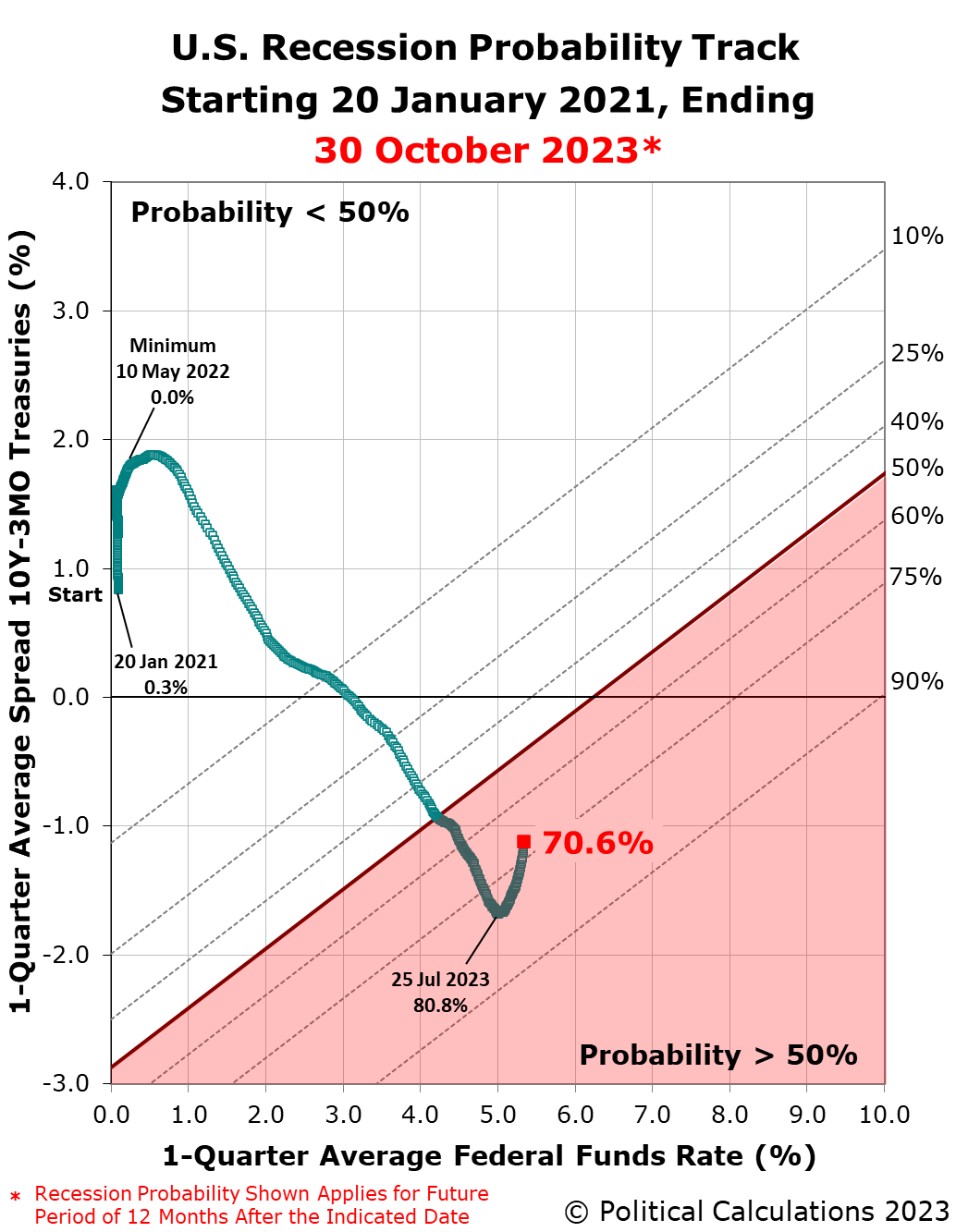

The probability the U.S. economy will experience an official period of recession continued to recede during the past six weeks.

The probability peaked at 80.8% on 25 July 2023, just before the U.S. Federal Reserve announced it would hike the Federal Funds Rate by another quarter point, bringing its target range up to 5.25-5.50%. The Fed has since held rates steady at that level and is expected to announce it will continue doing so after its Federal Open Market Committee concludes its two-day meeting on 1 November 2023.

Since July, the probability of a recession starting sometime in the next 12 months has declined. That change coincides with the spread between the constant maturity 10-year and 3-month U.S. Treasuries becoming less inverted in the weeks since the recession probability peaked, with the 3-month yield holding relatively steady while the 10-year yield increased. The 10-year yield recently peaked just under 5% on 19 October 2023.

However, the U.S. treasury yield curve is still inverted and the probability of recession remains elevated. Here's the latest update to the Recession Probability Track illustrating how things stand going into the FOMC's two-day meeting:

The Recession Probability Track indicates the probability a recession will someday be officially determined to have begun sometime in the next 12 months. For this update, that applies to the dates between 30 September 2023 and 30 September 2024, where the probability is 70.6%.

