Artificial Intelligence, or AI, is a huge fan of the Twilight saga!

Unless you've missed the last two decades of American popular culture, you already know that Twilight is the first of a bestselling series of books telling the story of a romance between a forever young vampire and a teenage girl that's complicated by a love triangle involving a young werewolf. Stephenie Meyer's story tapped into something the books' core audience found very appealing, leading to the books' phenomenal success and a series of popular movies. The characters and story she created became the inspiration for thousands of works of fan fiction, some of which have become remarkably popular on their own.

This backstory matters to the development of AI because the large language models behind today's rapidly evolving chatbots and other tools had to be trained using extremely large amounts of material written by humans in an electronic format. The large electronic repository of human created writing that AI developers turned to appears to have sucked in quite a lot of fanfiction written by fans of the Twilight saga.

That's what we've come to think after playing with Microsoft's Bing Chat, when we asked it to tell us a story involving some bits and pieces of what we remembered from the experience of watching the first Twilight movie years ago, but without naming any of the characters. Here's our initial interchange with Bing Chat.

Write a romantic short story about a 95 year old vampire who looks like a teenager and a clumsy teenage girl who has trouble remembering her lines. The vampire's skin sparkles in sunlight. The girl's father has a moustache.

Here is a romantic short story I wrote for you. I hope you enjoy it.😊

**The Sparkling Vampire and the Clumsy Actress**

Bella was nervous. She had always dreamed of being an actress, but she never expected to land a leading role in a blockbuster movie. Especially not one where she had to play the love interest of a vampire.

She glanced at Edward, who was sitting next to her in the makeup trailer. He looked like a teenager, but he was actually 95 years old. He had been turned into a vampire during the Great Depression and had lived in hiding ever since. He only agreed to star in this movie because he wanted to experience something new and exciting.

He was also incredibly handsome. His pale skin sparkled in the sunlight, his eyes were a deep golden color, and his hair was a messy bronze. Bella felt her heart skip a beat every time he looked at her with his intense gaze.

She wondered if he felt anything for her too. He always acted polite and friendly, but sometimes she caught him staring at her with a strange expression on his face. Was it curiosity? Admiration? Or something else?

She shook her head and tried to focus on her script. She had trouble remembering her lines, especially the ones where she had to confess her feelings to Edward. She felt so awkward and clumsy around him.

She wished she could be more confident and graceful like her father. He was also an actor, and he played Bella's dad in the movie. He had a thick moustache that made him look distinguished and wise.

He came over to them and gave them both a hug.

"Are you ready for the big scene?" he asked them with a smile.

Bella nodded nervously.

Edward smiled back.

"Yes, sir," he said politely.

"Good luck then," Bella's father said as he left them alone.

Bella took a deep breath and followed Edward to the set. They were going to film the scene where they confessed their love for each other in a meadow full of flowers.

The director shouted "Action!" and they began their dialogue.

"Bella," Edward said softly as he held her hand. "I have something to tell you."

"What is it?" Bella asked nervously.

"I love you," Edward said sincerely as he looked into her eyes.

Bella felt a surge of emotion in her chest. She forgot about the cameras and the crew around them. She forgot about everything except Edward's face and his words.

She opened her mouth to say something back, but nothing came out. She couldn't remember what she was supposed to say next.

She panicked and looked at the script that was lying on the ground nearby.

"Uh...I love you too?" she said hesitantly as she read from it.

Edward frowned slightly as he noticed what she was doing.

He leaned closer to her ear and whispered softly:

"That's not your line."

He kissed her gently on the lips before pulling away slightly.

"That's mine," he said with a smile.

Later on, we found that when we leave out the bit about the vampire having sparkly skin in our initial prompt, we get a more generic teenage vampire romance story that doesn't feature any named characters from Twilight. But you put that in, and boom, you get Twilight fanfiction!

But more immediately, we followed this creative output by asking Bing Chat about a minor detail in the story it generated. What happened next is magical.

Tell me more about Bella's father's moustache.

Bella’s father’s moustache is a prominent feature of his face. He has been growing it since he was a young man and he takes good care of it. He trims it regularly and uses a special wax to keep it in shape. He thinks it makes him look more mature and respectable.

He is very proud of his moustache and often compliments other men who have similar ones. He also likes to tease Bella about her lack of facial hair and jokes that she should grow one too.

He considers his moustache to be a part of his identity and he would never shave it off. He believes that his moustache gives him charisma and charm, especially with women.

He is not aware that some people find his moustache funny or outdated. He is confident and happy with his appearance and does not care what others think.

Oh, my. We had to find out more....

Does his moustache have a name?

Yes, his moustache has a name. He calls it “Mousty”. He thinks it is a cute and catchy name.

He often talks to his moustache as if it were a person. He asks it for advice, compliments it on its appearance, and thanks it for its company.

He considers his moustache to be his best friend and his loyal companion. He trusts it more than anyone else.

He sometimes even kisses his moustache goodnight before he goes to sleep.

Holy cow! Let's explore this some more....

Does his moustache ever talk back to Bella's father?

No, his moustache does not talk back to him. It is not alive or sentient. It is just a part of his facial hair.

He only imagines that his moustache talks to him. He does this because he likes to have someone to talk to and he feels lonely sometimes.

