The final week of May 2022 saw the S&P 500 (Index: SPX) deliver the index' sixth Lévy flight event of the year. In doing that, the index rose 6.6% from where it ended the previous week. The week-over-week increase breaks what had been the worst start for the S&P 500 for any year since 1939.

The move came as investors shifted their forward looking attention away from 2022-Q2 toward 2022-Q3. This shift has been expected since investors drew in their focus on 2022-Q2 back on 5 May 2022. Here's what the shift in the time horizon of investors looks like on the latest update to the dividend futures-based model's alternative futures chart:

The news that prompted the shift were the 23 May 2022 comments by Atlanta Fed President suggesting the Federal Reserve would pause its planned rate hikes after September 2022 (2022-Q3). Such a pause would be needed should the economy slow faster than the Fed desires as it tries to slow inflation, so Bostic's comments effectively closed the door on the possibility of the Fed announcing a three-quarter point rate hike in 2022-Q2. His comments then combined with other news during the remainder of the week to redirect investors to reset their forward-looking attention onto 2022-Q3 as the period of interest to focus upon next.

All that was left was a short squeeze to provide the mechanism by which the large upward move in stock prices would take place. Here, a number of unlucky hedge fund managers were happy to fuel what became the S&P 500's sixth Lévy flight event of 2022.

We don't often call our shots, so let's recap the key part of last week's edition of our S&P 500 chaos series, where we did just that:

... the clock is ticking down for how long investors can continue to fix their focus on 2022-Q2, which points to a potential investing opportunity that will exist until their forward-looking attention does shift to another point of time in the future in what will be the stock market's next Lévy flight event.

The lowest risk part of that specific investing opportunity is now gone, but there's still some upside remaining. Provided of course that investor expectations for dividends in future quarters don't erode, which would coincide with the U.S. economy becoming so pinched by inflation and the Fed's attempts to rein it in that it falls into recession.

We did mention that investors were influenced by other news during the week. Here's our summary of the market moving headlines that made up the random onset of news that investors continuously absorb:

- Monday, 23 May 2022

- Signs and portents for the U.S. economy:

- Fed minions meet the new boss, same as the old boss; start getting cold feet about rate hikes:

- Powell sworn in to second four-year term as U.S. Fed chief

- Fed's Bostic suggests pausing rate hikes in September to assess impact

- Bigger trouble, stimulus developing in China:

- China lockdowns, war risk derailing global jobs recovery: ILO

- China says it will take targeted steps to support the economy

- ECB minions say they're thinking about hiking rates later in 2022:

- Eurozone minions thinking about stopping doing so much stimulus:

- Wall Street rallies on back of big tech, banks

- Tuesday, 24 May 2022

- Signs and portents for the U.S. economy:

- U.S. business activity slows in May, survey shows

- Record high U.S. house prices, rising mortgages depress new home sales

- Fed minions starting to get cold feet on rate hikes:

- Fed policymakers back two more big rate hikes, but then what?

- As Fed amps up inflation fight, one policymaker urges caution

- NY Fed sees 3-yr balance sheet rundown to $5.9 trln, slow MBS decline absent sales

- Bigger trouble developing in China, United Kingdom:

- China's property market woes expected to worsen in 2022 - Reuters poll

- Sharp slowdown in UK business activity rings recession alarm

- Positive signs in the Eurozone:

- Euro zone business growth slowed in May but still resilient -PMI

- German economy remains on growth path for now -PMI

- S&P 500, Nasdaq slide as weak economic data, dire outlooks stoke recession fears

- Wednesday, 25 May 2022

- Signs and portents for the U.S. economy:

- U.S. core capital goods orders growth slows in April; shipments increase

- Oil edges higher on tight supply, rising U.S. refining activity

- Fed minions deliver no surprises:

- Fed minutes may shape debate over what follows June, July rate hikes

- Fed embraces 50-basis-point rate hikes in June, July to curb 'very high' inflation

- Bigger trouble developing everywhere?

- IIF cuts 2022 global GDP growth estimate in half, flows to EM to drop 42%

- World Bank's Malpass says war in Ukraine may trigger global recession

- Bigger stimulus developing in China:

- Central bank minions taking actions to address inflation:

- New Zealand raises cash rate 50 bps, signals a lot more to come

- Japan govt to urge BOJ to meet inflation goal sustainably - draft

- S.Africa's central bank flags inflation as major risk to domestic financial system

- Swiss National Bank chairman says global monetary policy moving into tightening phase - magazine

- Wall Street climbs after Fed minutes meet expectations

- Thursday, 26 May 2022

- Signs and portents for the U.S. economy:

- U.S. pending home sales dive to two-year low in April

- U.S. labor market hot, but declining profits cast shadow over economy

- Fed minions see diminishing role for U.S. dollar as global reserve currency; are expected to pause rate hikes after September 2022:

- Fed's Brainard: We can't take global status of U.S. dollar for granted

- Fed may pause policy tightening in September, BofA says

- Bigger trouble, stimulus developing in China:

- China property market slumps on developers' debt crisis, weak buyer sentiment

- COVID-hit Shanghai heads for lockdown exit but China still lost in economic gloom

- China central bank urges more lending to small firms amid COVID shocks

- BOJ minions provide first indication they might not continue stimulus indefinitely:

- BOK minions act to hike rates to combat inflation:

- Wall Street surges on upbeat retail guidance, easing Fed fears

- Friday, 27 May 2022

- Signs and portents for the U.S. economy:

- Key inflation gauge slowed to still-high 6.3% over past year

- Equities rise, yields fall after data shows U.S. inflation may have peaked

- Signs that Fed minions won't hike rates as much as previously expected shift investor focus to 2022-Q3:

- Peak interest rates may be lower than expected as growth slowdown looms

- Cooling U.S. inflation builds case for September slowdown in Fed rate hikes

- Bigger trouble developing in China:

- China's industrial profits slump in April as COVID curbs squeeze firms

- Japan Apr factory output seen posting first fall in 3 months on China lockdown - Reuters poll

- China punishes local officials for falsifying economic data

- Shanghai takes baby steps towards ending COVID lockdown

- China's lending policy could trigger new debt crisis - Germany's Scholz

- Wall Street rallies to end longest weekly losing streak in decades

The CME Group's FedWatch Tool is now projecting half point increases in the Federal Funds Rate after the Fed meets in June (2022-Q2) and July (2022-Q3), followed by quarter point increases at six week intervals through February 2023, topping out at 2.75%-3.00%.

