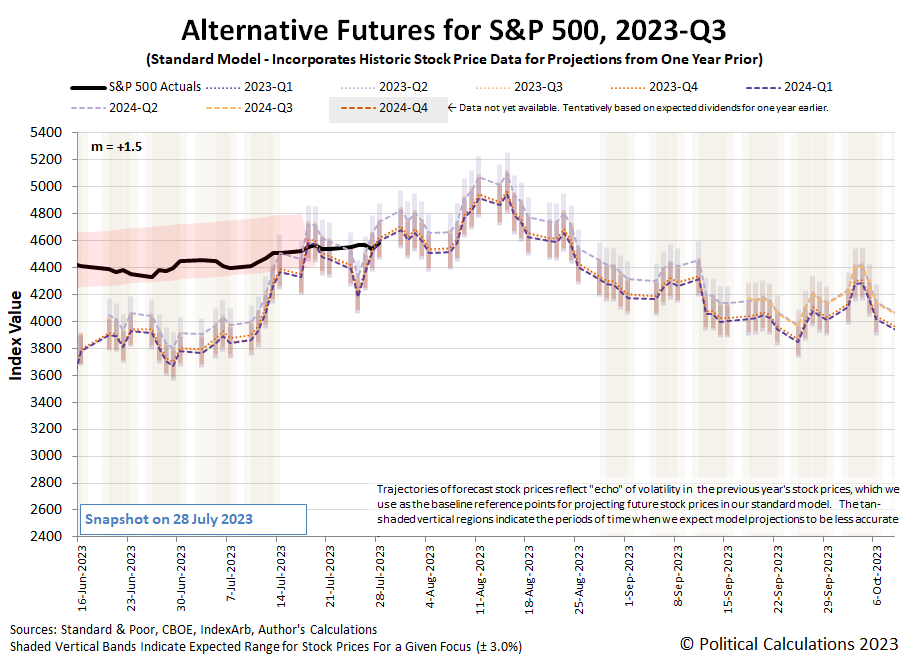

The S&P 500 (Index: SPX) rose 1% during the fourth and final week of July 2023. The index closed out the trading week at 4582.23.

The major market-moving news event of the week was the Federal Reserve's quarter point rate hike, which it announced on Wednesday, 26 July 2023. And though Fed Chair Jay Powell did his best to try to convince anyone listening the Fed was looking to increase the Federal Funds Rate higher at the following press conference, investors weren't buying it.

Instead, after watching the Fed hike the Federal Funds Rate to a target range of 5.25%-5.50%, the CME Group's FedWatch Tool now projects no future rate hikes through April 2024, six weeks longer than what they expected before the Fed's meeting. The FedWatch Tool then anticipates a series of quarter point rate cuts will begin as early as 1 May (2024-Q2) that are expected to continue at six-to-twelve-week intervals through the end of 2024.

The latest update to the alternative futures chart shows the trajectory of the S&P 500 is consistent with what the dividend futures-based model predicts it would be if investors were focusing their forward looking attention on either 2023-Q4 or 2024-Q1. Although there's very little difference between the alternate future trajectories projected by the model, we'll assume investors are looking ahead to the fourth quarter of 2023 until we have more evidence to indicate otherwise.

We use the Federal Reserve's regularly-paced announcements of how it will set the Federal Funds Rate as calibration events to determine the value of the multiplier (m) for the dividend futures-based model. Since 9 March 2023, we've observed the value of multiplier is approximately 1.5, which continues to hold after the Fed's July 2023 announcement.

Other stuff happened during the week to affect the trajectory of stock prices in the U.S. Here's our summary of those market-moving headlines.

- Monday, 24 July 2023

-

- Signs and portents for the U.S. economy:

- Bigger trouble, stimulus developing in China:

- China property giants tumble as cash crunch bites

- China to step up policy adjustments amid tortuous recovery

- JapanGov minions want BOJ minions on board for hitting inflation target:

- ECB minions excitement growing over next rate hike despite worsening Eurozone economy:

- Factbox-Brokerages ramp up ECB rate hike bets on sticky inflation, hawkish policymakers

- Worsening euro zone business downturn reignites recession fears

- Dow leads Wall Street higher as investors eye beyond tech

- Tuesday, 25 July 2023

-

- Signs and portents for the U.S. economy:

- Fed minions hurt there won't be a happy dance:

- Bigger stimulus developing in China:

- ECB minions getting results they wanted:

- Dow notches longest win-streak since Feb. 2017, Nasdaq, S&P close with gains

- Wednesday, 26 July 2023

-

- Signs and portents for the U.S. economy:

- US commercial property delinquencies rise further in July -report

- US new home sales fall, but trend remains strong

- Oil falls 1% after Fed rate hike, smaller-than-expected US crude stockdraw

- Fed minions do the expected, threaten to hike rates again, claim there will be no recession:

- Fed lifts rates, Powell leaves door open to another hike in September

- Fed staff drop US recession forecast, Powell says

- ECB minions getting new problems to think about:

- European banks flag bad loan risks as global economy falters

- Euro zone lending slows further as rate hikes bite

- Nasdaq, S&P falter; Dow matches record longest win-streak with 13th straight day in green

- Thursday, 27 July 2023

-

- Signs and portents for the U.S. economy:

- Oil settles above April peak on tighter supply

- US bank regulators announce sweeping proposals on capital rules

- US pending home sales rise for first time since February

- Bigger trouble developing in the Eurozone:

