Thanks largely to the effects of the Federal Reserve's actions to reduce short term interest rates, the Recession Probability Track now visually confirms the probability the U.S. economy will enter into a national recession peaked at 11.3% on 9 September 2019 and has indeed begun to recede. What that means is that should the National Bureau of Economic Research someday determine a recession began in the U.S. in either 2019 or 2020, the odds are highest that it will identify a month in the period from September 2019 through September 2020 as Month Zero for such a recession, or rather, the last month in which the U.S. economy's business cycle expanded before entering into a sustained period of contraction. Much like December 2007 marks the final month of economic expansion before the onset of the Great Recession.

Though the Fed took action again on 30 October 2019 to cut the Federal Funds Rate by another quarter point for the third time since 30 July 2019, the receding recession odds indicated by the Recession Probability Track is mainly responding to the Fed's previous two quarter point interest rate reductions, although the end of the inversion between the 10-Year and 3-Month constant maturity U.S. Treasuries is also contributing to the reduction in forecast recession risk.

The Recession Probability Track is based on the recession forecasting method introduced by Jonathan Wright in his 2006 paper, The Yield Curve and Predicting Recessions, which uses the level of the effective Federal Funds Rate and the spread between the yields of the 10-Year and 3-Month Constant Maturity U.S. Treasuries to estimate the probability of recession based on historical data.

That method may be greatly understating the probability of a recession starting between September 2019 and September 2020, since that historical data does not take the effects of the Federal Reserve's quantitative tightening policies into account, where the Fed reduces its holdings of U.S. Treasuries and Mortgage-Backed Securities on its balance sheet as a way to achieve the effects of an interest rate hike without actually hiking interest rates - the opposite of what Fed officials set out to achieve during their various quantitative easing programs from 2009 through 2015 after the Federal Funds Rate reached a level near zero percent.

These unusual monetary policies are comparatively recent developments, which Wright's 2006 paper did not contemplate. We've developed an alternate scenario analysis that factors in the effects of the Fed's most recent quantitative tightening policy that continued until 30 July 2019, which would make the effective Federal Funds Rate much higher than the 'official' Wright method indicates, boosting the odds of recession starting in the months from September 2019 through September 2020 as high as 54-55%.

There's no reason though why we should be the only ones to consider that kind of scenario in determining the probability of a future recession! If you would like to consider your own recession probability scenarios, please take advantage of our recession odds reckoning tool, which has become increasingly popular over the last year.

It's really easy. Plug in the most recent data available, or the data that would apply for a future scenario that you would like to consider, and compare the result you get in our tool with what we've shown in the most recent chart showing the 'official' Wright recession odds we've presented above.

On a final note, now that the probability of recession indicated by Wright's method is declining, there is no connection between its level and how long a forecast recession might last should one come to pass - the most it can do is indicate the odds of a recession getting started during the next 12 months. For a history of the analysis we've previously presented throughout the 2017-2020 cycle, here are links to all the analysis we've presented going back to when we restarted this series in June 2017.

Previously on Political Calculations

- The Return of the Recession Probability Track

- U.S. Recession Probability Low After Fed's July 2017 Meeting

- U.S. Recession Probability Ticks Slightly Up After Fed Does Nothing

- Déjà Vu All Over Again for U.S. Recession Probability

- Recession Probability Ticks Slightly Up as Fed Hikes

- U.S. Recession Risk Minimal (January 2018)

- U.S. Recession Probability Risk Still Minimal

- U.S. Recession Odds Tick Slightly Upward, Remain Very Low

- The Fed Meets, Nothing Happens, Recession Risk Stays Minimal

- Fed Raises Rates, Recession Risk to Rise in Response

- 1 in 91 Chance of U.S. Recession Starting Before August 2019

- 1 in 63 Chance of U.S. Recession Starting Before September 2019

- 1 in 54 Chance of U.S. Recession Starting Before November 2019

- 1 in 42 Chance of U.S. Recession Starting Before December 2019

- 1 in 26 Chance of U.S. Recession Starting Before February 2020

- 1 in 16 Chance of U.S. Recession Starting Before April 2020

- 1 in 14 Chance of U.S. Recession Starting Before April 2020

- 1 in 13 Chance of U.S. Recession Starting Before May 2020

- 1 in 12 Chance of U.S. Recession Starting Before June 2020

- 1 in 11 Chance of U.S. Recession Starting Before July 2020

- Odds of U.S. Recession Before August 2020 Rise to 1 in 10

- 1 in 10 Chance of U.S. Recession Starting Before August 2020

- What The Dickens Is Going On With Recession Indicators?

