On 28 December 2013, approximately 74,000 Illinoisans who had been unemployed for more than 26 weeks but less than 73 weeks lost their unemployment insurance benefits when the federal government's emergency extended unemployment benefits program expired. Paying an average benefit of $320 per week, up to a maximum of $413 per week, Democratic Party politicians and interest groups vowed to do whatever it took to get their unemployment benefits back.

By spring, Illinois' elected representatives in the U.S. Congress used their influence to get the Illinois Department of Economic Security (IDES) to exploit a unique set of data it collects, which gave it the ability to track how these individuals fared in the state's labor market in the months following when they lost their eligibility to continue receiving the state's politically-coveted and federally-funded extended unemployment insurance benefits. In April 2014, the IDES reported that in January 2014, 10,000 of the 74,000 Illinoisans who had lost their unemployment benefits had gotten jobs.

One month later, the IDES reported that 12,700 of the 74,000 Illinoisans who had stopped receiving their extended unemployment checks when the federal government's program expired were working as of February 2014.

That was the last time the Illinois Department of Economic Security made that data public. Earlier this month, we contacted IDES to inquire if they would be publishing any additional data regarding the work status of these 74,000 individuals. Illinois DES spokesman Greg Rivara indicated that they had provided the data in response to requests from elected officials to support the legislative effort in Washington D.C. to reestablish federal funding for the program. Since that effort had stalled out, IDES' analysts had moved on to other work. Rivara also indicated that there were no plans to resume reporting Illinois' unique data on how well this segment of the state's jobless population was faring in the job market beyond what it had already provided.

But we have a really good idea of what happened next. We've already determined that the net number of marginal jobs created in Illinois surged after February 2014.

Let's next apply the bits of information that IDES has already provided about how well the state's population of 74,000 long-term unemployed have fared since their eligibility to continue receiving the state's unemployment benefits expired.

Since these individuals were outside of the employed portion of Illinois' civilian labor force, it is very unlikely that these individuals displaced people who were already employed. That would mean then that the members of this large population of individuals, who were suddenly seeking to replace the income they had previously been collecting in the form of weekly extended unemployment benefits, would most likely be filling the newly created marginal jobs in the state. The next chart shows how that played out for this population using the data we know for January and February 2014, then projects the range of most likely outcomes for this group with respect to those newly generated marginal jobs over the next four months.

In both January and February 2014, we find that approximately 25.1% of the new increase in jobs that were generated in the state were claimed by Illinoisans who had previously been receiving extended unemployment benefits. We then apply that percentage of total new marginal jobs created as being representative of what the minimum number of hires would be each month from March through June 2014 for this unique segment of Illinois' civilian labor force.

But here, we should note that most individuals who start a job search from scratch will typically find work some three to six months after they get serious about it and start seeking employment in earnest. And with an average weekly income of $320, any full time job paying at least Illinois' minimum wage of $8.25 per hour would be capable of replacing the unemployment benefits they had been receiving for as long as the previous 17 months. And of course, jobs that pay higher wages could do the same for them with fewer hours worked.

We've therefore also indicated on the chart a potential likely trajectory that would represent the pace of re-employment for the 74,000 Illinoisans who became ineligible to receive any additional unemployment insurance benefits after 28 December 2013. What we clearly observe is that the net increase in the number of jobs in the margin of Illinois' economy is more than sufficient to provide for the employment of these 74,000 individuals.

So in addition to a general decline in the state of Illinois' economy in 2014, which we observe in the decline of non-farm payroll jobs after December 2013, in which we also observe an increase in the total employment figure as these displaced workers start working in marginal jobs, we see that the loss of extended unemployment benefits for 74,000 Illinoisans could have also contributed to the large boost of employment in hiring to fill newly created marginal jobs in the state during the first six months of 2014.

Ultimately, this outcome is why Illinois' elected representatives in the U.S. Congress will likely no longer be using their influence to get the Illinois Department of Economic Security to resume its accounting of the fate of those 74,000 Illinoisans whose extended unemployment benefits ran out after 28 December 2013 anytime soon. And you can bet that the political activists who mindlessly cite the IDES' data in their calls to crank up the federal government's extended unemployment benefits program will be happy to never see that data updated beyond February 2014 as well.

For such activists, that's just part of the modus operandi that is part and parcel with their kind of rent seeking.

And that's a shame for serious analysts, because the kind of economic data that can provide really useful insights in how people respond to incentives in their environment is far more rare than it should be.

Update: The Wall Street Journal reports on a study that confirms what we found!

Also, Kevin Erdmann wonders if the federal government's Extended Unemployment Insurance (EUI) program for the long-term unemployed hurt these displaced, marginal workers far more than it actually helped them:

I've been fairly clear that I don't think such long term EUI was a wise policy. I'm not sure we did these workers any favors by having such generous EUI policy. If the main point of this policy was to lessen the incentive for them to accept sub-optimal work opportunities in the months following their loss of work, it seems that what we have done is to create about a million and a half workers, who, at the end of the labor contraction, still are in a position where they will need to accept sub-optimal work opportunities, but now have to try to acquire those opportunities with a big red flag on their resumes. So, they are likely, after having missed two years or more of potential productive work time, to be facing even worse opportunities than they had initially. In trying to save workers from uncomfortable, but manageable, outcomes, we may have subtly pushed them into desperate outcomes with no obvious, systematic solution.

Data Sources

U.S. Bureau of Labor Statistics. States and selected areas: Employment status of the civilian noninstitutional population, January 1976 to date, seasonally adjusted. [Text Document]. Accessed 25 July 2014.

U.S. Bureau of Labor Statistics. Economy at a Glance: Illinois. [HTML Document]. Accessed 25 July 2014.

