Arizona's coronavirus pandemic experience is nearing its end has come to an end.

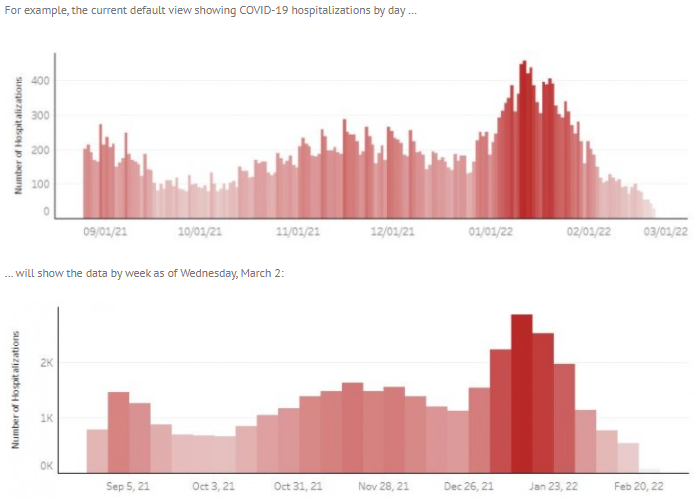

The first sign that was the case came just a few days after the penultimate update to our long-running series. Arizona's Department of Health Services announced it would suspend daily reporting of the state's data on cases, hospitalizations, deaths, and numerous other related metrics on 26 February 2022 in a transition to weekly reporting that would begin on 2 March 2022. Here's an example of how the state's presentation of its data for new COVID-related hospital admissions presentation changed:

We've followed Arizona's experience with the coronavirus pandemic for two reasons. First, we were among the first analysts to confirm the state had become an epicenter for COVID-19 infections within the U.S. in June 2020. Second, Arizona is one of 26 states that presented its high quality COVID-19 data on a daily basis, which made it possible to use back calculation techniques to identify both the timing and causes of major turning points in the state's pandemic experience, which we've featured throughout the series.

The change to weekly reporting however closes off our ability to continue our analysis, because the weekly data isn't granular enough to zero in on events contributing to changes in the state's COVID trends. That change however is something that only makes sense for public health officials if they no longer anticipate a need to continue that kind of tracking. It's good news.

Flashing forward one month later, Arizona remained one of 21 states with active COVID-19 emergency orders in effect. Arizona's public officials began signaling they would soon end the state of emergency for the coronavirus pandemic. Here's a Q&A with Arizona's Governor Doug Ducey from 23 March 2022:

Q: Any plans to end the state of emergency?

Ducey: Yes. The emergency is over, look around. The state is wide open. I think we had record number of people out for the Waste Management Phoenix Open. Spring training in full bloom and people are coming here from around the country and around the world to watch the games, so we’re excited about it. We’re winding down a number of things that are purely administrative. We’re working with the legislature, the general fund and federal authorities to bring an end to all of that.

So are we a couple of weeks away from that ending? Months? Days? "It's coming," Ducey remarked.

On 25 March 2022, Arizona's state government took a major step that will allow it to lift its two-year-old state of emergency for the pandemic.

Arizona Gov. Doug Ducey has signed legislation that will prevent temporary medical licenses issued under his coronavirus executive orders from immediately becoming invalid if he ends the state of emergency he issued two years ago.

Friday’s action extends temporary licenses issued since the Republican governor first declared a state of emergency on March 11, 2020. They will be valid until the end of the year if they were active at the start of this month.

Rep. Joanne Osborne of Goodyear told fellow Republicans in a caucus meeting last week that more than 2,200 licenses remain active, including about 1,200 issued to nurses. A waiver issued by the Department of Health Services under Ducey’s emergency order allowed doctors, nurses and other qualified health professionals to be licensed even if they lack current training or other requirements for an Arizona license.

The extension of the temporary licenses will allow boards that issue them time to process permanent license applications. The bill passed the Senate and House with only one no vote.

“If we want the emergency orders to end, this has to be taken care of first,” Republican Rep. Regina Cobb said at the same meeting of GOP House members. “And then once this is taken care of, then the governor can do what he needs to do as far as ending any emergency orders.”

At this writing, though it hasn't officially happened yet, the proverbial writing is on the wall. We've reached the end of our series on Arizona's experience with the coronavirus pandemic!

Previously on Political Calculations

Here is our previous coverage of Arizona's experience with the coronavirus pandemic, presented in reverse chronological order.

- The End of Arizona's Coronavirus Pandemic Experience

- Omicron Rapidly Fades in Arizona

- Omicron Arrives in Arizona

- Upswing in Arizona COVID Cases Shows Signs of Peaking, Crowded ICUs

- COVID-19 Cases on Upswing in Arizona

- Arizona's COVID Hospital Admissions Unexpectedly Plunge

- All Indicators Confirm COVID Third Wave Receding in Arizona

- Arizona's Third COVID Wave Peaks and Begins to Recede

- Arizona COVID Cases Rising in Third Wave

- Arizona COVID Cases on Slow Uptrend in Summer 2021

- Increase in Arizona COVID Cases from Border Migration Crisis Stabilizing

- COVID-19 and the 2021 Border Migration Crisis in Arizona

- Improving COVID Trends Bottom and Flatline in Arizona

- Surge of Migrants, Lifting of Business Capacity Limits Change Arizona COVID Trends

- COVID-19 in Retreat in Arizona With Vaccines Gaining Traction

- The Ebb and Flow of COVID-19 in Arizona's ICUs

- Arizona's Plunging COVID-19 Caseloads and the Vaccines

- Arizona Enters Downward Trend for COVID-19 After Second Peak

- Arizona Passes Second COVID-19 Peak

- A Tale of Two States and the Coronavirus

- COVID-19 Questions, Answers, and Lessons Learned from Arizona

- The Deadly Intersection of Anti-Police Protests and COVID-19

- 2020 Campaign Events Drive Surge in Arizona COVID Cases

- Arizona Arrives at Critical Junction for Coronavirus Cases

- Arizona To Soon Reach A Critical Junction For COVID-19

- Getting More Than Care from Arizona's COVID ICU Beds

- Arizona's Decentralized Approach to Beating COVID

- Going Back to School with COVID-19

- Arizona Turns Second Corner Toward Crushing Coronavirus

- Arizona's Coronavirus Crest in Rear View Mirror

- The Coronavirus Turns a Corner in Arizona

- A Delayed First Wave Crests in the U.S. and a Second COVID-19 Wave Arrives

- The Coronavirus in Arizona

- A Closer Look at COVID-19 Deaths in Arizona

- The New Epicenter of COVID-19 in the U.S.

