A very well done video explaining the meaning of Kurt Gödel's incompleteness theorems for a general audience, which are about the limits of mathematical knowledge. It's 34 minutes long, but it might be the most educational way to spend a small part of this long Memorial Day holiday weekend.

Bonus question: To what extent does Gödel's incompleteness extend into physics?

Labels: math

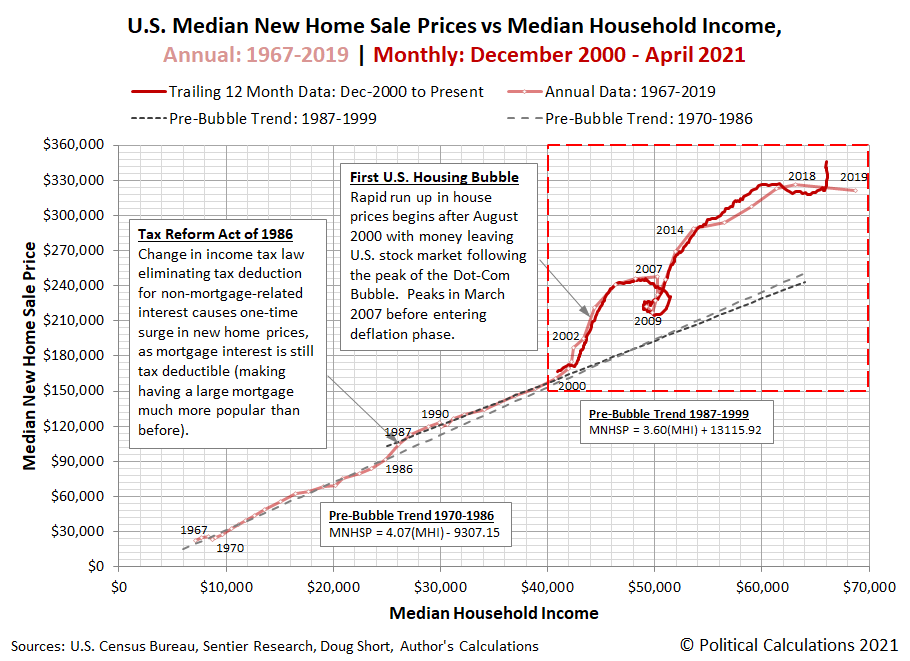

Average new home sale prices are continuing to set new record highs. Initial estimates for April 2021 indicate they have reached $435,400, which is up nearly 5% from February 2021's initial estimate of $416,000.

Median new home sale prices in April 2021 nearly reached a new high as well, with an initial estimate of $372,400, falling just $800 short of January 2021's $373,200.

The price escalation of new homes in the United States continues to be unprecedented, which is driven home when we show the relationship for median new home prices with respect to median household income.

Over the past year, since April 2020, the trailing twelve month average of median new home sale prices has risen by nearly $25,000 (7.8%), while median household income has fallen within a $300-wide range between $65,800 and $66,100.

The next chart shows all the available historial data for these figures going back to 1967.

The past year from April 2020 through April 2021 really is unprecedented.

References

U.S. Census Bureau. Median and Average Sales Prices of New Homes Sold in the United States. [Excel Spreadsheet]. Accessed 25 May 2021.

Labels: real estate

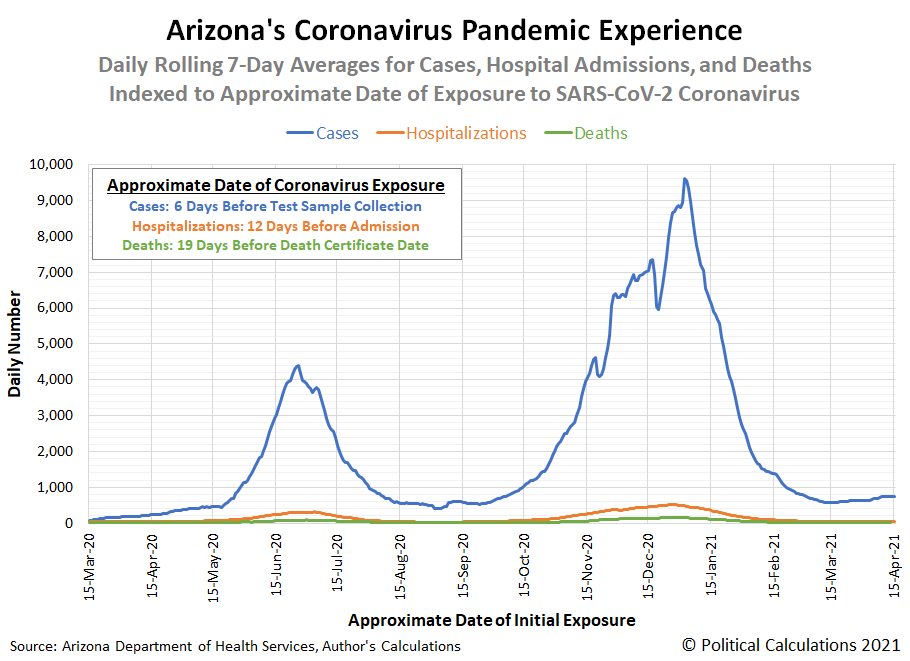

Six. Twelve. Nineteen.

For those who have had COVID-19, those are the median number of days you would need to subtract from the date they...

- experienced symptoms and went to be tested, or

- became sick enough to be admitted to hospital, or

- passed away if they became especially sick,

... in order to determine approximately when they first became infected by the SARS-CoV-2 coronavirus.