References

Abraham, Katharine, G., Haltiwanger, John C., Sandusky, Kristin and Spletzer, James. Exploring Differences in Employment Between Household and establishment Data. Journal of Labor Economics, Vol. 31, No. 2, Pt 2, pp. S129-S172. [PDF Document]. http://www.jstor.org/stable/10.1086/669062. 11 June 2013.

U.S. Bureau of Labor Statistics. Employment Situation Technical Note. [HTML Document]. Last Modified 3 July 2014. Accessed 12 July 2014.

Labels: jobs

What does it mean when the trends for non-farm payroll jobs and total employment in the U.S. are on two separate and diverging tracks?

We're asking that question today because of something we've observed in the data for the state of Illinois while working on a different project. The chart below shows what we found when we looked at that state's total employment numbers and nonfarm payroll jobs since December 2012.

Here, we observe that the trends for the state's total employment and for the state's non-farm payroll jobs would appear to be on diverging trajectories over time. As we've previously discussed in considering the differences between the Household and Establishment surveys that document employment trends in the U.S., that pattern is largely due to cyclical factors related to turning points in the economy:

One other factor that can contribute to differences between the two surveys' reported data is driven by cyclical factors, which are often present during economic turning points, such as the beginning of recessions or periods of economic expansion. Here, during recessions, the Establishment survey will show job losses as recessionary conditions take hold and workers are laid off, while the Household survey will show gains as those displaced workers move into the kind of marginal employment that is captured by that survey.

That script gets flipped when an economic recovery takes hold, as establishments boost their hiring, pulling workers out of marginal employment, with the results showing up in the data as job gains in the Establishment survey but as a falling level of employment in the Household survey.

The chart above shows those patterns. Here, in 2013, the total employment level declined as the number of people who had been marginally employed declined as the number of people in non-farm payroll "establishment" jobs increased, which suggests that labor market conditions in Illinois improved throughout the year.

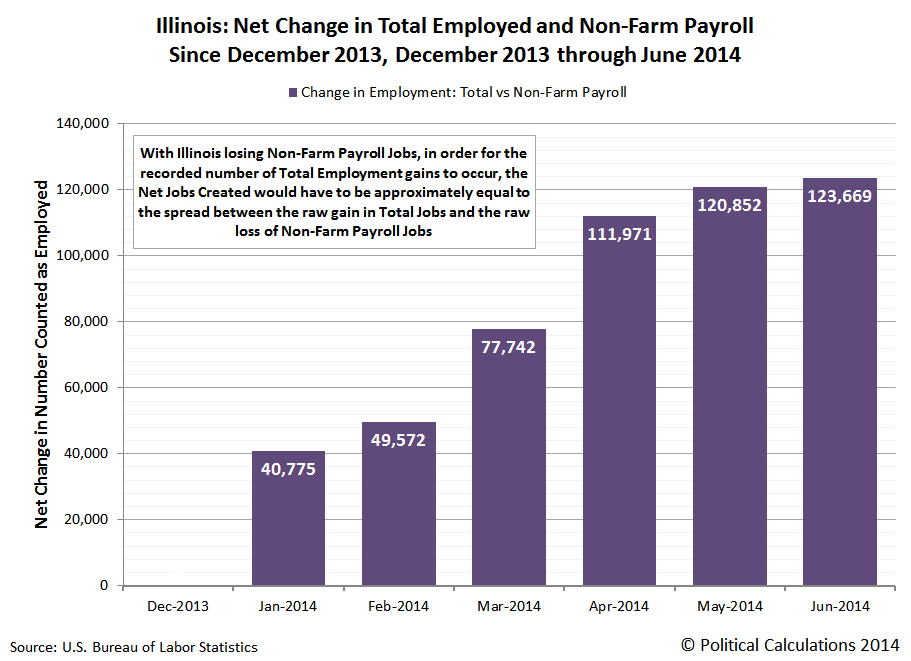

But those improving conditions for Illinois' labor market would appear to have reversed since the end of 2013. Here, the number of people employed in non-farm payroll jobs have declined while the total employment figure for the state has increased rather dramatically, which suggests a massive increase in the number of people who are marginally employed in Illinois beginning in January 2014. The chart below takes a closer look at the recent trend in Illinois' employment situation.

Although the data for non-farm payroll jobs and total employment are based on different surveys and cover different portions of the civilian U.S. labor force, we're going to treat them as if they do fit neatly together like jigsaw puzzle pieces in the following analysis to get a sense of how the number of newly created jobs in Illinois would have had to change in order to produce these figures. The chart below shows the change in the number of people counted as being employed for each data series since December 2013.

What's important to consider here is the spread between the disappearing number of jobs counted in Illinois' non-farm establishments and the increasing number of jobs that were counted in surveying Illinois' households. That spread would represent the number of newly generated marginal jobs in the state.

The curious thing here is that the magnitude of the net increase in the number of marginal jobs in Illinois through June 2014 is over eight times greater than the actual loss of non-farm jobs at Illinois' establishments during the same period of time. That difference suggests that what we're seeing isn't the migration of workers from establishment to marginal employment after being laid off, but rather a large scale increase in the number of people in Illinois from outside of the state's employed population into marginal jobs that have been created since the beginning of the year.

Where that extra population of job-finding Illinoisans came from will be our next stop in this series.

Data Sources

U.S. Bureau of Labor Statistics. States and selected areas: Employment status of the civilian noninstitutional population, January 1976 to date, seasonally adjusted. [Text Document]. Accessed 25 July 2014.

U.S. Bureau of Labor Statistics. Economy at a Glance: Illinois. [HTML Document]. Accessed 25 July 2014.

