What if you could collect all the particles of SARS-CoV-2 coronavirus there are in the world together in one place. How much space do you think it would occupy?

Mathematician Kit Yates ran a back-of-the-envelope calculation to find out, where the final result might surprise you. The basic math has been described in the following short video:

In U.S. terms, 160 milliliters is the equivalent of 5.4 fluid ounces, which would better fit in a 5.5 fl. oz. V-8 juice can, the smallest size container in which this particular product may be purchased! Or if you prefer to reference another popular Campbell's product, all the coronavirus in the world would fit in just about half of a single iconic 10.75 fluid ounce can of Campbell's Condensed Tomato Soup.

For our regular readers, if the name Kit Yates sounds familiar, it's because we've been linking to a BBC Four radio interview he gave in April 2020, in which he describes how back calculation may be used to identify the specific timing of events that have changed the trends for coronavirus infections. We've been employing that method as an integral part of our series exploring Arizona's experience during the coronavirus pandemic. In case you missed it, here is the previous entry in that series.

Labels: coronavirus, food, math, soup

Unlike other states coping with the winter surge in serious COVID-19 cases in their hospitals, Arizona never ran out of available Intensive Care Unit (ICU) bed space.

Here's a chart from the Arizona Department of Health Services COVID-19 data dashboard, which shows the daily percentage usage of ICU beds in the state, including for COVID-19 patients from 10 April 2020 through 20 February 2021:

ICU bed usage peaked at 93% on 30 December 2020, as the number of open ICU beds in the state dropped to 121, the lowest figure recorded during the state's experience with the coronavirus pandemic.

But while this chart ably communicates the percentage share of ICU beds that were either open, used by COVID-19 patients, or by non-COVID-19 patients, it doesn't communicate the story of how Arizona was able to avoid the situation that states like California faced in running out of ICU beds during the same period of time.

The following chart reveals that part of Arizona's secret to avoiding running out of ICU bed capacity was to increase its supply of ICU beds. In the chart, we've shown the daily numbers of open ICU beds, the ICU beds used by both COVID-19 and non-COVID patients, and also the total number of ICU beds in the period from 10 April 2020 through 20 February 2021, against the backdrop of the major turning points driving the number of COVID-19 cases in Arizona.

Here, we find that Arizona went from an average total of roughly 1,650 ICU beds early in the coronavirus pandemic to over 1,800 at its peak.

We also see that the number of COVID-19 and non-COVID-19 patients are inversely related, with one rising while the other falls, which points to another secret to Arizona's relative success in managing its limited ICU capacity. Hospital officials proactively managed non-COVID-19 patient ICU bed usage, which helped ensure ICU beds would be available for COVID patients.

At the same time, treatments available for COVID-19 patients have improved from lessons learned during the state's first wave of SARS-CoV-2 coronavirus infections. These improved treatments helped keep a considerable COVID-19 patients from needing to be placed in ICU beds.

That can be seen by the relative number of COVID-19 patients in Arizona hospital ICU beds. That number peaked at 970 during the state's first wave, and peaked at 1,183 during the state's second wave, a 22% increase.

By contrast, the rolling seven day moving average for the number of patients admitted to Arizona hospitals for COVID-19 peaked at 315 per day on 16 July 2020 during Arizona's first wave, and at 535 per day on 8 January 2021 during the state's second wave, a 70% increase. The much smaller percentage increase in ICU bed usage during Arizona's second wave may therefore be attributed to improved care and treatments available for COVID-19 patients at Arizona's hospitals.

The story of how Arizona's hospitals have managed its periodically worst-in-the-nation surge of COVID-19 has been absent in media reports. We thought it was time that somebody addressed even a small part of what looks to be an all-too-rare good news story.

Previously on Political Calculations

Here is our previous coverage of Arizona's experience with the coronavirus pandemic, presented in reverse chronological order.

- The Ebb and Flow of COVID-19 in Arizona's ICUs

- Arizona's Plunging COVID-19 Caseloads and the Vaccines

- Arizona Enters Downward Trend for COVID-19 After Second Peak

- Arizona Passes Second COVID-19 Peak

- A Tale of Two States and the Coronavirus

- COVID-19 Questions, Answers, and Lessons Learned from Arizona

- The Deadly Intersection of Anti-Police Protests and COVID-19

- 2020 Campaign Events Drive Surge in Arizona COVID Cases

- Arizona Arrives at Critical Junction for Coronavirus Cases

- Arizona To Soon Reach A Critical Junction For COVID-19

- Getting More Than Care from Arizona's COVID ICU Beds

- Arizona's Decentralized Approach to Beating COVID

- Going Back to School with COVID-19

- Arizona Turns Second Corner Toward Crushing Coronavirus

- Arizona's Coronavirus Crest in Rear View Mirror

- The Coronavirus Turns a Corner in Arizona

- A Delayed First Wave Crests in the U.S. and a Second COVID-19 Wave Arrives

- The Coronavirus in Arizona

- A Closer Look at COVID-19 Deaths in Arizona

- The New Epicenter of COVID-19 in the U.S.

