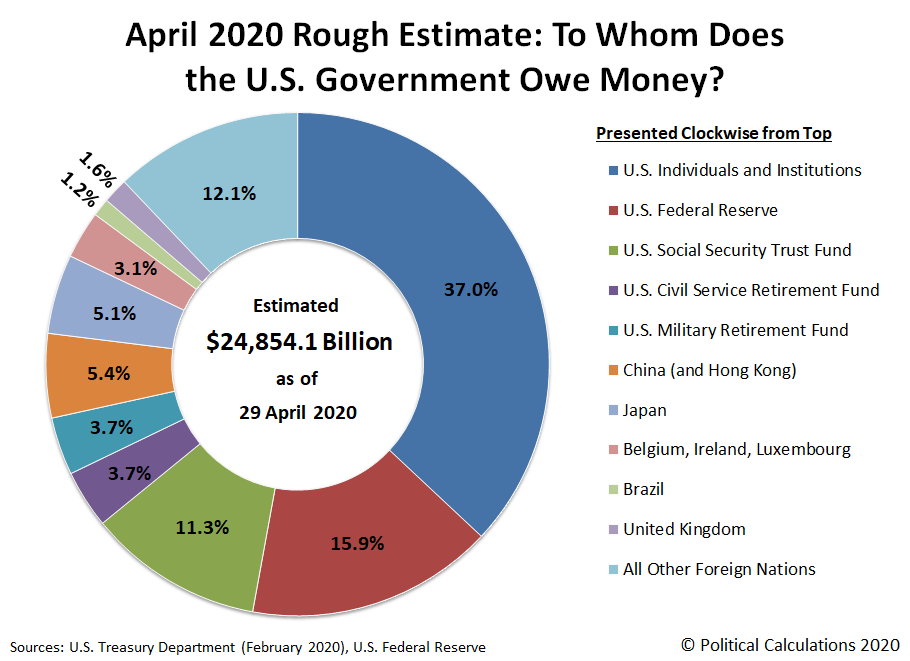

The U.S. government has gone on a borrowing binge since the global coronavirus pandemic reached the nation's shores and the number of known cases began increasing relentlessly at the end of February 2020, just over two months ago. From 26 February 2020 through 29 April 2020, the U.S. government's total public debt outstanding has increased by $1.427 trillion, from $23.427 trillion to $24.854 trillion.

That's a lot of money to borrow, and for all practical purposes, all of it was loaned to the U.S. government by its new Number One creditor, the U.S. Federal Reserve, to whom the U.S. government now owes more money than it does to its previous largest single creditor, Social Security. According to the Federal Reserve's H.4.1 statistical release for 29 April 2020, the Fed holds $3.945 trillion worth of U.S. Treasury securities, up from $2.465 trillion back on 26 February 2020, shortly before the number of known coronavirus cases in the U.S. began their rapid rise, which triggered the government actions that crashed the economy.

Our sharp eyed readers who do the math will catch that the Federal Reserve's holdings of U.S. government-issued debt securities increased by $1.480 trillion, more than the amount by which the federal government's total public debt outstanding increased over the same period of time.

How is that possible? Under current law, the Federal Reserve is prohibited from directly loaning money to the U.S. government, so it is actually acquiring debt securities that were originally issued by the U.S. Treasury when it borrowed money from banks and other financial institutions. The Federal Reserve can then pay them for their holdings of U.S. treasuries through its open market operations, much like how the lender you might have originally gotten your mortgage through might sell it to another financial institution. The money that was borrowed is still owed under the same terms as before, but now it's paid back to a different entity.

Doing that gives the original creditor more money to be able to go out and loan even more money to the U.S. government, which in the current environment, the Fed will then pay to acquire it from them. That process will repeat until the Fed decides it has had enough and tries to stop. Like it has before, which didn't really work out all that well for it.

In any case, that's how the Fed went from holding less than one in ten of all the dollars the U.S. government has borrowed to about one in six, making it the new single largest creditor to Uncle Sam.

So to answer the question of how the Fed's holdings of U.S. treasuries is increasing faster than the rate at which the U.S. government is borrowing money, it's because the Fed's holdings are being tapped out of the larger pool of treasuries held by U.S. individuals and institutions, which is then quickly replenished.

We're calling this a rough estimate because not all the data in the chart is synced together. The data for the amount of debt held by the U.S. government's major foreign creditors is preliminary and is only current through February 2020, while data for Social Security and the civil and military retirement trust funds is from March 2020. It's as close as we can estimate with the data that's available.

How do you suppose the Fed will want to be paid back? And where do you suppose the U.S. government will get the cash to do that?

