It used to be that when August ended, Major League Baseball fans had a pretty good idea of which teams were going to contend for the world championship. Those were the days before the number of divisions in each league increased from two to three and MLB also introduced the wild card, which gave a chance to the best teams in baseball that didn't win their division.

Is that still true? And if it is, with sports betting having become so popular, is it worth wagering on the teams with the best odds of winning the World Series at the end of August?

As we write this, we have reached that point in the 2023 season, making these timely questions. Better still, we had no idea what the answer to the questions might be before we took on the challenge of answering them as they had been posed to us.

Here's how we went about answering them. We tracked down the historic odds Las Vegas bookmakers had given each major league baseball team in each season from 2012 through 2022, omitting the coronavirus pandemic-impacted 2020 season that is too different from a regular season to be used for comparison. These years represent what we'll call the modern era for major league baseball's postseason competition.

From 2012 through 2021, that format awarded ten teams in both the American and National Leagues with the opportunity to compete to win the World Series in postseason play, which expanded to twelve teams in 2022. In this format, the three teams from each league that win their divisions get an automatic invitation to post-season play. Then the leagues award several wild card slots to additional teams in each league with the highest regular season winning percentages that didn't win a division title. From 2012 through 2021, that was two extra teams in each league, which expanded to three extra teams in each league starting in 2022.

For our analysis, we only care about the teams Las Vegas bookmakers thought had the best odds of going on to win the World Series as of 1 September during these seasons. In the following table, we've presented the lines for the top three ranked teams in each full season from 2012 through the 2023 season-to-date, only omitting 2020's pandemic-lockdown shortened season that isn't really comparable with the others. We've then indicated which team actually won the World Series and how much money a bettor would have if they wagered $100 on each of the top three teams, who then may or may not have gone on to win the World Series. Here's the table:

| Odds of Winning the World Series as of 1 September | |||||

|---|---|---|---|---|---|

| Season | Most Favored Team (Odds) |

Second-Most Favored (Odds) |

Third-Most Favored (Odds) |

World Series Winner (Odds) |

Post-World Series Outcome of $100 Bets on Each Team |

| 2012 | Texas Rangers (+450) |

New York Yankees (+500) |

Washington Nationals (+650) |

San Francisco Giants (+1200) |

$0 |

| 2013 | Los Angeles Dodgers (+350) |

Detroit Tigers (+500) |

Atlanta Braves (+600) |

Boston Red Sox (+700) |

$0 |

| 2014 | Oakland Athletics (+400) |

Los Angeles Dodgers (+600) |

Los Angeles Angels (+700) |

San Francisco Giants (+2000) |

$0 |

| 2015 | Toronto Blue Jays (+400) |

Kansas City Royals (+500) |

St. Louis Cardinals +600 |

Kansas City Royals (+500) |

$600 |

| 2016 | Chicago Cubs (+250) |

Washington Nationals (+580) |

Texas Rangers (+535) |

Chicago Cubs (+250) |

$350 |

| 2017 | Los Angeles Dodgers (+220) |

Houston Astros (+495) |

Cleveland Indians (+630) |

Houston Astros (+495) |

$595 |

| 2018 | Boston Red Sox (+345) |

Houston Astros (+475) |

New York Yankees (+725) |

Boston Red Sox (+345) |

$445 |

| 2019 | Houston Astros (+230) |

Los Angeles Dodgers (+260) |

New York Yankees (+450) |

Washington Nationals (+2500) |

$0 |

| 2021 | Los Angeles Dodgers (+280) |

Houston Astros (+425) |

Chicago White Sox (+700) |

Atlanta Braves (+1300) |

$0 |

| 2022 | Los Angeles Dodgers (+300) |

Houston Astros (+375) |

New York Yankees (+475) |

Houston Astros (+375) |

$475 |

| 2023* | Atlanta Braves (+320) |

Los Angeles Dodgers (+425) |

Houston Astros (+700) |

TBD | TBD |

The odds in the table represent how much a bettor would win if they placed a simple $100 money line bet on 1 September for the indicated team going on to later win the season's World Series title. If one of these teams win, they would get the $100 they bet on it back plus the payout indicated by the odds. For example, a winning $100 bet on team with a payout line of (+450) would mean our gambler would have $550 (getting their $100 back plus $450 for winning) after the World Series. But since our hypothetical gambler can't predict the future, we've assumed they bet $100 on each of these three teams in each season, so even if one of these teams wins, they would lose the other $200 they bet on the other two teams.

How did our gambler do? First, we found that each of these teams reached the postseason in each full season from 2012 through 2022, so that already gave them a leg up over other teams. But making it into the postseason is only the first hurdle of the challenge. Of these teams, only 4 of Las Vegas' top-ranked teams qualified as wild card contenders, the other 26 were division winners.

Did any of Las Vegas' top-ranked teams go on to win the World Series? Over these 10 full seasons, we find 5 teams managed to hang on and win enough games to claim baseball's world championship. That happened in 2015, 2016, 2017, 2018, and 2022. The winning teams in these years were either ranked first or second by Las Vegas' bookmakers. In only one of these seasons, 2017, did any of the top ranked teams by Las Vegas' odds play each other for baseball's crown.

How did betting on Las Vegas' Top 3 ranked teams work out? In the five seasons where one of Las Vegas' Top 3 teams won the World Series, our gambler would have placed bets totaling $1,500, but would recover $500 and gain $1,965, leaving them with $2,465 in their pocket. That gain seems like it would be a good payout, but that requires ignoring the five other seasons where all of their bets were losing ones. Overall, of the $3,000 they wagered in total, they would have $2,465 left after accounting for all their winnings and losses. That's a net loss of $535 over these ten seasons.

Looking at World Series winners, we find 8 of the 10 teams won their respective divisions, even if the odds of their winning the World Series at the end of August put them outside the Top 3. Only two wild card teams, 2014's San Francisco Giants and 2019's Washington Nationals have won a world championship.

Of the ten World Series that took place over this period, only 2014's fall classic featured two teams that won wild card slots for the postseason. Two additional seasons, 2019 and 2022, featured a regular season division winner against a wild card team. The remaining seven other World Series were strictly between teams that won their divisions during the regular season.

Overall, the expansion of baseball's wild card playoffs have made the outcome of baseball championship race much less wild than we might have guessed. But if you think about it, the bookmakers are the only consistent winners when it comes to gambling on who will win the World Series.

