Every year, U.S. exports of soybeans peak during the months of October, November, and December. Since most of those exports head to China, we thought it might be interesting to take a snapshot of how 2022's crop is stacking up against previous years.

We pulled the available data on U.S. exports of soybeans to China from the U.S. Census Bureau's USA Trade Online database and calculated the month-by-month cumulative value of soybeans exported to China from January 2016 through the available year-to-date data for September 2022. We then estimated the quantity of soybeans exported each month by dividing these figures by the month's average soybean price per bushel. We generated two charts to illustrate the data and set them to cycle in the following animated chart, which takes us up to the beginning of the U.S.' peak soybean export season in 2022:

With the average price of soybeans mostly hovering within two dollars of $10 per bushel over this period, the cumulative value and quantity exported charts for most years are very similar to each other, including during the U.S-China trade war impacted years of 2018 and 2019. But two years really stand out as different from the others.

Let's start with the most obviously different. At first glance, the cumulative value of soybeans exported by the U.S. to China during 2022 leads all other years by a wide margin. But the animation quickly makes it very clear that the cumulative bushels of exported soybeans is very different, with 2022's quantity of exports far below 2016 and 2017's very high levels. That difference is directly attributable to the inflation of soybean prices, which began in 2021 and has continued in 2022.

2022's soybean price escalation is fairly easy to explain. Many of the soybean-growing regions in the U.S. experienced drought conditions, which both negatively affected crop yields and the ability of farmers to ship their crops to seaports by river. That drought comes as much of South America's soybean growing regions also experienced drought conditions during the year, with the resulting shortages boosting 2022's global soybean prices.

But it doesn't explain 2021's soybean price escalation, during which the seeds of today's soybean inflation were first sown. Here's the title of an article that identifies many of the additional factors that have contributed to that inflation.

Analysis: 'It's a madhouse': Organic U.S. soy prices hit record, fuel food inflation

Reading this October 2021 article, we find many of the underlying seeds behind today's soybean inflation were sown by several government interventions and failures that contributed to the shortages and price increases it describes for organic soybeans.

U.S. prices for organic soybeans used to feed livestock and manufacture soy milk have surged to record highs as imports that make up most of the country's supply have declined, triggering price increases for food including organically raised chicken.

The costly soybeans and higher-priced organic products are fueling food inflation at a time consumers are eager to eat better and focus on health during the COVID-19 pandemic. The $56 billion U.S. organic food sector is also grappling with a shortage of shipping containers and a tight labor market as global food prices hit a 10-year high....

U.S. imports of organic soybeans from September 2020 through August 2021 fell by 18% to about 240,585 tonnes, according to U.S. Department of Agriculture data. Shipments sank by 30% from Argentina, the biggest supplier to the United States.

Imports from India fell by 34%, extending a pre-existing decline after the United States in January toughened its requirements to certify Indian crops as organic.

There's a lot to unpack from this excerpt. First, we see the shortfall of organic soybean imports from India is directly attributable to the Biden administration's regulatory imposition of organic farming requirements as part of its anti-free trade measures aimed at protecting the special interests of a very small number of U.S. organic soybean farmers. Despite harming U.S. consumers, these anti-free trade measures have continued into 2022 with negative impact to both organic soybean prices and other downstream food products. Products like organic chicken, for example, that rely on consuming organic soybean feed to qualify as having been raised to meet arbitrary "organic" standards.

Meanwhile, the other factors the excerpt mentions also negatively impact the price of regular soybeans. The shortage of shipping containers is directly related to the Biden administration's leadership failures in addressing the logjam at the U.S.' west coast ports that it allowed to fester for months before taking its first actions to remedy it during October 2021. Finally, the shortfall of Argentina's soybeans can be traced to the Argentinian government's export policies, which have led many of its farmers to choose to stop growing soybeans in favor of corn, reducing the global supply.

None of these government interventions and failures would have stopped the drought conditions that inflated soybean prices throughout 2022. But that inflation would have been lower had they not contributed to starting the soybean inflation in the first place. In that regard, today's high inflation is very much a fiscal policy choice by politicians putting their special interests ahead of consumers.

Political Calculations initial estimate of the market capitalization of the U.S. new home market fell to $26.74 billion in October 2022. This partially complete twelve month moving average is 11.2% below the new home building industry's November 2020 peak. It's also 3.6% below the revised estimate of $27.75 billion for September 2022, which was revised down from an initial estimate of $28.29 billion.

The latest update of the chart tracking the time-shifted trailing twelve month average of the U.S. new home market cap shows that development.

The following two charts show the latest changes in the trends for new home sales and prices:

For these time-shifted moving twelve month averages, these changes are being clocked now as older, higher sales and price data from previous months are dropping out of the moving average calculation. There are indications however from October 2022's raw data that the downward trend may be slowing. Here's how Reuters reported an "unexpected" reversal:

Sales of new U.S. single-family homes unexpectedly jumped in October, shrugging off rising mortgage rates and house prices, which have drastically eroded affordability.

New home sales rebounded 7.5% to a seasonally adjusted annual rate of 632,000 units last month, the Commerce Department said on Wednesday. September's sales pace was revised down to 588,000 units from the previously reported 603,000 units.....

The median new house price in October was $493,000, a 15.4% increase from a year ago.

These figures refer to the raw figures provided in the U.S. Census Bureau's latest monthly report on new residential sales. That report also indicates the average new home sale price for October 2022 was $544,000, the highest average sale price recorded since July 2022's just finalized all-time record peak of $564,900. That the new, unexpectedly high figure is below that value potentially confirms the peak in new home sale prices.