References

Abraham, Katharine, G., Haltiwanger, John C., Sandusky, Kristin and Spletzer, James. Exploring Differences in Employment Between Household and establishment Data. Journal of Labor Economics, Vol. 31, No. 2, Pt 2, pp. S129-S172. [PDF Document]. http://www.jstor.org/stable/10.1086/669062. 11 June 2013.

U.S. Bureau of Labor Statistics. Employment Situation Technical Note. [HTML Document]. Last Modified 3 July 2014. Accessed 12 July 2014.

Labels: jobs

Every month, when the U.S. Bureau of Labor Statistics (BLS) puts out its Employment Situation report, it provides the results of two different surveys that it conducts each month: the Household survey and the Establishment survey. We thought we'd take this opportunity to note the differences between the two.

The Household portion of the Employment Situation report is conducted by the U.S. Census Bureau, which surveys some 60,000 American households during the week of the 12th of each month as part of its Current Population Survey (CPS). In addition to determining the employment status of the individuals in each surveyed household, which it classifies as employed, unemployed or not in the civilian labor force, the Census collects data on their demographic profiles, including race, Hispanic origin, age, sex, et cetera.

Meanwhile, data for the Establishment is collected by the U.S. Bureau of Labor Statistics as part of its Current Employment Statistics (CES) survey, which incorporates the payroll records of some 144,000 non-farm establishments and government agencies, covering workers at some 554,000 individual worksites. In addition to determining the number of people employed at the surveyed locations as of the payroll period including the 12th of each month, the BLS collects data on the number of hours worked, earnings and the industries in which individuals are employed at the surveyed organizations.

The BLS notes the following differences between the surveys:

- The household survey includes agricultural workers, self-employed workers whose businesses are unincorporated, unpaid family workers, and private household workers among the employed. These groups are excluded from the establishment survey.

- The household survey includes people on unpaid leave among the employed. The establishment survey does not.

- The household survey is limited to workers 16 years of age and older. The establishment survey is not limited by age.

- The household survey has no duplication of individuals, because individuals are counted only once, even if they hold more than one job. In the establishment survey, employees working at more than one job and thus appearing on more than one payroll are counted separately for each appearance.

These differences mean that the results from each survey do not necessarily fit together neatly like the pieces of a jigsaw puzzle. Census Bureau statisticians have suggested that in addition to the differences noted above, many of the discrepancies between the surveys may be attributed to the characteristics of marginally-employed workers, such as those who work as independent, self-employed contractors or in "off-the-books" or other types of non-standard occupations, which are often captured by the Household survey but not by the Establishment survey.

One other factor that can contribute to differences between the two surveys' reported data is driven by cyclical factors, which are often present during economic turning points, such as the beginning of recessions or periods of economic expansion. Here, during recessions, the Establishment survey will show job losses as recessionary conditions take hold and workers are laid off, while the Household survey will show gains as those displaced workers move into the kind of marginal employment that is captured by that survey.

That script gets flipped when an economic recovery takes hold, as establishments boost their hiring, pulling workers out of marginal employment, with the results showing up in the data as job gains in the Establishment survey but as a falling level of employment in the Household survey.

But economic turning points like recessions are not the only driving factor that can produce these results, which is an idea that we'll be exploring in upcoming posts.

References

Abraham, Katharine, G., Haltiwanger, John C., Sandusky, Kristin and Spletzer, James. Exploring Differences in Employment Between Household and establishment Data. Journal of Labor Economics, Vol. 31, No. 2, Pt 2, pp. S129-S172. [PDF Document]. http://www.jstor.org/stable/10.1086/669062. 11 June 2013.

U.S. Bureau of Labor Statistics. Employment Situation Technical Note. [HTML Document]. Last Modified 3 July 2014. Accessed 12 July 2014.

Labels: jobs

We think we may finally have a decent handle on how to compensate for the echo effect in our forecasting of the S&P 500's future.

To briefly recap the story to date, our index value forecasting method incorporates historic stock prices from a year earlier as part of the base reference points from which we project the future value of stock prices. The "echo effect" is something that results from our use of that historic data, particularly when stock prices had experienced a "noise event". A noise event is when stock prices deviate from the level that their fundamental underlying driver, the change in the growth rate of their trailing year dividends per share expected at a discrete point of time in the future, would otherwise suggest they should be set according to our model of how stock prices work.

Those deviations from various noise events are clear when you compare what our model had forecast against the actual trajectory that stock prices took in 2013.

We had previously come up with a filtering technique that initially showed promise, but which turned out to not be able to handle the situation where the stock market had undergone a volatile series of disruptive noise events, which was the case from mid-June through mid-October 2013. So we pulled the plug on it last month.

So we seemed to be up a creek without a paddle for compensating for the echo effect in our forecasting. That much is certainly evident when you compare our forecast with the current trajectory of stock prices, where it would appear that the stock market began experiencing a significant negative noise event on 17 July 2014, but which turns out to really be an artifact of the echo effect in our projections - the echo of the noise events of a year ago.

We started thinking about how we recognize the presence of noise in the market in the first place, where we observe it as the deviation from our forecast trajectory of where stock prices would go when investors are focused on a particular point of time in the future. We know what that trajectory looks like and we know what the actual trajectory of stock prices was.

So what if we used our older forecast as the baseline reference for projecting future stock prices?

Well, that wouldn't make much sense, would it? After all, it's a projection, one that was significantly different from the trajectory that stock prices actually took. We shouldn't be in the business of making forecasts based on the hypothetical path that stock prices could have taken a year ago.

