The final full trading week of October 2022 saw the S&P 500 (Index: SPX) rise 148.31 points, or just shy of 4%, to end the week at 3,901.06. That's the highest close for the index since 14 September 2022, which puts it 895.50 points away from its record high close of 4,796.56 on 3 January 2022.

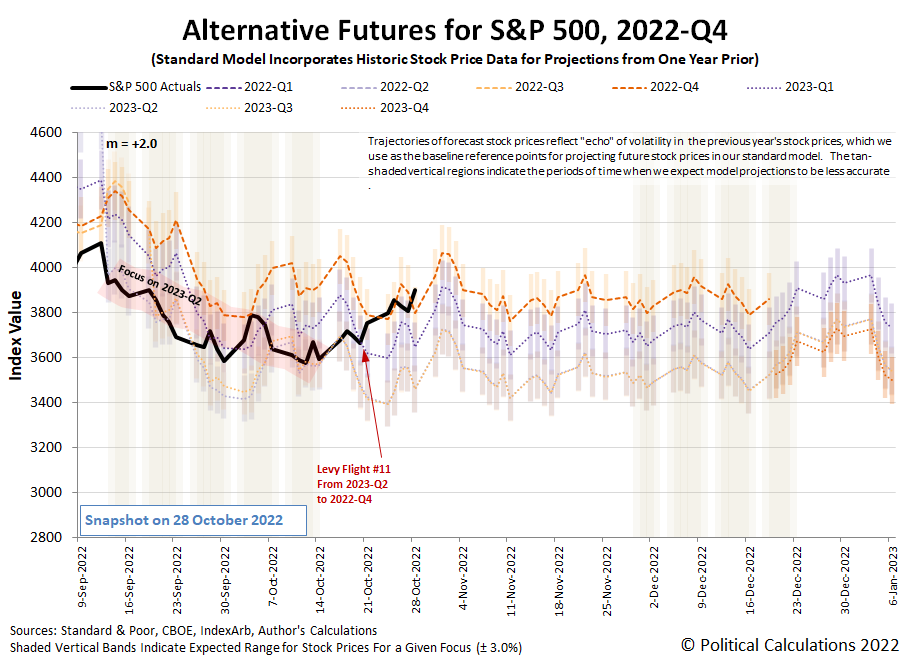

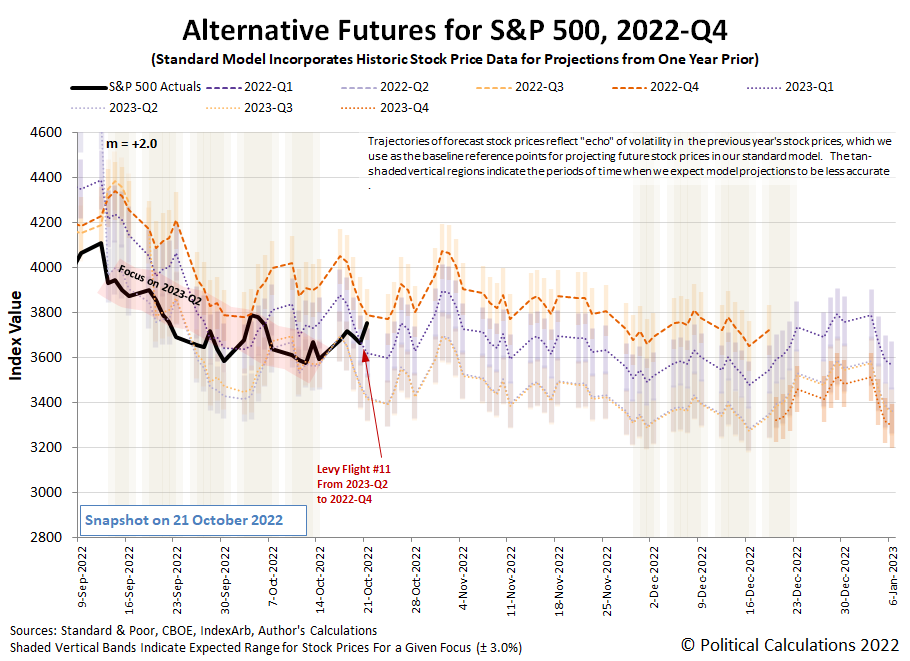

The S&P 500's trajectory during the week remains consistent with investors focusing on the current quarter of 2022-Q4 in setting current day stock prices. The latest update to the alternative futures chart shows where that puts the S&P 500's trajectory with respect to the dividend futures-based model's projections of where the index would be if investors shifted their attention to more distant future quarters.

We're taking the trouble to point those alternative futures out because investors being focused on the current quarter means one thing with absolute surety. By the time this quarter ends, they will shift their forward looking focus to one of these other points on the time horizon. That shift, regardless of which future quarter they might settle upon, will be accompanied by a downward movement in the level of the index. How much of a downward movement will be determined first by which quarter draws their gaze and second by how much the expectations for dividends for that quarter might change.

We've seen that phenomenon before. It happened most recently during the second half of the second quarter of 2022 as the level of the S&P 500 repeatedly see-sawed between the levels associated with investors looking at different points of time in the future. For us, it's exciting to watch these Lévy flight events play out in real time. Depending on how you're invested, your entertainment factor while experiencing such high percentage changes in value may differ....