The Atlanta Fed's GDPNow tool projects real GDP growth of 1.9% in 2022-Q2, down from last week's projection of 2.4%.

This story caught our attention because it falls right into our wheelhouse. It's a tale of a government failure that is responsible for systematically reducing the supply of American oil and contributing to rising oil and gas prices from the early months of the Biden administration. At the center of it all, lies the incompetent implementation of a mathematical model by the Biden administration's bureaucrats.

Here's the background:

The Biden administration privately acknowledged in late April that a mathematical error is delaying the federal offshore oil and gas program, in a letter to industry leaders.

Richard Spinrad, the head of the National Oceanic and Atmospheric Administration (NOAA), said a subagency “discovered a miscalculation” that has caused a massive backlog in permitting, in the April 29 letter obtained by The Daily Caller News Foundation. Spinrad acknowledged the National Marine Fisheries Service (NMFS) — the subagency tasked with analyzing the impact of offshore drilling projects on wildlife — has used faulty modeling on such impacts and, as a result, overestimated wildlife effects, delaying permitting on existing leases.

“NMFS understands the concerns of industry and is working with [the Bureau of Ocean Energy Management (BOEM)] to expeditiously develop … revised regulations,” Spinrad wrote in the letter to the National Ocean Industries Association (NOIA).

The NOAA administrator’s letter came in response to an April 5 letter from NOIA, the American Petroleum Institute and the EnerGeo Alliance, warning that energy producers had experienced significant permitting delays. In particular, oil and gas companies have reported delays in obtaining letters of authorization (LOA) from the NMFS to conduct pre-drilling activity, including seismic surveying and geological exploration, in the Gulf of Mexico.

The Biden administration implemented the faulty modeling through an April 2021 regulation, according to the industry groups. A spokesperson for the Department of Commerce, which oversees NOAA and NMFS, said Thursday that the administration was “working to consider all possible solutions to expedite the rulemaking process to the greatest extent possible.”

What is the error behind the faulty output of the Bureau of Ocean Energy Management's environmental math model? It is double counting its estimates of the population of wildlife species in the Gulf of Mexico. Here's the National Oceanic and Atmospheric Fisheries agency's explanation of what they've been doing wrong for more than a year.

In particular, while processing requests for individual letters of authorization (LOAs) under the incidental take rule using the methodology for developing LOA-specific take numbers presented in the rule, NMFS has discovered that the estimated maximum annual incidental take from the proposed survey activities and the total take from all activities that BOEM projected in its revised incidental take rule application were miscalculated, and are therefore likely to be reached much sooner than was anticipated for some species. NMFS contacted BOEM regarding this, and BOEM determined that, when it reduced its scope of specified activity in March 2020 by removing the Gulf of Mexico Energy Security Act (GOMESA) moratorium area from the proposed action, it underestimated the level of take by inadvertently factoring species density estimates into its revised exposure estimates twice. Generally, this miscalculation caused BOEM to underestimate the total predicted exposures of species from all survey activities in its revision to the incidental take rule application, most pronouncedly for those species with the lowest densities (e.g., killer whales).

By double counting its estimates of wildlife populations in the environmental math model it mandated, the Biden administration effectively imposes a much higher regulatory barrier to approving offshore oil drilling than is justified using accurate data. Consequently, offshore drilling permits have only trickled out during the past year, progressively resulting in today's artificially constrained domestic oil and gas production. The cumulative shortages from this reduced supply have contributed to the rising price of oil and gas in the U.S. since April 2021.

This is the kind of problem that should be very easy to repair. Unfortunately, as we've seen with other major supply chain problems involving container ships and baby formula, the Biden-Harris administration's preferred first response to the supply chain problems they've created is to let them fester without action for months before doing anything to correct them.