- How Long Does a Serious COVID Infection Typically Last?

- How Deadly is the COVID-19 Coronavirus?

- Governor Cuomo and the Coronavirus Models

- How Do False Test Outcomes Affect Estimates of the True Incidence of Coronavirus Infections?

- How Fast Could China's Coronavirus Spread?

References

We've continued following Arizona's experience during the coronavirus pandemic because the state's Department of Health Services makes detailed, high quality time series data available, which makes it easy to apply the back calculation method to identify the timing and events that caused changes in the state's COVID-19 trends. This section links that that resource and many of the others we've found useful throughout the coronavirus pandemic.

Arizona Department of Health Services. COVID-19 Data Dashboard. [Online Application/Database].

Stephen A. Lauer, Kyra H. Grantz, Qifang Bi, Forrest K. Jones, Qulu Zheng, Hannah R. Meredith, Andrew S. Azman, Nicholas G. Reich, Justin Lessler. The Incubation Period of Coronavirus Disease 2019 (COVID-19) From Publicly Reported Confirmed Cases: Estimation and Application. Annals of Internal Medicine, 5 May 2020. https://doi.org/10.7326/M20-0504.

U.S. Centers for Disease Control and Prevention. COVID-19 Pandemic Planning Scenarios. [PDF Document]. Updated 10 September 2020.

More or Less: Behind the Stats. Ethnic minority deaths, climate change and lockdown. Interview with Kit Yates discussing back calculation. BBC Radio 4. [Podcast: 8:18 to 14:07]. 29 April 2020.

Labels: coronavirus, health care

Having covered the state of Earth's economy yesterday, we have a unique opportunity to extend our planetary scale analysis to Mars, whose economy is starting to register signs of life after what many scientists believe is a 600 million year recession.

There is, after all, now signs of activity on the Martian surface. The following footage of some of that activity was recorded on 18 February 2021:

With the arrival of NASA's Perseverance rover, we estimate Mars' GDP to now be greater than $0, which is where Mars' economy had been stuck since the Mars Opportunity rover ceased operation in 2019, and which has been Mars' average GDP for millennia.

Although the Perseverance mission itself cost more than $2.4 billion, which does not include an additional $300 million for landing and operating a rover on the surface of Mars. Nearly all of these costs are properly counted toward Earth's GDP however, where nearly all of the mission's activity has occurred to date.

With an active mission on its surface, Mars' GDP is no longer at $0, but is now greater than $0.

Economic development plans are in the works for Mars, which may become the first planetary economy to run entirely on cryptocurrency.

The Perseverance rover will collect samples that will someday be exported to Earth, making the mission the one of the first to begin developing interplanetary trade within the solar system.

Update 25 February 2021: A panorama of Perseverance's view from the Jezero Crater (HT: Michael Wade)

How much do you suppose Mars' first produced exports will be worth?

Labels: development, economics, ideas, technology, trade

After new rounds of government-mandated lockdowns sent large portions of the global economy into a double dip recession in December 2020, the global economy continued cooling in January 2021 as the recessionary impact of the lockdowns deepened.

We can see that happening in the falling rate of change of atmospheric carbon dioxide measured at the remote Mauna Loa Observatory. The following chart shows that latest trend in the context of the history of the metric since January 1960.

In addition to the earlier European government-imposed lockdowns, the data for Janaury 2021 is now including some of the impact of regional lockdowns in both China and Japan, and also states like California in the U.S.

Increasingly unpopular in addition to being economically disruptive, many government officials in these regions have begun easing their lockdown measures. Combined with declining numbers of cases in much of the world, we anticipate the relative impact of the double dip coronavirus recession will be much smaller than the first wave.

We estimate that first wave cost the global economy some $12 trillion in lost GDP in 2020. We'll take a closer look at how much more global GDP has been lost to government-imposed coronavirus lockdowns in our next update to this series to find out how much the second lockdown recessions are harming Earth's economy.

Previously on Political Calculations

Here is our series quantifying the negative impact of the coronavirus pandemic on the Earth's economy, presented in reverse chronological order.

- Global Double Dip Coronavirus Recession Deepens

- Global Economy Enters Double Dip Coronavirus Recession

- Global Economy Teeters on Double Dip Recession

- World GDP Lost Due to Coronavirus Reaches $12 Trillion

- Cumulative World GDP Loss From Coronavirus Pandemic Tops $11 Trillion

- Estimates of World GDP Lost to the Global Coronavirus Recession

- Finding Human Fingerprints in Atmospheric CO2

- The Coronavirus and Atmospheric CO2 in April 2020

- The Coronavirus, Atmospheric CO2, and GDP

Labels: coronavirus, environment, recession

The S&P 500's upward momentum stalled out in the MLK holiday shorted trading week. The index closed the week at 3,906.71, down 0.7% from the previous week's record high closing value.

