Welcome to the Friday, October 30, 2009 pre-Halloween edition of On the Moneyed Midways!

Welcome to the Friday, October 30, 2009 pre-Halloween edition of On the Moneyed Midways!

We say pre-Halloween because nearly every money or business-related blog carnival we reviewed for this week's edition of OMM offered a Halloween theme. To which, we say, please, make the horror stop!

Honestly, blog carnival hosts, it's difficult to pull off a themed blog carnival, because making a good one requires much more effort on your parts than does the regular, run of the mill blog carnival. If you're not willing to put in the time, don't do the crime....

Still, two blog carnivals we reviewed stood out by not doing Halloween wrong. First, Sharon Lauby's HR Bartender's edition of the Carnival of HR, which was organized by category according by each post contributor's favorite drink, provided an excellent example of what can happen when a blog carnival host goes the extra mile to make their edition unique (caipirinhas all around!)

Second, Zillow Blog's Sarah Greenleaf's no nonsense, let's just cut out all the crap, only two posts make the cut edition of the Carnival of Real Estate was much appreciated in a week filled with far too many ghosts and pumpkins!

Remember, we suffer so you don't have to! The best posts we found from the week that was await you below....

| On the Moneyed Midways for October 30, 2009 | |||

|---|---|---|---|

| Carnival | Post | Blog | Comments |

| Carnival of Debt Reduction | Should You Stop Funding Retirement to Focus on Debt? | Get Rich Slowly | Adam Baker, also of Man vs Debt, challenges Get Rich Slowly's J.D. Roth's bit of conventional wisdom about choosing between paying off debt or investing in your retirement, arguing that you should "only pay yourself first if you deserve it." Absolutely essential reading! |

| Carnival of HR | Does Your Firm Know What It's Getting from Corporate Giving? | i4cp Trendwatchers | What exactly is your business getting from having an employee volunteering program? Lorrie Lykins describes how these charitable efforts are changing and how they might affect a company's bottom line. |

| Carnival of Personal Finance | Does It Matter Who the "Breadwinner" Is Anymore? | Budgets Are Sexy | J. Money notes the trend toward women becoming the primary income earners in many households, and doesn't have a problem with that. At all! |

| Carnival of Real Estate | Extend the $8,000 First-Time Home Buyer Credit? | River Banks to Corn Fields | Rob Cook is a licensed Realtor® who would just as soon buck the National Association of Realtors® and do away with the first time homebuyer tax credit stimulus incentive altogether! Absolutely essential reading! |

| Festival of Stocks | The Great Depression II: Says Who, Huh? | The Financial Blogger | Did you know that bank stocks have just about fully recovered to where they were before crashing in August 2008? We didn't either, but then, we're talking about the Canadian stock market, where The Financial Blogger is up for challenging some widespread misperceptions! |

| Money Hacks Carnival | Dollar Cost Averaging: Useful Tool, Bad Idea, or Marketing Gimmick? | Affine Financial Services | The Best Post of the Week, Anywhere! Helen Maynard asks a great question and builds cases both pro and con on all sides for the popular long term investing strategy. |

| Money Hacks Carnival | 6 Frugal Halloween Costume Ideas for the Kids | Len Penzo dot Com | If you and your kids haven't been out costume shopping yet, Len Penzo offers advice on what to wear for Halloween right out of your kids' closet, with options like "Little League Bench Warmer" and "Environmentalist Gym Rat!" Absolutely essential reading! |

Previous Editions

- OMM's Running Index for 2008

- OMM's Running Index for 2007

- The Best Blogs Found in 2006 (and our full 2006 index)!

Labels: carnival

God bless the U.S. State department! For all the government's bureaucrats who find their way to us through Google to answer the questions they have, we've found that those serving in the United States Department of State ask the wackiest ones.

Today's example comes to us via our Sitemeter traffic log:

Their question asked of Google: "why obama won the nobel prize".

Our answer, which showed up in Google's rankings for searches on the topic in 11th place when we performed the search ourselves: How Obama Won the Nobel Prize.

P.S. Hi Hillary! Sorry - that was the best answer we could up with when we asked the question ourselves....

Labels: none really

Markets are places where people who create solutions can seek and find individuals who are searching for solutions. The act of marketing then serves a highly important role: it helps people find the solutions to problems that they might not have known they had, or perhaps more accurately, allows them to solve problems they haven't well defined.

Markets are places where people who create solutions can seek and find individuals who are searching for solutions. The act of marketing then serves a highly important role: it helps people find the solutions to problems that they might not have known they had, or perhaps more accurately, allows them to solve problems they haven't well defined.

The best part of that process is that the solutions that exist can inspire entirely new solutions, sparking positive feedback cycle where the only limits are those of human creativity.

To that end, and in celebration of Halloween this year, we've identified several solutions that a number of designers might argue satisfy a deep human need to sit on things that scare them. First up, if you're considering dressing up in a costume for a Halloween party this year, why shouldn't your furniture join in the fun? Designer Hongtao Zhao has created a costume for chairs (see above right.)

But perhaps that solution doesn't push the limits far enough to really satisfy your need to sit on something scary. Perhaps then you might consider a design created by Yu-Ying Wu called the "Breathing Chair," which was inspired by the structure of plant cells in tofu. Just imagine the experience of sitting on what appears to be a rectangular block that deforms to envelop your body when you sit on the area with the largest open spaces. Then recall that you're sitting on something inspired by tofu. Pretty chilling....

