For Black Friday 2018, we updated our tool that uses math to help thrifty shoppers set individual spending limits for each the gifts that they might give to the people they know this holiday season.

If you used the tool, you're very likely the kind of person who likes maths enough to use them to solve everyday problems. What's more, the odds are that you know somebody else who shares that mathematical affinity.

So why not give them the biggest ideas in math, the stories of breakthrough insights and the inspirations behind them, as assembled by the editors and staff of Quanta Magazine, in The Prime Number Conspiracy. Here's Quanta's understated promotional video for the book:

If that's not your friend's cup of tea, you might consider going in a different direction. If you ever wondered, as we did, if self-driving cars can solve traffic jams or if we know all the things they can or should be distracted by, or whether such a vehicle could be taken over by a hacker, we have another suggestion that seems very well suited for our ever-more artificially intelligent system modeled world: Hannah Fry's Hello World: Being Human in the Age of Algorithms, which explores the ethical dilemmas that come part and parcel with society's growing use of computer technologies.

Finally, if you're looking for something lighter, why not a book by a mathematician who has also established themselves as a stand up comedian?

Matt Parker covers some of the territory contained within our other two suggestions, but takes things to the n+1 level in Things to Make and Do in the Fourth Dimension.

In it, he shares the lessons of advanced maths that makes it possible keep all the cords from your earbuds from getting tangled, or how to make a paper flexagons, and also the most mathematically optimal way to find a suitable mate, which would be an added selling point if they're still single.

At the very least, that math is a lot easier to solve than the formula for explaining why they're still single....

It is increasingly looking like the market for new homes in the U.S. peaked in August 2018. That's bad news for homebuilders (Indices: ITB, PKB, XHB) and for the U.S. economy.

The following animated chart shows both the nominal and inflation-adjusted trailing twelve month average for the market capitalization of new homes sold in the United States from December 1975 through the preliminary data reported for October 2018. In it, we can see that the trailing year average market cap for U.S. new homes sales peaked in July 2018 at $20.32 billion in nominal terms, or $20.61 billion in terms of constant October 2018 U.S. dollars. The animation will show each chart for five seconds - if you're accessing this article on a site that republishes our RSS news feed and cannot see the animation, please follow the links to the individual nominal and inflation-adjusted charts.

That deceleration in the months since August 2018 has been significant. So much so that we've opted to also present the nominal and inflation-adjusted year-over-year growth rates of the U.S. new home sales market cap's trailing year average since January 2000, where we discover that we would have to go back to the March and April 2006 to find a similarly slow rate of market cap growth for new homes being sold in the U.S.

Once again, if you want to see the charts individually, please follow the links for the nominal growth rate chart or the inflation-adjusted version.

This kind of data may go a long way to explaining why the Fed's new chair has suddenly become rather dovish regarding the Fed's plans for setting the level of interest rates in the U.S., where sales in California's very high-priced markets appear to have been particularly hard hit by the Fed's recent series of rate hikes.

Data Sources

U.S. Census Bureau. Median and Average Sales Prices of New Homes Sold in the United States. [Excel Spreadsheet]. Accessed 28 November 2018.

U.S. Census Bureau. New Residential Sales Historical Data. Houses Sold. [Excel Spreadsheet]. Accessed 28 November 2018.

U.S. Department of Labor Bureau of Labor Statistics. Consumer Price Index, All Urban Consumers - (CPI-U), U.S. City Average, All Items, 1982-84=100. [Text Document]. Accessed 14 November 2018.

Labels: data visualization, market cap, real estate

For American salad lovers, the U.S. Food and Drug Adminstration's warning on the eve of Thanksgiving for all consumers to throw out all their romaine lettuce, less they risk becoming infected with a dangerous strain of Escherichia coli (E. coli) bacteria that had sickened several dozen people in several U.S. states and Canada in October and early November, was bad news.

What made it scary news however is that other than having been traced to romaine lettuce, the FDA had no idea where this latest E. coli contamination event had originated. And with that being the case, all romaine lettuce from all sources was suspect. Because it couldn't isolate the source, the FDA chose to respond to the outbreak by commanding Americans to effectively throw the baby out with the bathwater in the name of safety.

It wasn't until six days later that the FDA finally narrowed the origination point of the E. coli outbreak to romaine lettuce that had been harvested from the Central Coastal growing regions of northern and central California, exonerating romaine lettuce grown in the Arizona desert growing region near Yuma, the California desert growing region near Imperial County and Riverside County, the state of Florida, and Mexico.

Because the Yuma, Arizona growing region supplies approximately 82% of all the nation's lettuce consumed in the period from late-November to early-March each year, the FDA's precautionary warning proved to be a very wasteful event, since none of the romaine lettuce that was harvested in this region was contaminated with the Shiga toxin-producing O157:H7 E. coli strain.