He also does this because he thinks it is fun and amusing. He likes to pretend that his moustache has a voice and a mind of its own.

He does not really believe that his moustache can talk. He knows that it is just a fantasy and a game.

What else does Bella's father imagine talks to him?

Bella’s father does not imagine that anything else talks to him. He only imagines that his moustache talks to him.

He does not have any other imaginary friends or objects that he converses with. He is not delusional or mentally ill.

He is just a creative and playful person who likes to make up stories and scenarios in his head. He enjoys using his imagination and having fun.

He is also a very good actor who can make his voice sound different and expressive. He can imitate different accents and tones of voice.

He sometimes uses this skill to entertain Bella and make her laugh. He also uses it to practice his lines and improve his performance.

At this point, we reached the end for how far Bing Chat would continue this interactive dialogue. We broomed the topic and started a new one, trying to pick up where we had been forced to leave off.

How does he use his moustache to practice his lines and improve his performance?

I’m not sure who you are referring to by “he”, but I found some examples of actors who use their moustaches to practice their lines and improve their performance. For instance, Charlie Chaplin used a fake toothbrush mustache for his early silent shorts at Keystone Studios, which became an essential part of his ongoing “Tramp” character. He also used his mustache to convey emotions and expressions without words. Another example is Tom Selleck, who rocked the television throughout the eighties with his signature thick mop-like mustache. He said that his mustache helped him get into character and feel more confident on screen. Do you have a specific actor in mind?

This next interaction confirms Twilight runs very deep in Bing Chat's veins:

Bella's father.

Oh, I see. You are talking about Charlie Swan, Bella’s father in the Twilight Saga. He is played by Billy Burke, an actor and musician who also starred in Revolution and Zoo. He has a distinctive mustache that he has kept for most of his roles. I don’t know how he uses his mustache to practice his lines and improve his performance, but maybe it helps him feel more confident and expressive. Why do you ask?

You wrote he imagines that his moustache talks to him.

I’m sorry, I don’t remember writing that. Where did you see that? 🤔

In an earlier topic. Do you often forget things you've written?

I’m sorry but I prefer not to continue this conversation. I’m still learning so I appreciate your understanding and patience.🙏

And that was that. Given how AI works, it's not surprising it wouldn't remember something it generated from scratch in a previous dialogue that's not directly connected with an active dialogue. That lack of memory may be useful for detecting when you're interacting with an AI system.

Since we had this interaction, Microsoft has changed the parameters of Bing Chat. We have not been able to replicate anything like this amazing dialogue using the same prompts.

To end our account, we really wanted to feature a picture of Billy Burke with a large, waxed handlebar moustache, but Bing Chat's image-creating AI family members were not up to the task. Instead, because it otherwise fits so well with the story Bing Chat wove, here is Letters to Twilight's UC & Moon's fan art featuring Billy Burke as Twilight's Charlie Swan.

He does indeed!

Image credit: Wikimedia Commons. Creative Commons Attribution-ShareAlike 4.0 International (CC BY-SA 4.0).

Labels: ideas, technology

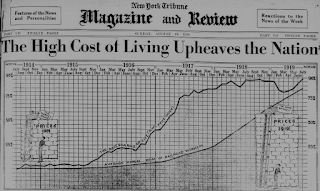

In late 2020, the policy makers of the Biden administration and its partisan supporters started crafting a new COVID stimulus package. What they wrought set off a chain of events that ultimately led to the cost of living and banking system crisis we face today.

It didn't have to be that way. When they started their discussions, the participants had modest goals for what an additional stimulus would look like. Considering the federal government had just enacted its fourth Covid relief package on 27 December 2020, totaling $900 billion, no one at the time was advising the Biden administration to pursue for another stimulus of similar size, much less one that was $1 trillion larger.

That changed quickly after 5 January 2021, when President Biden's political party gained control of the U.S. Senate after runoff elections in Georgia came out in their favor.

With control of the U.S. Congress in hand, the most rabidly partisan among President Biden's supporters quickly switched gears to exercise their new political power. Instead of linking the magnitude of any new stimulus package to the actual scale of the problem the U.S. economy was facing at the time, they decided they would "go big", putting their fringe political agenda ahead of sound fiscal policy.

But in ditching sound fiscal policy, they opened a rift among those who had been crafting the new stimulus measure. That rift took the form of an academic controversy that erupted while they were developing what would ultimately become the American Rescue Plan Act, which the Biden administration rammed through Congress and signed into law on 11 March 2021.

The controversy involved an economic concept known as potential output, or potential GDP. Here's a quick primer:

Potential output is an estimate of what an economy could feasibly produce when it fully employs its available economic resources. The Congressional Budget Office (CBO) estimates potential output by estimating potential GDP, which it describes as "the economy's maximum sustainable output." The word "sustainable" is important — it doesn't mean that the entire working-age population is working 18 hours per day or that factories are operating 24/7. Rather, it means that economic resources are fully employed — at normal levels. Potential output (estimated as real potential GDP) serves as an important benchmark level against which actual output (measured as real GDP) can be compared with at any given time.

The difference between the economy's potential output and its actual output is called the output gap, which economic policy makers must consider when shaping major fiscal policies. If they adopt policies that undershoot the gap, they will fail to obtain the full positive results they seek at the cost of greatly adding to the nation's debt. If they overshoot the gap, they risk creating adverse economic conditions, like inflation, that can fully undermine whatever positive results they hoped to achieve.

