How much does bootlegging tobacco products pay in New York?

How much does bootlegging tobacco products pay in New York?

That's a good question because unlike Hawaii, New York's tobacco product consumers have lots of options for evading the state's highest-in-the-nation cigarette tax of $4.35 per pack, which went into effect during the summer of 2010, bringing the average cost of a pack of cigarettes in New York state to $9.20.

For instance, looking at the map, they could easily drive across the state's border with Vermont ($2.24 per pack tax), or Massachusetts ($2.51 per pack tax), or Connecticut ($3.00 per pack tax), or New Jersey ($2.70 per pack tax), or Pennsylvania ($1.60 per pack tax) to buy the same tobacco products they could in New York, which would have the same base price but with much lower taxes.

So to find out just how much money a tobacco consumer could save by avoiding New York's tobacco taxes just by traveling to its neighboring states, we've adapted the tool we developed for our original "Business of Bootlegging" post to apply to New York's situation.

In our tool, the default data applies to the situation where a hypothetical tobacco product consumer who lives in the state capital of Albany would travel 124 miles on U.S. interstate highways to Matamoras, Pennsylvania to exploit the savings of $2.75 per pack in cigarette taxes between the two states.

Here, we'll assume our casual cigarette bootlegger makes the round trip just once per week, bringing back 30 cartons per trip, which they then sell for $8.00 per pack. The same price the New York Post reports they paid to a vendor in New York City for a pack that didn't carry the state's cigarette tax stamp (HT: Newmark's Door).

Can our hypothetical bootlegger make a profit by making a run for the border? Just click the "Calculate" button to find out!

What we find is that our hypothetical bootlegger could net a profit of $12,100 per year, tax free, just making that one trip per week. That's what's left after an annual revenue of $120,000 less annual costs of $107,900.

But what about a serious smuggler? One willing to risk the penalties associated with evading New York's tobacco taxes by making the trip at least once per business day? Which if this case from May 2010 is any indication, resulted in federal charges being filed against 41 individuals who face the risk of life in prison for money laundering and criminal conspiracy.

Modifying our tool to increase the number of trips per year to 260, we find that our professional smuggler would have an annual revenue of $624,000 against annual costs of $561,080, producing an income tax free net gain of $62,920 for what we might describe as a one-person operation.

Meanwhile, New York's tobacco product consumers are saving 13.0% over what they might legally have to pay by shifting their buying to support the bootlegging operations.

Is it any wonder then that New York tobacco product consumers are turning to the black market? So much so that the state now estimates that it has failed to collect as much as $20 million per month in cigarette taxes as what it had predicted before imposing its pre-highest-tax-in-the-nation level of tobacco product consumption since the new tax went into effect in July 2010:

The underground tobacco market is spreading like a fast-growing cancer in the wake of tax hikes that make New York cigarettes the most expensive in the nation -- and it's costing the state tens of millions a month in lost tax revenue, a Post analysis has found.

Illegal cigarettes are pouring into neighborhood bodegas by the truckload from neighboring Indian reservations, lower-tax states in the South and even as far away as China, authorities say.

Government data show that New York state is being smoked out of as much as $20 million a month from all these illegal cigarette purchases -- an estimated 7.3 million packs a month sold off the state tax radar.

If we up the "Retail Price per Pack (Where Sold)" in our tool by $1.50 (to account for New York City's own tobacco tax), bringing it up to $10.80 per pack, we find that the typical savings for a tobacco product buyer who chooses to participate in New York's underground cigarette economy rises to 25.9%.

With that kind of savings on the consumer end and that kind of money to be made on the bootlegger's side, we can say with confidence that New York's cigarette smuggling problem is only going to get bigger.

Previously on Political Calculations

When we last looked at the trend in new unemployment claims, it was Election Day in the United States. At that time, we made the following forecast:

For the week of 30 October 2010, we would anticipate that these claims will fall in a range between 411,000 and 508,000. Assuming the current trend remains in effect, we should see the overall level of jobless claims fall at a very sluggish rate of 220 per week.

That forecast was almost perfectly on target. Through the week of 30 October 2010, the rate at which initial unemployment insurance claims have been filed since the current trend began on 21 November 2009 was declining by 215 per week, with the actual new claims number coming in just above the middle of our statistically forecast range at 459,000 (initially reported as 457,000).