Notes

* Lines from BetMGM on 26 August 2023. We assume these will be reasonably close to the odds that will be recorded for 1 September 2023.

Image credit: Photo by Joshua Peacock on Unsplash.

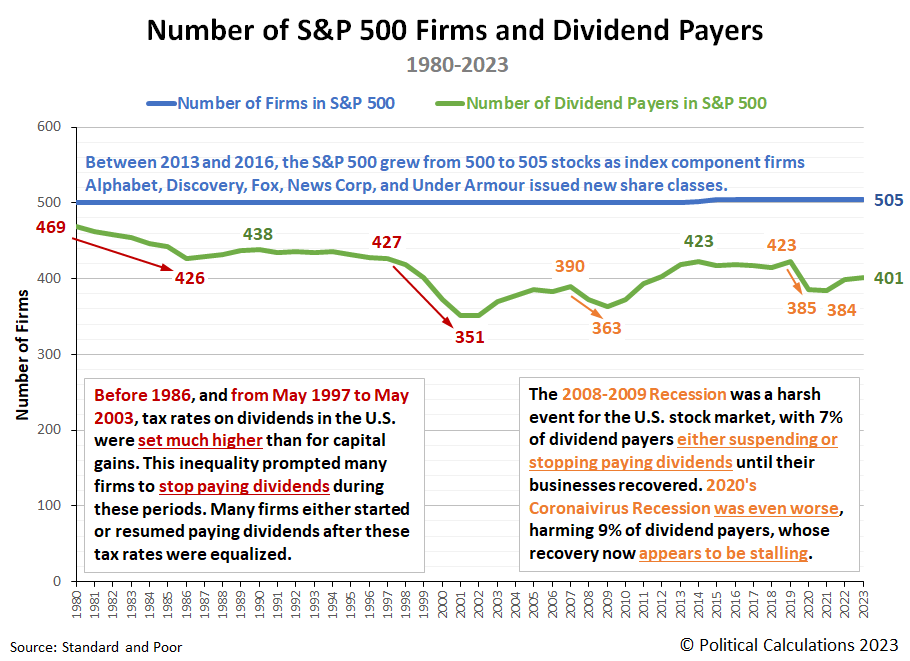

How many companies are in the S&P 500 (Index: SPX)? How many of them pay dividends? What factors affect whether companies pay dividends or not?

The answers to all three of these questions are presented in the following chart!

The data for 2023 is preliminary, reflecting available information as of 31 July 2023.

References

Dai, Zhonglan and Shackelford, Douglas A. and Zhang, Harold Huibing, Capital Gains Taxes and Stock Return Volatility. Available at SSRN: https://ssrn.com/abstract=972349 or DOI: 10.2139/ssrn.972349. 11 August 2010.

De Silva, Matthew. The art and science of stewarding the S&P 500. Quartz [Online Article]. 25 September 2019.

Political Calculations. What Caused the Dot Com Bubble to Begin and What Caused It to End? [Online Article]. 15 December 2010.

Silverblatt, Howard. S&P 500 Indicated Rate Change. Standard and Poor. S&P Dow Jones Indices. [Excel Spreadsheet]. 31 July 2023. Accessed 26 August 2023.

Silverblatt, Howard. S&P 500 Market Attributes Web File. S&P 500 Dividend Payers vs Non-Payers Performance. Standard and Poor. S&P Dow Jones Indices. [Excel Spreadsheet]. 31 July 2023. Accessed 26 August 2023.

Labels: dividends, recession, SP 500, taxes

In 2010, economist Mark Zandi identified weekly chain store sales in a short list of indicators he described being "often misleading". Or rather, data for which he said "the signal to noise ratio is very high and thus hard to interpret."

That was an unfortunate way to phrase that rationale, because he really meant to say the opposite. It is information that comes with a low signal-to-noise ratio that's problematic, because it's having too much noise and not enough signal that makes it tough to find out what you want to know in that situation.

Knowing that, what exactly is it about weekly chain store sales that makes it less than useful for an analyst who might be attempting to divine the direction of the economy?

Just for fun, we asked ChatGPT the question "what makes weekly chain store sales data less than useful for analysis?" Here's how the AI system responded:

Weekly chain store sales data can be less useful for analysis because it only provides a snapshot of sales activity for a given week. It doesn’t provide any information about the underlying trends or patterns that may be driving those sales. Additionally, weekly chain store sales data may not be representative of overall retail sales trends, as it only captures sales activity at a subset of retail stores.

The point about the data only coming from a small subset of retail stores is a good one. Trading Economics describes what the data specifically covers:

In the US, chain store sales refer to retail sales of goods and services in department stores excluding discount department stores. Values are based on data from the Monthly Retail Trade Survey. The survey covers companies with one or more establishments that sell merchandise and related services to final consumers, such as furniture & home furnishings; electronics & appliances; clothing & accessories; sporting goods, hobby, musical instrument, and book; general merchandise; office supply, stationery, and gift stores. Chain store sales do not include data from online-only stores.

How good is that data? We found a 1996 research paper by New York Fed economists Ethan S. Harris and Clara Vega that describes the potential usefulness of the weekly chain store sales data for analysts:

Our empirical tests provide mixed support for the use of chain store data. On the one hand, we find that weekly indexes and monthly reports from individual companies are too erratic to be useful for forecasting. On the other hand, we find that monthly chain store indexes, if given the appropriate weights in forecast models, add significantly to the accuracy of in-sample and out-of-sample predictions for several measures of consumer spending.

In other words, provided you weight it and combine it with other economic variables, you could get useful results from monthly chain store sales data. But the weekly chain store sales data is pretty close to garbage for getting any kind of accurate picture of the current state of retail sales, much less finding any trends that might be useful for forecasting their future.

Harris and Vega also cited the small fraction of consumer spending in the chain store sales data as a weakness in their 1996 paper. Since then, that fraction of total consumer spending has shrunk, where the chain store sales data omits sales at online retailers like Amazon or the discount dollar store retailers that have come to dominate consumer retail transactions in many regions of the U.S. The chain store sales data has a growing hole in what it data covers.

Let's summarize what's wrong with weekly chain store sales data. It's erratic. It doesn't cover a large enough sample of retail sales to be able to tell much about them or where they might be going. Its problems have been getting worse over time.

