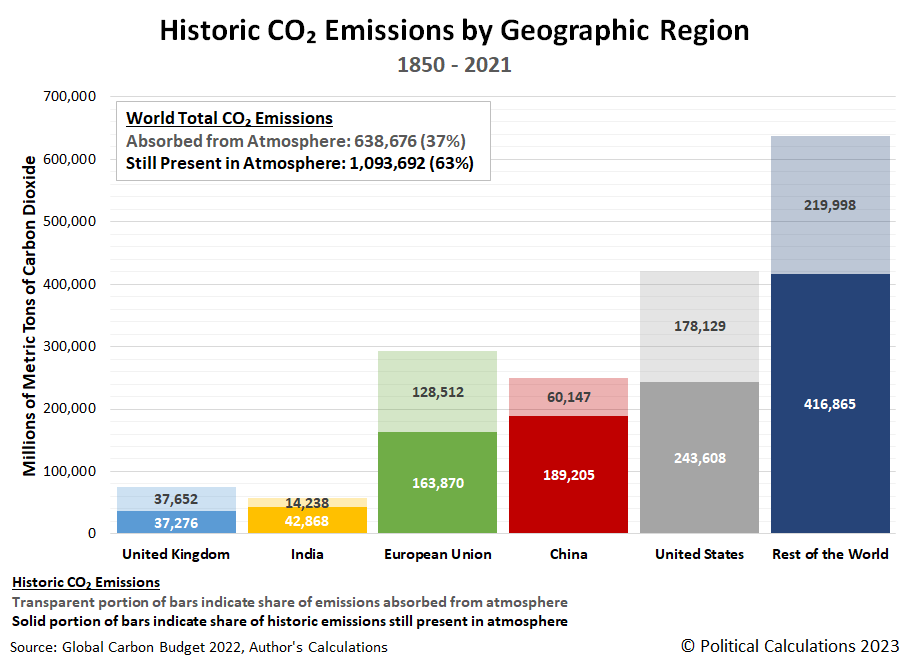

The Global Carbon Budget offers a wealth of data on carbon dioxide emissions. That includes estimates of how CO₂ each nation has emitted into the Earth's atmosphere in each year since 1850. At least, for the period for which records are available for the various nations.

When that historical data is presented, it's almost always given in terms of the total emissions emitted over that time for a given territory. Which is misleading, because not all that previously emitted carbon dioxide is still in the Earth's air. A significant fraction of it [has been taken out of the atmosphere, absorbed by various carbon sinks on land and sea.

We wondered how much of the carbon dioxide in the air today originating from fossil fuels could be attributed to various nations or territories. To find out, we tapped the Global Carbon Budget's territorial data to find out how much has been emitted by several nations or regions of interest and how much has been removed from the air over the years from 1850 through 2021. The following chart illustrates our results:

The next chart gives the percentages of each nation's or region's fossil fuel-based carbon dioxide emissions that are still present in the atmosphere.

Perhaps the most surprising result is for the United Kingdom. The portion of the U.K.'s CO₂ emissions that are still present in the air is less than half it's total emissions since 1850. This outcome owes a lot to the United Kingdom's leading role in the industrial revolution. The U.K. initially dominated global carbon dioxide emissions, but its relative contribution has declined over time as other nations and regions industrialized. As time has passed, most of the U.K.'s historic carbon dioxide emissions from consuming fossil fuels have been absorbed from the atmosphere.

A similar pattern is playing out with the regions of the European Union and the United States, which also industrialized early. Meanwhile, nations like China and India that are among today's sources for increasing CO₂ emissions industrialized much later, which is why a larger share of their historic emissions are still in the atmosphere.

What does that mean for the Earth's atmosphere of today? More or less, it means the share of carbon dioxide in the air today from our nations and regions of interest looks like what we've illustrated in the following treemap chart:

This chart shows the largest share for any single nation is that for the United States, to which a little over one-fifth of the CO₂ is attributed. China ranks second by that measure at over 17% and the combined nations of the European Union come in third at 15%. We also find India's 3.9% share outranks the United Kingdom's 3.4%. The "Rest of the World" combines for nearly two-fifth's of the excess fossil-fuel based carbon dioxide emissions present in the atmosphere through 2021.

But these relative shares are not going to stay that way. We also asked "what if each of these nations or regions had the same carbon dioxide output they did in 2021 for the next ten years through 2031?" to see how this last chart might change. We found that in 2031, China will replace the United States as the largest single national contributor of carbon dioxide in the air.

In reality, that outcome will occur before the end of the 2020s. China's carbon dioxide emissions have soared since 2021 so our assumption of level CO₂ emissions for the "what if" scenario we ran does not hold.

References

Friedlingstein et al. Global Carbon Budget 2022, Earth System Science Data, 11 November 2022. DOI: 10.5194/essd-14-4811-2022.

Political Calculations. How Long Does Carbon Dioxide Stay in the Atmosphere? [Online Article, Tool]. 19 July 2023.

Political Calculations. How Much Fossil Fuel CO2 Is in the Air? [Online Article]. 15 August 2023.

Labels: data visualization, environment

The trend for the market capitalization of the U.S. new home market continued to benefit from the "golden handcuffs" problem afflicting the owners of existing homes in August 2023.

That assessment is comes despite the initial estimate of new home sales falling to 54,000 in August 2023 from a revised estimate of 61,000 new homes sold in July 2023. The mean sale price of new homes sold rose to an initial estimate of $514,000 in August 2023, up from July 2023's revised estimate of $507,900.

When we do the market cap math, multipling the mean sale price of new homes by their number of sales, we find the raw market capitalization of the U.S. new home market dropped from $30.98 billion to an initial estimate of $27.76 billion from July to August 2023. However, that dip was not sufficient to break what has been an upward trend for the new home market cap since November 2022.