- Other central banks go into copycat mode:

- Gulf central banks raise key interest rates by 25 bps, mirroring Fed

- Hong Kong central bank raises interest rate after Fed hike

- Thai central bank to hike rates by 25 bps on Aug. 2, ending tightening cycle - Reuters poll

- ECB raises key rate to historic high, keeps options open

- ECB fans talk of September pause after raising rates to 23-year high

- But the BOJ minions have something different in mind:

- Japan to maintain accommodative policy - govt official quotes BOJ's Ueda

- BOJ seen keeping ultra-low rates, may debate tweak to yield cap

- Bigger trouble, stimulus developing in China:

- China industrial profits extend double-digit slide on weak demand

- China to boost credit support to consumer sector - regulator

- Wall Street closes down, Dow snaps longest winning streak since 1987

- Friday, 28 July 2023

-

- Signs and portents for the U.S. economy:

- Oil posts fifth week of gains on signals of tighter supply

- US annual inflation slows in June, consumer spending solid

- Softening inflation props up U.S. consumer sentiment

- Bigger trouble, stimulus developing in China:

- China factory activity likely to contract for fourth month in July: Reuters poll

- China's housing minister urges efforts to strengthen property recovery

- BOJ minions tweak never-ending stimulus:

- ECB minions starting to have second thoughts about more rate hikes:

- ECB's Stournaras says further interest rate rise in September 'looks difficult'

- ECB contemplates end of rate hikes as outlook worsens

- Intel results, soft inflation data boost S&P, Dow; Nasdaq posts best day since late May

The BEA's first estimate of real GDP growth in the second quarter of 2023 came in at 2.4%, in line with the final projection of the Atlanta Fed's GDPNow tool. That tool is now looking at the current quarter of 2023-Q3, where its first estimate of the real GDP growth rate 3.5%.

Image credit: Photo by Daniel Lloyd Blunk-Fernández on Unsplash.

It's a typical day for any scientist or engineer. You're doing some calculations while playing around with the fundamental forces of nature and... you suddenly realize that what you're doing could have fatal consequences. As in the potential death toll starts in the dozens, if not hundreds or thousands. Worst case, you find what you're doing could cause the apocalypse.

Movie fans who hung around after watching Barbie to also watch Oppenheimer as part of the "Barbenheimer" social media-inspired double feature craze recently become aware that's a thing the people that do this kind of work deal with on a daily basis. Admittedly, for many of these fans, seeing the main character of Oppenheimer getting all worked up over results of math that suggested a runaway nuclear reaction could end the world could be a real consequence of detonating an atomic bomb caused a real head rush.

So what's in the math that Robert Oppenheimer did that made him think the proverbial end of the world was something that had a non-zero chance of happening because of the work he was doing? Welch Labs explains the math Oppenheimer did in the following short video:

We now return you to the world that continued muddling through when the invention of the atomic bomb didn't cause it to end.

Labels: math, movies, technology

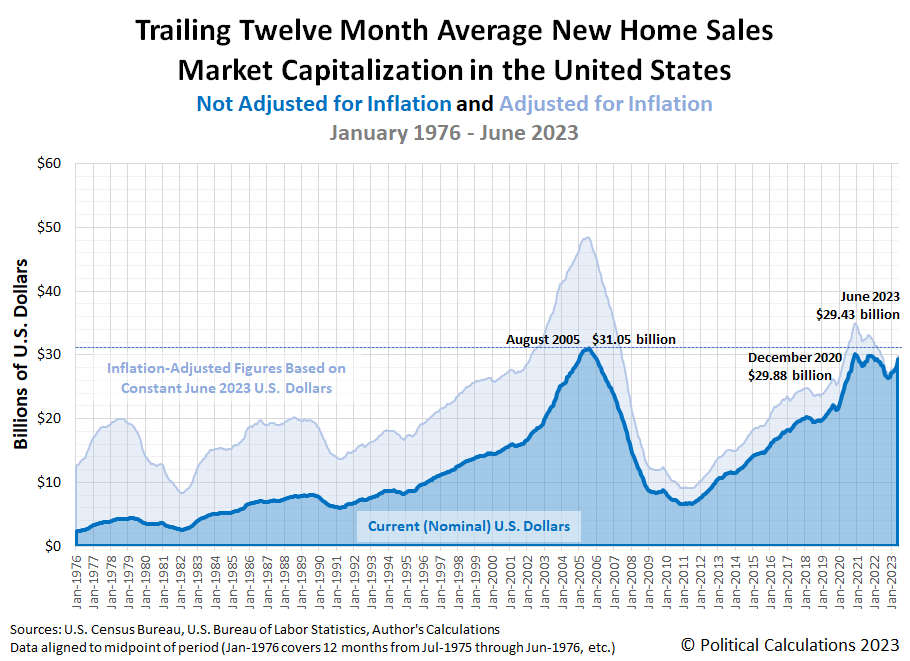

June 2023 saw continued upward momentum for new home sales in the United States. The initial estimate of the market cap of the U.S. new home market during the month is $29.43 billion, which at first glance, would appear to have dipped by a near-trivial amount from May 2023's initial estimate of $29.44 billion.

But that would not take the downward revisions to the three previous months estimated number of new home sales into account. After those adjustments, June 2023's initial market cap estimate represents a 3.4% increase from April 2023's revised market cap estimate of $28.46 billion.

