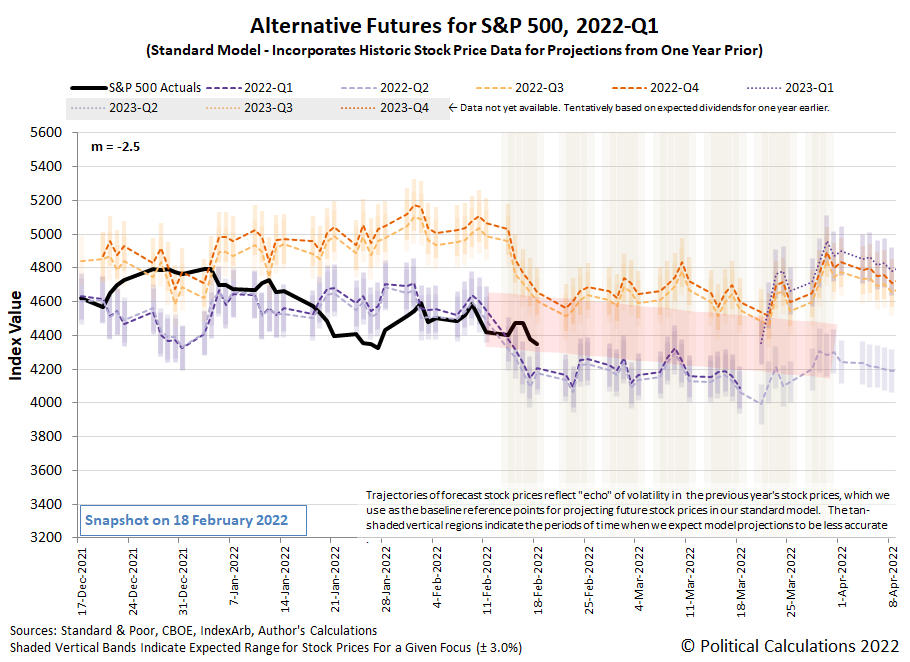

The S&P 500 (Index: SPX) continued following a volatile, downward trajectory in the trading week ending 18 February 2022. The latest update to the alternative futures chart reveals the index is falling within the projected range of the downward-pointing redzone forecast, which assumes investors are focusing on the near term future as they set current day stock prices.

The news of the past week confirms that attention, with investors paying close attention to both when and how the U.S. Federal Reserve will begin implementing rate hikes, with noise contributed by the Biden administration's disjointed attempt at geopolitics through its seemingly Zeno's paradox-based media strategy featuring claims of an imminent Russian invasion of Ukraine that would start on 16 February 2022, but didn't, only to be replaced by regularly updated claims of an ever-imminent Russian invasion. Which hadn't happened through the end of the trading week ending on Friday, 18 February 2022, but that was before the events of the long holiday weekend added more noise to the situation. Here is the market-moving news that did happen during the trading week that was:

- Monday, 14 February 2022

- Signs and portents for the U.S. economy:

- Record job-switching rates are pushing U.S. inflation higher, Chicago Fed study finds

- Oil hits 7-yr highs as Ukraine fears Russian attack imminent

- Fed minions worried they are losing credibility, not expected to do a sneak rate hike:

- Bullard: Fed "credibility is on the line" in inflation fight

- U.S. short-term rate futures pare back odds of Fed inter-meeting move

- ECB minions would rather go green than fight inflation:

- BOE minions dealing with inflation:

- UK employers plan biggest pay rises in nearly 10 years - CIPD

- BoE to raise rates again in March, inflation to peak soon after

- Japanese government minions want more inflation, BOJ minions happy to oblige:

- Japan govt spokesman voices hope BOJ will continue effort to hit inflation goal

- BOJ defends key bond yield target as global rates pressure builds

- The S&P 500 closes lower as Russia-Ukraine tensions heat up

- Tuesday, 15 February 2022

- Signs and portents for the U.S. economy:

- World Bank minion tells Fed minions what they should do, U.S. Treasury yield curve sends different message:

- World Bank chief says gradual rate hikes, bond 'tapering' unlikely to control inflation

- Analysis-U.S. yield curve prices for Fed tightening, shows fears of policy error

- Bigger stimulus developing in China:

- ECB minions expected to boost deposit rate to -0.25% by end of 2022:

- Wall Street surges as Russia-Ukraine tensions cool

- Wednesday, 16 February 2022

- Signs and portents for the U.S. economy:

- U.S. mortgage interest rates top 4% for first time since 2019

- U.S. retail sales rebound sharply in January

- U.S. manufacturing output rises moderately in January

- U.S. import prices rebound sharply in January

- Fed minions provide tea leaves for investors to decipher, looks like they'll make things up as they go:

- Fed minutes likely to provide details on rate hikes, balance sheet reduction

- Readout of January meeting shows Fed not wed to particular pace of rate hikes

- Fed's Kashkari: 'Let's not overdo it' on Fed rate hikes

- Slowing growth, inflation developing in China:

- ECB minions say scary inflation coming from inside the housing:

- Surging housing costs boosting overall euro zone inflation: ECB

- ECB warns about vulnerable property market in euro zone

- BOJ minions afraid of losing money unless it keeps stimulus going:

- BOJ may suffer losses in event it exits easy policy, says governor Kuroda

- BOJ's Kuroda says no plan to change long-term yield cap - for now

- The S&P 500 reverses losses, closes slightly higher after release of Fed minutes

- Thursday, 17 February 2022

- Signs and portents for the U.S. economy:

- Europe and Mideast crude premiums soar, with few options for buyers

- U.S. Senate aims for prompt passage of stop-gap bill to avert government shutdown

- U.S. labor market still tightening; freezing temperatures chill homebuilding

- Fed minion calls for bigger, faster rate hikes, start thinking about selling off mortgage bonds:

- Fed's Bullard repeats call for 1 percentage point in rate increases by July 1

- What could drive the Fed to a 'Plan B' for balance sheet reduction

- ECB minions like easy money policies, in no rush to end them as IMF approves:

- ECB's De Cos says withdrawal of stimulus scheme should be data-dependent, gradual

- ECB's Lane says no fixed size, frequency for rate hikes

- IMF backs ECB's easy policy as it sees inflation easing

- S&P 500 down 2% as Ukraine crisis sparks flight to safety

- Friday, 18 February 2022

- Signs and portents for the U.S. economy:

- Oil ends week mixed on geopolitical uncertainty, supply hopes

- U.S. leading economic indicator unexpectedly falls in January

- U.S. existing home sales accelerate; investors elbowing out first-time buyers

- Fed minions say they have policy wrong, but can still stick a 'soft landing' for U.S. economy even though economists don't believe them:

- Fed's Evans says policy "wrong-footed," but may not need to be restrictive

- NY Fed's Williams says central bank can manage soft landing for economy

- Fed's hopes for low inflation and lots of jobs may fall flat, economists say

- Bigger stimulus keeps rolling out in China:

- Chinese cities ease home purchase down-payments to reignite demand

- China issues new measures to spur COVID recovery for services sector

- China to boost commodity price supervision in push for industrial growth

- BOJ minions chill with inflation, ECB minions think about doing something about inflation later:

- Japan's inflation may exceed 1% but stay below BOJ goal, says central bank official

- Explainer-After defending its yield target, what's next for the BOJ?

- ECB's Kazimir calls for ending bond buying in August -Bloomberg

- Wall Street ends lower as investors eye Ukraine conflict

After trading closed on 18 February 2022, the CME Group's FedWatch Tool projects a total of six quarter point rate hikes in 2022, starting in March 2022 (2022-Q1), followed by quarter pint rate hikes in May 2022 (2022-Q2), June 2022 (2022-Q2), July 2022 (2022-Q3), September 2022 (2022-Q3) and December (2022-Q4). Meanwhile, the Atlanta Fed's GDPNow tool has boosted its real GDP growth to 1.3% for the current first quarter of 2022, up from last week's estimate of 0.7% real growth.

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.