Taken as the time-shifted, partially complete rolling twelve month average of the raw total value of new home sales, we find August 2023 registered the highest market cap since December 2020, with an initial estimate of $30.28 billion. That figure tops the finalized estimate of $30.12 billion recorded in December 2020. Here is the latest update to our chart illustrating the market capitalization of the U.S. new home market since January 1976:

The next two charts show the latest changes in the trends for new home sales and prices:

The trends through December 2022 in these charts are now fully finalized outside of any major revisions the Census Bureau may release at a future date. December 2022 saw the first uptick in the new home market cap, rising to $26.69 billion after having bottomed at $26.45 billion in the preceding month.

We'll review the affordability of new homes sometime next week, which will include the downward revisions in our estimates of median household income from March 2021 through July 2023, in addition to presenting the initial new home affordability estimate for August 2023.

References

U.S. Census Bureau. New Residential Sales Historical Data. Houses Sold. [Excel Spreadsheet]. Accessed 26 September 2023.

U.S. Census Bureau. New Residential Sales Historical Data. Median and Average Sale Price of Houses Sold. [Excel Spreadsheet]. Accessed 26 September 2023.

Image credit: Photo by Avi Waxman on Unsplash.

Labels: real estate

We're afraid we have to start this edition of the "less than useful data" series with a dire announcement. Job cut announcements jumped in August 2023 and are up 210% year to date. Let's turn now to Challenger Gray & Christmas for the Challenger Report August 2023 with the details:

U.S.-based employers announced 75,151 cuts in August, a 217% increase from the 23,697 cuts announced one month prior. It is 267% higher than the 20,485 cuts announced in the same month in 2022, according to a report released Thursday from global outplacement and business and executive coaching firm Challenger, Gray & Christmas, Inc.

So far this year, companies have announced plans to cut 557,057 jobs, a 210% increase from the 179,506 cuts announced in the same period last year. It is the highest January-August total since 2020, when 1,963,458 cuts were recorded. It is the third-highest year-to-date total since 2009.

“Job openings are falling, and American workers are more reluctant to leave their positions right now. The job market is resetting after the pandemic and post-pandemic hiring frenzy,” said Andrew Challenger, labor expert and Senior Vice President of Challenger, Gray & Christmas, Inc.

That sounds pretty bad. But we'll need more context to tell if it's really as dire as it sounds. The following chart from Trading Economics shows the last 25 years of Challenger's periodic layoff reports:

source: tradingeconomics.com

We can quickly see the current level of layoffs is being compared with a period in which the the announced layoffs were abnormally low following the Coronavirus Pandemic Recession, which inflates the reported percentages. We also see the level of layoffs in 2023 is the highest since 2009, so that observation is correct. However, we also see they're at about the same level that held through much of the decade of the 2000s, so what exactly is that telling us anything about the state of today's economy? Is this a cause for great concern going forward? Is the job market going back be more like it was in the early part of the 21st century with respect to the pace of announced layoffs? Can any of these questions be answered with the layoff report's data?

That's the rub. Moody's economist Mark Zandi included the Challenger layoff report in a short list of economic indicators he pays less attention to because they can be either misleading or hard to interpret given their signal-to-noise ratio.

Unlike other entries in this series, we think the Challenger layoff data has a lot of value as a lagging economic indicator that confirms whether the economy experienced a period of contraction after the fact. But its value as a forward-looking economic indicator is limited because it often raises more questions than it can answer, which is almost certainly why market forecasters like Zandi don't give Challenger layoff announcements more attention.

So if you're a economic historian, it's useful, but if you're a forward-looking analyst, Challenger layoff announcments are much less so. It all comes down to where your time arrow is pointing.

Previously on Political Calculations

- Less Than Useful Data in the World of Big Data

- Less Than Useful Data: Consumer Confidence

- Less Than Useful Data: FHFA House Price Index

- Less Than Useful Data: Index of Leading Economic Indicators

- Less Than Useful Data: Weekly Chain Store Sales

- Less Than Useful Data: Challenger Layoff Announcements

Image credit: Layoffs image by Gerd Altmann from Pixabay.

Labels: ideas

The results of 2022's Consumer Expenditures surveys have been released and it once again falls to us to visualize its historic trends.

Starting in 1984, the U.S. Bureau of Labor Statistics conducts multiple surveys each year to capture the spending of American "consumer units", the affectionate nickname the BLS' data jocks apply to what is pretty close to, but isn't quite, American households. In addition to describing how much and on what they spend money on, the results of the Consumer Expenditures surveys are used to determine the weighting of various consumer spending categories within the Consumer Price Index (CPI), the most commonly cited measure of inflation for the U.S. economy.

Because the data is used this way, it's important to track how the composition of consumer spending changes over time. For example, because the Affordable Care Act of 2010 (ACA) made health insurance much more costly, changes in the cost of health insurance has a bigger effect on consumer price inflation today than they did before the ACA was passed. Meanwhile, the amount that Americans spending on apparel has declined over time, so changes in apparel prices have a smaller effect on the consumer price index than what they had in the 1980s.

Having set that background, our first chart presents the average annual amount of consumer expenditures by American "consumer unit" households for each year from 1984 through 2022.

These figures represent the nominal, or non-inflation adjusted, total average consumer spending in each year. The next chart breaks out that spending into major expenditure categories, such as housing, transportation, food, life insurance & pension savings & Social Security, health insurance & medical expenses, entertainment, charitable contributions, apparel & other products, and education, to put them in order from highest to lowest:

The third chart reveals the trends for these categories, showing how their individual share of total average annual consumer expenditures has been changing since 1984.

The final chart puts all these changing trends together. The major categories of consumer spending that have had a falling share of total consumer spending over time are shown in shades of green, those claiming a rising share over time are shown in shades of purple.

If you want to know specifically how spending on these major categories of consumer spending have changed since last year, we'll close with the following excerpt from the BLS' press release for 2022's consumer expenditures (boldface emphasis ours).

Selected spending patterns, 2022

- Housing expenditures increased 7.4 percent in 2022, after a 5.6-percent increase in 2021. Expenditures on both rented dwellings and owned dwellings increased by 6.5 percent and 8.4 percent, respectively. (For more information on how owned dwellings is defined see the methodology section). The largest housing-related spending increase in all major components of housing was in other lodging, up 30.9 percent, due largely in part to a 38.6-percent increase in lodging on out of town trips.