Previously on Political Calculations

Labels: environment, math

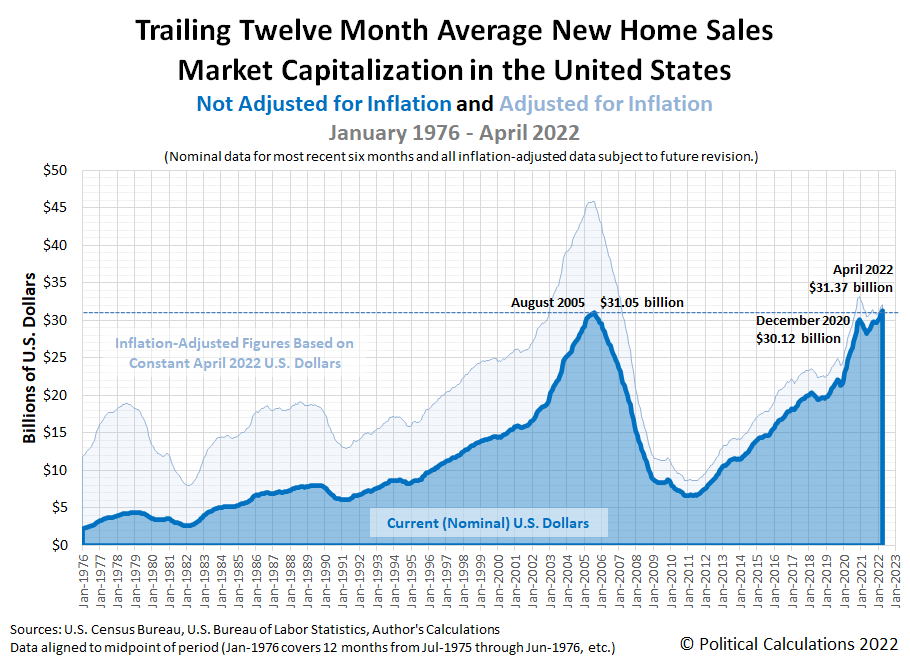

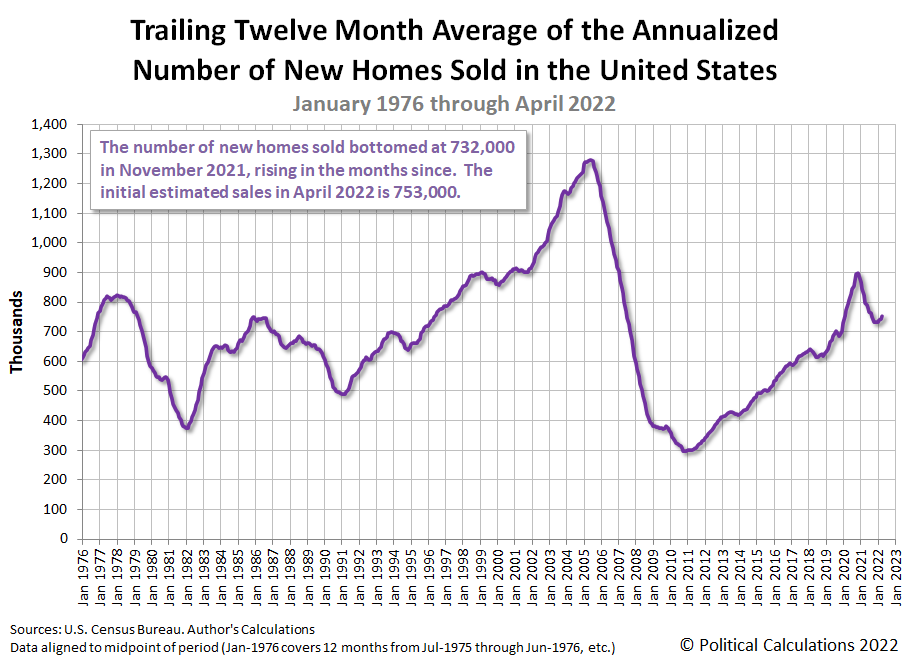

Political Calculations' initial estimate of the U.S. new homes market cap for April 2022 is $31.37 billion. That figure is 1.7% higher than March 2022's revised nominal market cap of $30.86 billion.

The following chart shows what that new record looks like in the context of the new home market cap history since January 1976:

Soaring prices are the primary driver of April 2022's increase in the market cap for new homes sold in the U.S. In the two years since the Coronavirus Recession bottomed in April 2020, the trailing twelve month average of new home sale prices have increased by 35.2%. Meanwhile, the trailing twelve month average number of new home sales continued its upward trend in April 2022, but the increase in this component of the market capitalization math is much smaller than the contribution from the increase in new home sale prices.

The trailing twelve month average for new home sales removes the effects of annual seasonality from this data, while the math helps smooth the month-to-month noise in new home sale prices, making it easier to identify trends for both data series. Since new home sales are counted toward GDP when their sales contracts are signed, a rising trend in the market cap for new homes represents an economic plus for the U.S. economy. The National Association of Home Builders estimates new home sales contribute 3% to 5% of the nation's Gross Domestic Product.

Labels: market cap, real estate

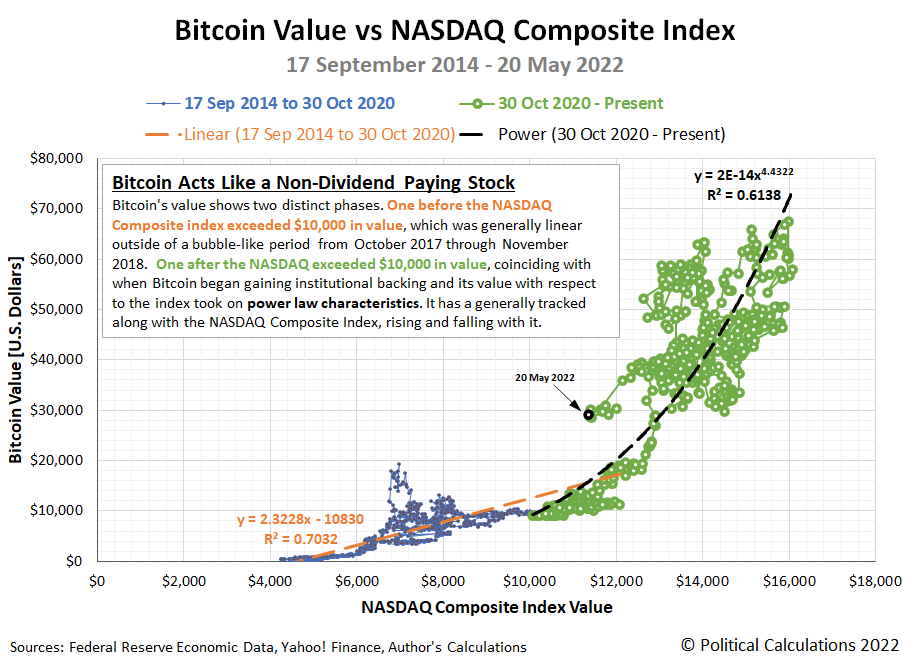

What is the best way to think about what Bitcoin (BTC-USD) is as an investment?

We've already demonstrated what it isn't. Bitcoin isn't "Gold 2.0". We know that's true because Bitcoin doesn't act like gold (KITCO: Live Gold Price), which rises in value whenever inflation forces real interest rates to fall. If anything, we found changes in the value of Bitcoin is almost completely independent of inflation-adjusted interest rates. If gold were a duck, Bitcoin wouldn't look, walk or quack anything like it.

Which then raises the question: what does Bitcoin look, walk and quack like?

We think Bitcoin looks, walks, and quacks like a non-dividend paying stock.

The thing that put us onto that line of thought was a recent headline: Bitcoin’s correlation with the Nasdaq 100 index reaches a new all-time high.

To be highly correlated with something is akin to looking, walking and quacking like it. So we put that proposition to the test, tracking the relationship between Bitcoin and the Nasdaq Composite Index (NASDAQ: COMP.IND), which is a broader measure of the stocks that trade on the NASDAQ stock exchange. The following chart shows what we found after we mapped the available data we have for the historic value of Bitcoin against the value of the Nasdaq Composite Index over the same period of time, from 17 September 2014 through 20 May 2022.

In the chart, we see that Bitcoin's value has two distinct phases. One before the NASDAQ Composite index exceeded $10,000 in value, which was generally linear outside of a bubble-like period from October 2017 through November 2018. One after the NASDAQ exceeded $10,000 in value, coinciding with when Bitcoin began gaining institutional backing and its value with respect to the index took on power law characteristics. In both cases though, outside short periods where changes in its valuation decoupled from changes in the value of the stock index, Bitcoin has a generally tracked along with the NASDAQ, rising and falling with it in a positive relationship.