Falling sales and now falling prices. There's a reason why the sentiment of new homebuilders has reached a decade low. After all, the last time the industry's market cap was falling at a similar pace was during the deflation phase of the early 2000s housing bubble.

References

U.S. Census Bureau. New Residential Sales Historical Data. Houses Sold. [Excel Spreadsheet]. Accessed 23 November 2022.

U.S. Census Bureau. New Residential Sales Historical Data. Median and Average Sale Price of Houses Sold. [Excel Spreadsheet]. Accessed 23 November 2022.

Labels: market cap, real estate

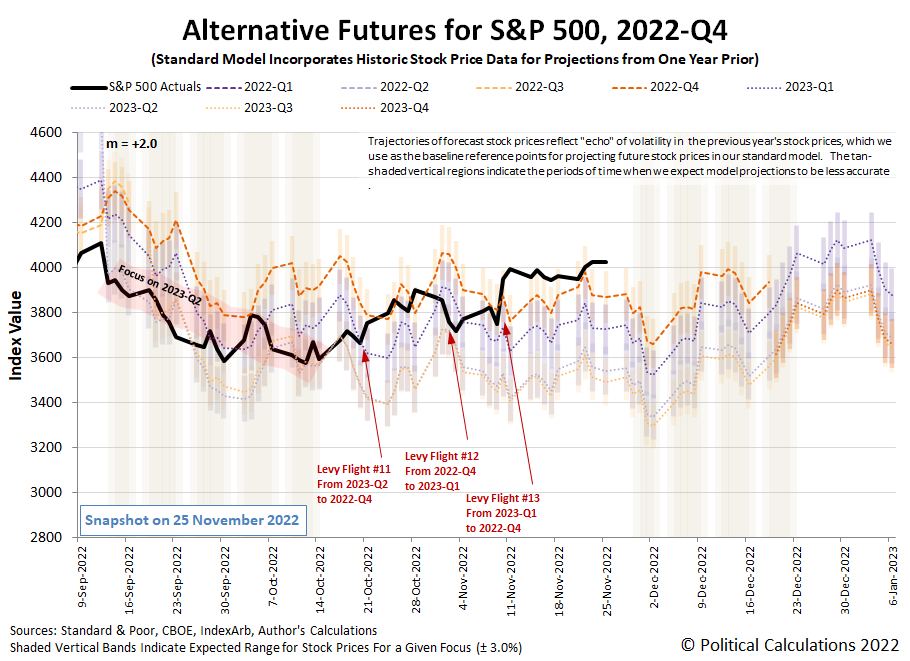

Shortened by the Thanksgiving Day holiday, the S&P 500 (Index: SPX) mostly rose during a slow trading week, only dipping slightly on Friday, 25 November 2022 to end the week at 4,026.12. The index is 770.44 points (or 16.1%) below the index' all-time record high close on 3 January 2022.

The newly updated alternative futures chart shows the index' trajectory as running to the high side of the range associated with investors focusing their attention on the current quarter of 2022-Q4.

We'll soon be entering a period where the echoes of past volatility will skew the dividend futures' model's raw projections. Looking past that period however, we see the projections for 2023-Q1 are rising to a similar level as today's stock prices. That opens up the possibility that when investors act to shift their forward-looking focus away from the current quarter, which they'll be forced to do in the next several weeks, stock prices may not change much from their current level.

Until, that is, investors have reason to look past 2023-Q1 to consider what comes after. As we've seen over the past several weeks, the top two drivers affecting how far into the future investors are looking is what the Fed will do with interest rates and when it will do them.

We'll cover what changes they're expecting and when they're expecting them at the end, but for now, here are the market moving headlines of the week to provide the context in which investors made decisions during the holiday-shortened, slow trading week that was.

- Monday, 21 November 2022

- Signs and portents for the U.S. economy:

- Fed minions say smaller rate hikes ahead, Federal Funds Rate to peak around 5%

- Fed's Mester says she supports smaller rate hike in December

- Fed's Daly: Currently expect fed funds rate to top out around 5%

- Bigger trouble developing in China:

- Bigger stimulus developing in China:

- China tells banks to step up credit support for economy

- China leaves lending benchmarks unchanged for 3rd straight month in Nov

- China regulator plans to improve balance sheets of 'good quality' developers

- China to provide 200 billion yuan in loans to commercial banks for housing completions

- JapanGov, BOJ minions looking to deliver more stimulus:

- Japan finance minister urges swift adoption of more spending measures

- BOJ deputy governor candidate calls for more flexible rate policy

- Positive growth signs, bigger stimulus developing in Eurozone:

- German tax take rebounds in October -ministry report

- German industry calls for more support to diversify beyond China

- ECB minions thinking about backing off from bigger rate hikes, say Eurozone inflation will top out in early 2023:

- ECB's Lane makes case for smaller rate hikes ahead - MNI

- ECB's Villeroy: inflation in France and Europe will peak in first half of 2023

- Wall Street slips as concerns rise of stricter China COVID curbs

- Tuesday, 22 November 2022

- Signs and portents for the U.S. economy:

- Fed minions say their focused on fighting inflation with rate hikes, wonder why Americans aren't saving more:

- Fed's Mester: Lowering inflation remains Fed's main goal

- Fed's George: Could take higher interest rates for longer to encourage saving

- Bigger trouble, stimulus developing in the Eurozone:

- Europe to be hit hardest in global slowdown -OECD

- Euro zone must keep investing during slowdown, help ECB fight inflation -Commission

- BOJ minions see inflation hit record high while they continue never-ending stimulus:

- ECB minions excited to deliver smaller rate hikes with Eurozone entering recession:

- ECB set to raise deposit rate 50 bps as euro zone enters recession -economists: Reuters poll