While the remainder of 2022-Q4 may not be quite as volatile as 2022-Q2 was, the one thing that can prompt investors to suddenly shift their time horizons is what they find in the random onset of new information. With that in mind, here are the market-moving headlines investors absorbed during the past week.

- Monday, 24 October 2022

- Signs and portents for the U.S. economy:

- U.S. business activity weakens again in October -S&P Global survey

- Oil prices ease on Chinese demand data, stronger dollar

- Poll of economists show their expectations of Fed minions:

- Fed to hike by 75 bps again on Nov. 2, should pause when inflation halves - economists: Reuters poll

- Some positive signs for China's economy:

- China's Sept copper imports jump on infrastructure spending

- China Q3 GDP growth tops forecasts but meaningful rebound elusive

- But bigger trouble still developing in China:

- Xi says China's economy has high resilience, room for manoeuvre

- China central bank head likely to step down amid reshuffle - sources

- China's Sept exports grow 5.7%, beat forecasts, imports weak

- China's Q3 pork output growth slows as farmers reduce breeding herds

- China's new home prices fall for second month on weak sentiment

- And more bigger trouble developing in the Eurozone:

- Euro zone October PMI adds to evidence bloc is heading for recession

- German companies increasingly struggling to access credit - Ifo

- BOJ minions busy keeping yen from crashing, JapanGov minions to launch more stimulus:

- Japan intervened, buying yen in foreign exchange market Friday -sources

- Japan ruling party indicates stimulus to total around $174 billion -Kyodo

- Wall St closes sharply higher on hopes of abating Fed

- Tuesday, 25 October 2022

- Signs and portents for the U.S. economy:

- Oil falls by more than $1/bbl as demand fears linger

- Inflation worries hurt U.S. consumer confidence; house prices decelerating

- U.S. home price growth slows in August, surveys show

- Fed minions claim to have multiple paths to get to same place, politicians plead with Fed chief to back off rate hikes:

- Fed's Bullard, Evans, show two paths to the same policy rate

- Fed's Powell, on eve of next rate hike, urged to protect jobs

- Bigger stimulus developing in China:

- China seeks to promote development of private businesses with more loans

- China makes it easier for firms to borrow from overseas as yuan drops

- China to promote foreign investment in manufacturing

- Bigger trouble developing in China:

- China's Q4 GDP hits early speed bump as COVID stifles economy

- China seeking to curb liquidity risks in $1.4 trln money market fund - sources

- Exclusive-China FX regulator surveys banks about positioning as yuan plunges - sources

- Bigger trouble developing in the Eurozone:

- S&P 500 adds to mid-October rebound from bear market low

- Wednesday, 26 October 2022

- Signs and portents for the U.S. economy:

- U.S. mortgage interest rates jump to 7.16%, highest since 2001

- U.S. new home sales fall in September; prices remain high

- BOJ minions working to keep never-ending stimulus alive:

- Central bank rate hike mania hits Canada, IMF says it wants MOAR rate hikes:

- Bank of Canada surprises with 50 bps hike, says slight recession possible

- Quotes: Top Bank of Canada officials speak after rate decision

- Bank of Canada slows pace of rate hikes as recession fears mount

- IMF chief wants central banks to keep raising rates to hit 'neutral' level

- S&P 500 ends lower, snapping rally on mounting slowdown fears

- Thursday, 27 October 2022

- Signs and portents for the U.S. economy:

- U.S. economic growth rebounds in Q3 on trade, but demand is slowing

- Biden says U.S. Q3 growth shows economic recovery 'continuing to power forward'

- Oil rises on strong crude demand, despite China fears

- U.S. core capital goods orders unexpectedly fall in September

- The Fed has "soothsayers":

- Fed's soothsayers see signs of an inflation downshift

- Column-Central bank guns spiked by bank windfall backlash: Mike Dolan

- Bigger trouble developing in China, South Korea, Germany:

- China sees growing risk of weakening external demand in Q4

- S.Korea moves again to ease credit crunch sparked by Legoland developer default

- Germany needs billions to solve its energy crisis, but buyers are shunning its bonds

- JapanGov minions keeping upping their fiscal stimulus plans:

- Japan's extra budget for stimulus package to exceed $198 billion -NHK

- Japan to unveil $200 billion spending package to ease inflation pain - sources

- BOJ minions determined to keep never-ending stimulus alive:

- ECB minions excited to deliver more rate hikes:

- S&P 500, Nasdaq slide, while Dow ends higher on mixed earnings picture

- Friday, 28 October 2022

- Signs and portents for the U.S. economy:

- U.S. consumer spending rises strongly; wage growth moderating

- Oil prices down 2% as China widens COVID curbs

- Fed minions losing money, may pay attention to Treasury yield curve inversion, not expected to stop hiking rates:

- Fed on track for tens of billions in losses amid inflation fight

- Fed may be alert to favoured yield curve alarm :Mike Dolan

- Fed pivot not on horizon even as over-tightening risks loom- strategists

- Bigger trouble developing in the Eurozone:

- Looking backward, Taiwan Q3 GDP growth tied to China lifting zero-COVID lockdowns:

- JapanGov minion thinking about doing more to keep yen from crashing:

- ECB minions excited to deliver rate hikes as Eurozone recession develops:

- Wall Street surges to sharply higher close ahead of Fed week

The CME Group's FedWatch Tool continues to project a three-quarter point rate hike when the FOMC next meets on 2 November 2022 and a half point rate hike on 14 December (2022-Q4). In 2023, the FedWatch tool projects another half point rate hike in February (2023-Q1), but now anticipates a quarter point rate hike in May (2023-Q2). That's followed by two quarter point rate cuts, the first as early as June (2023-Q2) and the second in November (2023-Q4).