The probability of recession peaked at 80.8% on 25 July 2023, which makes the period from July 2023 through July 2024 the mostly likely period in which the National Bureau of Economic Research will someday identify a point of time marking the peak in the U.S. business cycle before it entered a period of contraction.

Analyst's Notes

The Recession Probability Track is based on Jonathan Wright's yield curve-based recession forecasting model, which factors in the one-quarter average spread between the 10-year and 3-month constant maturity U.S. Treasuries and the corresponding one-quarter average level of the Federal Funds Rate. If you'd like to do that math using the latest data available to anticipate where the Recession Probability Track is heading, we have a very popular tool to do the math.

We will continue to follow the Federal Reserve's Open Market Committee's meeting schedule in providing updates for the Recession Probability Track until the U.S. Treasury yield curve is no longer inverted and the future recession odds retreat below a 20% threshold.

For the latest updates of the U.S. Recession Probability Track, follow this link!

Previously on Political Calculations

We started this new recession watch series on 18 October 2022, coinciding with the inversion of the 10-Year and 3-Month constant maturity U.S. Treasuries. Here are all the posts-to-date on that topic in reverse chronological order, including this one....

- U.S. Recession Probability Continues Receding on All Hallow's Eve

- U.S. Recession Probability Starts to Recede

- Probability of Recession Starting in Next 12 Months Breaches 80%

- U.S. Recession Probability on Track to Rise Past 80%

- U.S. Recession Probability Reaches 67%

- U.S. Recession Probability Shoots Over 50% on Way to 60%

- Recession Probability Nearing 50%

- Recession Probability Ratchets Up to Better Than 1-in-6

- U.S. Recession Odds Rise Above 1-in-10

- The Return of the Recession Probability Track

Image credit: Looking through a dark crystal ball photo by Zaeo on Unsplash.

Labels: recession forecast

The scary season for October 2023 is living up to its moniker for investors.

The S&P 500 (Index: SPX) fell 2.5% during the trading week ending on Friday, 27 October 2023. The index closed the week at 4117.37.

That puts the index 14.2% below its all-time record high peak from 3 January 2022. It also represents a retreat of 10.3% from the highest value the S&P 500 reached during the current year, when it closed at 4588.96 on 31 July 2023. The decline in stock prices in the three months since now qualifies as a correction.

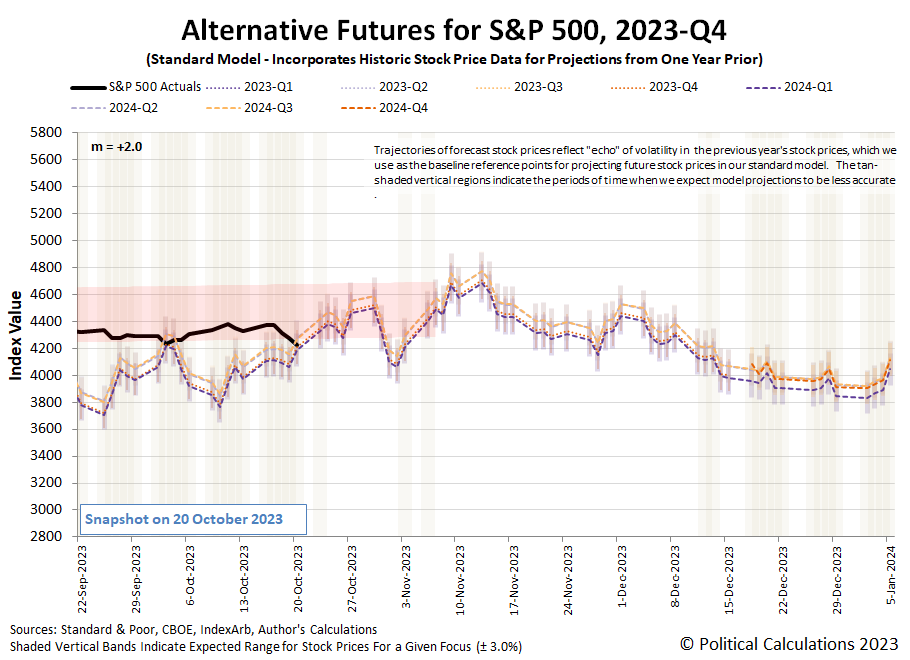

While we cannot yet say that order has broken down for the S&P 500, the index is just a little over a 1.5% decline in value away from crossing the threshold where that scenario becomes more than an academic question. While that's happening, the trajectory of the index remains below the redzone forecast range shown on the alternative futures chart, which raises a new possibility: the index may be undergoing a regime change.

By regime change, we're referring to a change in the market environment that alters the multiplier of the dividend futures-based model. While the multiplier can remain nearly constant for prolonged periods of time, it can and has changed suddenly with little to no warning. The projections shown on the alternative futures chart reflect the value of the multipler, m, being equal to +1.5, which has been the case since 9 March 2023.

In breaking and staying below the redzone forecast range, it suggests the value of the multiplier has increased. However, we'll need more trading data before we can determine how high. Since the breakout indicating the old market regime no longer applies occurred on 19 October 2023, we're looking at market-moving events occurring on or near that date as the potential trigger for the regime change. At this time, we think the spike in the 10-year Treasury up toward a 5% yield on that date is the leading candidate for it.