We're going to drive home the significance of those numbers using Arizona's detailed data for COVID cases, hospital admissions, and deaths, where we should see the peaks in the data for each these outcomes synchronize. Here's the graphical result of the math:

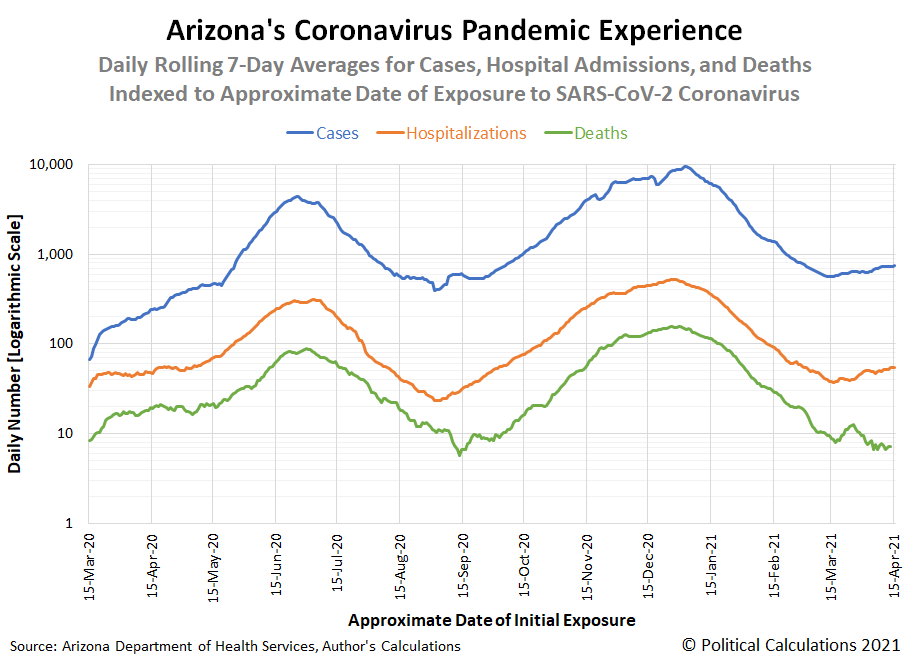

In this visualization, the relative scale of cases, hospitalizations, and deaths make it tough to see the pattern in the data. In the following chart, we're showing the exact same data, but using a logarithmic scale to better illustrate the synchronized pattern.

Using the logarithmic scale lets us compare data that differs by orders of magnitude. For COVID-19, the daily number of those testing positive in Arizona often ranged in the thousands, while the number of those admitted to hospital peaked in the hundreds, and the number of deaths could be counted by tens.

Taking noise in the data into account, the synchronization pattern is fairly strong between all three sets of data when indexed to date of initial viral exposure.

There is an interesting pattern when comparing the timing of troughs for deaths when compared to the other two howver, where the the trend for deaths continue downward for a short period after the trends for cases and hospitalizations have reversed and begun tracking upward. We think this characteristic might be attributable to the age demographics of those being exposed to COVID-19, with older individuals more at risk of dying from COVID lagging in initial exposure behind younger individuals.

We also think the data for deaths is subject to considerably greater noise at low levels than the other datasets, especially when its daily numbers drop down toward single digits. This characteristic can been seen in the short-term trough coinciding with 15 September 2020 and a short-term spike in deaths occurring in late March 2021.

We're featuring this data visualization exercise today because we haven't seen anyone else present COVID data this way anywhere else, and because it will be helpful in answering a different question we have, which we'll feature in upcoming weeks!

Labels: coronavirus, data visualization

Campbell's Condensed Tomato Soup is an iconic American consumer good that's been around over 123 years. That means we have over 123 years worth of monthly price data on how much consumers have paid for a standard 10.75 ounce can whenever grocers have put it on sale on their store shelves.

For the latest in our coverage of Campbell's Tomato Soup prices, follow this link!

But we're not going to revisit that whole history today. Instead, we're going to look at the price trends for Campbell's Tomato Soup since January 2000, where we really want to focus on the months of the Coronavirus Recession. The following chart shows the individual price per can and the trailing twelve month average Americans have paid for a can of Campbell's iconic soup from January 2000 through May 2021.

Through May 2021, the trailing twelve month average of Campbell's condensed tomato soup has risen to $0.96 per can, up 13% from an average price of $0.86 per can in February 2020 (Month 0 for the coronavirus recession).

Much of that increase has been driven by higher demand, where retailers have been much less likely to discount their sale prices over the last 15 months. The only exception to that came in January and February 2021, when the second wave of the coronavirus pandemic in many parts of the U.S. prompted a temporary shift in consumer demand in favor of Campbell's Chicken Noodle Soup, which many believe helps relieve cold, flu, and COVID symptoms. That shift in consumer demand led to a relative oversupply of tomato soup on retailers' store shelves, which in turn, prompted them to discount their prices to sell relatively more tomato soup during these months.

With the decline in COVID cases since January 2021, that relative imbalance in consumer demand has ebbed. Discounted sales have ended, but sale prices for tomato soup remain elevated.

The potential for the escalated prices of tomato soup to continue is high, with higher inflation having taken hold in the U.S. in recent months. The test for that will come this summer as seasonal demand for tomato soup declines, where the absence of discounted sale pricing would effectively lock in the pandemic price increase.

Just for fun, we'll close by pointing to exactly where the price data in the chart during the coronavirus pandemic comes from! Follow the links below to see the advertisements from the indicated retailers seeking to sell Campbell's Condensed Tomato Soup during the months of the Coronavirus Pandemic Recession:

The S&P 500 (Index: SPX) appears to have returned to the upside-down.

That's the situation that exists when the behavior of stock prices acts contrary to the usual rules that apply to them. In terms of the dividend futures-based model we use to project the future for the S&P 500, we see that change in the value of m, the amplification factor in the model, when it changes from a positive to a negative value.

When that happens, it's safe to say the market has undergone a regime change, which is a possibility we first raised last week. This week, we've accumulated enough data to take a stab at an initial estimate of the new value for m. The latest update to the alternative futures chart shows that change in regime as if it began on 11 May 2021.

In setting the start date for the new market regime, we're using our previous redzone forecast range as a statistical hypothesis test, which in truth, is really what it is. Extending it slightly forward, we find the level of stock prices has dropped definitively outside its range as of 11 May 2021, which means at least one of the assumptions behind the redzone forecast no longer applies.