Image credit: Hello I'm Nik 🎞

Labels: national debt

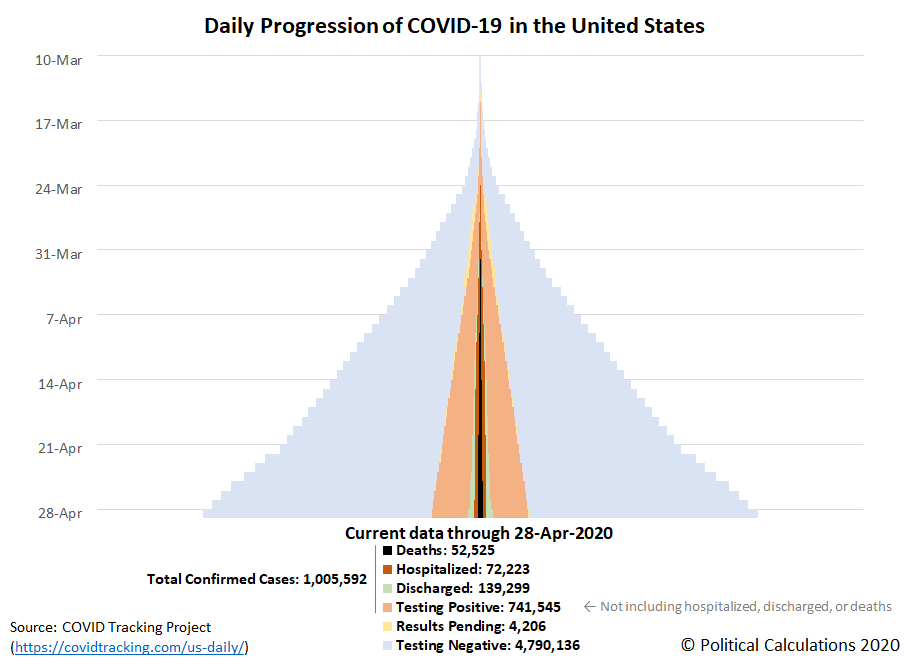

The seventh week of the global coronavirus epidemic in the U.S. has come to an end. Over 1 million Americans have tested positive for the SARS-CoV-2 coronavirus infection, with 52,525 deaths as reported by the COVID Tracking Project through 28 April 2020.

Those are big numbers, yet there are increasing signs the spread of COVID-19 is decelerating, though some states are still seeing growing numbers of cases. Here's what the daily progression of cumulative coronavirus testing, confirmations, hospitalizations, and deaths look like when tracked at the national level in a tower chart over the seven weeks from 10 March 2020 through 21 April 2020.

Starting from 22 April 2020, the volume of testing in the U.S. has kicked up into a higher gear, with anywhere from 190,000 to 314,000 tests results now being recorded per day. In the last week, the overall 'test positivity' rate of daily testing has dropped below 15% for the nation, confirming the expansion of testing beyond those suspected of having been infected by the coronavirus that originated in China.

The following chart shows the number of newly confirmed coronavirus cases and deaths attributed to COVID-19 reported within the U.S. each day during the seven weeks since 10 March 2020 when time series data became available.

A sudden transition from exponential to relatively steady growth appears to have taken place on 4 April 2020, with the number of new cases showing noisy day-to-day volatility in the weeks since, with since of further slowing in the past week. The number of deaths attributed to COVID-19 each day has lagged behind the overall case count, with a peak having been reached on 21 April 2020.

The changes affecting the national pattern are actually taking place at the state and local level, where a more mixed picture continues to be present in the pandemic's seventh week in the U.S. Those changes may be seen in the following skyline tower charts, where you can start to see some of the improvements that have begun to take place. Each of these charts span the same period of time and the width of each corresponds to 2.0% of each state or territory's population, making it very easy to see which states and territories have been most impacted and which have been the least impacted through the first seven weeks of the coronavirus epidemic in the U.S., especially since we've ranked them from the highest percentage of infection within the state's population to the least as you read from left-to-right, top-to-bottom.

This is the first weekly update for which we haven't needed to adjust the horizontal scale of the charts.

If you look at the top row of the chart, you can see the growth in cases in the state of New York continues to slow, though they are still at a level that puts New York at the top of the list for states and territories most impacted by the coronavirus. The other state we highlighted last week, Louisiana, is considerably further along in showing a trend of improvement, which is allowing it to drop down to fifth place in our skyline chart rankings. Both states are now reporting much higher numbers of recovered coronavirus cases among their populations.

The highly ranked states of New Jersey, Massachusetts, Rhode Island and Connecticut however continue to show a widening base of coronavirus cases, though not at the level that the state of New York experienced. We've been updating New York's situation separately on a daily basis, where you can catch up with the latest analysis here. There has been some very disturbing news about Governor Andrew Cuomo and his administration's management of New York's coronavirus epidemic in the news during the past week, which goes a long way to understanding why the state's death count has been so much higher than what other states and many countries have experienced.

Previously on Political Calculations

Here's our series of articles featuring the data visualization we developed to cover the story:

- Introducing Skyline Charts for Tracking Coronavirus Cases in the U.S.

- Visualizing the Progression of COVID-19 in the United States (Updated daily)

- Visualizing The First Four Weeks Of The Coronavirus Epidemic In The U.S.

- Signs Of Slowing COVID-19 Spread Among U.S. States

- A Mixed Picture Emerges For Progression of COVID-19 in U.S.

- COVID-19 In New York (Updated daily)

Meanwhile, if you prefer your data in the form of tables presenting numbers and percentages, we also have you covered!

- COVID-19 Coronavirus Cases in the U.S. (Updated daily)

- Ranking the World for COVID-19 Coronavirus Cases (Updated daily)

Labels: coronavirus, data visualization

Housing sales are something of a slow motion economic indicator, where March 2020's recently released data is only beginning to show the effects on new home sales, which for the month, were primarily affected in the U.S. Census Bureau's West region.

That makes sense when you consider that the states of Washington and California were among the first to report confirmed coronavirus cases within the U.S. At the national level however, the impact within these states is comparatively small with respect to how we anticipate it will be affected in upcoming data releases, which will show the impact of the statewide lockdowns that were implemented in the latter weeks of March 2020.

For now, we can provide a picture of what the U.S. market for new home sales looked like before the response to the coronavirus pandemic shut down large sectors of the nation's economy. The following chart shows the trailing twelve month average market cap for the U.S. new home market, from January 1976 through March 2020, which spans all the available monthly data for it:

Going into the coronavirus recession, the U.S. new home market was already experiencing a dip in its market capitalization, having recently reached its last peak in September 2019.