The trajectory of stock prices during the week that was were affected by more than that event from last week. Here are the market-moving headlines we noted for the last full trading week of October 2023.

- Monday, 23 October 2023

-

- Signs and portents for the U.S. economy:

- Ten-year U.S. Treasury yield hits 5%

- BlackRock warns of US earnings stagnation, remains bullish on AI, Japan

- Fed hawks, Fed doves: What U.S. central bankers have been saying

- Bigger stimulus developing in China:

- Bigger trouble developing in Canada:

- BOJ minions may be forced to "tweak" never-ending stimulus again:

- Bigger trouble developing in the Eurozone:

- Nasdaq, S&P, Dow end mixed as bond market volatility weighs; US10Y retreats from 5%

- Tuesday, 24 October 2023

-

- Signs and portents for the U.S. economy:

- Bigger stimulus developing in China:

- China set to approve $137 billion in extra sovereign debt on Tuesday -sources

- China's Xi makes first known visit to central bank -sources

- Hong Kong may seek to kick-start ailing property market in policy address

- Bigger trouble, continued stimulus developing in Japan:

- Japan's factory, service sector activity under pressure in Oct - PMI

- Japan to extend until April 2024 subsidies to curb fuel costs - stimulus package draft

- BOJ minions act to keep never-ending stimulus alive despite inflation:

- Bank of Japan to conduct unscheduled bond-buying operation

- Japan's price trend gauge hits record, signals broadening inflation

- Bigger trouble developing in the Eurozone:

- Euro zone October PMI at near 3-year low, stirring recession worries

- German business activity slump suggests recession 'well underway' -PMI

- Euro zone lenders and borrowers shun credit as rates climb - ECB

- Wall Street surges to close higher, powered by upbeat earnings, guidance

- Wednesday, 25 October 2023

-

- Signs and portents for the U.S. economy:

- U.S mortgage rates soar to highest in more than 23 years

- Oil prices settle up about 2% on worries about Middle East

- US new home sales scale 19-month high as median price drops

- Fed minions thinking about lowering debit card fees:

- Bigger stimulus, trouble developing in China:

- China Kicks Fiscal Stimulus Into Overdrive With Deficit-Busting 1 Trillion Yuan In New Debt

- China's new bonds to help economic recovery, official says, as budget deficit rises

- China's central bank structural policy tools rise to $959 billion at end-Sept

- Exclusive-China's cabinet curbs debt growth in 12 "high risk" regions - sources

- Bigger trouble developing in the Eurozone:

- S&P 500, Nasdaq end sharply lower as Alphabet disappoints, Treasury yields bounce

- Thursday, 26 October 2023

-

- Signs and portents for the U.S. economy:

- US economic growth accelerates in third quarter

- Yellen says US GDP is a 'good strong number', may keep bond yields higher

- Yellen: Possible long-term yields will come down, but 'no one knows for sure'

- Oil falls after U.S. stockpiles climb, Middle East tensions in focus

- Bigger trouble developing in Japan?

- Economists think BOJ minions thinking about ending never-ending stimulus next year:

- ECB minions swing into inaction:

- Wall Street ends lower on mixed earnings, robust data

- Friday, 27 October 2023

-

- Signs and portents for the U.S. economy:

- Oil prices up 3% on worries about Middle East supplies

- Inflation to dog world economy next year, postponing rate cuts

- Fed seen keeping rates on hold well into next year

- Bigger stimulus getting traction in China:

- BOJ minions get data that won't help them keep never-ending stimulus alive:

- Core inflation in Japan's capital unexpectedly accelerates, BOJ in spotlight

- Japan's Matsuno expects BOJ to coordinate with govt on monetary policy

- ECB minions looking forward to having elevated inflation for another year:

- Nasdaq, S&P, Dow fall more than 2% each for the week, primarily on big tech weakness

The CME Group's FedWatch Tool projects the Fed will hold the Federal Funds Rate steady in a target range of 5.25-5.50% through May (2024-Q2), unchanged from last week. Starting from 12 June (2024-Q2), investors expect deteriorating economic conditions will force the Fed to start a series of quarter point rate cuts at six-to-twelve-week intervals through the end of 2024.

The Atlanta Fed's GDPNow tool's final forecast of annualized real growth rate during 2023-Q3 of +5.4% was respectfully close to the BEA's initial estimate of +4.9% for the quarter. The Atlanta Fed's first estimate of real GDP growth for the current quarter of 2023-Q4 is +2.3%.

Image credit: Bing Image Creator. Prompt: "A colorful painting of a growling grizzly bear in the style of Kelsey Rowland".

The Universe is mind-boggingly huge. It's filled with everything from the tiniest of subatomic particles to superclusters of galaxies, not to mention even larger voids between them all.

Needless to say, the wildly different scales of all these things makes it very hard to fit them all onto a single chart for the purpose of comparing their relative sizes. But thanks in part to the power of logarithms to compare things of vastly different sizes, Charles Lineweaver and Vihan Patel have done that for a wide range of selected objects. Here's the "Plot of All Objects", the second figure from their 2023 paper "All objects and some questions":

The online version of the paper features a brief video discussing the mysterious "forbidden by gravity" and "quantum uncertainty" which we cannot embed, we do recommend clicking through to it for the valuable introduction it provides.