Meanwhile, the average new home sale price increased by a small margin. June 2023's initial new home sale price estimate of $494,700 is up by 1.5% from the previous month's initial estimate of $487,300 and by 1.2% from May 2023's revised average new home sale price of $487,300.

Altogether, we find the rising trend for the market capitalization of the U.S. new home market is continuing. Here is the latest update to our chart illustrating the market capitalization of the U.S. new home market:

The next two charts show the latest changes in the trends for new home sales and prices:

Reuters finds the gloom in June 2023's data, but cannot deny what's still an unbroken rising trend for new home sales since November 2022:

Sales of new U.S. single-family homes fell in June after three straight monthly increases, but the trend remained strong as an acute shortage of previously owned homes underpins demand.

Reuters later goes on to echo our analysis from last month:

With the inventory of existing homes near historically low levels and multiple offers on some properties, potential buyers are seeking out new houses, driving up homebuilding. Many homeowners have mortgage loans with rates below 5%, reducing the incentive to put their houses on the market.

The rate on the popular 30-year fixed mortgage is just under 7%, according to data from the Mortgage Bankers Association.

The shortage is also boosting house prices, which had been in retreat or declining earlier this year as higher mortgage rates pushed buyers to the sidelines. According to the National Association of Home Builders, fewer builders were offering incentives, including cutting prices to increase sales.

Rising mortgage rates plus rising new home sale prices is a recipe for rising unaffordability for American consumers. We'll take a closer look at that aspect of the new home market in the near future.

References

U.S. Census Bureau. New Residential Sales Historical Data. Houses Sold. [Excel Spreadsheet]. Accessed 26 July 2023.

U.S. Census Bureau. New Residential Sales Historical Data. Median and Average Sale Price of Houses Sold. [Excel Spreadsheet]. Accessed 26 July 2023.

Image credit: New Home Construction by by Paul Brennan via PublicDomainPictures.net. Creative Commons. CC0 1.0 Universal (CC0 1.0) Public Domain Dedication.

Labels: real estate

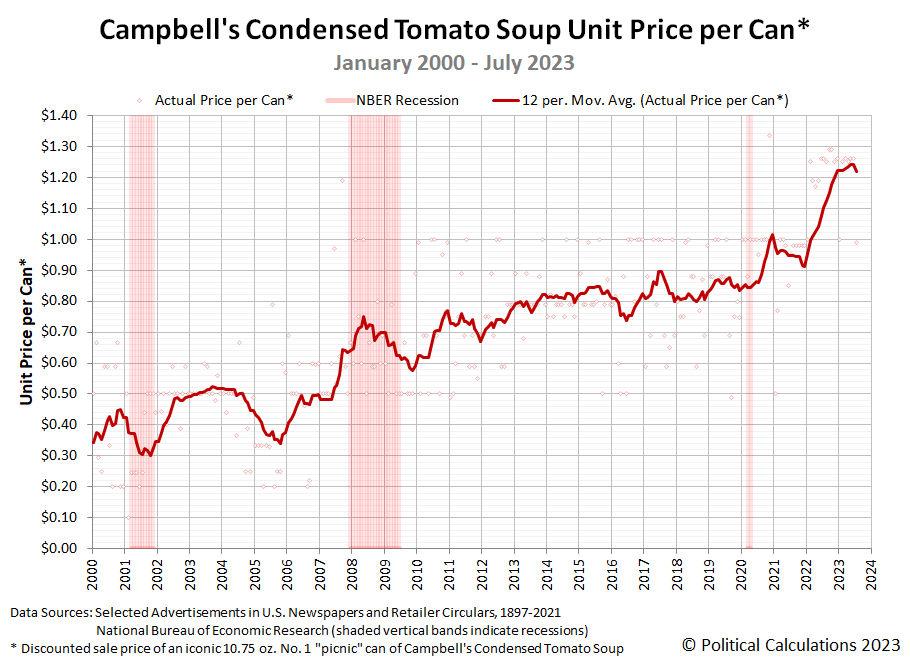

The pace of price increases affecting Campbell's Condensed Tomato Soup have slowed!

That's a positive development as the price of the iconic Number 1 size can of Campbell's condensed tomato soup has mostly held steady since the end of 2022. If you're a sharp-eyed shopper, you might also have been able to find it being sold at a deeply discounted price of 99 cents, which until 2021, represented the most you would ever have to pay for a can of America's most famous tomato soup.

For most Americans today, the typical price they pay is at least 25% higher than that. Depending on where they shop for tomato soup, it can be even higher.

We checked in with our ten major national or regional grocers. Here's what we found when we sampled their prices for Campbell's condensed tomato soup in July 2023 and compared them to our sampling from January 2023. We'll warn you in advance there's one really big coincidence....

- Walmart: $1.26/each, unchanged

- Amazon: $1.26/each, decrease of $0.33 (-20.7%)

- Kroger: $0.99/each, decrease of $0.01 (-0.1%)

- Walgreens: $2.29/each, increase of $0.30 (+15.1%), unchanged or unchanged at $1.50/each when you buy two cans

- Target: $1.39/each, unchanged

- CVS: $1.89/each, temporarily reduced $0.40 (-17.5%), or unchanged at $1.50/each when you buy two cans

- Albertsons: $1.69/each, increased $0.40 (+31.0%)

- Food Lion: $1.25/each, unchanged

- H-E-B: $1.31/each, increase of $0.02 (+1.6%)

- Meijer: $1.29/each, unchanged

The one big coincidence involves catching Kroger having discounted its price for Campbell's Condensed Tomato Soup from its regular price in both January 2023 and July 2023. In between these months, Kroger shoppers would have paid $1.29 per can, the price it will go back to once this month's promotion has ended.