- How Long Does a Serious COVID Infection Typically Last?

- How Deadly is the COVID-19 Coronavirus?

- Governor Cuomo and the Coronavirus Models

- How Do False Test Outcomes Affect Estimates of the True Incidence of Coronavirus Infections?

- How Fast Could China's Coronavirus Spread?

References

Political Calculations has been following Arizona's experience with the coronavirus experience from almost the beginning, because the state makes its high quality data publicly available. Specifically, the state's Departent of Health Services reports the number of cases by date of test sample collection, the number of hospitalizations by date of hospital admission, and the number of deaths by date recorded on death certificates.

This data, combined with what we know of the typical time it takes to progress to each of these milestones, makes it possible to track the state's daily rate of incidence of initial exposure to the variants of the SARS-CoV-2 coronavirus using back calculation methods. Links to that data and information about how the back calculation method works are presented below:

Arizona Department of Health Services. COVID-19 Data Dashboard: Vaccine Administration. [Online Database]. Accessed 17 February 2022.

Stephen A. Lauer, Kyra H. Grantz, Qifang Bi, Forrest K. Jones, Qulu Zheng, Hannah R. Meredith, Andrew S. Azman, Nicholas G. Reich, Justin Lessler. The Incubation Period of Coronavirus Disease 2019 (COVID-19) From Publicly Reported Confirmed Cases: Estimation and Application. Annals of Internal Medicine, 5 May 2020. https://doi.org/10.7326/M20-0504.

U.S. Centers for Disease Control and Prevention. COVID-19 Pandemic Planning Scenarios. [PDF Document]. 10 September 2020.

More or Less: Behind the Stats. Ethnic minority deaths, climate change and lockdown. Interview with Kit Yates discussing back calculation. BBC Radio 4. [Podcast: 8:18 to 14:07]. 29 April 2020.

Labels: coronavirus

How much health risk do you have from carrying too much mass around your midsection?

That question arises because studies point to the Waist-to-Height Ratio (WHtR) as a better indicator of early health risk than the Body Mass Index (BMI). As a general rule of thumb, if the circumference of your waist is greater than half your height, you have an elevated risk for developing chronic conditions like hypertension, diabetes mellitus, hypercholesterolemia, joint and low back pains, hyperuricemia, and obstructive sleep apnea syndrome.

The Waist-to-Height Ratio is also reported to be better than BMI in predicting heart attacks, especially for women, with higher ratios corresponding to higher risk.

That sounds like good bit of information to have, so we've built a tool to calculate your Waist-to-Health Ratio. Since you probably already know your height, the hard part will be finding out your waist circumference. Here's a video showing how to measure it.

Once you've done that for yourself, you're ready to go. If you're accessing this article on a site that republishes our RSS news feed, please click through to our site to access a working version of the tool. Here it is:

In using the tool, be sure to use the same units of measurement for both waist circumference and height. You'll get accurate results so long as you don't start mixing and matching inches and centimeters together....

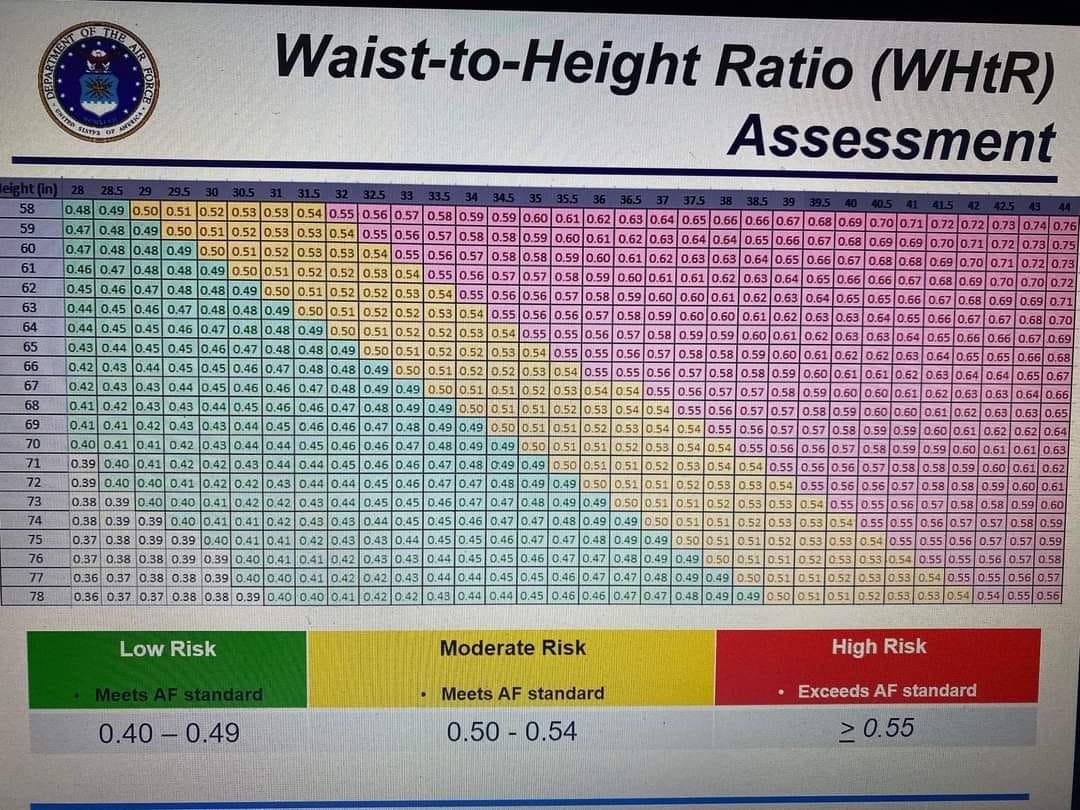

According to documents leaked in February 2022, starting in July 2022, U.S. Air Force personnel will have their Waist to Height Ratio assessed. Individuals with waists that measure at more than half their height will be reassessed six months later, with those whose waists exceed that threshold at the later measurement date separated from service. "Seperated from service" meaning "discharged from the Air Force". Here's the chart the Air Force will be using to make that determination:

The thresholds shown on this chart for low, moderate, and high risk are those we've built into the tool's feedback. We've also made a point of giving the answer to the same two-decimal place results as would be used by Air Force medical personnel in their assessments, so there are no surprises for what to expect.