But perhaps that solution doesn't push the limits far enough to really satisfy your need to sit on something scary. Perhaps then you might consider a design created by Yu-Ying Wu called the "Breathing Chair," which was inspired by the structure of plant cells in tofu. Just imagine the experience of sitting on what appears to be a rectangular block that deforms to envelop your body when you sit on the area with the largest open spaces. Then recall that you're sitting on something inspired by tofu. Pretty chilling....

Not scary enough? Okay then, perhaps student designer Rich Gilbert's SuperFoam chair concept is for you. Admittedly, this is more due to the lighting effect that makes the chair appear to provide the kind of moist, goo-laden descent into some alien digestive process sitting experience that you might secretly desire, but still, you have to admit it's pretty scary looking!

Not scary enough? Okay then, perhaps student designer Rich Gilbert's SuperFoam chair concept is for you. Admittedly, this is more due to the lighting effect that makes the chair appear to provide the kind of moist, goo-laden descent into some alien digestive process sitting experience that you might secretly desire, but still, you have to admit it's pretty scary looking!

It all rather puts the Picasso-inspired furniture we previously featured to shame!

Hat Tip

We discovered all the images presented in this post on Core77's blog - here are their related posts:

Labels: none really

We were thinking about the history of federal minimum wage increases in the U.S. this morning, when we had a flash of inspiration: we thought of a way we could illustrate how the rate of unemployment in the U.S. might have changed in response to changes in the minimum wage in the overall context of the health of the U.S. economy at the time they occurred.

How you ask? Easy! We took our dividend data for the S&P 500 and calculated the year over year change in its rate of growth after adjusting it for inflation. We then assigned the result a score of either +1 when the year over year change in real dividends per share was positive or a score of -1 when the year over year change was negative.

That provides a framework against which we can present the results of a similar exercise for changes in the year over year rate of unemployment, assigning a positive score when the unemployment rate fell or a negative score when the unemployment rate rose. We could then identify the milestones for when the federal minimum wage increased.

Here's how the analytical part works. When the U.S. economy is healthy, the stock market's dividends per share will rise and the rate of unemployment will fall. On our chart, that's indicated by the situation where both the year over year changes in dividends and unemployment have scored a positive value. It's during these times that we would expect that the U.S. economy can absorb an increase in the minimum wage.

When both these scores are negative, that likely corresponds to a period of recession or stagnation for the U.S. economy. This would correspond to a period in which raising the minimum wage would aggravate the unemployment situation.

Finally, there is the situation where the two measures are out-of-sync with one another. This indicates a period in which the economy is relatively weak. In these circumstances, if the U.S. economy is not in recession, raising the minimum wage might indeed spark enough job loss to push the U.S. into recession.

Examining our chart, we find the following:

- Of the 20 minimum wage increases that have taken place from January 1949 through the present, 5 occurred at times when unemployment rates were falling from where they were a year earlier, and 15 occurred approximately when the rate of unemployment in the U.S. was rising. This observation suggests that the U.S. Congress is uniquely unfortunate in its choice of the dates it selects when it mandates a minimum wage increase should take place.

- 7 of the 20 minimum wage increases correspond closely with sudden reversals from falling rates of unemployment (good) to growing rates of unemployment (bad). The dates of the related minimum wage increases are 1 March 1956, 3 September 1963, 1 February 1967, 1 May 1974, 1 January 1979, 1 April 1990, and 24 July 2007.

- 2 of the 20 minimum wage increases correspond closely with sudden improvements in the rate of unemployment (1 January 1976, 1 October 1996). Here, the 1 January 1976 improvement coincides with an improving situation for the stock market, coming at the end of a series of disruptive events for the U.S. economy which had severely impaired its performance. The period surrounding the 1 October 1996 appears to be a very short-term anomaly occurring within a period of otherwise strong economic growth.

- There are 4 instances when unemployment rates rose at times corresponding to minimum wage increases, even as stock market dividends per share were growing (1 March 1956, 3 September 1963, 1 April 1990 and 24 July 2007.)

The takeaway from all this is that when the U.S. Congress acts to increase the minimum wage, this action either directly coincides with the loss of jobs in the U.S. economy one-third of the time or with the continuance of job losses for another one-third of the time. And one out of five times, these job losses occur despite economic growth as indicated by growing stock market dividends.

Worse, since the U.S. Congress has historically acted to pass minimum wage increases in periodic batches, with increases occurring at annual intervals following the first increase of the batch, the situation of these additional minimum wage tend to represent an ongoing worsening of the employment picture.

So the bottom line answer to the question we asked in the post title is very likely "Yes."

Update 29 October 2009: We replaced the original chart we included with this post with the much prettier one you now see above!

Labels: economics, minimum wage, politics

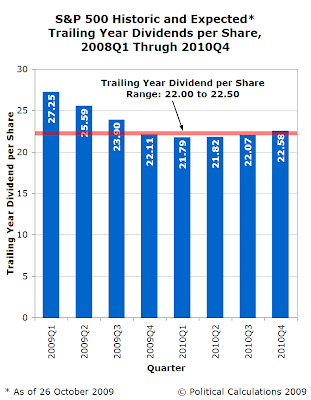

Understanding how the stock market's dividends are changing is key to understanding what investors are expecting in the future of the market. Today, we're going to look at four snapshots in time, which correspond to different points in time of the now 60% rally in stock prices that has taken place since the market bottomed earlier this year.

Understanding how the stock market's dividends are changing is key to understanding what investors are expecting in the future of the market. Today, we're going to look at four snapshots in time, which correspond to different points in time of the now 60% rally in stock prices that has taken place since the market bottomed earlier this year.