But then we thought about it some more. That forecast incorporated the historic stock prices of a year earlier, which are a very real thing that we could use as our baseline point of reference. Instead of using the stock prices of a year ago as the base reference point of our projections, we would instead be using the stock prices of two years ago.

Better still, we wouldn't even need to complicate our basic math like we did with our initial echo filtering technique - we would just need to adjust all the older data points to use the same, but older data that applied at the older point in time. The same math could work!

So that's what we did. Here's the result of our rebaselining the calculation to incorporate the historic stock data in our projections of today:

Suddenly, we find that stock prices would appear to be once again predictable, currently following the trajectories that are consistent with investors continuing to be focused on either 2014-Q3 or 2015-Q2 in setting current day stock prices - just as they were before we ran into the echo effect using our regular one-year ago base reference period!

But now, we appear to have reached a fork for that trajectory, where we'll soon determine which future investors are really focused upon.

Now, there are some obvious downsides with this approach, as in addition to trading the base reference points for our projections, we've also traded one year's noise events for the preceding year's. But since the period of 2012-Q3 was relatively quiet in terms of those events, we should expect stock prices to fall within the expected error range for whichever alternative trajectory that coincide with the actual point of time in the future where investors are currently focused, with any major deviations we observe now being attributable to current day noise events rather than the echoes of noise events past.

Previously on Political Calculations

We've been working on how to crack the echo effect in our S&P 500 forecasting method since November 2013. The posts below, presented in reverse chronological order, describe our experience in that endeavor to date as we've worked out how to compensate for the echo effect in real time.*

- RIP: Our S&P 500 Echo Filtering Technique - 23 June 2014

- Shifting the Future for the S&P 500 - 9 June 2014

- Time to Enter the Summer Doldrums - 2 June 2014

- Echoes, Aftershocks and the S&P 500 - 12 May 2014

- S&P 500: Nothing Much to See Here - 28 April 2014

- An Uneventful Week for the S&P 500 - 21 April 2014

- The Evolving Future of the S&P 500 - 7 April 2014

- Extending the Alternate Futures - 31 March 2014

- A Better Frame of Reference, Mean Reversion and the S&P 500 - 18 March 2014

- Rewriting the Alternate Futures - 10 March 2014

- The S&P 500 in February 2014 - 3 March 2014

- Calibrating the Futures of the S&P 500 - 18 February 2014

- With and Without the Echo - 10 February 2014

- S&P 500: Right About on Target - 20 January 2014

- The S&P 500 Behaving as Expected in the First Week of 2014 - 13 January 2014

- The S&P 500 As We Saw It in Real Time in 2013 - 7 January 2014

- A Last Look at the S&P 500's Future in 2013 and a First Look to 2014 - 16 December 2013

- The S&P 500's Echo-Adjusted Reverberations - 9 December 2013

- The S&P 500 After the Echo Arrives - 3 December 2013

- Filtering the S&P 500's Echoes of the Past, Part 2 - 20 November 2013

- Filtering the S&P 500's Echoes of the Past, Part 1 - 19 November 2013

- The Anniversary of the Great Dividend Raid of 2012 - 18 November 2013

- The S&P 500 Before the Echo Event Begins - 9 November 2013

Reading through all these, we can see why we stuck with our echo-filtering technique for so long, even though we never really liked it very much because of how much it complicated the basic math behind our S&P 500 forecasting method. In the end, it turned out to be capable of compensating for relatively stable short-term echoes, such as from the Great Dividend Raid Rally and the subsequent Fiscal Cliff Deal Rally spanning 15 November 2012 through 17 April 2013, but not the echoes from the much more volatile series of noise events that defined the QE-Uncertainty and Debt Ceiling Crisis noise events that disrupted the U.S. stock market in the period from 19 June 2013 through 17 October 2013.

* Note: To the best of our knowledge, we're the only stock market analysts who have made our work product fully transparent by developing it in public and sharing our observations and results in near-real time on the Internet. And we've been doing it since we announced our original discovery of what really drives stock prices on 6 December 2007.

Welcome back to the cutting edge!

It was a triumphant story that was first published by the Northport Patch back on 5 August 2011. Then, the tiny community web site of the tiny town located on the northwest corner of Long Island, New York announced that then 13-year old Northport Middle School student Aidan Dwyer had applied a mathematical principle found in trees that could improve the performance of solar panels and had been granted a provisional U.S. patent for an invention stemming from his insight:

Aidan Dwyer has accomplished more in his life than most people three times his age. He sails, he golfs-- and he is a patented innovator of solar panel arrangements.

Dwyer applied the Fibonacci sequence, a mathematical principle widely occurrent in nature, to solar panel arrays in a months-long backyard experiment. He found that small solar panels arranged according to the Fibonacci sequence found in tree branches produced 20 percent more energy than flat panel arrays, and prolonged the collection window by up to two and a half hours.

Most remarkably, the elegant tree design out-performed the flat panel array during winter exposure, when the sun is at its lowest point, by up to 50 percent.

The feel-good story quickly built steam over the next two weeks, when it blew up into the big time as a number of mainstream media outlets, including Popular Science, heralded 13-year old Aidan Dwyer's achievement. The popular environmental news site Earthtechling offered the following lead for its story on the 13-year old's naturist's insight and invention:

One would be excused for suspecting that Aidan Dwyer, said to be 13, is in fact a small, very young-looking, 37-year-old college-educated con-man of the highest order. Such is not the case though for what the young Long Island lad has accomplished in a feat typically associated with much older individuals. As reported on the Patch community website out of Northport, N.Y., Aidan has used the Fibonacci sequence to devise a more efficient way to collect solar energy, earning himself a provisional U.S. patent and interest from "entities" apparently eager to explore commercializing his innovation.And you're wondering what the Fibonacci sequence is. Aidan explains it all on a page on the website of the American Museum of Natural History, which recently named him one of its Young Naturalist Award winners for 2011. The awards go to students from middle school through high school who have investigated questions they have in the areas of biology, Earth science, ecology and astronomy.