That makes it very much like a non-dividend paying stock, especially during the period after it began gaining significant institutional backing. We know that from the exponent of the power law relationship that exists between Bitcoin and the Nasdaq Composite Index during this period, which represents the ratio of the exponential growth rates of Bitcoin and that of the Nasdaq index, which includes dividend-paying stocks.

In doing that, Bitcoin is very much looking, walking, and quacking like a volatile non-dividend paying stock, which shares those characteristics. Unless and until it starts acting differently, that's perhaps the best way for investors to think about Bitcoin's qualities as an investment.

Update 26 May 2022

We're not the only ones looking at a cryptocurrency and wondering what it looks, walks, and quacks like! Elsewhere on the interwebs, Mitchell Zuckoff argues many cryptocurrencies are passing the Ponzi duck test.

References

Federal Reserve Economic Data. NASDAQ Composite Index. [Online Database (Text File)]. Accessed 20 May 2022.

Yahoo! Finance. Bitcoin USD (BTC-USD), 14 September 2014 through 21 April 2022. [Online Database]. Accessed 20 May 2022.

Previously on Political Calculations

- The Sun, in the Center

- Deriving the Price Dividend Growth Ratio

- Say, What's This Bitcoin Thing We Keep Hearing About in the News?

- The Definition of a Bubble

- Real Yields and the Price of Gold

- Bitcoin Is Not Gold 2.0

Image credit: Photo by Ross Sokolovski on Unsplash.

Labels: data visualization, stock market, stock prices

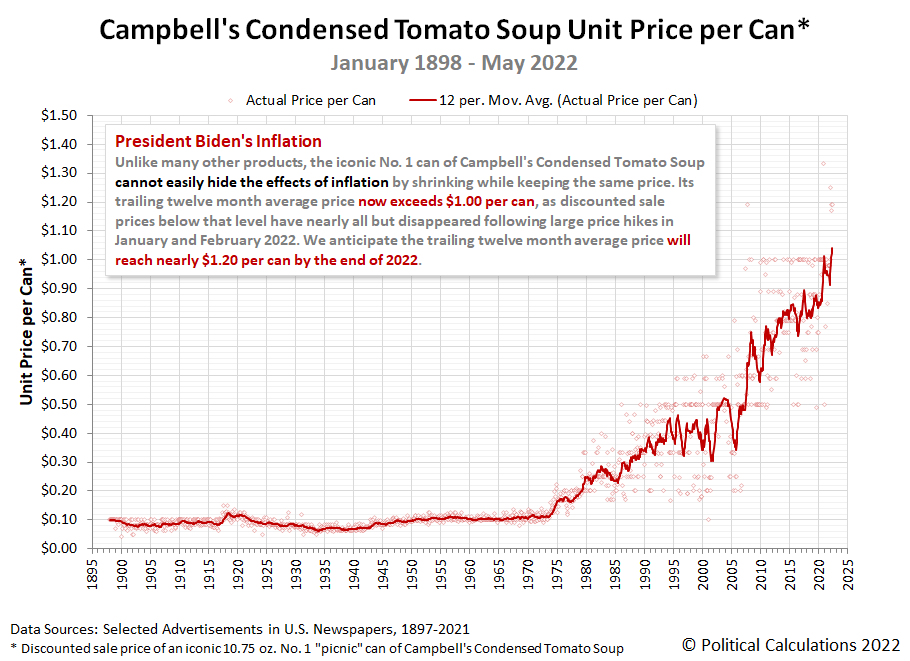

More grocery stores have increased their prices to consumers for an iconic No. 1 size can of Campbell's Condensed Tomato Soup. Here's how prices have changed since our previous snapshot of prices at ten of the U.S.'s largest grocery-selling retailers roughly two months ago.

- Walmart: $1.17/each, unchanged

- Amazon: $0.99/each, unchanged (Lowest)

- Kroger: $1.25/each, unchanged

- Walgreens: $1.50/each, unchanged when you buy 2 cans

- Target: $1.29/each, increase of $0.10 (+8.4%)

- CVS: $2.19/each, increase of $0.40 (+22.3%, Highest)

- Albertsons: $1.59/each, increase of $0.59 (+59.0%)

- Food Lion: $1.19/each, increase of $0.19 (+19.0%)

- H-E-B: $1.21/each, unchanged

- Meijer: $1.19/each, increase of $0.19 (+19.0%)

For the latest in our coverage of Campbell's Tomato Soup prices, follow this link!

Among these sellers, only Amazon continues to sell a can of Campbell's condensed tomato soup for under $1.00. The next lowest price available to consumers is Walmart's $1.17 per can.

Since Amazon sells many fewer cans of tomato soup than all these other grocery-selling retailers, that means most tomato soup-buying American households are now typically paying far more than $1.00 for each can of Campbell's tomato soup they buy. So much so that the trailing twelve month average of a can of Campbell's Condensed Tomato Soup has jumped to reach a new record high of $1.04 per can. The following chart presents the entire price history of a No. 1-size can of Campbell's Condensed Tomato Soup we've assembled to mark the occasion:

We anticipate the trailing twelve month average for Campbell's Tomato Soup will reach nearly $1.20 per can by the end of 2022. How long do you suppose Amazon might continue selling the product at what is now a deeply discounted sale price of $0.99?

The third week of May 2022 came and went with Federal Reserve officials signaling their willingness to hike interest rates higher than they've previously suggested. S&P 500 (Index: SPX) investors locked their forward-looking focus on the current quarter of 2022-Q2 in response, held there by the uncertainty of what will come from the decisions the Fed will make before its end.

That's what we read in the latest update to the alternative futures chart, which reveals the index is tracking remarkably closely to the alternative trajectory associated with investors focusing their attention on the current quarter according to the dividend futures-based model.

It's unusual for the actual trajectory of stock prices to track so closely along with a particular projection for investors focusing on a given quarter. We normally see more noise in day-to-day trading than we've had during the past week. That said, the clock is ticking down for how long investors can continue to fix their focus on 2022-Q2, which points to a potential investing opportunity that will exist until their forward-looking attention does shift to another point of time in the future in what will be the stock market's next Lévy flight event.