What we find interesting here is that stock prices had risen over 32% from their bottom at this point in time, even as the expected level of dividends per share eroded without suggesting stronger growth in the future. What that observation tells us is that much of the market rally through this point in time was based on the expectation by investors that the situation of publicly traded companies was becoming "less bad."

These two observations contradict what many market and economic analysts have indicated they believe lies behind the stock market rally we've observed in 2009: the hypothetical expectation by investors of a "V-shaped" economic recovery. In our view, this hypothesis has become something of a "straw man" argument, one made specifically for the purpose of knocking it down to make the analyst appear more credible.

But here, we see a significant reversal from the trend we've seen throughout the market rally. Each quarter going forward from that point is both higher than where it was forecast on 3 August 2009, but also progressively higher in two of the three following quarters. What this observation suggests is that investors are now expecting a real recovery for the publicly traded companies of the stock market.

How real is that suggestion of a recovery though? We've dug into the data behind the dividend futures data and found two significant changes that have altered investors' view of the future for the stock market.

First, on 12 October 2009, JP Morgan Chase (NYSE: JPM) announced that they would be very likely to substantially increase their dividends in 2010. This announcement is significant in that the bank had previously slashed their dividend by 87% to just five cents per share as requirement imposed by the government for having received funding from the Troubled Asset Relief Program (TARP) in October 2008.

At the time, the slashing of the company's dividend help contribute to the market crash in October 2008, so the resumption of the company's dividends at higher levels would indeed indicate a recovery, although perhaps an artificial one. By that, we're referring to the role of the government in mandating all TARP recipients cut their dividends to no more than five cents per share, regardless of their financial health. Since JP Morgan Chase was considered to be a healthy company at the time it cut its dividends, so its resumption of paying higher dividends doesn't necessarily indicate that economic conditions are improving substantially.

That brings us to today, where once again dividend futures have leapt in value over the past weekend, as Freeport-McMoRan Copper and Gold (NYSE: FCX) announced that it will resume paying its dividend. The mining and raw material producing company had previously suspended its dividend payments in early December 2008 as the world economic situation was worsening at the time.

Between the two dividend announcements, the Freeport-McMoRan is more significant in that it is not influenced by the U.S. government's intervention into the market, which indicates that the economic situation is indeed improving.

What we have then from our observation of how stock market dividends are changing is a mixed-to-slightly favorable impression that an economic recovery is indeed taking place. What we'd like to see is more publicly-traded companies in industries where the government hasn't co-opted basic business decisions follow suit in boosting their dividends, which would confirm that the apparent recovery has strength.

In the interest of disclosure, Ironman holds no positions in either JP Morgan Chase or Freeport-McMoRan.

Labels: economics, forecasting, stock market

Welcome to the Friday, October 23, 2009 edition of On the Moneyed Midways, where we may be posting late on Friday, but at least not so late where this week's OMM transforms into a "special" Saturday edition!

Welcome to the Friday, October 23, 2009 edition of On the Moneyed Midways, where we may be posting late on Friday, but at least not so late where this week's OMM transforms into a "special" Saturday edition!

For those of you just joining us, each week, On the Moneyed Midways surveys the world of blog carnivals that are somehow related to the topics of money and business. We select the top post we find in each carnival we review and award one of these with the title of being The Best Post of the Week, Anywhere! Those posts that are near-contenders for that title are identified as being Absolutely essential reading!

And that's it! The best posts we found in the week that way await you below....

| On the Moneyed Midways for October 23, 2009 | |||

|---|---|---|---|

| Carnival | Post | Blog | Comments |

| Carnival of Debt Reduction | How to Get Rid of $106,000 in Debt | Free Money Finance | FMF tells the story of Kandy and Russell Hildebrandt, who paid off over a hundred thousand dollars of debt in five years, despite starting with an annual income of $60,000. On a side note, this post dovetails really well with another CoDR contribution from Get Rich Slowly's J.D.: Spend Less Than You Earn (Between the two posts, you'll have read 2/3 of this week's CoDR!) |

| Carnival of Personal Finance | Most Valuable U.S. Coin | Bargaineering | You might want to check your pocket's after Jim Wang's entertaining post on the most valuable "regular" coin in circulation. And it's not because of coinflation! |

| Cavalcade of Risk | Why Executives Risk Their Jobs to Tip a Hedge Fund | Daily Finance | Peter Cohan describes the kind of warped judgment that would seem to exist in the minds of executives who trade insider information to hedge funds for a cut of the action. Absolutely essential reading! |

| Festival of Frugality | Nearly Impossible: Cheap & Healthy | Domestic Cents | Nicki notices the difference in costs between healthy and unhealthy foods and describes the things she does to try to buy healthy for less. |

| Festival of Stocks | Gold Investment | Financial Highway | Ray took the opposite side of the argument in a previous post, but here, he explores why some people (not him) might find gold to be an attractive investment. |

| Money Hacks Carnival | Quit Worrying About 80% of Your Life | Frugally Green | Tyler describes how he went from being a control freak where money matters were concerned to someone who enjoys life a lot more by applying the Pareto principle. Absolutely essential reading! |

| Carnival of Money Stories | What Christmas Ornaments Taught Me About Money | The Amateur Financier | What did Roger learn about money and business from his ornament creation career as a tween? The answer to that question is The Best Post of the Week, Anywhere! |

| Carnival of Pecuniary Delights | Finding Affordable Self Employed Health Insurance | Bargaineering | Jim Wang answers a reader's e-mail about how and where to find inexpensive health insurance if you work for yourself. |

| Best of Money | ETFs vs Index Mutual Funds: The Ultimate Battle! | The Financial Blogger | Seeing as we've already selected BoM's top post as being the best post in another carnival, we've defaulted to the #3 choice with the Financial Blogger's run down of why he believes index funds have the edge over exchange traded funds! |

Previous Editions

- OMM's Running Index for 2008

- OMM's Running Index for 2007

- The Best Blogs Found in 2006 (and our full 2006 index)!