- Transportation expenditures increased 12.2 percent in 2022, after an increase of 11.6 percent in 2021. This increase was driven by the component category public and other transportation spending (+86.9 percent), followed by a 45.3-percent increase in gasoline, other fuels, and motor oil. Average expenditures for vehicle purchases (net outlay) were down 6.9 percent in 2022, after a 6.7-percent increase in 2021. A net outlay is defined as the household's total payment or purchase amount of a good or service minus any reimbursements. A net outlay is commonly referred to as the total out of pocket spending. Vehicle purchases (net outlay) includes the purchase price minus trade-in value on new and used domestic and imported cars and trucks and other vehicles, such as motorcycles.

- Spending on food increased 12.7 percent in 2022, compared to an increase of 13.4 percent in 2021. The increase was driven by food away from home spending, up 20.1 percent, accompanied by an increase in food at home spending, up 8.4 percent. Expenditures for food away from home in 2022 exceeded 2019 levels, marking the first time since the onset of the COVID-19 pandemic that this has happened.

- Personal insurance and pensions spending increased 11.0 percent in 2022, after increasing 8.7 percent in 2021. This was driven by an 11.1-percent increase in contributions to pensions and Social Security. Within contributions to pensions and Social Security, there was a 28.8-percent increase in expenditures on non-payroll deposits to retirement plans. At the same time, spending on life and other personal insurance increased by 9.7 percent.

- Entertainment expenditures decreased 3.1 percent in 2022, after exhibiting an increase of 22.7 percent in 2021. This decrease was driven by a 24.5-percent decrease in other entertainment supplies, equipment, and services expenditures, which contrasts with the 60.6-percent increase in 2021. Toys, hobbies, and playground equipment also decreased from 2021 to 2022 (-16.1 percent). Although there was a 27.4-percent increase on fees and admissions, this was offset by the previously stated declines.

- Spending on cash contributions increased 14.1 percent in 2022, after a 5.8-percent increase in 2021. This increase in 2022 was driven by a 36.3-percent increase in other cash gifts.(2) Cash contributions includes cash contributed to persons or organizations outside the consumer unit, including alimony and child support payments; care of students away from home; and contributions to religious, educational, charitable, or political organizations.

- Spending on apparel and services increased 10.9 percent in 2022, after an increase of 22.3 percent in 2021. All major components of apparel and services exhibited increases, the largest being an 18.8-percent increase in footwear. With this 10.9-percent growth in apparel and services, spending has surpassed 2019 levels, before the COVID-19 pandemic.

- Personal care products and services increased 12.3 percent in 2022, which follows the large increase of 19.3 percent from 2021. Personal care products increased by 15.5 percent after a 1.0-percent decrease in 2021. Personal care services increased by 9.1 percent, particularly notable since this follows the 50.4-percent rise from 2021.

The data confirms American consumers experienced considerable inflation during both 2021 and 2022.

References

U.S. Bureau of Labor Statistics. Consumer Expenditure Survey. Multiyear Tables. [PDF Documents: 1984-1991, 1992-1999, 2000-2005, 2006-2012, 2013-2020, 2021-2022]. Reference URL: https://www.bls.gov/cex/home.htm. 8 September 2023.