Lineweaver and Patel explained why they collected and presented the information as they have in the conclusion of their purposefully thought-provoking paper:

Here, we provide an overview of the history of the Universe and the sequence of composite objects (e.g., protons, planets, galaxies) that condensed out of the background as the Universe expanded and cooled. We describe the role of the effective number of relativistic degrees of freedom (g∗) needed to understand the thermal history of the Universe during the first few minutes after the big bang. We compute and plot the background density and temperature of the Universe (Fig. 1). To extrapolate into the first billionth of a second, we make some common, explicit, but speculative assumptions.

We then make the most comprehensive pedagogical plot of the masses and sizes of all the objects in the Universe (Fig. 2). This plot draws attention to the unphysical regions forbidden by general relativity and quantum uncertainty—regions bounded by black holes and the Compton limit. The Compton limit creates an ambiguous region beyond which object size and position are conflated by quantum uncertainty, thus undermining the classical notion that the size of an object can be arbitrary small. Figure 2 also helps navigate the relationship between gravity and quantum mechanics and helps formulate some fundamental questions about the limits of physics: How can we interpret the regions forbidden by general relativity and quantum uncertainty? How should we interpret the fact that the two boundaries of the forbidden regions intersect at the instanton (Planck-mass black holes)? Are instantons the smallest possible objects? Do their size, density and temperature make them the best candidates for the initial conditions of the Universe (Fig. 1)? Is the Schwarzschild radius the minimum size for an object of a given mass? Or might the non-singular cores of black holes be objects with the Planck density?

Those are the kinds of questions whose answers might win their answerers Nobel prizes in physics.

References

Lineweaver, Charles H. and Patel, Vihan M. All objects and some questions. American Journal of Physics, 91, 819-825 (2023). DOI: 10.1119/5.0150209. [PDF document].