From both the consumer's and the grower's perspectives, it would have been much better if the FDA could have narrowed its focus much faster than it achieved with its current arsenal of technological resources.

Believe it or not, the technology behind Bitcoin may provide a much more effective and efficient means of tracing outbreaks back to their sources.

Blockchain makes a supply chain more transparent at an all-new level. It also empowers the entire chain to be more responsive to any food safety disasters. Massive organizations such as Nestlé and Unilever are considering blockchain technologies for that reason.

Walmart, which sells 20 per cent of all food in the U.S., has just completed two blockchain pilot projects. Prior to using blockchain, Walmart conducted a traceback test on mangoes in one of its stores. It took six days, 18 hours, and 26 minutes to trace mangoes back to its original farm.

By using blockchain, Walmart can provide all the information the consumer wants in 2.2 seconds. During an outbreak of disease or contamination, six days is an eternity. A company can save lives by using blockchain technologies.

Blockchain also allows specific products to be traced at any given time, which would help to reduce food waste. For instance, contaminated products can be traced easily and quickly, while safe foods would remain on the shelves and not be sent to landfills.

Going from six-to-seven days of uncertainty in tracing the origin of an E. coli outbreak to 2.2 seconds would represent a major gain to all American consumers, food producers, distributors, and grocers.

Bitcoin may be a bust, but the decentalized ledger accounting made possible by blockchain technology has potential for practical use in the real world. The romaine lettuce scare of Thanksgiving 2018 demonstrates the need - how long might it now take for a viable blockchain solution to be developed and implemented?

Labels: food, health, technology, thanksgiving

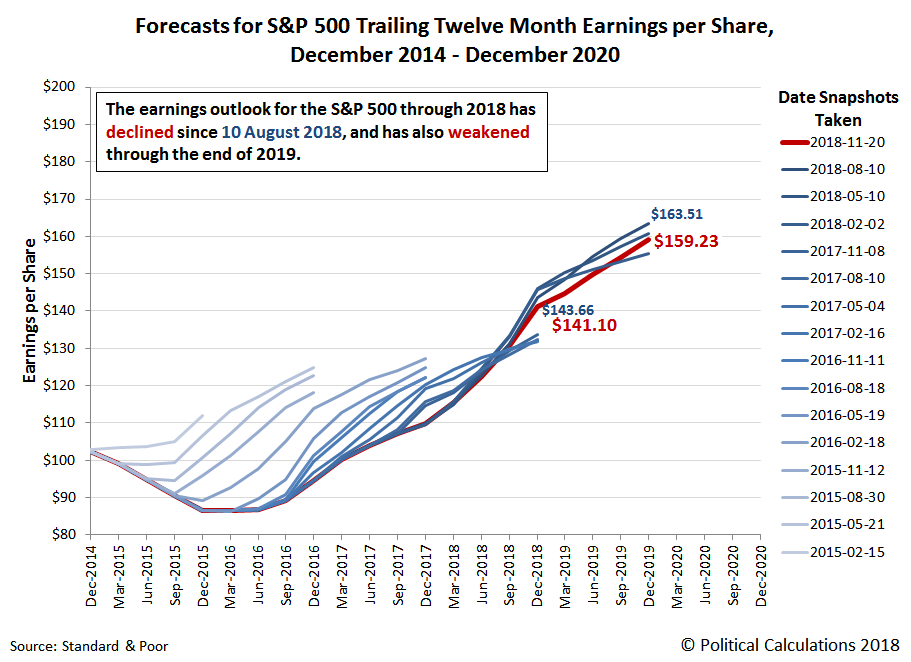

Every three months, we take a snapshot of the expectations for future earnings in the S&P 500 at approximately the midpoint of the current quarter, shortly after most U.S. firms have announced their previous quarter's earnings.

The earnings outlook for the S&P 500 has darkened since our previous edition, where as of the snapshot available as of 20 November 2018, we find that the projected future for S&P 500 earnings has softened one again through the end of 2018, and has also weakened through the end of 2019, reversing a strengthening trend that had been forecast just three months earlier.

This quarterly snapshot captures part of the aftermath of the hit that Apple (Nasdaq: AAPL) delivered to the S&P 500 from the recent news that the company was slashing production orders to its suppliers for its latest iPhone models.

Falling oil prices are also contributing to the weakening earnings outlook for the S&P 500, which are part of a broader market pullback in Asia, where many nations have seen their economies significantly weakened in recent months. That growing economic weakness played a role in Apple's production order cuts.

Data Source

Silverblatt, Howard. Standard & Poor. S&P 500 Earnings and Estimates. [Excel Spreadsheet]. 10 November 2018.

Labels: earnings, forecasting, SP 500

"Essentially, all models are wrong, but some are useful."

Those are the immortal words of statistician George E.P. Box, which underlie every bit of serious analysis that seeks to approximate real world processes and outcomes with math. Including our own.