This assumes we don't see significant erosion in the expectations for dividends expected in the upcoming quarters to which investors might next shift their attention. Fortunately, that prospect is so far a low risk consideration for the near term.

Here are the market-moving news headlines that helped shape investor expectations in the week that was.

- Monday, 16 May 2022

- Signs and portents for the U.S. economy:

- Biden team sees few options on inflation before November midterms

- New York state factory activity slumps again in May; price pressures easing

- Fed minions thinking about undoing their overstimulus of U.S. housing market:

- Bigger trouble developing in China, Eurozone:

- China's economy skids as lockdowns hit factories, retailers

- Hungary PM Orban warns of "era of recession" in Europe

- S&P 500 ends lower as Tesla falls, while energy rallies

- Tuesday, 17 May 2022

- Signs and portents for the U.S. economy:

- Strong U.S. retail sales, manufacturing output boost economic outlook

- Oil falls 2% on hopes for Venezuela supply

- Chief minion gets to keep collecting paycheck, says will turn screws as needed; other Fed minions say no recession over next 18 months and that fixing supply chain would fix inflation:

- Federal Reserve Chair Jerome Powell confirmed by Senate for a second term

- Fed's Powell vows to raise rates as high as needed to kill inflation surge

- Quotes: Powell says Fed won't hesitate to move past neutral

- Bullard: U.S. growth likely to continue above trend amid strong consumption

- Fed's Kashkari: how high rates need to go depends on supply side

- Bigger trouble developing in China:

- Eurozone economy less bad than previously thought:

- BOJ minions got a fever, the only prescription is more stimulus cowbell:

- ECB minions thinking some more about hiking rates to combat Eurozone inflation, will devote more time to listening to central bank heads:

- ECB to hike deposit rate 25 bps in July, ditch negative rates by end-September: Reuters poll

- Exclusive-ECB's Lagarde gives national central bank chiefs louder voice on policy

- Wall Street ends sharply higher, fueled by Apple

- Wednesday, 18 May 2022

- Signs and portents for the U.S. economy:

- Wells Fargo sees end-of-year U.S. recession, cuts GDP view

- Oil falls 2.5% as U.S. refiners ramp up output, equities retreat

- U.S. housing market cooling as building permits tumble, starts fall

- Prospective Fed minion wants to fight inflation, established Fed minions claim they want smaller rate hikes:

- Fed nominee Barr says he's committed to bringing down inflation

- Fed's Evans wants smaller U.S. rate hikes by July or Sept

- Fed's Harker sees 50 bps rate hikes in June, July, then 'measured' hikes

- Bigger trouble developing in China, Japan:

- China lockdowns impeding supply chain recovery, slowdown risks spillovers, Yellen says

- Japan's GDP shrinks as surging costs raise spectre of deeper downturn

- ECB minions still thinking about hiking interest rates someday, worry about Ukraine war's effect on Eurozone economy:

- ECB policymakers push for quick monetary policy normalisation

- ECB tells banks to buckle up as Ukraine war hits economy

- Wall Street ends sharply lower as Target and growth stocks sink

- Thursday, 19 May 2022

- Signs and portents for the U.S. economy:

- U.S. existing home sales fall for third straight month; house prices at record high

- Investors jolted as U.S. retailers show inflation hitting consumers

- U.S. labor market in spotlight as weekly jobless claims hit 4-month high

- Oil swings wildly, rebounding to gains after steep losses

- Fed minions say they're not worried about falling stock prices:

- Bigger trouble, stimulus developing in China:

- China's zero-COVID policy dashes global hopes for quick economic return to normal

- China seen lowering lending benchmark LPR to support economy: Reuters Poll

- Egypt's central bank launches serious assault against inflation:

- ECB minions put credibility on the line while thinking about hiking rates to fight inflation someday:

- As ECB pares back stimulus, investors alert for fragmentation risk

- ECB accounts show debate over speed of policy tightening

- S&P 500 ends lower as Cisco and Apple sink

- Friday, 20 May 2022

- Signs and portents for the U.S. economy:

- Most dovish Fed minion now setting expectations for bigger rate hikes:

- Bigger trouble, stimulus developing in China:

- Taiwan export orders fall for first time in 2 years, hurt by China lockdowns, global weakness

- Shanghai economy hit on all sides in April by COVID lockdown

- China cuts borrowing rate more than expected to revive housing sector

- China pledges to give virus-hit companies easier access to capital markets

- BOJ minions elated to finally hit their inflation target after years of deflationary conditions, pledge to keep stimulus going:

- Japan April consumer inflation beats BOJ target for 1st time in 7 years

- BOJ's Kuroda vows to keep easy policy, remain dovish G7 outlier

- Former central banker says central banks share blame in creating inflation:

- ECB minions thinking they can safely hike rates to combat inflation:

- ECB can move rates back into positive territory: Visco

- ECB can safely raise rates out of negative territory, Visco says

- Money markets price in 50-50 chance of 50 bps July ECB hike

- Wall Street ends mixed, Tesla falls

The CME Group's FedWatch Tool continues to project the Fed will hike rates by a half-point in June (2022-Q2), followed by a two more half-point hikes in July and September (2022-Q3). After which, the tool projects the Fed will slow down, hiking rates by just a quarter point each in November and December 2022 (2022-Q4) to close out the year.

The Atlanta Fed's GDPNow tool projects real GDP growth of 2.4% in 2022-Q2, up from last week's projection of 1.8%.

Michael Reeves has carved out a unique niche in the online world through his comedy-tech videos, combining his programming skills and love of modern technology with rapid fire jokes and satire.

In his latest production, he's taken on the world of meme investing, as represented by the favorite stocks pitched by top contributors to r/WallStreetBets, and pitted them against pure random selection, as represented by the stock picks of his pet goldfish. In the following 15-minute video (featuring some NSFW language and visual humor), he explains how he did it and presents his experimental results:

Our favorite part is when he pitches the "FISH" system to potential investors.

Reeves' experiment makes sense in the light of the real results of the Wall Street Journal's long-running investment dartboard challenge, in which the performance of stocks picked by professional investors competed against stocks picked by WSJ reporters who threw darts at the newspaper's stock listings to pick stocks at random. Superficially, it appeared the pros beat the darts, but that was because they benefitted from two secret advantages that were hidden in plain sight:

Professor Burton Malkiel of Princeton University, who for decades has been arguing that you can't beat the market, and a colleague found that the stocks the experts picked were risky. They were far more volatile than those the reporters picked using darts or the stocks that make up the S&P 500. When the stocks of the three groups are adjusted for risk, the returns of the experts fall precipitously below those of the dartboard or the index.