Previously on Political Calculations

References

Margaret Ashwell and Sigrid Gibson. Waist-to-height ratio as an indicator of ‘early health risk’: simpler and more predictive than using a ‘matrix’ based on BMI and waist circumference. BMJ Open 2016:6:3010159. [DOI: 10.1136/bmjopen-2015-010159 | NIH: PDF Document]. 14 March 2016.

Sanne A.E. Peters, Sophie H. Bots and Mark Woodward. Sex Differences in the Association Between Measures of General and Central Adiposity and the Risk of Myocardial Infarction: Results From the UK Biobank. Journal of the American Heart Association. Vol. 7, No. 5. [DOI: 10.1161/JAHA.117.008507]. 28 February 2018. American Heart Association. Waist size predicts heart attacks better than BMI, especially in women. [Online Article]. 28 February 2018.

Darsini Darsini, Hamidah Hamidah, Hari Basuki Notobroto, and Eko Agus Cahyono. Health risks associated with high waist circumference: A systematic review. Journal of Public Health Research. Vol. 9, No. 2: Papers from the 4th International Symposium of Public Health (4th ISOPH), Brisbane, Australia. 29-31 October 2019. [DOI: 10.4081/jphr.2020.1811 | NIH: PDF Document]. 2 July 2020.

ShapeFit. Waist to Height Ratio Calculator - Assess Your Lifestyle Risk. [Online Article and Tool]. 31 March 2015.