The feel-good bubble for solar power enthusiasts burst just days later when it became clear that 13-year old had made mistakes in his science work backing his invention, which if corrected, would almost entirely diminish any advantage that 13-year old Aidan Dwyer's invention might provide for deploying solar panel technology. Earthtechling summarized the rapid debunking that followed the previous triumphant stories:

Welcome to the digital age, Aidan Dwyer, where a hero becomes a bum in a blink of an eye and you need a neck brace to protect against media whiplash. One day, credulous news outlets – including the one you’re reading now – were glomming onto 13-year-old Aidan’s award-winning science project and advertising it to the world as a solar-power breakthrough. Now, a veritable cottage industry of Dwyer-debunkers has sprung up, and his work is being called way off base.

“Was Our Beloved 13-Year-Old Solar Power Genius Just Proven Wrong?” asks Gizmodo. “Why 13-year-old’s solar power ‘breakthrough’ won’t work,” writes Tuan C. Nguyen on Smart Planet. “Blog Debunks 13-Year-Old Scientist’s Solar Power Breakthrough,” says The Atlantic Wire. “This is where bad science starts,” headlines an exhaustive, nearly 4,000-word takedown of Aidan (and, even more pointedly, the media who grabbed his story and ran with it) on the No One’s Listening blog.

Keeping in mind that it took the effort of people with considerably more scientific knowledge and experience to even detect the errors that 13-year old Aidan Dwyer made, it is perhaps not so surprising that a 13-year old made mistakes in his scientific investigation. People who do real science in real life often go down what turn out to be blind alleys on the path to discovery all the time. Failure is both an integral and illuminating part of the scientific process.

But while the story of how 13-year old Aidan Dwyer's invention turned out to be one of those blind alleys, a more remarkable story is that the original story of 13-year old Aidan Dwyer's insight and invention refuses to die. Instead, scientifically-illiterate environmental activists are continually recycling it! Here's a quick sampling:

| Recycling a 13-Year Old's "Solar Breakthrough" | |

|---|---|

| Date | Link |

| 17 October 2012 | Fibonacci Department: 13-year-old spirals tree branching into solar panels |

| 21 March 2013 | 13-Year Old Replicates Fibonacci Sequence to Harness Solar Power |

| 23 September 2013 | 13-Year Old Replicates Fibonacci Sequence to Harness Solar Power |

| 21 November 2013 | 13-Year-Old Replicates Fibonacci Sequence in Trees |

| 29 December 2013 | 13-year-old investor cracks the secret of trees to revolutionize solar energy |

| 30 December 2013 | 13 Year Old Invents Fibonacci Solar Panel Designs |

| 12 March 2014 | This Boy Walked Into A Forest. What He Found Could Change Mankind's Future |

| 14 April 2014 | Biomimicry - Tree Solar Panels |

| 9 June 2014 | 13-Year Old Replicates Fibonacci Sequence to Harness Solar Power |

It's always the same story too. It's as if the community of environmental activists are too scientifically illiterate to even be curious to find out more about it, much less what can be found on the first page of Google search results.

But do you know what the best part of all this recycling is? Aidan Dwyer never gets any older! Even though it's three years later (at this writing in 2014), he's *always* 13-years old!

Somehow, in failing to make a solar breakthrough with the Fibonacci sequence, 13-year old Aidan Dwyer would appear to have accidentally discovered the fountain of youth!

Labels: technology

Previously, we found that the worst state for jobs for teens in the U.S. is California.

But we have bad news for the teens in that state. In 2014, the worst state for job-seeking teens, California, is getting worse:

Here is how that compares with the job market for adults in California (Age 20 and over) since the total employment level in the U.S. peaked in November 2007, just ahead of the U.S. economy's peak of expansion in December 2007, marking the official beginning of the so-called "Great Recession":

To make it to the bottom in this category takes a unique combination of poor government policies and poor economic growth prospects, the latter which can be demonstrated by their not being sufficient to offset the negative effects of the former. For the state's teen population, California would appear to have developed both in spades.

Labels: jobs

What are the best and worst states for U.S. teens between the ages of 16 and 19 for finding jobs?

To find out, we turned to the U.S. Bureau of Labor Statistics, whose Geographic Profile of Employment and Unemployment provides the data by detailed age group on an annual basis for the years from 1999 through preliminary figures for 2013. We used that data to calculate the ratio of the number of employed U.S. teens from Age 16 through 19 with respect to their numbers in the U.S. population to create the following chart.

In the chart, we see that North Dakota is currently the leader among all states, surging considerably in 2013. We also see that the state has consistently ranked high by this measure from 1999 through the present. That's likewise true for the states that also ranked highly in 2013. The Top 5 states for teen jobs are:

- North Dakota

- Iowa

- Nebraska

- South Dakota

- Wyoming

Meanwhile, we observe that the worst place for jobs for U.S. teens is the District of Columbia, which currently and has chronically occupied the basement in the rankings by a wide margin during each year for which we have data.

But since this geographic region reserved to be the seat of the nation's capitol is not a state, the state that really ranks as being the worst state for job-seeking teens in 2013 is California. Here are the Bottom 5 states for teen jobs:

- New York

- West Virginia

- Mississippi

- Georgia

- California

In 2013, these five bottom-dwelling states were home to 23.6% of the entire population of 16-19 year olds in the United States.