The week however provided the clarity we needed to fix the starting point for the redzone forecast range shown on the latest update to the alternative futures chart. Investors were focusing on 2021-Q2 as the S&P 500 caught up to the echo of past volatility from last year's coronavirus recession crash.

Although its not shown on the chart, we've tied the opposite end of the redzone forecast range to the dividend futures-based model's projection of the trajectory associated with investor expectations for the distant future quarter of 2021-Q4, on the opposite side of the volatility echo, which extends to 10 May 2021. In doing this, we're assuming investors will have shifted their forward-looking attention outward by that point of time, which is an assumption we may need to revisit.

There wasn't much in the way of market moving headlines in the news of the week that was, but what there was indicates investors are focusing on 2021-Q2 at the present time.

- Tuesday, 16 February 2021

- Signs and portents for the U.S. economy:

- Fed minions have positive outlook, want more government spending, but see COVID-19 closed schools advocated by teacher union-controlled Biden administration as harmful:

- U.S. financial outlook mostly good, growth could outpace China: Fed's Bullard

- Fed's George: Fiscal policy will remain important until pandemic is over

- COVID school closures may slightly stunt U.S. economic growth: Fed paper

- Less big trouble developing in the Eurozone:

- Scenario of 1.4 trillion euros in NPL's in Europe after pandemic less likely: ECB's McCaul to paper

- French unemployment falls to pre-crisis levels in fourth-quarter, skewed by lockdown

- Euro zone fourth quarter GDP falls less than earlier estimated

- Germany dashes hopes of businesses for quick reopening of economy

- Stimulus hopes drive Dow to closing peak but interest rate worries loom

- Wednesday, 17 February 2021

- Signs and portents for the U.S. economy:

- Oil rises 1% as Texas freeze prompts U.S. production drop

- U.S. manufacturing production rises solidly despite semiconductor shortage

- Fed minions optimistic, see benefits to pandemic, think they will keep missing their inflation target, but are okay with overrunning it:

- Fed's Barkin is 'quite optimistic' on U.S. outlook

- Pandemic led to U.S. housing boom, reduced credit card debt, New York Fed says

- Inflation not likely to hit Fed's target through 2022, Rosengren says

- Bigger debt developing all over:

- Nasdaq ends lower as tech slides; inflation concerns weigh

- Thursday, 18 February 2021

- Daily signs and portents for the U.S. economy:

- Oil falls after surging past $65 on Texas freeze

- Democratic drive for Biden's $1.9 trillion stimulus plan could leave progressive priorities behind

- U.S. housing starts fall in January; permits soar

- U.S. labor market struggling to regain momentum

- Fed minion wants maximum jobs, sustainable growth, financial firms to address climate risk, and a pony. Analysts say Fed is locked into money printing to deliver:

- Brainard: Fed wants maximum employment, growth that is "sustainable"

- Analysis: Debt-laden world, rising bond yields - a toxic taper tantrum combo

- Wall St closes down on tech slide, rising jobless claims

- Friday, 19 February 2021

- Daily signs and portents for the U.S. economy:

- Oil extends losses as Texas prepares to ramp up output after freeze

- U.S. existing home sales unexpectedly rise in January

- U.S. factory activity cools; cost pressures mounting

- Fed minions see risk of business failures, do not fear overheated economy, look forward to economic recovery, but really want more government spending and affordable child care:

- Fed sees 'considerable' risk of ongoing U.S. business failures

- Fed's Williams does not expect economy to overheat due to fiscal aid

- Barkin: Economy should surge even absent full herd immunity to coronavirus

- Fed's Rosengren says large fiscal package appropriate, hopes for full employment within two years

- Bigger trouble developing in Canada:

- Mixed recovery signs... :

- ... in Japan:

- Japan cuts economic outlook in Feb for first time in 10 months

- Japan January factory output to rise for first time in three months: Reuters poll

- ... in the Eurozone:

- ECB, Eurogroup minions starting to worry about debt:

- ECB faces tricky balancing act after pandemic debt surge

- Eurogroup chief says debt can't be reduced without solid recovery

- Wall Street closes flat as cyclicals shine, big tech falls

Elsewhere, Barry Ritholtz names the positives and negatives he found in the past week's economics and markets news.

In two weeks since our previous update, Arizona's number of COVID-19 cases, hospital admissions (including ICU bed usage), and deaths have been plummeting.

That good news prompted us to put together an animation showing the results of the back calculation method we've been using to identify the events that led to significant turning points in the trends for COVID-19 in Arizona. The animation cycles through the charts we've created using Arizona's high quality data for the number of daily positive COVID-19 test results by date of sample collection, the number of daily COVID-19 hospitalizations by date of hospital admission, and the daily number of COVID-19 deaths according to death certificate data.