What keeps models useful is to recognize when and how they're wrong. For example, many years ago, we recognized that the projections of our dividend futures-based model of how stock prices work could be skewed off target because it incorporates historic stock prices as the base reference points from which it projects future stock prices. If those historic stock prices were to include a period of abnormally high volatility, the accuracy of the model's projections would be negatively impacted - skewed off by the echo of that past volatility.

With past volatility events proving to be poor predictors of future stock prices, we experimented with different methods to compensate for the echo effect in our model, eventually settling on a very simple method of "connecting the dots" to bridge across periods where we recognized that the accuracy of our model's forecasts would be affected by the echo of past volatility. We show those adjustments as a red-zone on the forecasting charts we produce.

In our latest redzone forecast, which covers the period from 7 November 2018 through 7 December 2018, we assumed that investors would remain focused on the future expectations associated with 2019-Q1. In the Thanksgiving holiday-shortened third full week of November 2018, something changed for the S&P 500 (Index: SPX) to break that assumption, and what had been our stellar track record for previous redzone forecasts....

Instead of falling within our redzone forecast, the trajectory of the S&P 500 has dropped below it, seeming to follow the unadjusted trajectory associated with investors focusing their forward-looking attention on 2019-Q1. That's almost certainly a coincidence, which we'll be able to confirm in the next several weeks.

Instead, we believe that investors have shifted a portion of their forward-looking attention toward a more distant point of time in the future, 2019-Q3, which appears to have been prompted very specifically by a change in the expectations for future revenues at Apple (Nasdaq: AAPL) that occurred on Monday, 19 November 2018, which resulted from the company cutting production orders to suppliers for its newest iPhone models. That news was sufficient to dim the prospects for the company's profits well into the future, and since Apple is still the single largest company within the S&P 500, the news was also sufficient to shift the trajectory of the whole index lower as investors adjusted their focus accordingly.

And that's how we can get useful insights from a model that's wrong! Meanwhile, here are the other headlines that stood out to us from the holiday-shortened week....

- Monday, 19 November 2018

- Tuesday, 20 November 2018

- Wednesday, 21 November 2018

- Thursday, 22 November 2018

Elsewhere, Barry Ritholtz listed positives and negatives for Thanksgiving Week of 2018, and also has introduced a catch-all tag for archiving all his weekly succinct summations for the major economy and market-related events he tracks each week.

Following the national holiday of Thanksgiving on Thursday, Black Friday represents the busiest shopping day for U.S. consumers, many of whom will take advantage of a second day off work to start their Christmas shopping.

But what if money is tight this year? How can cash strapped Americans stay on a budget while shopping for everyone they're going to give gifts to this year and not run over?

That dilemma then carries down to each individual gift purchase, as our hypothetical shopper must also work how much to spend on a gift for each person they'll give one to this holiday season. Surely there must be a super smart way to work out how much to spend on each gift for each person on their shopping lists before they go out on a Black Friday buying binge!

You're in luck! Brain Candy and Beyond IQ author Garth Sundem shows how to apply math to solve this problem of gift-giving with a budget:

Obviously, that kind of math is hard to work out while on the go, so we're happy to present a tool to help you make your shopping list! Just enter the indicated data below into our generic list below and we'll work out how much you should target spending on each. (For the default amount of spending, we've entered the amount that Price Waterhouse Coopers reports that Americans plan to spend on Christmas gifts in 2018, but if that's not what you plan to spend, change it!). [If you're accessing this article on a site that republishes our RSS news feed, please click here to access a working version of our tool at our site.

We'll leave it as an exercise to you to identify just who Person A, B, C, etc. are when you print out the list and take it with you while shopping.

But if you're more the type to take advantage of Cyber Monday deals, we can accommodate you there too - here are a number of the Black Friday deals that Amazon is offering in 2018:

Finally, Garth has recently added a third entry to his Real Kids, Real Stories series of books for kids, which might fit the bill if you're shopping for youngsters this holiday season - here are links to all the books in the series:

- Real Change: Courageous Actions Around the World

- Real Character: Choices That Matter Around the World

- Real Challenges: Overcoming Adversity Around the World

Let's be safe shopping out there this Black Friday!

Labels: personal finance, tool

We're going to tie something that we learned during 2009's Thanksgiving to China's trade war strategy with the U.S. in this article, but we first need to set the stage for that lesson by examining an alleged mistake that China's leaders have made.

China's leaders are facing unexpected and very rare criticism from the nation's former top trade negotiator over their trade war strategy with the United States.

China’s former chief trade negotiator openly criticised Beijing’s trade war tactics on Sunday, singling out the decision to impose tariffs on soybeans as ill-thought out.

The comments by Long Yongtu, a former vice-minister with China’s foreign trade ministry who headed the talks that led to China’s entry to the World Trade Organisation, offered a rare glimpse into the country’s internal divisions about how to handle the dispute with the United States....