- ECB's Nagel opens door to smaller hikes but sees long way to go

- ECB's Rehn says inflation, economy will decide pace of rate hikes

- ECB's Holzmann says leaning towards a 0.75% rate hike as things stand

- ECB still has long way ahead of it on rate hikes -Ifo president

- S&P closes at more than two-month high on retail, energy lift

- Wednesday, 23 November 2022

- Signs and portents for the U.S. economy:

- Oil slides over 3% on Russian price cap talks, U.S. gasoline build

- U.S. weekly jobless claims at 3-month high; equipment spending resilient

- U.S. new home sales unexpectedly rise in October

- U.S. business activity weakens further in November - S&P Global survey

- U.S. core capital goods orders, shipments rebound strongly in October

- Fed minions getting set to shrink size of rate hikes:

- Bigger stimulus developing in China:

- ECB minions thinking about smaller rate hikes as they expect recession to take hold this quarter:

- Centeno wants ECB to send clear message of gentler rate hikes

- Euro zone growth will likely be negative in Q4, inflation high, ECB's De Guindos Says

- Wall Street rises as Fed signals slowdown in rate hikes

- Friday, 25 November 2022

- Signs and portents for the U.S. economy:

- Bigger trouble developing in Japan:

- Japan Nov factory activity shrinks at quickest pace in 2 years

- Consumer inflation in Japan's capital rises at fastest pace in 40 years

- BOJ minions looking for reasons to continue never-ending stimulus:

- Bigger stimulus developing in China:

- China banks pledge $162 billion in credit to developers, shares rally

- Bank of China agrees to provide credit lines totaling more than 600 billion yuan to 10 property developers

- China frees up $70 billion for banks to underpin slowing economy

- ECB minions point at inflation to justify rate hikes, claim its peaking:

- ECB accounts show inflation fears justifying more rate hikes

- Euro area inflation likely near its peak, ECB's De Guindos says

- ECB's Schnabel pushes back on smaller rate hikes

- ECB's Lane plays down wage, core inflation fears

- Nasdaq ends down as investors eye Black Friday sales, China infections

The CME Group's FedWatch Tool continues to project a half point rate hikes at the Fed's upcoming December (2022-Q4) and February 2023 (2023-Q1) meetings. Followed by a quarter point rate hike in March (2023-Q1), the Federal Funds Rate is still projected to peak at a target range of 5.00-5.25%. Looking further forward, the FedWatch tool now anticipates a quarter point rate cut in July (2023-Q3) as the Fed is forced to go into reverse by developing recessionary conditions in the U.S. economy.

The Atlanta Fed's GDPNow tool's projection for real GDP growth in 2022-Q4 rose slightly to +4.3% from last week's +4.2% estimate. There continues to be a large gap between its current projection and the so-called "Blue Chip consensus" that predicts near zero growth in 2022-Q4.

We haven't yet seen the iteration of the CSI: Crime Scene Investigation television franchise that rips this story from the headlines, but in 2007, turkey DNA was instrumental in proving the guilt of a criminal.

We had high hopes when we first saw the headline Utah State University Helps Solve Iowa Turkey Crime. Could it be that the crime being investigated involved a frozen turkey leg used as a murder weapon that was subsequently cooked in an effort to destroy evidence by serving it to the police who were investigating it? But no, it was nothing so dramatic. The crime in question involved poaching, where the murder victims were themselves wild turkeys.

Here's the key to how the Utah State University researchers cracked the case:

When game wardens served a search warrant on Iowa hunter Justin Jones, they found five packages of turkey meat. They suspected Jones used a 12-gauge shotgun to poach wild turkeys.

He beat a similar rap once before because no one could prove the meat came from wild turkeys instead the grocery store. This time authorities shipped meat samples to Utah State where they have the only nationwide wild turkey DNA database.

Who knew we needed one? But in this case it was invaluable. Samples from Justin Jones' private stash of turkey meat matched the DNA of wild turkey. "It was pretty convincing that they were, in fact, poached, that they were not domestic turkeys," genetics lab manager Carol Rowe said.

There was more to it than just comparing DNA matches to samples in USU's database. Here's how the Utah State researchers described how they got their man.

Roberg contacted Mock, who agreed to help with the investigation – but she needed help. Mock required DNA samples from known wild turkeys in the same geographic region as the suspected poached birds.

“If you’re showing a particular bird came from a particular population, you have to figure out the probability that this genotype came from your target population rather than from some other population,” says Mock, assistant professor in USU’s Department of Wildland Resources.

With help from Iowa conservation officers and state DNR personnel 78 samples were collected and shipped to USU’s lab. Mock and her team went to work and discovered that the samples seized from the suspect’s freezer showed a high probability of coming from the Iowa wild turkey population.

In the end, they had the suspect dead to rights, leading to perhaps the most boring legal outcome possible:

In October, Jones entered a guilty plea in court and was ordered to pay fines and court costs plus $1,000 toward the cost of USU’s efforts.

This 15-year old case is surprising in many ways. But perhaps the most surprising is how low the cost of doing DNA analysis had become. Consider the following:

- There is an exclusive database with the DNA samples of both wild and domesticated turkeys.

- It is worthwhile for conservation officers to call up the equivalent of CSI: Wild Turkeys for assistance in resolving criminal cases.

DNA analysis has become even cheaper since. Offenders committing turkey-related crimes should beware!

Image Credit: Stable Diffusion DreamStudio Beta - "A cooked turkey in a laboratory, beside a microscope, scientists".

Labels: crime, technology, thanksgiving

Like most holidays, the social dynamics of Thanksgiving can present challenges. Dealing with those challenges can be challenging. We challenge you to overcome the challenging challenges you face... by laughing at them.