The new home market cap is the product of the number of sales and the average sale price of new homes sold in the U.S., where both component factors have fallen in recent months. The following chart shows median and average new home sale prices from January 2000 through March 2020:

At this time, we can expect the volume of housing sales will fall when the data for April 2020 becomes available next month. What's less clear is what will happen with median and average new home sale prices, where we can see two possible likely scenarios:

- Both median and average new home sale prices decline along with number of sales, but not as steeply because most homebuilders are simply on pause until their local markets can reopen, which would reflect supply being matched as best as possible to the available demand.

- Both median and average new home sale prices rise sharply, because only sales at the high end of the real estate market are able to proceed in the current economic environment.

That latter scenario reflects the disruption from the coronavirus-related job layoffs, which have disproportionately impacted Americans in lower income earning occupations. Americans at the higher end of the income spectrum have been less affected by employment disruptions, where new home sales that are completed will reflect the higher relative proportion of these sales within the nation than would have occurred if not for the coronavirus lockdowns.

Which of these options do you see as being more likely? Or is there another option that better describes what we can expect to see when the sales data for April is released late next month?

And what scenario explains Florida Man Tom Brady's recent housing escapade? We don't even know where to begin with that one!...

Labels: real estate

The pace of dividend cuts in the U.S. surged during the past week and a half, where we've added an additional 44 distressed firms either reducing their dividends or suspending payments to our ongoing tally for April 2020.

To put that number in perspective, when recessionary conditions are present in the U.S. economy, we'll see firms announce dividend cuts at a rate of 25 or more during the course of a single month. We now anticipate triple that figure by the time April 2020 is over.

The following chart compares the current pace of dividend cuts during 2020-Q2 to the same quarter in the years 2017, 2018, and 2019, which is the stock market equivalent to those excess mortality charts illustrating the full impact of the COVID-19 coronavirus pandemic.

We confirm the number of dividend cuts and suspensions announced in the quarter to date for our 2020-Q2 sampling is elevated well above the comparatively healthy quarters of 2017-Q2 and 2018-Q2, and is also considerably higher than the year ago quarter of 2019-Q2, when the oil and gas sector of the U.S. economy experienced a relatively short period of distress.

Here is the list of U.S. firms announcing dividend cuts or omitting dividend cuts in the seven trading days since our previous report:

- Apache (NYSE: APA)

- Goodyear Tire & Rubber (NYSE: GT)

- Cedar Shopping Centers (REIT-Retail) (NYSE: CDR)

- Green Plains Partners (NASDAQ: GPP)

- Noble Energy (NYSE: NBL)

- Chesapeake Energy (NYSE: CHK)

- Permianville Royalty Trust (NYSE: PVL)

- VOC Energy Trust (NYSE: VOC)

- Service Properties (REIT-Hotel) (NASDAQ: SVC)

- Kohl's (NYSE: KSS)

- Schlumberger (NYSE: SLB)

- Targa Resources (NYSE: TRGP)

- San Juan Basin Royalty Trust (NYSE: SJT)

- Cross Timbers Royalty Trust (NYSE: CRT)

- Permian Basin Royalty Trust (NYSE: PBT)

- Western Midstream Partners (NYSE: WES)

- RBB Bancorp (NASDAQ: RBB)

- EnLink Midstream (NYSE: ENLC)

- Mesa Royalty Trust (NYSE: MTR)

- Landmark Infrastructure (Real Estate) (NASDAQ: LMRK)

- HCA Healthcare (NYSE: HCA)

- Anworth Mortgage Asset (REIT-Mortgage) (NYSE: ANH)

- DCP Midstream (NYSE: DCP)

- STMicroelectronics (NYSE: STM)

- BBX Capital (NYSE: BBX)

- Retail Opportunity Investments (REIT-Retail) (NASDAQ: ROIC)

- Moelis (NYSE: MC)

- Manning & Napier (NYSE: MN)

- Black Stone Minerals (NYSE: BSM)

- Bluegreen Vacations (NYSE: BXG)

- Patterson-UTI Energy (NYSE: PTEN)

- Alliance Data Systems (NYSE: ADS)

- Invesco (NYSE: IVZ)

- 1st Source (NASDAQ: SRCE)

- Lifetime Brands (NASDAQ: LCUT)

- Northern Technologies (NASDAQ: NTIC)

- Blackstone Group (NYSE: BX)

- San Juan Basin Royalty Trust (NYSE: SJT)

- Holly Energy Partners (NYSE: HEP)

- USD Partners (NYSE: USDP)

- Dynamic Materials (NASDAQ: BOOM)

- Community West Bancshares (NASDAQ: CWBC)

- CONSOL Coal Resources (NYSE: CCR)

- CenterPoint Energy (NYSE: CNP)

The oil and gas sector makes up 20 of the 44 firms above, an outcome of the fall in demand and oil prices that has taken place since with the global coronavirus pandemic. The finance sector, including real estate investment trusts, accounts for another 10 firms, with the remainder split among 11 other industrial sectors, confirming the broad impact of the coronavirus recession.

The distribution of these dividend cuts among industries is a consequence of both the degree of distress they are facing and also of the calendar, with many companies following their regular schedule for declaring dividends, with the past seven trading days being heavily loaded with firms in the oil and gas sector. We'll have a more complete analysis after the end of the month with the next installment of our monthly Dividends By The Numbers series.

References

Seeking Alpha Market Currents Dividend News. [Online Database]. Accessed 24 April 2020.