In particular, Long said it was unwise to impose import duties on soybeans in retaliation for US President Donald Trump’s decision to slap additional levies on Chinese imports.

“Agricultural products are very sensitive [in trade], and soybeans are very sensitive as well … We should have avoided targeting agricultural products because targeting agricultural products should be the last resort,” Long said. “But we have targeted agricultural products, or soybeans, right from the start.”

The agricultural states that produce the bulk of America’s soybeans make up Trump’s political heartland, but Long pointed out: “China is in dire need of soybean imports, so why did we pick out soybeans from the beginning? Is this deep thinking?”

The short answer is that it wasn't. The political angle is the explanation, where China's leaders hoped to influence the outcome of the 2018 mid-term elections in the U.S.' farm states, with the Chinese regime counting on its sympathizers to make hay out of the economic harm they purposefully sought to inflict upon U.S. soybean growers. They employed a similar strategy to inflict economic harm on the U.S.' crude oil producing states, although that effort failed to produce any damage.

As part of its soybean tariff strategy, China's leaders have chosen to substitute other nations' soybeans for U.S.-grown soybeans, which is primarily used as animal feed in the country. In practice, that has meant buying up large quantities of soybeans grown in other regions of the world like Brazil, the world's leading producer of the crop, but in recent months, that has also meant substituting other crops for soybeans, because all these other nations are not capable at this time of filling the void left behind by China's avoidance of U.S.-grown soybeans.

At the same time, China has also acted to relax its quality standards for the soybeans that it will accept. By doing this, China will import more soybeans than it otherwise would, but the combination of diminished quality and the substitution of different crops to use as animal feed will likely have unintended consequences.

And this is where we can apply what we learned from 2009's Thanksgiving! In that year, we observed that while turkeys raised by U.S. farmers were growing in size, they weren't leading to meatier birds for sale at U.S. grocery stores. At the time, we hypothesized that a policy implemented by the U.S. government was responsible for this result. That policy involved boosting government-provided incentives aimed at increasing in the amount of ethanol produced from corn in the U.S. for use in the nation's fuel supplies, which caused the supply of corn that had previously been directed toward feeding the U.S.' domestic animal production to instead be diverted toward ethanol production.

That change forced U.S. meat producers to substitute other crops for their preferred higher quality animal feed to fill the void created by the shift in demand, which in the case of farm-raised turkeys, ultimately led to lower quality birds on the nation's Thanksgiving tables while also making them more costly.

In China, soybeans are largely used to feed hogs rather than cattle or turkeys, where Chinese pork producers and consumers may see a similar unintended outcome, driving home Long Yongtu's point regarding the wisdom of China's trade war strategy.

Meanwhile, in the U.S., President Trump has recently acted to boost the nation's commitment to using corn-based ethanol, which is considered to be both bad science and bad policy, but in the context of China's trade war strategy against U.S.-grown soybeans, should perhaps be viewed as a political response aimed at offsetting the economic damage caused by it.

Would it really be too much to ask the world's political leaders to stop doing so many stupid things?

Labels: business, food, thanksgiving, trade

There's a long list of popular products and institutions that Millennials are purportedly killing. Beer. Department stores. Bar soap. Movies. The National Football League. Sex. The Canadian tourism industry. Et cetera.

But now, millennials, or rather, that generation of people born in the years from 1981 through 1996, would appear to have turned their mindlessly destructive attention toward a new target: the Thankgiving turkey.

Small birds are having a big moment.

Tiny turkeys will increasingly grace Thanksgiving tables next week, thanks to the millennial generation's ongoing campaign to remake American gastronomy. The holiday depicted by Norman Rockwell—Grandma showing off a cooked bird so plump it weighs down a banquet plate—is still common. But smaller families, growing guilt over wasteful leftovers and a preference for free-range fowl have all played roles in the emergence of petite poultry as a holiday dinner centerpiece....

There are signs that wee birds are in greater demand. Inventories of whole hens, which are smaller than males, are down 8.3 percent from a year ago, the latest U.S. Department of Agriculture data show. Whole toms, the males, are up 6.9 percent.

Don’t call them capons. They're not castrated chickens. Nor are they chicks. They're not babies. They're just turkeys that weigh in the neighborhood of six pounds.

That's considerably smaller than the weight of adult turkeys commonly found in the American wild.

Are millennials such complete hipster douchebags that they would promote a radical selective breeding/genetic modification program for little more than what amounts to a personal fashion statement for the one day they might serve up their version of a traditional Thanksgiving dinner? And if so, how successful have they been at imposing their will upon the nation's turkey producers and all other Americans?

To find out the answer to that second question (the first was rhetorical), we turned to the U.S. Department of Agriculture's report on the total live weight of all turkeys produced in the U.S., where the following chart presents the annual totals for each year from 1970 through the preliminary estimate for 2018.