The Atlanta Fed's GDPNow tool's first projection for real GDP growth in 2022-Q4 is +3.1%. Meanwhile, to close the books on 2022-Q3, the Bureau of Economic Analysis first estimate of real GDP for 2022-Q3 is 2.6%, slightly lower than the GDPNow tools' final forecast of 2.9% for the recently ended quarter.

Labels: SP 500

Once again, we're on the cusp of All Hallow's Eve, that time of year when the supernatural converges with our plane of existence to scare the bejeebers out of everyone.

In that spirit, we're returning to an old annual tradition here at Political Calculations. We celebrate the season by exploring the world of furnishings not meant to comfort, but to terrify. Won't you have a seat?

This is artist Cao Hui's Gutsy Chair. We think of it as the kind of chair you might find in either a psychologist's office or a police station. Places where you might be encouraged to spill your guts. Clearly, this chair was guilty.

But if you were offered to sit in this next chair, your host might not have to bother offering you a snack, since it appears to be made of meat.

Chair Apollinaire is the creative vision of Canadian artist Jana Sterbak, who fashioned it from flank steak and black button thread on a polyester resin structure.

Perhaps your host is bit more passive aggressive. Sure, they'll offer you a seat, but good luck figuring out how to sit in this next chair (HT: Core77):

This is Phillips Collection's Entropy Chair, which the studio describes as a "frenetically woven choice for seating." It's also an actual chair you can buy (for $1,799) and sit in, though we'll defer to the designer's website for evidence supporting how that might be done....

Finally, if you were wondering about the title of this post, cathisophobia is the fear of sitting. Happy Halloween!

Previously on Political Calculations

Labels: technology

Sales of new homes in the U.S. fell in September 2022. According to Reuters, that's because higher mortgage rates are "choking" the U.S. real estate market.

Here are the topline numbers from the report:

New home sales decreased 10.9% to a seasonally adjusted annual rate of 603,000 units last month, the Commerce Department said on Wednesday. August's sales pace was revised down to 677,000 units from the previously reported 685,000 units....

The median new house price in September was $470,600, a 13.9% increase from a year ago.

These figures refer to the raw figures provided in the U.S. Census Bureau's latest monthly report on new residential sales.

Political Calculations pulls other data from the report to estimate the market capitalization for U.S. new homes. Our initial estimate of the seasonally-adjusted trailing twelve month average market cap in September 2022 is $28.29 billion, which represents a decrease of 5.1% from our initial estimate of $29.81 billion for August 2022.

Our revised estimate for August 2022 came in 1.4% lower than the initial estimate at $29.39 billion. The estimate for July 2022's market cap was also revised downward from $31.47 billion to $30.02 billion, as this month's data was significantly revised downward by 4.6%. Even with that downward revision, July 2022 still ranks as the peak month for the market capitalization of the new homes during the Biden administration, which falls below the peak of $30.12 billion recorded a month before the Biden administration began.

The latest update of our chart shows U.S.' new home market cap's time-shifted trailing twelve month average.

The following two charts show the latest changes in the trends for new home sales and prices:

We've included the raw monthly data for new home sales and their average monthly sale prices in these latter two charts to illustrate the month-to-month noise in the data. The data for new home sales is typically finalized some three months after it is first reported.

The developing question for U.S. new homebuilders is when might falling sales from an economy fading into recession and falling home prices translate into a collapse of the industry's market capitalization? The new home industry already hasn't registered any sustained growth since December 2020, so it hasn't provided any tailwind to boost the U.S. economy even when its sales were higher and prices were rising more rapidly. The next data release for new home sales will come on 23 November 2022.

Finally, since Reuters identified rising mortgage rates as a main contributor to both falling new home sales and prices, we'll take a closer look at that factor in our next look at how the affordability of new homes is changing. Look for it in the next week.

References

U.S. Census Bureau. New Residential Sales Historical Data. Houses Sold. [Excel Spreadsheet]. Accessed 26 October 2022.

U.S. Census Bureau. New Residential Sales Historical Data. Median and Average Sale Price of Houses Sold. [Excel Spreadsheet]. Accessed 26 October 2022.

Labels: market cap, real estate

What are the best tools investors can use to detect potential accounting fraud at the firms in which they might invest?

That's not an easy question to answer. That's because accounting fraud is almost invariably an inside job, where most investors are on the outside looking in. Most investors simply don't have the access to information about the transactions that constitute the bulk of accounting fraud where it exists.

But for publicly-traded firms, investors can access their financial statements. If the scope and scale of potential accounting fraud at a firm is big enough, the signs of it can show up in them. Accounting professionals have developed tools to help them identify known signs of fraud within financial statements.

That brings us back to the beginning. What are the best tools investors can use to find the signs of potential accounting fraud in financial statements?

A 2021 paper by Messod Beneish and Patrick Vorst, who evaluated seven fraud prediction models. They sought to identify the tools that could successfully identify firms where real accounting fraud may be occurring, without triggering too many costly false positives in the process. Here's the list of tools they evaluated, which are identified by their creator(s) and the year the tool was introduced:

- Beneish (1999) M-Score

- Cecchini et al. (2020)

- Dechow et al. (2011) F-Score

- Amiram et al. (2015) FSD Score

- Alawadhi et al. (2020)

- Bao et al. (2020)

- Chakrabarty et al. (2020) ABF Score

The M-Score was developed by Messod Beneish, so as the analysis goes, we should recognize that he has skin in the game for the evaluation.