Wall Street Journal. Dividend Declarations. [Online Database]. Accessed 24 April 2020.

The S&P 500 (Index: SPX) continues to defy gravity in the upside down market the Fed has wrought, closing the trading week ending on 24 April 2020 at 2,836.74, 599.34 points (21.1%) above its 23 March 2020 coronavirus recession low, and 549.10 points (16.2%) below its 19 February 2020 pre-coronavirus recession high, giving an indication of the extreme volatility that has characterized the stock market during the last two months.

The alternative futures forecast chart shows the level of the S&P 500 is consistent with an amplification factor m in the dividend futures-based model being equal to -1 following the Fed's last action to backstop the liquidity of the commercial bond market.

Dividend futures have also been rebounding, which in today's upside down market, means that the expected future level of the S&P 500's quarterly dividends per share won't be as low as they were projected a month ago when the market hit bottom.

Here's the wrap-up of the market-moving news headlines we tracked during the past week.

- Monday, 20 April 2020

- Signs and portents for the U.S. economy:

- Oil crashes, ends negative for the first time in history

- With Congress feuding, a small business deal seems elusive

- North America extends coronavirus travel restrictions: U.S. official

- Some life insurers hit pause on older Americans during coronavirus crisis

- Bigger stimulus, handouts developing in the U.S.:

- Restaurants: U.S. restaurants seek more aid, on track to lose $240 billion by end of 2020

- Airlines: United Airlines sees $2.1 billion loss as coronavirus hits Latin America growth hopes, seeks more federal aid

- U.S. senators propose $500 billion rescue for state, local governments

- Bigger trouble developing all over:

- IMF's Georgieva says coronavirus crisis is worst since Great Depression

- Italy sees its virus-hit economy falling 8% in 2020: sources

- China's fiscal revenue plunges 26.1% as virus ravages economy

- Bigger stimulus developing in China, not so much in the Eurozone:

- China cuts key rate for second time this year, more easing likely

- ECB will do more if needed to keep prices stable: Villeroy

- Wall Street drops as oil traders cannot give away U.S. crude

- Tuesday, 21 April 2020

- Collapsing global oil prices:

- Brent oil futures plunge as growing glut feeds market panic

- Trump to consider halting Saudi oil imports, says U.S. has 'plenty'

- Oil price plunge below zero sends 'oil tourists' on wild ride

- A hunt for any storage space turns urgent as oil glut grows

- Bigger trouble developing in Eurozone, China finding their bigger stimulus isn't delivering their desired results:

- European new car sales plunge by 51.8% in March due to coronavirus: ACEA

- As China splashes out vouchers to revive retail, many just buy necessities

- Australia to suffer a 'once in a century' economic contraction: central bank governor

- Bigger stimulus developing in the U.S.

- U.S. Senate passes nearly $500 billion coronavirus bill aiding small business

- U.S. Treasury releases $2.9 billion in airline support, finalizes payroll agreements

- Strained U.S. mortgage firms get support but push for liquidity facility

- ECB minions continue calling for 'Pan-European' response

- Pan-European response needed in Coronavirus crisis: ECB's Knot

- Euro zone fiscal response to crisis inadequate: ECB's Panetta

- Fed minions concerned state and local economy lockdowns harming U.S. economy:

- Wall Street tumbles as oil crash adds to pandemic fears

- Wednesday, 22 April 2020

- Signs and portents for the U.S. economy:

- Brent crude rebounds from more-than 20-year low; U.S. oil up 20% in wild trade

- U.S. auto sales show signs of life after gloomy coronavirus March: J.D. Power

- Coronavirus to spur largest single loss in insurance history: Chubb CEO

- Bigger trouble developing in the Eurozone:

- Euro zone economy set for deepest recession on record: Reuters poll

- Lagarde draws line on how far ECB largesse can go

- Still bigger stimulus developing in China:

- EU minions wonder what to do about bigger trouble:

- EU 'misunderstandings' push back deal on coronavirus economic recovery

- ECB's Rehn: EU leaders must show solidarity with coronavirus package

- Explainer: How the EU can finance economic recovery after the COVID-19 pandemic

- German government wants to launch tax relief worth 4.5 billion euros: newspaper

- Wall Street surges as Congress preps more stimulus and oil bounces back

- Thursday, 23 April 2020

- Oil rallies on faster output cuts to offset virus-induced falloff in demand

- Bankruptcy looms over U.S. energy industry, from oil fields to pipelines

- U.S. new home sales tumble in March

- Millions of Americans join unemployment line as coronavirus savages economy

- Bigger trouble in the Eurozone, Japan:

- Euro zone business activity ground to a halt in April: PMI

- ECB's Lagarde tells EU leaders: coronavirus can cut 15% of output: source

- ECB warns EU leaders of doing too little, too late about coronavirus effects

- Japan offers bleakest view of economy in over a decade as virus damage deepens

- Bigger stimulus developing in China, Eurozone:

- China President Xi says to boost investments, employment

- EU lays out trillion euro escape route from coronavirus pandemic

- Wall Street trims gains after report on coronavirus drug trial

- Friday, 24 April 2020

- Signs and portents for the U.S. economy:

- Oil rises, but ends wild week lower as coronavirus slashes fuel demand

- As U.S. coronavirus death toll tops 50,000, handful of states edge toward reopening

- Insurers feel the heat as chefs, Trump join calls for payouts

- Trump signs fourth coronavirus relief bill into law, pushes back against USPS aid

- Congressional estimators see major U.S. economic decline in mid-2020 as coronavirus stifles activity

- Bigger trouble developing in Eurozone:

- Bigger stimulus still developing in China:

- ECB, EU minions at odds on coronavirus pandemic relief:

- Indecisive EU to force ECB into more emergency action

- ECB's de Cos calls for common actions to address budgetary risks at EU level

- ECB begins reluctant journey into junk debt

- Tech titans Apple and Microsoft propel Wall Street rally

But wait, there's more! Barry Ritholtz listed the positive and negative news he picked out of the week's news stream to provide a bigger picture than what we've presented!