- 1 in 9 Chance of U.S. Recession Starting Before October 2020

- U.S. Recession Odds Peak, Begin to Recede

Labels: recession forecast

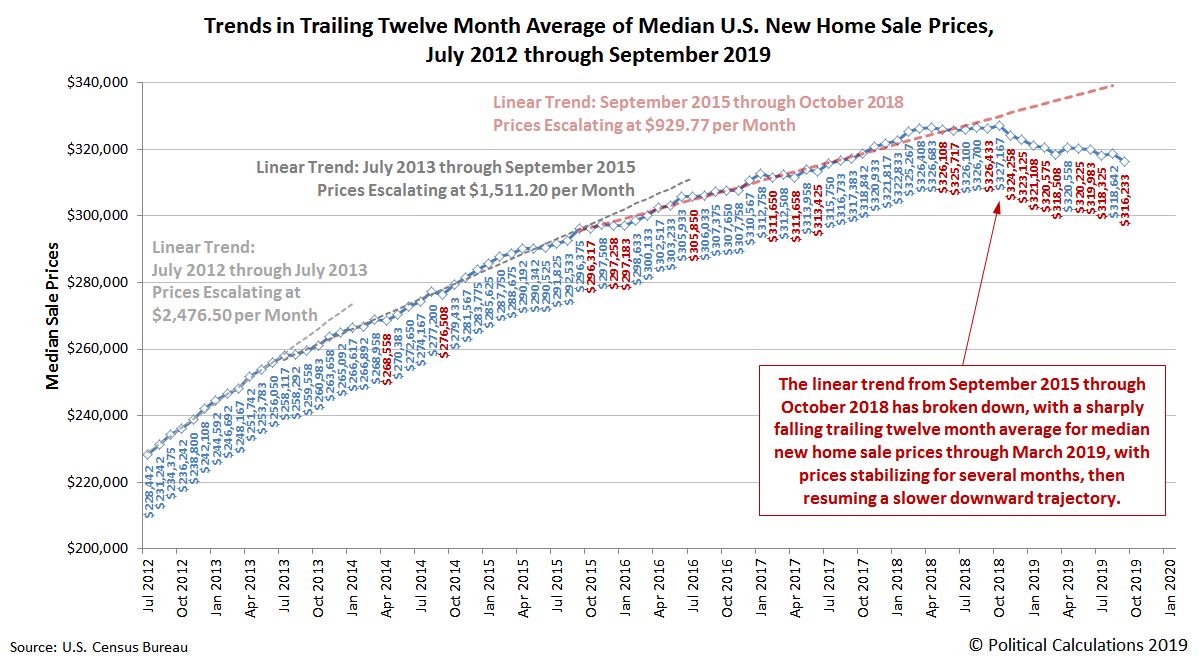

After having held relatively steady in recent months, new home sale prices have resumed falling. The chart below shows the raw median and average new home sale prices reported by the U.S. Census Bureau since January 2000, where we have to go back to early January 2017 to find similarly low prices.

After smoothing out the month-to-month volatility in the data for median new home sale prices by calculating its rolling twelve month average, we can confirm the resumption of the falling trend that originally began in October 2018 in the following chart that focuses on the period since July 2012.

In terms of affordability, at a preliminary estimate of 4.93 times median household income for September 2019, the falling median new home sale price in the United States is now the lowest it has been since April 2013. The following chart shows the ratio of the trailing twelve month averages of median new home sale prices and median household income from 1967 to the present.

This median affordability ratio has generally only been higher during periods of time when the real estate market experienced bubble conditions, or more accurately, supply shortage conditions.

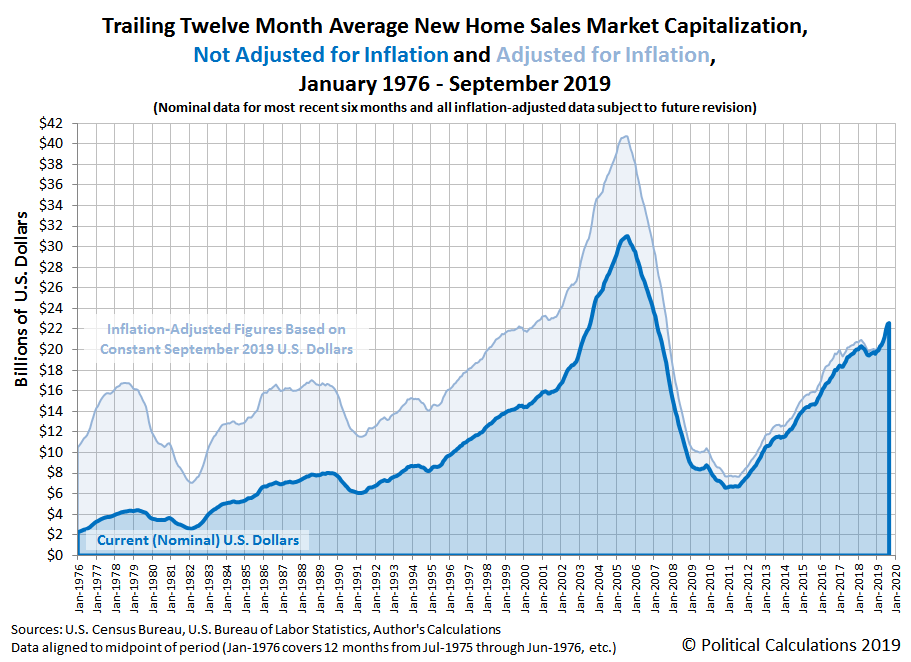

For new home builders, the falling trend for sale prices is coming as new home sales are slowing, which we can see in the slowing rise of the industry's market capitalization, the aggregate value of all new home sales across the United States.