Labels: carnival

Just for the sake of putting the stock market in proper perspective, let's take a look at the S&P 500 from January 1871 through September 2009, as plotted against the index' trailing year dividends per share. First, in normal scale:

And now on a logarithmic scale:

Ain't reversion to the mean grand?

Labels: SP 500

Finally! Thanks to President Barack Obama's Office of Management and Budget, we can now calculate the number of jobs directly created by the American Recovery and Reinvestment Act of 2009, or as everybody likes to call it, "The Stimulus Package".

Finally! Thanks to President Barack Obama's Office of Management and Budget, we can now calculate the number of jobs directly created by the American Recovery and Reinvestment Act of 2009, or as everybody likes to call it, "The Stimulus Package".

Here's how, as described by Orville B. Fitch, the director of New Hampshire's Office of Economic Stimulus in his recent report to that state's governor, John H. Lynch (HT: Ed Morrissey):

The federal government calculates a Job Full-Time Equivalent ("FTE") for ARRA purposes as the total hours worked during the reporting period divided by the total hours one full-time employee would have worked had he or she worked for the entire reporting period.

You know what comes next, right? Here's our tool with New Hampshire's estimate of the number of labor hours directly paid for through its portion of the $787 billion (787,000,000,000 USD) from 17 February 2009 through 30 September 2009 (for those of you looking at your states or the U.S. as a whole, you're more than welcome to substitute the values that apply for your situation!):

At 3007 jobs created or saved, that seems like a pretty healthy number. But, Fitch cautions that New Hampshire's share of the stimulus package is nearly shot, which means that many of those jobs will disappear:

The Federal Jobs FTE statistic is a cumulative statistic. At each quarter it reports job creation and retention since February 17, 2009. This continues until the last dollar is spend and reported. For example, the State Fiscal Stabilization Fund - Government Services grant has expended over 90% of its funds. The remaining funds will be expended over the recovery period. We, therefore, expect the number of FTEs attributed to that program by the Federal Jobs FTE statistic to decrease in each future quarterly report.

We can illustrate this inevitable outcome with an example that Fitch provided earlier in his report, which shows what will happen to the calculated number of jobs created or saved when the number of labor hours being directly funded by stimulus bill spending stops growing because the funds to pay them have run out:

For example, one might consider a job FTE as full-time work for one person for one year. using this approach to calculate the "FTE-Full-Time Job for a Year" statistic one would divide the total hours, 3,872,686 by 2080, the number of hours worked in a full year by a person working 40 hours per week. This "FTE - Full-Time Job for a Year" statistic for this reporting period would be 1862. In other words, if the estimated hours paid for, so far, by ARRA had been paid out only to people working full-time at 40 hours per week and had been paid out to them over the course of one full year, 1862 full-time, full-year jobs would have been paid for by ARRA.

1862 jobs saved or created is quite a reduction from the 3007 calculated for just the limited period of time required to be reported by the President Obama's Office of Management and Budget.

Both figures, by the way, are a far cry from the 16,000 jobs the President's administration predicted would be "created or saved" in New Hampshire.

As for the composition of New Hampshire's "created or saved" jobs, NowHampshire reports that of the 3007 estimated positions "created or saved" between 17 February 2009 and 30 September 2009, just 221 were in the private sector, or 7.3% of the total.

Of course, this analysis is just looking at the number of jobs "created or saved" directly from the stimulus spending. As our Keynsian fans out there might ask, isn't there some kind of multiplier effect for this government spending?

That depends upon who you ask. If you ask President Obama's administration, they'll tell you the Keynsian multiplier is equal to 4, as the people paid through the government spending program interact with the larger economy. Applied to the estimated number of jobs directly "created or saved" over the period in question, that would suggest that 12,028 jobs have been "created or saved" through the stimulus spending in New Hampshire.

If you go by academic economists Robert Barro or Valerie Ramey however, evidence indicates that it's really somewhere between 0.8 and 1.2. Which if we split the difference would put the estimated number of "created or saved" jobs back at 3007.

There is, of course, a relatively easy way to get the answer to the question of how effective the stimulus spending was in creating or saving jobs - by comparing the amount of income tax revenue actually collected with how much would have been if the stimulus package wasn't enacted. But don't look for anyone in the Obama administration to bring that up anytime soon.

Previously on Political Calculations

- Stimulus Package: Our Entry for Worst Idea Competition

- Always Behind the Curve

- Better Ideas for Fiscal Stimulus Packages

- Where the Stimulus Money Is Going

- How to know If the "Stimulus" Worked

- Sports Stadium Stimuli?

- Pouring Taxpayer Money Down the Drain

- Simulating Stimuli

Labels: economics, politics, tool

Sometimes, we're just in awe of what the web has wrought. The image below is taken from die.net's World Sunlight Map, which incorporates satellite weather imagery with where the sunlight is striking at any given moment on the Earth's surface:

If you click the image above for a larger version, check out how dark the space is between China and South Korea and across much of Africa, which is a key indicator of a lack of economic activity, especially given the relative population densities of these areas with respect to genuinely unpopulated areas, like northern and western Australia.