Unlike the weeks preceding it, the trading week ending on Friday, 24 April 2020 was relatively subdued. So much so that unless we see daily volatility rise to an interesting level, which we define as a greater than 2% change in either direction from the previous day's closing value, we'll discontinue appending daily updates throughout the week to this article. If the market should change by more that 2% from one day to the next in the trading week ending Friday, 1 May 2020, please follow this link for our unscheduled 'below the line' coverage the following morning.

S&P 500 Rises 2.7% As The Fed Works Its Mojo

Update 29 April 2020, 6:30 PM Eastern: The S&P 500 (Index: SPX) climbed 2.7% to close at 2,939.51 as all eyes were on the Fed and what signal it would send for providing relief for coronavirus-stricken markets.

And they signal they sent was that the Fed will be "committed to using every tool", which is to say they are going to continue doing what they have been doing, and more of it.

In addition to sending stock prices higher, that message also sent dividend futures higher. Here are the latest versions of the S&P 500's dividend futures and the alternative futures chart, where we find the trajectory of the S&P 500 is following the new upside-down order the Fed has created in the stock market.

In other news, the coronavirus recession crashed U.S. GDP by at least 4.2% in the first quarter, with virtually all of it in March 2020, and U.S. firms are cutting or suspending dividend payments at never-before-seen rates. How long do you suppose the Fed will need to keep working its monetary mojo?

Roman Hill is an abstract imagery artist. In the following six minute long video As Above, he zoomed way in on an 8-mm square surface to film a chemical reaction in progress, with no special effects or computer generated imagery:

See more of his work here!

HT: Kottke

Labels: technology

In a virus-filled world, opening doors presents a problem.

If you weren't concerned about the risk of infection, you could just reach out and grab a door knob, turn it, or if it has a handle, perhaps push or pull it, and through the door you go. But if you are afraid of coming into contact with a virus, where you have no idea how many people have touched the door handle and left infectious germs behind, does every door handle suddenly look like designer Naomi Thellier de Poncheville's whimsical Door Hand-Le concept?

Does that look inviting or scary to you?

If it looks scary, there's a new Kickstarter project that solves the problem the same way a pirate would. Or at least one public domain pirate named Captain Hook: replace your hand with a hook! The following video introduces StatGear's Hygiene Hand, which they've clearly tailored as a solution for several very modern problems involving handling things that other, potentially contagious, people have touched so you don't have to!

The project easily cleared Kickstarter's pledge bar of $5,000, collecting around a half-million from over 9,000 backers, so the Hygiene Hand is something you may soon see. Especially in coronavirus-ravaged New York City.

But what about regular door knobs? A hook may work with a handle, but a typical cylindrical door knob doesn't offer much surface for a hook to grab onto.

That's where Rafael Vargas, Cristina Centeno, and Chad M. Wall's dorrhandle attachment might come in handy. It's a 3D printed easy-to-assemble latch that can slip over most door knobs, transforming them into handles that you don't need to touch with your hands to operate. If you have access to a 3D printer, they've made the model of their design available. Here's an animated image of it in action, which also highlights a feature of the material they used in their design:

The plastic they used in their design is thermochromic, which changes color when heat is applied to it. As it does in the animation after it has been in contact with someone's fingers for a short time, letting you know the handle was recently handled.

These solutions might work in public, but what about at home? If you would like to not have to accessorize just to access your own home, you might consider swapping out your current door handles with products that are made with antimicrobial copper, such as Olin Brass' CuVerro alloy, or that are covered with a silicone treated with antibacterial silver.

In a virus-filled world, opening doors shouldn't be a physical challenge. What will the world's inventors come up with next?

HT: Core77, where you can see what's in the future of everyday objects!

Labels: coronavirus, technology

With COVID-19 coronavirus testing results continuing to dominate the news, many Americans are getting a crash course in the limits of statistical analysis, whether they wanted it or not.

For example, a study by Stanford University researchers recently made a large splash in the news because it found that "between 48,000 and 81,000 people in Santa Clara County alone may already have been infected by the coronavirus by early April — that's 50 to 85 times more than the number of official cases at that date."

Those numbers are alarming because through Saturday, 18 April 2020, 28,963 people in the entire state of California had been officially tested positive for having been infected by the SARS-CoV-2 coronavirus. If double that many people had already been infected in just Santa Clara County alone, which is consistent with the lower end estimate of the Stanford study, that result would directly affect how medical resources are being allocated within the state.

For example, with such a high number of previous infections compared to the number of deaths attributed to COVID-19, it would be evidence the coronavirus is far less deadly than previous analysis indicated, which could lead public health officials to dial back their efforts to limit the rate of growth of new infections.

But if the newer, headline-grabbing analysis is incorrect, that would be a very wrong action to take. If the incidence of COVID-19 infections is really much less, with the same death toll, more serious action would be needed to mitigate the potentially fatal infection.