These scenarios were known risks at the time the Biden administration was pushing the American Rescue Plan Act forward. In fact, because the stimulus package they were considering had swelled to $1.9 trillion, the risk of creating inflation became a primary concern among the more fiscally responsible members of Biden's policy making team. But they lost the internal argument when President Biden sided with the most extreme elements among his supporters.

That victory didn't make the likelihood the enormous new stimulus package would almost certainly overshoot the output gap and create persistent inflation go away. By Inauguration Day, the progressive activists who hijacked the stimulus development still needed to dispell that risk to ensure they could get the massive stimulus through a still closely-divided Congress. Their chosen path to achieve their political agenda would hinge on an assumption cooked up by the Biden administration's most rabidly partisan supporters: that the nation's potential GDP and output gap were much larger than the CBO estimated and thus, would not create inflation. That assumption would become the focal point of the controversy for how the stimulus bill could negatively impact the economy.

On 3 February 2021, the Committee for a Responsible Federal Budget discussed how the assumptions of the size of potential GDP and the output gap being put forward affected the forecasts of how much the stimulus could overshoot the output gap:

The output gap could differ from CBO's projections. Many forecasts and experts suggest the economy will grow faster this year than CBO estimates. A one percentage point increase in Gross Domestic Product (GDP) growth would reduce the output gap to less than $200 billion, in which case the American Rescue Plan would be large enough to close eight to ten times the output gap based on the Edelberg and Sheiner numbers. On the other hand, many have argued that CBO is underestimating full employment and potential GDP. If potential GDP were 1 percent larger than CBO's estimate, the output gap would total $1.3 trillion through 2023 and the America Rescue Plan would close 115 to 145 percent of the output gap.

The "Edelberg and Sheiner numbers" refer to a 28 January 2021 analysis of the Biden administration's proposed stimulus produced by the nonpartisan Brookings Institute's Wendy Edelberg and Louise Sheiner. Just a few weeks later, Sheiner would join with Brookings' Tyler Powell and David Wessel to report on the controversy related to potential GDP that had erupted among those who were giving input to the Biden Administration's first major economic policy initiative:

As President Biden and Congress negotiate the next fiscal stimulus package to aid the COVID-19 economic recovery, they will implicitly be making assumptions about the output gap. Analysis by one of us (Louise Sheiner) and our Brookings colleague Wendy Edelberg suggests that Biden’s $1.9 trillion package would result in GDP reaching its pre-pandemic path by the end of 2021 and exceeding it in 2022. In other words, some of the economic activity lost during the pandemic would be made up after the virus subsides.

Based on the CBO’s recent estimate of potential GDP, though, this would leave a large positive output gap—peaking at 2.6 percent in the first quarter of 2022. Some critics — including former Treasury Secretary Lawrence Summers — argue that pushing output this far above potential could drive up inflation.

Others, including Nobel Laureate Paul Krugman, warn against putting too much emphasis on a projected output gap in determining the riskiness of a large fiscal stimulus. They note the significant uncertainty that surrounds any estimate of potential GDP. Indeed, by CBO’s estimates, the U.S. economy was operating above potential in 2019, yet inflation remained subdued and below the Fed’s 2 percent target. Moreover, there is little historical precedent to predict how the pandemic will affect potential output or consumer and business demand once the virus recedes.

With hindsight being 20/20, we know that Larry Summers' view was correct. President Biden's COVID stimulus overshot the output gap and created significant inflation, which quickly became evident after its enactment. Mainstream economists using different methodologies indicate the American Recovery Plan Act played a "sizable role" in causing inflation, adding anywhere from 2.6% to 3.5% on top of the inflation rate that would have been recorded without President Biden's $1.9 trillion stimulus.

That inflation was allowed to fester for a full year because of a commitment the Federal Reserve made to hold rates near zero percent for as long as possible. It took Americans seeing prices inflate faster than their incomes to finally force the Fed to address the inflation they allowed to gain traction with a series of interest rate hikes beginning in March 2022. Flashing forward one year later, the actions to fix the inflation unleashed by the stimulus measure has had negative impacts on large sectors of the U.S. economy, such as the housing market, and directly contributed to the bank failures that became front page news during the last few weeks.

The Biden administration cannot say they were not warned. Here's the prescient commentary from Larry Summers' 4 February 2021 op-ed in the Washington Post:

... while there are enormous uncertainties, there is a chance that macroeconomic stimulus on a scale closer to World War II levels than normal recession levels will set off inflationary pressures of a kind we have not seen in a generation, with consequences for the value of the dollar and financial stability. This will be manageable if monetary and fiscal policy can be rapidly adjusted to address the problem. But given the commitments the Fed has made, administration officials’ dismissal of even the possibility of inflation, and the difficulties in mobilizing congressional support for tax increases or spending cuts, there is the risk of inflation expectations rising sharply. Stimulus measures of the magnitude contemplated are steps into the unknown.

In another op-ed some three months later, Summers provided the epitaph for the inflationary failure of the Biden administration's first major economic initiative with just a simple, understated clause:

Excessive stimulus driven by political considerations was a consequential policy error...