Let's cut to the chase and go straight to the conclusion to find out which tools the authors evaluated came out on top in their analysis and why they did:

We compare seven fraud prediction models that have been proposed in prior research. We find that the higher true positive rates in recent models come at the cost of higher false positive rates and that even the best models trade off false to true positives at rates exceeding 100:1. Indeed, the high number of false positives makes all seven models considered too costly for auditors to implement, even when we consider extreme subsamples where a priori firms’ management has higher incentives and/or ability to misreport. We believe this could explain audit practitioners’ apparent reluctance to use these models, despite the fact that models have nearly doubled their success at identifying fraud when compared to the initial models in Beneish (1997, 1999).

For investors, M-Score and the F-Score when used at higher cut-offs are the only models providing a net benefit when applied to the sample as a whole. We conjecture this occurs because the M-Score and the F-Score exploit fundamental signals that have been shown to predict future earnings and returns, and the main component of investors’ false positive costs is the profit foregone (or the loss avoided) by not investing in a falsely flagged firm. In addition, we find that most models are economically viable if applied to top or bottom quintiles of characteristics of firms in which managers a priori have greater incentives and/or ability to misreport.

At this point, we'll point out that we also have skin in the game, which is why the conclusion of this paper attracted our attention. Political Calculations has tool based on the F-Score fraud detection model: Using the F-Score to Detect Accounting Fraud. Meanwhile, a tool based on Beneish's M-Score model is also freely available in both spreadsheet and online tool formats.

Aside from having built a tool based on one of these potential accounting fraud prediction models, we'll recommend using either or both. It's hard enough as an investor to do proper due diligence to choose which companies you might invest in. If the potential for fraud is a concern, it's worth the time and effort to use the most effective tools to either rule it in or out of your portfolio.

References

Messod D. Beneish and Patrick Vorst. The Cost of Fraud Prediction Errors. The Accounting Review. DOI: 10.2308/TAR-2020-0068. [SSRN Preprint]. 30 December 2021.

Image Credit: Stable Diffusion DreamStudio beta "A lonely accountant uses advanced internet based analytical models to detect fraud at a publicly-traded firm."

Labels: crime, investing, personal finance, review, tool

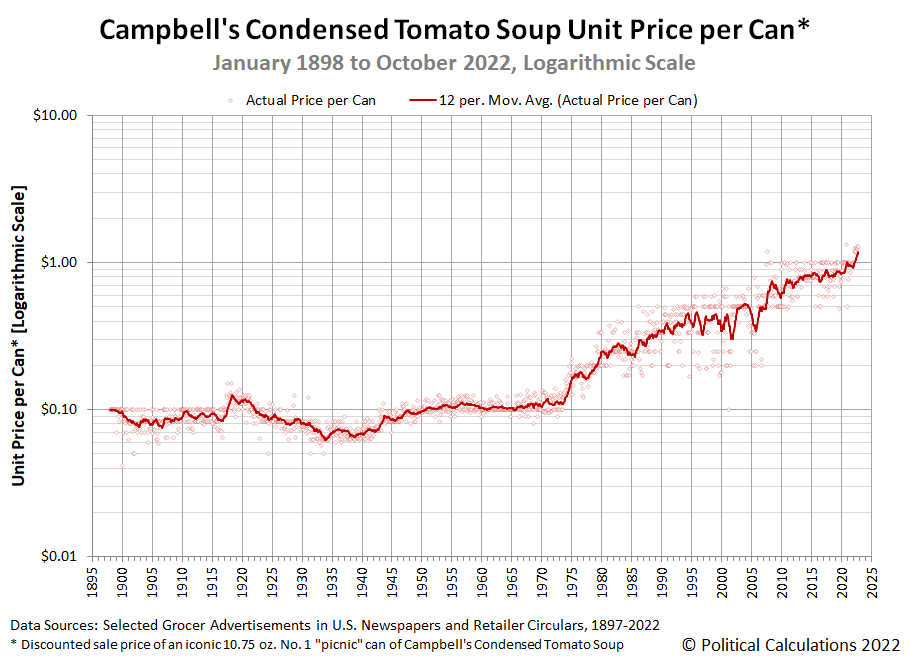

Two years ago, it was rare to find Campbell's Tomato Soup selling anywhere for more than $1.00 per can. That was true for much of 2021 as well.

But 2022 has seen the price of a Number 1 can of America's second-most popular and among the longest-selling condensed soups escalate because of President Biden's stimulus-fueled inflation. The rate at which its cost to consumers is rising is on par with the fastest pace of price escalations it has experienced in its almost 125 year history. Prices today, as measured by the trailing twelve month average cost of a 10.75 ounce can of Campbell's Condensed Tomato Soup, are rising about as fast as they did after President Nixon's price controls on food were lifted in April 1974. It's also similar to post-recession periods where tomato soup prices rapidly recovered to their pre-recession levels.

The historic prices on this chart are shown in logarithmic scale, where straight line changes represent exponential growth in prices and the steeper the line, the faster the cost growth. The only times the trailing year average cost of Campbell's Tomato Soup has risen faster came following recent periods of recession, when prices recovered rapidly to pre-recession levels as the demand for tomato soup crashed and recovered.