Using the newly added data accumulated in the past week allows us to initially estimate a new value of -5 for the amplification factor. At the same time, the data suggests investors have shifted their forward looking focus to 2021-Q4 in setting current day stock prices. Combined with the regime change we just described, these Lévy flight shift would help explain the market's recent volatility.

It's very early days for determining these values. We'll continue testing them behind the scenes.

In the 11+ years since we first developed the dividend futures-based model, we've only seen the S&P 500 go into the upside-down once before, when a combination of changes in the Federal Reserve's monetary policies and some extreme speculation on the part of the "Nasdaq Whale" sent it there during the summer of 2020, ending only when the Nasdaq whale exited their speculative trades in September 2020.

At this time, we're not aware of any similar speculative activity in the markets. Then again, it wasn't until weeks after the Nasdaq whale started trading that their impact on the markets was traced to their trades. That's why we keep paying attention to market-moving news as it comes across the wires. Speaking of which, here are the headlines we flagged during the trading week ending on Friday, 21 May 2021.

- Monday, 17 May 2021

- Signs and portents for the U.S. economy:

- Oil climbs 1% on economic recovery hopes despite fresh Asian restrictions

- Households including most U.S. children to get monthly stimulus payment

- Fed minions not worrying about inflation, see 7% growth:

- Bigger inflation developing all over:

- Japan April wholesale prices jump on rising material costs

- Inflation re-cycling: Chinese exporters pass higher costs on to customers around the world

- Global shortages developing in China:

- Wall St ends lower, pulled down by tech stocks

- Tuesday, 18 May 2021

- Signs and portents for the U.S. economy:

- Oil settles lower on reports of potential Iran nuclear deal

- Surging lumber prices weigh on U.S. homebuilding

- Service sector activity surged at record pace in May, NY Fed survey finds

- Fed minions focus on jobs comes at cost of inflation:

- Bigger trouble developing in Eurozone, Japan:

- Euro zone recession confirmed at start of 2021

- Japan's economy slumps back into decline as COVID-19 hits spending

- ECB minions thinking about keeping stimulus going:

- ECB's Lagarde committed to further support for euro zone economy

- ECB's Villeroy plays down inflation risks, says ECB policy should stay very accommodative

- Germany’s top court rejects complaint against ECB's bond buying scheme

- Euro zone inadvertently supported zombie firms, ECB finds

- Wall Street closes lower on weak telecom stocks despite strong retail earnings

- Wednesday, 19 May 2021

- Signs and portents for the U.S. economy:

- Oil prices dive $2 on fears of Asian pandemic, possible U.S. rate hikes

- U.S. mortgage applications tick up, purchase applications at 3-month low - MBA

- Fed minions becoming concerned with inflation to start talking taper of bond buys; other minions try throwing cold water:

- FOMC minutes reveal more talk of taper at April meeting

- Ahead of jobs miss, some Fed officials edged towards 'taper' debate

- Fed officials: Crypto rout not a systemic concern

- Fed's Bostic says not yet at bar for any QE taper

- Fed's Bullard: Expectations of 1 million jobs a month "hyped up," half a million more realistic

- Bigger inflation developing all over:

- UK inflation more than doubles as post-lockdown price climb begins

- Canadian home price gains accelerate in April from prior month -Teranet

- Euro zone inflation accelerates in April on energy, services

- Bigger stimulus developing in Japan:

- ECB minions thinking about keeping stimulus going, see problems from keeping stimulus going:

- ECB's de Guindos says credit still cheap, cautious on stimulus withdrawal

- Property bubbles, corporate debt among Europe's top risks: ECB

- Wall Street closes lower after Fed minutes, crypto fall

- Thursday, 20 May 2021

- Signs and portents for the U.S. economy:

- U.S. weekly jobless claims drop further; mid-Atlantic factory activity slows

- Oil falls 2% on possible return of Iranian supply

- Fed minions wants to start tapering stimulus bond buys:

- Bigger inflation developing all over:

- UK factories boom but bottlenecks pushing up prices - CBI

- China's industrial commodities slide after Beijing warns of market crackdown

- S&P 500 gains 1% as tech shares rally, Treasury yields fall

- Friday, 21 May 2021

- Signs and portents for the U.S. economy:

- Analysis-How the post-pandemic labor crunch is curbing U.S. manufacturing

- U.S. existing home sales extend decline; house prices race to record high

- U.S. manufacturing accelerates; tight supply pushes home sales to 10-month low

- Oil jumps on weather concerns in Gulf of Mexico

- Fed minions out to lower jobs expectations, want to talk about slowing stimulus bond buys:

- Fed officials, new data, start lowering expectations for U.S. jobs in May

- Fed's Harker says important to talk about tapering sooner rather than later

- Bigger inflation developing all over:

- No let-up for inflation that is haunting emerging markets

- Global inflation-linked bonds draw massive inflows in week to May 19 -Lipper

- ECB minions addicted to doling out stimulus:

- ECB's Lagarde says too early to discuss life after emergency support

- Euro zone business growth hits three-year high but ECB cautious

- U.S. stocks end mixed as Dow recovers on strong economic data

What was positive and negative about the past week's markets and economics news? Be sure to check out Barry Ritholtz' succinct summary!

There's a saying about inventions:

"If you build a better mouse trap, the world will beat a path to your door."

As we all know, the mousetrap was perfected in 1882, so inventors since have been forced to turn their attention to solving other problems. Namely, how to entertain their cats because the mouse problem had been solved [1].