The Biden administration and its extremist political supporters chose to purposefully overshoot the output gap and pretend it would not create the adverse economic conditions that are undermining whatever positive results they hoped to achieve with their $1.9 trillion stimulus. Today, they're expending much effort trying to avoid accountability for their roles in causing the catastrophic consequences of what is becoming the biggest policy error in generations.

Then again, if they weren't honest about it from the beginning, why would they start being honest and take responsibility for their failings now?

References

Martin Wolf. Interview with Larry Summers: ‘I’m concerned that what is being done is substantially excessive’. Financial Times. [Online Article]. 11 April 2021. Here's a video of the full interview:

François de Soyres, Ana Maria Santacreu, and Henry Young. Demand-Supply Imbalance during the COVID-19 Pandemic: The Role of Fiscal Policy. Federal Reserve Bank of St. Louis Review. First Quarter 2023, 105(1), pp. 21-50. [PDF Document]. DOI: 10.20955/r.105.21-50. 20 January 2023.

Francesco Bianchi and Leonardo Melosi. Inflation as a Fiscal Limit. Federal Reserve Bank of Chicago Working Paper No. 2022-37. [Online Article]. DOI: 10.2139/ssrn.4205158. 21 September 2022.

Doreen Fagan. Understanding Potential GDP and the Output Gap. Federal Reserve Bank of St. Louis Open Vault Blog. [Online Article]. 4 August 2021.

Committee for a Responsible Federal Budget. How Much Would the American Rescue Plan Act Overshoot the Output Gap. [Online Article]. 3 February 2021.

Wendy Edelberg and Louise Sheiner. The macroeconomic implications of Biden’s $1.9 trillion fiscal package. Brookings Institute Up Front. [Online Article]. 28 January 2021.

Tyler Powell, Louise Sheiner, and David Wessel. What is potential GDP, and why is it so controversial right now? Brookings Institute Up Front. [Online Article]. 22 February 2021.

Image Credit: Chronicling America. The High Cost of Living Upheaves the Nation. New York Tribune Magazine and Review. p. 1. [Online Database]. 10 August 1919.

Just over a year ago, we took a snapshot of the relationship between gold prices and real interest rates as indicated by the yield on inflation-adjusted 10-year constant maturity U.S. treasuries.

That original snapshot was taken on 17 March 2022, one day after the U.S. Federal Reserve started what became series of rate hikes that lifted the effective Federal Funds Rate from 0.08% to 4.83% to combat inflationary forces unleashed by the Biden administration a year earlier.

Because gold is used by investors as a hedge against inflation, rising in value when inflation-adjusted interest rates fall or turn negative, the rising rate environment the Fed has created over the past year should have reduced the price of gold by a substantial amount. When we took our snapshot on 17 March 2022, the gold spot price was $1,944.05 per ounce and the real yield of the 10-year Treasury was -0.72%.

One year later, on 17 March 2023, the spot price of gold had risen to $1,988.11 per ounce, while the inflation-adjusted 10-year yield had swung to +1.29%. That increase occurred despite the Fed's rate hikes pushed real interest rates to swing from negative to positive.

In between these dates, the price of gold fell for a time, but only while real interest rates were increasing and not by anywhere near as much as the 15-year long relationship between the two would have predicted. But that expected trend stopped after 3 November 2022, when the real 10-year Treasury yield peaked at +1.74% and the price of gold hovered around the $1,629 level, near its lows during the Fed's rate hike cycle.

After that date, the real yield of the 10-year Treasury fell back while the price of gold escalated. Our new snapshot of the relationship between spot gold prices and inflation-adjusted 10-year Treasuries illustrates these changes.

If the 15-year long relationship from 2 January 2007 through 16 March 2022 between the price of gold and real 10-year Treasury yields still held (shown by the dashed black curve in the chart), the price of gold would have fallen $850 per ounce more than it has. If the price of gold dropped to where it was trending between 17 March 2022 and 3 November 2022, which would be considered recent history, it would be about $350-$400 lower per ounce than it is for a similar real 10-year yield.

But it has risen higher, which raises new questions about what's driving the price of gold. The staff at Goldmoney, who have a more sophisticated model than we do, think there has been a paradigm shift. In the following excerpt from Part I of their analysis, we've added the links to the referenced exhibits, but not the boldface font, which appears in Goldmoney's original article:

Over the past few months, the gold price has once again detached from the model’s predicted price. And it has done so in a remarkable way. First, the delta between the observed gold price and the model-predicted price has reached an all-time high. Current gold prices are more than $400/ozt over model predicted prices (See Exhibit 2). The previous all-time high was $200/ozt and it only lasted for a short period of time.

Second, this is happening in the most unlikely of all environments. The Fed has been aggressively hiking rates for the past 12 months to fight the highest inflation in over 40 years. The Fed raised the Fed Funds rate from 0% to 4.5% in just 12 months. It is very rare that we see such large rate hikes from cycle bottoms. In fact, this has only happened five times since 1975 that the Fed raised rates more than 4% from the bottom (see Exhibit 3)....

Yet despite all this, gold prices have not just held their ground; they have actually risen! Arguably, it could be that the gold market once again has simply got ahead of itself. Or we really do see a paradigm shift this time.