Labels: none really, technology

Deep down, managers are a form of administrative zombie. What other explanation could possibly explain the apparently brain dead things that so many of them do repeatedly during the course of carrying out their duties on the job?

Deep down, managers are a form of administrative zombie. What other explanation could possibly explain the apparently brain dead things that so many of them do repeatedly during the course of carrying out their duties on the job?

Okay, maybe that's a bit harsh, but let's face some hard facts. A manager is supposed to coordinate the work of a group of people with that of other groups within an organization for the purpose of maximizing their output. As part of that responsibility, managers seek to boost the performance of the employees of the organization in their charge, since this has a direct impact upon the overall effectiveness of the organization.

But managers do a lot of things that neither boost an individual employee's performance nor do they maximize the output of the group they lead. Worse, many of these things waste both time and money, which benefits nobody. What makes that situation even more worse is that they often know it and continue to do those things anyway.

If we assume, just for a moment, that managers are not administrative zombies and are just as human as their employees, what accounts for their seeming brain-deadness?

The stunning answer is that it is because they are trained to do it. And like trained monkeys, they're rewarded when they follow through and perform those practices as desired and are disciplined when they try to deviate from them.

The stunning answer is that it is because they are trained to do it. And like trained monkeys, they're rewarded when they follow through and perform those practices as desired and are disciplined when they try to deviate from them.

So what are these brain dead management practices that our well-trained monkey managers are using to keep their staffs and organizations from reaching their full potential?

Management and behavioral researcher Aubrey C. Daniels outlines thirteen of them in book OOPS! 13 Management Practices That Waste Time & Money (and what to do instead), which we've excerpted from Ray B. Williams' Psychology Today blog post reviewing the book:

- Employee of the Month [and most other forms of recognition and reward].

What's wrong with it: It focuses attention on one employee, but most work is a team effort.

What to do about it: Acknowledge achievement for everyone the moment it happens.- Stretch Goals.

What's wrong with it: Employees end up overwhelmed and frustrated if they fail to reach aggressive goals.

What to do about it: Set achievable short term goals and chart employee progress month by month.- Performance Appraisal.

What's wrong with it: It's hated by both managers and employees; it's done once a year and then appraisal is ignored for the rest of the year; it's not motivational.

What to do about it: Give immediate management feedback to employees for success or failure.- Ranking employees.

What's wrong with it: Even if the gap between employees is small some end up at the top and others at the bottom. The ones at the bottom feel like failures.

- Rewarding Things a Dead Man Can Do (rewarding negatives).

What's wrong with it: If you reward employees for zero defects, the sure way to meet that target is to try nothing that has a chance of failing, or falling short.

What to do about it: reward every success, not matter how small.- Salary and Hourly Pay (merit pay, automatic bonuses).

What's wrong with it: Once a raise is given, it is permanent, but it's unlikely to continue to motivate and bonuses are viewed as entitlements, even if performance is less than satisfactory.

What to do about it: Pay for performance or revenue sharing that must be earned each year.- You did a good job, but.... (good news-bad news feedback).

What's wrong with it: "Yes, but," is not a motivator, but a punisher, and seen by employees as management "nagging."

What to do about it: praise and criticism should come in two separate conversations.- The Sandwich [Criticism sandwiched between two positive statements].

What's wrong with it: People naturally place more focus on negative messages than positive, so the focus on the positive is lost.

What to do about it: If management needs to confront an employee about an issue, do so in a straight forward manner, with no sugar-coating.- Overvaluing Smart, Talented People (you don't buy people's brains, you buy their behavior).

What's wrong with it: Management focuses on resumes and IQ not performance. Provide growth opportunities for all employees and give them opportunities to shine.

- The Budget Process.

What's wrong with it: Tedious, time-consuming divvying up of resources creates an expectation for everyone to want more.

What to do about it: Budge according to what each part of the organization can prove they need to get results.- Promoting People No One Likes.

What's wrong with it: employees perform out of fear rather than commitment and loyalty.

What to do about it: Promote people who are liked and have superior interpersonal and emotional intelligence abilities.- Downsizing.

What's wrong with it: Many things including the stress placed on those employees that remain, and the costs of new hires after the recovery.

What to do about it: Find more creative ways of costs savings, done by many companies.- Mergers, Acquisitions, And Other Forms of Reorganizing.

What's wrong with it: Decisions are made mostly on financial terms, with little focus on integrating corporate cultures and declining performance.

What to do about it: Get teams of people together to manage the integration over time, rather than by management edict.

If you were to randomly select a company in the Fortune 500, chances are that you would find these very performance-destroying practices in action. The question is why.

Somewhere, someone got the idea that these management practices promote individual performance and maximize the output of groups of people. As a result, thanks to the modern managerial industrial complex, many of these practices have become widespread and instituted in many workplaces, complete with mechanisms for evaluating the ability of managers to perform these practices and to correct them if they deviate from them.

But that happened without any real understanding of what those practices actually do to individual and organizational performance when implemented on a grand scale.

That situation can be fixed, but our best guess is that the repair process is unlikely to occur anytime soon. After all, the first step would be for our most senior level of zombie monkey managers to admit they have a problem. Call us cynical, but we just don't see that happening anytime soon....

Zombie Image Credit: Halloween Express

Labels: business, management

Welcome to the Friday, October 16, 2009 edition of On the Moneyed Midways! We are your weekly source of the best there is to be found among the Social Media 1.0 phenomenon that is the past week's business and money-related blog carnivals

Welcome to the Friday, October 16, 2009 edition of On the Moneyed Midways! We are your weekly source of the best there is to be found among the Social Media 1.0 phenomenon that is the past week's business and money-related blog carnivals

This was very much one of those weeks where there wasn't much going on in the world of blog carnivals, as we're falling into the gap between for the biweekly, bimonthly and monthly blog carnival editions.

