Two big things happened to the S&P 500 (Index: SPX) in the past week, as the index fell to 4224.16 through Friday, 20 October 2023, a 2.4% week-over-week decline.

The first big thing to happen was a surge in the yield of the 10-year U.S. Treasury, which was accompanied by mortgage rates spiking up to their highest levels since the early 2000s.

The second big thing to happen came on Thursday, 21 October 2023, when Federal Reserve Chair Jerome Powell spoke and signaled the Fed might resume hiking short term interest rates, even though Fed officials were saying the surge in the interest rate yields of Treasuries were doing their job for them.

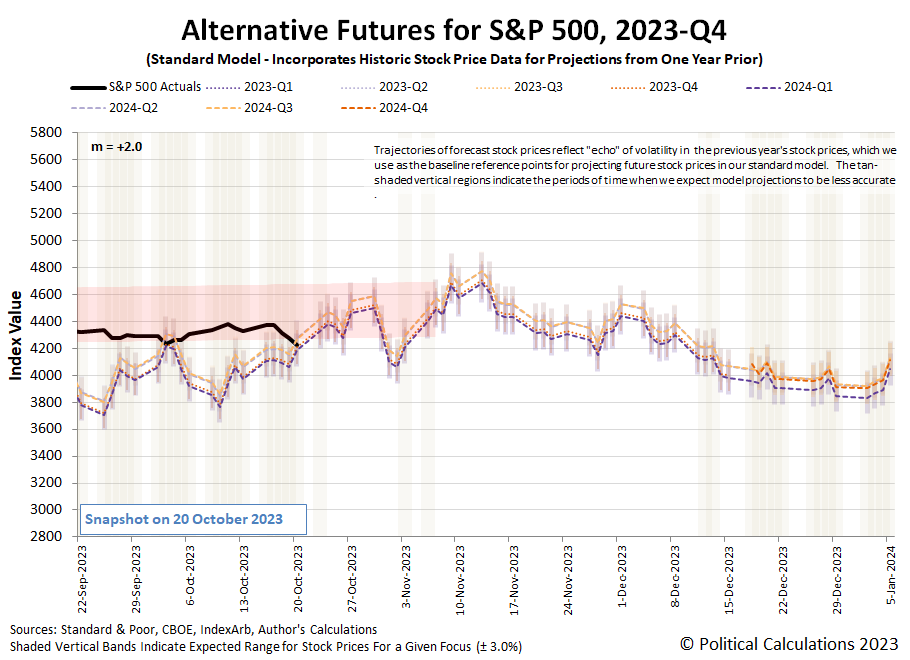

For the market, that statement came as a number of mid-size banks reported lower earnings because of rising interest rates increasing their costs. The combined effect of this new information for investors pushed the trajectory of the S&P 500 below the lower end of the latest redzone forecast range on the dividend futures-based model'a alternative futures chart. Here's the latest update for the chart:

The S&P 500's trajectory breaking below the bottom end of the redzone forecast range comes as the index coincidentally dropped below its 200-day moving average. For the record, the upper and lower limits we set for the redzone forecast range are not based on the moving averages used in technical analysis, which we view as unreliable indicators at best. It's more useful to ask if that change is an an outlier event or a warning signal indicating order is breaking down in the stock market. We'll find out which of these options is the correct reading of what's going on in the stock market soon enough.

While those were the biggest events to move markets during the week that was, here are the week's other market moving headlines to provide more context in what new information investors had to absorb.

- Monday, 16 October 2023

-

- Signs and portents for the U.S. economy:

- Fed minions claim inflation is over, acknowledge they are choking off first time new home buyers, think they have a tough messaging job:

- Fed's Goolsbee says fall in US inflation is not just a blip- FT

- Fed's Harker says high interest rates closing off housing for new buyers

- Fed's Powell faces 'what, me worry?' moment of spiking bond yields, war, political stalemate

- Bigger trouble, provincial government bailouts, more stimulus developing in China:

- China'a Q3 GDP growth seen slowing to 4.4% as headwinds persist: Reuters poll

- China ramps up liquidity support to banking system

- Factbox-China's measures to shore up its indebted property sector

- ECB minions getting results they wanted from rate hikes, claim they won't cut rates any time soon:

- German wholesale prices fall for sixth month in a row

- ECB 'quite some distance' from rate cuts -ECB chief economist

- Wall Street ends up on earnings optimism; eyes remain on Middle East

- Tuesday, 17 October 2023

-

- Signs and portents for the U.S. economy:

- Strong retail sales, factory output point to robust US growth in third quarter | Reuters

- US manufacturing output rises solidly in September

- U.S. home builder confidence falls to lowest since January

- Oil prices edge higher ahead of Biden Middle East trip

- Fed minions thinking they should still worry about inflation, may need to hike rates again:

- Fed's Kashkari: inflation still too high

- Fed's Barkin: can't rely on tightening from long-term rates

- Bigger provincial government bailout developing in China:

- Exclusive-China tells banks to roll over local government debts as risks mount - sources

- Country Garden's entire offshore debt to be in default if Tuesday payment not made

- Nasdaq, S&P, Dow end with small moves as yields soar after hot retail sales data

- Wednesday, 18 October 2023

-

- Signs and portents for the U.S. economy:

- Brent hits $93 as Middle East strife heightens supply concerns

- 30-year fixed-rate mortgage touches 8%, highest level since mid-2000

- Fed minions thinking about sitting on their hands for a longer time:

- Fed on pause as policymakers parse mixed data

- Fed done hiking rates, but higher for longer message gaining traction

- Signs of bigger stimulus getting traction in China:

- Signs of less bad trouble developing in China:

- BOJ minions thinking about raising inflation target to keep never-ending stimulus alive:

- Wall St falls more than 1%; yields rise, investors assess earnings

- Thursday, 19 October 2023

-

- Signs and portents for the U.S. economy:

- Oil settles up 1% on nagging worries about Middle East

- U.S. 10-year Treasury yields hits 5% for first time since 2007

- US existing home sales drop to 13-year low in September

- Fed minions speak, threaten more rate hikes, worried about risk of more bank failures:

- Powell: Strong economy may need more restraint, but bond markets are helping

- Fed's Bostic: Lowering inflation still main US central bank mission

- Fed developing extra 'stress test' scenarios to test for bank weaknesses: official

- BOJ minions get data to absorb, happy about some of it:

- BOJ upbeat on regional Japan but warns of uncertain wage outlook

- Japan's bank lobby head warns of hit to economy from rising yields

- Japan govt considering income tax cut to ease blow from inflation - NHK

- Japan exports hit record level, first rise in three months

- Wall St ends lower on Powell remarks as benchmark Treasury yields near 5%

- Friday, 20 October 2023

-

- Signs and portents for the U.S. economy:

- Oil set for second weekly gain on Gaza escalation fears

- Red October rumbles on as U.S. bond yields touch 5%

- US auto strike's economic fallout starts to hurt global businesses

- Fed minions starting to think they'll need to cut interest rates in second half of 2024:

- Fed has 'some time' to see data before deciding next rate move, says Logan

- Fed's Bostic: possible Fed could lower rates in late 2024 - CNBC

- Fed's Mester says plenty of room left to run on balance sheet drawdown

- Fed's Mester says plenty of room left to run on balance sheet drawdown

- Bigger trouble developing in China:

- BOJ minions get unwelcome sign of inflation, really want to keep never-ending stimulus alive despite signs it shouldn't:

- Japan's property market shows signs of overheating -BOJ

- BOJ will debate pros, cons of unconventional policy at workshop

- Bank of Japan intervenes as 10-year JGB yield hits new decade high

- Japan's core inflation slows below 3% for first time in over a year

- Nasdaq, S&P, Dow end week with hefty losses as focus turns to Q3 earnings deluge

- US mid-sized bank shares slump after downbeat interest income forecasts

The CME Group's FedWatch Tool continues to project the Fed will hold the Federal Funds Rate steady in a target range of 5.25-5.50% through May (2024-Q2), unchanged from last week. Starting from 12 June (2024-Q2), investors expect deteriorating economic conditions will force the Fed to start a series of quarter point rate cuts at six-to-twelve-week intervals through the end of 2024.

The Atlanta Fed's GDPNow tool's forecast of annualized real growth rate during 2023-Q3 increased to +5.4% from last week's forecast of +5.1%. The so-called "Blue Chip Consensus" estimates range from a low of +2.4% to +4.5%, with a median estimate of +3.5%.

Image credit: Stable Diffusion DreamStudio Beta. Prompt: "megan duncanson style painting, angry bear on Wall Street, early stages of sunset, psychedelic effects --ar 16:9".

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.