Labels: data visualization, ideas

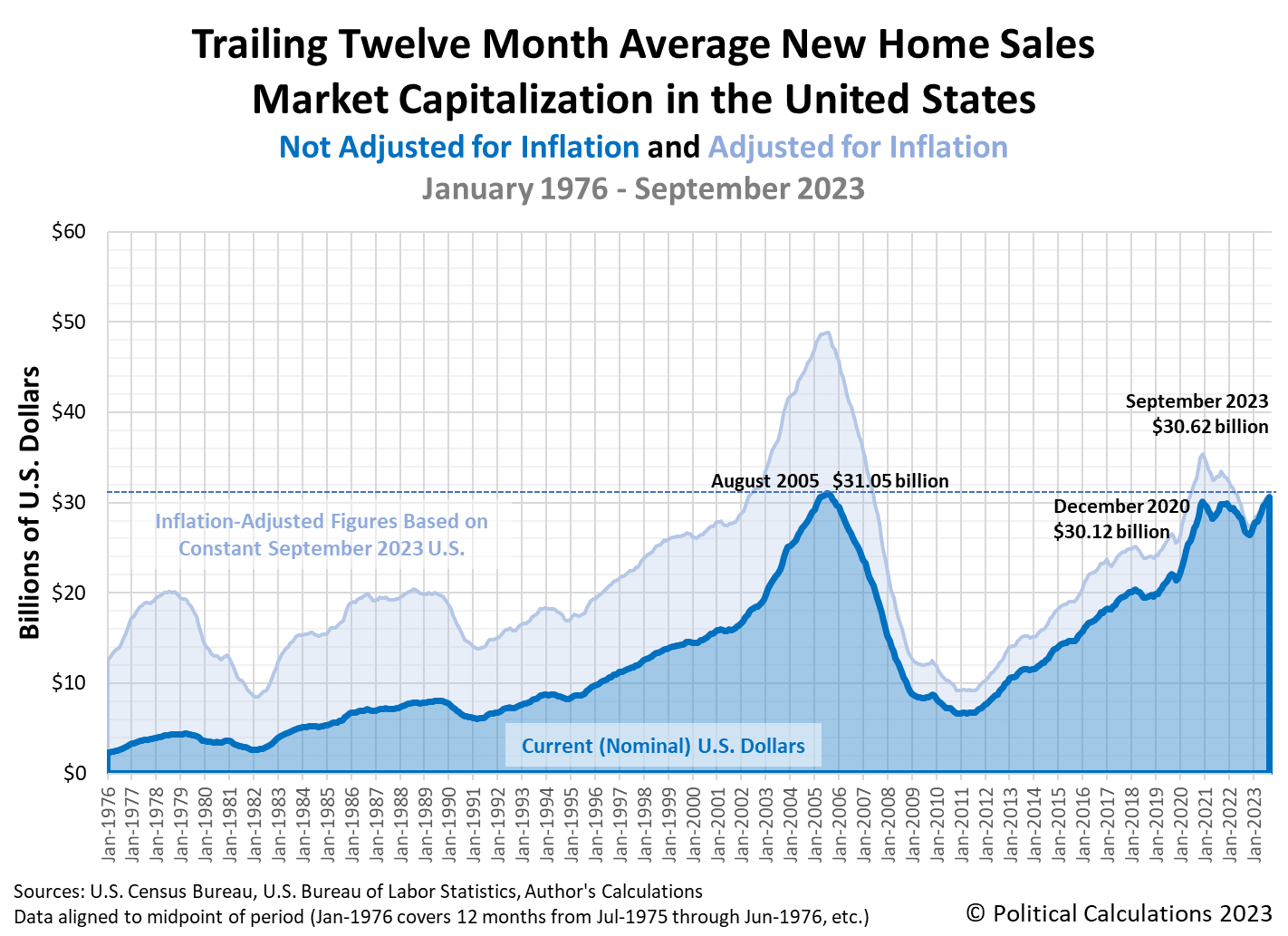

Political Calculations' initial estimate of the market capitalization of new homes sold during the month of September 2023 is $30.62 billion. That figure is less than half a billion away from the nominal (non-inflation adjusted) peak of $31.05 billion that was reached in August 2005.

While this figure will be revised over the next several months, it continues a year-long trend for the non-inflation adjusted valuation of the number of new homes sold in the U.S. That trend coincides with a growing shortage of existing homes being put up for sale, which has boosted new home sales.

The underlying reason for the trend is the "golden handcuffs" scenario facing many existing home owners who purchased their homes at historically low mortgage rates, which had bottomed at 2.68% for a conventional 30-year fixed rate mortgage in December 2020. With today's 30-year mortgage rates now touching 8.0% and the average new home still selling for over $500,000 despite declining since peaking a year earlier, many existing home owners simply cannot afford to sell their home and buy a new one.

Here is the latest update to our chart illustrating the market capitalization of the U.S. new home market since January 1976:

The next two charts show the latest changes in the trends for new home sales and prices:

While September 2023's market cap is approaching the nominal, non-inflation adjusted peak from the housing bubble days of the early 2000s, it falls far below when inflation is taken into account. In terms of September 2023's U.S. dollars, the housing bubble era peak is the equivalent of $48.8 billion. In real terms, today's new home market is much smaller.

On the plus side for the U.S. economy, new home sales contribute roughly 3-5% to the nation's Gross Domestic Product. The rising trend for the new home market cap has been contributing a tailwind to the U.S. economy since September 2022.

References

U.S. Census Bureau. New Residential Sales Historical Data. Houses Sold. [Excel Spreadsheet]. Accessed 25 October 2023.

U.S. Census Bureau. New Residential Sales Historical Data. Median and Average Sale Price of Houses Sold. [Excel Spreadsheet]. Accessed 25 October 2023.

Image credit: Photo by Jens Behrmann on Unsplash.

Labels: market cap, real estate

In theory, the ADP Employment Index should provide analysts with highly valuable information. Automatic Data Processing (NYSE: ADP) is the largest firm that provides payroll services to thousands of U.S. businesses with millions of employees. As such, it has a unique view into how the private sector of the U.S. economy is performing.

And yet, its flagship research report that seeks to leverage its database to provide a picture of private sector employment seems to have never lived up to its potential. In 2010, it was flagged by two of the analysts interviewed by Time's Justin Fox for being an overrated indicator. Here were their comments:

Harm Bandholz, UniCredit Markets and Investment Banking: My least favorite economic indicator is by a wide margin the ADP employment index (hope that is prominent enough). The guys at ADP have repeatedly revised the calculation methodology so that their index has some ability to explain payroll changes ex ante. But the out of sample forecasting ability is just awful. I do not understand, why anybody should follow the index.

Kurt Karl, Swiss Re: The ADP report—too inaccurate and not early enough to be helpful.

That was in 2010. Has ADP's employment index gotten better in the 13 years since?

This being 2023, we opted to let artificial intelligence do the research legwork for us, asking Bing Chat to answer the question "What makes the ADP employment index less than useful?" Here is its response, with links to its sources:

The ADP Employment Index has faced criticism for several reasons:

- Methodology: The ADP has been criticized for its methodology, which led to a decision to pause the release of its private-sector employment report to retool the methodology.

- Discrepancies with Government Data: There have been instances where the ADP's job numbers were significantly different from the government's. For example, in one instance, the ADP reported that U.S. companies had added 568,000 jobs in a month, while a Labor Department report showed they'd added 317,000. This discrepancy was attributed to a miss in the leisure and hospitality sector.

- Estimation Challenges: The current labor market is tumultuous, making it hard to distinguish between permanent and temporary layoffs. This causes estimation challenges for both ADP and the Bureau of Labor Statistics.

These factors can make the ADP Employment Index less useful for some analysts and investors.

Right off the bat, the first item of the Methodology in producing the ADP employment index looks like it was never satisfactorily addressed in between 2010, when Harm Bandholz identified it as an issue, and 30 June 2022, when Barron's reported ADP would "retool" its private-sector employment index. That by itself would be enough to raise caution flags for any analyst looking to divine useful information from the report.

In our view, ADP's discrepancies with government data is less of a concern. As ADP and the BLS draw their data from different sources, differences should be expected. What is really useful is consistent quality in the reported data. If the ADP employment index produces data of consistent quality, differences between it and official government employment data would not be an issue.