Full size versions of the animation and the three individual charts may be found by clicking the four links presented above.

The continued downward trend is exciting, where we were hoping to start seeing the effects of the COVID vaccines that began being administered in the state beginning in December 2020. As of 17 February 2021, over 1.33 million doses have been administered in Arizona, with 332,070 Arizonans having had both the first and second doses of the vaccines developed by Pfizer and Moderna. The following chart shows the daily progress in Arizona's COVID-19 vaccination program:

The inset of the chart presents the age distribution of the state's vaccination program, which has initially prioritized first responders, health care workers, teachers, and the elderly. The population of Arizonans below Age 20 doesn't include individuals who belong to these prioritized groups, which offers an opportunity for an interesting natural experiment.

Because Arizona's Age 0-19 population has so far been excluded from the state's COVID-19 vaccination program, we should be able to see effects of the vaccine in preventing coronavirus by comparing the incidence of COVID-19 in this age group with others. With over 528,000 Arizonas Age 65 or older having received at least one dose of the COVID-19 vaccines as of 17 February 2020, or the equivalent of about 40% of the population of this age demographic group in the state assuming that everyone in this group has had one dose of the vaccine, we thought it would be interesting to compare these two groups.

The next chart shows eight months worth of the rolling 7-day moving average for Arizona's age demographic data indicating the numbers of those who have tested positive for COVID-19 by age group, from 17 June 2020 through 17 February 2021. This data is different from the data for positive COVID-19 test results we presented earlier, because the daily data used for this chart reflects the daily reported number of cases, which can span many days worth of sample collections. We will assume this data generally follows the similar patterns indicated by the more precise data that tracks the date of test sample collections.

Until recently, there have generally been more Age 0-19 individuals with confirmed COVID-19 cases than seniors (Age 65+), but with the exception of the 'back to school' surge in cases for the Age 0-19 population in the period from mid-August to late-September, the pattern for the incidence of cases for the two age groups has been generally similar.

Our next step was to calculate the simple ratio of the number of seniors (Age 65+) testing positive for COVID-19 to the number of Age 0 to 19 year olds testing positive in Arizona. In the next chart, that ratio is presented as a percentage, where values greater than 100% indicate more seniors than Age 0-19 year olds and values less than 100% indicate more Age 0-19 individuals tested positive for COVID-19 than seniors.

This presentation makes it easy to see the back to school surge for the Age 0-19 year olds, where the number of individuals infected by the SARS-CoV-2 coronavirus caused the ratio to plunge in August-September 2020, before recovering then stabilizing in October 2020. After that, the ratio skewed in favor of seniors with the state's second COVID-19 surge, which the back calculation method traces back to political events that occurred in the weeks ahead of the 3 November 2020 elections.

The ratio then went on to peak on 29 December 2020, just as Arizona's COVID-19 vaccination program began providing inoculations to Arizonans Age 75 or older. The ratio then dips, but stabilizes at an elevated level into February, when the ratio spikes above the 100% threshold once again, as relatively more seniors than Age 0-19 year olds have been testing positive for COVID-19.

That's a disappointing result for considering the effectiveness of the COVID-19 vaccines, because it means the decline in positive test results among unvaccinated Arizonans (as indicated by the Age 0-19 population) is falling faster than the decline in positive test results for seniors Age 65 or older, where over a third of this population have received at least one dose of the COVID vaccines.

That observation suggests that getting past the 2020 holiday season and its increased levels of social mixing is primarily responsible for Arizona's decline in COVID-19 cases, hospital admissions, and deaths.

There are other ways we might parse the data to see if we can tease out any effects from the vaccines on the trajectory of COVID-19 in Arizona, which we'll look closer at in our next update. For now however, we cannot meaningfully attribute any part of Arizona's plunging COVID-19 caseload to the introduction of the vaccines.

Previously on Political Calculations

Here is our previous coverage of Arizona's experience with the coronavirus pandemic, presented in reverse chronological order.

- Arizona's Plunging COVID-19 Caseloads and the Vaccines

- Arizona Enters Downward Trend for COVID-19 After Second Peak

- Arizona Passes Second COVID-19 Peak

- A Tale of Two States and the Coronavirus

- COVID-19 Questions, Answers, and Lessons Learned from Arizona

- The Deadly Intersection of Anti-Police Protests and COVID-19

- 2020 Campaign Events Drive Surge in Arizona COVID Cases

- Arizona Arrives at Critical Junction for Coronavirus Cases

- Arizona To Soon Reach A Critical Junction For COVID-19

- Getting More Than Care from Arizona's COVID ICU Beds

- Arizona's Decentralized Approach to Beating COVID

- Going Back to School with COVID-19

- Arizona Turns Second Corner Toward Crushing Coronavirus

- Arizona's Coronavirus Crest in Rear View Mirror

- The Coronavirus Turns a Corner in Arizona

- A Delayed First Wave Crests in the U.S. and a Second COVID-19 Wave Arrives

- The Coronavirus in Arizona

- A Closer Look at COVID-19 Deaths in Arizona

- The New Epicenter of COVID-19 in the U.S.