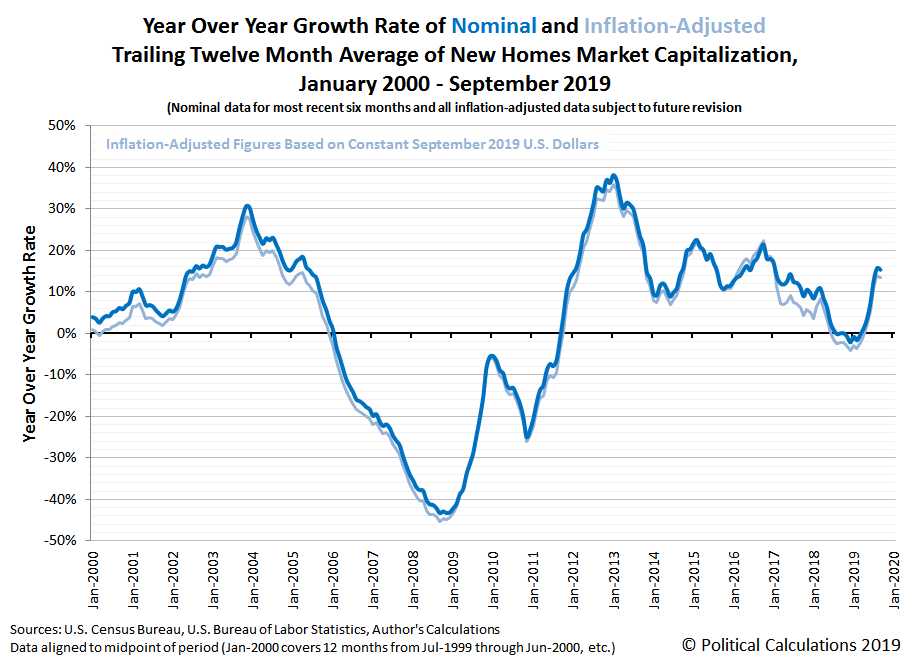

While preliminary data indicates the U.S. new home market cap is still rising, September 2019 saw the first deceleration in that growth in the months since falling mortgage rates sparked a rebound in the national new home market following its recent recessionary trough, which ran from mid-2018 to early-2019. September 2019's sudden deceleration is easier to see in the following chart showing the year over year rate of growth of the U.S. new homes market cap.

Unfortunately, the U.S. Census Bureau's new home sales data doesn't allow for the kind of state or local-level analysis we can do with existing homes data, but their available regional data points to the West region as having seen significantly falling sales in September 2019. When the state level existing homes sales data for September 2019 becomes available next month, we'll take a closer look at the West region, where we assume that whatever is happening with the trends for new homes in those states will be paralleled in the much more detailed existing homes sales data.

Labels: real estate

Existing home sales in the U.S. largely continued treading water through August 2019, with the initial estimate of the seasonally-adjusted aggregate value of recorded sales across the U.S. dipping slightly to $1.51 trillion.

We've broken the state-level trends down regionally, where we find the aggregate dollar total of sales in the Midwest are slightly up while sales in the Northeast region of the country are holding steady.

Aggregate sales in the West also held steady in August 2019, though the region is still well below its March 2018 peak. But the South region has developed a downward trajectory since April 2019.

We can start finding an explanation for the downward trend developing in the South region by checking the Top Five markets for existing homes in the U.S., where Texas, the third largest market for existing homes in the U.S. as measured by the aggregate value of existing home sales, has seen its number of sales decline across the state since April 2019.

Texas stands out because of the relative size of the oil and gas production sector of its economy, which has slowed since crude oil prices last peaked in April 2019. The spot price of West Texas Intermediate crude oil has fallen by 18%-20% since that time (dropping by over $10 per barrel), coinciding with a falling demand for oil in the slowing global economy.

Preliminary and revised state level existing home sales data through August 2019 is now available from Zillow's databases, where price data for Texas hasn't been updated past June 2019. In our charts above, we're using price data from June 2019 to estimate the aggregate value of transactions in the state for July and August 2019, for which data on the number of sales in the state is available. Zillow's city-level data also confirms the falling number of existing home sales in the state.

Oklahoma and Louisiana also stand out for the relative share the oil and gas production industry has within their state economies. The market for existing homes in each has lagged behind Texas', but both show declines in recent months, with a small dip in Oklahoma and a more significant drop in Louisiana, though the latter may be attributable to the landfall of Hurricane Barry in the state in July. Since this data may be subject to considerable revision in upcoming months, it bears watching to see if the housing markets in these states follow Texas' downward trend.

Labels: real estate

The S&P 500 (Index: SPX) toyed with reaching a new all-time high on Friday, 25 October 2019, buoyed up by positive earnings reports and news reports the U.S. and China were close to hammering out the details of the 'Phase 1" trade deal. Toyed with, but ultimately retreated below its current record high to close out the week at 3,022.55.

That buoyancy was enough to push the S&P 500 up to the top edge of our dynamic redzone forecast range, which assumes that investors would be splitting their forward-looking attention about 50/50 between the current quarter of 2019-Q4 and the following quarter of 2020-Q1 through 8 March 2019. We think this level is consistent with investors putting a heavier weight on 2020-Q1 and the expectations associated with it in making their current day investment decisions, although the mixed earnings news coming out now for U.S. firms is responsible for holding a significant portion of their attention on the current quarter of 2019-Q4.

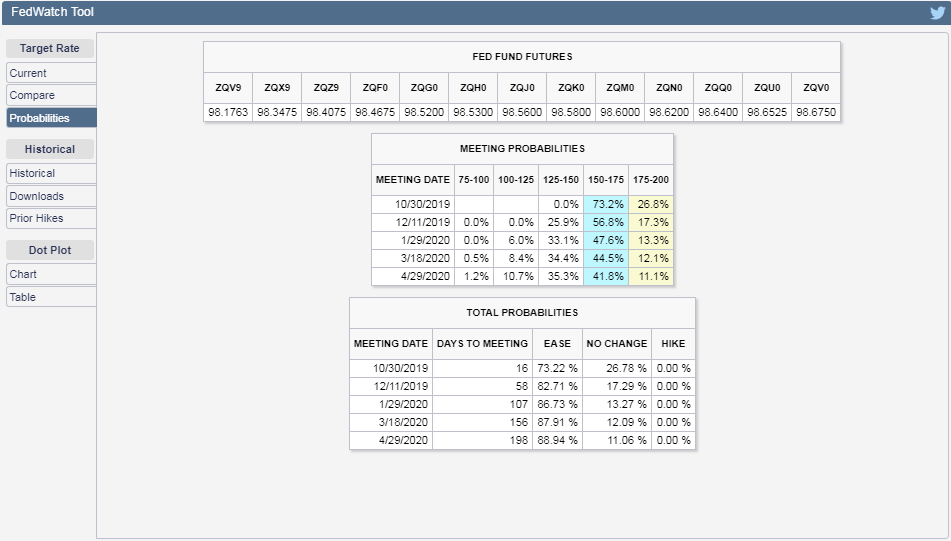

Meanwhile, investors because they are betting the Federal Reserve will act next week to cut the Federal Funds Rate by another quarter point, which appears to be the last rate change they are now anticipating in 2019. The CME Group's FedWatch Tool is forecasting about a 46% chance of the Fed cutting rates by another quarter point at the Federal Open Market Committee's 18 March 2020 meeting, where the odds of that happening have been fluctuating around the 50% mark in recent weeks, which is why we believe 2020-Q1 is commanding a larger share of the forward-looking focus of investors at this time.