That's why today's edition of Inventions in Everything is focusing on the progressive improvements several inventors have patented in the field of feline entertaiment methods and devices. Starting with the patent that revolutionized the cat entertainment world and the subsequent inventions intended to solve the remaining problem that original invention left unsolved. Let's jump straight that revolutionary invention:

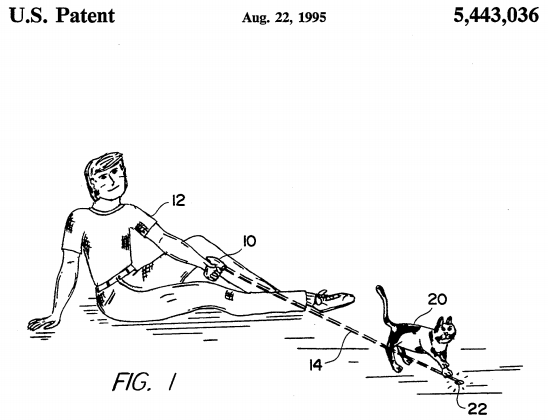

U.S. Patent 5,443,036 Method of Exercising a Cat

In many ways, this patent redefined what U.S. patent examiners were willing to accept in deciding to issue a U.S. patent. While some have called it either obvious or covered by prior art, others have heralded the achievement of inventors Kevin T. Amiss and Martin H. Abbott in successfully obtaining the issuance of this patent in 1995. They addressed that prior art in the patent:

Cats are not characteristically disposed toward voluntary aerobic exercise. It becomes the burden of the cat owner to create situations of sufficient interest to the feline to induce even short-lived and modest exertion for the health and well-being of the pet. Cats are, however, fascinated by light and enthralled by unpredictable jumpy movements, as for instance, by the bobbing end of a piece of hand-held string or yarn, or a ball rolling and bouncing across a floor. Intense sunlight reflected from a mirror or focused through a prism, if the room is sufficiently dark, will, when moved irregularly, cause even the more sedentary of cats to scamper after the lighted image in an amusing and therapeutic game of "cat and mouse." The disruption of having to darken a room to stage a cat workout and the uncertainty of collecting a convenient sunbeam in a lens or mirror render these approaches to establishing a regular life-enhancing cat exercise routine inconvenient at best.

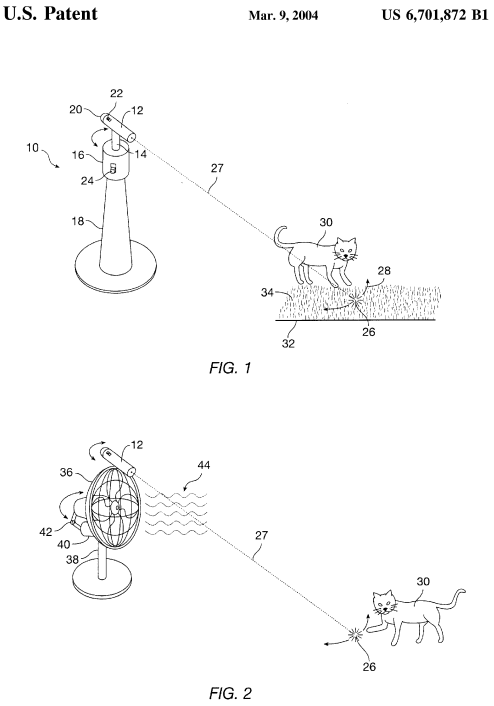

Having struck down the argument against their invention not being sufficiently novel given the state of prior art, we can now describe their invention: a hand-held laser device operated by a person for the purpose of shining its light on surfaces where the cat might chase after it. Here's Figure 1 from the patent to illustrate the conceptual leap:

Having solved the fundamental challenge, inventors since have focused solving the remaining problem the introduction of lasers into the world of cat entertainment devices left untouched: the need for a human operator of the laser device.

U.S. Patent 5,934,223 Pet Toy

This patent is one of the first to identify the need to eliminate the person to entertain a cat:

In practically every pet store and other stores there may be purchased a wide variety or toys for domestic animals such as cats and doge. Different types of balls, bones, toys which squeak etc. can be purchased. In almost every case, each of the toys is passive. The only way that any of the toys can become movable is through the toy being thrown by a human being or upon the toy being moved by the animal itself.

It is well known that domestic animals love to chase anything that moves. One objective of the present invention is to construct a pet toy which automatically projects a randomly moving light image of a prey, such as an image of a mouse or bird, thereby freeing the owner from the sometimes onerous and time consuming duty of entertaining a bored, unhappy pet, and at the same time providing the pet owner with the pleasurable entertainment of watching his/her active pet. It is the unique utilization of this chase instinct in most animals by this pet toy that makes it especially attractive and useful as a pet toy.

More particularly, the pet toy of the present invention is a pet toy that projects a moving image into a room, as determined by a computer chip, so that a pet may be entertained by the moving image without requiring a person to be in the room to move the image. The pet toy comprises an upright housing containing batteries and supported by a heavy base with a ball bearing unit at the top of the housing. The ball bearing unit has a lamp unit attached thereto. A plurality of glass units with various cut-outs that may be removably attached to the lamp unit so that the glass units may be used to change the image projected by the lamp unit. A control unit contained in the housing controls the speed of the rotatable ball bearing unit to control the speed of the moving light image.

This patent shares an important bit of inventive philosophy shared by the innovators of all the remaining patents we're featuring today. See if can pick out what that is before we get to the end!...

U.S. Patent 6,505,576 Pet Toy

This patent represents an incremental improvement over the invention introduced in U.S. Patent 5,934,223:

The present invention relates to a pet toy and, more particularly, to a new and improved automated pet toy that projects a moving light beam in various directions to entertain a pet. The present invention finds particular application as a timer-controlled, switch-activated automated moving light beam and is described herein with particular reference thereto. However, it is to be appreciated that the present invention is also amenable to other applications.

It is well known that domestic pets enjoy chasing moving objects. For example, cats are known to chase a piece of moving string and dogs are known to chase a ball. Similarly, cats and dogs are known chase the projected red dot of a laser pointer when the red dot projected by the laser pointer is moved across a room or area by a person. Although such an activity may entertain pets for a lengthy period of time, heretofore, a person was required to continuously move the laser pointer around the room or area to keep the red dot moving.

The present invention provides a new and improved automated moving light beam for entertaining pets that only requires a person to initially actuate the device.

Advancing with inventive progress....