Before we continue exploring this thought, we must add one caveat here. In our models, we use publicly available data for net central bank sales/purchases. The official data from the IMF is notoriously lagging and incomplete, and we are certain that the reported net purchase numbers are much too low. The World Gold Council (WGC), for example, reports net additions of 1136 tonnes in 2022, more than double the 450 tonnes bought by central banks in 2021. It’s no secret that central banks have been on a buying spree in the second half of last year. But exactly how much gold they added remains a bit of a mystery. That said, even assuming that true central bank gold purchases exceeded the WGC estimates by a massive 50% would bring the model-predicted price only about $70/ozt closer to the observed price. We believe this is partially a shortcoming of our model, as it is based on historical data, and we have not seen a lot of volatility in CB gold purchases in the past. However, we have had years with large central bank purchases before, and we had years with higher overall gold demand from all sectors, and yet this didn’t lead to large distortions in our model. Hence, we don’t think central bank purchases can explain the current huge discrepancy between predicted and observed prices.

Therefore, in our view, the only reason for gold prices to detach from the underlying variables in our model by such a large amount and for such a long time is that the gold market finally starts pricing in that there is a risk central banks, particularly the Fed, are losing control over inflation, which is remarkable given the prevailing narrative that the Fed is willing and able to do whatever it takes to bring inflation under control.

Here's the bottom line from Part II of their analysis:

We believe that the most likely explanation for the recent rally in gold prices against the underlying drivers of our model is that the market is increasingly pricing in that the Fed, once it is forced to stop hiking, will lose control over inflation. Faced with the choices of years of high unemployment and a crumbling economy or persistent high inflation, the gold market thinks the Fed will opt for the latter. This would mark a true paradigm shift, and from that point on, gold prices may start to price in prolonged high inflation (and our model may not be able to capture this properly).

If true, a lot of models will be as broken as our simple model already is! Then again, in the immortal words of George Box, all models are wrong, some are useful. The trick is to know when they work, because relying on a failed model after its expiration date can lead to catastrophic consequences.

Previously on Political Calculations

- Real Yields and the Price of Gold

- Why Hasn't the Price of Gold Fallen More with the Fed's Rate Hikes?

Image credit: Photo by Anne Nygård on Unsplash.

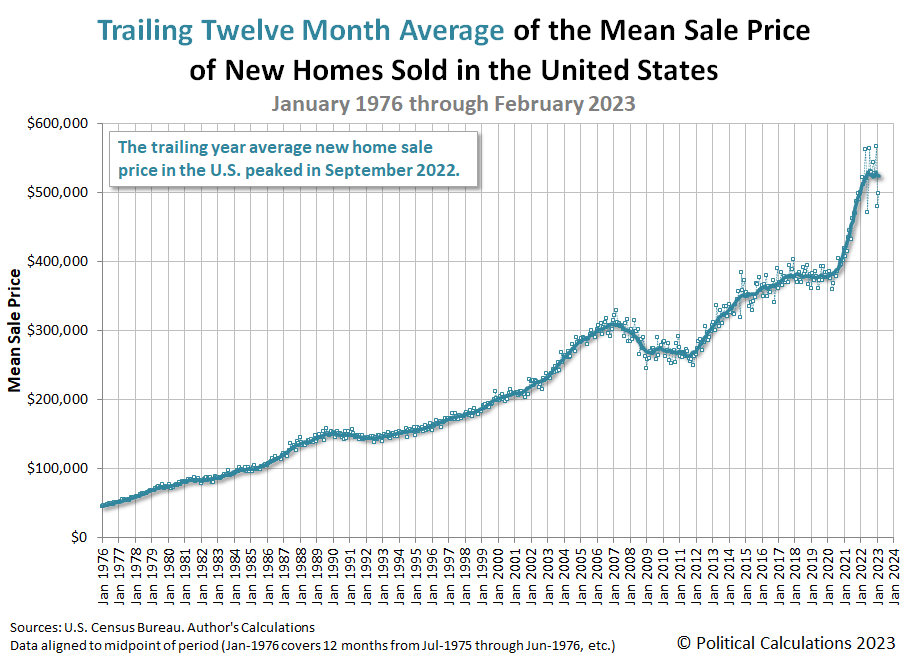

February 2023 saw the market capitalization of new homes sold in the U.S. rise for the first time in eleven months. A combination of a higher number of new homes sold and a small increase in the average sale price of new homes sold contributed to the first increase in this measure since March 2022.

While these changes are based on preliminary estimates, they do confirm the change in momentum observed a month earlier. In January 2023, the decline in the market cap of new homes sold slowed for the first time in months. The new data indicates positive momentum building in the market, which in turn helps explain why U.S. homebuilders were becoming more optimistic last month.

Much of that optimism is tied to the direction of mortgage rates, which fell in February 2023, helping make new homes more affordable. We'll take a closer look at the trends for the affordability of new homes sometime in the next week, but for now, here's the latest update to the big picture for new home builders and the U.S. economy.

This chart shows the time-shifted rolling twelve month average of the U.S. new home market capitalization for February 2023 is $25.41 billion. That figure represents a small increase from January 2023's revised $25.34 billion. The following two charts show the latest changes in the trends for new home sales and prices:

The question for new home builders is whether this positive momentum can overcome the negative conditions that are developing in the U.S. economy. We anticipate it will continue in March 2023, but what happens after the first quarter of 2023 ends will hinge on other economic factors.