Those occasional sale prices are important however, because Kroger's family of grocery stores is one of the highest volume purveyors of Campbell's Tomato Soup. So much so we factor its promotions into our rolling twelve-month average of the price Americans pay for a 10.75-oz can of condensed tomato soup. Its periodic discounts have played a large role in holding the price of tomato soup relatively steady in a range between $1.22 and $1.24 in our accounting during 2023.

For its part, Campbell Soup (NYSE: CPB) has not announced any new price increases since it announced its fourth wave of Biden-era price hikes in December 2022.

Here's how the company's CEO Mark Clouse described the business outlook for its soups at its 2023-Q3 earnings call on 7 June 2023.

Dollar consumption was essentially flat versus prior year, reflecting inflation-driven pricing mitigated by below historical norm elasticities and some increasing share pressure. As competitors improve supply, we are seeing some increased promotional activity. On a net sales basis, soup was down 11%, primarily reflecting the disproportionate impact of cycling the inventory recovery from a year ago, which accounts for the majority of this decline.

Strategically, we continue to believe strongly in our ability to grow the soup business and are pleased with the progress we've made in leading the renewed relevance of the category over the last four years. For example, the improved relevance of condensed soup, especially cooking, where we have supported the growth of in-home meals. Importantly, this has attracted new younger consumers to Campbell's.

In addition to cooking, our condensed eating icons, including Chicken Noodle and Tomato, are also up significantly from pre-COVID levels, providing a strong foundation for our business. However, some flankers like Healthy Request in our Kids' flavors, which have been key drivers of recent share softness, remain an area of opportunity.

Next is the complete restage and growth of Chunky Soup. This brand has been fundamentally transformed from a product purchase primarily on deep discount promotion to a great everyday value with a compelling position that focuses on protein and quick in-home lunches. This positioning has been particularly relevant with younger consumers, especially given the current economic climate and in contrast to higher-priced frozen food or away-from-home options.

The impressive four-year growth in dollar consumption up 31% and share of 2 points has been fueled by great marketing, effective inflation-driven pricing, and innovation like our Spicy line. We did experience a step-up in some competitive pressure in Q3, but we're already seeing the return to share growth, up 1 point in the latest four weeks.

Put a little more simply, Campbell Soup is positioning its soup products as a more affordable option compared other foods (not just soups). In doing so, the company is counting on American consumers to turn its products as they try to conserve money in the ongoing higher inflation environment.

As for the inflation they've seen, the four waves of price increases they've implemented combined with their efforts to operate more efficiently have helped "mostly offset" the increases they've experienced in their costs of doing business during the past two years.

For the latest in our coverage of Campbell's Tomato Soup prices, follow this link!

Previously on Political Calculations

Political Calculations' analysis of Campbell's Tomato Soup dates back to 2015! Along the way, we've filled in the gaps we had in the historic price data and have explored America's second-most popular soup from a lot of different angles.

- The Price of Campbell's Tomato Soup Since 1897 (2015)

- The Tomato Soup Standard (2015)

- The First Ad Ever for Campbell's Condensed Tomato Soup (2015)

- War and Soup (2015)

- Working Backwards from Retail to Cost (2015)

- Early Advertising Milestones for Campbell's Condensed Soups

- Updated: The Price of Campbell's Tomato Soup Since 1897 (2016)

- Everyday Low Prices (2017)

- Soup and Recession (2017)

- Soup and Steel Tariffs (2018)

- Tomato Soup, Oil and Inflation (2018)

- Celebrating 150 Years of the Campbell's Soup Company (2019)

- The Price History of Campbell's Tomato Soup (2020)

- Campbell's Tomato Soup Sales Soar as Americans prep for Home Quarantines (2020)

- Campbell's Soup Presents "The Magic Shelf" (2020)

- The Price of Campbell's Tomato Soup in the Coronavirus Pandemic (2021)

- The Pandemic Price Escalation of Campbell's Tomato Soup (2021)

- Shrinkflation and a New Tool to Track Price Inflation in Real Time (2021)

- Absence of Discounts Confirms Tomato Soup Inflation (2021)

- The Ship of Theseus and Campbell's Tomato Soup (2021)

- The S&P 500 and Campbell's Tomato Soup (2021)

- Upward Price Pressure at the Start of Soup Season (2021)

- Recent Price Trends for Campbell's Tomato Soup (2021)

- The Price History of Campbell's Tomato Soup (2022)

- Campbell's Tomato Soup Prices Explode Higher (2022)

- Major Grocers Continue Hiking Tomato Soup Prices (2022)

- Campbell's Tomato Soup Prices Keep Escalating (2022)

- Campbell's Soup to See Third Wave of Price Increases (2022)

- Amazon Hikes Campbell's Tomato Soup Prices (2022)

- Cost of Campbell's Tomato Soup Keeps Rising (2022)

- The Price History of Campbell's Tomato Soup (2023)

Image credit: Campbell's Tomato Soup Can photo by Girl with red hat on Unsplash.

Labels: soup

As expected, the probability that a recession will start in the U.S. economy has breached the 80% threshold over the past six weeks.