That leads to the question of how the Stanford researchers collected their data and did their analysis. Here's an excerpt from their preprint paper:

On 4/3-4/4, 2020, we tested county residents for antibodies to SARS-CoV-2 using a lateral flow immunoassay. Participants were recruited using Facebook ads targeting a representative sample of the county by demographic and geographic characteristics. We report the prevalence of antibodies to SARS-CoV-2 in a sample of 3,330 people, adjusting for zip code, sex, and race/ethnicity. We also adjust for test performance characteristics using 3 different estimates: (i) the test manufacturer's data, (ii) a sample of 37 positive and 30 negative controls tested at Stanford, and (iii) a combination of both. Results The unadjusted prevalence of antibodies to SARS-CoV-2 in Santa Clara County was 1.5% (exact binomial 95CI 1.11-1.97%), and the population-weighted prevalence was 2.81% (95CI 2.24-3.37%).

We're going to focus on the unadjusted infection rate of 1.5%, since that's the figure they directly determined from their 3,330 solicited-via-Facebook-ad sample of Santa Clara County's 1.9 million population, in which 50 tested positive for having SARS-CoV-2 antibodies.

That's the researchers' reported rate of COVID-19 infections in Santa Clara County, but what's the true rate?

Estimating that value requires knowing what the testing's rate of both false positives (people who aren't really infected but who have test results indicating they are), and false negatives (people who really are infected, but whose test results gave them an 'all-clear'). Alex Tabarrok explains how to do the math to estimate the true infection rate if you know those figures:

The authors assume a false positive rate of just .005 and a false negative rate of ~.8. Thus, if you test 1000 individuals ~5 will show up as having antibodies when they actually don’t and x*.8 will show up as having antibodies when they actually do and since (5+x*.8)/1000=.015 then x=12.5 so the true rate is 12.5/1000=1.25%, thus the reported rate is pretty close to the true rate. (The authors then inflate their numbers up for population weighting which I am ignoring). On the other hand, suppose that the false positive rate is .015 which is still very low and not implausible then we can easily have ~15/1000=1.5% showing up as having antibodies to COVID when none of them in fact do, i.e. all of the result could be due to test error.

In other words, when the event is rare the potential error in the test can easily dominate the results of the test.

To illustrate that point, we've built the following tool to do that math, where we've standardized the various rates to be expressed as percentages of the sampled population, which we've also standardized at 1,000 individuals. If you're accessing this article on a site that republishes our RSS news feed, please click through to our site to access a working version of the tool.

Considering Alex' two scenarios, the tool confirms the results of a true infection rate of 1.25% for the default values, while increasing the false positive rate from 0.5% to 1.5% returns a true incidence rate of 0.00%, which indicates that all the reported positives could indeed be the result of false positive test results within the sampled population.

The ACSH's Chuck Dinerstein reviewed the study and discusses how the rate of false positives among the raw sample would affect the statistical validity of the report's population-adjusted findings:

The test for antibodies, seropositivity, is new, and the sensitivity and specificity of the test are not well calibrated. The researchers tested the test against know positive and negative serum (based on a more accurate nucleic acid amplification test – the swab in the nose or collected before the COVID-19 outbreak) among their patients and made use of the sensitivity and specificity studies done by the manufacturer on similar clinically confirmed COVID-19 patients and controls. While the specificity, false positives, with high and very similar for both test conditions, the sensitivity, the false negatives, were much higher in the local serum as compared to the data from the manufacturer. The researchers used blended false positives and negatives in their calculations.

- Fewer false positives lowered the calculated incidence of COVID-19 to 2.49%.

- Higher false positives increased the calculation to 4.16%.

- Their blended value gave the 50-fold increase being reported.

In that thoughtful "peer-review," it is pointed out that the false-positive rate may be higher, it depends on how it is calculated. As that false positive rate increases, given their sample size, the conclusion may become lost in statistical uncertainty. In other terms, in the 50 positive tests, there might be 16 to as many as 40 false-positive results.

Before we go any further in this discussion, we should note the Stanford team's results are being torn apart by statisticians, including Luis Pedro Coelho and Andrew Gelman, the latter of whom is demanding the study's authors provide an apology for wasting everybody's time with what he describes in detail as avoidable statistical errors. Gelman also has this to say about Stanford University's credibility:

The authors of this article put in a lot of work because they are concerned about public health and want to contribute to useful decision making. The study got attention and credibility in part because of the reputation of Stanford. Fair enough: Stanford's a great institution. Amazing things are done at Stanford. But Stanford has also paid a small price for publicizing this work, because people will remember that "the Stanford study" was hyped but it had issues. So there is a cost here. The next study out of Stanford will have a little less of that credibility bank to borrow from. If I were a Stanford professor, I'd be kind of annoyed. So I think the authors of the study owe an apology not just to us, but to Stanford.

Before we close, take a closer look at the image we featured at the top of this article, particularly the solution to the algebra problem that appears on the whiteboard. This image was snapped from Stanford University's promotional materials for its graduate school of education. It's not just rushed studies that Stanford professors have to be annoyed about coming out from the university these days.