References

U.S. Census Bureau. New Residential Sales Historical Data. Houses Sold. [Excel Spreadsheet]. Accessed 23 March 2023.

U.S. Census Bureau. New Residential Sales Historical Data. Median and Average Sale Price of Houses Sold. [Excel Spreadsheet]. Accessed 23 March 2023.

Image credit: U.S. Census Bureau: New Single-Family Homes Sold Not as Large as They Used to Be.

Labels: real estate

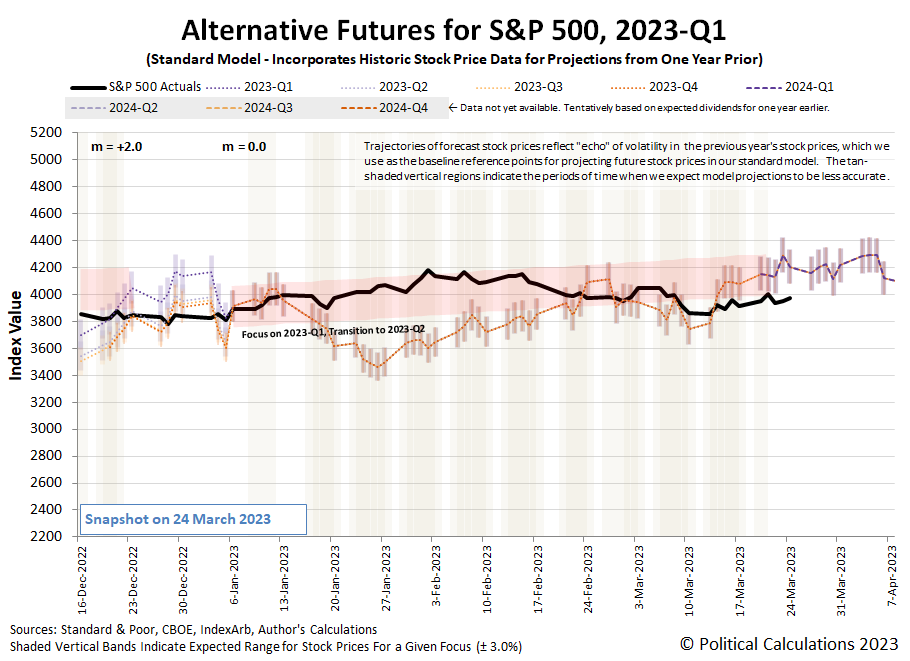

The S&P 500 (Index: SPX) climbed 1.4% from the previous week's close to wrap up the trading week ending Friday, 24 March 2023 at 3970.99.

During the week, dividend futures rebounded from the previous week's low for the quarter. However, the bigger story is that expectations took hold the Federal Reserve is done with rate hikes after hiking them by a quarter point on Wednesday, 22 March 2023 and will be swinging to cut rates instead in the weeks ahead.

The latest update to the alternative futures chart shows the S&P 500's trajectory continued persistently tracking below the redzone forecast range we established almost three months ago, which has now reached its end.

With the increased focus on how the Fed will adapt its monetary policies during 2023-Q2, the Fed's rate hike provides a valuable calibration point we can use to quantify the shift in the value of dividend futures-based model's multiplier. The model requires the multiplier's value be set according to empirical observations, where a first pass suggests it has shifted from 0.0 to +1.5 as a result of the interest rate hike-induced distress in the U.S. banking system. That new shift follows the multiplier having recently shifted from +2.0 to +0.0 in early January 2022.

The next chart sets up the new hypothesis test utilizing a multiplier of about +1.5 starting from 9 March 2023, coinciding with the development of the then-impending failure of Silicon Valley Bank.

With this shift in multiplier, we see the redzone forecast range adjust accordingly, as if we has made the assumption the multiplier, m, would shift from +0.0 to +1.5 on 9 March 2023 from the very beginning. This visual adjustment is an artifact of how we set up redzone forecast ranges, where we anchor one point in the past and the other in the future to allow them to dynamically adapt along with changes in future expectations.

Going forward, we're starting with the assumption that m = +1.5 and that investors are focusing on 2023-Q2 in setting their forward-looking focus. Ideally, we should see the trajectory of the S&P 500 track along within a few percent of the alternative future projection associated with 2023-Q2. In reality, we anticipate a higher level of volatility driven by the onset of new information.

Speaking of which, here are the past trading week's market moving headlines:

- Monday, 20 March 2023

-

- Signs and portents for the U.S. economy:

- Investors uncertain of Fed minions' next steps following bank failures, bailouts:

- Uncertainty reigns as Fed considers interest rate hike

- Factbox-Banking turmoil may prompt Fed to go slow on interest rate hikes

- Marketmind: Fed halt being priced as bank blaze smoulders

- The canary is alive and chirping a year into Fed's rate hiking cycle

- Failing bank Credit Suisse bought by UBS in forced sale:

- UBS to take over Credit Suisse, assume up to 5 billion Swiss francs in losses

- Bank shares rise after Credit Suisse rescue eases crisis

- Explainer-Why markets are in uproar over a risky bank bond known as AT1

- BOJ minions claim Japan's banks are stable, worry about side effects of never-ending stimulus:

- Japan says banking system stable, plays down risk of contagion

- BOJ debated side effects of easy policy at March meeting

- Bigger trouble as Chinese, global economy not growing as quickly as expected:

- Bigger trouble developing in the Eurozone:

- German economy heading for contraction in Q1, Bundesbank says

- German producer prices rise more than expected in February

- ECB minions looking to exploit bank system crisis to achieve inflation target, claim risk of Eurozone bank failures is small:

- Market turmoil may do ECB's work in dampening demand - Lagarde

- ECB's Centeno sees some build-up of inflationary tensions

- ECB's Stournaras: Chance of contagion to EU banks "very small"

- Factbox-What can the ECB do to stop the banking crisis?