That development occurred despite the Federal Reserve's decision to pause its series of rate hikes that began back in March 2022 at the end of its 14 June 2023 meeting. Now, on the cusp of its July 2023 meeting, the Fed looks set to implement another quarter point rate hike in the Federal Funds Rate.

Doing that however will prompt the odds of recession to increase a little faster. The rise in that probability had slowed during the past six weeks in the absence of a rate hike in June 2023.

The latest update to the Recession Probability Track shows how the recession odds are progressing.

The Recession Probability Track shows the current probability of a recession being officially determined to have begun sometime in the next 12 months, between the dates of 24 July 2023 and 12 July 2024, is 80.8%.

In six weeks, the probability the National Bureau of Economic Research will identify a month between September 2023 and September 2024 as marking a peak in the U.S. business cycle before the economy enters a period of contraction will be higher.

Analyst's Notes

The Recession Probability Track is based on Jonathan Wright's yield curve-based recession forecasting model, which factors in the one-quarter average spread between the 10-year and 3-month constant maturity U.S. Treasuries and the corresponding one-quarter average level of the Federal Funds Rate. If you'd like to do that math using the latest data available to anticipate where the Recession Probability Track is heading, we have a very popular tool to do the math.

For the latest updates of the U.S. Recession Probability Track, follow this link!

Previously on Political Calculations

We started this new recession watch series on 18 October 2022, coinciding with the inversion of the 10-Year and 3-Month constant maturity U.S. Treasuries. Here are all the posts-to-date on that topic in reverse chronological order, including this one....

- Probability of Recession Starting in Next 12 Months Breaches 80%

- U.S. Recession Probability on Track to Rise Past 80%

- U.S. Recession Probability Reaches 67%

- U.S. Recession Probability Shoots Over 50% on Way to 60%

- Recession Probability Nearing 50%

- Recession Probability Ratchets Up to Better Than 1-in-6

- U.S. Recession Odds Rise Above 1-in-10

- The Return of the Recession Probability Track

Image credit: Recession by Mike Lawrence via flickr. Creative Commons. Attribution 2.0 Generic (CC BY 2.0).

Labels: recession forecast

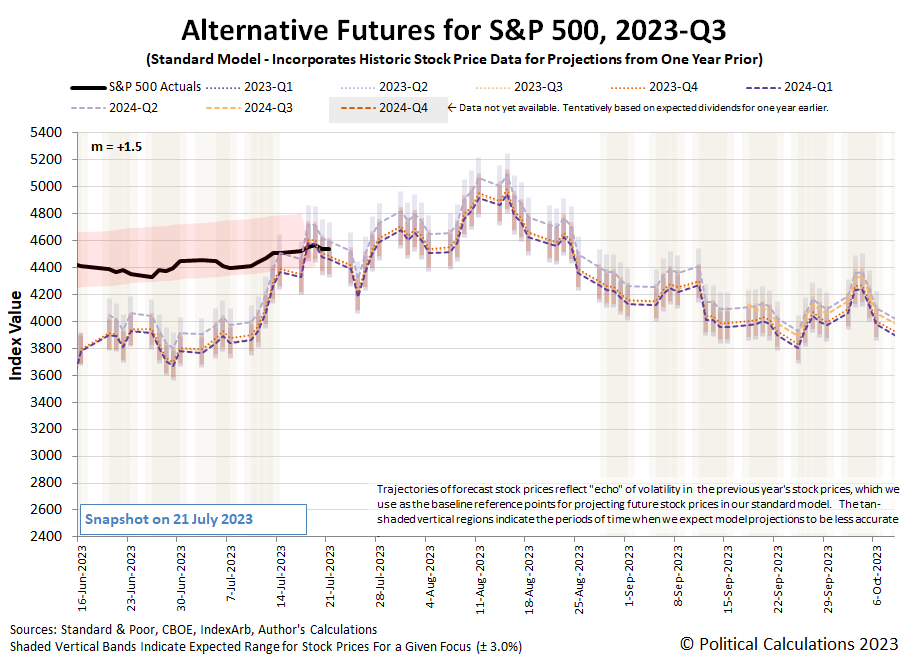

The S&P 500 (Index: SPX) continued its upward trajectory in trading week ending 21 July 2023. The index closed the week at 4536.34 with a week-over-week gain of 0.7%.

The main factors lifting the market during the week were positive bank earnings reports and additional data indicating tamer-than-previously expected inflation. Of these, the positive news for banks, particularly regional banks that reports earnings during the week, boosted the market because it indicates the negative factors that sunk Silicon Valley Bank, Signature Bank, and First Republic Bank earlier in the year are now relatively contained.

The news pointing to tamer-than-expected inflation was also positive, because it reduced the probability of another rate hike beyond the quarter point increase in the Federal Funds Rate expected to be announced at the end of the Fed's two-day meeting next week on Wednesday, 26 July 2023. In the previous edition of the S&P 500 chaos series, investors were giving a greater-than-50% probability of one more rate hike that would take place during 2023-Q4, which now appears off the table.

Investors however remain focused on 2023-Q4 after having set their forward-looking attention on that quarter in the previous week. The following update to the dividend futures-based model's alternative futures chart shows the level of the S&P 500 at the end of the third week of July 2023 is consistent with that forward time horizon.

The chart also shows we've fully exited the period of the redzone forecast range we first added to the chart in early April 2023. Longtime readers know we add these ranges to the alternative futures chart when we recognize the past volatility of stock prices, which the dividend futures model uses as the base reference points for projecting the future for the S&P 500 index, will affect the accuracy of its projections for a sustained period of time by more than a few percent.