Meanwhile, estimation challenges simply comes with the territory of analyzing employment data. It's neither surprising nor disqualifying for ADP to have the same issues as the government's Bureau of Labor Statistics' data jocks do. If anything, that should be an advantage for ADP's research team, because they have access to a 100% sample of the company's private sector payroll databases for its clients. In addition, ADP offers analysts a real potential benefit in providing an independent source for employment data and trends, not the least of which has been the periodic absences of timely government-reported employment data during the various government shutdowns that have taken place since 2010.

Going back to its methodology, there's a natural question that arises from the fact of ADP's 2022 "retooling" of how it determines its employment index: is the revised version more useful? Here's how ADP described what they would be doing in the future in a 23 August 2023 press release:

ADP Research Institute (ADPRI) and the Stanford Digital Economy Lab (the Lab) have developed a new methodology for the ADP National Employment Report (NER) that will provide a more robust, high-frequency view of the labor market with a focus on both jobs and pay. Using fine-grained data, this new measure will deliver a richer labor market analysis that will help answer key economic and business questions and offer insights relevant to a broader audience.

It has been less than a year since the retooled ADP employment index has been producing reports, so the jury is still out on whether it has become a more reliable and useful indicator of the private sector employment situation in the United States. We'll have to revisit this topic at a later date.

The jury however has long since delivered its verdict for the pre-retooled version of the ADP employment index. It never lived up to its potential and was considerably less than useful.

Previously on Political Calculations

- Less Than Useful Data in the World of Big Data

- Less Than Useful Data: Consumer Confidence

- Less Than Useful Data: FHFA House Price Index

- Less Than Useful Data: Index of Leading Economic Indicators

- Less Than Useful Data: Weekly Chain Store Sales

- Less Than Useful Data: Challenger Layoff Announcements

- Less Than Useful Data: ADP Employment Index

Image credit: Wikimedia Commons ADP logo sourced from ADP's 2007 Annual Report. Public domain image.

Labels: ideas

After the trajectory of the S&P 500 (Index: SPX) dropped below both the dividend futures-based model's redzone forecast range and its 200-moving day average, the latter of which matters to people who buy into technical analysis, we set up a useful question to answer. Here's the set-up and question:

The S&P 500's trajectory breaking below the bottom end of the redzone forecast range comes as the index coincidentally dropped below its 200-day moving average. For the record, the upper and lower limits we set for the redzone forecast range are not based on the moving averages used in technical analysis, which we view as unreliable indicators at best. It's more useful to ask if that change is an an outlier event or a warning signal indicating order is breaking down in the stock market.

We can find the answer to these questions by borrowing some well-established techniques from statistical analysis. In the following chart, we've tracked the day-to-day trajectory of the S&P 500 index with respect to its trailing twelve month dividends per share.

Framing the data this way allows us to first verify the S&P 500 has been in a relative period of order since 30 September 2022 and to establish the range where we would expect to find the value of the index while that order holds. We find that through Friday, 20 October 2023, the level of the S&P 500 is neither an outlier nor has the current period of relative order for the index broken down.

For it to be either, the S&P 500 would need to first drop roughly another four percent from its 20 October 2023 closing value. If then it were an outlier, it would quickly bounce back up above the red-dashed line and resume following its established trend. If order were to break down instead, the S&P 500 would stay below the red-dashed curve for sustained period of time.

Of the two scenarios, having order break down is the one to worry about, because that would be a real sell signal. To understand why that matters, check out what happened after investors got the "ultimate sell signal" in 1929.

Labels: chaos, data visualization, SP 500

Two big things happened to the S&P 500 (Index: SPX) in the past week, as the index fell to 4224.16 through Friday, 20 October 2023, a 2.4% week-over-week decline.

The first big thing to happen was a surge in the yield of the 10-year U.S. Treasury, which was accompanied by mortgage rates spiking up to their highest levels since the early 2000s.

The second big thing to happen came on Thursday, 21 October 2023, when Federal Reserve Chair Jerome Powell spoke and signaled the Fed might resume hiking short term interest rates, even though Fed officials were saying the surge in the interest rate yields of Treasuries were doing their job for them.

For the market, that statement came as a number of mid-size banks reported lower earnings because of rising interest rates increasing their costs. The combined effect of this new information for investors pushed the trajectory of the S&P 500 below the lower end of the latest redzone forecast range on the dividend futures-based model'a alternative futures chart. Here's the latest update for the chart:

The S&P 500's trajectory breaking below the bottom end of the redzone forecast range comes as the index coincidentally dropped below its 200-day moving average. For the record, the upper and lower limits we set for the redzone forecast range are not based on the moving averages used in technical analysis, which we view as unreliable indicators at best. It's more useful to ask if that change is an an outlier event or a warning signal indicating order is breaking down in the stock market. We'll find out which of these options is the correct reading of what's going on in the stock market soon enough.

While those were the biggest events to move markets during the week that was, here are the week's other market moving headlines to provide more context in what new information investors had to absorb.