Labels: data visualization, economics

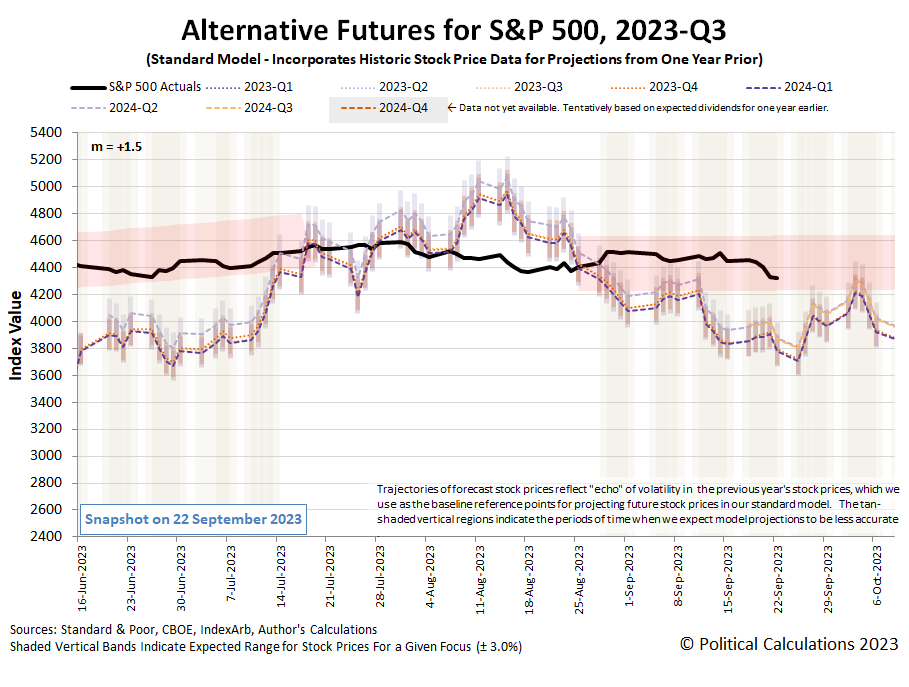

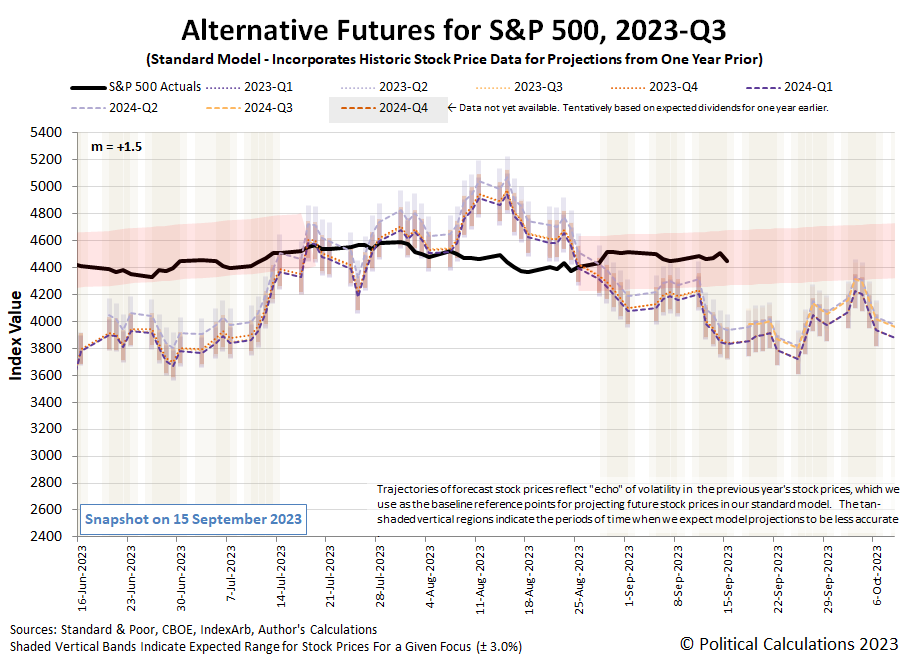

The S&P 500 (Index: SPX) was rocked by the outcome of the Federal Reserve's two day meeting ending on Wednesday, 21 September 2023. The index dropped 2.9% from the previous week's close to end the week at a level of 4320.06.

Almost all of the week's drop for the S&P 500 was concentrated in the period after the Fed announced it would not hike interest rates in September 2023 but signaled it would hold rates higher for longer than investors had previously expected. The effect of that change can be seen in the CME Group's FedWatch Tool, which now projects the Fed will hold the Federal Funds Rate steady in a target range of 5.25-5.50% through July (2024-Q3), six weeks longer than expected last week. Starting from 31 July (2024-Q3) however, investors expect deteriorating economic conditions will force the Fed to start a series of quarter point rate cuts at six-to-twelve-week intervals through the end of 2024.

The prospect of holding rates higher for longer was especially felt by the debt-laden firms that make up the Nasdaq 100 index (Index: COMP) and real estate firms, many of which are components of the S&P 500. As for the dividend futures-based model, we find the trajectory of the S&P 500 is still consistent with investors holding their attention on the end of 2024, with the index now in the lower half of the redzone forecast range. Here's the latest update of the alternative futures chart:

Here's our summary of the week's market-moving headlines, where you'll find most of the action in the latter part of the week that was:

- Monday, 18 September 2023

-

- Signs and portents for the U.S. economy:

- Fed minions excited they may get results they want without more rate hikes:

- Central banks getting ready to stop hiking rates:

- India cenbank says stabilising core inflation shows easing price pressures

- Bank of England readies what may be its final rate hike

- Bank Indonesia to hold rates at 5.75% for rest of 2023, cut early next year - Reuters poll

- ECB minions thinking about cleaning up mess they've made:

- Nasdaq, S&P, Dow end just above flatline as investors in 'wait & watch mode' ahead of Fed

- Tuesday, 19 September 2023

-

- Signs and portents for the U.S. economy:

- Oil prices ease after hitting 10-month highs as investors take profits

- US housing starts hit three-year low; surge in permits point to underlying strength

- Yellen says US growth rate needs to slow amid full employment

- Expectations set in for what Fed minions will do next:

- Fed to hold rates steady, but signal policy path in meeting this week

- Some investors bet peak policy rate is near ahead of Fed decision

- Bigger trouble developing in Canada:

- BOJ minions excited to keep never-ending stimulus alive, JapanGov minion says they'll end it someday:

- Japan's central bank will keep stimulus for now as risks grow

- Japan's industry minister predicts eventual end to ultra-easy policy

- Nasdaq, S&P, Dow end slightly lower on eve of Fed rate decision; Instacart soars in debut

- Wednesday, 20 September 2023

-

- Signs and portents for the U.S. economy:

- Oil falls as rate hike expectations offset US stock draw

- US two-year Treasury yield rises to 17-year high on hawkish Fed

- Fed minions won't hike rates, but raise threat they won't reduce them in 2024:

- Bigger trouble developing in Japan, China:

- Japan's exports extend declines as China slowdown bites

- China economy faces many difficulties, challenges -state planner official

- China pledges to accelerate introduction of more economic policies

- ECB minions get reason to not hike rates again:

- Nasdaq slides ~1.5%, S&P slumps, Dow ends in the red after Fed signals 'higher for longer'

- Thursday, 21 September 2023

-

- Signs and portents for the U.S. economy:

- Oil falls as US rate hike expectations offset tight supply outlook

- US weekly jobless claims drop to eight-month low; labor market remains tight

- 10-year yields hit 16-year peak as Fed seen higher for longer

- Fed minions expected to keep U.S. interest rates higher for longer:

- Expectations rise BOJ minions will end never-ending stimulus sometime next year:

- ECB minions disappointed by results they're getting from their rate hikes, starting to worry about what will happen if they keep hiking:

- ECB's Nagel says inflation not falling at desired pace

- ECB policymakers warn over risk of further hikes

- S&P posts worst day since late March, Nasdaq down nearly 2%, Dow slides more than 1%

- Friday, 22 September 2023

-

- Signs and portents for the U.S. economy:

- Oil ends week lower as demand concerns face Russia supply ban

- U.S. business activity nears stand-still in September, survey says

- Fed officials flag further hikes even after holding steady

- Fed's Daly says she is not sure if need to hold rates, or go higher

- Fed's Collins: Further tightening possible, though "patience" required

- Nobody Knows Anything, Dot Plot Edition

- Some central bank minions pausing rate hikes, others proceeding with them:

- Bank of England hits stop on rate hike run as economy slows

- Swiss central bank in wait and see mode after surprise pause in hikes

- Norway raises rate to 4.25%, likely to hike again in Dec

- Indonesia central bank holds rates, keeps focus on rupiah

- Swedish central bank tightens policy, says it may need to do more

- BOJ minions excited to continue never-ending stimulus as economy slows and inflation grows:

- BOJ keeps ultra-loose policy, dovish guidance, yen skids

- QUOTES: BOJ Governor Ueda's comments at news conference

- With Most Central Banks Ending Their Tightening Cycle, The BOJ Remains Too Terrified to Even Start

- Japan's factory activity shrinks, service sector growth slows in Sept - PMI

- Japan's Aug inflation stays above BOJ target for 17th month

- Bigger trouble developing in Eurozone from things ECB minions did:

- S&P 500, Nasdaq notch biggest weekly losses since March

The Atlanta Fed's GDPNow tool's forecast of annualized real growth rate during 2023-Q3 held steady at +4.9%.