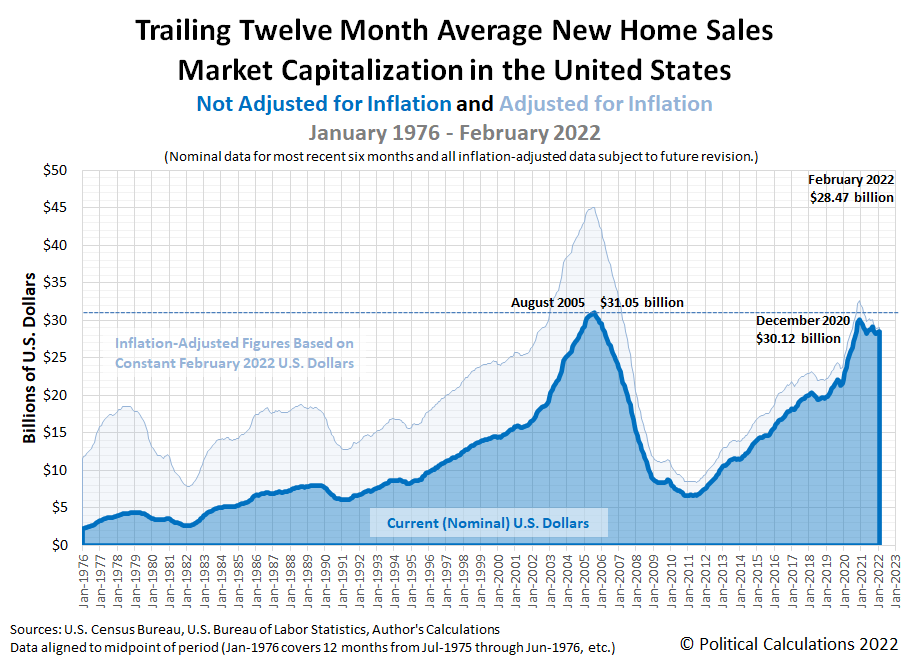

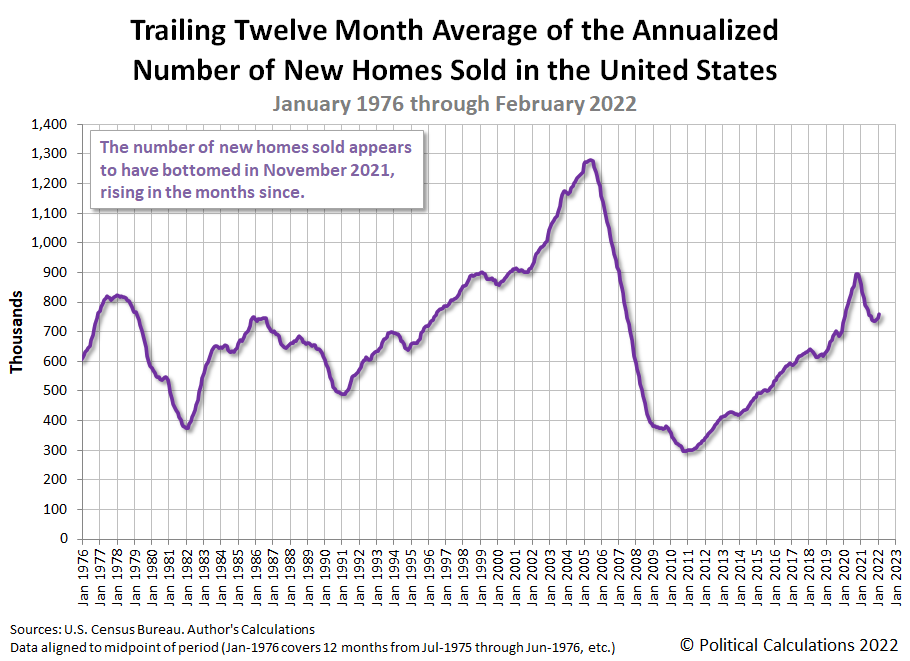

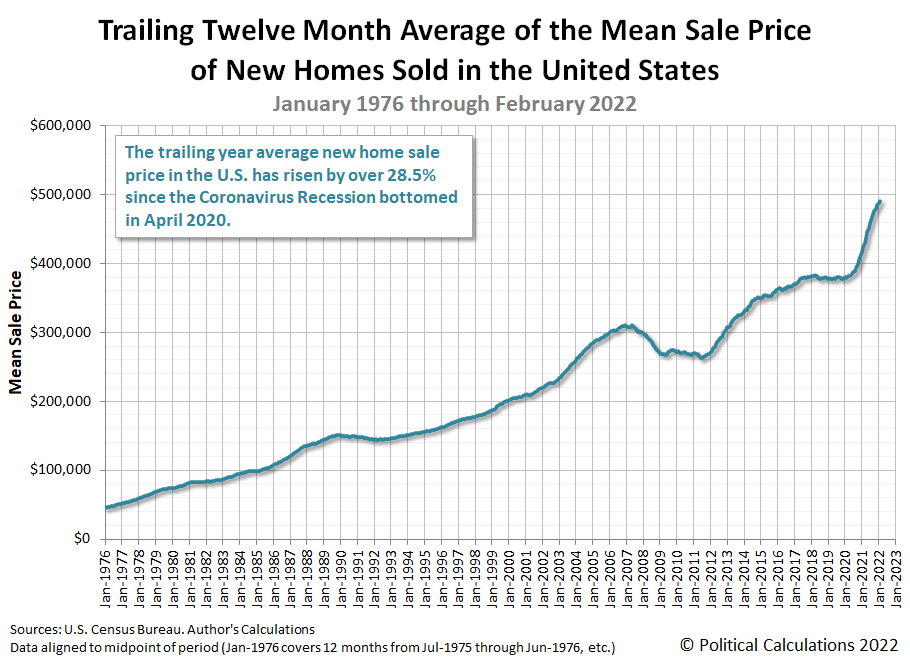

After a positive January, the market capitalization for new homes sales in the U.S. dipped ever so slightly in February 2022. Political Calculations' initial estimate of the overall market capitalizaton of the U.S. new home market is $27.47 billion, holding essentially flat with respect to January 2022's revised estimate of $27.49 billion for the rolling 12 month average.

February 2022's barely noticeable dip is the result of downward data revisions in previous months. The month itself was one of the strongest in the past year, seeing both rising average prices and number of sales. The following two charts visualize the trailing twelve month averages of the U.S. new home market's underlying annualized sales and average price data.

New home sales are counted toward GDP when their sales contracts are signed, so a flat or falling trend in the market cap for new homes represents an economic headwind for the U.S. economy. According to the National Association of Home Builders, new homes sales average roughly 3% to 5% of the nation's GDP.

Labels: market cap, real estate

The S&P 500 (Index: SPX) completed its second Lévy flight event. The dividend futures-based model alternative futures chart indicates investors have shifted their forward-looking focus to the more distant future quarter of 2022-Q3.

The signals sent by the Federal Reserve's minions for their next steps are responsible for the shift in how far forward in time investors are looking in making their current day investment decisions. In the past week and a half, investors absorbed the new information that the Fed's March 2022 rate hike will be followed up by half point hikes through the end of 2022-Q2, which shifted the uncertainty window for what happens next to 2023-Q3.

Those new expectations can be seen in the CME Group's FedWatch Tool, which now projects the Fed's next move will be two consecutive half point rate hikes in May and June 2022 (2022-Q2), followed by a resumption of quarter point rate hikes every six weeks with hikes in July and September 2022 (2022-Q3), and more hikes in November and December 2022 (2022-Q4), followed by two more in 2023, one in February 2023 (2023-Q1) and in May 2023 (2023-Q2).

At the same time, there has not yet been any change in the expectations for the year-over-year change in the growth rate of S&P 500 dividend in 2022-Q3, the outlook for which is more positive than the current quarter of 2022-Q2. As would be expected, the level of the S&P 500 has risen substantially with the shift in focus from 2022-Q2 to 2022-Q3.

The large difference between the dividend growth rates expected between 2022-Q2 and 2022-Q3 also puts the index at risk of a substantial decline, even without any erosion in expected future dividends. Should investors have reason to fully shift their attention back to the current quarter of 2022-Q2, it would likely be accompanied by sharp, sudden decline, on the order of 9-10%. That's without any erosion in the expectations for the S&P 500 future dividends.

The thing that could trigger such a shift is the random onset of new information. Here's our summary of the market-moving headlines from the second to last week of March 2022.

- Monday, 21 March 2022

- Signs and portents for the U.S. economy:

- Crude settles up more than 7% as EU mulls Russian oil ban

- U.S. rate futures raise odds for hefty rate hike in May after Powell comments

- Fed minions wants rate hikes, lots of 'em!

- Fed's Bostic sees 6 rate hikes this year, war risks

- Fed open to speedier interest rates hikes if high inflation persists - Powell

- Bigger inflation developing in the Eurozone:

- Bigger stimulus developing in China:

- ECB minions thinking they may need to do something about inflation, but not along with Fed:

- ECB's Holzmann argues again for rate rise - paper

- ECB will react to second-round inflation effects - Handelsblatt

- ECB should keep 2022 rate hike on agenda, if inflation warrants it -Nagel

- Expect ECB, Fed to be out of sync: ECB's Lagarde

- Wall Street slips after Powell's hawkish remarks

- Tuesday, 22 March 2022

- Signs and portents for the U.S. economy:

- Oil edges lower as EU looks less likely to ban Russian oil

- Gold slips to near 1-week low on Fed Powell's hawkish stance

- Fed minions want rate hikes, big ones! Starting to get onboard with crypto they can control:

- Fed policymakers call for bigger rate hikes to fight inflation

- Fed's Daly: rates need to rise to tamp down too-high inflation

- Fed's Mester calls for frontloading rate hikes, sees rise to 2.5% in 2022

- Fed's Williams: potential for stablecoins to be "very useful"

- Bigger stimulus developing in Japan:

- Japan's central bank renews powerful easing pledge after hawkish Fed signal

- Japan eyes more stimulus as record budget clears parliament

- ECB minions don't think they have a stagflation problem, want to keep stimulus flowing:

- Wall Street gains, with tech, growth shares in the lead

- Wednesday, 23 March 2022

- Signs and portents for the U.S. economy:

- Oil jumps 5% as Caspian pipeline disruption adds to supply fears

- March U.S. auto sales to tumble on rising inflation, Ukraine crisis- data

- U.S. new home sales drop further as mortgages rates rise; prices push higher

- Fed minions getting on board with frequent, bigger rate hikes:

- Fed officials nod to big rate hikes to fight 'inflation, inflation, inflation'

- Bullard: High inflation means Fed must think bigger, faster

- Bigger inflation developing in the UK, India, Russia:

- UK inflation hits 30-year high of 6.2% as Sunak readies response

- Indians tighten belts as Ukraine war drives up prices of necessities

- Inflation in Russia spikes above 14.5%, highest since late 2015

- Bigger stimulus developing in Japan:

- ECB minion wants to keep stimulus flowing, doesn't think dealing with inflation is needed:

- Wall St drops as oil rally, Russia-Ukraine conflict fuel worries

- Thursday, 24 March 2022

- Signs and portents for the U.S. economy:

- Oil slides 2% as EU fails to boycott Russian crude

- U.S. weekly jobless claims drop to lowest level since 1969

- U.S. business activity rises to eight-month high in March - survey

- Fed minions starting to be concerned by rising house prices, getting really excited about hiking rates:

- U.S. housing costs should play role in guiding Fed policy, Waller says

- Fed's Evans backs 'timely' rate hikes, but says careful touch needed

- Fed's Kashkari wants rate hikes, but warns of overdoing it

- Bank of Mexico, Swiss National Bank, BOJ minions start looking to deal with inflation:

- Mexico's president lets slip central bank's announcement of rate hike to 6.5%

- Swiss National Bank shifts focus to inflation after doubling forecast

- BOJ policymaker warns of prolonged inflation due to Ukraine war

- ECB minions studying how to keep rolling out stimulus, say Eurozone won't have recession:

- ECB to weigh more bond buying if war crashes economy -Schnabel

- ECB's Centeno says recession not in ECB's scenario despite Ukraine

- Wall St resumes rally, led by Nasdaq as chipmakers soar

- Friday, 25 March 2022

- Signs and portents for the U.S. economy:

- Oil rises to over $120/bbl after attack on Saudi facilities

- Farm equipment makers cut pre planting season production as U.S. inflation bites

- The Treasury market tumble in 5 charts

- U.S. pending home sales approach two-year low; consumer sentiment slumps

- Fed minions getting excited about hiking rates, maybe not so much about launching digital dollar:

- Fed's Williams open to bigger rate hike if high inflation persists

- Fed's Waller says he sees no need for U.S. central bank digital currency

- Economic impacts from oil geopolitics:

- Core inflation in Tokyo hits 2-year high as energy costs soar

- German ministry wants to halve dependence on Russian oil by summer -Spiegel

- S&P 500 ends higher with financials as Treasury yields jump

The Atlanta Fed's GDPNow tool's latest estimate of real GDP growth in 2022-Q1 has fallen back to 0.9% after data confirming the continued shrinkage of the U.S. real estate market was released.

The online word puzzle Wordle took the social media world by storm in 2022. So much so that the original game has spawned several clones and imitators.

Among those are several number and maths-related puzzles, which we'll feature today. First up is Primel, which is played just like Wordle but using numbers, in which the goal is to correctly identify a five-digit prime number within six lines of guesses. But here's the catch: each line entry has to be a five-digit prime number! Here's a screenshot of our attempt to play the game last weekend:

The prime numbers we entered for the first two rows aren't random. We specifically picked them to identify the digits that would be used in the target prime. As it happens, we got lucky in also identifying the location of three of the digits, which made it possible to correctly identify the target prime by the third row.

If this particular game sounds suitably challenging, please click here to access today's game directly. To help you get started, here's a list of five-digit prime numbers to use for reference.

If you find Primel to be too easy, let's kick it up a notch by introducing math equations into the mix! There are two prominent puzzles of interest in this category: Nerdle and Numberle. Both are played the same way, where you need to enter a valid math equation for each of your guesses, with the results giving you hints as to what each day's target equation is.

Of these two maths puzzles, Nerdle has become more popular thanks to its creator's social media efforts. Here's our solution to one of the daily games from this past weekend:

We played this one a lot less strategically than we played the Primel game. Here, we gave ourselves the additional limitation that if we got any of the digits, operators, or equals signs right, we would stick with that result. Fortunately, we were able to get to the target equation by the sixth row.

But what if that's still too easy? Or if it's too hard? That's where Numberle comes in, because unlike Primel or Nerdle, it allows you to customize the puzzle you solve. You can set it up to play it with as few as 5 characters or as many as 12. Or you can generate your own puzzle with which to share and challenge your friends. Here's a screenshot of the settings screen to give you an idea of how you might tweak the puzzle how you like:

As for how you play Numberle, it's just like Nerdle, but a little more user friendly for new players since it provides examples and instructions below the day's puzzle.

Featured Maths Puzzles

Labels: math

As promised, we're comparing Political Calculations estimates of median household income in the United States with those of our competition!

In the private sector, that competition is represented by Sentier Research, which produced monthly estimates of median household income from December 2000 through December 2019 utilizing a methodology the firm's former Census Bureau analysts' developed using data from the U.S. Census Bureau's monthly Current Population Survey. In the public sector, the competition is the Federal Reserve Bank of Atlanta, whose analysts project their own estimates from the Census Bureau's one-year estimates of median household income from the American Community Survey, where their estimates start in January 2006.

The following chart visualizes all three data series from January 2006 through December 2021, which covers nearly all the period where they overlap.