- Monday, 16 October 2023

-

- Signs and portents for the U.S. economy:

- Fed minions claim inflation is over, acknowledge they are choking off first time new home buyers, think they have a tough messaging job:

- Fed's Goolsbee says fall in US inflation is not just a blip- FT

- Fed's Harker says high interest rates closing off housing for new buyers

- Fed's Powell faces 'what, me worry?' moment of spiking bond yields, war, political stalemate

- Bigger trouble, provincial government bailouts, more stimulus developing in China:

- China'a Q3 GDP growth seen slowing to 4.4% as headwinds persist: Reuters poll

- China ramps up liquidity support to banking system

- Factbox-China's measures to shore up its indebted property sector

- ECB minions getting results they wanted from rate hikes, claim they won't cut rates any time soon:

- German wholesale prices fall for sixth month in a row

- ECB 'quite some distance' from rate cuts -ECB chief economist

- Wall Street ends up on earnings optimism; eyes remain on Middle East

- Tuesday, 17 October 2023

-

- Signs and portents for the U.S. economy:

- Strong retail sales, factory output point to robust US growth in third quarter | Reuters

- US manufacturing output rises solidly in September

- U.S. home builder confidence falls to lowest since January

- Oil prices edge higher ahead of Biden Middle East trip

- Fed minions thinking they should still worry about inflation, may need to hike rates again:

- Fed's Kashkari: inflation still too high

- Fed's Barkin: can't rely on tightening from long-term rates

- Bigger provincial government bailout developing in China:

- Exclusive-China tells banks to roll over local government debts as risks mount - sources

- Country Garden's entire offshore debt to be in default if Tuesday payment not made

- Nasdaq, S&P, Dow end with small moves as yields soar after hot retail sales data

- Wednesday, 18 October 2023

-

- Signs and portents for the U.S. economy:

- Brent hits $93 as Middle East strife heightens supply concerns

- 30-year fixed-rate mortgage touches 8%, highest level since mid-2000

- Fed minions thinking about sitting on their hands for a longer time:

- Fed on pause as policymakers parse mixed data

- Fed done hiking rates, but higher for longer message gaining traction

- Signs of bigger stimulus getting traction in China:

- Signs of less bad trouble developing in China:

- BOJ minions thinking about raising inflation target to keep never-ending stimulus alive:

- Wall St falls more than 1%; yields rise, investors assess earnings

- Thursday, 19 October 2023

-

- Signs and portents for the U.S. economy:

- Oil settles up 1% on nagging worries about Middle East

- U.S. 10-year Treasury yields hits 5% for first time since 2007

- US existing home sales drop to 13-year low in September

- Fed minions speak, threaten more rate hikes, worried about risk of more bank failures:

- Powell: Strong economy may need more restraint, but bond markets are helping

- Fed's Bostic: Lowering inflation still main US central bank mission

- Fed developing extra 'stress test' scenarios to test for bank weaknesses: official

- BOJ minions get data to absorb, happy about some of it:

- BOJ upbeat on regional Japan but warns of uncertain wage outlook

- Japan's bank lobby head warns of hit to economy from rising yields

- Japan govt considering income tax cut to ease blow from inflation - NHK

- Japan exports hit record level, first rise in three months

- Wall St ends lower on Powell remarks as benchmark Treasury yields near 5%

- Friday, 20 October 2023

-

- Signs and portents for the U.S. economy:

- Oil set for second weekly gain on Gaza escalation fears

- Red October rumbles on as U.S. bond yields touch 5%

- US auto strike's economic fallout starts to hurt global businesses

- Fed minions starting to think they'll need to cut interest rates in second half of 2024:

- Fed has 'some time' to see data before deciding next rate move, says Logan

- Fed's Bostic: possible Fed could lower rates in late 2024 - CNBC

- Fed's Mester says plenty of room left to run on balance sheet drawdown

- Fed's Mester says plenty of room left to run on balance sheet drawdown

- Bigger trouble developing in China:

- BOJ minions get unwelcome sign of inflation, really want to keep never-ending stimulus alive despite signs it shouldn't:

- Japan's property market shows signs of overheating -BOJ

- BOJ will debate pros, cons of unconventional policy at workshop

- Bank of Japan intervenes as 10-year JGB yield hits new decade high

- Japan's core inflation slows below 3% for first time in over a year

- Nasdaq, S&P, Dow end week with hefty losses as focus turns to Q3 earnings deluge

- US mid-sized bank shares slump after downbeat interest income forecasts

The CME Group's FedWatch Tool continues to project the Fed will hold the Federal Funds Rate steady in a target range of 5.25-5.50% through May (2024-Q2), unchanged from last week. Starting from 12 June (2024-Q2), investors expect deteriorating economic conditions will force the Fed to start a series of quarter point rate cuts at six-to-twelve-week intervals through the end of 2024.

The Atlanta Fed's GDPNow tool's forecast of annualized real growth rate during 2023-Q3 increased to +5.4% from last week's forecast of +5.1%. The so-called "Blue Chip Consensus" estimates range from a low of +2.4% to +4.5%, with a median estimate of +3.5%.

Image credit: Stable Diffusion DreamStudio Beta. Prompt: "megan duncanson style painting, angry bear on Wall Street, early stages of sunset, psychedelic effects --ar 16:9".