Image credit: Angry Bear Mask image created with AI assistance by Gabriel Colmenares via Wikimedia Commons. Creative Commons. CC0 1.0 Universal (CC0 1.0) Public Domain Dedication.

Automobiles have been manufactured on assembly lines since the days of the Model T in the early years of the twentieth century. The following four minute video shows how Henry Ford's workers put the innovation to use to support the mass production of autos:

Since then, auto manufacturers have had over a 100 years to advance assembly line technology. With that being the case, you might think there's not much more room for improvement left in this now very well established technology.

Unless you think outside of the box. Check out the following five and half minute video for a glimpse of the potential improvements that might yet be made for how automotive vehicles will be produced in the future:

If successful, the first manufacturers who can pull the "unboxed" parallel manufacturing concept off will cut their production costs by up to half, while taking up substantially less space than vehicle manufacturers consume today. Those potential advantages mean legacy manufacturers who are late to adapt to the new production methods will be at an extreme disadvantage in the market. We may be on the cusp of the equivalent of a space race for carmakers.

Labels: technology

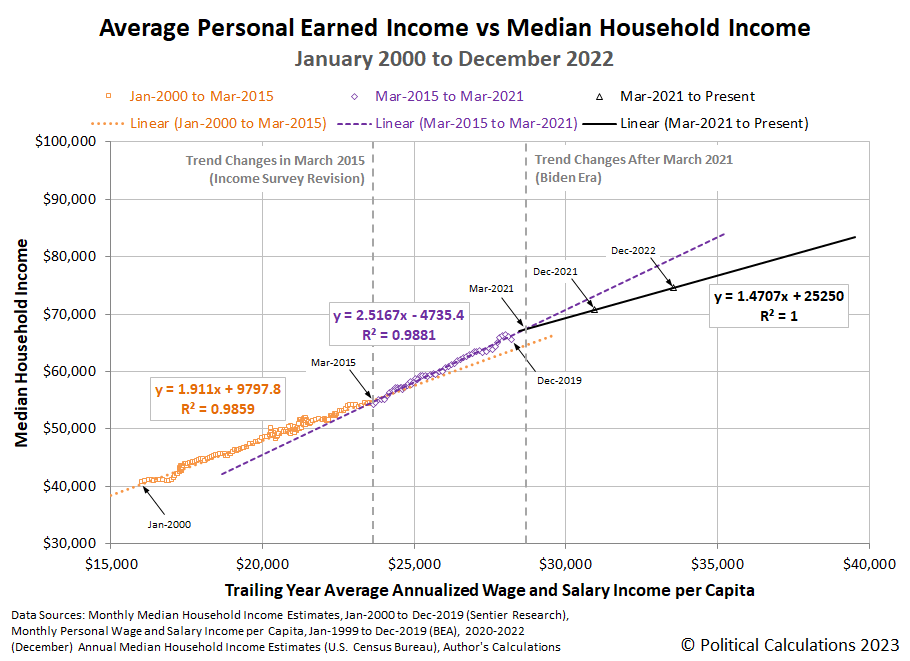

How different would the trajectory of median household income have been if not for what changed in March 2021?

That marks the last month before the growth of the trailing year average of personal earned income per capita in the U.S. began growing more quickly than it had before that time. But instead of changing with it at the same rate it had established during the preceding six years, median household income has grown much more slowly in all the months since.

How much more slowly can be seen in the following chart. We've established a counterfactual based on how median household income would have changed if the existing trend from March 2015 through March 2021 had continued, and show how that compares with how median household income has actually changed in the period from March 2021 through July 2023. The difference is substantial.

The figures indicated for December 2021 and December 2022 in the new trend correspond to the U.S. Census Bureau's annual estimates for median household income for their calendar years. We find that through December 2021, median household income was 3.3% less than the counterfactual projects. Through December 2022, the difference increases to 6.4%.

The period in which the growth of median household income slowed compared to its previous trend coincides with the onset of high inflation within the U.S. economy. From March 2015 through March 2021, consumer inflation in the U.S. ranged between -0.1% and +2.9%, and was +2.6% in March 2021. Since March 2021, it has been as high as +9.1% (June 2022) and has not been less than 3.0% (June 2023). It was 3.2% in July 2023.

In the face of such inflation, the slower pace of median household income growth since March 2021 is especially painful. Slower nominal income growth combined with an elevated rate of inflation makes that outcome inevitable.

For the latest in our coverage of median household income in the United States, follow this link!

References

Political Calculations. Comparing Median Household Income Estimates and Visualizing Trends. [Online Article]. 20 September 2023.

U.S. Bureau of Economic Analysis. Table 2.6. Personal Income and Its Disposition, Monthly, Personal Income and Outlays, Not Seasonally Adjusted, Monthly, Middle of Month. Population. [Online Database (via Federal Reserve Economic Data)]. Last Updated: 31 August 2023. Accessed: 31 August 2023.

U.S. Bureau of Economic Analysis. Table 2.6. Personal Income and Its Disposition, Monthly, Personal Income and Outlays, Not Seasonally Adjusted, Monthly, Middle of Month. Compensation of Employees, Received: Wage and Salary Disbursements. [Online Database (via Federal Reserve Economic Data)]. Last Updated: 31 August 2023. Accessed: 31 August 2023.

U.S. Census Bureau. Current Population Survey, 1968 to 2023 Annual Social and Economic Supplements (CPS ASEC). [Excel Spreadsheet]. 12 September 2023.