We know you need something like this because you're reading this here, on Thanksgiving, rather than engaging with whoever you've gathered with for the holiday. It's okay. We understand. We got you!

Go ahead and take a moment at this critical juncture of your Thanksgiving holiday experience to enjoy the following 15 minute video featuring the somehow Thanksgiving-related stories shared by stand-up comedians Brad Upton, Will Marfori, Tommy Drake, Key Lewis, Tony Deyo, Dylan Mandlsohn, Michael Palascak, Maija Digiorgio, Lucas Bohn, Corey Rodrigues, and Kevin Jordan. Because it might make all the difference in how you experience whatever challenge you're having at your Thanksgiving celebration.

Now, if that 15 minutes didn't do the job, follow the links below for additional survival tips to make it through the day. And remember, once you have made it through the day, you'll have a full year to come up with better plan for how to deal with it than what you had this year!

Labels: thanksgiving

Having covered the inflating cost of a Thanksgiving turkey in 2022, we're turning our attention to something very different: the shrinking size of U.S. farm-raised turkeys in 2022.

That became a cause of concern for American consumers after the U.S. government warned that big turkeys would be scarce in 2022. Here's Axios' executive summary:

The U.S. government is warning of a big shortage of big birds this Thanksgiving.

Why it matters: Because of this year's avian flu outbreaks, finding 20-pound turkeys in some regions of the country could be challenging, U.S. Secretary of Agriculture Tom Vilsack said in a call with reporters on Tuesday.

The bird flu has killed more than 8 million turkeys, according to CDC data.

What they're saying: "Some of the turkeys that are being raised right now for Thanksgiving may not have the full amount of time to get to 20 pounds," Vilsack said on the call, which was about the administration's effort to reduce meat and poultry prices in the long-term.

We've seen this show before, since avian flu was also behind 2015's turkey shortage. But Axios' article doesn't answer the direct question it raises. How much smaller are U.S. farm-raised turkeys in 2022?

To find out we started with the U.S. Department of Agriculture's estimate of the total "Ready-To-Cook" (RTC) weight of turkeys that will brought to market during 2022. That figure is 5.214 billion pounds.

Looking at the last 10 years worth of data, we determined the RTC weight of turkeys averaged 79.1% of the live weight of U.S. farm-raised turkeys. Dividing the total RTC weight by this percentage gives us an estimated total live weight for farm-raised turkeys of 6.592 billion pounds. If we broaden our analysis to look at the range of RTC-to-Live weight percentages over the last 10 years, we find it has fallen between 77.46% (2021) and 79.94% (2015). Doing the same math with these figures gives us a potential range of 6.522 to 6.731 billion pounds for the live weight estimate. The higher the percentage, the smaller the estimated live weight.

All we need to know now is the estimated population of turkeys on U.S. farms. For 2022, that preliminary estimate is 212 million turkeys. That figure is two percent below 2021's final count of 216.5 million turkeys.

We can now estimate the average live weight of a U.S. farm raised turkey. Dividing the total live weight of all turkeys by their population in 2022 tells us that figure is 31.1 pounds (with a potential range between 30.8 and 31.8 pounds based on the range of total live weights). The following chart shows how that fits with all the data reported since 1970.

If the USDA's estimates hold, 2022 has seen the largest year-over-year reduction in the average weight of turkeys in U.S. history. Talk about turkey shrinkflation!

References

U.S. Department of Agriculture. Economic Research Service. Livestock, Dairy, and Poultry Outlook. (LDP-M-339). [Excel Spreadsheet]. 16 September 2022.

U.S. Department of Agriculture. National Agricultural Statistics Service. Turkeys Raised. [PDF Document]. 23 September 2022.

Labels: thanksgiving, turkey

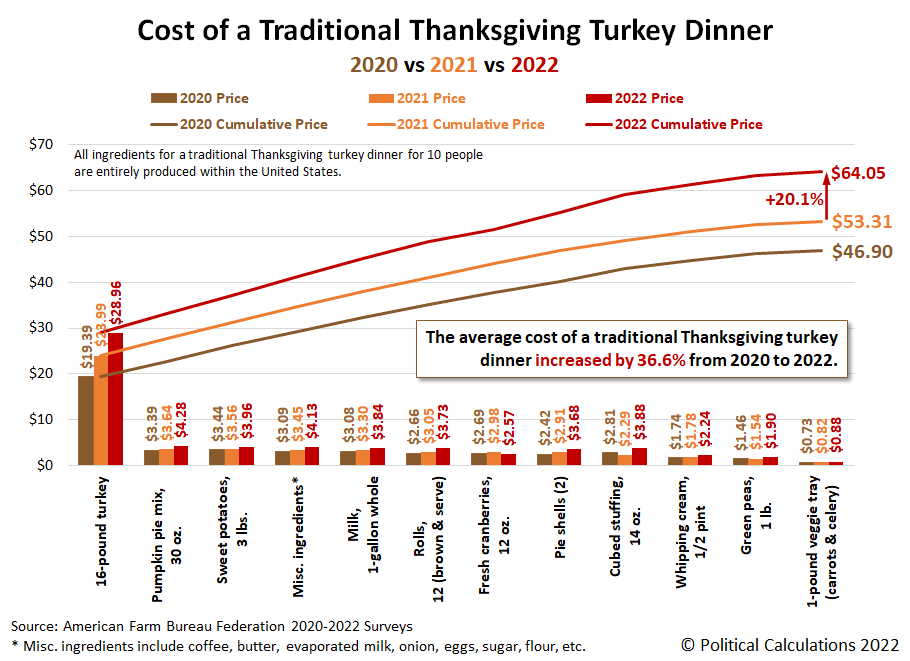

The American Farm Bureau Federation reports the cost of providing a traditional Thanksgiving turkey dinner for 10 people in 2022 is 20% higher than a year ago. The identical grocery items that cost $53.31 a year ago now cost $64.05 according to the Farm Bureau's shopping survey, which is released each year just one week ahead of the Thanksgiving holiday. That new food inflation comes on top of the year-over-year 14% increase recorded last year. Over the past two years, the grocery bill for a traditional Thanksgiving dinner has risen by 36.6%.

