Fed statement

- Thursday, 16 June 2022

- Signs and portents for the U.S. economy:

- Bigger trouble developing in Japan:

- Bigger trouble, bigger stimulus developing in China:

- China steps up fixed-asset investment to steady COVID-hit economy

- China May new home prices fall again, more stimulus expected

- ECB minions thinking about three half point rate hikes in 2022, other central banks already acting:

- New ECB tool allows three big rate hikes in 2022: Deutsche Bank

- Europe's central banks jack up interest rates to fight inflation surge

- Swiss National Bank raises rates in shock move, ready for more

- Wall St. fights for footing after steep selloff on recession worries

- Friday, 17 June 2022

- Signs and portents for the U.S. economy:

- Oil slumps 6% to four-week low on recession worries, strong dollar

- U.S. manufacturing output softens; leading indicator extends decline

- Rates on U.S. 30-year mortgages see biggest one-week increase since 1987

- Fed minions say they're out to fight inflation, not doing much to suggest they have a plan that doesn't involve crashing economy:

- BOJ minions want to keep rates low and stronger yen, won't get both:

- ECB minions thinking about bigger rate hikes to combat record high Eurozone inflation if it gets worse:

- ECB's Knot says several 50 bps rate hikes possible if inflation worsens

- Euro zone inflation confirmed at record high 8.1% in May

- Wall St ends up but still down on week as volatility rules

After the Fed's 15 June 2022 three-quarter point rate hike, the CME Group's FedWatch Tool projects half point rate hike for both July and September 2022 (2022-Q3), then another half point rate hike in early November (2022-Q4). Beyond that the FedWatch tool anticipates three quarter point rate hies at six-week intervals from December (2022-Q4) and again in February 2023 (2023-Q1), topping out in the 3.75-4.00% range.

The Atlanta Fed's GDPNow tool turned even more pessimistic in the past week. Its forecast of real GDP growth of 0.0% for the U.S. in 2022-Q2 is down from last week's projection of 0.9% annualized growth. If that holds, it suggests the U.S. economy is in the midst of experiencing two consecutive quarters of real GDP shrinkage, which many people associate with the economy being in recession.

How long would it take someone who has no idea what your password is but who has a lot of computational capability to crack it using brute force?

By brute force, we mean using their code-cracking computer systems to systematically run through all the possible permutations of characters that may be in your password. Which for all they know, may be anywhere from 1 to 22 characters long.

For their part, cybersecurity specialists Hive Systems put the following chart together to show how long that might take a well-equipped independent hacker. Or rather, one with the code-cracking technology Hive's analysts believe is already available to them in 2022.

But what about tomorrow's technology? What about passwords with more than 18 characters? What if you could use more kinds of characters?

Answering questions like those is why we created the following tool, which we built after reverse-engineering the results from Hive Systems' table. If you're reading this article on a site that republishes our RSS news feed, please click through to our site to access a working version.

Here's an article discussing the math behind the tool. The default of 95 kinds of characters represents the 10 numbers, 26 lower case letters, 26 upper case letters and 33 special characters available on most U.S. English keyboards. If you play with these figures, you should be able to reasonably duplicate the results from Hive Systems' chart. Within a relatively small margin of error, that is.

The tool is also computationally limited in how many characters might be in a password, to avoid exceeding JavaScript's computational limits. We've arbitrarily limited the potential passwords to be a maximum of 20 characters, which works for 95 kinds of characters, but may not for larger potential character sets. If you get results that seem haywire for the numbers you've entereed, odds are you've run into that computational limit.

But the thing we're most leery of in building the tool is that we set "billions" as the basic unit for entering the number of attempts per second for the hacker's password cracking system. How long will it be before that seemingly large number becomes unreasonably small?