The rate change probabilities projected by the FedWatch tool after the Fed's upcoming 20 April 2020 meeting were not available until after the market closed on 25 October 2019. This additional information indicates a greater than 50% probability of another quarter point rate cut occurring as early as the end of 2020-Q2, which rises to more than a two-thirds by early November in 2020-Q4.

This past week has also seen considerable activity with the S&P 500's quarterly dividend futures, which has shifted several of the trajectories presented in our alternate futures chart above, in addition to our dynamic redzone forecast which is defined by those alternate future trajectories.

Here are the news headlines that caught our attention for their market moving potential in the fourth week of October 2019, which was a relatively quiet week since the Fed's minions have been silenced by the communications blackout period preceding the FOMC's two day meeting in the final week of October 2019.

- Monday, 21 October 2019

- Oil prices fall 1% as global demand concerns grow

- Bigger trouble developing in China:

- China September home price growth flatlines, fewer cities see price gains

- China disposed of 1.4 trillion yuan bad loans in January-September

- Many firms in China's third-biggest province struggling to pay debt - S&P

- Trade hopes boost Wall Street; tech shares lead gains

- Tuesday, 22 October 2019

- Oil prices rise on prospects for U.S.-China trade deal

- China offers tariff-free quota for 10 million T of U.S. soybean purchases: sources

- Treasury yield curve may be back to normal but U.S. economy is not

- U.S. existing home sales drop more than expected in September

- U.S. companies facing worker shortage race to automate

- Mixed earnings, failed Brexit vote push down S&P 500

- Wednesday, 23 October 2019

- Oil rises on surprise U.S. crude drawdown, prospect of OPEC action

- Bigger trouble developing in the Eurozone:

- Bigger stimulus developing in China:

- Wall Street ticks higher, but chip stocks tumble

- Thursday, 24 October 2019

- Oil extends gains despite weak demand outlook

- Bigger stimulus developing in China:

- China Doubles Value of Infrastructure Project Approvals to Stave Off Slowdown

- China Cuts Banks' Reserve Ratios, Frees Up $126 Billion for Loans

- Bigger trouble developing in China all across Asia:

- Chinese Local Government Funds Run Out of Projects to Back - Translation: China is starting to run out of ideas to jump start economic growth through government spending

- Facing 'huge' revenue pressure, Indonesia to overshoot fiscal deficit target - Translation: Indonesia's economy isn't generating enough growth for the government to collect as much in taxes as they were hoping.

- South Korea's third-quarter growth slips, global risks scar exports and economic outlook

- Japan factory activity shrinks at quickest pace since 2016 in October: flash PMI

- S&P 500, Nasdaq rise on strong tech earnings

- Friday, 25 October 2019

If you would like to see the bigger picture beyond the headlines we've presented, Barry Ritholtz identified six positives and six negatives in the past week's economics and market-related news.

Prime numbers can be very strange. One is believed by some to be an embodiment of evil.

That number is known as Belphegor's prime. Named after the demon Belphegor, one of the seven princes of Hell, this prime number is a numeric palindrome, which means it will read the same if you write its 31 digits either forwards or backwards.

1000000000000066600000000000001

If you don't look at it too closely, you might dismiss it as a harmless binary number, if not for the Number of the Beast, 666, which itself is the sum of the squares of the first seven prime numbers, lurking within the middle of it.

As it is, you would write Belphegor's prime by starting with the number 1, followed by 13 zeroes, then the aforementioned Number of the Beast, then another 13 zeroes before ending again with the number 1. If you wanted to convert it into binary format, it is a much less interesting 100 digits worth of 1s and 0s. The true terror of it must be experienced in decimal form.

And yes, it is indeed a prime number that may not be divided evenly by any other whole number other than itself or 1. Check it out for yourself, if you dare!

But if not, at least you now know how to terrify a mathematician on the next Halloween by unleashing the ugly specter of numerology.

Labels: junk science, math

The price of nickel is rising rapidly because Indonesia, the world's second largest exporter of nickel ore, has announced it will stop exporting the metal in 2020 so the country can protect and build up a domestic smelting industry.

As of 23 October 2019, the spot price of nickel has risen to $15,748.64 per metric ton, up from an average of $8,931.76 per metric ton in 2018.

Unless you are familiar with the global metal trade, it can be tough to tell just how expensive nickel is getting when you price it by the metric ton, so we're going to put it in terms of pocket change, and specifically, the U.S. five-cent coin. The Nickel is made from an alloy of 25% nickel and 75% copper, where we've taken the average cost of the component copper and nickel needed to make a Nickel and visualized them over the period from 1980 through 2018, showing the current spot prices for both as of 23 October 2019 to represent the cost in 2019.

To economically produce each coin, the U.S. Mint needs to buy the raw material at a combined cost that is less than the face value of the Nickel. There have been six years from 1980 to 2019 where the value of the metal in the coin was greater than the face value of the Nickel: the years 2006 through 2008 and the years 2010 through 2012. In every other year, the face value of the Nickel was worth more than the value of the metal used in making it.