Veterinarians and the staffs at animal care or rescue centers are often confronted with unique challenges. One of the most dangerous they face comes when they need to retrieve uncooperative animals from their kennels. The simple act of opening a kennel and reaching in to collect its occupant can result in serious injuries from being scratched by claws or bitten by sharp teeth. The chances of going from caretaker to needing care are high.

How can that necessary task be made more safe for all those involved? Campbell Pet's EZ-Nabber solves that problem with a deceptively simple invention. Here's a three-and-a-half minute video introducing the product and showing how it may be used to improve safety for those who need to handle potentially dangerous animals:

It's not a device for which there is a mass market, but for those who have the specific challenge the EZ-Nabber is designed to solve, it's a fantastically useful innovation. It's an example of outside the box thinking to solve an inside the box problem.

Or would it be more accurate to say it's an example of inside the box thinking?

HT: Core77.

Labels: technology

How different would New York City's experience during the first wave of 2020's coronavirus pandemic have been if public officials had better and more timely information about how many people were really being infected by it?

That's a fascinating question raised by the Empire Center's Bill Hammond's retrospective analysis of the pandemic's impact in New York. In that analysis, Hammond features a chart comparing the information public officials had on the number of confirmed COVID-19 cases with the Institute for Health Metrics and Evaluation's improved estimates of how extensive coronavirus infections likely were in reality in early 2020. Here's a slightly modified* interactive version of the chart:

Compared with the official count produced by the New York State Department of Health (NYSDOH) in early 2020, COVID-19 infections were much more numerous and peaked much earlier in the IHME's improved estimates Hammond describes what the chart shows:

As seen in Figure 1, the state’s outbreak likely began by early February, a full month before its first laboratory-confirmed case [2]. The estimated number of infections soared to more than 60,000 per day on March 19, which was six times higher and three weeks earlier than shown by the state’s testing data.

A second attempt to model the first wave of New York’s pandemic estimated that it began on Jan. 19 and reached a peak infection rate of almost 100,000 per day on March 24 [3]. These estimates indicate that the curve had already begun to bend – that is, the rate of increase had begun to slow – before Cuomo issued his stay-at-home order effective March 22 – likely because individuals and businesses were spontaneously limiting their activities in reaction to official warnings and news coverage.

Hammond explains how better knowledge of the true picture for the spread of COVID-19 infections could have shaped the response of both New York's governor and the state's public health officials:

The virus’s rapid spread in February and early March of 2020 shows the importance of detecting outbreaks early and responding quickly. If officials had become aware of this surge even a week or two sooner – and notified the public – they almost certainly could have avoided swamping hospitals and saved thousands of lives.

If they had merely known when the wave reached its peak, they might have avoided mistakes in late March.

For example, Cuomo and his administration would have had less cause to worry about a looming shortage of hospital capacity. They could have avoided spending time and money to build emergency hospital facilities that went largely unused. And they might never have issued the March 25 directive transferring Covid-positive patients into nursing homes – a decision that likely added to the high death rate in those facilities and contributed to Cuomo’s political downfall. [6]

Here's an example of the official data and modeled projections they did have in early 2020. The following chart is taken from the Institute for Health Metrics and Evaluation (IHME)'s 25 March 2020 projections showing its estimates of the minimum, likely, and maximum number of additional hospital beds that would be needed in the state of New York to care for the model's expected surge of coronavirus patients.

This chart presents just one of several coronavirus models whose projections were being combined and presented to Governor Cuomo by consultants from McKinsey & Co. to assist their ad hoc public health policy making. Had New York state government officials instead known the daily number of new COVID-19 infections had already passed its peak, they almost certainly would not have reached the point of panic they did. Panic that resulted in their creating one of the worse public health outcomes in U.S. history.

Unlike those now mostly-former New York state officials, the IHME is at least learning from its mistakes in modeling 2020's coronavirus pandemic.

Previously on Political Calculations

References

Hammond, Bill. Behind the Curve: The Extreme Severity of New York City's First Pandemic Wave. Empire Center. [PDF Document]. 30 August 2023.

Institute for Health Metrics and Evaluation. COVID-19 estimate downloads. March 25, 2020. [ZIP folder]. Accessed 15 October 2023.

Footnotes from Behind the Curve

[2] https://www.healthdata.org/covid/data-downloads.

[3] David García-García et al., “Identification of the first COVID-19 infections in the US using a retrospective analysis (REMEDID),” Spatial and Spatio-temporal Epidemiology, Vol. 42, August 2022. https://www.sciencedirect.com/science/article/pii/ S1877584522000405#fig0001.

[6] For more on the Cuomo administration’s handling of the pandemic in nursing homes, see the Empire Center’s August 2021 report, “ ‘Like Fire Through Dry Grass’: Documenting the Cuomo Administration’s Cover-up of a Nursing Home Nightmare.” https://www.empirecenter.org/publications/like-fire-through-dry-grass/

Other Notes

* We altered the dimensions of the chart and the line thickness for the IHME estimate of infections. We also added the options for downloading a copy of the chart and sharing it on social media.

Labels: data visualization, health, risk

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.