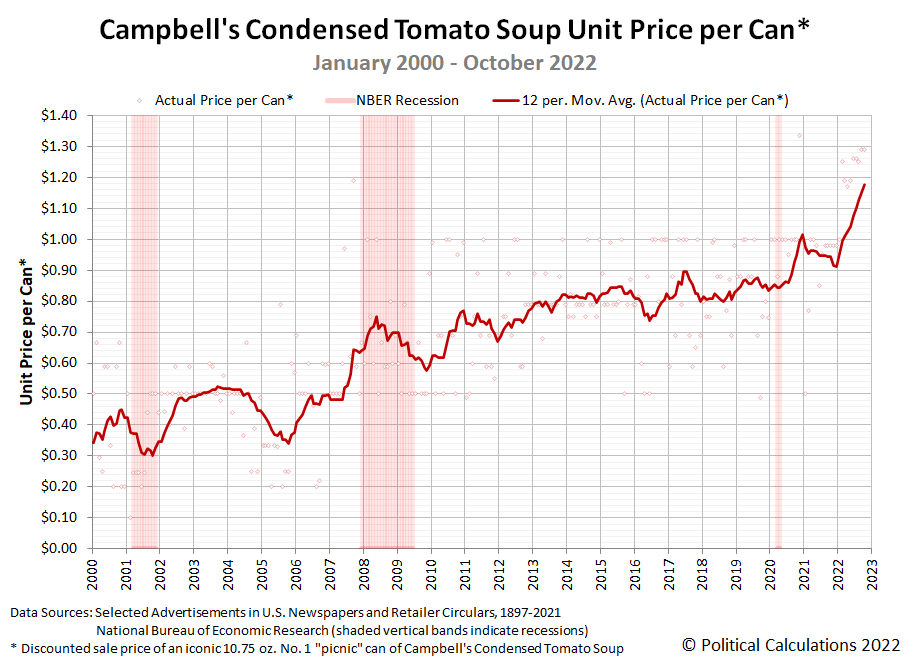

The next chart switches to linear scale to focus on the period since January 2000. Through October 2022, the trailing year average for the unit cost of Campbell's Condensed Tomato Soup has risen to $1.18 per can.

Here are prices of Campbell's Tomato Soup at the ten major grocery-selling retailers we use to track the typical price American consumers pay for an iconic can of the long-selling product. This latest price data confirms its price to consumers is converging toward a level of $1.25-$1.30 per can as soup season gets underway in the United States.

- Walmart: $1.26/each, unchanged

- Amazon: $1.26/each, decrease of $0.53 (-29.6%)

- Kroger: $1.29/each, increase of $0.04 (+3.2%)

- Walgreens: $1.99/each, unchanged or $1.50/each when you buy two cans

- Target: $1.39/each, increase of $0.10 (+7.8%)

- CVS: $1.79/each, decrease of $0.50 (-21.8%) or $1.50/each when you buy two cans

- Albertsons: $1.29/each, decrease of $0.40 (-23.7%)

- Food Lion: $1.25/each, unchanged

- H-E-B: $1.30/each, unchanged

- Meijer: $1.29/each, unchanged

Two years ago, a price of $1.00 was the most you'd ever pay for Campbell's Condensed Tomato Soup. Today, that's near the lowest price you'll see it discounted to when grocers put it on sale.

Previously on Political Calculations

If you want to explore the price history of an iconic can of Campbell's condensed tomato soup further than the start of the 21st Century, we've compiled it going all the way back to January 1898! Aside from the logarithmic scale chart featured in this article, we most recently featured its price history in January 2022:

This article provides links to our older coverage, but if you want to catch up with our newer analysis, follow this link!

The S&P 500 (Index: SPX underwent its eleventh Lévy flight event of 2022, jumping to close out the third week of October 2022 at 3,752.75, up 159.99 points (+4.4%) from the previous week's close.

That's an exciting development, because while previous swings in recent weeks have come close, they weren't quite large enough to qualify as a full Lévy flight event where investors shift their forward looking focus from one point of time in the future to another. For this latest event, it appears investors shifted their attention from 2023-Q3 inward to the nearer term future of the current quarter of 2022-Q4.

That change coincides with signals members of the Federal Reserve sent, mainly on Friday, 21 October 2022, that they were looking to reduce the size of their expected rate hike in December 2022. Previously, investors were anticipating another three-quarter point rate hike in December, but were focusing on 2022-Q2 because that period coincided with when they expected the Fed's current series of rate hikes would peak.

We don't know how long investors might hold their attention on 2022-Q4. If investors become more concerned about the timing of when the Fed's rate hikes will top out, it would make sense for them to shift their focus to the next future quarter of 2023-Q1. The alternative futures chart indicates the Lévy flight that would coincide with such a change would be a low energy event. Stock prices could simply move mostly sideways to achieve that result. Meanwhile, if investors shift their term horizon back to 2023-Q2, the S&P 500 would see a noteworthy decline.

The only thing we know for sure is that investors will shift their investment horizon away from the current quarter at some point, and will absolutely do so by the end of the third Friday in December 2022.

When that happens will be subject to the random onset of new information. Speaking of which, here are the market-moving headlines we noted during the week that was.