Professor Malkiel goes further. He argues that the unadjusted returns of the experts were higher because Wall Street Journal readers noted the selections after they were published and then bid them higher. Had the experts chosen their stocks on the day the stock picks were published instead of the day before, their return would fall a whopping 3 percentage points!!!

All in all, Reeves' goldfish-based investing system is a fun way to revisit those old results.

Previously on Political Calculations

Labels: ideas, investing, stock market

Since the S&P 500 (Index: SPX) peaked at 4,796.56 on 3 January 2022, the index has dropped by 18.2% of that record high value. But that simple observation raises a question. What should the value of the S&P 500 be?

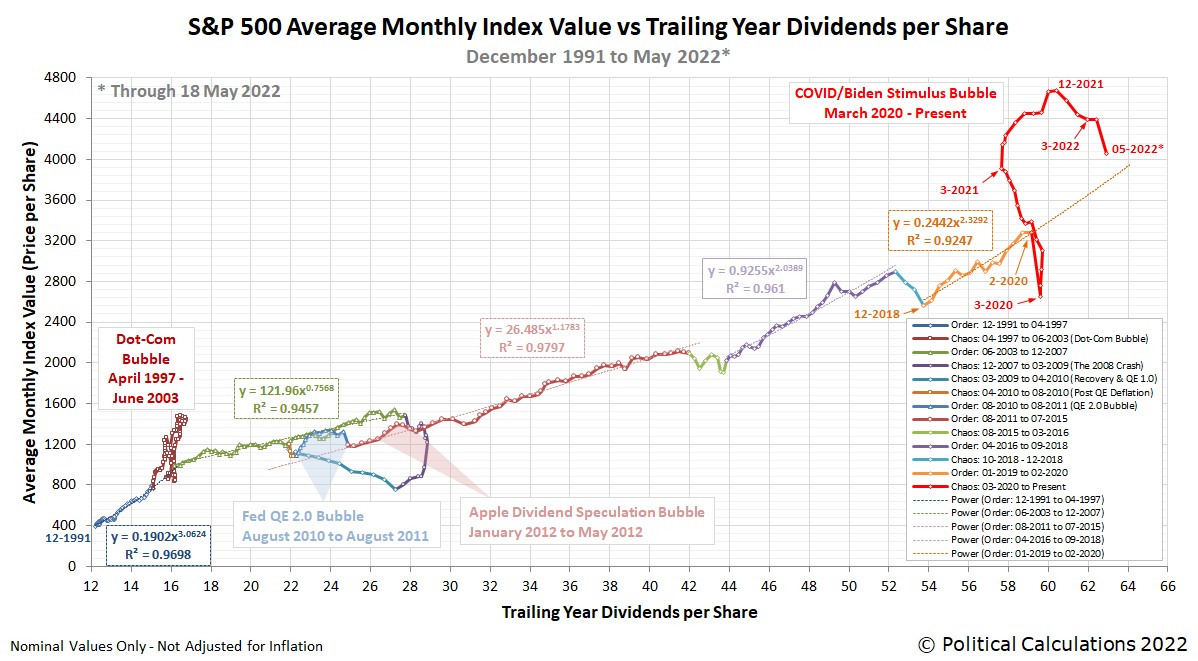

We have a couple of interesting ways to approach answering that question, the first of which relies upon how investors set the average level of the index with respect to its trailing year dividends per share during periods of relative order in the U.S. stock market. The following chart illustrates the five major periods of order the S&P 500 has experienced since December 1991, which have been periodically interrupted by periods of relative chaos.

In the chart, we show the mathematical relationships that have applied during those relative periods of order, which connects the average monthly value of stock prices (y) with the level of the index' trailing year dividends per share (x). We've built the following tool to do the related math to see how investors would set the value of the S&P 500 for the period of order you select for the trailing year dividends per share you enter. If you're accessing this article on a site that republishes our RSS news feed, you may need to click through to our site to access a working version of the tool.

Using the default selection of the most recent period of order, which lasted from December 2018 through February 2020, until the arrival of the coronavirus pandemic initiated a period of chaos for the U.S. stock market, we find that with May 2022's estimated $62.90 for trailing year dividends per share, the corresponding value of the S&P 500 would be $3,777.

Or rather, that's what the math suggests would be a reasonable level for the S&P 500 had that relative period of order continued to the present. Since that value is below the current level of the index, this result suggests stock prices still have room to fall, but it's important to note that this level is neither a ceiling nor a floor. It simply represents the mean to which stock prices would revert during this particular previous relative period of order.

That mean level is visualized as the extended trajectory for this relative period of order in the chart above, where you can see the chaotic impact the arrival of the coronavirus pandemic had in March 2020, followed by the bubble inflated by the COVID stimulus programs of 2020 and President Biden's inflation-generating American Rescue Plan Act stimulus program of March 2021. That bubble entered its deflation phase after December 2021, which is still underway today.

With more than one previous relative period of order to choose from, there's a lot of room for interpretation. Other selectable options, such as the one for the early 1990s, may suggest the S&P 500 is greatly undervalued for the dividends per share you enter. One of the cool things about this tool is you can do the math for any level of trailing year dividends per share you choose, so you can find out how stock prices could alternatively been set during the days of the Dot Com Bubble, if that's your area of interest, or during any of the other periods in between. Go ahead and take the tool for a test drive to explore the world of alternate S&P 500 valuations!

Can you project where the S&P 500 could go during periods of chaos?

We know what you're thinking. Wouldn't it be nice if you could project what a reasonable level for the S&P 500 would look like during periods of chaos for the stock market? It would indeed, and we have you covered there as well.

If you know what the expectations are for changes in the growth rate of dividends at different points of time in the future, and you know how far into the future investors are focusing their forward-looking attention as they set current day stock prices, you can reasonably project the level for the S&P 500 even during periods of chaos in the stock market. It has been possible since April 2009 and became practical to accomplish after November 2009, when the CBOE introduced modern quarterly dividend futures for the S&P 500.