All these changes are illustrated in the following chart, in which we've visualized the costs of all the items on the Farm Bureau's annual Thanksgiving shopping list from 2020 through 2022.

In the chart, we've ranked the cost of the individual items and groupings used by the Farm Bureau for their traditional turkey dinner menu from high to low according to their 2021 cost as you read from left to right. We've also tallied the cumulative cost of the meal, with the totals for each shown on the far right side of the chart.

Ranking the data this way lets us see that the increase in the cost of turkey is once again responsible for most of the year-over-year increase in the cost of the meal. Here we see the cost of a 16-pound bird rose by 20.7% to $28.96 in 2022. This single item alone accounts for over 46% of the year-over-year increase in the total cost for the meal. Since 2020, the cost of turkey has increased by $9.57, making up 56% of the realized increase in Thanksgiving dinner ingredient costs over that time.

Meanwhile, only the price of cranberries fell compared to last year, dropping by 13.8%. Every other Thanksgiving dinner items increased in cost during 2022.

Among those items, a 1-pound veggie tray of carrots and celery registered the smallest year-over-year price increase of 7.3%. Every other item's cost was up significantly, recording double-digit year-over-year price increases ranging from a low of 11.2% for sweet potatoes to a high of 69.4% for a 14-ounce package of cubed bread stuffing.

During the last ten years, the cost of a traditional Thanksgiving dinner held steady within a relatively narrow range between $46.90 (2020) and $50.11 (2015). Thanks to the cumulative effect of President Biden's inflation, celebrating Thanksgiving with a traditional turkey dinner has never been more costly for Americans.

Thanksgiving 2022

If you missed it, last Friday kicked off Political Calculations' annual celebration of Thanksgiving, the most American of holidays! We'll continue focusing on turkeys and the holiday through the rest of the week!

References

American Farm Bureau Federation. Farm Bureau: Survey Shows Thanksgiving Dinner Cost Up 14%. [Online Article]. 17 November 2022.

American Farm Bureau Federation. Farm Bureau: Survey Shows Thanksgiving Dinner Cost Up 14%. [Online Article]. 18 November 2021.

American Farm Bureau Federation. Thanksgiving Dinner Cost Survey: 2022 Year to Year Prices. [PDF Document]. 17 November 2022.

Labels: food, inflation, thanksgiving, turkey

The S&P 500 (Index: SPX) mostly drifted sideways to lower during the third trading week of November 2022. That's mainly because nothing happened to change the time horizon of investors, who maintained their forward-looking focus on the current quarter of 2022-Q4.

At least, that's how we're reading the latest update to the alternative futures chart.

We think the drifting lower part of the S&P 500's movement is related to dissipating noise from the previous week. Otherwise, the news of the week indicates what the Fed will be doing with interest rates, and more importantly, what they say they're going to be doing with interest rates in 2023 at its upcoming December 2022 meetings is holding investor attention on 2022-Q4.

Here are the market moving headlines from the trading week ending on Friday, 18 November 2022.

- Monday, 14 November 2022

- Signs and portents for the U.S. economy:

- IMF says global economic outlook getting 'gloomier', risks abound

- Oil settles $3 lower on China COVID surge and firmer dollar

- Fed minions dialing back rate hikes, claim they're serious about slowing inflation:

- Fed may cut size of rate increases, but is not 'softening' inflation fight, Waller says

- NY Fed: Inflation expectations jump in October on gasoline cost fears

- Bigger stimulus developing in China:

- China Plans Property Rescue as Xi Surprises With Policy Shifts

- China further extends loan repayment for small firms hit by COVID

- BOJ minions can't stop, won't stop never-ending stimulus:

- Eurozone economy better than expected back in September:

- ECB minions say they're okay with smaller rate hikes:

- ECB policymakers caution against tightening policy too fast

- Euro zone wages finally rising but inflation expectations muted, ECB VP says

- Wall Street ends lower as investors gauge Fed's policy path

- Tuesday, 15 November 2022

- Signs and portents for the U.S. economy:

- White House says more infrastructure spending coming, rejects inflation link

- Slowed producer prices another plus for Fed's inflation fight

- Oil prices settle higher on Druzhba oil pipeline disruption

- Port of Los Angeles October imports tumble, pressured by labor worries

- Fed minions focusing on fighting inflation they haven't yet dented, but thinking about the perfect time to pause rate hikes and the risk to financial system from crypto fails:

- Fed focused on addressing 'much too high' inflation: Cook

- Fed's Harker: better to pause rate hikes at the right time than risk overtightening

- Fed's tighter monetary policy hasn't dented inflation yet, Bostic says

- Fed's Barr: Concerned about blowback to financial system from crypto

- Bigger trouble developing in China, Japan, Eurozone:

- China's economy loses momentum as COVID curbs hit factories, consumers

- Japan's economy unexpectedly shrinks as hot inflation, global slowdown take toll

- Dutch economy shrank 0.2% in Q3 as inflation bites

- German machinery exports dip, burdened by China - VDMA

- Bigger stimulus developing in Eurozone:

- Central bankers falling into line with Fed's rate hike actions and plans:

- Australia central bank stuck with smaller hike as wary of falling house prices

- Philippine central bank to raise rates by 75 bps- Reuters poll

- India's cenbank likely to go for smaller rate hikes as inflation eases -analysts