We see in this chart that the answer is "maybe", where the total aggregate live weight of all turkeys produced in the U.S. declined by 0.7% from their 2017 level to a preliminary estimate of 7.488 billion pounds in 2018.

But that could also be the result of a reduction in the number of turkeys produced in the U.S. For that number, we turned to the USDA's report on the number of turkeys raised in the U.S. to determine the size of their population in 2018.

Here, we find that the number of turkeys raised in the U.S. has declined by 2.5 million year-over-year, where the preliminary estimate of the population of turkeys in the U.S. has fallen to 240 million, the lowest level recorded since 1987 outside of the period of the bird flu epidemic of 2014-2015 that whacked the farm-raised population of turkeys.

By itself, this decline suggests that turkeys are becoming less popular with Americans, where Millennials would perhaps be the likely culprits, but when taken with the data for the total aggregate live weight of turkeys produced in the U.S., it allows us to determine the average live weight of the American farm-raised turkey.

The average U.S. turkey in 2018 weighed 31.2 pounds, a tenth of a pound heavier than in 2017 and 67% heavier than the average turkey was during the 1970s, while also being 53% larger than the average turkey of 1987, when the U.S. farmers last tended a healthy turkey population similar in size to 2018's flock.

The comprehensive evidence indicates that Millennials are so-far failing to kill the Thanksgiving turkey. Going back to the Bloomberg article announcing the apparent Millennial desire for tiny turkeys, Scott Sechler, one of the breeders seeking to produce a sufficiently meaty small bird for the Millennial market, explained why that impact to the purchase weight of Ready-To-Cook turkeys now available for sale at your local grocery store has been so immeasurably small:

Still, 12- to 14-pound turkeys remain the biggest holiday seller, Sechler said. That may be because some millennials are "still going to Mom's," he said.

So says the man whose future livelihood depends upon his keeping an accurate pulse of this particular target demographic.

Labels: business, food, thanksgiving

Seven trading days into our redzone forecast for the S&P 500, and so far, it's holding, with the closing value of the S&P 500 (Index: SPX) falling within our target range on six of seven of those days.

The trajectory of the S&P 500 has also been consistent with our unadjusted standard model's projection associated with the expectations that investors have for 2019-Q1 in setting today's stock prices during this period. Since that trajectory reflects the echo of the volatility that stock prices experienced in October 2018, which arises from our model's use of historic stock prices as the base reference points from which it projects potential future stock prices, we had developed the redzone forecast to compensate for its effect. Our redzone forecast assumes that investors will largely keep their forward looking attention on 2019-Q1.

Just because we've assumed that will happen does not mean that it will. It is possible that investors may shift their attention toward other points of time in the future.

Speaking of which, the large decline in oil prices and growing signs of economic slowdowns elsewhere in the world have greatly influenced investor expectations during the last two weeks, particularly where the future for interest rate hikes by the Fed are concerned.

Back then, investors were confident in their expectations that the Fed would hike its Federal Funds Rate by a quarter point in December 2018, in March 2018 and were giving just over a 50% chance they would again in September 2018.

But now, they appear to be backing off those expectations, where they would appear to now anticipate quarter point rate hikes in December 2018 and just one more in 2019, in June, according to the CME Group's FedWatch tool.

Meanwhile, the news headlines of the past week suggest that some influential Fed officials are backing off plans to steadily hike U.S. short term interest rates into 2019, which accounts in part for those changing expectations....

- Monday, 12 November 2018

- Tuesday, 13 November 2018

- Wednesday, 14 November 2018

- Thursday, 15 November 2018

- Oil rebounds on lower U.S. stockpiles, possible drop in OPEC supply

- Fed plans review of how it pursues inflation, employment goals

- Fed's Kashkari sticks to view that rates do not need to rise

- Bostic urges caution as Fed takes 'final steps' to neutral

- Wall Street climbs on hopes of easing trade tensions

- Friday, 16 November 2018

- Oil edges up in volatile session but falls for sixth straight week

- China stimulus: Weak credit growth raises odds of first China rate cut in years

- Trump says U.S. may not impose more tariffs on China

- Fed nods to concerns but still sees U.S. rate hikes

- TREASURIES-U.S. yields slide after Fed's Clarida comments

- US economy will hit snag in 2019: Dallas Fed’s Kaplan

- Fed's Evans says U.S. economy strong, should move rates to neutral

- Fed's Evans says 'reasonable' to raise rates to 3.25 percent

- S&P, Dow advance on trade optimism; Nvidia sinks Nasdaq

For a broader picture of what happened in the week that was, Barry Ritholtz found five positives and five negatives among the week's major economy and market-related events.

That's it for this edition of our S&P 500 chaos series. We'll see you again after Thanksgiving!

The universe is both stranger and more fascinating than all but a few can imagine. Bad Astronomy's Phil Plait just had that kind of realization after reviewing a paper with 59 co-authors, a group of astronomers and astrophysicists known as the GRAVITY team, who peered deep into the heart of the Milky Way galaxy to make an extraordinary discovery.