But now in late 2019, the cost of the metal to make a Nickel has risen to be over 82% of the face value of the coin. When you add in the Mint's production costs of striking nickels and putting them into circulation, they have actually been losing money. In 2018, when the cost of the metal in a Nickel was worth just 65% of the coin's face value, the total cost of making each Nickel was seven cents per coin, which if we substitute today's spot prices for copper and nickel into the cost of production, has risen to nearly eight cents per coin in 2019. In 2018, the U.S. Mint produced 1,256,400,000 nickels, so if the Mint strikes the same number of nickels in 2019, it will lose $37.7 million in making five-cent coins.

That's why the U.S. Mint is considering a redesign for the coins, changing up the amount of copper (Cu) and nickel (Ni) it uses and perhaps adding manganese (Mn) and zinc (Zn) into the mix to produce a much less costly five cent coin. However, rebalancing the metal composition of the Nickel while preserving important characteristics needed to allow the coins to be used in existing vending machines and other applications potentially comes with an aesthetic cost:

... there is a clear trade-off between the cost and color. The cost is decreased by reducing the amount of Ni. However, as the Ni content is decreased, the amount of Mn needed to maintain the desired electrical conductivity increases and the color of the alloy becomes less desirable (more yellow).

Would you be okay with a Yellow Nickel? Because with the price of nickel rising, it's likely the U.S. Congress will have to act to prevent the U.S. Mint from continuing to lose money by making money, which means Americans might soon be seeing lots of Yellow Nickels in circulation.

Labels: data visualization, economics, ideas

One of the neatest things about the annual Consumer Expenditure Survey (CEX) is that you can track changes in how Americans spend money over time. Some of those changes can explain a lot about Americans have themselves changed.

Let's start by reviewing how much the average American household spends on food each year in the context of their total expenditures, where the amount spent on Food ranks third highest in all years. The first chart below reveals that the average amount American households spend on food each year has fairly steadily risen from $3,290 in 1984 to $7,923 in 2018. But as you can see in the second chart, the relative amount that Americans spend on food each year has declined as a share of total household expenditures in the 35 years from 1984 through 2018, from 15.0% to 12.9%. [Please click on the charts to access larger versions.]

We've dug deeper into the food category, which the CEX divides into the two subcategories of "Food At Home" and "Food Away From Home". In the next two charts, we visualize both the amount of annual spending on these subcategories and also the share of spending for each with respect to the average household's total food expenditures for each year from 1984 through 2018.

For the "Food At Home" category, the average amount spent each year by an American household has increased from $1,970 in 1984 to $4,464 in 2019. For the "Food Away From Home" category, the spending numbers have changed from $1,320 to $3,459 over the same period. As a share of average total food expenditures, the percentage of food at home with respect to total food expenditures has held relatively stable over all that time, ranging between a low of 56% and a high of 62% from 1984 through 2018, trending toward the low end of that range in recent years.

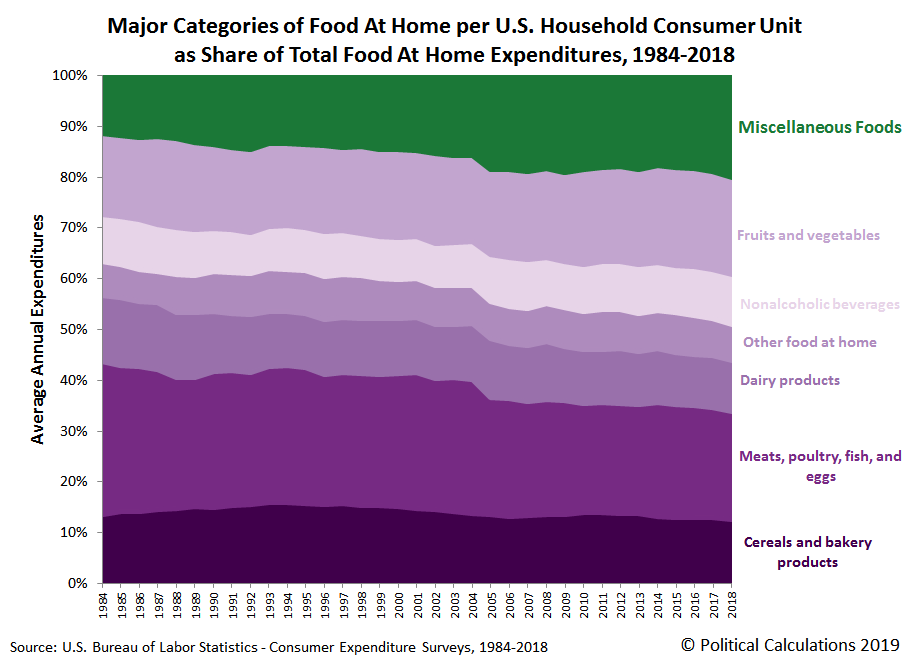

Fortunately, the CEX breaks the "Food At Home" category down into finer subcategories, which gives us some remarkable insight into how the American diet is actually changing over time. In the following charts, we've visualized the average household expenditures of the major subcategories of "Food At Home" from 1984 through 2018 and also how the share of those subcategories are changing:

The first chart reveals that average household expenditures for all these subcategories has risen from 1984 to 2018, but one has risen considerably faster than all the others: "Miscellaneous Foods". Here's how the CEX describes what's in this subcategory of Food At Home:

Miscellaneous foods includes frozen prepared meals and other foods; canned and packaged soups; potato chips, nuts and other snacks; condiments and seasonings, such as olives, pickles, relishes, sauces and gravies, baking needs and other specified condiments; and other canned and packaged prepared foods, such as salads, desserts, baby foods, and vitamin supplements.