- How Long Does a Serious COVID Infection Typically Last?

- How Deadly is the COVID-19 Coronavirus?

- Governor Cuomo and the Coronavirus Models

- How Do False Test Outcomes Affect Estimates of the True Incidence of Coronavirus Infections?

- How Fast Could China's Coronavirus Spread?

References

We've continued following Arizona's experience during the coronavirus pandemic because the state's Department of Health Services makes detailed, high quality time series data available, which makes it easy to apply the back calculation method to identify the timing and events that caused changes in the state's COVID-19 trends. This section links that that resource and many of the others we've found useful throughout the coronavirus pandemic.

Arizona Department of Health Services. COVID-19 Data Dashboard. [Online Application/Database].

Maricopa County Coronavirus Disease (COVID-19). COVID-19 Data Archive. Maricopa County Daily Data Reports. [PDF Document Directory, Daily Dashboard].

Stephen A. Lauer, Kyra H. Grantz, Qifang Bi, Forrest K. Jones, Qulu Zheng, Hannah R. Meredith, Andrew S. Azman, Nicholas G. Reich, Justin Lessler. The Incubation Period of Coronavirus Disease 2019 (COVID-19) From Publicly Reported Confirmed Cases: Estimation and Application. Annals of Internal Medicine, 5 May 2020. https://doi.org/10.7326/M20-0504.

U.S. Centers for Disease Control and Prevention. COVID-19 Pandemic Planning Scenarios. [PDF Document]. Updated 10 September 2020.

More or Less: Behind the Stats. Ethnic minority deaths, climate change and lockdown. Interview with Kit Yates discussing back calculation. BBC Radio 4. [Podcast: 8:18 to 14:07]. 29 April 2020.

Labels: coronavirus, data visualization, health

Every three months, we take a snapshot of the expectations for future earnings in the S&P 500 (Index: SPX) at approximately the midpoint of the current quarter, shortly after most U.S. firms have announced their previous quarter's earnings.

The latest forecast for S&P 500 earnings in the first quarter of 2021 suggests a stronger rebound for earnings than the forecast from the Fall 2020 snapshot.

The chart shows two previous earnings recessions for the S&P 500, going back to 2014. It also indicates that 2020-Q4 marks the bottom of the coronavirus earnings recession, which looks like it will extend into the third quarter of 2021 before the S&P 500's earnings per share recover to their pre-coronavirus recession level.

Reference

Silverblatt, Howard. Standard & Poor. S&P 500 Earnings and Estimates. [Excel Spreadsheet]. 11 February 2021. Accessed 12 February 2021. (As a bonus feature, if you follow the link to the spreadsheet before his next update, you'll find Howard's photo of New York City's 34th St. after a 17-inch snowfall in early February 2021 embedded within it!)

Labels: earnings, forecasting

Dividend paying stocks in the U.S. stock market are continuing to coast on the positive momentum they established in the second half of 2020. At the midpoint of the first quarter, we find the number of firms having announced they will reduce their dividends is running well below the levels recorded in the first quarters of 2018, 2019, and 2020.

As can be seen in a chart tracking the cumulative number of dividend cuts by day of the quarter, they are also well within the range that indicates the U.S. economy is relatively healthy.

Here's the sampling of ten companies that declared they are reducing their dividends in the first half of the first quarter of 2021.

- The GEO Group (REIT-healthcare) (NYSE: GEO)

- Tanger Factory Outlet Centers (REIT-Retail) (NYSE: SKT)

- Permian Basin Royalty Trust (NYSE: PBT)

- Cross Timbers Royalty Trust (NYSE: CRT)

- VOC Energy Trust (NYSE: VOC)

- JD Bancshares (OTC: JDVB)

- Dorchester Minerals (NASDAQ: DMLP)

- Pzena (NYSE: PZN)

- Sabine Royalty Trust (NYSE: SBR)

- Healthpeak Properties (REIT-Healthcare) (NYSE: PEAK)

Four are oil and gas royalty trusts that pay variable dividends, three are Real Estate Investment Trusts (two of which are in the healthcare sector, one is in the retail sector), and there is one firm each from the mining, banking, and financial services industries. All in all, it has been a quiet quarter for dividend cuts so far.

References

Seeking Alpha Market Currents. Filtered for Dividends. [Online Database].

Wall Street Journal. Dividend Declarations. [Online Database when searched on the Internet Archive].

Labels: dividends

The S&P 500 (Index: SPX) inched up to close at a new record high of 3,934.83 on Friday, 12 February 2021.

Which is nice, but we have a bigger problem ahead of us. The echo of the onset of the coronavirus pandemic in the U.S. a year ago is about to play havoc with the projections of the dividend futures-based model we use to forecast the future of the S&P 500.