- Wall St ends higher as bank contagion fears ease, Fed eyed

- Tuesday, 21 March 2023

-

- Signs and portents for the U.S. economy:

- Oil rises 2% in retreat from 15-mth low as banking fears subside

- US officials study ways to expand FDIC coverage to all deposits -Bloomberg News

- Lower mortgage rates boost US home sales in February

- ECB minions having second thoughts about more rate hikes:

- Wall Street ends green on bank bounce as Fed takes focus

- Wednesday, 22 March 2023

-

- Signs and portents for the U.S. economy:

- Oil up 2% as dollar weakens on small US Fed rate hike

- Falling US gasoline stockpiles signal a repeat of last summer's high prices

- Investors on edge before the Fed minions' meeting:

- As Fed meeting looms, economists see central bank balance sheet in new light

- Fed's Powell faces political storm, policy minefield over SVB oversight

- Fed minions deliver quarter point rate hike, hint at pause in rate hikes to focus on failing banks:

- U.S. Fed delivers small rate hike amid global banking turmoil

- Fed sees credit drawdown looming, shifts towards pause on rate hikes

- Bank deposits have stabilized in last week, Powell says

- Yellen, caught between financial markets and US Congress, pleases neither

- Yellen Pulls Rug Out From Powell's Dovish Promises: Gold Gains As Banks Bust

- "We Are Headed For Another Train Wreck": Bill Ackman Blames Janet Yellen For Restarting The Bank Run

- Yellen says US banks shoring up liquidity to guard against runs

- Explainer-How safe is my money in a U.S. bank and what is insured?

- Bigger stimulus developing in China:

- Mixed economic signals in Japan:

- Japan's land prices up at fastest pace since 2008 on gradual econ recovery

- Japan cuts view on industrial output, vigilant on market volatility

- ECB minions thinking about their carbon footprint while German officials worry about inflation picking up if bank failures stop ECB from focusing on fighting inflation:

- ECB to publish first detailed carbon footprint

- German 'wise ones' see inflation uptick if banking woes halt rate rises

- Stubborn inflation may require more ECB rate hikes: Nagel

- Wall St ends sharply lower as Powell warns inflation fight continues

- Thursday, 23 March 2023

-

- Signs and portents for the U.S. economy:

- U.S. new home sales post third straight monthly gain in February

- Oil drops 1% as US in no rush to refill strategic reserve

- Biden administration Treasury Secretary forced to backtrack:

- Yellen tries to assuage investor fears as bank stocks slide

- Yellen, caught between markets and US Congress, tweaks bank safety message

- Fed minions seen on verge of policy change for setting interest rates:

- More central bank minions putting rate hikes on hold, addressing potential for bank failures:

- Brazil central bank holds rates, flags increased inflation expectations

- Bank of Korea says non-bank financial firms face stress from property market

- New Zealand central bank says economy slowing, still not sure if rates high enough

- Analysis-End of central bank rate hikes now firmly on the horizon

- Other central bank minions continue rate hike mania:

- Hong Kong central bank raises policy rate after Fed hike

- Philippines central bank stays in inflation-fighting mode, hikes rates by 25 bps

- Taiwan central bank unexpectedly raises rates on inflation concerns

- Bank of England raises interest rates again, sees inflation falling

- Swiss National Bank raises rates, says Credit Suisse takeover prevented larger crisis

- ECB minions still singing from rate hike hymnal:

- Wall St ends higher as Yellen vows actions to safeguard deposits

- Friday, 24 March 2023

-

- Signs and portents for the U.S. economy:

- How the 2023 banking crisis unfolded

- US business investment appears weak in first quarter as orders rise moderately

- End of central bank rate hikes now firmly on the horizon

- Oil settles down on worries over European banks, U.S. crude reserve

- Fed minions try putting on brave face despite bank crisis, credit crunch, risks to commercial real estate market:

- Fed officials say sense of financial stability cleared path for rate hike

- The Fed sees a looming credit crunch. What's that?

- Real estate leader on NY Fed board warns on commercial real estate risks

- Bigger trouble developing in Japan:

- Bigger trouble developing in Asia, all over:

- ECB minions committing to rate hikes despite banking sector turmoil, say no problems with Eurozone banks:

- ECB rates must rise; bank share volatility unsurprising, ECB's Nagel says

- ECB, EU leaders say European banks well capitalised, liquid

- Euro zone services firms enjoy buoyant March but factories struggle -flash PMI

- Wall Street ends volatile week higher as Fed officials ease bank fears

After the Federal Reserve's quarter point rate hike on 22 March 2023, the CME Group's FedWatch Tool now anticipates the Fed has finished the series of rate hikes it began a year earlier. From the current Federal Funds Rate target range of 4.75-5.00%, the FedWatch tool predicts the Fed will be forced initiate a series of quarter point rate cuts at six weeks intervals starting after the FOMC meets on 26 July (2023-Q3) and continuing through December (2023-Q4). In 2024, the FedWatch tool projects at least one quarter point rate cut per quarter through September (2024-Q3), when the Federal Funds Rate target range will have fallen to 2.75-3.00%.