Image credit: Losing money for a variety of reasons photo by Jp Valery on Wikimedia Commons. Creative Commons. Attribution-ShareAlike 4.0 International (CC BY-SA 4.0). Photo by Jp Valery also available on Unsplash.

Labels: median household income

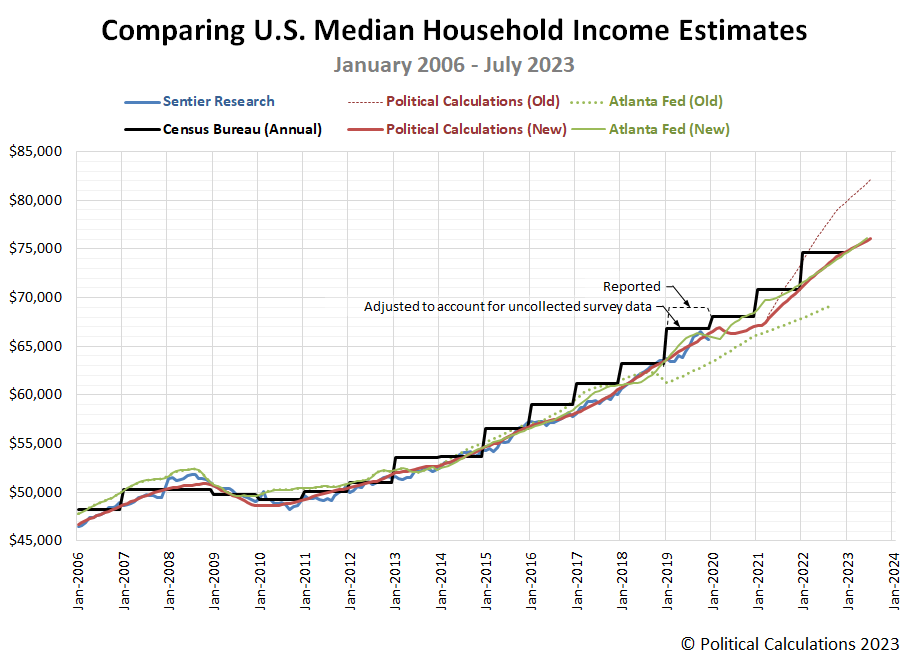

When the U.S. Census Bureau released its annual estimate for 2022's median household income 12 September 2023, it confirmed something we've suspected for the past year. The relationship between average personal income and median household income has changed.

It also solved a challenge we had, because we didn't have enough data to quantify that change until the report was issued. But since we now have it, let's get to it!

Political Calculations' basic methodology for estimating median household income on a monthly basis was last updated in December 2019. The following chart reveals how its estimates compare with those of other sources, including the U.S. Census Bureau's annual estimates through the 2022 calendar year. The chart also indicates how we and other sources for median household income data have revised their estimates over time.

Here's what's going on in the chart. The heavy black "steps" represent the U.S. Census Bureau's annual estimates. These values can be considered to correspond to twelve months of income received through the end of December in their indicated calendar year. That data is collected by the Census Bureau in its Annual Social and Economic Supplement (ASEC) survey of tens of thousands of American households in March of the following year, which is then compiled and analyzed for six months before finally being reported to the public in September.

Because median household income is highly useful demographic information, analytical firms have sought to generate estimates of it more frequently. Sentier Research was the most successful, using data collected by the U.S. Census Bureau's monthly Current Population Survey to generate survey-based estimates of median household income every month, which it did from January 2006 through December 2019. The blue line in the chart corresponds to those estimates.

Sentier Research however closed up shop after reporting its median household income data for December 2019. After they shut down, only two sources were left to provide monthly estimates of this demographic factor: the Federal Reserve Bank of Atlanta and Political Calculations. Both the Atlanta Fed and Political Calculations developed models to estimate median household, which have periodically been revised.

The chart shows the Atlanta Fed's estimates in green and Political Calculations in red. The dotted data series for each represents old estimates that have since been superseded and replaced by new estimates that are shown as solid lines. As you can see, both the Atlanta Fed's and Political Calculations' revised models are in close agreement with each other. The Atlanta Fed's last model revision took place about a year ago, ours is taking place... now!

We've been waiting for the Census Bureau's September 2023 release of 2022's annual median household income data because it provides enough data uncomplicated by data collection issues associated with 2020's coronavirus pandemic to update our modeling based on the relationship between average personal income and median household income. After we got the data, we were able to determine the previous trend that began in March 2015 does not hold past March 2021, after which, the deviation between our estimates and the U.S. Census Bureau's annual survey-based estimates grows larger with time, with our estimates running to the high side of them.

Since the relationship between trailing year average personal income and median household income is linear, we could take advantage of it to determine when the transition from old relationship to new relationship occurred, which ultimately tracked back to March 2021 as the break between old and new trends. The following chart shows those relationships, adding the new trend to the two that preceded it:

We tried to track down the Atlanta Fed's explanation of how they modified their model, which had been increasingly falling out of sync with the Census Bureau's annual estimates to the low side over time before it was revised, but came up empty. They have however provided some explanation of how they produce their estimates in the Frequently Asked Questions for their Home Ownership Affordability Monitor.

For our modeling however, we can use the strong relationship that existed between average personal income and median household income from March 2015 through March 2021 as a counterfactual, or rather, a reasonable projection of what median household income would be had the relationship continued. Since this article is long enough already, we'll take advantage of that property in the very near future in looking at how different our estimates are for median household income from our previous estimates from March 2021 through July 2023.

For the latest in our coverage of median household income in the United States, follow this link!

References

Here are the major milestone posts in our median household income series where we either introduced or announced modifications to our analytical methods.

- June 2017 Median Household Income

- April 2018 Median Household Income

- Telescoping Median Household Income Back in Time

- Median Household Income in June 2019

- Median Household Income in December 2019

Here's a summary of entries in the series addressing substantial revisions to the data we use to create our median household income estimates or that compares those results to estimates published by other sources.