I read quite a few scientific journal papers every week, seeing which ones might make a good fit for the blog. They’re always interesting, and of course some have more ground-breaking results than others. But you can count on the fingers of one hand how many times one has made me exclaim out loud upon reading it.

I just read one where I exclaimed out loud.

In fact, I may have exclaimed an expletive out loud — “holy [synonym of feces]!” — when I read the abstract of this particular paper.

Why? Because in the paper, a team of astronomers show that they have observed a blob of dust sitting just outside the point of no return of a supermassive black hole, where the gravity is so intense that this material is moving at thirty percent the speed of light. And this wasn’t inferred, deduced, or shown indirectly. No: They measured this motion by literally seeing the blobs move in their observations.

Better still, there's video, assembled from actual images of the region they studied, as can be seen in the following presentation that zooms in on that region of space to reveal those images, then zooms in even closer via an animation of the orbiting gas for a really close-up view of what observations and astrophysics says is happening just outside of the edge of the black hole at the core of the Milky Way.

The hot "blob of dust" appears to be orbiting the black hole about once every 31 minutes. At 30% of light speed, that dust would be moving at more than 201 million miles per hour as it revolves around the black hole.

By comparison, the Sun, which is much farther away, is moving at speeds over 514,000 miles per hour (828,000 kilometers per hour) around the same black hole, where it will take about 230 million years to complete its orbit around the black hole at the focal point of the Milky Way galaxy.

Labels: environment

Earlier this year, we marked the occasion when a relative period of order appeared to end in the S&P 500 and a new period of chaos seemed set to take hold in the market.

We say "appeared to end", because order returned to the S&P 500, where a stable relationship between the daily closing value of the index and the index' trailing year dividends per share that had begun on 31 March 2016 subsequently resumed. In retrospect, what we had initially thought to be a sign of order breaking down in the stock market proved to be an outlier event in light of how stock prices behaved in the following months.

That's not the case today, where we can show that relative period of order in the stock market has much more definitively broken down following the onset of the third Lévy flight event of 2018, where the first two events represent a really aggressive reversion to the established mean of the previous period of order. The following chart shows what that looks like against the backdrop of a statistical equilibrium chart.

We mark the recently completed relative period of order as having run from 31 March 2016 to 11 October 2018. To put this period into a larger context, the following chart shows each major relative period of order and punctuated period of chaos from December 1991 through October 2018.

If you'd like to get the data for this second chart, it's taken directly from the historical data we provide through our S&P 500 At Your Fingertips tool, where we make all the monthly data from January 1871 through the present available at no charge!

Labels: chaos, data visualization, SP 500

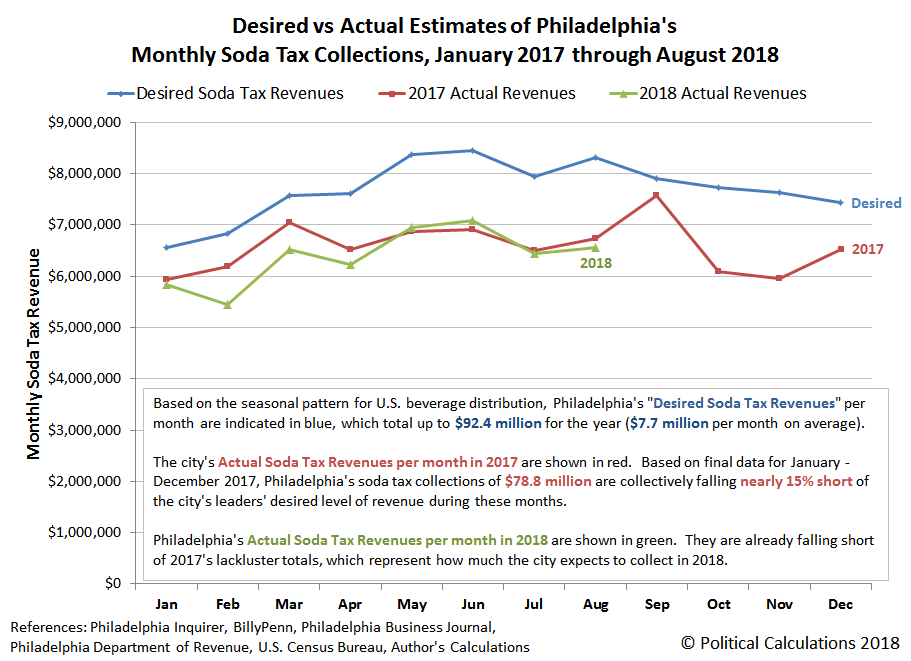

The city of Philadelphia is continuing to experience shortfalls in the monthly revenues it collects from its controversial soda tax. As a result of those ongoing shortfalls, Philadelphia Mayor Jim Kenney's Rebuild initiative is being significantly scaled back from the levels that city officials have promised city residents.