The echo effect arises from the model's use of historic stock prices as the base reference points from which its projections of the future are made. Here, the extreme volatility that defined the stock market for months beginning in February 2020 is greatly skewing those projections.

We do have a useful trick to compensate for the echo of past volatility, which is indicated by the redzone forecast range shown on the chart. As shown right now, the entire redzone forecast assumes investors will focus on the distant future quarter of 2021-Q4, but we haven't locked it in just yet. That will happen later this week, where the level of the index will determine to which future quarter's trajectory it will be fixed. The other end of the redzone forecast range will continue to float, tied to the trajectory the model projects for investors' focusing on 2021-Q4, on the other side of the echo.

What we've just described will be clearer next week, after we've fixed the near term end of the redzone forecast range.

Until then, we'll be paying close attention to any changes in the expectations investors have for the future, which will determine how far investors set their time horizon. Speaking of which, here are the market-moving headlines we tagged during the past week.

- Monday, 8 February 2021

- Signs and portents for the U.S. economy:

- U.S. 10-yr yield rises to 1.2%, inflation expectations build

- U.S. households expect to boost spending, NY Fed survey finds

- Oil hits more than 1-year high on supply cuts, stimulus hopes

- Biden $15 minimum wage plan would cut 1.4 million jobs in 2025: CBO

- Oil rises 2% to more than one-year high on supply cuts, stimulus hopes (reuters.com)

- Fed minions to keep money wheels greased for indefinite futures:

- Fed's Mester says monetary policy will stay accommodative for very long time

- Fed's Barkin says U.S. economy still needs support: FT

- Bigger trouble developing in Japan:

- Japan's economic recovery from pandemic likely stalled in fourth quarter: Reuters poll

- Japan bank deposits rise at record pace as firms, households hoard cash

- ECB minions okay with easy money policies and higher inflation:

- Wall Street sets record closing highs on stimulus hopes, vaccine deployment

- Tuesday, 9 February 2021

- Signs and portents for the U.S. economy:

- Biden's pick for OMB downplays concerns about inflationary pressures

- Oil prices surge for seventh straight day of gains

- Cash flush Americans buying shares as pandemic limits spending options

- Biden says coronavirus relief should be limited to making less than $250,000

- Bigger trouble developing in Japan:

- Wall St. thinking about moving, analysts see short squeeze boosting S&P 500, Nasdaq up but Dow and S&P 500 dip slightly on day

- Wednesday, 10 February 2021

- Signs and portents for the U.S. economy:

- Oil in longest rally in two years as vaccines boost demand hopes

- U.S. consumer prices increase steadily in January

- OMB nominee says U.S. GDP won't reach pre-pandemic levels for years without more aid

- Fed minion doesn't want to be fired, commits to Bidenomics:

- Wall Street rally runs out of steam ahead of Powell talk

- Powell's Valentine to the Fed: 'I love my job'

- Fed's Powell, invoking war effort, calls for national jobs drive

- Bigger trouble developing in South Korea, France:

- South Korea January jobs fall at sharpest pace in more than two decades

- French industrial output weaker than expected in December

- BOJ minion sees potential downside to BOJ's monetary policy, new blood expected to want more of it:

- BOJ policymaker highlights cost of huge asset buying, signals tweak in March review

- Analysis: As deflation looms, BOJ reshuffle gives more voice to advocates of big stimulus

- ECB minion wants more government spending in Eurozone:

- Wall Street rally pauses as big tech loses steam

- Thursday, 11 February 2021

- Signs and portents for the U.S. economy:

- Oil eases after record rally as OPEC, IEA fret about demand

- Pelosi aims to finish COVID-19 relief by month's end

- New U.S. data next week to show 7.8% of workforce have multiple jobs

- CBO projects $2.26 trillion U.S. deficit in 2021 before Biden stimulus spending

- Fed minions have surprisingly positive outlooks:

- Fed's Barkin: U.S. economy doesn't need 'herd immunity' to rebound

- Fed's Harker says he does not see inflation roaring past 2%: CNBC

- Bigger trouble developing in the Eurozone:

- Exclusive: EU faces bankruptcies and bad loans as COVID-19 help for firms ends - EU document

- Euro zone growth in 2021 to rebound less than expected

- Nasdaq, S&P 500 gain on tech stocks, hopes for more stimulus

- Friday, 12 February 2021

- Daily signs and portents for the U.S. economy:

- Oil edges higher on U.S. stimulus hopes, tighter supplies

- Friendly fire erupts as economists spar over U.S. stimulus

- Lower-income households dim U.S. consumer sentiment

- Fed minions see some trouble:

- Fed's Kaplan says labor market still far from maximum employment

- Fed eyes trouble in commercial real estate, corporate debt in 2021 stress tests

- Bigger trouble developing in the Eurozone, Japan:

- Euro zone in double-dip recession, recovery risks to downside: Reuters poll

- Japan to suffer bigger-than-expected slump in first quarter amid pandemic curbs: Reuters poll

- S&P 500 hits record peak as stocks post weekly gain

The Big Picture's Barry Ritholtz identifies the positives and negatives he found in the week's economics and markets news.