Still, what we found is still the very best of the best! Just scroll down for a shortened sample of the best of the week that was!...

| On the Moneyed Midways for October 16, 2009 | |||

|---|---|---|---|

| Carnival | Post | Blog | Comments |

| Carnival of Debt Reduction | Deprioritizing Our Debt Payoff | Modern Tightwad | a.b. (aka Mrs. Modern Tightwad) is deranking paying off debt as her family's top priority. Absolutely essential reading! |

| Carnival of HR | Do You Snoop Online on Prospective Employees? | Human Resources Blog | Susan M. Heathfield posts her reaction to a recent trend among employers, where some are requesting job candidates to provide their passwords to social media sites such as Twitter and Facebook. The Best Post of the Week, Anywhere! |

| Carnival of Real Estate | Estimating and Executing Rehab on a Single-Family Investment Property | Lifestyles Unlimited | With so many foreclosed properties now at prices low enough to entice real estate investors, what challenges might they face in getting a return on their investment? Shauwn Digman, an established house flipper, describes his process. |

| Festival of Frugality | A Frugal Idea Backfires | M Is for Money | Miss M thought she'd save money by going back to her natural hair color, but forgot to take into account everything else that she would have to change (like makeup and wardrobe) because all her previous purchasing decisions in these areas were based in part on her old dye job! |

| Festival of Stocks | Gold Hype? You're Being Taken for a Ride | Darwin's Finance | We see it hawked in countless television commercials on the cable networks and thanks to its latest runup in price, on CNBC. But is gold really a good investment? Darwin applies a dose of common sense to his analysis of why gold's glitter isn't really attractive. |

| Money Hacks Carnival | How to Avoid Ebay Seller Scams | Stumble Forward | Shelly paid for a dress she found on eBay, but the seller took her money and disappeared, leaving Shelly both dressless and poorer. Chris Holdheide tells Shelly's story and describes what to do to protect yourself in similar circumstances. |

| Carnival of Money Stories | Would You Rather Be Fat or In Debt? | Man vs. Debt | Baker weighs the things that cost more because he's overweight and vows to put the pounds behind him, launching a new blog "Man vs Fat" in the process! |

Previous Editions

- OMM's Running Index for 2008

- OMM's Running Index for 2007

- The Best Blogs Found in 2006 (and our full 2006 index)!

Labels: carnival

That's pretty remarkable, given that most of our predictions involve forecasting the level of the S&P 500.

The table below provides our track record since 16 July 2009, including any updated results for older predictions:

| Political Calculations' Plus-Minus Score Update, 15 October 2009 | |||

|---|---|---|---|

| Date | Prediction | Outcome | +/- Score |

| 1 July 2009 | We forecast a range for the S&P 500 in July 2009 between 925 and 945. | +1 | |

| 27 July 2009 | We jumped the gun before getting all the data that July 2009 had to offer and preliminarily forecast the S&P 500 to average somewhere between 991 and 1007 in August 2009. | August 2009 came in with an average value for the S&P 500 of 1009.74. We hate to score a miss, but let's face it, we were off by 0.2%! We'll once again leave it to our readers to judge for themselves how a near-miss should be used to evaluate our forecasting chops. | -1 |

| 3 August 2009 | Now armed with all of July 2009's data, we up our forecast average value of the S&P 500 in August 2009 would be between 1005 and 1020. | Well, what a difference a few extra days of data makes!... | +1 |

| 13 August 2009 | We make fun of 47 economists for predicting that the U.S. recession would end in the third quarter, based on the "Cash for Clunkers" program. We point out that the dividend futures data for the S&P 500 has been saying the recession would be over in 2009Q3 for months, long before C4C even became legislation! | Too soon to tell. This prediction looks pretty likely, but we'll have to wait for the NBER to get around to declaring the date of the end of the recession. | +0 |

| 31 August 2009 | With August 2009 just about done, we anticipated that the S&P 500 would average between 1005 and 1020 in September 2009. And then we anticipate that a significant amount of noise would enter the stock market between 10 September and 16 September, which we initially anticipated would make stock prices dip. In a 10 September 2009 update to the post however, we reverse that forecast and instead predict a surge in stock prices, based on what we found when we dug deeper into the data. | We followed up our 10 September 2009 update on 16 September 2009, as we identified the likely source funding the rise in stock prices during this time. Meanwhile, the average level of the S&P 500 in September 2009 was 1044.55, which means that 2 of the 3 predictions recorded in this post were wrong, and one was correct. That nets us a -1 on this batch! | -1 |

| 8 September 2009 | We suggest that teen employment figures might soon begin to improve provided no further minimum wage increases are in the works. | Too soon to tell. Since the data comes out monthly, it may not be until early January (when December 2009's jobs data is released) where we'll have an answer. | +0 |

| 16 September 2009 | After confirming the run-up in stock prices above where our forecasting methods would place them, we anticipate that a selling opportunity is lurking in the near future. | That selling opportunity came by 30 September 2009, right before the S&P dove back down close to our forecast range for September 2009 in early October, before rebounding. | +1 |

| 30 September 2009 | We come to the fork in the road for our method of forecasting the direction of the S&P 500. Option A puts the average for the index in October 2009 between 867 and 892. Option B puts the average for the index between 1089 and 1106. | Too soon to tell. Right now, it's looking like investors have chosen Option B! | +0 |

| 8 October 2009 | We take a closer look at what we believe drove stock prices up in September 2009, finding that those forces are still at work in October. In a chart, we identify two approximate dates where the upward ride provided by our suspect source of market noise might come to an end: 15 October 2009 and 17 November 2009 (both one year after the actual indicated dates shown on the chart.) | Too soon to tell. At this writing, we would say that 17 November 2009 looks more likely, mainly because of the sustained fall-off in the year-ago 10-Year/3-Month spread in U.S. Treasuries. We'll find out within the next several days if there's anything to the large drop in the year-ago spread that we see after 15 October. | +0 |