- Median Household Income in April 2019

- Median Household Income in October 2019

- How the Pandemic Affected U.S. Median Household Income

- Different Views of Monthly Median Household Income

- Comparisons of U.S. Median Household Income Estimates

- Median Household Income in August 2022

- Median Household Income in April 2023

Data Sources

U.S. Bureau of Economic Analysis. Table 2.6. Personal Income and Its Disposition, Monthly, Personal Income and Outlays, Not Seasonally Adjusted, Monthly, Middle of Month. Population. [Online Database (via Federal Reserve Economic Data)]. Last Updated: 31 August 2023. Accessed: 31 August 2023.

U.S. Bureau of Economic Analysis. Table 2.6. Personal Income and Its Disposition, Monthly, Personal Income and Outlays, Not Seasonally Adjusted, Monthly, Middle of Month. Compensation of Employees, Received: Wage and Salary Disbursements. [Online Database (via Federal Reserve Economic Data)]. Last Updated: 31 August 2023. Accessed: 31 August 2023.

U.S. Census Bureau. Current Population Survey, 1968 to 2023 Annual Social and Economic Supplements (CPS ASEC). [Excel Spreadsheet]. 12 September 2023.

Federal Reserve Bank of Atlanta. Home Ownership Affordability Monitor. [Online Database]. Accessed 12 September 2023.

Image credit: Rising stack of U.S. coins photo by Gabriel VanHelsing on Wikimedia Commons. Creative Commons. CC0 1.0 Universal (CC0 1.0) Public Domain Dedication.

Labels: median household income

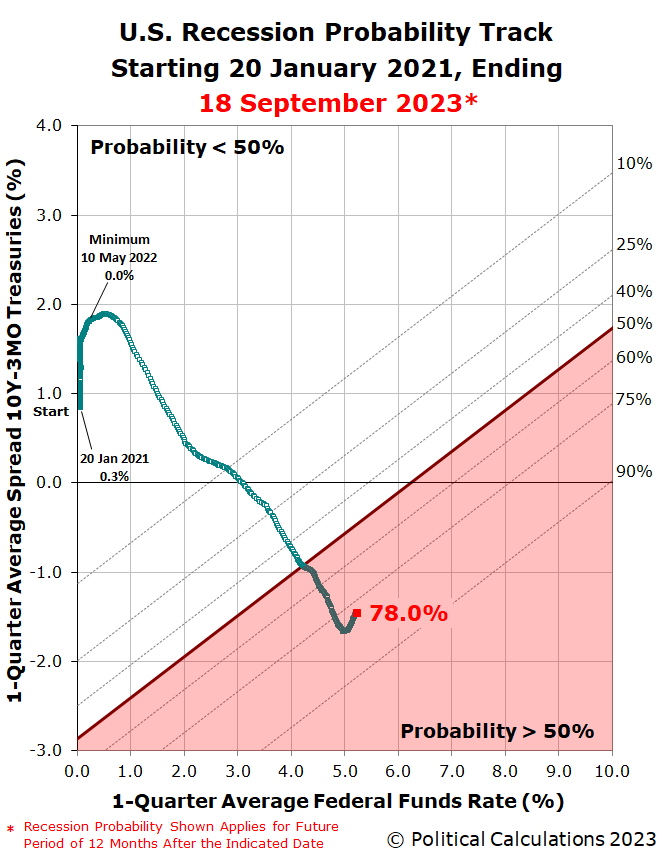

The probability the U.S. economy will experience an official period of recession has begun to recede.

Those odds peaked at the time of our previous update, just before the U.S. Federal Reserve announced it would hike the Federal Funds Rate by another quarter point, bringing its target range up to 5.25-5.50%. This change had been widely expected.

But despite that increase, the probability of recession began to fall as longer term interest rates have risen. As measured by the spread between constant maturity 10-year and 3-month U.S. Treasuries, the treasury yield curve has become less inverted in the weeks since.

That reduced inversion is why the odds of recession have receded. Here's the latest update to the Recession Probability Track visualizing these latest developments:

The Recession Probability Track shows the current probability of a recession being officially determined to have begun sometime in the next 12 months, between the dates of 18 September 2023 and 18 September 2024, is 78.0%. The probability of recession peaked at 80.8% on 25 July 2023, which makes the period from July 2023 through July 2024 the mostly likely period in which the National Bureau of Economic Research will someday identify a point of time marking the peak in the U.S. business cycle before it entered a period of contraction.

With the recession probability starting to recede without a recession having been declared, it might seem as if the U.S. economy could escape a period of contraction. Such an outcome would be an exception however. Historically, the Recession Probability Track has peaked and begun to recede ahead of any recession declaration by the NBER. The event often marks when it's time to start the recession announcement countdown clock.

But not always. There have been exceptions in the past. The questions that matters now is will this be one of them and how confident are you of that possibility?

Analyst's Notes

The Recession Probability Track is based on Jonathan Wright's yield curve-based recession forecasting model, which factors in the one-quarter average spread between the 10-year and 3-month constant maturity U.S. Treasuries and the corresponding one-quarter average level of the Federal Funds Rate. If you'd like to do that math using the latest data available to anticipate where the Recession Probability Track is heading, we have a very popular tool to do the math.

We'll continue to follow the Federal Reserve's Open Market Committee's meeting schedule in providing updates for the Recession Probability Track until the U.S. Treasury yield curve is no longer inverted. Or rather, until the interest rate yield on the 3-month constant maturity U.S. Treasury is no longer higher than the yield on the 10-year constant maturity U.S. Treasury.

For the latest updates of the U.S. Recession Probability Track, follow this link!

Previously on Political Calculations

We started this new recession watch series on 18 October 2022, coinciding with the inversion of the 10-Year and 3-Month constant maturity U.S. Treasuries. Here are all the posts-to-date on that topic in reverse chronological order, including this one....

- U.S. Recession Probability Starts to Recede

- Probability of Recession Starting in Next 12 Months Breaches 80%

- U.S. Recession Probability on Track to Rise Past 80%

- U.S. Recession Probability Reaches 67%

- U.S. Recession Probability Shoots Over 50% on Way to 60%

- Recession Probability Nearing 50%

- Recession Probability Ratchets Up to Better Than 1-in-6

- U.S. Recession Odds Rise Above 1-in-10

- The Return of the Recession Probability Track

Image credit: A fortune teller sideshow photo by Nick Fewings on Unsplash.