We had also speculated, via the graph included with our last review, that the large number of waivers the Obama administration was granting to the big corporations and unions it favors above all other U.S. business entities from having to comply with the new health care reform law might be a significant factor that could affect the U.S. layoff trend.

As it happened, the data for 30 October 2010 allows us to rule that potential factor out. With the number of layoffs that week exceeding the mean value we had forecast, we find that no clear break in the overall trend for U.S. layoffs may be attributed to the Obamacare waivers granted to big businesses and unions.

But something bigger may be taking place today!

Updating our chart showing the major trends and break-points since 2006, we find that the U.S. may indeed now be on the verge of breaking out of the overall trend for new unemployment claim filings established when HR 3962, the first credible legislative forerunner to what ultimately became the Obamacare health reform law, squelched the improving situation for layoffs in the U.S. when it was introduced.

Unfortunately for the Obama administration, the something bigger that might finally be positively affecting the outlook for the bulk of U.S. businesses would appear to be the results of Election Day 2010, where the opposition Republican Party won a clear majority in the U.S. House of Representatives, establishing a clear check on the unfettered ability of the Obama administration and the former Democratic Party majority in the U.S. Congress from achieving their anti-small business objectives.*

To confirm that a clear break from the trend established since 21 November 2009 has occurred, we will to see the number of seasonally-adjusted initial unemployment insurance claim filings drop below 401,000 for the week of 27 November 2010 and to sustain that lower level in the weeks ahead.

* Most of what we describe as "anti-small business objectives" consist of a large number of regulatory policies combined with laws passed by the former Democratic Party majority in the U.S. Congress that increase the relative cost of doing business for small-to-middle size U.S. firms, or that threaten to do so in the case of potential legislation or regulations, both of which negatively affect the outlook for U.S. businesses. An important thing to note for the 2010 election results is that a key component of the Republican platform was to reverse or mitigate many of the cost-hiking provisions of the recently passed health reform law, which has clearly acted to stall the U.S. economic recovery since it was first introduced.

Labels: jobs

Welcome to this Friday, November 26, 2010 edition of On the Moneyed Midways! Each week, we present the best posts we found in the best of the past week's money and business-related blog carnivals!

Welcome to this Friday, November 26, 2010 edition of On the Moneyed Midways! Each week, we present the best posts we found in the best of the past week's money and business-related blog carnivals!

It's the day after Thanksgiving 2010 and we're definitely still experiencing something of a turkey coma. That said, as we pile down black coffee before venturing out to participate in Black Friday, we'll just get right to this week's edition of OMM.

The best posts we found in the week that was follow below!...

| On the Moneyed Midways for November 26, 2010 | |||

|---|---|---|---|

| Carnival | Post | Blog | Comments |

| Best of Money | It’s Only a Money-Back Guarantee If You Ask For It | Control Your Cash | Author Greg attended a book publishing conference that promised a "100% money back guarantee" if the attendees didn't believe they got the full value of the $500 they paid to attend. Well, Greg didn't believe he did.... |

| Carnival of Debt Reduction | How to Fix a Late Payment on a Credit Card | Miss Bankrupt | What can you do if you miss a your credit card's payment due date? Christina walks through the steps you can take to eliminate the late fees you'll be charged and how you can avoid having it happen again. |

| Carnival of HR | The HR Nightmare | HR Ringleader | A woman Michelle Berg had been forced to let go several months earlier called her at home in the middle of the night to threaten her. The story of how this negative experience became the impetus for Michelle to leave her job and to establish her own HR consulting business is The Best Post of the Week, Anywhere! |

| Carnival of Personal Finance | Beware of Men Counting Pennies | The Kitchen Sink | Aloysa shares her and her friend's horror stories about men she calls "penny pinchers." For good reason, it turns out.... |

| Festival of Frugality | Is It Frugal, Stealing or Just Plain Cheap | Passive Family Income | Which of the following things would you consider to be frugal, stealing or just plain cheap?: Halloween candy, lowering your cable bill by threatening to switch carriers, taking coupons, regifting, sneaking food into a movie, sneaking liquor into a restaurant, claiming your child is under an age that gets a discount, returning a once-worn item and returning an item for store credit. |

OMM's Running Index for 2010

Presented in reverse chronological order....