U.S. Patent 6,557,495 Laser Pet Toy

This patent focuses on solving the problems a human laser device operator might encounter:

Many pet toys involve motion because it is a known fact that pets, particularly cats, are attracted to moving objects. It is also a known fact that cats are attracted to LASER (light amplification by stimulated emission of radiation) beams. Unfortunately, to operate most pet toys, the owner must use repetitive motions over long periods of time to keep the interest of the cat. These repeated movements over an extended time can cause soreness, strain and even pain for the owner's fingers, wrists, elbow and hand. Prior art of this type is described in U.S. Pat. No. 5,443,036.

To operate the laser pet toy disclosed in U.S. Pat. No. 5,443,036 the owner must continuously press the trigger switch with his/her fingers while, at the same time, move his/her hand, wrist and elbow in a repeated motion so that the cat will chase the laser beam around the room. Since such movement is strenuous and hurtful to the owner's ligaments, the cat's activity is usually stopped long before the cat wants the activity to end. This results in an unused toy....

Each of these disclosures is subject to the limitations discussed above, thereby making none of the prior art pet toys entirely satisfactory. Thus, there exists a need for an improved laser pet toy that overcomes, in combination, all of the limitations heretoforementioned above. Accordingly, a need exists for an improved laser pet toy that entertains pets, especially cats, without causing soreness and strain to the owner's ligaments. There is a further need for a stand alone pet toy which appears self-animated and does not require the device to be within the pet's reach thereby addressing safety concerns. And yet a further need exists for a low cost laser pet toy that provides both a circular and linear randomness motion in a range that is beneficial to a cat's natural predatory instinct as well as environmentally suitable to the pet owner.

We omitted the portion of the background that identified several potential deficiencies in the invention described in U.S. Patent 5,934,223, which these inventors believed their new device would solve. But there was still room for improvement, as we're about to find out.

6,651,591 Automatic laser pet toy and exerciser

This invention is a more general improvement over the devices described in the previous patents.

The present invention exploits the recognized characteristic of an animal, such as a cat or a dog, to be attracted to, and to chase after, the intense focused coherent light of a laser beam. The invention concerns an automatic multidimensional moving virtual laser target that induces animals to follow and chase a virtual prey, thereby obviating the need-for human intervention, activity or manual stimulation.

It is an object of the invention to provide an automatic device, which does not employ conventional motors, for moving a laser beam target through three dimensions so as to provide animal stimulation and exercise without the need for human expenditure of effort or energy.

It is also an object of the invention to automatically, at user-selected intervals, power up the device periodically for short intervals and to thus stimulate and exercise the pet without owner involvement or presence.

Generally speaking, the present invention comprises a miniaturized, silent, projected moving laser target generator which does not use conventional motors.

Have you picked up on the common wisdom being passed down from inventor to inventor yet? You'll have one last chance!...

U.S. Patent 6,701,872 Method and apparatus for automatically exercising a curious animal

This invention is special because it solves a second problem, this time related to improving the quality of the cat's physical environment:

This invention relates to apparatus for exercising curious animals, especially pet cats. This invention is an improvement over the invention described in U.S. Pat. No. 5,443,036 issued Aug. 2, 1995. Laser pointers are known and in particular it is known that cats are attracted by and stalk the spot of a laser pointed in their vicinity. It is also known that cats are attracted to the air movement of a fan, often to be cooled by such air movement. Heretofore the method for inducing exercise in a cat has been to manually move the spot beam in an arbitrary manner to stimulate exercise.

It has been found that the prior art exercise method is limited my the need for manual intervention, which may not always be desirable. An example is in a cage in a zoo, where large curious animals may need exercise. What is needed is an exercise apparatus which eliminates the need for manual intervention.

So how can the two problems be solved within the same patent?

According to the invention, an apparatus for exercising a curious animal such as a pet housecat comprises a laser pointer mounted on a shaft driven by a motor mounted on a pedestal. The rotatable shaft is preferably vertically disposed and the direction of the pointer is preferably obliquely downward so that activation of the motor causes the spot beam of the laser to track a vector of motion to attract a cat into interaction with the spot beam. In a further specific embodiment, the laser pointer may be mounted on the head of an oscillatory air circulation fan with a pedestal. The oscillation of the spot beam, together with the air movement of the oscillatory fan, further stimulates activity in a cat while conveniently inducing convective cooling.

These concepts are illustrated in Figures 1 and 2 of the patent:

What have we learned from all these patents? First, we've learned that cats are attracted to moving objects and/or lights, because they all reference this indisputable fact of nature. Second, we learn there is still a lot of room for inventive improvements in cat entertainment devices!

Notes

[1] This is a tongue-in-cheek claim on our part! In truth, better mousetraps have continued to be invented and patented in the years since 1882, with the latest example at this writing having been patented in 2019!

Labels: technology

How many migrants have unlawfully crossed the U.S. border into Arizona during the Biden-Harris border migration crisis?

That's a question we realized we might be able to answer using the state's detailed COVID-19 data after seeing the surge in detentions along the southwestern border since January 2021. The trick to doing that lies in converting the number of excess COVID-19 cases in the state arising from the incoming migrants into a back-of-the-envelope estimate of their total number.