Labels: recession forecast

If investors in the S&P 500 (Index: SPX) were looking for direction from the newstreams for how to shape their portfolios, they didn't find much to influence them.

That's despite Friday, 15 September 2023 being a triple witching trading day for U.S. markets with the scheduled expiration of derivative contracts for stock options, stock-index options, and stock index futures that are often associated with higher-than-average volatility.

Without much news to motivate them, the index pretty much just sat around, mostly trading within 1.1% of where it closed the week before. The S&P 500 wrapped up the week at 4450.32, down 0.16% from where it closed the week before.

For the latest update to the dividend futures-based model's alternative futures chart, we find the index dipped just enough to move into the lower half of the redzone forecast range. Which is to say stock prices are behaving very predictably.

As far as dividends futures are concerned, 2023-Q3 came to an end on Friday, 15 September 2023 and we are now in 2023-Q4. We'll continue updating the 2023-Q3 alternative futures chart for another two weeks however before we roll the chart forward to show 2023-Q4.

Meanwhile, here's what passed as market-moving headline during the week that was:

- Monday, 11 September 2023

-

- Signs and portents for the U.S. economy:

- Fed minions expected to hold Federal Funds Rate steady next week and to start cutting interest rates in 2024:

- Fed to leave rates unchanged on Sept. 20; cut unlikely before Q2 2024: Reuters poll

- DoubleLine's Gundlach expects Fed rate cuts in first half of 2024

- Bigger trouble, stimulus developing in China:

- More Chinese seek bargains at Beijing market as confidence in economy wanes

- China's Aug new bank loans jump more than expected, more policy steps expected

- BOJ minions daring to think about ending never-ending stimulus:

- Bigger trouble developing in the Eurozone:

- Nasdaq ends sharply higher as Tesla soars on AI optimism

- Tuesday, 12 September 2023

-

- Signs and portents for the U.S. economy:

- US inflation eroded 2022 wages, as child poverty jumped, Census says

- Oil jumps 2% to near 10-month high as OPEC predicts tight supplies

- Panama Canal to further reduce daily transits if drought continues

- Bigger trouble developing in China:

- Wall Street ends lower as Oracle tumbles on weak forecast

- Wednesday, 13 September 2023

-

- Signs and portents for the U.S. economy:

- US consumer prices accelerate in August on gasoline

- Oil dips as surprise US crude stockbuild faces supply cuts

- Recession risk "coin flip" over the next year - PIMCO

- US holiday sales set for slowest year since 2018 as consumers turn frugal - report

- Expectations that Fed minions are done with rate hikes lock in for September 2023 meeting:

- Traders keep view the Fed is probably done with rate hikes

- Some big US bond investors say Fed hikes have peaked despite sticky inflation

- Fed gets an August inflation curveball to keep hikes alive

- Fed to leave rates unchanged on Sept. 20; cut unlikely before Q2 2024

- JapanGov minions want higher wages, to put political pressure on BOJ minions:

- Japan's Kishida: cabinet to ensure wage growth exceeds rate of inflation

- Japan's new cabinet priorities to keep BOJ in political spotlight

- ECB minions don't see Eurozone inflation falling below 3%, are getting results they wanted from rate hikes:

- ECB's crucial 2024 projection to put inflation above 3%, source says

- German govt sees economy shrinking up to 0.3% this year - Bloomberg News

- S&P 500 ends higher as CPI data cements bets for Fed pause

- Thursday, 14 September 2023

-

- Signs and portents for the U.S. economy:

- Oil rises to highest in 2023 on tight supply expectations

- US crude prices above $90/bbl ignite inflation worries

- US retail sales beat expectations as Americans pay more for gasoline

- A third of would-be buyers cannot find affordable US homes -NAR

- Former Fed minion thinks inflation may force more rate hikes:

- Bigger stimulus developing in China:

- China's central bank set to boost liquidity but keep policy rate steady

- China cuts banks' reserve ratio for second time in 2023 to aid recovery

- China to avoid 'Lehman moment' despite property woes, Goldman says

- BOJ minions get flimsy reason to keep never-ending stimulus alive:

- ECB raises rate to record high and signals end of hikes

- Lagarde comments at ECB press conference

- ECB cuts growth outlook but raises key 2024 inflation projection

- Dow jumps ~1%, Nasdaq, S&P rise as Arm's big debut resurrects IPO market hopes

- Friday, 15 September 2023

-

- Signs and portents for the U.S. economy:

- Exclusive-US retailer holiday hiring to drop to levels last seen in 2008

- US manufacturing production barely rises in August

- Fed minions losing money because of their rate hikes, change in inflation expectations have investors expecting them to deliver one more hike:

- Fed losses breach $100 billion as interest costs rise

- Forecast for Fed's new forecasts - still one more rate hike to go

- Signs stimulus getting traction in China, but bigger trouble still developing:

- China's economy shows signs of stabilising but property slump threatens outlook

- China's property slump worsens, clouding recovery prospects

- ECB minions to start getting help from Eurozone governments in fighting inflation, don't want to cut rates:

- Euro zone ministers agree fiscal policy must aid ECB inflation fight

- ECB policymakers push back on rate cut expectations

- Nasdaq, S&P, Dow slump on triple witching day, put in mixed performance for the week

The CME Group's FedWatch Tool showed little change in the past week. It continues to show no rate hike when the Fed next meets on 19-20 September (2023-Q3). After which, the tool projects the Fed will hold rates steady until 12 June (2024-Q2), which is expected to mark the first of a series of quarter point rate cuts continuing at six-to-twelve-week intervals through the end of 2024.

The Atlanta Fed's GDPNow tool's forecast of annualized real growth rate during 2023-Q3 is +4.9%, falling from last week's prediction of +5.6% growth.

Image credit: Restful bear photo by Mark Basarab on Unsplash.

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.