- On the Moneyed Midways - November 26, 2010

- On the Moneyed Midways - November 19, 2010

- On the Moneyed Midways - November 12, 2010

- On the Moneyed Midways - November 5, 2010

- On the Moneyed Midways - October 30, 2010

- On the Moneyed Midways - October 22, 2010

- On the Moneyed Midways - October 15, 2010

- On the Moneyed Midways - October 8, 2010

- On the Moneyed Midways - October 1, 2010

- On the Moneyed Midways - September 24, 2010

- On the Moneyed Midways - September 17, 2010

- On the Moneyed Midways - September 10, 2010

- On the Moneyed Midways - September 3, 2010

- On the Moneyed Midways - August 27, 2010

- On the Moneyed Midways - August 20, 2010

- On the Moneyed Midways - August 13, 2010

- On the Moneyed Midways - August 6, 2010

- On the Moneyed Midways - July 30, 2010

- On the Moneyed Midways - July 23, 2010

- On the Moneyed Midways - July 16, 2010

- On the Moneyed Midways - July 9, 2010

- On the Moneyed Midways - July 3, 2010

- On the Moneyed Midways - June 25, 2010

- On the Moneyed Midways - June 18, 2010

- On the Moneyed Midways - June 11, 2010

- On the Moneyed Midways - June 4, 2010

- On the Moneyed Midways - May 28, 2010

- On the Moneyed Midways - May 21, 2010

- On the Moneyed Midways - May 14, 2010

- On the Moneyed Midways - May 7, 2010

- On the Moneyed Midways - April 30, 2010

- On the Moneyed Midways - April 23, 2010

- On the Moneyed Midways - April 16, 2010

- On the Moneyed Midways - April 9, 2010

- On the Moneyed Midways - April 2, 2010

- On the Moneyed Midways - March 26, 2010

- On the Moneyed Midways - March 19, 2010

- On the Moneyed Midways - March 12, 2010

- On the Moneyed Midways - March 5, 2010

- On the Moneyed Midways - February 26, 2010

- On the Moneyed Midways - February 19, 2010

- On the Moneyed Midways - February 13, 2010

- On the Moneyed Midways - February 5, 2010

- On the Moneyed Midways - January 29, 2010

- On the Moneyed Midways - January 23, 2010

- On the Moneyed Midways - January 15, 2010

Older Editions

- OMM: The Best Posts of 2009 and our full index for the year!

- OMM's Running Index for 2008

- OMM's Running Index for 2007

- The Best Blogs Found in 2006 (and our full 2006 index)!

Labels: carnival

Here at Political Calculations, we care about your Thanksgiving experience. So to that end, we'll present Esquire's Glen Waggoner's list of the three things you should never do with food on Thanksgiving Day:

- Don't be "creative" with the menu.

- Don't even think of serving anything other than turkey.

- Don't get a frozen turkey.

The explanations of why you shouldn't do these things are here....

We know that for many of you, it's simply too late to avoid making these mistakes at this point, but at least you now have a short starter list of the things you did wrong this Thanksgiving!

And although it might truly be too late for you to have made at least one more surprisingly common mistake, to help you avoid the stigma of perhaps setting your house on fire and sending innocent bystanders to the hospital, here's Alton Brown's invaluable guide to what you need to know and do to deep fry your turkey:

Happy Thanksgiving!

Labels: food, thanksgiving, turkey

In previous recessions, turkey production and consumption in the U.S. has risen. At least, that was the pattern in 1991, 2001 and even in 2008. But in 2009, something very different happened: both the quantity and price of turkeys plunged as the relative demand for turkeys plummeted.

That change is all the more remarkable because it came just a year after the quantity and price of turkeys in the U.S. had soared on increased demand, even though the U.S. economy had entered into recession nearly a year earlier in December 2007.

Why then was the experience of 2009 so different from 2008? Today, we're going to get to the bottom of that economic detective story.

We've already eliminated the price of turkey itself as being a potential culprit for the massive reduction in the quantity of turkeys produced in 2009. If the price of turkeys had spiked in 2009, we could have then attributed the fall in turkey consumption and its related production to the consumer reaction to extremely high prices, just like what occurred with the price and consumption of oil in the summer of 2008.

But it didn't, so we had to look elsewhere. We decided to take a closer look at the recession itself, to see whether the job loss related to it might be the culprit. After all, nothing kills off consumer demand quite like consumers who have lost their jobs.