That description of the kinds of foods included in the "Miscellaneous Foods" category stood out to us because it closely resembles what a team of National Institute of Health nutrition researchers categorized as "ultra-processed foods" in a ground-breaking randomized controlled trial experiment they conducted in 2018, the results for which they published earlier this year. They explained the context and significance for that distinction in their paper:

Increased availability and consumption of ultra-processed foods have been associated with rising obesity prevalence, but scientists have not yet demonstrated that ultra-processed food causes obesity or adverse health outcomes. Researchers at the NIH investigated whether people ate more calories when exposed to a diet composed of ultra-processed foods compared with a diet composed of unprocessed foods. Despite the ultra-processed and unprocessed diets being matched for daily presented calories, sugar, fat, fiber, and macronutrients, people consumed more calories when exposed to the ultra-processed diet as compared to the unprocessed diet. Furthermore, people gained weight on the ultra-processed diet and lost weight on the unprocessed diet. Limiting consumption of ultra-processed food may be an effective strategy for obesity prevention and treatment.

To illustrate what the researchers mean by ultra-processed foods, check out the daily menus they developed for comparing the effects of diets based on ultra-processed versus unprocessed foods in their clinical trial, where the "ultra-processed" category aligns with much of what is in the CEX's "Miscellaneous Foods" subcategory.

The NIH researchers also identified an economic contributor to what the CEX confirms in the changing composition of the average American diet over time:

The weekly cost for ingredients to prepare 2,000 kcal/day of ultra-processed meals was estimated to be $106 versus $151 for the unprocessed meals as calculated using the cost of ingredients obtained from a local branch of a large supermarket chain.

Miscellaneous foods have grown from 11% of the average total expenditures for the "Food At Home" category in 1984 to 20% of total expenditures in 2018, where this subcategory including ultra-processed foods now ranks as the second highest within the "Food At Home" category the CEX tracks.

This change coincides with a rising incidence of obesity in the United States over this period, where the U.S. ranks only behind Mexico*, which has also experienced increased rates of obesity since the early 1980s. The combination of studies and consumer trends explains why ultra-processed foods are now being subjected to much greater scrutiny by scientists and U.S. policy makers, although policy makers have recently fixated their attention on using tax policies to reduce sales of sweetened beverages because they provide a simpler path for increasing tax revenues, even if the soda taxes provide few, if any, meaningful health benefits for the populations subject to them.

* Mexico has coincidentally also seen a similar rising trend for ultra-processed food purchases, which researchers report have doubled since 1984.

References

U.S. Bureau of Labor Statistics and U.S. Census Bureau. Consumer Expenditure Survey. Multiyear Tables. [PDF Documents: 1984-1991, 1992-1999, 2000-2005, 2006-2012, 2013-2018]. Reference Directory: https://www.bls.gov/cex/csxmulti.htm. Accessed 10 September 2019.

Hall, Kevin D. et al. Ultra-Processed Diets Cause Excess Calorie Intake and Weight Gain: An Inpatient Randomized Controlled Trial of Ad Libitum Food Intake. Cell Metabolism: Clinical and Translational Report. Volume 30, Issue 1, pp 67-77. https://doi.org/10.1016/j.cmet.2019.05.008. 2 July 2019.

Labels: data visualization, food, health, personal finance

Net wealth is looking like it will be a hot topic in the upcoming 2020 election season in the United States, with several candidates proposing to tax high net worth households to only partially pay for the explosion in federal government spending they are also proposing.

How at risk are you might be to these newly proposed taxes on wealth depends on what your household's net worth is and how your rank in net worth among all Americans. To help answer the first part of that question, we'll direct you to Bankrate's Net Worth Calculator, which will add up the value of your assets and subtract out your liabilities to estimate your household's net worth, assuming you haven't already done that math.

After you have that figure, plug it into the following tool, where we'll estimate your household's percentile ranking among all U.S. households, based on data for 2016 that was recently published by the U.S. Census Bureau. Hopefully, you'll be entering a positive number, but if not, our tool can handle if your household is underwater and you have to enter a negative value. If you're reading this article on a site that republishes our RSS news feed, please click through to our site to access a working version of the tool.

Now you have a fairly good sense of what percentage of all 129,600,000 U.S. households have a net worth that is either less than or equal to yours! The chart below shows our model for the distribution of net worth in the United States and how it compares to the data recorded by the U.S. Census.

Overall, the tool is generally accurate to within about 1.5 percentiles of the reported data, which is pretty good given how we modeled the data, where we spliced two very different regressions to generate our results.

In addition to the Census Bureau's wealth distribution data, the Federal Reserve's Survey of Consumer Finances provides an alternate source of data for household net worth in the U.S. The SCF is conducted every three years, where the data for 2019 will likely become available in late October 2020.

If you want to find out how your household ranks to the nearest half percentile according to the Federal Reserve's survey data, be sure to check out Don't Quit Your Day Job's Net Worth Percentile Calculator. Better still, if you want to find out how your household's net worth ranks among people in your age group, DQYDJ's Net Worth by Age Calculator has you covered!

Finally, we discovered that Microsoft (NYSE: MSFT) chairman Bill Gates had the highest reported net worth in 2016 thanks to the value of the shares he owns in the company he founded, which at $75 billion, would place him just off the top right end of the chart. The second highest net worth for an American belongs to Warren Buffett, whose accumulated net wealth over the last 49 years as the head of Berkshire Hathaway (NYSE: BRK.A, BRK.B) would appear on the chart at $60.8 billion (equivalent to a natural logarithm of 24.8).

References

U.S. Census Bureau. Net Worth and Asset Ownership of Households: 2016. [Excel Spreadsheet]. 25 September 2019. Accessed 19 October 2019.