- Monday, 17 October 2022

- Signs and portents for the U.S. economy:

- China economy rebounding from summer zero-COVID lockdowns:

- Bigger trouble, stimulus developing in China:

- China delays release of key economic data amid party congress

- Big Chinese banks pledge enhanced support for economy as Xi sounds call for growth

- Exclusive-China's state banks seen acquiring dollars in swaps market to stabilise yuan - sources

- Bigger trouble developing in Japan:

- Bank of Japan likely to raise inflation forecast to over 2.5% - Kyodo

- Japan keeps up warnings over rapid yen moves after G20

- Japan PM hints that decision on next BOJ chief still months off

- Japan not ruling out corporate, income tax hikes to boost military spending

- Wall Street ends sharply higher, dollar dips on UK U-turn, strong earnings

- Tuesday, 18 October 2022

- Signs and portents for the U.S. economy:

- Oil prices settle lower on U.S. supply, lower China demand

- U.S. factory output solid in September; builder sentiment slumps further

- Some Fed minions wanted bigger rate hikes this past summer; other minions growing concerned about U.S. labor market:

- Minneapolis Fed directors wanted 100 bp discount rate hike in September

- Fed's Bostic: U.S. needs to work through labor market "shuffle and churn"

- Central bank rate-hike-o-mania:

- Australia's central bank says to hike rates more, can keep pace with global peers

- Bank Indonesia playing catch-up, to deliver another 50 bps rate hike on Thursday: Reuters poll

- India should pause rate hikes as growth fears loom - MPC's Varma

- New Zealand Q3 inflation smashes expectations, boosts case for hawkish hikes

- BoC to dial down size of rate rises again but not done yet - Reuters poll

- BOJ minions

- BOJ's Kuroda says has no intention of resigning

- Japan will respond appropriately to excessive FX moves, Finance Minister says

- Japan repeats warnings on yen as market watches for intervention

- With weak yen, Japan aims to earn $34 billion from tourists next fiscal year

- Goldman, Lockheed results buoy Wall Street

- Wednesday, 19 October 2022

- Signs and portents for the U.S. economy:

- Oil up in tight market as U.S. sets release of more reserves

- U.S. single-family home starts fall to lowest level in more than two years

- Fed minions starting to be concerned about potential for bad effects from bigger rate hikes:

- Fed says firms gloomier on outlook, but inflation pressures easing

- Fed's Kashkari says labor shortages still a big issue for business

- Fed's Evans: Keeping unemployment below 5% would be 'good' outcome in inflation fight

- BOJ minions more okay with falling yen than stopping never-ending stimulus:

- BOJ policymakers rule out countering weak yen with rate hike

- Japan imports surge on weaker yen, fanning inflation fears

- ECB minions thinking about another big rate hike:

- Wall St ends red, Treasury yields climb on dour guidance and looming recession fears

- Thursday, 20 October 2022

- Signs and portents for the U.S. economy:

- U.S. weekly jobless claims fall

- Oil near flat, inflation worries counter potential boost in China demand

- U.S. container imports tumble as supply stress gives way to slack

- U.S. existing home sales slide again in September; jobless claims fall

- Fed minions want more rate hikes, worry about lockdown learning loss, and start thinking about keeping a lower profile:

- Fed's Harker says high inflation calls for more rate hikes

- Fed's Bowman says critical to address pandemic-related learning loss

- St. Louis Fed to 'think differently' about private events after Citi forum

- Bigger trouble developing in Canada, India, Germany:

- Canada recession may be ‘necessary evil’ as central bank queues big hike

- India's economic growth outlook stagnates, stuck in lower gear: Reuters Poll

- German producer prices rise more than expected in September

- BOJ, JapanGov minions working to keep value of yen from collapsing and never-ending stimulus alive:

- Yen softens past 150 per dollar for first time since 1990

- Japan ramps up intervention threats after yen slides past key 150 level

- BOJ conducts emergency bond buying to underpin debt market, but yields keep rising

- Wall Street ends lower as Fed worries outweigh earnings

- Friday, 21 October 2022

- Fed minions start signaling they want to slow down rate hikes:

- Fed's rate debate shifts to how, and when, to slow down

- Analysis (added on 25 October 2022) - Weekly Market Pulse: Did Powell Just Blink?

- Fed's Daly says it's time to start talking about slowing rate hikes

- Fed's Evans: need to get policy rate to a bit above 4.5%, then hold

- BOJ minions in hot seat as bigger trouble developing in Japan:

- Wall Street ends higher as hopes for less aggressive Fed grow

The CME Group's FedWatch Tool continues to project a three-quarter point rate hike when the FOMC next meets on 2 November 2022, but pulled back to project just a half point rate hike on 14 December (2022-Q4) following Friday's signals from the Fed. In 2023, the FedWatch tool now projects just a single half point rate hike in February (2023-Q1), setting the top for the Federal Funds Rate's target range at 4.75-5.00% and holding at that level for much of the rest of the year. Looking further forward, the FedWatch tool anticipates a quarter point rate cut in December (2023-Q4).

The Atlanta Fed's GDPNow tool's projection for real GDP growth in the recently ended calendar quarter of 2022-Q3 is +2.9%. The Bureau of Economic Analysis will provide its first official estimate of real GDP growth in 2022-Q3 on 27 October 2022, so the GDPNow tool should soon start forecasting real GDP for 2022-Q4.