Now for the good news. Aside from Trading Economics' continuing tracking of the data series, weekly chain store sales data has nearly disappeared from regular media reporting. It appears to have lasted into 2020 at one outlet, but the top search results on Google include articles from 2002, 2007, and 2016. We did find weekly chain store sales mentioned in a 2023 article, but it is in reference to a different, more comprehensive weekly data series, which is not the same animal.

It's quite possible the weekly chain store sales data Trading Economics tracks to this day is the zombie remnant of a data series that's barely hanging on, but whose time has finally passed!

Previously on Political Calculations

- Less Than Useful Data in the World of Big Data

- Less Than Useful Data: Consumer Confidence

- Less Than Useful Data: FHFA House Price Index

- Less Than Useful Data: Index of Leading Economic Indicators

- Less Than Useful Data: Weekly Chain Store Sales

Image credit: Photo by Daniel Jensen on Unsplash.

Labels: ideas

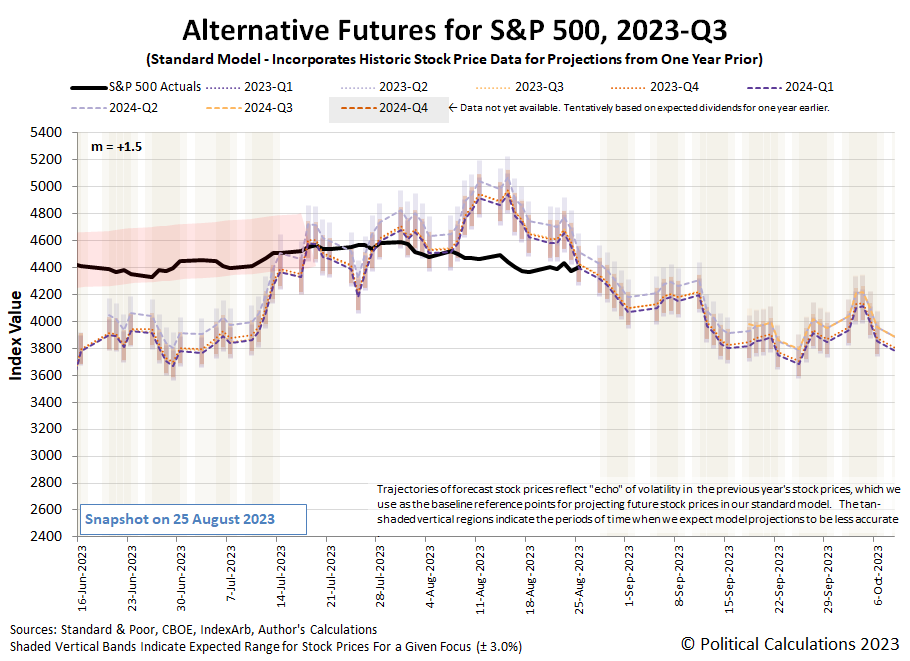

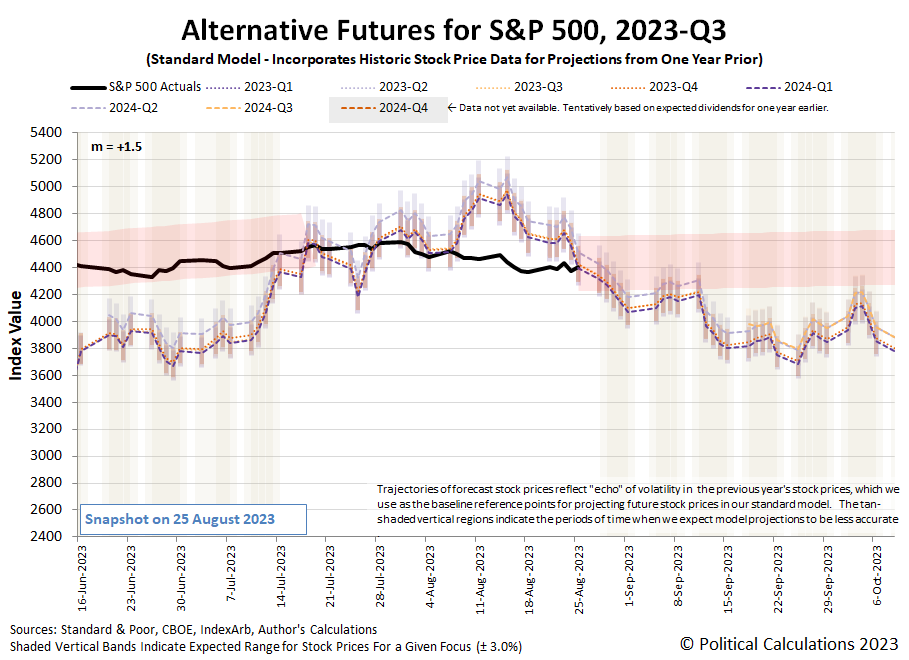

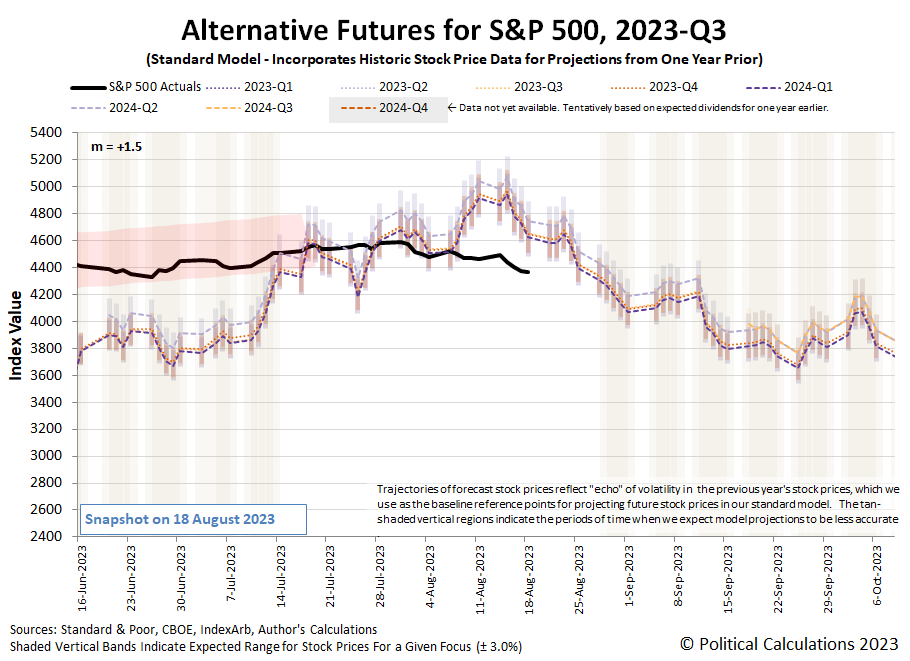

For the S&P 500 (Index: SPX), there may as well have been only one event taking place during the past week.