Because this latest redzone forecast range spans such a long period of time and breaks across regular calendar quarters, we thought it might be interesting to show it all in one chart. The following chart covers the period from 30 March 2023, or shortly before the last redzone forecast range was first added to the alternative futures chart, through 21 July 2023, which extends several days past the end of the added forecast range. We've also animated the chart to show how the forecast range changed between the snapshot dates of 6 April 2023 and 21 July 2023.

Perhaps the most remarkable thing illustrated by the chart is how little the projected future level of the forecast range changed from the "before" to the "after" snapshot. Stock prices largely behaved as expected, within the range expected, over the 15 weeks covered by the redzone forecast range.

Let's wrap up both these charts with our summary of the past week's market moving headlines:

- Monday, 17 July 2023

-

- Signs and portents for the U.S. economy:

- US bank mergers frozen by capital rules, regulatory uncertainty

- Oil dips over 1.5% on demand fears after weak Chinese data

- Bigger trouble, stimulus developing in China:

- Bigger trouble developing in the Eurozone:

- S&P, Dow kick off busy earnings week with small gains, Nasdaq rises nearly 1%

- Tuesday, 18 July 2023

-

- Signs and portents for the U.S. economy:

- US retail sales rise moderately; economy plodding along

- US manufacturing output falls in June; rebounds in second quarter

- Bigger stimulus developing in China:

- BOJ minions say they'll keep never-ending stimulus alive:

- Other central bank minions changing direction:

- Australia central bank hit pause as policy clearly restrictive, risking growth

- Two Polish central bankers say rate cut could come this year

- ECB minions thinking about looking at inflation data in the future:

- Bank results lift stocks; Dow up for seventh straight session

- Wednesday, 19 July 2023

-

- Signs and portents for the U.S. economy:

- Economists see July 2023 end to Fed minions' rate hikes:

- Bigger trouble, stimulus developing in China:

- China's sagging economy looms over quarterly results around the world

- China to increase support for private companies to bolster economy

- Changing inflation winds for central banks:

- Nasdaq, S&P, Dow end higher as earnings season heats up; eyes on Tesla, Netflix results

- Thursday, 20 July 2023

-

- Signs and portents for the U.S. economy:

- Oil settles higher amid low crude stocks, cautious economic outlook

- US labor market still tight; housing market slump persists

- US existing home sales fall; annual house price decline slows

- Fed minions get into instant payments game:

- Bigger trouble developing in China:

- Chinese professor says youth jobless rate might have hit 46.5%

- Exclusive-China's state banks seen selling dollars offshore to slow yuan declines - sources

- JapanGov minions say BOJ minions can expect to see more inflation, slow economy:

- Japan's govt sees inflation sharply exceeding BOJ target

- Japan exports underwhelm in June, global weakness drags on economy

- Economists expect ECB minions to deliver at least two more rate hikes:

- Tesla, Netflix pull Nasdaq and S&P lower, Dow ends higher

- Friday, 21 July 2023

-

- Signs and portents for the U.S. economy:

- Oil rallies higher for fourth straight week on tightening supply

- U.S. banks warn of interest income weakness after upbeat quarter

- Bigger stimulus developing in China:

- China seeks to boost demand by pushing urban development - state media

- China's steps to boost sales of cars, electronics disappoint market

- BOJ minions get mixed message on whether to tweak never-ending stimulus:

- Japan's inflation may have peaked, no imminent change seen to BOJ policy

- Japan's govt sees inflation sharply exceeding BOJ target

- ECB minions expected to deliver quarter point rate hike next week:

- S&P, Dow post solid weekly gains while Nasdaq retreats as tech takes a break

The CME Group's FedWatch Tool continues to project the Federal Reserve will hike the Federal Funds Rate by just a quarter point to a target range of 5.25-5.50% after it meets next week on 26 July (2023-Q3). Looking beyond that, the FedWatch Tool now says that's the peak for the Fed's series of rate hikes that began back in March 2022, where rates will hold at that level through January 2024. The tool then anticipates the Fed will swing into reverse and start cutting rates by a quarter point at six-to-twelve week intervals during 2024.

The Atlanta Fed's GDPNow tool estimate of the real GDP growth rate for current quarter of 2023-Q2 ticked up to +2.4% from the +2.3% growth rate projected a week earlier.

Image credit: Charging Bull Statue by Petr Kratochvil via PublicDomainPictures.net.

The last several weeks have provided examples of what's possible when you replace traditional fireworks displays with color LED-illuminated aerial drone shows. Let's start with Vivid Sydney's "Written in the Stars" drone show, which used 1,260 drones to put on an 11 minute show on 28 May 2023:

The next aerial spectacular was presented as part of Shenzhen's Boat Festival, featuring some 1,400-1,500 drones to execute the precision flying needed to produce the following visual effect that lasts a little over half a minute:

The final video is about three-and-a-half minutes long and presents a performance that captured a Guinness World Record for "longest aerial sentence", which was formed by 1,002 multirotor drones at Dallas-Fort Worth's Fourth of July celebration.

Drone shows have come a long way in a short period of time. More than anything else, these videos show their future potential because after seeing them, you want to see both more and better displays.

Labels: technology

We live in the world of big data. Some of it is very useful. Some of it not so much. In that world, into which category would you guess the Index of Leading Economic Indicators might fall?