As you can see, all these estimates range within a few percent of each other from January 2006 through October 2018. After that point, there's a major divergence between the Atlanta Fed's estimates and the others, where we note the following three differences:

- The Atlanta Fed's estimates understate the rising trend for median household income observed in 2019.

- They also completely miss the impact and recovery from the coronavirus recession in 2020.

- They significantly understate the robust growth in median household income we've observed since March 2021.

Political Calculations' estimates of median household income generally tracks with Sentier Research's estimates up through the period where they terminate in December 2019. The analysts who founded Sentier Research after retiring from the U.S. Census Bureau went on to permanently retire in 2020. Sentier Research is no longer an operating entity.

The reference section below will take you to each source, including our most recent update that contains direct links to our source data and indicates the methodology we've used to create our estimates of median household income. If you're reading this article on our site, following the median household income label will take you to the latest posts where we've either presented or used the estimates we've generated in our various analyses.

References

Federal Reserve Bank of Atlanta. Home Ownership Affordability Monitor (U.S. Census Bureau American Community Survey One-Year Estimates of Median Household Income, Projected to Indicated Month by Atlanta Fed Staff using additional data produced by the Current Population Survey and Decennial Census). [Online Database]. Accessed 20 March 2022.

Sentier Research. Household Income Trends: January 2000 through December 2019. [Excel Spreadsheet with Nominal Median Household Incomes for January 2000 through January 2013 courtesy of Doug Short]. [PDF Document]. Accessed 6 February 2020. [Note: We've converted all data to be in terms of current (nominal) U.S. dollars.] Note: Sentier Research is no longer an operating entity, we've linked to the Internet Archive's copy of this final report.

Political Calculations. Median Household Income in January 2022. [Online Article]. 1 March 2022.

Labels: median household income

Not long ago, we were asked about how inflation affects the price of gold. It's something of an occupational hazard, where a lot of people assume that because we know quite a lot about how stock prices work, that knowledge directly carries over to things like commodities.

For most commodities, like copper, or oil, or turkeys, we would default to supply and demand analysis or dig into the factors affecting their cost of production to explain their changes in prices over time.

Gold falls into a different category that doesn't fit well into that basic mold. Aside from its use in jewelry, it's not used in great quantity to support any industrial applications like nearly all other metals are. Instead, it's used in financial applications, often as a hedge for inflation. Which is to say that when inflation runs hot, the price of gold will rise. But not always. Something else affects it as well.

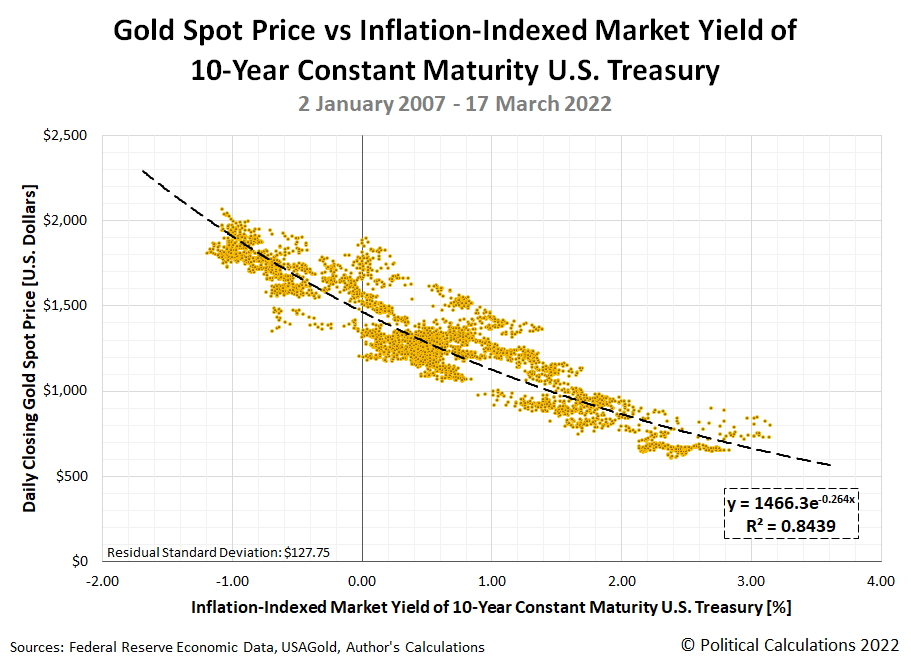

That something else would appear to be interest rates, where the recent history for gold prices points to their having an inverse relationship with inflation-indexed interest rates. By inverse relationship, that means that as real interest rates fall, the price of gold tends to rise in response. The following chart shows the relationship we found between the daily closing spot price for gold and the daily inflation-indexed market yield of 10-year constant maturity U.S. Treasuries over the past 15 years.

While the chart picks up the action at the start of January 2007, the pattern it shows began taking hold in 2006, coinciding with the deflation phase of the U.S. housing bubble. The inverse relationship we've identified only holds for the current period.

The most recent data point shown in the chart, for 17 March 2022, has the inflation-indexed market yield on 10-Year constant maturity U.S. Treasury securities at -0.71%, which is paired with gold's closing spot price for the day of $1,944.05. For reference, the nominal market yield for a 10-Year constant maturity U.S. Treasury was 2.20%. The inflation-indexed yield is negative because expected inflation rate over the 10 year period of the security is greater than the non-inflation indexed yield. That situation is consistent with a high price for gold.

After finding this relationship, we went searching for insight from other analysts who were already well familiar with it. Here's how Longtermtrends describes how gold prices work:

According to Erb and Harvey the correlation between real interest rates and the price of gold is -0.82. In other words, when real yields go down gold goes up. This correlation explains why inflation is gold's best friend while rate hikes are its worst enemy.

Here is a possible explanation for this relationship. Rising interest rates also mean rising opportunity costs of holding gold. Gold neither pays dividends nor interest. Thus, it is relatively expensive to hold it in the portfolio when real interest rates are high. On the other hand, when real yields are negative, holders of cash and bonds are losing wealth. In such a scenario, they are more prone to buy gold.