What we like about this approach is that if our predictive ability is no better than the random outcome determined by a coin toss, our plus-minus score will drift toward a value of zero over time. If we're better at making predictions than simple randomness would suggest, then our plus-minus score will grow higher in value over time. If we're wrong, then our plus-minus score will fall in value. If we're really bad, then our plus-minus score will plunge into deep negative territory!

Overall, since January 2008, our net scores are as follows:

- 10 no decisions or equally mixed outcomes (such as a multiple part prediction where one part is correct and one part is incorrect.)

- 10 incorrect predictions. This includes all our near-misses (there are three at this writing.)

- 28 correct predictions.

The numbers above don't add up to the number of predictions made due to the effect of multiple part predictions.

Previously on Political Calculations

- Plus-Minus for Predictions - 16 April 2009

- Our Plus-Minus Is Now Seventeen! - 16 July 2009

Labels: forecasting, track record

You might think that a government policy that delivers a cash subsidy to provide a benefit to an impoverished person or family to cover some essential expense is a good thing. After all, if they don't currently make enough money to pay for the thing themselves, then maybe the government should provide them with enough financial assistance to help them get it.

You might think that a government policy that delivers a cash subsidy to provide a benefit to an impoverished person or family to cover some essential expense is a good thing. After all, if they don't currently make enough money to pay for the thing themselves, then maybe the government should provide them with enough financial assistance to help them get it.

You might also think that it's only fair that someone who isn't as impoverished should get a smaller cash subsidy for the same benefit from the government. After all, if that individual or family makes more money than the really impoverished person or family does, then they can afford to pay a larger share of the full cost of the thing they're getting.

And if that person or family makes a lot of money, then it should also make sense to you that they shouldn't receive any benefit from the government to be able to get the same thing at all. After all, why should somebody who's easily able to pay the full price get a discount on the same thing that an impoverished family can only get with a large subsidy from the government?

Using that reasoning, who do you think is the worse off in that situation when it comes to obtaining the essential item? Is it the person or family that has a very low income, a middle-range income or that is really well off?

The answer is it depends. Specifically, it depends on how much benefit is lost as an individual or family's income rises.

You see, the government has two ways of really sticking it to people with taxes depending upon their income level: tax rates and the phaseout of benefits with a rising level of income.

The first is really straightforward - you directly see it when determining how much you have to pay in taxes. For instance, you probably have a very good idea of which income tax bracket you fall into because of your income level, because it's very easy to find out. It's stated explicitly.

But how much are you being taxed by being denied some or all of a benefit others receive due to their lower incomes because of your higher income level? And if you're moving up the income ladder, how much are you having to give up for your success because of these hidden, implicit taxes? That's not so easy to find out.

Until today. Our tool below will give you a basic idea of the implicit rate of taxation you might have to pay on account of earning a higher income. Just enter the indicated data and we'll work out what your implicit tax rate would be given the income-linked phase out of benefits you might receive if only you earned less money.

The default numbers in the tool above are taken from James Capretta's analysis of how the health care reform bill sponsored by Senator Max Baucus (D-MT), which was just approved by the Senate Finance Committee to go onto the next phase of the legislative process, will affect a hypothetical family of four in the year 2016, one at the poverty line, the other with an annual income double that. Here are his findings:

In the Baucus plan, a family of four at the poverty line (about $24,000 in 2016) would have pay to about $1,400 toward coverage, with the federal government paying the other $13,000 on their behalf. In addition, the government would also provide $3,500 to reduce the family’s deductible and co-payment costs for health services. Thus, the new entitlement provided by the Baucus bill would be worth a whopping $16,500 for a family at the poverty line.

As incomes rise, however, the Baucus bill cuts the value of the entitlement. A family with an income at twice the poverty line, or $48,000 in 2016, would get $9,072 in federal assistance for coverage — still a substantial sum. But it’s $7,400 less than the family would get if they earned half as much. The Baucus plan thus imposes an implicit marginal tax rate of about 30 percent ($7,400/$24,000) on wages earned by families in this income range.

And that would come on top of the high implicit taxes already built into current law. Low-wage families with children also get the Earned Income Tax Credit (EITC). The EITC boosts incomes for those with the very lowest wages, but it is also phased-out as incomes rise. Past a certain threshold (about $21,400 in 2016), the EITC is reduced by $0.21 for every additional $1 earned. Throw in the individual income tax rate (15 percent) and payroll taxes (7.65 percent), and the effective, implicit tax rate for workers between 100 and 200 percent of the federal poverty line would quickly approach 70 percent — not even counting food stamps and housing vouchers.

Going back to our original questions: "Who do you think is the worse off in that situation when it comes to obtaining the essential item? Is it the person or family that has a very low income, a middle-range income or that is really well off?"