Suppose, for a moment, that you are the super-villain in a James Bond movie. You want to make 007 suffer from prolonged dramatic tension before ultimately killing him. How would you do it?

In the following 15-minute Numberphile video, Matt Henderson explains how the dumbest way to solve a maze might be your ticket. Particularly if that maze involves flooding poison gas into one part, which then has to make its way to where Bond is tied up in another part of the maze to succeed. [To be fair, Henderson uses the example of poison gas killing a canary rather than James Bond, but the hypothetical outcome would be the same and we might as well raise the stakes for what's really a discussion about coding a simulation to solve a maze!...]

The path the "winning" poison gas molecule takes is determined by a random walk, or Brownian motion, in which it can change direction at any time.

Believe it or not, there are real world applications that utilize what Henderson calls the dumbest way to solve a maze. Labyrinth seals use maze-like structures called tortuous paths designed to either minimize the leaking of something you don't want to get out or to minimize potential contamination from something you don't want to get in.

But our favorite application is the Labyrinth Security Door Chain. Imagine being a Bond villain who puts those on every door in their secret lair!

Labels: math

Costco (NYSE: COST) recently made the news because of something the company didn't do. The wholesaler refused to raise the price of hot dogs sold at its food court:

Costco CFO Richard Galanti revealed last Thursday that its famous hot dog-and-soda combo deal of $1.50 will remain in place despite record-high inflation.

At an earnings call, Galanti said the profit margins the company is seeing in the gas and travel sectors allow Costco to make up for losses at the food court.

That's not necessarily news. Back in 2018, Costco's CEO Craig Jelinek approached company founder Jim Sinegal about raising the price of the company's hot dog and soda combo above the $1.50 price it has been held at since 1985. Here's what happened next:

“I came to (Jim Sinegal) once and I said, ‘Jim, we can’t sell this hot dog for a buck fifty. We are losing our rear ends.’ And he said, ‘If you raise the effing hot dog, I will kill you. Figure it out.’ That’s all I really needed. By the way, if you raised (the price) to $1.75, it would not be that big of a deal. People would still buy (it). But it’s the mindset that when you think of Costco, you think of the $1.50 hot dog (and soda).

“What we figured out we could do is build our own hot dog-manufacturing plant (in Los Angeles) and make our own Kirkland Signature hot dogs. Now we are doing so much hot dog business that we’ve opened up another plant in Chicago.

“By having the discipline to say, ‘You are not going to be able to raise your price. You have to figure it out,’ we took it over and started manufacturing our hot dogs. We keep it at $1.50 and make enough money to get a fair return.”

It's amazing what a CEO can do when properly motivated!...

But we wondered how other items on Costco's food court's menu have fared during the last several years, which includes both 2020's coronavirus pandemic that forced the company to shut down its food courts before being allowed to reopen them in 2021 when they were impacted by President Biden's inflation. To find out, we tracked down the following photo of a Costco food court menu with prices, which we think is from 2018 because it still shows the option of a Polish sausage along with the hot dog - they were eliminated from the menu in 2018:

Here's a more recent version of Costco's food court menu with prices from 17 October 2022:

We quickly find that prices for the twisted churros, mocha freezes, smoothies, ice cream, sodas, and chicken bakes have all increased. But if you look closer at the two menus, you'll find other changes as well.

In 2018, for example, you could get four different kinds of pizzas at Costco's food court: cheese, pepperoni, sausage, or a combo (featuring pepperoni, sausage, onions, and green peppers). In 2022, the available options have dwindled to just cheese and pepperoni.

You could also get a Chicken Caesar Salad in 2018. That choice is gone in 2022.

Let's take a closer look at Costco's hot dogs. In 2018, you weren't limited to ordering a hot dog - you could substitute a Polish sausage. You can't do that in 2022. Also notice the condiment selection shown on the 2018 menu photo - you could add pickle relish, onions, ketchup, mustard, or deli mustard to your order. The 2022 menu photo shows no condiments, but we can verify you can still put ketchup or mustard (but not deli mustard, pickle relish, or onions) on your Costco hot dog.

But wait, there's more! Several reports suggest the quality of Costco's continuing food court menu items have also declined over the last several years.

So let's review what Costco's CEO has figured out for the wholesaler's food court menu between 2018 and 2022:

- To keep hot dog prices the same, Costco built two factories to make its own hot dogs. [Side note: the company used a similar strategy to hold down the cost for its popular rotisserie chickens.]

- Costco raised prices for six other food and drink items it sells at its food court. Most of those price increases have taken place since 2020.

- Costco has eliminated options it previously offered for pizzas and condiments.

- Costco has degraded the customer-perceived quality of the food items it sells at its food courts. This can be considered a type of "shrinkflation".

Sounds like the CEO needs to figure it out some more.

Labels: business, inflation, personal finance

Do you remember 2021? Let's take a moment for a recap. When Joe Biden was sworn in as President of the United States on 20 January 2021, the U.S. national debt stood at $27.76 trillion. Just over eight months later, at the end of the U.S. government's 2021 fiscal year, the U.S. government's total public debt outstanding had risen to $28.43 trillion.

And now, one year after that, the U.S. national debt has risen to $30.93 trillion through the end of the U.S. government's 2022 fiscal year. That's an increase of $2.5 trillion over the past year and an increase of $3.17 trillion during President Biden's tenure in office.

To whom does the U.S. government owe all that money?