The Erb and Harvey study Longtermtrends references is from 2013, but it's good to see that the relationship we found is still very much in the same ballpark as the correlation they found. Just so, the price of gold is still governed by supply and demand. It's just that the demand for gold works quite a bit differently than it does for other commodities given its primary use as a hedge for negative real yields in today's financial applications.

References

Claude B. Erb and Campbell R. Harvey. The Golden Dilemma. Financial Analysts Journal. Vol. 69. No. 4. July/August 2013, pp 10-42. DOI: 10.2139/ssrn.2078535.

Federal Reserve Economic Data. Market Yield on U.S. Treasury Securities at 10-Year Constant Maturity, Inflation-Indexed. Online Database (Text File)]. Accessed 19 March 2022.

USAGold. Daily Gold Price History. [Online Database]. Accessed 19 March 2022.

Labels: data visualization, ideas, inflation, investing, personal finance

Imagine this scenario. Public health advocates campaign for your city to impose a tax on sugary beverages. They claim it will improve the public's health through fighting obesity by making soda and other soft drinks made with sugar more costly to buy, forcing budget-minded consumers to substitute much lower calorie containing beverages. Your city's politicians, always happy to get more tax revenue, go along with their scheme. How do you think consumers of sugary soft drinks in your city will respond?

If you answered they will drink more calorie-laden alcohol-based beverages, you're right!

The latest proof that consumers substitute beer and liquor for sugar-sweetened soft drinks comes to us from Seattle. In December 2017, the city imposed a unique $0.0175 per ounce tax on beverages containing calories from sugar, but not on beverages made with non-calorie-laden sweeteners. For example, consumers buying a two-liter bottle of Coca-Cola would pay an additional tax of $0.35 that consumers of the same size bottle of Diet Coke or Coke Zero would not.

At first glance, you might think consumers of Sugar-Sweetened Beverages (SSB) would choose to switch to the sugar-free versions of their previously preferred soft drink or to water to avoid having to pay so much more for it.

But that's not what happened according to a peer-reviewed study published in PLOS ONE, which found that the tax "induces substitution to alcoholic beverages". More specifically, the consumers preferred substitute wasn't sugar-free beverages. It was beer, whose sales rose by 7% relative to those of the demographically similar city of Portland, Oregon, which didn't impose a soda tax:

There was evidence of substitution to beer following the implementation of the Seattle SSB tax. Continued monitoring of potential unintended outcomes related to the implementation of SSB taxes is needed in future tax evaluations.

How many competent public health advocates do you suppose would push for new or expanded soda taxes knowing that real life consumers are more likely to shift to alcohol-based beverages with equivalent levels of calories instead of water or low-calorie sugar-free soft drinks? Not only do they miss any benefit from reducing calories consumed among the public, higher alcohol consumption comes with the "higher risk of motor accidents/deaths, liver cirrhosis, sexually transmitted diseases, crime and violence, and workplace accidents" to the public's health.

Then again, if you're a long-time reader of Political Calculations, you could have easily predicted that from our analysis of what happened to alcohol sales in Philadelphia after that city's soda tax went into effect.

Image credits: Coca-Cola Photo by Omar Elmokhtar Menazeli on Unsplash. Miller High Life Photo by Waz Lght on Unsplash.

References

Lisa M. Powell, Julien Leider. Impact of the Seattle Sweetened Beverage Tax on substitution to alcoholic beverages. PLOS ONE 18 January 2022. DOI: 10.1371/journal.pone.0262578.

Baylen Linnekin. Study: Seattle's Soda Tax Has Been Great for... Beer Sales? Reason. [Online Article]. 12 February 2022.

Previously on Political Calculations

The S&P 500 (Index: SPX) experienced its second Lévy flight event of 2022, as investors suddenly shifted their forward-looking attention away from the near-term quarter of 2022-Q2 to instead focus on more distant future quarters.

Precisely which quarter that is has yet to be determined, but here's how it looks on the latest update to the dividend futures-based model's alternative futures spaghetti forecast chart, where the magnitude of the shift spans the redzone forecast, going from its lowest limit to its highest at this point of time.

The redzone forecast range identifies where the model would place the level of the S&P 500 after adjusting for the echo effect of the past volatility of historic stock prices, which provide the base reference points from which its projections of the potential futures for the index are made. It is also based on the assumption that investors would fix their focus on the upcoming future quarter of 2022-Q2 through the period it is shown. Stock prices moving outside that range would simply confirm that assumption from six weeks ago no longer holds.

Whenever investors reset how far they are looking into the future, we recognize that stock prices are undergoing a Lévy flight event. These events can be a significant contributor to the outsized changes that occur periodically in stock prices. Since investors have different expectations for the pace of dividend growth that will be realized at different points of time in the future, those differences create the different trajectories shown in the alternative futures chart with each shown trajectory associated with the expectations that apply at specific points of time in the future. How much stock prices change in in a Lévy flight event depends upon how different the expectations for dividends are at the point of time they had been focusing upon and the point of time to which they turn their attention.

2022's second Lévy flight event was triggered by the Federal Reserve's release of its latest "dot plot" communicating the Fed's minions' new expectations for how they will set the Federal Funds Rate over the next year. ZeroHedge describes how that new information impacts how far forward investors are looking in time (the following excerpt omits ZH's charts):

After some early volatility, when stocks moved with every fake news headline either out of the FT, Ukraine or Russia, traders put World War III on the backburner to read the FOMC statement and listen to Powell. Initially there were no surprises when the Fed announce a 25bps rate hike, just as expected, a move which is woefully behind the curve as the last time CPI was 7.9%, the Fed funds was 13%...

... but the Fed also boosted its dots so high it effectively confirmed what the market had been saying all along: the Fed now expects 6 more rate hikes in 2022, or one rate hike at every meeting!

Hilariously, seven hikes is precisely what the market had been saying all along. However, once the Fed confirmed that the market was right, guess what happened? Rate hike odds tumbled.

Why? Because with even the Fed now forecasting a big slowdown to growth coupled with a surge in inflation...