Adapting our chart considering job loss by age group since total U.S. employment peaked in November 2007 (aka "Thanksgiving 2007"), we find that by Thanksgiving 2008, over 2.5 million fewer people were employed compared to Thanksgiving 2007. By Thanksgiving 2009, that figure reached 8.1 million.

We see that the recession certainly worsened between Thanksgiving 2008 and Thanksgiving 2009, but that doesn't explain why turkey production and consumption would rise by 6 million turkeys in 2008 when 2.5 million fewer people were working, before falling by 26 million in 2009 after an additional 5.5 million people were no longer counted as being employed.

And then it hit us. Looking at the age-related data on the chart, we see that a major shift began taking place beginning in November 2008 in who was no longer counted as working - individuals over Age 25!

We next combined the teens and young adults into a single Age 16-24 group and charted how their numbers in the workforce have changed over time compared to the Age 25+ group. We then charted the data, going back one additional Thanksgiving for good measure to get a larger sense of the overall trends.

What we find is teens and young adults bore the brunt of job loss in the recession up through October 2008. After October 2008, the employment situation in the U.S. significantly worsened for individuals Age 25 or older.

It's no secret why. October 2008 was the time when massive layoffs began taking place throughout the entire U.S. automotive industry production chain, which was devastated by the sudden change in consumer demand that occurred when oil prices spiked earlier that year.

But that age-based shift in job loss does explain why 2008 saw turkey consumption rise, while 2009 saw it decline dramatically.

Think about this question: what happens to a teen or young adult who loses their job? More often than not, they either continue to live at home, or in the case of young adults, they might simply move back home to live with their parents until they can find new work.

In both cases, the amount of food that their parents must provide increases. Since teens and young adults are less likely to host a traditional Thanksgiving dinner featuring a turkey as the centerpiece on their own, the amount of turkeys demanded increases as their parents host the annual holiday to feed their expanded households.

But that picture changes when it is the parents who are the ones who lose their jobs in an economic downturn, in addition to their older, working-age children. Suddenly, entire families must cut back, with U.S. turkey consumption falling as one result.

And many American families' Thanksgiving just isn't anywhere near the same.

Labels: economics, food, thanksgiving, turkey

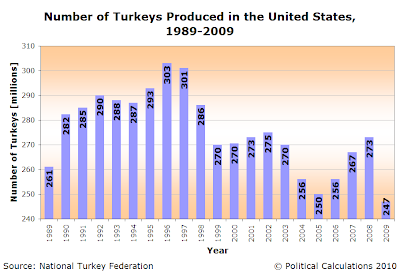

In 2009, turkey production in the United States was decimated. Literally!

Sure, the U.S. economy was in recession, but what happened to turkey production in 2009 contradicts the pattern we observed in each of the three previous U.S. recessions in 1991, 2001 and even 2008, where turkey production has historically risen to fly in the face of economic contraction.

But then, in 2009, like Ben Bernanke's money or turkeys dropped from a helicopter, they plunged to earth.

The question we have today is why was 2009 different from every other year of recession for which we have data where turkey production and consumption by Americans is concerned?

We began by first investigating whether the price of turkeys had suddenly or dramatically risen, which would lead fewer people to buy turkeys. To get an idea of the base price of a turkey, we took data from the National Turkey Federation related to the amount of turkey producer's farm income and divided it by the total turkey production in the U.S. to get an approximate unit price. We then adjusted the values to account for the effect of inflation over time, producing our second chart.

What we find is that the nominal base price of a turkey in 2009 dropped from $16.41 in 2008 to $14.45, a decline of 11.9% and in inflation-adjusted terms, the decline is an almost identical 11.6%.

By contrast, the recession year of 1991 saw turkey prices drop by 2.6% in nominal terms and 6.6% in real terms. In 2001, turkey prices dropped by 2.0% in nominal terms, while they fell 4.6% after adjusting for inflation. And in 2008, after nearly a full year of recession, turkey prices actually rose by 10.9% from the previous year, or 6.7% when adjusted for inflation, driven by increased demand!

So something changed between 2008 and 2009 to fully reverse the typical pattern we've observed in the U.S. where turkey consumption rises during a recession, seemingly regardless of the change in price.

In our next installment, we'll identify just what that something was. As a teaser, it's not so much of a what, so much as it is a who....

Until then, we can't resist. Here's the classic scene from WKRP in Cincinnati:

See the full episode Turkeys Away at Hulu!