- ECB minions thinking about keeping rate hikes going:

- Wall Street gains on inflation data, but rocky on geopolitics

- Wednesday, 16 November 2022

- Signs and portents for the U.S. economy:

- U.S. mortgage interest rates drop back below 7% - MBA

- U.S. import prices fall further in October

- U.S. manufacturing output barely rises; prior months revised down

- U.S. retail sales rise solidly; fourth-quarter GDP estimates raised

- Oil falls as Druzhba pipeline reopens, China COVID worries stay at the fore

- Fed minions giving up on soft landing for U.S. economy from its rate hikes, keep focus on what they'll do in December, claim they can't deliver financial stability:

- Fed's George says increasingly difficult to bring inflation down without a recession - WSJ

- Fed's Daly: top policy rate of 4.75%-5.25% 'reasonable'

- Fed's Williams says monetary policy not best tool for financial stability

- Bigger trouble developing in Japan:

- Bigger trouble, stimulus developing in China:

- China's home prices see biggest fall in 7 years, recovery bumpy

- China approves eight fixed-asset investment projects worth $1.27 billion in Oct

- China to step up prudent monetary policy, expand upward economic trend -central bank

- ECB minions claim inflation is top priority, starting to worry about hiking rates, will be "prudent" in unloading holdings of EU government debt and that green policies will eliminate inflation:

- ECB must keep inflation fight as top priority, de Guindos says

- ECB has room to raise rates further but should proceed with caution, De Cos says

- ECB doves make case for increased caution in policy tightening

- ECB promises "prudent" balance sheet cut as stability risks rise

- ECB's Panetta says green transition may help cut inflation

- Wall Street ends down after Target outlook, Micron supply cut

- Thursday, 17 November 2022

- Signs and portents for the U.S. economy:

- J.P.Morgan predicts a mild U.S. recession next year

- Gobble, gobble, gulp! Food prices put the bite on U.S. Thanksgiving feast

- Oil falls on worries of U.S. rate hikes, China demand outlook

- First TVs, now tortillas: U.S. companies set minimum prices to halt discounting

- U.S. housing starts tumble in October amid soaring mortgage rates

- U.S. labor market remains tight despite technology sector layoffs

- Fed minions signal more rate hikes coming, Fed chief to set size of rate hikes:

- Fed's Bullard: Even 'dovish' policy assumptions require more rate hikes

- Fed's Jefferson says low inflation key to U.S. prosperity

- Fed's Kashkari: not stopping rate hikes until inflation peaks

- Bigger trouble developing in China, Eurozone:

- China's imports, exports will see greater pressure in Q4 - commerce ministry

- German exports likely to fall 2% next year - DIHK survey

- BOJ minions determined to keep never-ending stimulus alive, or not:

- BOJ's Kuroda repeats commitment to continue monetary easing

- Nakaso, a contender to lead BOJ, urges removal of emergency support

- Wall Street drops as hawkish Fed official comments weigh

- Friday, 18 November 2022

- Signs and portents for the U.S. economy:

- U.S. existing home sales plunge; tight inventory keeps prices rising

- Oil slides 2%, posts second weekly decline as supply fears recede

- Fed minions keep investor focus on what they's do and say at December 2022 meeting, worry about bank liquidity:

- Fed to lift rates by 50 basis points, but peak policy rate may be higher: Reuters Poll

- Fed's Collins: Another 75-bps hike could be ahead

- NY Fed: Bank liquidity may be tighter than thought, with policy implications

- BOJ minions okay with inflation, stalling for time to keep never-ending stimulus alive:

- Japan's inflation hits 40-year high as BOJ sticks to easy policy

- BOJ Gov Kuroda rules out rate hike until wages rise more

- ECB minions taking money out of Eurozone economy, say they'll hike rates decisively, but could slow their pace and drag them out:

- ECB begins great cash mop-up as banks repay 296 billion euros of loans

- ECB policymakers hint at slower rate hikes but quicker start to debt run-off

- S&P 500 ends higher, led by defensive shares

The CME Group's FedWatch Tool continues to project a half point rate hike on tap for 14 December (2022-Q4). But in 2023-Q1, the FedWatch tool now projects a half point rate hike in February and a quarter point rate hike in March (2023-Q1), with the Federal Funds Rate reaching a peak target range of 5.00-5.25%. Looking further forward, the FedWatch tool still anticipates two quarter point rate cuts in 2023-Q4 (November and December) as the Fed is forced to go into reverse after developing recessionary conditions take hold in the U.S. economy.

The Atlanta Fed's GDPNow tool's projection for real GDP growth in 2022-Q4 rose to +4.2% from last week's +4.0% estimate. There continues to be a big gap between its forecast and the so-called "Blue Chip consensus" that continues to predict near zero growth in 2022-Q4.

With the Thanksgiving holiday later this week, we're not expecting much to happen with stock prices. As such, we're switching the rest of our week's analysis over to resume our annual Thanksgiving celebration, where we'll pick up with the next regular edition of the S&P 500 chaos series on Monday, 28 November 2022.

Although they may be really expensive and in short supply this year, most Americans Thanksgiving holiday dinner tables will still feature a turkey as its centerpiece. And those that do see that turkey ruthlessly butchered by non-professional carvers who will do more to process the meat into leftover hash than they will to serve elegant slices of turkey to their gathered families and guests.

That's because non-professional turkey carvers don't know how to deal with the bones. Wouldn't it have been much nicer if you could have bought a boneless bird? One that still looks the traditional bone-in centerpiece from Norman Rockwell's painting of a Thanksgiving celebration?