... the most likely outcome now is stagflation. This immediately manifested itself in a plunge in 30Y yields...

... as the entire yield curve pancaked...

... culminating with the 5s10s inverting, a clear sign that a recession - the same recession which the Fed hopes to induce to crush commodity demand - is now coming.

And while the 2s10s curve still has about 20bps before it too inverts and begins the countdown to the next recession...

... one look at the 3Y1Y - 1Y1Y OIS fwd shows that markets are now pricing in almost two rate cuts in the next 3 years...

... confirming that the Fed, which was trapped long before today's rate hike, will be forced to ease and/or resume QE in the not too distant future even as inflation continues to rage. Translation: policy error.

That's why we say we don't yet know to which future quarter they've shifted their attention. The anticipated timing of when the Fed might be forced to reverse its rate hike plans will be a recurring point of interest.

Dividend futures were stable throughout the week, where they have not yet begun changing with the anticipation of recessionary conditions. Since they would be expected to erode as such conditions develop, the higher trajectories associated with more distant future quarters in the alternative futures chart are unlikely to be sustained in the event of an earnings recession or full-fledged economic recession.

Regardless, another metric for investors to follow will be dividend cut annoucements, which also have the potential to re-shift how far investors are looking into the future when they are made in addition to directly changing the expectations for dividend growth. We could be in for a period of heightened volatility in stock prices as all these dynamics play out.

Here's our recap of the market-moving events of the week that was:

- Monday, 14 March 2022

- Signs and portents for the U.S. economy:

- Oil falls on Ukraine peace hopes, U.S. Treasury yields rise

- U.S. consumers lift inflation, spending expectations, NY Fed survey finds

- New wave of inflation - and disruptions - hits U.S. factory floors

- Bigger trouble developing in China, Ukraine:

- Economic impact of China's COVID resurgence must be watched - statistics bureau

- Ukraine economy to contract sharply in 2022 due to war, IMF report says

- Bigger stimulus developing in Brazil, China:

- Brazil government readies $32 billion of economic stimulus -sources

- China will ensure stable economic operations this year, cabinet says

- Eurozone minions thinking about tightening spending policies, but prepared to keep them going:

- Tech, growth stocks lead Wall Street to lower close as investors focus on interest rates

- Tuesday, 15 March 2022

- Signs and portents for the U.S. economy:

- Inflation surge, war cloud Fed's interest rate trajectory

- OPEC flags risk to oil demand outlook from Ukraine war, inflation

- First-time U.S. home buyers feeling 'defeated' by soaring prices, rising rates

- ECB minion says Eurozone growth is strong:

- Wall Street jumps as S&P snaps 3-day slump; Fed on tap

- Wednesday, 16 March 2022

- Signs and portents for the U.S. economy:

- Petroleum, food lift U.S. import prices in February

- U.S. business inventories rise solidly, but pace is slowing

- U.S. retail sales slow, huge savings likely to provide a cushion against inflation

- Oil dips on Russia-Ukraine talks, U.S. inventory data

- Fed minions hike rates, say they'll keep raising them:

- Bigger trouble developing in China, London Metals Exchange:

- COVID curbs bite at Chinese ports, threatening global supply chains

- Nickel market in disarray after chaotic London return

- Bigger stimulus developing in Japan:

- Japan PM Kishida signals new spending to soften fuel cost blow

- Japan Inc hikes pay by more than 2%, not enough for a big economic boost

- Bigger inflation developing in Japan, Canada, Russia:

- Japan consumers' inflation expectations hit record high in March - survey

- Canada's inflation rate surges to a fresh 30-year high

- Russian inflation accelerates to 12.5%, highest since 2015

- Wall Street closes higher after Fed hikes rates, signals more to come

- Thursday, 17 March 2022

- Signs and portents for the U.S. economy:

- Oil surges 8% amid warnings of Russian supply shortages

- U.S. economy flexes muscle with jobless benefit rolls at 52-year low; factories humming

- U.S. housing starts rebound sharply in Feb; building permits fall

- BOJ minions think Japan inflation will undershoot their target, again:

- ECB minions all over the map:

- ECB has 'extra space' before first rate hike, Lagarde says

- Europe's green transition to persistently boost inflation, ECB's Schnabel says

- ECB expects core inflation to fade as energy prices level off: Lane

- Wall Street stocks, oil prices rise after aggressive Fed hike outlook

- Friday, 18 March 2022

- Signs and portents for the U.S. economy:

- Oil settles up but posts second consecutive weekly decline

- U.S. home sales tumble; higher prices, mortgage rates eroding affordability

- Fed minions thinks Fed needs to be more aggressive to counter inflation, want to keep "balanced":

- Fed policymakers say dramatic rate hikes may be ahead

- Fed's Bullard, explaining dissent, says rates should top 3% this year

- Fed's Waller says series of half point rate increases may be needed at coming meetings - CNBC

- Fed may have to be more aggressive after hiking rates this year, Kashkari says

- Fed's rate path balances inflation fight and pandemic unknowns, Barkin says

- Bigger trouble, stimulus developing in China:

- China seen keeping lending benchmarks steady, cut expectations grow: Reuters poll

- China's land sales plunged in Jan-Feb though easing measures

- China Jan-Feb fiscal spending quickens in fight to support slowing economy

- BOJ minions keep stimulus rolling out:

- BOJ keeps huge stimulus, cautious tone as Ukraine crisis clouds outlook

- BOJ Governor Kuroda's comments at news conference

- Wall St closes higher after Biden-Xi talks end, oil steadies

The CME Group's FedWatch Tool projects the next quarter point rate hike in May 2022 (2022-Q2). It also projects it will be followed by a half-point rate hike in June 2022 (2022-Q2), then anticipates quarter point rate hikes at six-week intervals after each Federal Open Market Committee meeting through May 2023, with no other hikes for the rest of that year.

The Atlanta Fed's GDPNow tool's latest estimate of real GDP growth in 2022-Q1 has risen to 1.3%, boosted from last week's projection of 0.5% growth and converging toward the "Blue Chip Consensus" forecast.

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.