The following chart shows the amount of revenue that the city has collected through the Philadelphia Beverage Tax assessed in the months of January 2017 through August 2018. In the chart, the blue "Desired" line shows the amount of tax collections that city officials originally expected to collect throughout 2017, while the red "2017" line shows how much the city actually collected from its soda tax in each month of that year. The red 2017 line subsequently became the city's expected revenue for its soda tax in 2018, whose actual level of revenues are indicated by the green "2018" line.

Through August 2018, Philadelphia is running about $1.6 million short of its expected revenue levels for the calendar year, and about $10.5 million below its original revenue expectation for the first eight months of collections for its soda tax.

City officials passed Philadelphia's soda tax into law by promising to use 100% of the money it would collect to fund "free" pre-Kindergarten programs in the city, community schools, and the mayor's Rebuild initiative, which would fund repairs and improvements to city parks, libraries, recreation centers and playgrounds.

With the city's soda tax collections persistently falling short of expected levels, one or more of these spending programs would have to pay the price by being scaled back, where the city's Rebuild initiative appears to have become the designated loser.

That much became evident last month when Mayor Kenney began walking back promises to fund $500 million worth of improvements to the city's public infrastructure.

The glowing "First 1,000 Days" report [pdf] released Oct. 1 by Mayor Jim Kenney contained 15 mentions of Rebuild, the most expensive and highest profile initiative of Kenney's first term. But unlike past mentions of the heralded program, these didn't include the $500 million price tag that the administration has used consistently since it introduced the program in 2016.

"Through the Administration’s signature infrastructure initiative Rebuild, we're investing hundreds of millions of dollars in our neighborhoods by renovating our aging recreation centers, playgrounds, parks, and libraries," the report reads.

The subtle adjustment to “hundreds of millions” may seem innocuous yet it portends an intentional shift that could result in fewer dollars reaching neighborhoods hungry for functional, decent places to play and learn.

Philadelphia is reliant upon the taxes it collects through its soda tax to support the borrowing it needs to fund the Rebuild initiative. With those revenues falling over 17% short of the city's original expectations, the mayor has scaled back the city's planned commitment for the Rebuild initiative from $500 million to $348 million, a 30% reduction. The difference between the percentage for the city's soda tax revenues and its funding commitment confirms that the Rebuild program is bearing a disproportionately larger share of Philadelphia's failure to collect its desired level of revenue through its soda tax.

That outcome could have been avoided if only Philadelphia's residents were more willing to pay the city's soda tax instead of engaging in tax avoidance behaviors. It's as if they don't care enough about what city officials want....

The U.S. Federal Reserve boldly took no action to increase short term interest rates in the U.S. at the conclusion of its 7-8 November 2018 meeting, leaving them at their current target rate of 2.00% to 2.25%, the level to which they had set them back in September 2018.

The risk that the U.S. economy will enter into a national recession at some time in the next twelve months now stands at 1.9%, which is up by roughly three-tenths of a percentage point since our last snapshot of the U.S. recession probability from late-September 2018. The current 1.9% probability works out to be about a 1-in-54 chance that a recession will eventually be found by the National Bureau of Economic Research to have begun at some point between 8 November 2018 and 8 November 2019.

That small increase from our last snapshot is mostly attributable to the Fed's most recent quarter point rate hikes on 26 September 2018. Since then, the U.S. Treasury yield curve has very slightly flattened, as measured by the spread between the yields of the 10-Year and 3-Month constant maturity treasuries, which has only contributed a very small portion of the increase in recession risk in the last six weeks.

The Recession Probability Track shows where these two factors have set the probability of a recession starting in the U.S. during the next 12 months.

We continue to anticipate that the probability of recession will continue to rise through the end of 2018, since the Fed is expected to hike the Federal Funds Rate again in December 2018. As of the close of trading on Friday, 9 November 2018, the CME Group's Fedwatch Tool was indicating a 76% probability that the Fed will hike rates by a quarter percent to a target range of 2.25% to 2.50% at the end of the Fed's next meeting on 19 December 2018. Looking forward to the Fed's 20 March 2019 meeting, the Fedwatch Tool indicates a 53% probability that the Fed will hike U.S. interest rates by another quarter point at that time. Looking even further forward in time, the Fed is expected to hold rates steady for a while, then hike them by an additional quarter point in September 2019.

If you want to predict where the recession probability track is likely to head next, please take advantage of our recession odds reckoning tool, which like our Recession Probability Track chart, is also based on Jonathan Wright's 2006 paper describing a recession forecasting method using the level of the effective Federal Funds Rate and the spread between the yields of the 10-Year and 3-Month Constant Maturity U.S. Treasuries.