That event was the Federal Reserve's annual getaway meeting at Jackson Hole, Wyoming, at which Fed Chair Jerome Powell addressed inflation and the Fed's path ahead in charting a course to deal with it on Friday, 25 August 2023. Compared to the speech Powell gave last year, this year's speech was more positive for investors. The S&P 500 (Index: SPX) rose after Powell's speech, ultimately ending the week at 4405.71, a 0.8% increase over the prior week's close.

For us, because of intense interest investors have for the direction for the Federal Reserve's monetary policies, Powell's speech serves as a calibration point for setting the value of the multiplier in the dividend futures-based model. The event allowed us to confirm our current estimate of the multiplier's current value of +1.5 is still valid, with investors closely focused on the upcoming fourth quarter of 2023, which coincides with the expected timing of the Fed's next actions to change interest rates.

Here's what that looks like on the latest update for the alternative futures chart:

Speaking of charting courses, that brings us to our next challenge. The chart indicates the accuracy of the dividend futures-based model's projections of the future for the S&P 500 will soon be impacted by the echo effect. This is a consequence of using historic stock prices as the base reference points from which the model's projections of the future are made, where the past volatility of stock prices affects the model's projections of the future.

To compensate for that effect, we've added a new redzone forecast range to the chart, which we've anchored at the level of the S&P 500 on Friday, 25 August 2023. The opposite end of the forecast range is anchored to the projections associated with investors focusing on 2023-Q4 on 7 November 2023, after the echoes of past stock price volatility have dissipated.

Here's that version of the chart, which we'll be updating and presenting in the weeks ahead.

Since we discussed how we generate redzone forecast ranges in previous editions of the S&P 500 chaos series, we won't repeat that description here. Let's get to the handful of market-moving headlines that appeared in the newstreams of the past week.

- Monday, 21 August 2023

-

- Signs and portents for the U.S. economy:

- Crude oil settles lower as hope fades for Chinese demand

- Majority of small businesses believe US is in recession

- Fed minions think future economic growth will be weak:

- Bigger trouble and stimulus developing in China, government-run banks "mopping up" weak yuan:

- China's fiscal revenue slows as economy struggles

- China surprises with modest rate cut amid growing yuan risks

- China state banks seen mopping up offshore yuan to stem currency weakness

- Bigger trouble developing in the Eurozone; ECB minions getting results they wanted:

- Downturn in German housing construction worsens in July - Ifo

- German producer prices post first fall since late 2020

- Nasdaq rallies with Nvidia, tech shares; investors look toward Jackson Hole

- Tuesday, 22 August 2023

-

- Signs and portents for the U.S. economy:

- Oil prices settle lower on nagging worries about Chinese demand

- US existing home sales slide again, but prices up from a year earlier

- Fed minions claim they're worried about return of higher inflation, among other things:

- Strong US data makes 'reacceleration scenario' possible, Fed's Barkin says

- Fed doves, Fed hawks: US central bankers in their words

- BOJ minions claim they're not talking about propping up yen, ex-BOJ minion describes when they will:

- BOJ's Ueda meets premier, says didn't discuss recent yen volatility

- Ex-BOJ official predicts no yen intervention until breach of 150 threshold

- Dow, S&P 500 end down as US interest-rate worries mount, bank shares slip

- Wednesday, 23 August 2023

-

- Signs and portents for the U.S. economy:

- US bond yields surge despite muted inflation as investors look beyond Fed

- US 30-year mortgage rate soars to highest since 2000

- Oil slides on grim manufacturing data

- US job growth in year through March was less than estimated

- US economy near stalling point as consumer demand weakens, survey says

- Bigger trouble developing in China:

- Japanese economy shrinks more slowly:

- Much bigger trouble developing in the Eurozone, ECB minions expected to pause rate hikes:

- German business activity suffers steepest decline since May 2020-flash PMI

- Investors expect ECB rate-hike pause in September after dismal PMIs

- Indexes end sharply higher; AI chip maker Nvidia jumps again after the bell

- Thursday, 24 August 2023

-

- Signs and portents for the U.S. economy:

- Oil settles up, rebounds from lows after European storage report

- US economic activity picked up in July - Chicago Fed

- US department stores see higher credit delinquencies amid strained spending

- Fed minions like interest rates rising without them having to hike them, don't like "spend-happy" Americans:

- Two Fed officials tentatively embrace bond yield jump

- Fed's Collins: May be at a place where Fed can hold steady - Yahoo Finance

- Fed's Harker expects no more rate hikes needed this year, in CNBC interview

- Fed struggles to gain traction in battle with spend-happy consumers

- Wall St ends down sharply, focus shifts to upcoming Powell speech

- Friday, 25 August 2023

-

- Signs and portents for the U.S. economy:

- Oil futures up 1% to one-week high on soaring US diesel prices

- Large US homebuilders raise prices as existing home supply remains tight

- Expectations before Fed minion's Jackson Hole speech:

- Powell Talks At Jackson Hole, Says Nothing

- Fed's Powell: higher rates may be needed, will move 'carefully'

- Factbox-Highlights of Fed Chair Powell's Jackson Hole speech

- Rate hike chances rise after remarks by Fed's Powell

- Bigger trouble developing in China, currency bailout taking shape:

- Analysis-China has no pain-free solutions for its slowing economy

- Exclusive-China steps up yuan defence with bond limit guidance - sources

- BOJ minions expected to keep never-ending stimulus alive for another year despite inflation:

- BOJ will keep current policy until at least July 2024, most economists say: Reuters poll

- Inflation in Japan's capital slows in August, stays above BOJ target

- Bigger trouble developing in the Eurozone, expectations grow ECB minions will pause rate hikes:

- Gloomy Ifo fuels fears of second German recession in a year

- Euro zone inflation to remain "too high for too long" - Bank of Spain deputy chief

- Momentum growing for ECB rate hike pause as growth falters -sources

- Nasdaq, S&P 500 snap three-week losing streak, Dow ends slightly lower

The CME Group's FedWatch Tool continues to show no rate hike in September (2023-Q3), though it gives a greater than 50% probability the Fed will hike rates by a quarter point when it meets on 1 November (2023-Q4), which is now expected to stick nearly all the way through January 2024. However, on 31 January (2024-Q1), investors now expect the Fed to start a series of quarter point rate cuts that will continue at six-to-twelve-week intervals through the end of 2024.