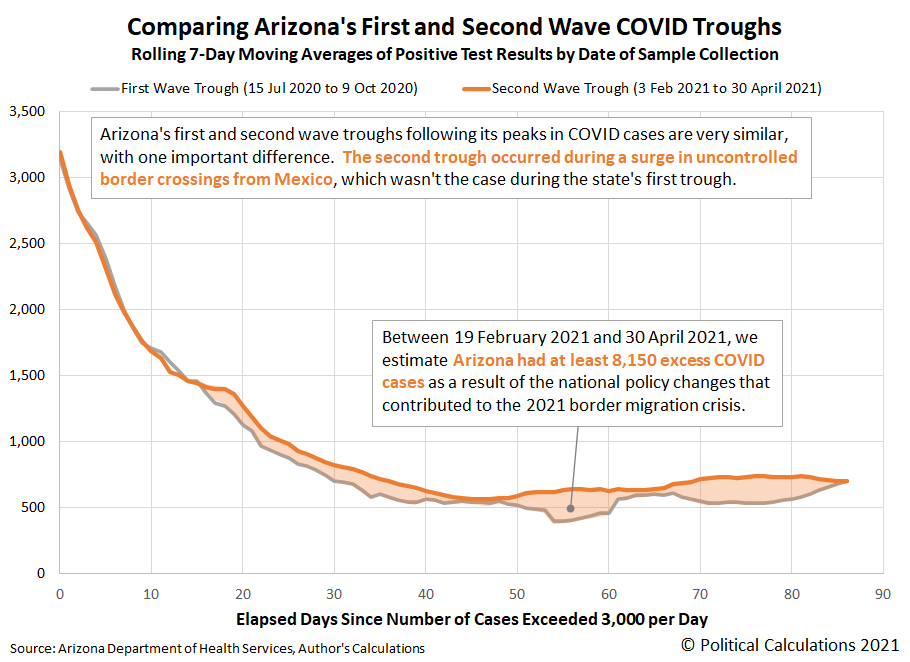

We've previously estimated that from 19 February 2021 through 30 April 2021, Arizona has recorded at least 8,150 excess COVID-19 cases because of the border migration crisis, as shown in the following chart, based on the difference between Arizona's first and second troughs following its recorded peaks in COVID cases:

That number includes the incoming migrants and also Arizona residents who might have been infected with the SARS-CoV-2 coronavirus from their encounters with any infected migrants who entered Arizona during these months, where the real number would be a percentage of that figure. That's something we can reasonably estimate. Once we have that number, we can divide it by the percentage of migrants in the U.S. government's detention facilities with COVID-19, which the Federal Emergency Management Agency indicated was "less than 6% positive" in mid-March 2021. Doing so will give us an estimate of the number of "surplus" migrants who have entered Arizona during the border migration crisis.

The rest is as easy as building a tool to do that math. Which we did, so you can supply the one missing piece of information we don't have: the percentage of Arizona's excess COVID-19 cases represented by the incoming migrants. We've set a conservative estimate default value of 50% in the following tool, which you can change as appropriate. Then click the "Calculate" button to generate your estimate (if you're accessing this article that republishes our RSS news feed, please click here to access a working version on our site).

Using the 50% default value, we estimate some 67,916 surplus migrants entered Arizona since the end of January 2021. That's a little shy of 1% of Arizona's estimated 2020 population of 7.4 million. If the percentage is higher, it's no wonder the Biden-Harris administration is taking steps to contain the negative impacts from its policies.

The following 15-minute video report describes how ICE's mishandling of COVID-19 fueled outbreaks around the country:

Many of the factors described in the video report have played out in Arizona since early February 2021 with the Biden-Harris administration's border migration crisis.

Labels: demographics, math, tool

Every three months, we take a snapshot of the expectations for future earnings in the S&P 500 (Index: SPX) at approximately the midpoint of the current quarter, shortly after most U.S. firms have announced their previous quarter's earnings.

Standard and Poor's newest forecast projects a full earnings recovery for the index' earnings per share by June 2021. In addition, S&P is projecting much more robust earnings growth than they were three months ago.

The more robust earnings growth can best be seen in the trailing year earnings per share projected for December 2021. Three months ago, S&P anticipated that figure would be $153.86 per share. Its 12 May 2021 projection indicates the year end earnings figure will reach $174.87 per share.

If that outcome is realized, it would put the S&P 500's trailing twelve month earnings per share nearly back on the trajectory that S&P projected back in February 2020, before the onset of the coronavirus pandemic recession hammered corporate earnings in the U.S.

Reference

Silverblatt, Howard. Standard & Poor. S&P 500 Earnings and Estimates. [Excel Spreadsheet]. 12 May 2021. Accessed 14 May 2021. (As a bonus for this edition, if you follow the link to the spreadsheet before his next update, you'll find Howard's photo celebrating the arrival of springtime in New York City.)

Labels: data visualization, earnings, SP 500

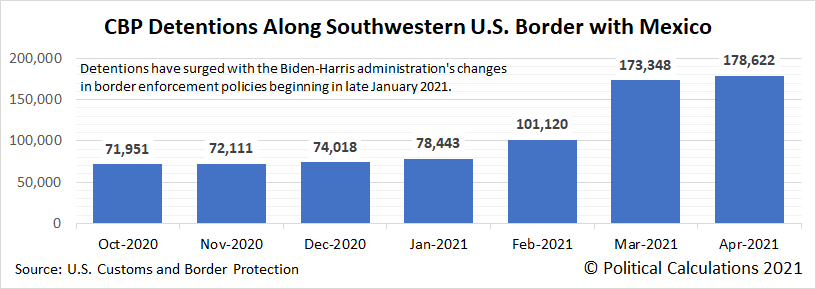

Beginning as the Biden-Harris administration assumed power on 20 January 2021, the border migration crisis in the U.S. arose as the new administration significantly altered the nation's established border enforcement policies. Now, the number of detentions along the southwestern border of the United States with Mexico have hit a 21-year high.

Here's what that looks like in terms of the U.S. Customs and Border Protection (CPB) agency's monthly count of detentions at the U.S.-Mexico border:

Here's where the problem originated:

Biden officials are trying to fulfill their campaign promises on immigration but have found that quickly reversing Trump’s policies can create an abundance of political headaches and contribute to a host of other problems, including trying to process and house a record number of unaccompanied children crossing the southern border.

That observation is backed up by the numbers, even as the Biden-Harris administration has started playing a shell game with how it manages the detained unaccompanied minors in its custody to try to conceal it.

Labels: data visualization, politics

The S&P 500 (Index: SPX) may be entering a new regime for inflation expectations.

In the dividend futures-based model we use to project the future for the index, we see those kinds of changes play out through a changing value for the model's amplification factor, m. Our estimate of its value was last reset on 22 September 2020, when we observed its value was approximately 1.5. Over the last month as expectations of future inflation have increased, we suspect it has increased in value as well, which shows up in the alternative futures chart with the trajectory of the S&P 500 running first to the low side, and now below, its forecast range.

That's not unexpected, since we anticipated the actual trajectory of the S&P 500 would undershoot the model's projections. Before we can estimate its new value to adjust the model's projections however, we'll need the market's recent volatility to stabilize. Until then, we'll be in a wait and watch mode.