The following chart illustrates who the U.S. government's biggest creditors are as of the end of the U.S. government's 2022 fiscal year along with the portion of the national debt they are owed.

The Overall Picture

The U.S. Federal Reserve is once again Uncle Sam's single largest creditor, accounting for 18.3% of the entire U.S. government's national debt. The Fed's share of the total public debt outstanding has decreased from 19.1% a year ago, mainly as the Federal Reserve has all but stopped underwriting the U.S. government's new spending. Instead, since March 2022, the Federal Reserve has been hiking interest rates in a campaign to slow the rise of inflation that was unleashed by President Biden's spending.

With the Fed having raised interest rates above the near-zero level they were at when President Biden was sworn into office, U.S. individuals and institutions (banks, insurance companies, pension funds, etc.) have picked up most of the slack now that loaning money to Uncle Sam has become more worthwhile with higher interest rates. The share owned by this category of major national debt holders has increased from 37.7% to 42.1%.

Meanwhile, the share of the U.S. government's national debt owed to Social Security has continued falling from 9.2% to 8.9%. That's because Social Security has been running in the red since 2009, forcing its Old Age and Survivors' Insurance Trust Fund to sell off U.S. treasuries it accumulated when it was operating in the black so it can keep paying out benefits at promised levels. Social Security's share of the U.S. national debt is projected to decline to 0% in 2034. After that happens, Social Security benefits will be reduced by somewhere between 20-25% as promised under current law.

The retirement trust funds for the U.S. government's military and civilian employees together account for 6.6% of the total U.S. national debt, down from 7.1% in 2021.

Foreign entities collectively hold 24.3% of the total debt liabilities issued by the U.S. government, down from the share of 26.6% they held at the end of the U.S. government's 2021 fiscal year. Of the portion of the national debt owed to foreign-based institutions, Japan continues to hold the greatest share at 3.9% of the U.S. national debt based on preliminary estimates, down from its 2021 share of 4.6%. China comes in second holding a share of 3.8%, falling from a share of 4.6% in 2021. Both countries have been selling off their holdings of U.S. government-issued debt securities to keep their currencies from losing too much value with respect to the U.S. dollar.

The international banking centers of Belgium, Ireland, and Luxembourg saw their share of the U.S. government's total public debt outstanding dip from 3.0% to 2.8%, while the United Kingdom saw its share slightly rise from 2.0% to 2.1%. Brazil and the remaining foreign nations saw their shares of the U.S. national debt dip year over year.

The following waterfall chart breaks down where most the money the U.S. government newly borrowed during its 2022 fiscal year came from:

About the Data

These figures represent the most current information available as of 18 October 2022, which for the total public debt outstanding is fully current through 30 September 2022. The Federal Reserve's holdings is current through 28 September 2022, data on U.S. government entity holdings is current through September 2022, and data for foreign holdings is based on estimates through August 2022 that were released on 18 October 2022.

Labels: national debt

When will the National Bureau of Economic Research find the U.S. economy went into recession?

That may seem like a strange question to ask, considering that the U.S. economy shrank in two consecutive quarters earlier in 2022, which qualifies as a "technical recession". That is a definition the U.S. government has previously coded into law to permit the U.S. Congress to fast-track a fiscal response when recessions are still developing.

But it's not the definition used by the NBER's academic economists, whose jobs do not require them to make policy decisions that affect people's lives when it matters. Instead, they're concerned with finding the tops and bottoms of business cycles in the national economy, which can take them a year or longer to identify after the fact.

Fortunately, there are tools we can use to determine what the probability is that the NBER will find a particular point of time marks both the end of a rising business cycle and the beginning of a national recession. One of those is the Recession Probability Track, which visually illustrates how that probability changes over time. For its 2022 return, we've set it to start from 20 January 2021 to show how the likelihood of an NBER recession declaration has evolved during President Biden's tenure in office:

The Recession Probability Track is based on Jonathan Wright's yield curve-based recession forecasting model, which factors in the one-quarter average spread between the 10-year and 3-month constant maturity U.S. Treasuries and the corresponding one-quarter average level of the Federal Funds Rate. If you'd like to do that math using the latest data available to anticipate where the Recession Probability Track is heading, we have a very popular tool to do the math!

As of 17 October 2022, the Recession Probability Track indicates a 6.6% probability of recession, or rather, roughly a 1-in-15 chance the NBER will identify a month between October 2022 and October 2023 as the peak from which a recession in the U.S. began.

That probability may seem low, but our previous series featuring the Recession Probability Track peaked with a 11.3% probability of a recession starting sometime between September 2019 and September 2020. Ultimately, it wasn't how the Fed was setting interest rates or the spread between 10-Year and 3-Month treasuries that threw the U.S. into recession, but rather policy actions by California Governor Gavin Newsom mandating the country's first statewide COVID lockdown that threw the U.S. economy immediately into recession during March 2020.

It only took the NBER's analysts three and half months after that event to identify February 2020 as the peak the preceding business cycle and Month 0 of the Coronavirus Pandemic Recession. You can see why their determinations are not what anyone in positions of responsibility should rely upon when policy decisions about how to respond to developing recessions need to be made.

Instead, it's much more useful to follow what CEOs or professional forecasters are saying. Right now, they're giving much higher odds of a recession taking hold in the next 12 months than Wright's more slow-moving forecasting method.

For the latest updates of the U.S. Recession Probability Track, follow this link!

Labels: recession forecast

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.