The Atlanta Fed's GDPNow tool now predicts an annualized real growth rate of +5.9% during 2023-Q3 which is up a tick from the previous week's estimate of +5.8%.

Image credit: Photo by orbtal media on Unsplash.

For mathematicians, prime numbers are special. Values that are only evenly divisible by themselves and one, they can be combined through either addition or multiplication to produce every positive integer greater than two, which makes them the building blocks of the set of all whole numbers.

But if you search for prime numbers, you'll find they're not evenly distributed among all those positive integers. While they are really dense at the low end of the positive number line, they thin out and appear less and less frequently as the count of numbers grows ever higher.

That leads to a natural question. If you count high enough, will you run out of prime numbers to discover?

Mathematicians are happy to confirm the answer to that question is no. There's always another larger prime number to be found!

They can confirm that characteristic of prime numbers with certainty thanks to one of the world's oldest mathematical proofs that was documented by the Greek mathematician Euclid around 2,300 years ago. James Grime talks through Euclid's proof in the following seven minute Numberphile video, in which the trick is to assume you can produce a list that contains all prime numbers, then prove that assumption is wrong:

Euclid's logic confirming prime numbers extend into infinity is an example of a proof by contradiction. It's a twisty-turny way of thinking, but one that works.

Here's something else that's neat about the prime numbers of Euclid's proof. If you remember that grid of numbers illustrating patterns of primes we introduced a while back, you'll always find prime numbers that satisfy Euclid's logic in the Set F column of the table.

For example, if we make a set of primes using just the first two in the table, the values 2 and 3, multiplying them together produces 6. Adding 1 to that value gives us 7, which is our first Euclid Set F prime number result if we treat Euclid's proof like an algorithm.

Let's take that algorithm one step further and include the third prime, 5, in the set of primes. Multiplying 2, 3, and 5 together results in a product of 30. Add 1 to that product, and we find 31 is our second Euclid Set F prime.

If we expand the list of primes to include 2, 3, 5, and 7, we find their product is 210 after multiplying them together. Adding 1, we reach the end of the presented table with our third Euclid Set F prime, 211.

We could continue, but since we've exceeded the listed values of the table, let's talk about why that works!

In the table, Set F values are always the result of taking a multiple of 6 and adding 1 to it. The way the table is set up, you can take the value 6, multiply it by the row number (ROW), and add 1 to produce the results shown in the Set F column.

Set F Value = 6*ROW + 1

Euclid's proof is doing identical math! The product of the first two prime numbers, P₁ (2) and P₃ (3), is 6, so we can extract them from the rest of the prime number multiplications:

Q = P₁*P₂*P₃*...*Pₙ + 1

Q = (P₁*P₂)*(P₃*...*Pₙ) + 1

Q = (2*3)*(P₃*...*Pₙ) + 1

Q = 6*(P₃*...*Pₙ) + 1

In this formulation, the product of the prime numbers P₃ through Pₙ is equivalent to the row number of the table. Recognizing that equivalence, we get:

Q = 6*ROW + 1

Where the Euclid prime Q will therefore always be a Set F value from the table. Specifically, they're the ones that correspond to the row numbers that are the cumulative products of prime numbers greater than 3.

Meanwhile, the largest confirmed prime numbers, which belong to the Mersenne family of prime numbers, are also all Set F primes, but that's a different discussion for another day....

References

Ansh Pincha. The Infinitude of Primes — Euclid’s proof. Quantaphy. [Online Article. 13 August 2023.

Chris K. Caldwell. Euclid's Proof of the Infinitude of Primes (c. 300 BC). PrimePages. [Online Article]. 2021.

Chris K. Caldwell. Proofs that there are infinitely many primes. PrimePages. [Online Article]. 2021.

Euclid. Proposition 20. Elements, Book IX. Circa 300 B.C.

Image credit: Photo of Prime Tower in Zurich, Switzerland by Claudio Schwarz on Unsplash.

Labels: math

The real estate market for single family homes can be described by two recent headlines that appeared within a day of each other. Can you tell what direction the U.S. home market is going from them?

- US existing home sales slide again, but prices up from a year earlier

- US new home sales rise in July, prices fall on annual basis

What's going on is really a tale of supply, demand, and interest rates. The available supply of existing homes has plummeted while U.S. mortgage rates have risen and demand has remained relatively high. That's a recipe for falling affordability because it results in high home prices and rising mortgage payments.

Existing homeowners, many of which financed their houses at very low mortgage rates in recent years, have become "trapped" in their homes. They are not able to afford either today's higher home sale prices or inflated mortgage payments. And that's only gotten worse with mortgage rates hitting their highest level during the 21st century within the past week. They cannot afford to move and because they cannot, they aren't putting their homes up for sale. That dynamic is what's behind the falling supply of existing homes for sale.

That lack of supply is forcing Americans who are shopping for homes to turn to the new home market to meet their demand. This increased demand has been boosting new home sales at the expense of the shrinking existing home market.