Inventor Peter Sieczkiewicz did, memorializing his unique method of preparing edible fowl in U.S. Patent 2,844,844! But before we go any further, Sieczkiewicz makes clear in the patent's description that we're talking about turkey:

For illustrative purposes, the invention will be described with reference to an edible turkey, although it will be appreciated that the method may equally well be employed in conjunction with other types of edible fowl, for example, chickens, geese, and the like.

Got it? If you've got an edible fowl, you can use the Sieczkiewicz method on it! Knowing that now, let's review what's wrong with every other method of preparing turkeys:

Turkeys are now processed in a variety of forms to comply with the needs and desires of different type consumers. In one conventional method, the meat of the turkey is stripped from the carcass and cut to a convenient size for packaging in various sized jars, and can containers. In another case, the flesh of the turkey is maintained intact and the turkey is similarly-packaged for sale in a pre-shaped can or the like. More recently, methods have been devised for completely removing the bones from the turkey and still retaining the skin and flesh structure. However, the latter methods have been dependent for their successful accomplishment upon; forming a plurality of incisions through the skin of the turkey as a preliminary step in order to facilitate and enable the successive removal of the different structures.

It will be apparent that a disadvantage characteristic of all the above methods presently used is the fact that either the skin of the turkey is completely removed or it is severed to the extent that the turkey as a whole does not retain its original appearance. In addition, it will be evident that after the boning operation has taken place, the turkey must be sewn along the incision lines or else firmly bound or tied together with the result that a further detraction from the natural appearance of the turkey will result.

What sane host would serve their guests something that looks like Frankenstein's Thanksgiving dinner? Fortunately, there's now a better way! But before we get into the patented Sieczkiewicz method for deboning a turkey while preserving its classic contours, let's get to the patent's illustrations because we'll need to refer back to them.

Here's what you're looking at:

Figure 1 is a view of a dressed turkey;

Figure 2 is "a general view of the bone structure of the turkey of Figure 1;

Figure 3 is a view of the turkey of Figure 1 after the bone structure, as shown in Figure 2, is removed therefrom; and, Figure 4 is a view of the turkey of Figure 3 after stuffing and final preparation for the consumer.

In Figure 1 there is shown a dressed fowl or turkey, as it is received by the butcher, with its intestines, feet and head removed. The turkey is shown as having legs 10 and wings 11. The back portion of the turkey is denoted by the numeral 14 and the breast portion is indicated at 15, while the neck or crop opening is identified by the numeral 13.

We're not going to hold back from this point on. Everything you need to know about deboning a turkey in the most aesthetically pleasing way possible is contained in the following extended excerpt:

In the performance of the method of the present invention, no special tools are required, and the removal of the bones may be, accomplished with a conventional butcher's boning knife, in conjunction with the use of his fingers and fingernails. Towards this end, the first step is to insert the boning knife through the neck opening 13 and begin the successive disjointing and removal of the various bones. The bone removal procedure may be more clearly described by reference to Figure 2.

Initially, the wing bones 16 are disjointed from and severed from the shoulder blade bones 17. The wing bones 16 are thereafter removed through the neck opening 13 as the wings 11 themselves are reversed such that the skin and flesh are turned back inside out. After the wing bones 16 have been removed and the wings 11 turned back, the shoulder blade bones 17 are cut away from their connection to the upper back bone 18 and similarly removed through the neck opening 13.

The next step is to remove the wish bone 19 connected to and forming the upper portion of the breast bone 20.

The wish bone 19 is severed from the breast bone 20 and similarly taken out through the neck opening. At this point either the breast bone 20 or the upper backbone 18 may be disjointed for removal. Before the breast bone 20 or upper backbone 18 are removed, rib bones 22 are first broken and removed from the turkey. Thereafter, the breast bone 20 and upper backbone 18 are taken out through the neck opening 13.

As this operation is proceeding, it is desirable for the butcher to continually roll back the skin and flesh as the bones are removed in order that he may have access to the bones still remaining within the turkey body.

Where certain larger bodied fowl are involved, it may not be necessary to turn back the skin except during the removal of the leg and wing bones. For the purpose of removing the bones, it is desirable that the butcher employ his fingers for breaking the bone joints, while at the same time utilizing the boning knife and his fingernails as a means of scraping back the flesh and skin, whereby the meat will not be drawn out with the bones.

Continuing with the bone removing steps, the thigh bones 23 are separated from the lower backbone 24 and from the leg bones 25, and the thigh bones 23 are then removed. Thereafter, the leg bones 25 may be simply removed. At this time the only bone structure remaining will be the upper backbone 21 and the lower backbone 24 which as a connected structure may be easily slipped out from within the body of the turkey.

That's the hard part. If you've been following along with your own turkey at home, the next passage will confirm you're looking at what you think you're looking at. It will also provide you with the final instructions you need to complete your deboning procedure:

In view of the progressive normal turning back of the skin and flesh, it will be appreciated that after all the bones have been removed in accordance with the foregoing method steps, the turkey will be substantially turned inside out with the skin in the interior and the flesh exposed. At this time, the turkey may be turned back to its normal position by drawing back the flesh towards the neck opening 13 so that the skin is again in its natural position on the outer surface of the turkey.

Without the supporting bone structure, the turkey will have the flat, flabby appearance as indicated in Figure 3, with the wings 11 and legs 10 stretched out. In order to prepare the turkey for distribution and sale, the turkey may be stuffed in a conventional manner, although it will be appreciated that since the fowl is limp and flabby that a great deal of care must be taken to assure that the skin and flesh will not be inadvertently ruptured or damaged. For this purpose the wings should either be secured with respect to each other, or with respect to the body of the turkey. Similarly, the legs should preferably be held together or to the body of the turkey as the stuffing operation is proceeding. Thereafter, the legs may be provided with skewers or similar strengthening members 26, as indicated in Figure 4, and the wings attached in a conventional manner to the breast portion of the turkey, whereby the turkey may then be precooked and frozen or merely frozen preparatory to eventual distribution and sale to the ultimate consumer.