Labels: coronavirus, math, quality, tool

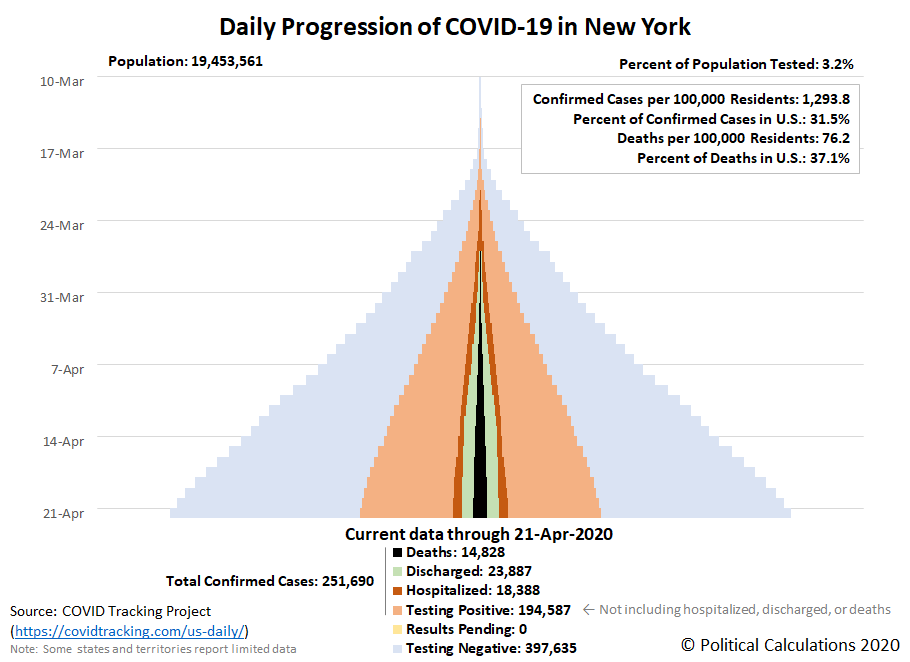

We have reached the sixth week of the global coronavirus epidemic in the U.S., where we're seeing both clear signs of improvement among some of the most impacted states and territories, but also signs that other states and territories have a long way to go.

Here's what the daily progression of cumulative COVID-19 testing, confirmations, hospitalizations, and deaths look like when tracked at the national level in a tower chart over the six weeks from 10 March 2020 through 21 April 2020.

With the increased volume of testing, perhaps the most important bit of information this chart is communicating is that the rate at which Americans are testing positive for COVID-19 has stopped increasing exponentially during the last two and a half weeks, but is instead increasing at a steady rate. That change is a bit easier to see in our next chart, where we've simply presented the number of newly reported positive coronavirus test results reported on each day since 10 March 2020.

A sudden transition from exponential to steady growth appears to have taken place on 4 April 2020, with the number of new cases showing noisy day-to-day volatility, with the peak in the daily number of new cases occurring on 10 April 2020.

The changes affecting the national pattern are actually taking place at the state and local level, where a more mixed picture is emerging in the pandemic's sixth week in the U.S. Those changes may be seen in the following skyline tower charts, where you can start to see some of the improvements that have begun to take place. Each of these charts span the same period of time and the width of each corresponds to 2.0% of each state or territory's population, making it very easy to see which states and territories have been most impacted and which have been the least impacted through the first six weeks of the coronavirus epidemic in the U.S., especially since we've ranked them from the highest percentage of infection within the state's population to the least as you read from left-to-right, top-to-bottom.

If you look at the top row of the chart, you can see the growth in cases in the state of New York is now clearly slowing, though they are still at a level that puts New York at the top of the list for states and territories most impacted by the coronavirus. The other state we highlighted last week, Louisiana, is considerably further along in showing a trend of improvement, which is allowing it to drop down to fifth place in our skyline chart rankings.

But that's not the case for the #2, #3, and #4 states of New Jersey, Massachusetts, and Connecticut, which are each continuing to steady growth in new coronavirus cases, nor is it true for the #6, #7, #8 ranked states or territories of Rhode Island, Washington D.C., and Michigan.

We should also note that the quality of data reported by individual states and territories varies considerably from one to another. For example, the District of Columbia doesn't report hospitalizations, but does report hospital discharges, which means hospitalizations are being underreported. At the same time, the District revised its count of confirmed cases a little over a week ago, which is why its skyline tower of coronavirus cases looks a bit like an orange Christmas tree. If you scan further down the chart, Vermont's chart is similarly creative, where a sudden large jump in the reported number of discharged patients on 21 April 2020 by the COVID data project is almost certainly in error.

Of all the regions that have been hardest hit within the U.S., the state of New York continues to stand apart as having experienced the greatest incidence of coronavirus infections. Here's the latest update to the state of New York's full tower chart:

The daily growth of New York's confirmed cases is still growing, but with clear signs of deceleration. The state's confirmed cases are now accounting for a little under one-third of the total positive test results in the United States.