Valentine's Day is nearly upon us once again and we're here to help you with instructions to make something magically mathematical for that special someone in your life! All you need are two Möbius strips of paper, one left-handed and one right, some tape, some scissors, and seven minutes of your time to watch Matt Parker convert these things into the epitome of romance:

For an added challenge, add extra Möbius loops to make an interlocking Valentine's Day chain of hearts!

Labels: math

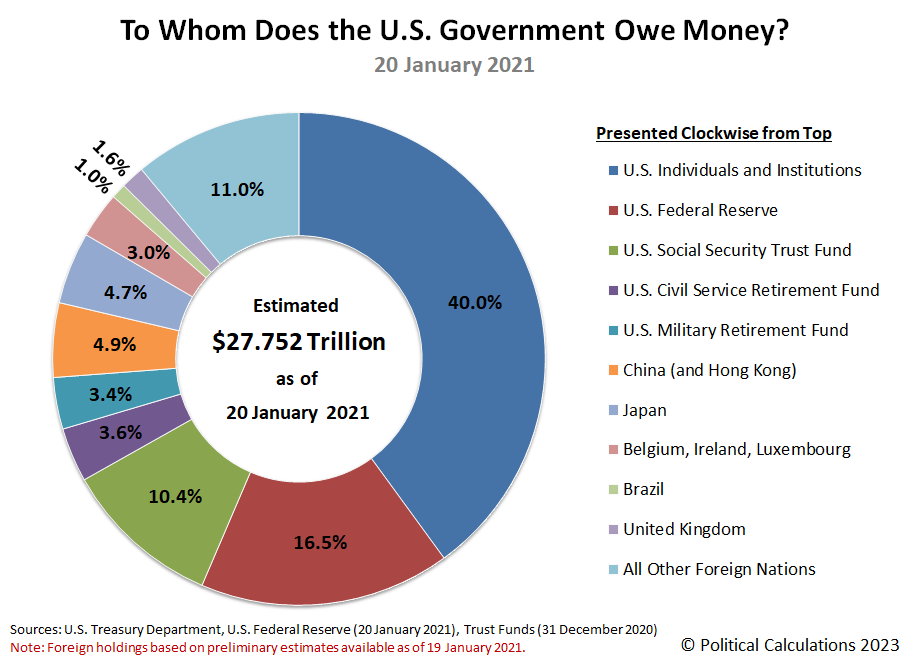

As Joe Biden was sworn in as President of the United States on 20 January 2021, the U.S. national debt reached $27.76 trillion. To whom did the U.S. government owe all that money on that date?

The following chart reveals the major lenders who have fed the U.S. government's spending appetites up through President Biden's inauguration day and shows the estimated share of the U.S. government's total public debt outstanding owed to each.

Update 9 March 2023: This chart has been corrected! We had erroneously copied the total public debt outstanding from 22 January 2021 instead of from 20 January 2021. The original version of the chart is available here.]

The U.S. Federal Reserve is Uncle Sam's largest single entity creditor, having overtaken the Social Security Old Age and Survivors Insurance Trust Fund operated by the U.S. government by a wide margin. The U.S. government owes one out of every six dollars of the U.S. national debt to the U.S.' central bank, which is overseen by an agency of the federal government.

Two other trust funds operated by the U.S. government account loaned a combined 7% of the U.S. national debt. The U.S. Civil Service Retirement Fund and the U.S. Military Retirement Fund have respectively lent 3.6% and 3.4% of the U.S. national debt to the federal government.

A diverse range of U.S. institutions, such as banks, insurance companies, independent corporations, investment firms and individuals combine to hold the largest share of money owed by the U.S. government, accounting for 40% of the total.

Foreign entities hold 25.4% of the total debt liabilities issued by the U.S. government. Of the portion of the national debt owed to foreign-based institutions, China (with Hong Kong) holds the greatest share at 4.9% of the U.S. national debt. Japan comes in second with 4.7%, followed by the international banking centers of Belgium, Ireland, and Luxembourg with a combined 3.0%. The United Kingdom holds 1.6%, while Brazil is owed 1.0% of the U.S. national debt. All the remaining nations of the world combine to hold 11.0%.

About the Data

These figures represent the most current information available as of 20 January 2021, which for the total public debt outstanding and the Federal Reserve's holdings is fully current through 20 January 2021, data on U.S. government entity holdings is current through December 2020, and data for foreign holdings is based on estimates through November 2020 that were published on 19 January 2021.

Labels: data visualization, national debt

Getting past the end of 2020's holiday season appears to have been the key to turning the corner on COVID-19 across much of the United States.