It's the end of this description that might make a turkey consumer wonder why they bothered removing all the bones from their bird in the first place. Unfortunately, that may also be why the Sieczkiewicz method never caught on with the Thanksgiving-enjoying public, which is why you will not find such a finely prepped fowl for sale at your local grocer over sixty years after the method was originally patented. That's why we've given you the detailed deboning directions from the patent in this edition of Inventions in Everything, because that's all that remains of Peter Sieczkiewicz' inventive inspiration.

Happy Thanksgiving!

Image Credit: Stable Diffusion DreamStudio Beta: "Photograph of homemade sliced roast turkey breast, intricate, elegant, highly detailed, digital painting, artstation, concept art, smooth, sharp focus, illustration, art by Annie Liebovitz".

More from the IIE Archives

The Inventions in Everything team has previously covered at least two other innovations created to solve the problems of disassembling food!

- The Kitchen Unitaskers You Cannot Live Without (including the "Meat Handling and Shredding Claws")

- Inventions in Everything: The Oreo Separator Machine

Labels: food, technology, thanksgiving

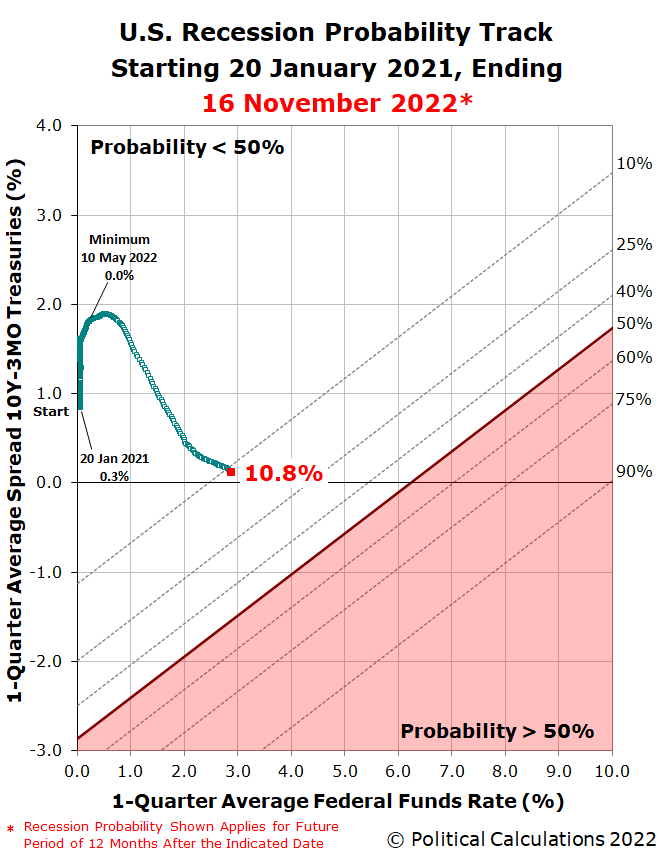

The odds that the National Bureau of Economic Research will someday identify a month between November 2022 and November 2023 as the point in time when the U.S. economy peaked before heading into recession have risen higher than 1-in-10.

That's up from the 1-in-15 odds we estimated a month earlier. Since that time, two things happened to make a recession more likely:

- The U.S. Federal Reserve hiked the Federal Funds Rate by 0.75%, increasing its target range to 3.75%-4.00%. That's the highest this interest rate has been since the so-called "Great Recession" got underway in January 2008 after the U.S. economy peaked in December 2007.

- The yield curve for constant maturity U.S. Treasuries inverted. Which is to say the yield (or interest rate) of the short-term 3-Month Treasury fell below the yield of the long-term 10-Year Treasury. The spread between the 10-Year and 3-Month Treasuries is now at its most negative since this portion of the Treasury yield curve first inverted on 18 October 2022.

For this update to the recession probability track, these two changes combined to shift its trajectory downward and to the right. It has reached a higher probability of recession of 10.8%, which is to say the probability is now closing in on odds of 1-in-9.

Of the two changes, the Fed's rate hike was the bigger driver for increasing the probability of recession.

The Recession Probability Track is based on Jonathan Wright's yield curve-based recession forecasting model, which factors in the one-quarter average spread between the 10-year and 3-month constant maturity U.S. Treasuries and the corresponding one-quarter average level of the Federal Funds Rate. If you'd like to do that math using the latest data available to anticipate where the Recession Probability Track is heading, we have a very popular tool to do the math.

Our next update will come shortly before the Federal Reserve's Federal Open Market Committee's next two-day meeting on 13-14 December 2022. At the end of that meeting, the FOMC is expected to announce they'll hike the Federal Funds Rate by a half point according to the CME Group's FedWatch tool.

Assuming the same yield curve inversion and Federal Funds Rate as today, the recession probability track could rise to over 17% by that time. That would put the odds of the NBER finding the next recession began sometime between December 2022 and December 2023 at better than 1-in-6. That's *before* the Fed's next anticipated rate hike. The odds will only rise higher with it.

For the latest updates of the U.S. Recession Probability Track, follow this link!

Previously on Political Calculations

We started this new recession watch series on 18 October 2022, coinciding with the inversion of the 10-Year and 3-Month constant maturity U.S. Treasuries. Here are all the posts-to-date on that topic in reverse chronological order, including this one....

Labels: recession forecast

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.