Forbes. The Full List Of Every American Billionaire 2016. [Online Article]. 1 March 2016.

Clementi, F.; Gallegati, M.; and Kaniadakis, G. A generalized statistical model for the distribution of wealth. Journal of Statistical Mechanics: Theory and Experiment, 2012, P12006. https://doi.org/10.1088/1742-5468/2012/12/P12006. [Ungated PDF Document]. 6 December 2012.

Hozo, Stela Pudar; Djulbegovic, Benjamin; and Hozo, Iztok. Estimating the mean and variance from the median, range, and the size of a sample. BMC Medical Research Methodology, volume 5, Article number: 13 (2005). https://doi.org/10.1186/1471-2288-5-13. 20 April 2005.

Labels: data visualization, income distribution, tool

For a market that got almost every bit of positive news it could have been hoping for in the week before last, the S&P 500 (Index: SPX) didn't carry any momentum into the third week of October 2019.

The proof can be found in the latest update to our spaghetti forecast chart for the index, where we find the S&P 500 skimmed along and just below the top edge of the redzone forecast range we added to the chart just last week.

That range assumes that the S&P 500 will track along with investors roughly equally splitting their forward looking focus between the current quarter of 2019-Q4 and the upcoming future quarter of 2020-Q1 in setting today's stock prices. Should the trajectory of the S&P 500 break outside of the redzone range, that would be an indication that investors have focused much more strongly on one of these two quarters.

Much of that dynamic has hinged on investor expectations for what the Federal Reserve will do in upcoming months with interest rates and its new T-bill buying policy. Right now, investors are betting the Fed will announce it will cut the Federal Funds Rate by a quarter point at its meeting at the end of this month, which could be the last cut for a while if the rate change probabilities indicated by the CME Group's FedWatch Tool is any indication:

And then, there's that little matter of corporate earnings, which will be rolling out over the next several weeks, as well as other economic news that might alter the focus of investors. Here are the more significant headlines we plucked out of the news stream during the week that was.

- Monday, 14 October 2019

- Oil falls more than 2% on doubts around phase one of U.S.-China trade deal

- Bigger trouble and stimulus developing in China:

- Bigger Trouble:

- China September exports, imports in deeper contraction as tariffs take toll

- China auto sales fall again in 'Golden September' as turnaround hopes fade

- Bigger Stimulus:

- Previous stimulus gaining traction:

- Stocks pause on unsettled trade deal; earnings eyed

- Tuesday, 15 October 2019

- Oil falls on weaker economic growth forecasts

- Bigger trouble developing in China:

- Bigger stimulus developing in China:

- Bigger trouble developing in Germany:

- German economy stuck in weak phase, crisis unlikely: ministry

- Germany to tap all fiscal options in case of economic crisis: Scholz

- Fed minions weigh future interest rate changes:

- Fed tooled up for 'ordinary recession', eyeing new repo ops: Bullard

- Zero rates and QE still in Fed's playbook for 'ordinary recession': Bullard

- Fed's 'insurance' rate cuts can be reversed if outlook improves: Bullard

- Fed's two interest rate cuts should sustain U.S. growth: Daly

- Narrow majority of Fed banks wanted to keep discount rate unchanged: minutes

- Upbeat earnings reports boost Wall Street

- Wednesday, 16 October 2019

- Oil rises on hopes OPEC will extend supply cuts, weaker U.S. dollar

- U.S.-China "Phase 1" trade deal on hold: Trump says likely won't sign China trade deal until he meets with Xi

- Bigger trouble developing in the Eurozone:

- Bigger stimulus developing in Asia:

- Fed minions continue weighing future for interest rates:

- Fed's Evans says central bank should be 'aggressive' to boost inflation in low rate world

- Fed's Evans says may struggle with reserves 'longer than we would like'

- Repo market liquidity crisis continues: U.S. effective fed funds rate rise to near top end of Fed's target range: data

- Fed's Brainard Views Cost-Benefit of Negative Rates Unattractive

- Wall Street slips as weak economic data offsets earnings strength

- Thursday, 17 October 2019

- Oil falls, fanned by inventory rise and global demand worries

- U.S. manufacturing production falls in September, hurt by GM strike

- Fed should cautiously probe for maximum employment: Evans

- Bigger trouble developing in China:

- Brexit deal at last?

- Money markets slash rate cut expectations after EU, Britain seal Brexit deal

- IMF, World Bank see Brexit deal boosting global growth outlook

- Wall Street edges higher on robust earnings, Brexit deal - but note it only edged higher. For the U.S. stock market, the Brexit saga has only contributed a fairly small amount of noise to the day-to-day volatility of stock prices.

- Friday, 18 October 2019

- Oil falls as China economic concerns outweigh rising refinery runs

- Spike in U.S. mortgage activity catches big banks flat footed

- Global economy slows, recession risk hangs in the balance:

- China's GDP growth grinds to near 30-year low as tariffs hit production

- Japan September exports to fall for tenth month on global slowdown: Reuters poll

- Fed minions confused on 'appropriate' next steps:

- Fed's Clarida keeps rate-cut door open; others less sure

- Fed's Clarida says officials will act 'as appropriate' to sustain economy and address risks

- Fed's Kashkari: data is 'softer,' need accommodative policy

- Kaplan: 'Agnostic' on October rate cut, may be wise to see 'more cards' before acting again

- Fed's Kaplan says Fed not in 'full fledged' rate cutting cycle

- Fed's Williams: Central bank will adjust response to money market volatility 'as appropriate'

- Boeing, J&J, dismal China data drag Wall Street lower

Barry Ritholtz found five positives and five negatives and no political noise that might affect the market in the past week's economics and market-related news.