Labels: chaos, data visualization, ideas, SP 500, tool

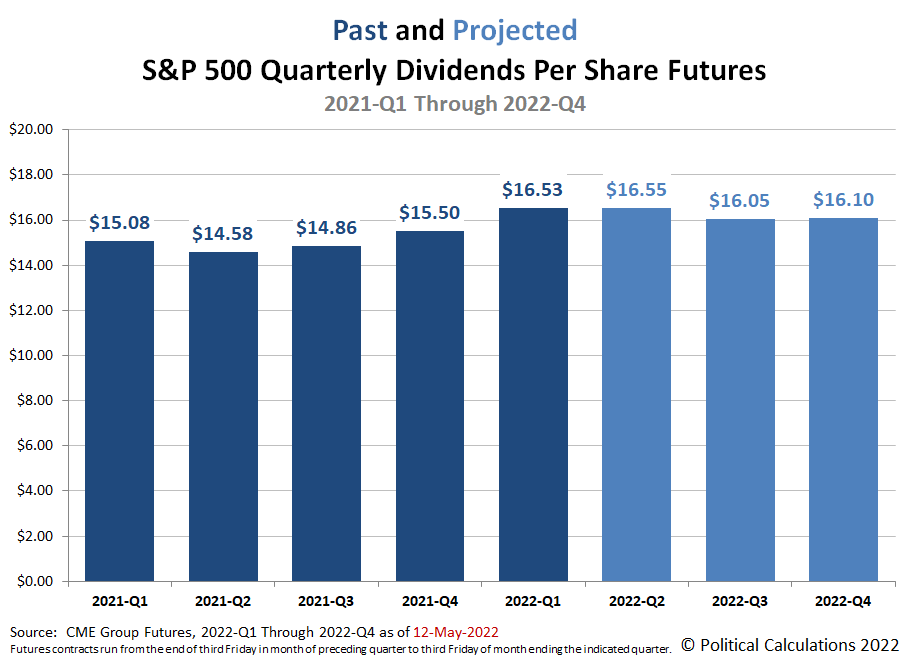

The outlook for the dividends per share of the S&P 500 (Index: SPX) brightened since we last checked on them at the midpoint of 2022-Q1. The following chart shows those expectations as of Thursday, 12 May 2022:

Here's how future expectations for the S&P 500's dividends per share have changed for each quarter in 2022 since our last snapshot three months ago:

- 2022-Q1: Up $0.13 per share

- 2022-Q2: Up $0.27 per share

- 2022-Q3: Up $0.58 per share

- 2022-Q4: Up $0.41 per share

These increases across each quarter point to an improved outlook for the S&P 500's dividends over the past three months. If you've been following our S&P 500 chaos series though, you know why the index has behaved as it has while falling in the time since our last look at the index' dividend futures.

About Dividend Futures

Dividend futures indicate the amount of dividends per share to be paid out over the period covered by each quarters dividend futures contracts, which start on the day after the preceding quarter's dividend futures contracts expire and end on the third Friday of the month ending the indicated quarter. So for example, as determined by dividend futures contracts, the "current" quarter of 2022-Q2 began on Saturday, 19 March 2022 and will end on Friday, 17 June 2022.

That makes these figures different from the quarterly dividends per share figures reported by Standard and Poor, who reports the amount of dividends per share paid out during regular calendar quarters after the end of each quarter. This term mismatch accounts for the differences in dividends reported by both sources, with the biggest differences between the two typically seen in the first and fourth quarters of each year.

Reference

The past and projected data shown in this chart is from the CME Group's S&P 500 quarterly dividend index futures. The past data reflects the values reported by CME Group on the date the associated dividend futures contract expired, while the projected data reflects the values reported on 12 May 2022.

Labels: dividends, forecasting, SP 500

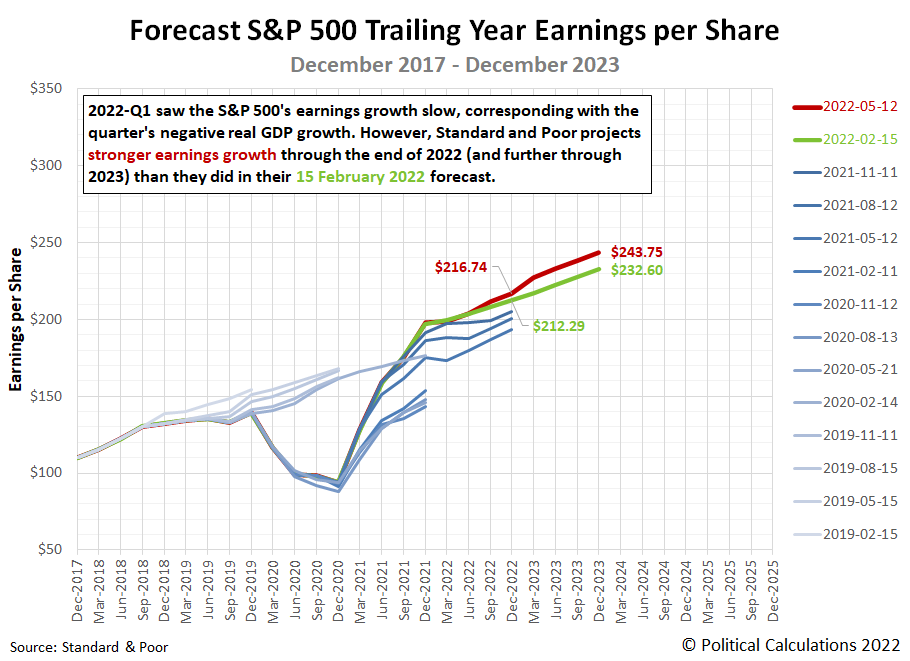

Every three months, we take a snapshot of the expectations for future earnings in the S&P 500 (Index: SPX) at approximately the midpoint of the current quarter, shortly after most U.S. firms have announced their previous quarter's earnings.

Since our last update three months ago, Standard and Poor's projections have strengthened, indicating expectations of stronger growth through 2022 and 2023. The following chart illustrates how the earnings outlook has changed with respect to previous snapshots:

The improved outlook for S&P 500 earnings has developed even though the Federal Reserve has begun raising interest rates and is signaling larger rate hikes to squelch excess inflation generated by the Biden-Harris administration's fiscal policies. Since those policies represent a growing headwind for the U.S. economy, it raises the question of how much more improvement would have been seen had the Fed chosen to continue holding the Federal Funds Rate at the zero bound.