Labels: technology, tool

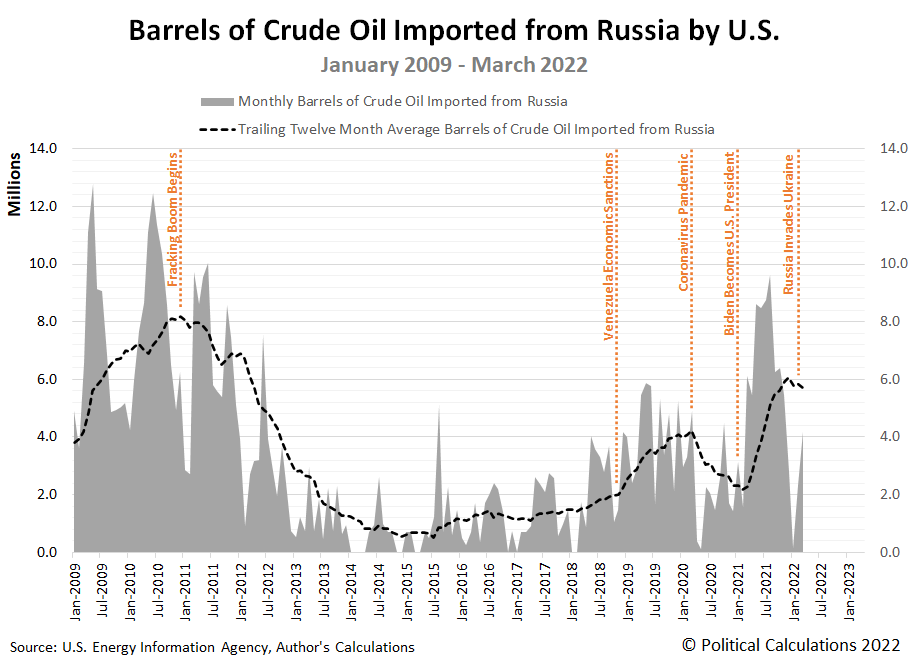

From time to time, we take on the challenge of telling a complex story through a picture. The story of the crude oil imported by the United States from Russia is just that kind of story because of all the economics and geopolitics involved.

Here's the picture, spanning the years from January 2009 through March 2022, in which we see U.S. imports of Russian crude oil rise and fall multiple times, each driven by different factors.

Here's the information the chart is expressing:

- November 2018

-

- Executive Order 13850 of November 1 2018 Blocking Property of Additional Persons Contributing to the Situation in Venezuela

- The sanctions on Venezuelan officials would soon be expanded to include a prohibition on the import of crude oil from the South American nation at the end of January 2019. U.S. oil importers read the tea leaves however and began switching to Russian-produced crude oil with the introduction of this earlier set of sanctions. Russia would rise to become the U.S.' second largest foreign source of crude oil within two years.

- December 2019

-

- A Decade in Which Fracking Rocked the Oil World

- U.S.-produced crude oil began displacing Russian crude oil imports in the U.S. from January 2011, rising on the fracking boom that continued all the way up to the coronavirus pandemic in 2020, which crashed oil prices and crippled the domestic industry. It still hasn't recovered, but we'll touch on that story again in this timeline.

From here, we'll let the headlines tell the most recent part of the story, which will begin from top of the latest peak in the U.S.' crude oil imports from Russia. Spoiler alert: they involve lots of new sanctions and actions that have contributed to today's much higher oil prices.

- August 2021

- September 2021

- December 2021

- January 2022

- February 2022

- March 2022

That ends the period covered on the chart, with Russian crude oil imports falling once again. But before any Biden administration official might celebrate the apparent success of their anti-Russia sanctions, there are two more breaking news stories that explains why they've so far failed to achieve the success they hoped for.

- Russia is on track to make more money off oil and gas exports this year than it did in 2021, and it's got the EU to thank.

- A fracking boom made the US the world's biggest oil producer. Now its end is pushing gas prices much higher.

In addressing domestic oil production, the Biden administration isn't as powerless as it makes itself out to be. It can take positive steps to boost and stabilize domestic oil production, such as lifting regulatory burdens and underwriting and insuring new investments to minimize the economic risks for producers that haven't recovered from the coronavirus pandemic crash. A good question to ask is why aren't they?

References

U.S. Energy Information Administration. U.S. Imports from Russia of Crude Oil. [Online Database]. Accessed 11 June 2022.

U.S. Energy Information Administration. U.S. Crude Oil Production. [Online Database]. Accessed 11 June 2022.

Labels: data visualization

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.