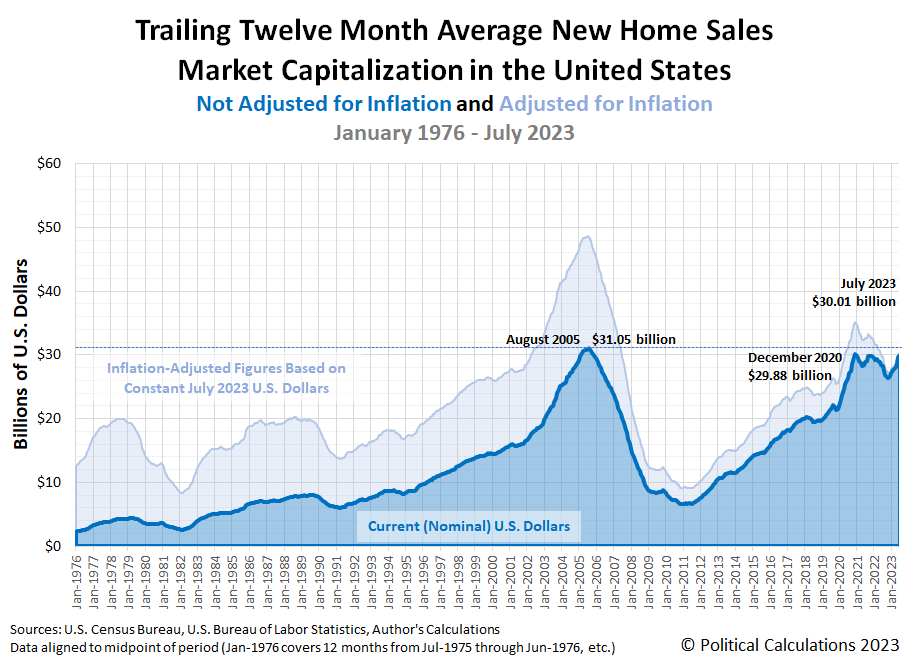

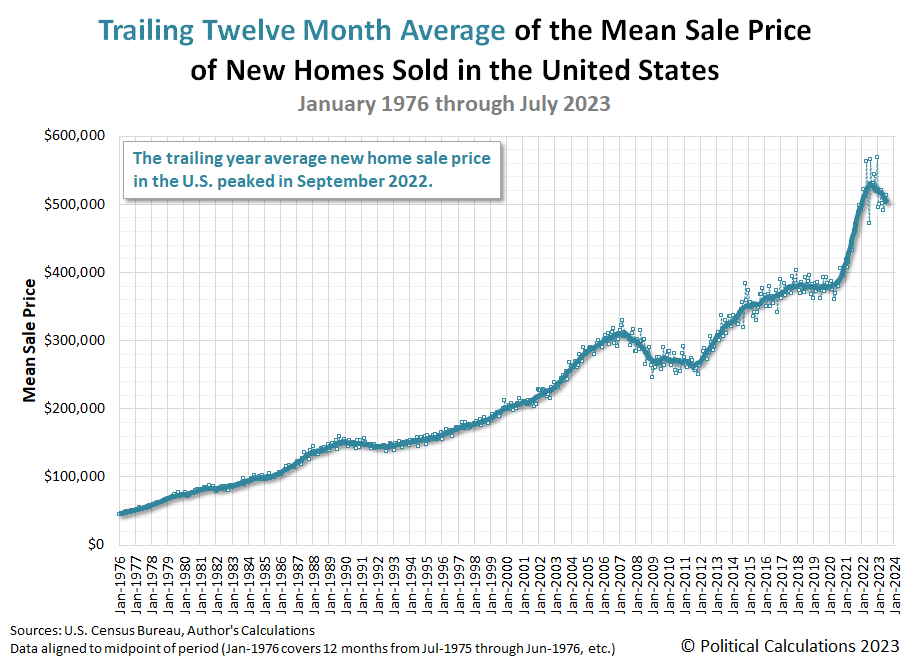

How much it's has been boosting the new home market can be seen in the following charts, which reveal the continuing upward momentum for new home sales in the United States. The initial estimate of the market capitalization of the U.S. new home market during the month is $30.01 billion, up from June 2023's initial estimate of $29.43 billion. New home sales, which have been rising since their trailing twelve month average bottomed in September 2022 to an initial estimate of 674,000. The average sale price of a new home has been falling since September 2022, but remained elevated above the $500,000 mark in July 2023.

Here is the latest update to our chart illustrating the market capitalization of the U.S. new home market:

The next two charts show the latest changes in the trends for new home sales and prices:

For analysis of the existing home market in the U.S., we'll turn to Region Bank's Richard Moody, who notes that part of the U.S. real estate market still hasn't hit bottom:

Existing home sales fell to an annualized rate of 4.070 million units in July from June’s sales rate of 4.160 million units.

Months supply of inventory stands at 3.3 months; the median existing home sale price rose by 1.9 percent year-on-year.

Total existing home sales fell to an annualized rate of 4.070 million units in July, just a bit short of our below-consensus forecast of 4.090 million units. On a not seasonally adjusted basis, there were 372,000 existing homes sold in July, below the 382,000 sales our forecast anticipated. Keep in mind that existing homes are booked at closing, so July closings would mostly reflect sales contracts signed from late-May through June. In other words, the July data on existing home sales reflect some, but by no means all, of the recent run-up in mortgage interest rates, effects that will be felt more fully in the August data. In addition to higher mortgage interest rates, lack of inventory also weighed on July sales, and while this is an old story, literally years old, it has been given a new twist by higher mortgage interest rates making current owners less inclined to trade up into a mortgage interest rate significantly higher than their existing rate. Turnover of the existing housing stock has for years been abnormally low, mainly reflecting demographic shifts, and is now even lower thanks to higher mortgage interest rates. This has helped steer prospective buyers to the market for new homes, but that there is still considerable pent-up demand for home purchases is evidenced by already low times on market being pushed lower while prices are once again being pushed higher, with the median existing home sales price up 1.9 percent year-on-year, ending a run of five straight months of over-the-year declines. At July’s sales rate, inventories of existing homes for sale were equivalent to 3.3 months of sales, far short of the 5.5-to-6.0 months indicative of a balanced market.

CNBC might have stumbled into the best description of the situation facing existing home owners. Rising mortgage rates have created a "golden handcuff effect" for them:

The recent spike in mortgage rates has created a so-called golden handcuff effect. The term is often used to describe financial incentives employers may offer to discourage employees from leaving a company. For homeowners, a low mortgage rate is similar.

Most homeowners today have mortgages with interest rates below 4% or even below 3%, after moving or refinancing when rates hit record lows during the Covid pandemic.

Nearly 82% of home shoppers said they felt “locked-in” by their existing low-rate mortgage, according to a recent survey by Realtor.com.

Because of that, there is a critical shortage of homes for sale, with year-to-date new listings roughly 20% behind last year’s pace.

At least we're not the only ones seeing it.

References

U.S. Census Bureau. New Residential Sales Historical Data. Houses Sold. [Excel Spreadsheet]. Accessed 23 August 2023.

U.S. Census Bureau. New Residential Sales Historical Data. Median and Average Sale Price of Houses Sold. [Excel Spreadsheet]. Accessed 23 August 2023.