Among the things we'll be watching is the random onset of new, market-moving information. Here's what we flagged as notable in trading week ending on 14 May 2021.

- Monday, 10 May 2021

- Signs and portents for the U.S. economy:

- Market at odds with Fed as inflation expectations hit 10-year highs

- Biden says unemployed offered jobs must take them or lose benefits

- Fed minions split on worrying about inflation, whether to keep stimulating economy, don't believe jobs data:

- Fed's Evans: Accommodative monetary policy will continue to be appropriate

- Fed's Kaplan sees strong job gains ahead, wants taper talk

- Fed's Daly says we are in 'transition,' no taper talk yet

- Bigger inflation developing all over:

- Bigger trouble developing in Japan:

- ECB minions thinking about buying more bonds:

- Wall Street closes lower as inflation fears prompt tech sell-off

- Tuesday, 11 May 2021

- Signs and portents for the U.S. economy:

- U.S. job openings hit record high in March

- White House says it takes possibility of inflation seriously

- Fed minions blame school closures for bad jobs report; are okay with stock bubble from super easy money policies; say 3% inflation is okay:

- Fed officials sift through tea leaves of weak U.S. jobs report

- Brainard: Pulling back support due to high stocks may hurt efforts to boost jobs

- Fed's Harker says 3% inflation is the maximum he would like to see

- Bigger inflation developing all over:

- Bigger trouble developing in Japan after positive March 2021:

- Japan March household spending posts biggest monthly rise in 18 months

- BOJ policymakers warned of risks to recovery prospects at April meeting

- ECB minions thinking about keeping stimulus going:

- Wall Street closes lower as inflation jitters spark broad sell-off

- Wednesday, 12 May 2021

- Signs and portents for the U.S. economy:

- U.S. consumer prices post largest gain since 2009 as inflation ramps up

- U.S. April CPI points to inflation heating up more than expected

- Some U.S. car shoppers are paying $5,000 over a vehicle's retail price - Cox Automotive

- Eurodollar futures price in Fed hike by December 2022 after inflation spike

- Fed minions thinking about digital currency, but not about changing monetary policy despite surprise of surging inflation:

- Fed's Rosengren says important to understand trade-offs of digital currencies

- Jobs, inflation data surprises not changing Fed plans, Clarida says

- Post-coronavirus pandemic recession recoveries gaining traction:

- China's April auto sales rise 8.6%, up for 13th straight month

- UK economy, gearing up for recovery, grows more than expected in March

- IEA sees oil demand recovery outpacing growth in supply

- European banks: Q1 full house is no winning hand just yet

- Bigger stimulus developing in Eurozone, less stimulus in Japan:

- Euro zone to rebound more strongly, borrowing curbs to stay on hold -EU

- BOJ likely in no mood yet to aid market with big ETF buying

- Wall Street ends with broad sell-off on spiking inflation fears

- Thursday, 13 May 2021

- Signs and portents for the U.S. economy:

- Fed minions think non-working Americans are clogging the economy, want to wait a few more months before considering changes to monetary policy to deal with inflation, and that the economy is great:

- Fed's Barkin: Ability to "unclog" labor market critical to recovery

- Fed's Waller wants 'several more months' of data before policy shift debate

- Fed's Bullard: U.S. on verge of moving from recovery to expansion

- BOJ minions to get back into stock ETF-buying business; ECB minion says Eurozone inflation is no worry:

- Kuroda says BOJ ready to buy ETFs 'boldly,' drops no hints on when

- ECB's Stournaras says Europe not facing same inflation worries as U.S.

- Wall Street gains as investors 'buy the dip' on upbeat jobs data

- Friday, 14 May 2021

- Daily signs and portents for the U.S. economy:

- U.S. retail sales pause, record savings seen supporting spending

- Some early U.S. data suggest May jobs report could echo April weakness

- Fed minions

- Bigger trouble

- Inflation re-cycling: Chinese exporters pass higher costs on to customers around the world

- Analysis: Japan Inc squeezed by surging costs and frugal consumer fears

- BOJ minions thinking about stimulus policies:

- Wall Street ends volatile week sharply higher

Want to know what the week's positives and negatives were? Check out Barry Ritholtz succinct summary of the week's markets and economics news!

Earlier this year, a cheating scandal erupted in the world of competitive computer gaming, where a Minecraft player recorded a world-record setting speedrunning round that was too good to be true.

Here's how PC Gamer described the controversy, which involves a popular Minecraft player who goes by the moniker "Dream":

Dream's popularity is largely thanks to the YouTuber's Minecraft speedrun videos, where he tries to complete the game as fast as possible, and their Minecraft manhunt series, which is ridiculously popular. Dream's speedruns continually break records and make the Minecraft world speedrun leaderboard, to the astonishment of many viewers. During this success, suspicions arose about the legitimacy of some of his runs, and in particular, accusations arose about Dream tampering with the game to get better luck.

The accusations arose in October 2020 from a fellow Minecraft speedrunner (whose tweets have since been deleted) who reported seeing higher RNG drops for key items in a run submitted by Dream earlier that month, the same run that placed 5th on the world leaderboards.

Minecraft speedruns are officiated by a team of moderators from speedrun.com and this accusation prompted the team to investigate. In December, they released a 29-page long research paper and accompanying YouTube video summarizing the two-month investigation.

Here's the video for the official moderator's analysis, which is a little over 14 minutes long. Don't watch it yet. Just scroll past it for now and come back to it if you want to later....

The reason we've suggested holding off in watching the official video is because there's a much better video that explains how unlikely the world record-setting accomplishment was, featuring Matt Parker. At nearly 40 minutes long, it is nearly three times the time investment to watch, but you'll be rewarded with a much better appreciation of why Speedrun.com's officials ultimately rescinded Dream's world-record setting title for being "too lucky."

Now for the real mystery. Other than for establishing bragging rights, why does any of this matter?