Labels: thanksgiving, turkey

It's time for our annual Turkey Week here at Political Calculations, where we drop everything else and celebrate the most American of holidays: Thanksgiving! We'll start our celebration this year with a question:

What effect does a deep recession have upon the production of turkeys in the United States?

Compared to the previous year, 2009 saw the number of turkeys produced in the U.S. plummet by 26 million, falling from 273 million produced in 2008 to 247 million in 2009. This drop marks the largest year-over-year change in the number of turkeys produced ever recorded by the National Turkey Federation, whose data extends back to 1989.

In percentage terms, 2009 also marked the largest ever one-year percentage change in the annual production of turkeys in the United States, with 9.5% fewer turkeys produced in 2009 as compared to 2008.

This pattern sharply contradicts what we observed last year, when we speculated that the increases in turkey consumption that we see have taken place in other years of recession was driven by people turning to traditional or comfort foods at times of economic stress.

2009's data strongly indicates that bigger forces were at work. We'll be digging deeper in the days ahead....

Labels: thanksgiving, turkey

Welcome to this Friday, November 19, 2010 edition of On the Moneyed Midways, where each week, we present the best posts we found in the best of the past week's money and business-related blog carnivals!

Welcome to this Friday, November 19, 2010 edition of On the Moneyed Midways, where each week, we present the best posts we found in the best of the past week's money and business-related blog carnivals!

This week's edition of OMM started out pretty much the same way that all editions of OMM have come together since our inaugural edition back on March 3, 2006. For this week, we reviewed nine business or money-related blog carnivals, and one whose edition we missed last week, of which five carnivals made our initial quality control cut for consideration. We then read through several dozen posts in seeking the best post presented in each.

It was the sheer quality of the posts we ultimately selected that really struck us this week. We recognized that each of the posts we selected as being the top contributions made to their respective carnivals would, in a typical week for OMM, qualify for the title of being The Best Post of the Week, Anywhere!

That *never* happens. Or at least, it had never happened before.

But this week clearly wasn't typical. It was, quite literally, the best week ever for OMM.

So we marked the occasion by naming all but one of our selected posts as being Absolutely essential reading!, the title we award to posts that are near-contenders for being The Best Post of the Week, Anywhere!

As for the remaining post, well, that is The Best Post of the Week, Anywhere!.

Don't just take our word for it. Judge for yourself - the best week we've ever had for OMM all begins.... now!

| On the Moneyed Midways for November 19, 2010 | |||

|---|---|---|---|

| Carnival | Post | Blog | Comments |

| Best of Money | Don't Become a Slave to the Rat Race | MoneyNing | Vered Deleeuw considers who the best sales people are considered to be, extracts an extraordinarily meaningful insight from a Jennifer Aniston movie, and argues that choosing to be unpopular is a path to real freedom in The Best Post of the Week, Anywhere! |

| Carnival of Personal Finance | The Cost of Your Health | Pennywise2Pennyworth | Stu is carrying about 10 pounds more than he wants to, but because he has a very tight budget, he needs to weigh his options as he considers whether to join a gym. Absolutely essential reading! |

| Trust Matters Review | Why Is It So Hard to Be Kind? | Bill Taylor | Bill's father had a lifelong relationship with Cadillac. The story of how he came to drive a Buick instead is Absolutely essential reading! |

| Cavalcade of Risk | Save Your Dog or Break the Bank? Is Pet Health Insurance Really Woof (Worth) It? | Good Financial Cents | If you have pets, but don't have a couple thousand dollars in the bank to accommodate a health emergency involving them, Jeff Rose's evolving study is Absolutely essential reading! |

| Carnival of Money Stories | Is Gambling a Good Motivation for Students? | Faithful With a Few | Khaleef Crumbley examines the moral implications of a web site that effectively allows students at certain universities to gamble on whether they will achieve the grades they target for their classes at the beginning of each semester. Absolutely essential reading! |

OMM's Running Index for 2010

Presented in reverse chronological order....