Labels: jobs

What are the odds that IRS employees deliberately targeted President Barack Obama's political opposition and have attempted to cover it up?

On 31 May 2013, the U.S. Internal Revenue Service (IRS) told Congressional investigators that they had identified at least 88 IRS employees and supervisors who were involved in targeting groups opposed to various aspects of President Barack Obama's political agenda. At that time, the IRS ordered these employees to preserve all the "responsive documents" related to the scandal on their personal computers, which would apply to documents going back as far as 2010.

On 21 July 2014, in written testimony before the U.S. Congress, IRS Deputy Associate Chief Counsel Thomas Kane indicated that the hard drives of up to as many as 20 of these IRS employees had experienced crashes, making e-mails and other documents stored on them inaccessible in explaining why the agency would not deliver the information that it had been ordered to provide to Congressional investigators.

What are the odds of that happening?

Fortunately, we have an app for that! You just need to enter the relevant data, which we have below, or adjust it as you might like, and we'll figure out the odds of so many members of such a small group of IRS employees and supervisors going through the experience of their hard drive crashing so bad that no information related to potentially unlawful activities would ever be retrieved from them.

In the tool above, we're using the findings of a 2007 study found that the odds of a single hard drive independently failing in a given year is about 3%. If you want to be precise however, the average rate of replacement for a failed hard drive in a single year is 2.88%.

Our tool's results indicate the probability of the events in question occurring by purely random chance. If you want to find the odds that IRS employees deliberately targeted President Barack Obama's political opposition and have since attempted to cover up evidence of their unlawful conduct, just subtract the percentage odds above from 100% to find the odds of that....

Other Probability Tools on the Web

We've previously found two really cool tools for doing this kind of math elsewhere on the web:

Richard Lowry presents the detailed calculations and an online calculator for finding binomial probabilities that gets around our tool's limitation of 170 opportunities!

Texas A&M offers a Java application for doing this kind of math that includes graphical output, so you can see where various outcomes might fall on a normal bell curve distribution!

Update 3:35 PM EDT: One of our readers points us to the perfect country tune to describe the IRS' "problem" with hard drives:

Labels: crime, politics, probability, tool

A new noise event rattled the markets on Thursday, 17 July 2014, when news broke that a Malaysian Airlines commercial jet had been shot down over eastern Ukraine, potentially by Russian-backed separatists. That act caused stock prices to drop below the level they would otherwise be, assuming that investors are now focused on 2015-Q2 (the quarter the Fed will likely hike interest rates from their current near-zero levels) in setting today's stock prices.

Our expectations/accelerations chart shows the negative impact upon stock prices with respect to the change in the growth rate of dividends expected in that future quarter.

While stock prices rallied strongly back on Friday, 18 July 2014, in reality, the negative noise generated by the missile attack on Malaysian Airlines Flight MH17 event is still present in the market and is keeping stock prices from rising as high as their fundamental relationship with their expected future dividends indicates that they would otherwise be.

That is evident from the relative position of the trajectory of stock prices with respect to the trajectory they would be taking if not for the negative impact of the terrorist act.

What this chart indicates is that the perception of investors of the event's potential negative impact on their expectations for the future did not worsen from the previous day, as the gap that opened up in response to the event did not widen. By that same token, the outlook of investors did not meaningfully improve either, as the gap between projected trajectory and actual trajectory did not close on 18 July 2014.

As of the close of market trading on Friday, 18 July 2014, investors were in a holding pattern as more information about the attack becomes known and its potential impact upon their expectations of the future can be assessed. Depending upon what they learned over the weekend, there is a potential for a significant difference between the value the market closed at and the value at which it will open later this morning (21 July 2014) to develop.

And you'll know what they thought of what they learned over the weekend by whether the gap between our forecast and actual stock prices widens or narrows.

If you are a leader, the example you set means everything.

Because it is the people in charge who have the responsibility for setting the priorities for those who work for them and also for shaping the environment in which they will do so. It is the people in positions of leadership who, by their policies and example, provide both the official and unspoken guidance that the people who work for them will follow in determining how they will act. Even when the boss is away - the cultural landscape they establish remains in effect.

In business, it's called "corporate culture". And it plays a massive role in how successful an organization can be. Especially during times of adversity, when challenges can become overwhelming in the absence of a solid organizational culture that can deal with them in a coherent, competent fashion.

As a case study of how important that aspect of leadership is and how much it is missed when it is lacking, let's consider a day in 2014 when the news of the death of 295 people aboard a Malaysian Airlines 777 commercial airliner became known around 11:30 AM EDT and how U.S. President Barack Obama handled it.

Here, we observe a large degree of disengagement on the part of President Obama that day, particularly after the news of the tragedy had become widespread. The White House press pool traveling with President Obama on that fateful day offered the following tidbit nearly an hour and a half after the news first broke:

At approximately 12:50 pm, the motorcade stopped at the Charcoal Pit, a popular, established restaurant just north of Wilmington, Del. Known for its burgers and sundaes. Obama shook hands and mingled with many of the diners, stopping at one point to pick up seven-month old Jaidyn Oates, and pose for a photo.

He invoked Vice Presiident [sic] Biden’s name a few names, noting to some diners, “Me and Joe, we share shakes all the time,” and to others, “Biden told me the burgers are pretty good.”

Just before hugging another young girl, whose mother lifted her across the booth to hug the president, Obama asked, “Do you give good hugs?”

At 1:01 pm Obama declared, “I’m starving!” He sat down to eat with Tanei Benjamin, who wrote the president a year ago. The president ordered a 4-ounce “Pit special,” which is burger with fries. He asked for it to be done medium well, and to have lettuce and tomato. He also asked for a water with lemon.