If only there were no political noise to have to filter out. Wouldn't that be something!

Are prime numbers randomly distributed, or is there an underlying structure that can predict where they will occur?

If you can definitively answer that question, say by either proving or disproving the Riemann Hypothesis, which says that yes, there is such an underlying structure, there's a million dollar prize waiting for you.

But if you just want to explore some the patterns that can be found in how prime numbers are distributed, you might find the following 22-and-a-half minute video from 3Blue1Brown right up your alley!

As a bonus, in addition to an introduction to Dirichlet's prime number theorem, you'll also find out why the fraction 355/113 is a particularly good rational approximation for the value of pi!

Labels: data visualization, math

In 2017, the average rent in the U.S. was "too damn high". In 2018, according to the Consumer Expenditure Survey, it was even higher.

Remarkably, the rent rose even as the cost to own, as measured by the average annual combined cost of mortgage principal and interest payments, fell. From 2017 to 2018, the average household consumer unit expenditure for rent increased from $4,167 to $4,269, while the cost to own declined from $5,104 to $5,002.

Before going any further, we should recognize the data reported by the Consumer Expenditure Survey is spreading all these payments out over all household consumer units in the United States. In 2018, there were an estimated 131,439,000 household consumer units, where 48,632,430 (37%) paying rent, an equal number of homeowners making mortgage payments, and 34,174,140 homeowners (26%) with no mortgage payments.

Doing the math for renters, multiplying the average $4,167 in annual rent payments by 131,439,000 household consumer units, we estimate the total rent paid in 2018 adds up to $547.7 billion. Dividing that result by the estimated 48,632,430 rent payers, we find the average annual rent is $11,262. Dividing by 12 gives an average monthly rent of $938.51, which is indeed slightly higher than the $935 per month figure we previously calculated for 2017.

Doing the almost identical math for homeowners making mortgage payments, we estimate aggregate mortgage payments to be $657.5 billion, with the average annual total of mortgage payments working out to be $13,519, which corresponds to an average monthly principal and interest mortgage payment of $1,126.58.

The average monthly rent paid in the United States in 2018 is 83% of the cost of a simple mortgage payment that omits any homeowners' insurance payments or property taxes that might be included with it.

In case you're wondering what ever happened to Jimmy McMillan, the founder of the Rent Is Too Damn High political party in New York who ran for state governor in 2006 and 2010, he has retired from politics, but since the rent keeps rising, we can only wonder if he is considering making a comeback!

Data Sources

U.S. Bureau of Labor Statistics and U.S. Census Bureau. Consumer Expenditure Survey. Multiyear Tables. [PDF Documents: 1984-1991, 1992-1999, 2000-2005, 2006-2012, 2013-2018]. Reference Directory: https://www.bls.gov/cex/csxmulti.htm. 10 September 2019.

Labels: demographics, personal finance, real estate

Americans collectively spent over $447.5 billion of their own money to cover the cost of unsubsidized health insurance in 2018, an increase of 0.8% from the more than $443.8 billion spent in 2017. At an average annual cost of $3,405 per household consumer unit however, 2018's spending represents the first year over year decline in this category of consumer expenditures since 1996, falling from 2017's average cost per household consumer unit of $3,414.

This data comes from Consumer Expenditure Survey (CEX), which shows the continuing effect of the skyrocketing cost of health insurance caused by the passage and implementation of the Affordable Care Act during the Obama administration. In this case, the rapid escalation of health insurance costs to higher income earning households that could previously afford coverage may be prompting them to choose to become uninsured, which would contribute to the indicated reduction in average cost.

From 2017 to 2018, the number of individual uninsured Americans rose by 1.9 million, from 25.6 million to 27.5 million, which the U.S. Census Bureau reveals a very large portion of this increase was uniquely concentrated in households earning well above the median household income of $61,392 for 2018:

Between 2017 and 2018, overall health insurance coverage decreased 1.0 percentage point for people in families with income from 300 to 399 percent of poverty and 0.8 percentage points for people in families with income at or above 400 percent of poverty. During this time, the overall health insurance coverage rate did not statistically change for any other income-to-poverty group.

Here's how that translates into the number of affected individuals:

The number of uninsured Americans in households with income above 400 percent of the poverty line increased by 1.1 million from 2017 to 2018, and the number of uninsured in households with income above 300 percent of the poverty line — about $75,000 for a family of four — increased by 1.6 million.

Households in this category, which includes many headed by small business owners and self-employed income earners who don't have access to other employer-provided health insurance coverage, are largely choosing to go from paying top dollar or near-top dollar for health insurance to no such coverage, even though they would still be subject to additional income taxes from the Affordable Care Act's mandate penalty. For these higher income earning households, since the rising cost of coverage they must pay has been driven up by the requirements of the Affordable Care Act to the point where it far exceeds the value of tax subsidies available to them, dropping the amount they pay for family coverage from nearly $20,000 to $0 per household is having a noticeable effect on the overall average cost paid out of pocket by all American households for health insurance, which is being captured by the CEX data for 2018.

The Trump administration has introduced reforms aimed at arresting the skyrocketing cost of health insurance for these households in late 2018 to address their specific needs, which may not show an effect until the 2019 data becomes available.

Data Sources

U.S. Bureau of Labor Statistics and U.S. Census Bureau. Consumer Expenditure Survey. Multiyear Tables. [PDF Documents: 1984-1991, 1992-1999, 2000-2005, 2006-2012, 2013-2018]. Reference Directory: https://www.bls.gov/cex/csxmulti.htm. 10 September 2019.

U.S. Census Bureau. Health Insurance Coverage in the United States: 2018. [PDF Document]. 10 September 2019.

Labels: demographics, health insurance, personal finance

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.