- On the Moneyed Midways - November 19, 2010

- On the Moneyed Midways - November 12, 2010

- On the Moneyed Midways - November 5, 2010

- On the Moneyed Midways - October 30, 2010

- On the Moneyed Midways - October 22, 2010

- On the Moneyed Midways - October 15, 2010

- On the Moneyed Midways - October 8, 2010

- On the Moneyed Midways - October 1, 2010

- On the Moneyed Midways - September 24, 2010

- On the Moneyed Midways - September 17, 2010

- On the Moneyed Midways - September 10, 2010

- On the Moneyed Midways - September 3, 2010

- On the Moneyed Midways - August 27, 2010

- On the Moneyed Midways - August 20, 2010

- On the Moneyed Midways - August 13, 2010

- On the Moneyed Midways - August 6, 2010

- On the Moneyed Midways - July 30, 2010

- On the Moneyed Midways - July 23, 2010

- On the Moneyed Midways - July 16, 2010

- On the Moneyed Midways - July 9, 2010

- On the Moneyed Midways - July 3, 2010

- On the Moneyed Midways - June 25, 2010

- On the Moneyed Midways - June 18, 2010

- On the Moneyed Midways - June 11, 2010

- On the Moneyed Midways - June 4, 2010

- On the Moneyed Midways - May 28, 2010

- On the Moneyed Midways - May 21, 2010

- On the Moneyed Midways - May 14, 2010

- On the Moneyed Midways - May 7, 2010

- On the Moneyed Midways - April 30, 2010

- On the Moneyed Midways - April 23, 2010

- On the Moneyed Midways - April 16, 2010

- On the Moneyed Midways - April 9, 2010

- On the Moneyed Midways - April 2, 2010

- On the Moneyed Midways - March 26, 2010

- On the Moneyed Midways - March 19, 2010

- On the Moneyed Midways - March 12, 2010

- On the Moneyed Midways - March 5, 2010

- On the Moneyed Midways - February 26, 2010

- On the Moneyed Midways - February 19, 2010

- On the Moneyed Midways - February 13, 2010

- On the Moneyed Midways - February 5, 2010

- On the Moneyed Midways - January 29, 2010

- On the Moneyed Midways - January 23, 2010

- On the Moneyed Midways - January 15, 2010

Older Editions

- OMM: The Best Posts of 2009 and our full index for the year!

- OMM's Running Index for 2008

- OMM's Running Index for 2007

- The Best Blogs Found in 2006 (and our full 2006 index)!

Labels: carnival

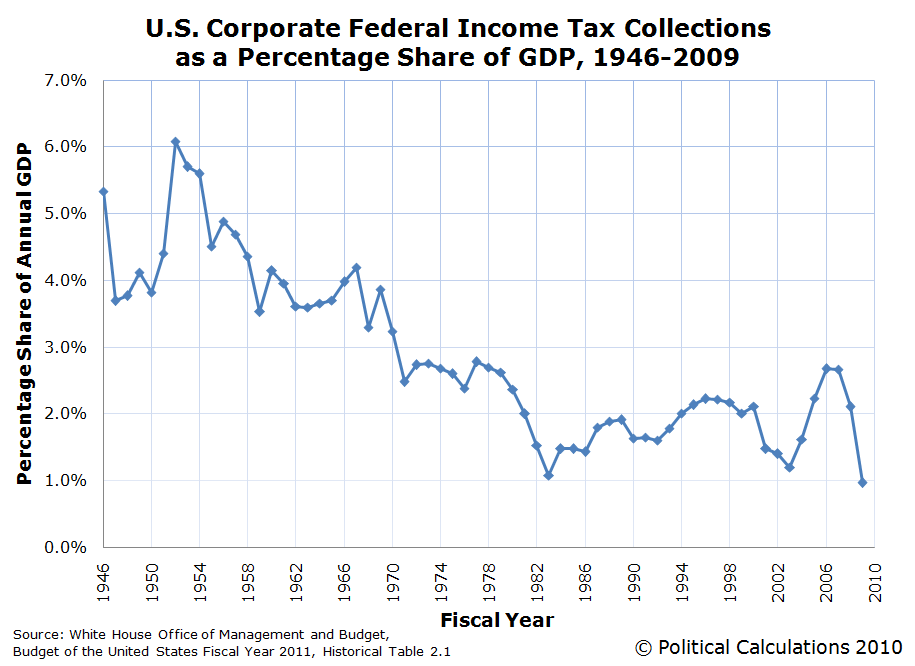

Let's begin with a quote today, shall we?