The composite index of Leading Economic Indicators (LEI) is a monthly index that uses ten economic components to predict future economic movements. It has been published by The Conference Board since 1995, when the private think tank took over the task of tracking the business cycle indicators that had previously been reported by the U.S. Bureau of Economic Analysis going back to the 1930s.

The LEI is designed to provide a broad-based look at the health of the economy and to predict turning points in the business cycle based on its ten components, which include:

- Average weekly hours, manufacturing

- Average weekly initial claims for unemployment insurance

- Manufacturers’ new orders, consumer goods and materials

- ISM® Index of New Orders

- Manufacturers’ new orders, nondefense capital goods excluding aircraft orders

- Building permits, new private housing units

- Stock prices, 500 common stocks

- Leading Credit Index™

- Interest rate spread, 10-year Treasury bonds less federal funds

- Average consumer expectations for business conditions.

The composite index combines all these factors into a single value aimed at analysts who need to make informed forecasts and decisions based on how it changes from one month to the next. The Conference Board claims it is a good indicator of what’s going to happen in the economy and can be correlated with business cycles and economic conditions. On paper, it sounds great.

But is it really as good as it's cracked up to be?

Back in 2010, Justin Fox asked a number of analysts what they thought were the most overrated economic datapoints. The Index of Leading Economic Indicators was the most commonly cited example they identified.

For example, here's how Goldman Sachs' Jan Hatzius responsded when asked Fox' broad question:

"My entry is the index of leading indicators, because it consists entirely of already-released information and the Conference Board’s forecasts, without adding new hard information."

The Economic Outlook Group's Bernard Baumohl took the criticism of the Conference Board's LEI to the next level:

"I would nominate the Index of Leading Economic Indicators by the Conference Board as one that most induces narcolepsy when it is released. This measure is merely a composite of other hi-frequency indicators that have already been published weeks earlier. So there’s nothing inherently new in the LEI—and thus the least useful in my opinion."

But that didn't hold a candle to the fire Lakshman Achuthan directed at the index as he faulted its then-recent performance:

Conference Board LEI because, even though its whole purpose is to predict recessions and recoveries, it has consistently failed to do so in real time. Case in point was April 2009, when its latest release showed a big drop—and without a single monthly uptick since June 2008, the Conference Board spokesman declared, “There’s no reason to think that this recession is going to end any time this spring or this summer”—when ECRI was predicting that the recession would indeed end by last summer.

All these observations date from 2010. Has the Index of Leading Economic Indicators proven itself to be useful in the thirteen years since?

Not according to John Authers, who unloaded on the LEI in a Bloomberg opinion piece in January 2023. Because that article is behind a paywall, we asked ChatGPT to summarize Authers' observations of what's wrong with the Index of Leading Economic Indicators using five bullet points.

- The leading economic indicators are not leading indicators but concurrent ones.

- They drop more or less exactly in line with a fall in the economy.

- So it’s not as though these are much use in showing the way.

- Not only that, but at the point of publication, they’re actually lagging information.

- There is nothing in the Leading Index that tells you something you already don’t know. So they’re not leading, they’re lagging, and they’re not indicating anything very much — except perhaps that human inattention is a constant.

Perhaps when the composite index was first presented in 1938, it represented a more timely means of compiling a picture of developing trends in the national economy from very different data streams. Ninety years later, it appears the world of big data has pretty much passed it by, where it no longer provides the value it once did.

Previously on Political Calculations

- Less Than Useful Data in the World of Big Data

- Less Than Useful Data: Consumer Confidence

- Less Than Useful Data: FHFA House Price Index

- Less Than Useful Data: Index of Leading Economic Indicators

Image credit: Useless information by Patrick Mackie/Geograph Britain and Ireland via Wikimedia Commons. Creative Commons. Attribution-ShareAlike 2.0 Generic (CC BY-SA 2.0).

How long does excess CO₂ stay in the atmosphere?

That question is surprisingly difficult to answer, because unlike greenhouse gases like methane (11.8 years) or nitrous oxide (109 years), climate scientists say there are multiple answers to it. Those answers include ones that apply when the cumulative accumulation of carbon dioxide in the atmosphere is low, as in the past-to-present period, or when the accumulation of CO₂ in the air reaches the much higher levels they project in the future.

And then there's the complexity of the carbon cycle itself. Some parts of that process start almost immediately. Other parts take place over decades, if not centuries. And that's before we get to the geological processes that take millennia!