The answer is still "it depends." Only now, we should point out that it's probably not who you originally thought. James Capretta concludes:

The more Obamacare is rushed through Congress, the more likely it is to produce highly regrettable unintended consequences. Surely even the Democrats in Congress can see how damaging it would be to send signals to low-wage breadwinners that it no longer makes sense to seek a higher-paying job.

Indeed. But then, that would require politicians to actually care about such consequences, instead of who knows what, as Senator Olympia Snowe (R-ME) reveals in her comment on why she voted in favor of Baucus' scheme: "when history calls, history calls."

We'll observe that there's nothing history loves more than unintended consequences. Except perhaps the folly of those who enable them.

Update 17 December 2009: Tweaked the layout of the data input table to make it more user-friendly. Also, for readers seeking to find the effective marginal tax rate for people affected by the income-linked phase out of government benefits, the result obtained using the tool above should be added to their corresponding marginal income tax rate. Finally, for readers seeking to project where the threshold for poverty has been set in the recent past or will be set in the near future, we have a specific app for that!

Labels: economics, politics, taxes, tool

Mish recently asked and answered a very good question: "Is the stock market a leading indicator?" Remarkably, he found that the stock market is, at best, a coincident indicator, which means that tells you in real time if the economy is distressed.

Mish recently asked and answered a very good question: "Is the stock market a leading indicator?" Remarkably, he found that the stock market is, at best, a coincident indicator, which means that tells you in real time if the economy is distressed.

That's remarkable in that to arrive at that conclusion, which we believe is correct, he applied his technical analysis skills, using candlestick charts showing how stock prices have changed over time to try to divine how effectively those changes anticipated recessions in the U.S. As you can see in the chart Mish created, the picture provided by that kind of analysis produces more questions than answers.

The problem with using technical analysis is that it doesn't tie into the basic fundamentals that drive stock prices, namely how the growth rate of their underlying dividends per share is changing. If we want to really be able to answer the question of the whether the stock market leads, coincides or provides a lagging indication of the economic situation in the U.S., we need to find a way to incorporate this driver into our analysis.

That makes sense because we should expect companies to act to change their dividends depending upon the economic situation they foresee. If they anticipate a worsening business situation, they will cut their dividends. Likewise, if they anticipate strong growth ahead, they'll act to raise their dividends. In both cases, stock prices will change, falling in the case of cut dividends and rising in the case or growing dividends, as investors react to the changing business situation.

But then, dividends are not the only driver of stock prices. As Mish asks in his chart above in looking at the market crash of October-November 1987, "What's This, Chopped Liver? Or a Blown Call?" We would, after all, reasonably expect stock prices to plunge if investors suddenly anticipated major dividend cuts. So is there a tool we can use to isolate the signal the stock market is sending that can also tell us if the market is reacting to a situation in advance of it happening, is reacting in step with it, or is catching up after the fact?

The answer to all these questions is yes. The price-dividend growth rate ratio we've developed can indeed answer these questions

More than that, we see that these spikes in value coincide with the periods of recession. This observation indicates that the stock market is most often a coincident-to-lagging indicator of the economic situation in the U.S.

But wait - there are more spikes in the price-dividend growth ratio than there are recessions! Is this a problem?

In short, no. What the price-dividend growth ratio is communicating is the level of distress seen by the companies of the U.S. stock market. What these "rogue" spikes correspond to may be thought of as microrecessions, or rather, periods in which economic growth slowed to a crawl or that reversed, but which either did not last long enough or did not affect enough of the U.S. economy for the NBER to declare a recession.

Looking at the crash of October-November 1987, we find that while stock prices fell off a cliff, there is no corresponding spike in the price-dividend growth ratio, so we can rule out the possibility of a recession or a microrecession being behind the drop in stock prices at that time.

All in all, our methods incorporating fundamental analysis represent a much more effective way to analyze the economy through the prism of the stock market than typical technical analysis alone.

Labels: chaos, dividends, recession forecast, stock market

How much life insurance do you need?

How much life insurance do you need?

That's the question we're asking today, as our latest tool is designed to put you in the right ballpark when it comes to making sure your loved ones have the resources they need to live the way they would if you were alive and providing for them.

However, we're only going to consider term life insurance for our tool. Sure, you could opt for a universal or whole life policy, or some other kind of hybrid policy, but really, when you get right down to it, all of these are just term life insurance policies that have some kind of investment vehicle attached to them, for which you still need to answer the question of "how much life insurance do you need?"

Our tool below is inspired by one that Certified Financial Planner Jeff Rose of Good Financial Cents used in his post "How Much Term Life Insurance Do You Need to Buy?" We reverse engineered the results he obtained from the tool he used for the example he considered (but for which he failed to provide a link!)

Our default numbers are the same as those he used for his example. If they don't apply to your situation, well, don't complain to us, change them!

The tricky thing about using this tool is considering the balance between income needed to support your survivors and debt payoff. For instance, if your policy provides enough to pay off all the different parts of your debt, such as your mortgage, car payments, student loans, child's college education, etc., then you likely don't need to replace the part of your income that goes to cover these things today. And vice versa - if you're replacing the income that cover your portion of the payments for all these different debts, why double up?

Beyond that, the interest rate that your benefit payout is assumed to earn through the years is where your survivors greatest risk lies. They'll need to account not just for the typical real rate of return that might be expected from where the invest the life insurance payout from your policy in the event of your death, but also the rate of inflation, so that the erosion in the value of money over time doesn't disadvantage them. Historically, the long-term average rate of inflation in the U.S. is 3.3%. These two rates should be added together to produce the interest rate used in the tool above.

Labels: personal finance, tool

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.