About an hour after lunch, President Obama finally noted the tragedy, inserting the following comments in a planned speech:

President Barack Obama offered his first public comments on Thursday about the Malaysia Airlines plane that crashed over Ukraine, saying his first priority is to find out whether there were any Americans on board the flight.

“Obviously, the world is watching reports of a downed passenger jet near the Ukraine border,” Obama said in brief comments before a planned speech in Delaware. “And it looks like it may be a terrible tragedy.”

Right now, we’re working to determine whether there were American citizens on board. That is our first priority. And I directed my national security team to stay in close contact with the Ukrainian government,” Obama said. “The United States will offer any assistance we can to help determine what happened and why. And as a country, our thoughts and prayers are with all the families of the passengers, wherever they call home.”

For the sake of context, here's the video of President Obama's remarks so you can appreciate how disengaged President Obama's first comments on the tragic events of 17 July 2014 really were, as the President gave them before going on to say that "it is great to be in the state that gave us Joe Biden":

Meanwhile, it was confirmed very early after the incident occurred that the lives of Americans had been claimed in the crash. In fact, the first reports of that fact were breaking at the same time President Obama was stopping for lunch, even though it would be some time for the exact number and their names were known.

But wait! Weren't there responsible people back at the White House to whom the President might have delegated the task of keeping up on tragic events as they occur? While President Obama's initial reaction was oddly disconnected, surely there were others that President Obama had placed into positions of authority who were on top of what the the President truly needed them to be doing.

Well, judge for yourself - our site saw the following site traffic at 9:08 AM PDT, or rather, 12:08 PM EDT, shortly after more extended news reports of the downing of the Malaysian 777 were hitting the airwaves:

Amazing the priorities that some have when commercial jetliners are shot down from the sky.

That odd level of extreme disengagement was also observed at other government agencies, including the State Department:

President Barack Obama is setting a very bad example of leadership. And it's showing all across the executive branch of the U.S. federal government.

Labels: business, income distribution, management, performance, quality

Who are the major holders of debt issued by the U.S. federal government going into the summer of 2014?

The answer is presented graphically below:

On the whole, there haven't been many changes since our previous edition. We see that the debt reported to be held by Belgium is still considerably inflated over historic levels, as this nation's banks would appear to have acted on behalf of Russian interests seeking to place their U.S. government-issued debt holdings in non-Russian financial institutions ahead of and in the months following Russia's actions to seize control of Crimea from Ukraine.

Tapering the Federal Reserve's Quantitative Easing Program

Our special area of focus on this update of our irregular series on the ownership of the U.S. national debt looks at the role of the Federal Reserve's Quantitative Easing (QE) programs as the central bank of the U.S. has gone from holding a low of $478.7 billion in U.S. government-issued debt securities on 18 June 2008 up to an astounding $2,414.8 billion on 28 May 2014. As of that date, the Federal Reserve held a a combination of $2,370.7 billion in U.S. Treasury securities and $44.1 billion in debt securities issued by other federal government agencies.

The Federal Reserves holdings of these securities now accounts for 13.8% of all the total public debt outstanding for the U.S. federal government, which totals $17.490 trillion as of 31 May 2014. On 1 January 2014, the U.S. national debt stood at $17.352 trillion, of which the Federal Reserve held some $2.266 trillion, or 13.06%.

The Federal Reserve also holds some $1,648 billion in mortgage-backed securities, which are primarily issued by government-backed entities, including the Government National Mortgage Association (Ginnie Mae), which is owned by the U.S. federal government, and the Federal National Mortgage Association (Fannie Mae) and the Federal Home Loan Mortgage Corporation (Freddie Mac), which are nominally private institutions, but which have been operating under government conservatorship since 2008. Although these government-backed entities issue mortgage-backed securities, their role is to collect and bundle the mortgages of U.S. homeowners and firms for the money they've borrowed into pools, which are then securitized and traded on the open market - it is not money borrowed by the U.S. Treasury or federal government agencies.

The Federal Reserve began its most recent round of QE government-issued debt buying in the fourth quarter of 2012, which it began doing to keep the U.S. economy from falling into a full-fledged recession at the time. Beginning in January 2014, the Federal Reserve has been steadily reducing the amounts its QE purchases every six weeks, as it believes the risk of falling into recession has diminished.

Even though the Federal Reserve has been reducing its purchases of U.S. government-issued debt securities since the beginning of 2014, as of 28 May 2014, it has boosted its net holdings of the federal government's liabilities by $148.8 billion. Meanwhile, the U.S. federal government borrowed an additional $138.1 billion from 1 January 2014 through 28 May 2014.

Or rather, the Federal Reserve has acquired 107.7% of the net new debt that has been issued by the U.S. Treasury and other federal government agencies during the first five months of 2014.

That's possible because of two factors. First, with the bills for U.S. federal income taxes coming due on 15 April 2014, the federal government experiences a surge of tax revenue during this part of the year, which can be enough to allow it to run a short-term surplus, reducing its need to borrow money during this period of time.

Second, the Federal Reserve is displacing other entities that lend money to the U.S. government, who are seeing their share of debt issued by the U.S. government fall as the debt they hold matures. That allows the U.S. Treasury to roll over a portion of the existing national debt and borrow more money, in this case, from the Fed, which doesn't show up as a net increase in the overall size of the national debt.

And that is how the U.S. Federal Reserve can lend more money to the U.S. federal government than the U.S. government appears to have borrowed, even as the Fed is reducing the amount it lends to the government!

Data Sources

Federal Reserve Statistical Release. H.4.1. Factors Affecting Reserve Balances. Release Date: 5 July 2013. [Online Document]. Accessed 16 July 2014.