Image credit: Photo by Avi Waxman on Unsplash.

Labels: real estate

The outlook for S&P 500 (Index: SPX) quarterly dividends per share continued to improve during the three months since our previous regular snapshot.

That's good news following the turmoil earlier this year kicked off by the Silicon Valley Bank run on 10 March 2023. Dividend futures quickly collapsed with projected dividends for the index in 2023-Q4 dropping from $16.99 to $15.94 per share by 29 March 2023.

By 24 April 2023 however, they had recovered to $16.95 per share, but that was before First Republic Bank's and PacWest Bank's reported troubles, which sent the expected dividends for 2023-Q4 back down to $16.75 per share, which is where it was at our last snapshot from 8 May 2023.

Since then, the S&P 500's expected dividends for the fourth quarter of 2023 have continued their rocky recovery path. The following chart shows what the outlook is for the S&P 500's dividends as of our latest snapshot on 18 August 2023.

We find the S&P 500's projected quarterly dividends per share for the fourth quarter of 2023 has risen to $17.03 per share in this new snapshot. However, in between 8 May 2023 and 18 August 2023, the projected dividends per share for this quarter had risen as high as $17.17 per share on 24 July 2023 before retreating to its current level. The path for the S&P 500's dividends per share continues to be rocky.

We'll take our next scheduled snapshot of the outlook for the S&P 500's quarterly dividends per share in about three months.

Labels: dividends, forecasting, SP 500

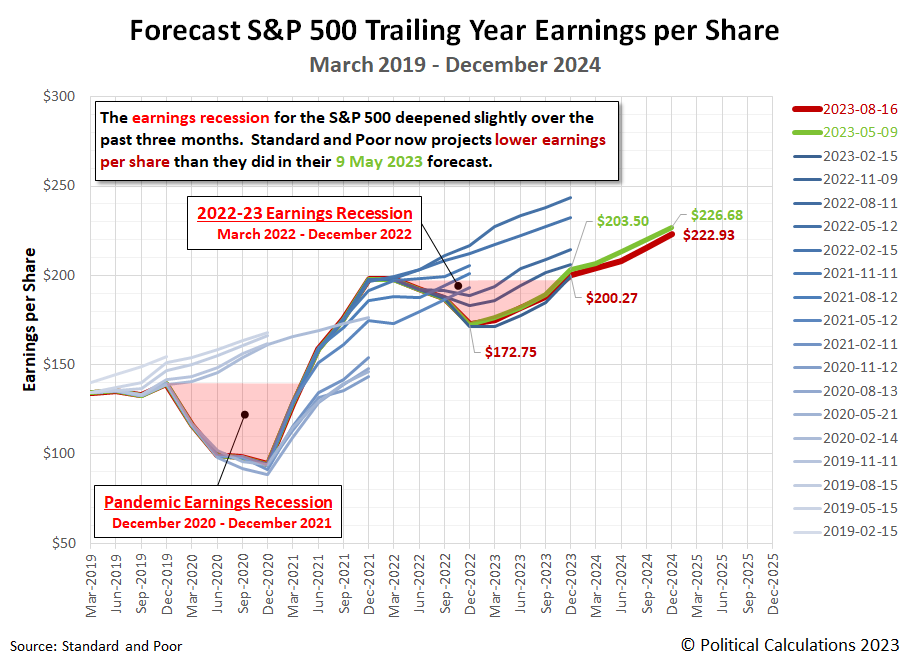

Every three months, we take a snapshot of the expectations for future earnings in the S&P 500 (Index: SPX) at approximately the midpoint of the current quarter, shortly after most U.S. firms have announced their previous quarter's earnings.

Since our last update three months ago, expectations for the S&P 500's earnings have dimmed slightly. Expectations for the index' future earnings per share through the end of 2023 has decreased from $203.50 to $200.27.

Never-the-less, that's still high enough to indicate a full recovery from 2022's earnings recession is still on track for the fourth quarter of 2023.

The following chart illustrates how the latest earnings outlook has changed with respect to previous snapshots:

Standard and Poor's projections through the end of 2024 also showed a small decline in thie index' earnings per share. They show the S&P 500's earnings per share decreasing to $222.93 from the $226.88 expected three months ago.

About Earnings Recessions

Depending on who you talk to, an earnings recession has one of two definitions. An earnings recession exists if either earnings decline over at least two consecutive quarters or if there is a year-over-year decline over at least two quarters. The chart identifies the periods in which the quarter-on-quarter decline in earnings definition for an earnings recession is confirmed for both the Pandemic Earnings Recession (December 2020-December 2021) and the new earnings recession (March 2022-December 2022) according to the first definition. The regions of the graph shaded in light-red correspond to the full period in which the S&P 500's earnings per share remained below (or are projected to remain below) its pre-earnings recession levels.

Our next snapshot of the index' expected future earnings will be in three months.

Reference

Silverblatt, Howard. Standard & Poor. S&P 500 Earnings and Estimates. [Excel Spreadsheet]. 16 August 2023. Accessed 16 August 2023.

Labels: earnings, forecasting, SP 500

There were two sets of news headlines that combined to impact the U.S. stock market during the trading week ending Friday, 18 August 2023.

Domestically, Fitch Rating's threatened downgrade of a dozen banks in the U.S., including JP Morgan Chase (NYSE: JPM) underscored the growing risks on their balance sheets from the Federal Reserve's series of rate hikes. The rate hikes have resulted in the rapid accumulation of unrealized losses for banks with large holdings of U.S. Treasuries, putting them at risk of failing like Silicon Valley Bank and other smaller banks did earlier in the year.

Internationally, the biggest economic story in the world continues to be China's sputtering economy. The Chinese government's action to terminate the reporting of its youth employment statistics revealing its developing troubles indicates those building problems are bigger than it wants to admit. At the same time, the government's official economic statistics agency is attempting to minimize the perceived risk to China's economy from the heavy debts of its real estate sector and the country's local governments.

For the S&P 500 (Index: SPX), the looming potential downgrades of U.S. banks carried more weight, leading the index to fall to 4369.71, a 2.1% decline from the previous week’s close. Here's the latest update to the alternative futures chart for the third quarter of 2023:

We've refrained from adding a redzone forecast chart to account for the deviation from the dividend futures-based model's projections over the last couple weeks for two reasons. First, the current deviation from the model's echo effect will be short-lived, as we expect the trajectory of the index to rejoin the model's projections on Friday, 25 August 2023. That will coincide with Jerome Powell's address at the Federal Reserve's Jackson Hole annual summer get-a-way.