A weak economy, new tax breaks, and aggressive tax sheltering have pushed corporate income tax receipts down to historically low levels, both relative to the size of the economy and as a share of total federal revenues. According to the most recent budget projections of the Congressional Budget Office, corporate revenues will remain at historically low levels even after the economy recovers, and even if the large new corporate tax breaks enacted in 2002 and 2003 are allowed to expire on schedule.

That's an excerpt from an 18-page report produced by the Center on Budget and Policy Priorities. In 2003. Really. And here we are, just over seven years later, and it might as well have been written today.

And it would still be a total crock. In reality, this kind of assertion is based on the old magician's trick of misdirection. "Look here," the master of deception commands, "as I waive my magic laser pointer at the following chart, and you will see with your own eyes that corporate income tax revenues have fallen over time!"

And so it would seem. But do you see the misdirection in what our charming conjurer has said?

The deceit lies in the words "corporate income tax revenues", which you, as a casual observer (aka "the mark"), are meant to take as being the only kind of taxes that corporations and all other businesses pay into the U.S. Treasury's coffers. The con would then continue as our trickster would go on to blame special tax breaks and loopholes as being the major reasons why corporate tax collections have fallen so far over time, not to mention those evil tax cuts lobbied for by those fat cat multinational corporations.

But that completely ignores that the other taxes that all businesses pay have steadily risen over that same period of time, whether by major corporations or limited liability companies or partnerships or even sole proprietors. Which you might not have noticed because you don't see them being paid by corporate America because they're in the background of the magician's stage, so to speak. As it happens, they're the employers' portion of the federal government's payroll taxes, which go by names like "Social Security" and "Medicare", or more simply, "FICA":

And just as surely as you see the deductions for these things on your own paycheck, you can rest assured that your employer has cut a separate check directly to the U.S. Treasury for the same amount. These payments account for one-half of the total amount of payroll taxes collected in every year.

Which brings us to our final chart, in which we reveal just how much the federal government has collected from all of American business as a percent share of GDP since 1946:

We've added the statistical control chart indicators to demonstrate just how consistent the full share of federal taxes paid by American businesses has been over that time. We find the long-term stable average of total corporate tax collections is 5.26% of annual GDP, with a standard deviation of 0.56% of GDP.

Now here's the real story behind that steady picture. Because the U.S. Congress has increased those payroll taxes over time to deal with the problem of a growing population of future beneficiaries for the programs supported by those payroll taxes, they've had to offset what would otherwise be a sharply increased tax burden on American businesses by reducing corporate income taxes. Otherwise, a large number of American businesses would have become completely noncompetitive in the global economy.

Sometimes, they've done that directly by cutting the corporate income tax rates, but mostly, elected politicians have found that it is more profitable for themselves to complicate the tax code by creating special loopholes that allow the various businesses they favor to avoid paying those taxes. Legally.

This might be one of those very rare situations where the outcome has turned out to be fair on whole, but all the means by which we get there are about as dirty as they can be. Which might make it a unique case study for public choice theory.

Data Sources

Tax Receipts by Source: White House Office of Management and Budget. Budget of the United States Fiscal Year 2011. Table 2.1 - Receipts by Source, 1934-2015.

GDP: White House Office of Management and Budget. Budget of the United States Fiscal Year 2011. Table 1.2 - Summary of Receipts, Outlays and Surpluses or Deficits (-) as Percentages of GDP: 1930-2015.

Elsewhere

Update: Tom Blumer fills in the gap for what actually happened with corporate tax collections between 2003 and today.

Labels: business, quality, taxes

Given the amount of data we handle, one of the larger challenges we face is how to visually present it.

A good case in point is our recently updated chart showing the United States' total federal tax receipts and personal income tax receipts from year to year as a percentage share of annual GDP. In addition to this basic information, we also present statistically-derived data on the chart, indicating the means and some key thresholds related to the standard deviation and normal distribution of the year-to-year data, similarly to what we might do on a statistical control chart:

The problem we run into is that while this data is indicated, it's difficult to tell exactly where those thresholds apply. We could, for instance, directly indicate the values of those thresholds for each data set on the chart, but with the penalty of adding clutter to the chart, making the chart more difficult to read.

It occurred to us though that the two datasets are related - since the federal government's personal income tax receipts are a component of its total tax receipts (along with payroll and corporate taxes), we could show the total tax receipts against the personal tax receipts.