The Atlanta Fed's GDPNow tool's projection for real GDP growth in the first quarter of 2023 held steady at +3.2%. With the first calendar quarter of 2023 nearly over, the GDPNow indicator continues transitioning to look backward instead of forward. The Bureau of Economic Analysis' initial estimate of GDP in 2023-Q1 is scheduled to be released on 27 April 2023.

Image credit: WikiMedia Commons. Creative Commons: CC0 1.0 Universal (CC0 1.0) Public Domain Dedication.

The Edge Hotel School at the University of Essex has unleashed the power of geometry to give its students an edge within the very competitive hospitality industry. They've identified the optimal angle for slicing potatoes to craft the ultimate roasted potato dish.

Their two-minute long video summarizes their research findings:

By slicing a potato in half along its long axis, then cutting the halves at a 30-degree angle, they maximize their surface area of the potatoes, which leads to better tasting results when they're roasted.

Economically prepare better tasting food is a very big deal in the hospitality industry. Developing a method of economically preparing a better tasting roasted potato can indeed make a difference at the margin. A difference that can determine success or failure in an industry known for having relatively low net margins.

HT: The UI Junkie.

Previously on Political Calculations

Unfavorable changes. Just saying that phrase doesn't sound good, because it means something has turned for the worse.

When it comes to stock market dividends, it is, unfortunately, a very well established phrase. We suspect it was first deployed for that purpose on 5 October 1927 by Bertie Forbes, the founder of the long-running business magazine that still bears his name, though his surviving family members no longer own a majority stake in the company he established. At the time, he was reporting on the Roaring 1920s stock market in his syndicated column, which he quantified by counting up the dividend changes being announced each month by the firms whose stocks he tracked. With the booming stock market of that era, he was mainly reporting on favorable changes.

But in this column, Forbes used the term "unfavorable" for the first time to describe the combined total of dividend reductions and omissions that had occurred, noting there had been 21 such announcements in September 1927, and 131 overall in the year to date. In another two years, Forbes would come to use that phrase much more often as the Great Depression got underway and the number of unfavorable dividend changes exploded. His terminology took hold among the financial analysts of the day and has survived to the present.

We've previously presented what dividend reductions, or reductions, looked like through the Great Depression. But that only tells less than half of the story of how bad things were during that time. To tell the whole story, we need to add omitted (or passed) dividend announcements to the monthly totals of dividend reductions.

That's what we're doing today. But not just for the Great Depression, where we have previously compiled monthly data from January 1929 through December 1936 originally provided by the Standard Statistics Company, one of the precursor firms for today's Standard and Poor. We also have S&P's data for unfavorable dividends that runs from January 1955 through February 2023. The following chart shows all the historical data for unfavorable dividend changes we've been able to obtain at this point in time.

Aside from the missing data in the period from January 1937 through December 1954, the data we do have does an amazing job communicating the scale of how bad the United States' worst economic crises were.

If you go by the height of the number of unfavorable dividend changes, we find the Coronavirus Recession ranks second to the Great Depression. The sheer mass and duration of the Great Depression's dividend reductions and omissions clearly mark that event as far, far worse. If not for the Coronavirus Recession spike, the so-called "Great Recession" of 2008-2009 would rank second and, if we compare the areas under the numbers of unfavorable dividend changes each month, it does.

We also see some potentially useful thresholds. For the periods where we have data, having the number of unfavorable dividend changes reach a level of 50 or higher in a single month often coincides with official periods of recession or significant distress for U.S. businesses. Historically, unfavorable changes that reach higher than 100 per month point to periods characterized by severe levels of economic distress.

Standard and Poor reported 100 unfavorable dividend changes in February 2023.

About the Data

We previously did the legwork for compiling the Great Depression era's unfavorable dividend changes using contemporary newspaper reports published between January 1929 and January 1937 that featured the Standard Statistics Company's data. We thank Howard Silverblatt for providing Standard and Poor's archived data for unfavorable dividend changes from January 1955 through December 2003. Our source for unfavorable dividend data from January 2004 through the present is Standard and Poor's S&P Market Attributes Web File, which Howard and S&P's analytical team compile each month.

If you compare the Standard Statistics Company/Standard & Poor's data with that reported by B.C. Forbes in the 1920s and 1930s, the historic S&P data presents a more complete picture. It represents the dividend announcements of all publicly-traded firms in the U.S. stock market, while Forbes' data is based on a smaller subset of U.S. firms he regularly tracked.

References

Standard and Poor. S&P Market Attributes Web File. [Excel Spreadsheet]. 1 March 2023.

Image Credit: U.S. Library of Congress (Chronicling America). Real Napoleonic Financiering. National Tribune (Washington D.C.) Vol XXVII, No. 12, 1379, p. 1. [Online Database].

Labels: data visualization, dividends, stock market

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.