Second, we'll be using that date as the starting anchor point for a much longer redzone forecast range that will last into mid-November 2023. We'll be adding that new redzone forecast range to the chart in the next edition of the S&P 500 chaos series.

But, that doesn't mean you can't sketch your own redzone forecast range on the chart for this short period! All you need to do is connect the dots for where the S&P 500 was on Monday, 7 August 2023 with where the dividend futures-based model projects it will be on Friday, 25 August 2023.

That raises the question of "which projection?", but that's easily answered. Investors are currently focused on 2023-Q4 in setting current day stock prices, so you would use the projection associated with that future quarter. It's not your imagination. It really is that easy, and the S&P 500 is already about two-thirds of the way there!

Here is our summary of the past week's market moving headlines:

- Monday, 14 August 2023

-

- Signs and portents for the U.S. economy:

- Fed minions counting on slowing rents to beat inflation down to 2% target:

- A smooth 'last mile' to 2% inflation may not be a stretch for Fed

- Not So Fast With The CPI Celebrations: Rents Are Surging Again And Back To Record Highs

- Bigger trouble developing in China:

- S&P 500, Nasdaq end up as Nvidia surge leads megacap higher

- Tuesday, 15 August 2023

-

- Signs and portents for the U.S. economy:

- U.S. gasoline prices at year high, tight supply weighs on motorists

- US import prices rebound in July, trend remains soft

- Fed minions claim they're not done with rate hikes yet:

- Strange things going on with official Chinese stats:

- China to stop releasing youth jobless rate data from Aug, says stats bureau

- China stats bureau sees no deflation risks, plays down property woes

- Bigger trouble developing in China:

- China's property investment slides for 17th month in July

- Explainer-How much worse can China's economic slowdown get?

- Suddenly much bigger stimulus developing in China:

- China central bank unexpectedly cuts rates to support sputtering economy

- China cuts key rates as weak batch of July data darken economic outlook

- Bigger fiscal stimulus developing in Eurozone:

- Broad Market Selloff Sends S&P 500 Below Its 50 Day Moving Average

- Wednesday, 16 August 2023

-

- Signs and portents for the U.S. economy:

- Motor vehicles lift US manufacturing output in July

- Oil settles lower as China fears, rate hikes counter tight US supply

- US weekly jobless claims fall as labor market remains tight

- Atlanta Fed model lifts US third quarter GDP view to 5.8%

- Fed minions divided in July over need for more rate hikes, minutes show

- Bigger trouble developing in China:

- China's economic woes mount as trust firm misses payments, home prices fall

- Analysis-Country Garden undone by promise to bring 5-star life to China's hinterland

- Chinese asset manager eyes restructuring to ease liquidity crunch amid contagion fears

- Bumpy road for China's ride hailing drivers as economy slows

- BOJ minions thinking about intervention to keep yen from falling:

- Stocks, oil slide as Fed mulls rates and China struggles

- Thursday, 17 August 2023

-

- Signs and portents for the U.S. economy:

- U.S. 10-year Treasury yield hits highest since October, drags on shares

- Oil edges up as China seeks to calm economic fears

- US weekly jobless claims fall as labor market remains tight

- US 30-year fixed mortgage rate jumps to near 21-1/2-year high

- U.S. Mid-Atlantic manufacturing sky-rockets to 16-month high

- Fed minions set date for their biggest event of the summer:

- Bigger trouble developing in China as investors bet on bailout:

- China investors jump into municipal bonds, hopes of state support outweigh debt woes

- Chinese asset manager eyes restructuring to ease liquidity crunch amid contagion fears

- Analysis: Why is China not rushing to fix its ailing economy?

- Chinese central bank issues warnings while promising stimulus:

- China cenbank says it will keep policy 'precise, forceful' to aid recovery

- Chinese banks should keep a 'proper level' of profit margins -central bank

- Bigger trouble developing in the Eurozone:

- Wall Street ends lower on healthcare losses, interest rate jitters

- Friday, 18 August 2023

-

- Signs and portents for the U.S. economy:

- "Slim" majority of economists say Fed minions done with rate hikes:

- Bigger trouble developing in China:

- China Evergrande seeks Chapter 15 protection in Manhattan bankruptcy court

- China trust deficit: crisis spurs shadow banking policy response calls

- Analysis-China's sputtering economy curbs outlook for diesel demand for rest of 2023

- Other signs of China's trouble spreading in Asia:

- Malaysia posts weakest GDP growth in nearly 2 years as exports slump

- Taiwan sees economic growth this year at slowest in 8 years

- Japan exports fall for first time since 2021, stoking concerns about economy

- Bigger stimulus developing in China:

- BOJ minions see justification to keep never-ending stimulus alive:

- ECB minions thinking about declaring victory over inflation despite sluggish economy in Germany, want to keep Eurozone banks from new taxes in EU countries:

- Euro zone inflation fall confirmed, easing pressure on ECB to hike

- Euro zone set for growth over next 'couple' of years - ECB's Lane

- German home building permits tumble amid calls for stimulus

- ECB to raise objections to Italy's windfall tax on banks - press

- Nasdaq, S&P 500 and Dow finish relatively unchanged as yields cool a bit

The CME Group's FedWatch Tool developed an interesting quirk this week. While it continues to show no rate hike in September (2023-Q3), it is now giving a greater than 50% probability the Fed will hike rates by a quarter point when it meets on 1 November (2023-Q4). But only for six weeks, because it also shows the Fed reversing to cut rates by a quarter point just six weeks later in December (2023-Q4). After that, it anticipates no other rate changes through May 2024, followed by a series of quarter point rate cuts will begin as early as 12 June (2024-Q2) and continue at six-to-twelve-week intervals through the end of 2024.

The Atlanta Fed's GDPNow tool strapped its estimate of real GDP growth in 2023-Q3 onto a rocket in the last week. It is now predicting annualized real growth of +5.8%, which is up a lot from the previous week's estimate of +4.1%. It's also much higher than the top end of the projected range for the so-called "Blue Chip Consensus" for the quarter. We'll find out which set of forecasters is more right a little over two months from now.

Image credit: Photo by Ussama Azam on Unsplash.

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.