A potential financial motive can be found in the PC Gamer article:

With 15.4 million subscribers and many of his videos hitting anywhere between 20-60 million views, it's safe to say that 2020 was one heck of a year for the Minecraft YouTuber, Dream. The speedrunner quickly rose to fame, gaining millions of followers so quickly that his subscriber count grew by 12 million between January and November last year alone.

Those rapid growth stats led us to ask "how much is having someone watch a video on YouTube worth to the video's creator?"

Vloggergear answered that question back in 2018, which is useful because even though the values may have changed in the years since, the method for finding the value to a Youtube content creator will be similar.

YouTube uses a method called CPM or “Cost Per Mille” which is a marketing term for cost per 1,000 views or in some cases impressions. Typically the CPM for YouTuber can range from 20 cents to $10 per 1,000 views. But typically an average channel will get about $1.50 – $3 per 1,000 views.

Let's say Dream's channel is at the bottom of the "average" scale. At $1.50 per 1,000 views of just one speedrun video, 20 million views could net $30,000.

A survey of Dream's YouTube channel indicates a posting frequency of 1-2 videos per month. We counted 23 videos that were clearly less than a year old, with a cumulative view total of 842 million. At $1.50 per 1,000 views, that's $1.263 million. And that is a low end estimate.

That revenue, even in the face of the Minecraft speedrunning scandal, perhaps explains Dream's response to having a world record title revoked:

It's a thorough report and, many statistical graphs and math calculations later, the team came to the conclusion that Dream was cheating by modifying the game. When moderators announced their decision, Dream categorically denied the accusation but has since respectfully accepted the team's conclusion without admitting fault.

When you're on track to collect over $1.2 million a year as a low end estimate for making online videos of your video game playing results, there's not much point in spending a lot of time contesting the statistical evidence for the sake of holding onto a title. Especially if like Dream, you can continue averaging between 30 and 38 million views per the handful of YouTube videos posted since the controversy erupted. It's also why the officials really aren't all that upset either. Plus, we haven't even mentioned Dream's revenue stream from merch yet, which we understand is pretty substantial in its own right.

In a lot of ways, it's a modern day replay of the 1950s quiz show scandals.

Now's the point in time to go back to the officials' 14 minute YouTube video if you like. Or to rethink your career choices.

We're going to tell a story with a single chart today. We've compared Arizona's first wave trough with its second wave trough in the following chart, where we've estimated the number of excess COVID cases Arizona has counted as a result of the Biden-Harris administration's border migration crisis. Click the image for a larger version.

The good news shown in the chart is that the number of new COVID cases in Arizona appears to be stabilizing, ending what had been a slowly rising trend.

For more background on the border migration crisis' effect on COVID in Arizona, follow the most recent links in the series listed below!

As for the border migration crisis itself, the Biden-Harris administration has reversed itself by resuming construction of a border wall project in Texas. At this time, there's no indication of a similar restart of border wall construction projects in Arizona.

Previously on Political Calculations

Here is our previous coverage of Arizona's experience with the coronavirus pandemic, presented in reverse chronological order.

- COVID-19 and the 2021 Border Migration Crisis in Arizona

- Improving COVID Trends Bottom and Flatline in Arizona

- Surge of Migrants, Lifting of Business Capacity Limits Change Arizona COVID Trends

- COVID-19 in Retreat in Arizona With Vaccines Gaining Traction

- The Ebb and Flow of COVID-19 in Arizona's ICUs

- Arizona's Plunging COVID-19 Caseloads and the Vaccines

- Arizona Enters Downward Trend for COVID-19 After Second Peak

- Arizona Passes Second COVID-19 Peak

- A Tale of Two States and the Coronavirus

- COVID-19 Questions, Answers, and Lessons Learned from Arizona

- The Deadly Intersection of Anti-Police Protests and COVID-19

- 2020 Campaign Events Drive Surge in Arizona COVID Cases

- Arizona Arrives at Critical Junction for Coronavirus Cases

- Arizona To Soon Reach A Critical Junction For COVID-19

- Getting More Than Care from Arizona's COVID ICU Beds

- Arizona's Decentralized Approach to Beating COVID

- Going Back to School with COVID-19

- Arizona Turns Second Corner Toward Crushing Coronavirus

- Arizona's Coronavirus Crest in Rear View Mirror

- The Coronavirus Turns a Corner in Arizona

- A Delayed First Wave Crests in the U.S. and a Second COVID-19 Wave Arrives

- The Coronavirus in Arizona

- A Closer Look at COVID-19 Deaths in Arizona

- The New Epicenter of COVID-19 in the U.S.

- How Long Does a Serious COVID Infection Typically Last?

- How Deadly is the COVID-19 Coronavirus?

- Governor Cuomo and the Coronavirus Models

- How Do False Test Outcomes Affect Estimates of the True Incidence of Coronavirus Infections?

- How Fast Could China's Coronavirus Spread?

References

We've continued following Arizona's experience during the coronavirus pandemic because the state's Department of Health Services makes detailed, high quality time series data available, which makes it easy to apply the back calculation method to identify the timing and events that caused changes in the state's COVID-19 trends. This section links that that resource and many of the others we've found useful throughout the coronavirus pandemic.

Arizona Department of Health Services. COVID-19 Data Dashboard: Vaccine Administration. [Online Database]. Accessed 25 April 2021.

Stephen A. Lauer, Kyra H. Grantz, Qifang Bi, Forrest K. Jones, Qulu Zheng, Hannah R. Meredith, Andrew S. Azman, Nicholas G. Reich, Justin Lessler. The Incubation Period of Coronavirus Disease 2019 (COVID-19) From Publicly Reported Confirmed Cases: Estimation and Application. Annals of Internal Medicine, 5 May 2020. https://doi.org/10.7326/M20-0504.

U.S. Centers for Disease Control and Prevention. COVID-19 Pandemic Planning Scenarios. [PDF Document]. Updated 10 September 2020.

More or Less: Behind the Stats. Ethnic minority deaths, climate change and lockdown. Interview with Kit Yates discussing back calculation. BBC Radio 4. [Podcast: 8:18 to 14:07]. 29 April 2020.

Labels: coronavirus, data visualization

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.