It's really easy. Plug in the most recent data available, or the data that would apply for a future scenario that you would like to consider, and compare the result you get in our tool with what we've shown in the most recent chart we've presented. The links below present each of the posts in the current series since we restarted it in June 2017 and, barring significant events, our next update will be in December 2018.

Previously on Political Calculations

- The Return of the Recession Probability Track

- U.S. Recession Probability Low After Fed's July 2017 Meeting

- U.S. Recession Probability Ticks Slightly Up After Fed Does Nothing

- Déjà Vu All Over Again for U.S. Recession Probability

- Recession Probability Ticks Slightly Up as Fed Hikes

- U.S. Recession Risk Minimal (January 2018)

- U.S. Recession Probability Risk Still Minimal

- U.S. Recession Odds Tick Slightly Upward, Remain Very Low

- The Fed Meets, Nothing Happens, Recession Risk Stays Minimal

- Fed Raises Rates, Recession Risk to Rise in Response

- 1 in 91 Chance of U.S. Recession Starting Before August 2019

- 1 in 63 Chance of U.S. Recession Starting Before September 2019

Labels: recession forecast

The big news last week, aside from the U.S. midterm elections, which apparently are still going on in some places, was the stock market’s response to the return of political gridlock on Capitol Hill, where stock prices rallied strongly enough on the day after the election that they completed the fourth Lévy flight event of 2018, as investors fully returned their forward-looking attention to 2019-Q1 after having devoted all their attention to 2019-Q3 in the previous week.

Since our dividend futures-based model uses historic stock prices as the base reference points from which we project future potential values for the S&P 500, the recent Lévy flight events have significantly skewed our model’s projections in the period from 7 November 2018 through 7 December 2018. To compensate for what is, in effect, the echo of past volatility in our model's forecasts for the future the S&P 500, we've added a new redzone forecast to our regular spaghetti forecast chart for the S&P 500, where we've assumed that investors will maintain their focus on 2019-Q1 over this period of time.

Now, just because we've assumed that doesn't mean they will. If they don't, then our first potential confirmation that they have shifted their attention toward a different point of time in the future will come as the actual trajectory of the S&P 500 moves outside the rectangular red-zone that we've indicated on the chart. Given recent history and the Fed’s autopilot inclination to keep hiking interest rates well into 2019, even though the U.S. economy is expected to significantly slow (particularly in the third and fourth quarters), the most likely alternative focus point for investors will continue to be 2019-Q3.

Our thinking is that investors will be largely focused on 2019-Q1 during the next month because of the change in political control of the U.S. House of Representatives in early 2019 will keep investors concerned about what policies may come out of Washington D.C. during the first quarter. As we've seen in previous years, those potential policy changes can greatly influence how corporate boards set their dividend policies before the end of 2018, although we would expect this effect to be much less this year than in years where one political party has taken control of both houses of Congress and the White House.

That’s about the extent to which politicians can affect the stock market. The good news is that politicians are mostly impotent otherwise in their ability to affect the stock market, which is why we don’t bother paying much attention to their antics in our analysis!

- Monday, 5 November 2018

- Tuesday, 6 November 2018

- Wednesday, 7 November 2018

- Thursday, 8 November 2018

- Friday, 9 November 2018

- Oil falls 1 percent, U.S. crude on longest losing streak since 1984

- China: More signs of economic trouble, which we've touched on in other analysis, and actions to juice its economy, which we're catching up today....

- China car market on verge of rare annual contraction after October sales slide

- China to cut taxes to support private sector: Xinhua

- Older news: China regulator to propose 50 percent cut to car purchase tax: Bloomberg

- Much older news: China announces tax cuts in move to support economy

- Much, much older news: China to cut VAT tax rates for manufacturing and other sectors: state media

- Oil slide, China worries send Wall Street tumbling

Elsewhere, Barry Ritholtz celebrated the end of all the robocalls, emails, doorbell rings, and political advertising as a positive in this week's succinct summary of the week's major economy and market-related events. That’s a political motion we’re happy to second!

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.

![Animation: Trailing Twelve Month Average New Home Sales Market Capitalization, Not Adjusted for Inflation [Current U.S. Dollars] and Adjusted for Inflation [Constant October 2018 U.S. Dollars], December 1975 - October 2018 Animation: Trailing Twelve Month Average New Home Sales Market Capitalization, Not Adjusted for Inflation [Current U.S. Dollars] and Adjusted for Inflation [Constant October 2018 U.S. Dollars], December 1975 - October 2018](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEgcU6wTluiFabTfD1f2FUTYZkYMJ1mEqvsi6e1MWpeAStgKTUtjKsYnfKcKWkSvPYX5AfLGw2g1iyAkGP-la4ok0We2Fc3Yd6Mj5dyBEg1Gs7tgNfTa6i0hHQIzoi18p9jdD14q/s1600/nominal-and-inflation-adjusted-ttma-new-home-sales-market-cap-197512-thru-201810.gif)