Doing so would then allow us to get a sense of how much of the variation in the federal government's total tax receipts might be explained by the variation in personal income tax receipts, which is only hinted at in our "control" chart showing the two datasets independently. The chart below shows what we found when we created that plot showing those key statistical thresholds and also performing a simple linear regression:

The chart above indicates the ±1σ (plus or minus one standard deviation) limits for each dataset as the horizontal (personal income tax receipts) and vertical (total federal tax receipts) shaded orange regions. These shaded regions are significant in that we can expect any point for the normally distributed data within each dataset to fall within those bounds some 68.1% of the time.

The dashed lines indicate the ±3σ (plus or minus three standard deviations) limits for each dataset, within which, we can expect any data point to fall for some 99.8% of all observations.

The resulting overlapping darker orange shaded box then is where we would then expect to find the vast majority of data points. Which we do!

Going to the linear regression portion of the analysis, we find that the resulting coefficient of determination indicates that the percentage of variance explained in the percent share of GDP for U.S. total federal tax receipts by the variance observed in just the government's personal income tax receipts is 82%. In this case, since we know what other components feed into total federal tax receipts, we can state that about 18% of the variation in total federal tax receipts may be attributed to the annual variation in corporate and payroll taxes.

Going back to our "control" chart, we find that while they may account for 82% of the variation in total tax collections from year to year, personal income taxes themselves only represent an average of 44-45% of total federal tax receipts in the period from 1946 through 2009.

This latter observation confirms that personal income taxes have a disproportionate impact upon the total tax collections of the U.S. federal government.

Labels: data visualization, math, taxes

On 10 November 2010, Erskine Bowles and Alan Simpson, the co-chairs of President Obama's blue-ribbon deficit reduction commission (whose work we've commented upon recently), released a document with their suggestions for getting the U.S. federal government's annual budget deficits back under control. We were especially intrigued by one of their proposals to completely revamp the entire U.S. income tax system, in which they would eliminate all deductions and tax credits while setting just three tax brackets for all income-earning Americans: 8%, 14% and 23%.

In doing that, they set a basic floor beneath these individual income tax rates, for which these tax rates would need to rise in order to still collect a particular amount of taxes while providing deductions and tax credits for politically-favored individuals. Such as families with children through the Child Tax Credit, poor, working Americans through the Earned Income Tax Credit or homeowners through the Mortgage Interest Tax deduction, to name three very popular deductions and tax credits in the current tax code.

But can that work? How much money would the federal government collect under such a scheme? And what would an individual's income taxes look like if such a plan actually became law?

To find out, we've adapted Political Calculations' Build Your Own Income Tax tool to accommodate the Bowles-Simpson zero plan tax proposal. To provide a frame of reference, we applied the distribution of income in the United States we previously modeled for 2006, since this distribution of income resulted in the federal government collecting nearly eight percent of annual GDP through personal income taxes in that year. This figure is significant in that it represents the long-term average amount of money collected by the federal government through personal income taxes since 1946, regardless of how individual income tax rates have been set through all that time.

And then we ran into a problem. While the Bowles-Simpson zero plan tax proposal lists the tax rates they believe should apply, they didn't specify at what income levels they would apply.

So we had to do some intelligent guesswork to identify the income thresholds for which the zero plan rates would be effective. Here, we looked at the level at which the current 28% tax rate clicks into effect, in terms of 2006 U.S. dollars. We found this level to be $30,650, so we set the top end of our lowest income tax bracket to be equal to that value.

We next set the low end of the topmost income bracket to be equal to ten times that value, or $306,500. We then cut that value in half to correspond with the point at which the middle tax rate would be effective.

To see our results, just click the "Calculate" button below with the default data shown. You're welcome to play with the numbers as you see fit to test drive other proposals or to create your own individual income tax plan. We'll run the numbers and compare them with the actual values recorded in 2006, and we'll also work out what your individual tax bill would look like under the proposed federal income tax scheme:

Comparing these results with the current income tax code, we find that low income earners will pay more, since they would lose the Earned Income Tax Credit and, if they have children, the Child Tax Credit. Higher income earners will also pay more, as they also lose the Child Tax Credit and the Mortgage Interest tax deduction, which provides the biggest tax breaks to households subject to the highest income tax rates. Of the two groups, lower income earners will see a larger percentage increase in their actual amount of taxes they will need to pay, but higher income earners will have to pay substantially larger amounts to the federal government.

Labels: income distribution, taxes, tool

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.