We've already affirmed that's the case with Arizona, where we now find the national data for the United States is following a very similar pattern. The peak in the rolling 7-day averages of newly confirmed COVID-19 cases was recorded on 11 January 2021 and the peak in daily reporting of deaths peaked two days later. Dramatic declines have followed in the days since these peaks, which can be seen in our first chart.

The decline in cases has been particularly dramatic during the past month, where our previous snapshot of this data came just after the peak on 11 January 2021.

The Progression of COVID-19 at the State and Territory Level

The latest update to the skyline tower chart presents the progression of positive COVID-19 cases in the U.S. by state or territory, ranked according to the reported percentage of cases within the state or territory's population. The individual charts depict the number of positive cases, the number of recovered patients or those discharged from hospitals, the number of hospitalized patients and the number of deaths. Each of these charts is presented in the same scale with respect to the size of its population over the period from 10 March 2020 through 9 February 2021, making it easy to visually compare a given state's or territory's experience with others.

Among individual states, North Dakota and South Dakota still lead in the measure of the percentage of population who has tested positive for COVID-19. The good news for these states however is that the rate of new infections has continued to drop to what are now very low levels. That change can be seen in the slower pace at which the bases of their individual tower charts are expanding in the skyline chart.

Meanwhile, nearly all other states are experiencing decelerating growth in the number of new COVID-19 cases, in what is perhaps the most remarkable month-over-month change during the entire coronavirus pandemic.

Bonus Update (10 February 2021): North Dakota vs South Dakota

We've already observed that North Dakota and South Dakota top the list of COVID-19 cases as a percentage share of their state population. But the two states differ considerably from each other in their approaches to dealing with the coronavirus pandemic, as Yinon Weiss notes in a tweet:

North and South Dakota were both hit relatively hard by COVID. They had very different responses but got to very similar outcomes.

— Yinon Weiss (@yinonw) December 19, 2020

The difference is that South Dakota's @govkristinoem respected people's rights AND their economy (now 3.5% unemployment rate).

Look at the data. pic.twitter.com/bnFDjXdiOX

Which state's policies do you suppose was more beneficial to its population?

New York's Nursing Home Death Toll

The past month has also seen a dramatic change in the state of New York which, thanks to a lawsuit filed by the Empire Center, has finally been forced to provide a more complete accounting of the number of deaths attributed to COVID-19 among the state's highly vulnerable residents of nursing home and assisted care facilities. According to data the state now officially acknowledges, at least 14,932 elderly and sick residents of New York's nursing homes and assisted care facilities are presumed to have died after having been infected by the SARS-CoV-2 coronavirus through 5 February 2021. That would be more than two out of every five deaths attributed to COVID-19 in the state of New York, the bulk of which occurred in the period from March through May 2020.

But this story is far from over. Governor Cuomo and his administration are continuing to stonewall on the reporting of the timing of these deaths, many of which are believed to have occurred as a direct consequence of their panic-borne policies in the early months of the coronavirus pandemic in the United States. For more background on Governor Cuomo's developing scandal, which has exploded in the past two weeks, be sure to follow our ongoing timeline detailing its major twists and turns.

Previously on Political Calculations

We've regularly tracked the progression of the coronavirus pandemic within the United States since data for it began being tracked on 10 March 2020. Here are the previous entries in our series featuring the skyline tower charts we developed to visualize its rates of spread within the individual states and territories of the U.S., presented in reverse chronological order.

- Widespread, Dramatic Declines in COVID-19 Cases Across U.S.

- Ten Months of the Coronavirus Pandemic in the U.S.

- Nine Months of the Coronavirus Pandemic in the U.S.

- Eight Months of the Coronavirus Pandemic in the U.S.

- The Coronavirus Pandemic in the U.S. at the Seven Month Mark

- Visualizing Six Months of the Coronavirus Pandemic in the United States

- Coronavirus Wave in Sunbelt States Crests and Begins to Recede

- A Delayed First Wave Crests in the U.S. and a Second COVID-19 Wave Arrives for Some States

- Three Months of the COVID-19 Pandemic In The U.S.

- Twelve Weeks of the Progression of COVID-19 in the United States

- United States Continues Trending Downward for Coronavirus

- U.S. Sees Widespread Improvements in Coronavirus Epidemic But Develops a New Regional Hotspot

- A Shifting Geography for Coronavirus Cases in the U.S.

- Most States Show Slowing Progression of Coronavirus in Week 8 of Epidemic

- Seven Weeks and One Million Coronavirus Cases Later...

- A Mixed Picture Emerges For Progression of COVID-19 in U.S.

- Signs Of Slowing COVID-19 Spread Among U.S. States

- Visualizing The First Four Weeks Of The Coronavirus Epidemic In The U.S.

- Visualizing the Progression of COVID-19 in the United States

- Introducing Skyline Charts for Tracking Coronavirus Cases in the U.S.

Labels: coronavirus, data visualization

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.