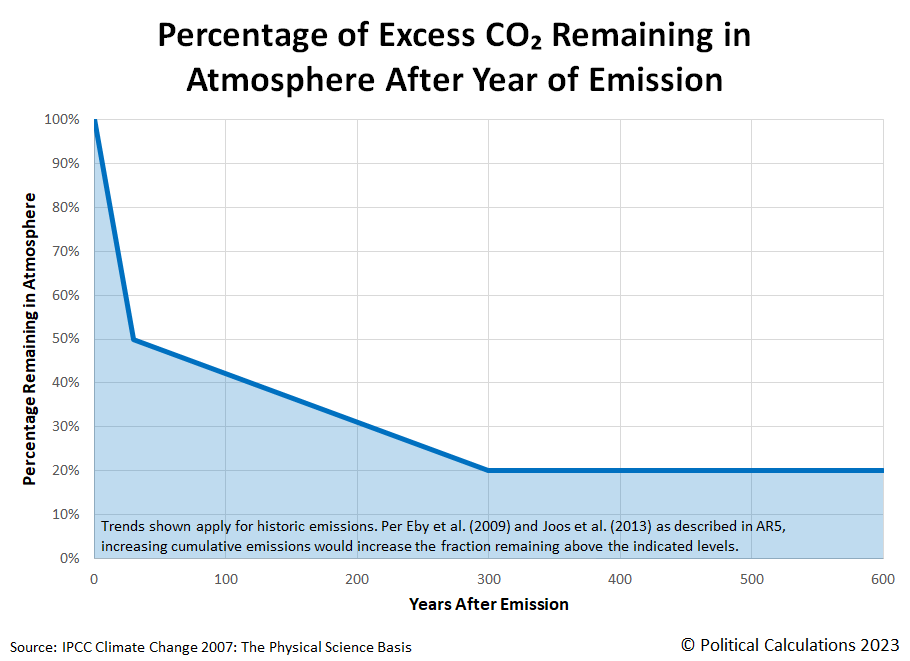

Because we have an upcoming project that focuses on the past-to-present period, we've put together the following chart and tool to estimate how much of a given year's excess carbon dioxide emissions remain after a given number of years. Here's the chart, which is based on estimates published by the Intergovernmental Panel on Climate Change (IPCC) in 2007.

Here's the description of what the chart is illustrating:

Carbon dioxide cycles between the atmosphere, oceans and land biosphere. Its removal from the atmosphere involves a range of processes with different time scales. About 50% of a CO₂ increase will be removed from the atmosphere within 30 years, and a further 30% will be removed within a few centuries. The remaining 20% may stay in the atmosphere for many thousands of years.

Later findings from May 2009 indicate the drawdown of excess CO₂ "is accurate for relatively small amounts of emissions at the present time", which in May 2009, meant an average atmospheric concentration of 390.36 parts per million. Fourteen years later, the average atmospheric concentration of CO₂ measured at the Mauna Loa Observatory increased by less than 9%, so we'll assume the math done by the tool below based on the absorption of CO₂ by plants and the ocean is still very reasonably close to accurate.

Here's the tool, where you can find out what percent of the excess CO₂ emissions from a past year might still be left in the air after the elapsed number of years you enter. If you're accessing this article on a site that republishes our RSS news feed, please click through to our site to access a working version.

In the tool and chart, we've arbitrarily capped the number of years to estimate the percentage carbon dioxide remaining at 600 years. That's actually more twice as long as we need for an upcoming project where we'll make use of the math behind this tool. Seeing as there are fewer than 300 years of excess carbon dioxide emission generation that are attributable to large-scale human industrial processes, we don't need more than that!

References

Presented in reverse chronological order. We had to daisy chain through multiple references to arrive at the estimates we presented above and verify their applicability to historic data.

NASA. Global Climate Change. Graphic: Major Greenhouse Gas Sources, Lifespans, and Possible Added Heat. Online Article. 22 June 2023.

Forster, P., T. Storelvmo, K. Armour, W. Collins, J.-L. Dufresne, D. Frame, D.J. Lunt, T. Mauritsen, M.D. Palmer, M. Watanabe, M. Wild, and H. Zhang, 2021: The Earth’s Energy Budget, Climate Feedbacks, and Climate Sensitivity. In Climate Change 2021: The Physical Science Basis. Contribution of Working Group I to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change [Masson-Delmotte, V., P. Zhai, A. Pirani, S.L. Connors, C. Péan, S. Berger, N. Caud, Y. Chen, L. Goldfarb, M.I. Gomis, M. Huang, K. Leitzell, E. Lonnoy, J.B.R. Matthews, T.K. Maycock, T. Waterfield, O. Yelekçi, R. Yu, and B. Zhou (eds.)]. Cambridge University Press, Cambridge, United Kingdom and New York, NY, USA, pp. 923–1054, doi:. 923–1054. [PDF Document]. DOI: 10.1017/9781009157896.009.

Stocker, B., Roth, R., Joos, F. et al. Multiple greenhouse-gas feedbacks from the land biosphere under future climate change scenarios. Nature Clim Change 3, 666–672 (2013). DOI: 10.1038/nclimate1864.

M. Eby, K. Zickfeld, A. Montenegro, D. Archer, K. J. Meissner, and A. J. Weaver. Lifetime of Anthropogenic Climate Change: Millennial Time Scales of Potential CO₂ and Surface Temperature Perturbations. Journal of Climate, Volume 22. 15 May 2009. 2501-2511. [Ungated PDF Document]. DOI: 10.1175/2008JCLI2554.1.

Archer, D., Brovkin, V. The millennial atmospheric lifetime of anthropogenic CO2. Climatic Change 90, 283–297 (2008). [PDF Document]. DOI: 10.1007/s10584-008-9413-1.

Moore, Lisa. Greenhouse Gases: How Long Will They Last? Environmental Defense Fund Climate 411 Blog. [Online Article]. 26 February 2008.

Denman, K. L., and Coauthors, 2007: Couplings between changes in the climate system and biogeochemistry. Climate Change 2007: The Physical Science Basis, S. Solomon et al., Eds., Cambridge University Press, 589–662. [PDF Document]. DOI: 10.1080/03736245.2010.480842.

Image credit: Demonstrative example of Carbon Cycle by U.S. Department of Energy Biological and Environmental Research Information System via Wikimedia Commons. Public Domain.

Labels: environment, tool

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.