U.S. Treasury. Major Foreign Holders of Treasury Securities. Accessed 16 July 2014.

U.S. Treasury. Monthly Treasury Statement of Receipts and Outlays of the United States Government for Fiscal Year 2013 Through May 31, 2014. [PDF Document].

Labels: national debt

There are two Californias. There is one where adults (Age 20 and over) are gaining jobs at a rate that's slightly faster than was the case in the years before the December 2007-June 2009 recession in the U.S.

And there is the one where teens (Age 16 to 19) are falling further and further behind in the job market.

Notes and Observations

The data in both charts is the trailing twelve month average for non-seasonally adjusted data. Taking the trailing year average of this data allows us to account for the effect of seasonality in the data.

California increased its minimum wage from $6.75 per hour to $7.50 per hour on 1 January 2007. The effect upon teens in the labor market was minimal since California's economy was still growing, which allowed employers to somewhat offset the 11% increase at the time. That said, instead of keeping pace with the job market for adults, we see that the employment situation for California's teens basically flatlined during 2007. We also see that the number of employed teens began falling in the months prior to the minimum wage increase, as employers anticipated the hike.

California increased its minimum wage from $7.50 per hour on 1 January 2008. Once again, the job market for adults was little affected, with the number of employed Age 20+ Californians growing through July 2008 before finally being negatively impacted by economic contraction and its associated deflationary pressures.

By contrast, the employment situation for Californians teens began deteriorating rapidly after the higher minimum wage was imposed, with the rate of decline in the number of employed teens in the state not decelerating until September 2010 - one year and three months after the recession in the U.S. ended, before beginning to decline at a much slower pace.

Meanwhile, adult Californians saw their job market turn around months earlier, growing at a pace similar to that from before the recession through July 2011, then at a faster pace afterward.

The job market for teens in California didn't bottom out until January 2012, then began recovering at a much slower pace than that for adults. That slow rate of improvement lasted through December 2013. Since January 2014, the trailing twelve month average for the number of employed teens in California has been falling in the months in advance of the state's next minimum wage hike from $8.00 per hour to $9.00 per hour on 1 July 2014.

Throughout all this time, California has been home to one out of 8 teens in the United States. In January 2005, one out of 10 employed teens in the U.S. lived and worked in California. In May 2014, one out of 12 employed teens in the U.S. lived and worked in California.

Americans between the ages of 16 and 19, by the way, make up approximately 25% of all individuals who earn the minimum wage in the United States.

Labels: demographics, jobs, minimum wage, recession

How many dividend paying companies are there in the S&P 500?

Through 9 July 2014, we count 425 companies among the components of the S&P 500 that currently pay cash dividends to shareholders. Our chart below shows how their number has changed since 1980, which we note is largely in response to how the U.S. federal government has set the tax rates for both dividends and capital gains.

In terms of the most recent trend, 85% of the companies in the S&P 500 are now paying dividends, up from the 70.2% that were in 2002, the last full year before the tax rates for both dividends and capital gains were once again set to be equal to one another.

Factors Affecting the Number of Dividend Paying Companies in the S&P 500

While recessions tend to temporarily lower the number of companies paying dividends, which we would expect since some of the 500 companies that make up the S&P 500 would lack the earnings needed to pay dividends during these periods of contraction in the U.S. economy, we find that the biggest driver of what affects the number of companies paying dividends to individual shareholders, pension and retirement plans, et cetera is the relative tax rates of dividends and capital gains with respect to each other.

For example, in 1978, before we have data showing the percentage of S&P 500 dividend payers, the capital gains tax rate was reduced from a maximum tax rate of 39.9% (that's on paper - the real maximum capital gains tax rate was 49.9% as a result of an interaction with the maximum regular income tax rate) to 28%, which was then lowered to 20% in 1981.

By contrast, the tax rate for dividends was the same as for personal income taxes, with a maximum tax rate of 50% beginning in 1982. Prior to 1982, the maximum personal income tax rate was 70%.

That changed with the U.S. Tax Reform Act of 1986, which equalized the maximum tax rates for both dividends and capital gains at 28%.

In the period before 1986, the number of S&P 500 companies that paid dividends to their shareholders declined from 469 in 1980 (or 93.8% of all companies making up the index) to 426 companies in 1986 (or 85.2%). After 1986, the number of dividend paying companies in the S&P 500 was largely stable, ranging between 426 and 438 for the next decade.

That stability ended with the Taxpayer Relief Act of 1997. Here, the capital gains tax rate was reduced from 28% to 20%, while the tax rate of dividends was held at the 28% level. As we can see in the chart above, this change in tax law coincided with a dramatic drop in the number of companies within the S&P 500 that paid dividends, which plummeted from 427 in 1997 to 351 in both 2001 and 2002.

The Taxpayer Relief Act of 1997, by the way, caused the Dot-Com Bubble to form in the U.S. stock market.

That decline in the number of S&P 500 companies paying dividends wasn't reversed until 2003, with the passage of the Jobs and Growth Tax Relief Reconciliation Act, which once again equalized the tax rates of both capital gains and dividends, but this time at 15%.

Since then, the number of dividend paying companies in the S&P 500 has rising from 351 in 2002 to 425 at this point in 2014, despite a recession-driven dip to 363 companies in 2009, and also the increase in the maximum tax rates for dividends and capital gains to 23.8% as part of the Fiscal Cliff tax deal in January 2013.

Data Source

Standard & Poor. S&P 500 Issue Indicated Dividend Rate Change. [Excel Spreadsheet]. Accessed 9 July 2014.

Previously on Political Calculations

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.