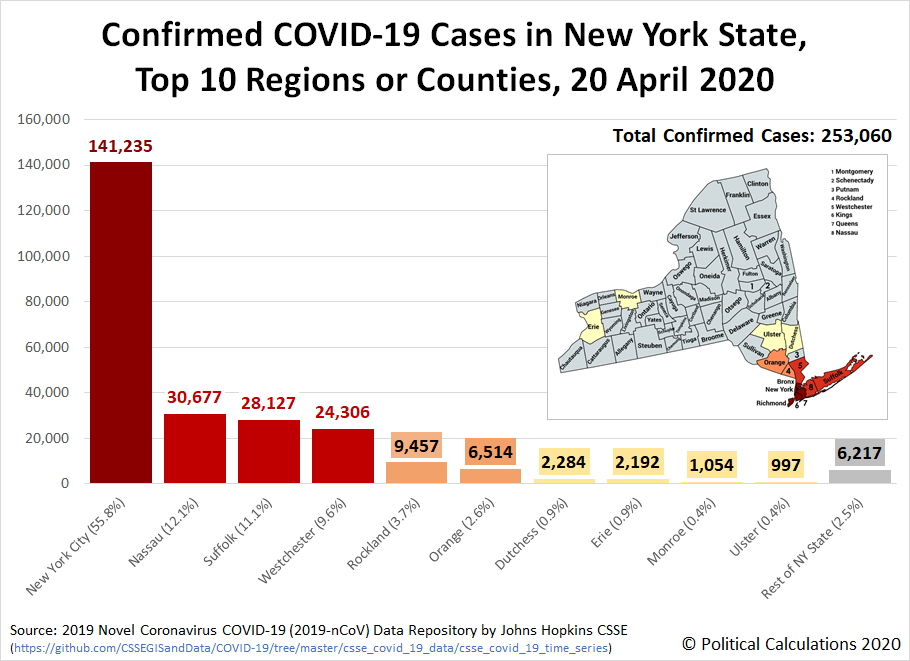

Here's a little more detail on the geographical distribution of confirmed cases in the state, where the following chart identifies the top 10 regions or counties, through 20 April 2020:

The region of New York City includes Bronx, Kings, New York, Richmond, and Queens counties. The most affected counties are adjacent to New York City.

Why is New York's situation with the coronavirus so bad? The New York Times points to the poor judgment of government officials, including Governor Andrew Cuomo and particularly New York City Mayor Bill De Blasio. Their grave mistakes greatly amplified the poor judgment and sluggishness of bureaucrats in the Centers for Disease Control and the Food and Drug Administration, who the New York Post reports failed to treat the rapidly developing crisis like a rapidly developing crisis.

But wait, there's more! A new study is pointing to the city's public transportation system, particularly its subways and buses, as major contributors in exposing New Yorkers to the coronavirus. The failure to regularly decontaminate the city's trains and buses while keeping them running on a reduced schedule that resulted in packing more New Yorkers into highly contaminated spaces ensured they would be at much higher risk of being exposed to the SARS-CoV-2 coronavirus (shades of what happened on the Diamond Princess cruise ship). Here's a map from the paper showing the incidence of coronavirus cases within New York City overlaid with the access points to the city's subway system:

Are New York's subways really a big player in the spread of coronavirus infections? The key phrase to remember here is that "correlation is not causation", where the apparent results have been challenged.

As for ending the business closures and stay-at-home orders they've imposed, on 16 April 2020, Governor Cuomo indicated he will extend his statewide order through 15 May 2020, while Mayor De Blasio will keep New York City locked down well into July or August 2020.

Much of the rest of the nation will be ready to reopen closed businesses and end their stay-at-home orders much earlier, though states and territories like New Jersey, Massachusetts, Connecticut, Rhode Island, Michigan, and the District of Columbia may not based on their current trends.

Previously on Political Calculations

Here's a very short guide to some of the data visualization we've featured for tracking the spread of the coronavirus epidemic in the United States in this series:

- Introducing Skyline Charts for Tracking Coronavirus Cases in the U.S.

- Visualizing the Progression of COVID-19 in the United States (Updated daily)

- Visualizing The First Four Weeks Of The Coronavirus Epidemic In The U.S.

- Signs Of Slowing COVID-19 Spread Among U.S. States

- COVID-19 In New York (Updated daily)

Meanwhile, if you prefer your data in the form of tables presenting numbers and percentages, we also have you covered!

- COVID-19 Coronavirus Cases in the U.S. (Updated daily)

- Ranking the World for COVID-19 Coronavirus Cases (Updated daily)

Labels: coronavirus, data visualization

We periodically take snapshots of the S&P 500's total market capitalization, including the index' Top 10 component firms by market cap weighting. We were curious to see how the Coronavirus Recession has affected who's on top in the S&P 500, so we created the following animated chart to visualize how the index' and its top 10 firms' market capitalization has changed from the time before first coronavirus case in the U.S. was documented and the present.

The earlier snapshot is from 8 January 2020, 13 days before the first U.S. coronavirus case was reported in the state of Washington, while the later snapshot was taken on 16 April 2020.

It's a little surprising, but eight of the firms whose market cap weightings placed them in the index' Top Ten back on 8 January 2020 are still in the Top Ten. Here is that list, ranked by their market caps as of 16 April 2020:

- Microsoft (NASDAQ: MSFT)

- Apple (NASDAQ: AAPL)

- Amazon (NASDAQ: AMZN)

- Facebook (NASDAQ: FB)

- Johnson & Johnson (NYSE: JNJ)

- Alphabet (Class C) (NASDAQ: GOOG)

- Alphabet (Class A) (NASDAQ: GOOGL)

- Berkshire Hathaway (Class B) (NYSE: BRK.B)

The following two firms dropped out of the S&P 500's Top Ten during the last three months, JP Morgan Chase (NYSE: JPM), which went from #6 to #12 overall, and Visa (NYSE: V), which dropped from #10 to #11.

Two firms have replaced them in the Top 10 of the S&P 500 by market cap weighting. Proctor & Gamble (NYSE: PG) went from #11 to #9, and UnitedHealth Group (NYSE: UNH) went from #15 to #10.

Between 8 January 2020 and 16 April 2020, the total market cap of the S&P 500 has shrunk by 17%, from $27.5 trillion to $22.8 trillion. Many of the firms in the Top 10 have seen their relative share within the index increase because their market caps haven't shrunk by as much as others have declined during the Coronavirus Recession. The two exceptions in the Top Ten are Microsoft, whose contract win over Amazon to provide cloud computing services to the U.S. Department of Defense was upheld last week, and Amazon, whose market share for selling consumer goods has greatly benefited from the various coronavirus-related business closures and stay-at-home orders that state and local government officials have implemented across much of the U.S.

Labels: coronavirus, data visualization, market cap, SP 500

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.