Reference

Silverblatt, Howard. Standard & Poor. S&P 500 Earnings and Estimates. [Excel Spreadsheet]. 12 May 2022. Accessed 13 May 2022.

Labels: earnings, forecasting, SP 500

After starting the week with a bang, the S&P 500 (Index: SPX) saw its level of volatility die down as investors solidified their forward-looking attention on 2022-Q2.

How long it might stay there is a question that remains to be answered, but the latest update of the alternative futures chart shows the level of stock prices is fully consistent with that assessment.

Better still, we've moved out of the period where the echoes of the past volatility of stock prices affected the accuracy of the dividend futures-based model's projections, which had required us to add redzone forecast ranges to the chart to compensate in helping track the S&P 500's latest Lévy flight events.

Since we've already outlined what may come next for the S&P 500 in an update to the previous entry of our ongoing S&P 500 chaos series, let's recap the market-moving news headlines from the week that was:

- Monday, 9 May 2022

- Signs and portents for the U.S. economy:

- U.S. yields ease after hitting 3-1/2 year highs on rate hike unease

- Oil tumbles about 6% as China COVID lockdowns weigh

- Exclusive-Biden sidelined global energy partners with record emergency oil release -sources

- Fed minions claim Fed hasn't missed boat to keep inflation under its control, starting to think supply chain constraints won't go away, hope 75 bps rates won't be needed:

- Fed hawks Waller, Bullard push back on 'behind the curve' view

- Fed may have to carry bulk of burden in hitting inflation goal - Kashkari

- Bostic sees no 75 bps rate hike, hopeful inflation cools

- Bigger trouble developing in China:

- China's exports growth hits two year-low as virus curbs hit factories

- China's April new yuan loans seen falling as demand weakens-Reuters Poll

- Bigger stimulus developing in China:

- ECB minions suggest they may someday combat inflation:

- BOJ minions doubling down on keeping stimulus policies going:

- S&P 500 ends below 4,000 for 1st time since March 2021; growth shares lead decline

- Tuesday, 10 May 2022

- Signs and portents for the U.S. economy:

- U.S. producers undo years of efficiency gains in fight for supplies

- U.S. oil settles below $100 a barrel on economic worries, strong dollar

- Biden says Fed targeting inflation, China tariffs could fall

- Fed minions anticipate rising unemployment in best case scenario, trying to set expectations for half-point future rate hikes:

- Fed's Williams: 50 bps interest rate hikes at next two meetings "makes sense"

- Fed's Barkin says central bank can tweak path once its gets to neutral rate

- Fed's Mester backs 50 bps rate hikes, sees no sustained downturn

- Fed's Mester: Will need "compelling" drop of inflation to slow rate hikes

- Mester: MBS sales could mean market losses for Fed

- Fed's Waller says now is the time to 'hit it' on raising rates

- BOJ minions doubling down on keeping stimulus going, indications it is no longer independent of Japanese government:

- BOJ rules out widening yield band to stem yen fall

- BOJ's bond buying draws scrutiny after ex-PM calls central bank a govt 'subsidiary'

- Brazil central bankers anticipate more aggressive action to combat inflation:

- S&P 500, Nasdaq end up but investors cautious before inflation data

- Wednesday, 11 May 2022

- Signs and portents for the U.S. economy:

- U.S. inflation simmers, worst of price gains likely behind

- Oil up more than 5%, as Russia-EU energy quarrel intensifies

- Average U.S. mortgage interest rate rises to 5.53%, applications up

- Bigger trouble developing in Japan, Ukraine:

- Japan's economy to suffer Q1 slump on lower consumption

- Ukraine Finance Minister forecasts 45% GDP drop, committed to servicing debt

- Central banks acting to hike interest rates to combat inflation:

- India's cbank likely to raise inflation projection in June meeting, consider more rate hikes-source

- Hungary cenbank raised interest rates by 100 bps in unanimous April vote -minutes

- Bank of England interest rate could hit 4% or more, ex-policymakers warn

- ECB minions waiting until July 2022 to hike rates to combat inflation:

- Wall Street ends lower as U.S. inflation data offers little relief to investors

- Thursday, 12 May 2022

- Signs and portents for the U.S. economy:

- Oil rises as supply concerns outweigh reduced demand, recession risks

- U.S. Treasury's Yellen says Fed can bring down inflation without causing recession

- U.S. labor market still tightening; producer price gains moderate

- Cass Freight Index sees 'considerable' U.S. freight recession risk

- Fed minions still trying to say only half point rate hikes in the future, start looking to shift blame if U.S. economy experiences a "hard landing" from their policies:

- Fed's Daly backs half-percentage-point rate hikes at next meetings

- Fed Chair Jerome Powell: “Whether we can execute a soft landing or not, it may actually depend on factors that we don’t control.”

- Bigger trouble developing in the U.K., Eurozone:

- UK economy shrinks in March as recession risks mount

- Europe's gas supply crisis grows after Russia imposes sanctions

- Bigger stimulus developing in China:

- ECB minions still thinking about doing something about Eurozone inflation:

- S&P drops on fears of prolonged inflation

- Friday, 13 May 2022

- Signs and portents for the U.S. economy:

- Fed minions not doing much to boost confidence in their actions:

- How much Fed must do depends on supply outlook: Kashkari

- Fed's Mester: Need "several months" of inflation moving down to call the peak

- Bigger trouble developing in China:

- China April new bank loans tumble as COVID jolts economy

- Headline fix: That should read "China April new bank loans tumble as government's COVID lockdowns jolt economy"

- Bigger stimulus developing in China:

- BOJ minions struggling with inflation and falling yen:

- Japan April consumer inflation seen exceeding central bank's 2% goal: Reuters poll

- Japan warns again about sharp yen moves, BOJ focuses on speed of change

- Wall Street ends tumultuous week with broad rally

According to the CME Group's FedWatch Tool, the Fed will hike rates by a half-point in June (2022-Q2), followed by a two more half-point hikes in July and September (2022-Q3). The Atlanta Fed's GDPNow tool projects real GDP growth of 1.8% in 2022-Q2, down from last week's projection of 2.3%.

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.