The S&P 500 (Index: SPX) rose a little over 1.8% largely as expectations the Federal Reserve will start a series of rate cuts in September 2023 firmed. The index closed out the trading week ending on Friday, 10 May 2024 at 5,222.68, just 0.6% below its 28 March 2024 record high.

Those expectations firmed despite the comments of Federal Reserve officials, whose pronouncements during the week were all over the map. Several see inflation running too high, prompting them to suggest they will continue to hold rates where they're at. Some are worried enough about inflation they're suggesting they would be okay with seeing economic growth slow and weaken. Others are saying they already see slowing growth, so they're looking ahead to having to cut rates to stimulate the economy, although they're unsure of their timing.

With that kind of shotgun spread from Fed officials about how they'll be setting monetary policy during 2024, investors continued focusing on September 2023 as the likely timing for when the Fed will start cutting U.S. interest rates. The CME Group's FedWatch Tool continued holding steady in anticipating the Fed will hold the Federal Funds Rate steady in a target range of 5.25-5.50% until 18 September (2024-Q3) for the fourth week in a row. For the second week in a row, the tool anticipates the Fed will start a series of 0.25% rate cuts on that date, which will proceed well into 2025 at 12-week intervals.

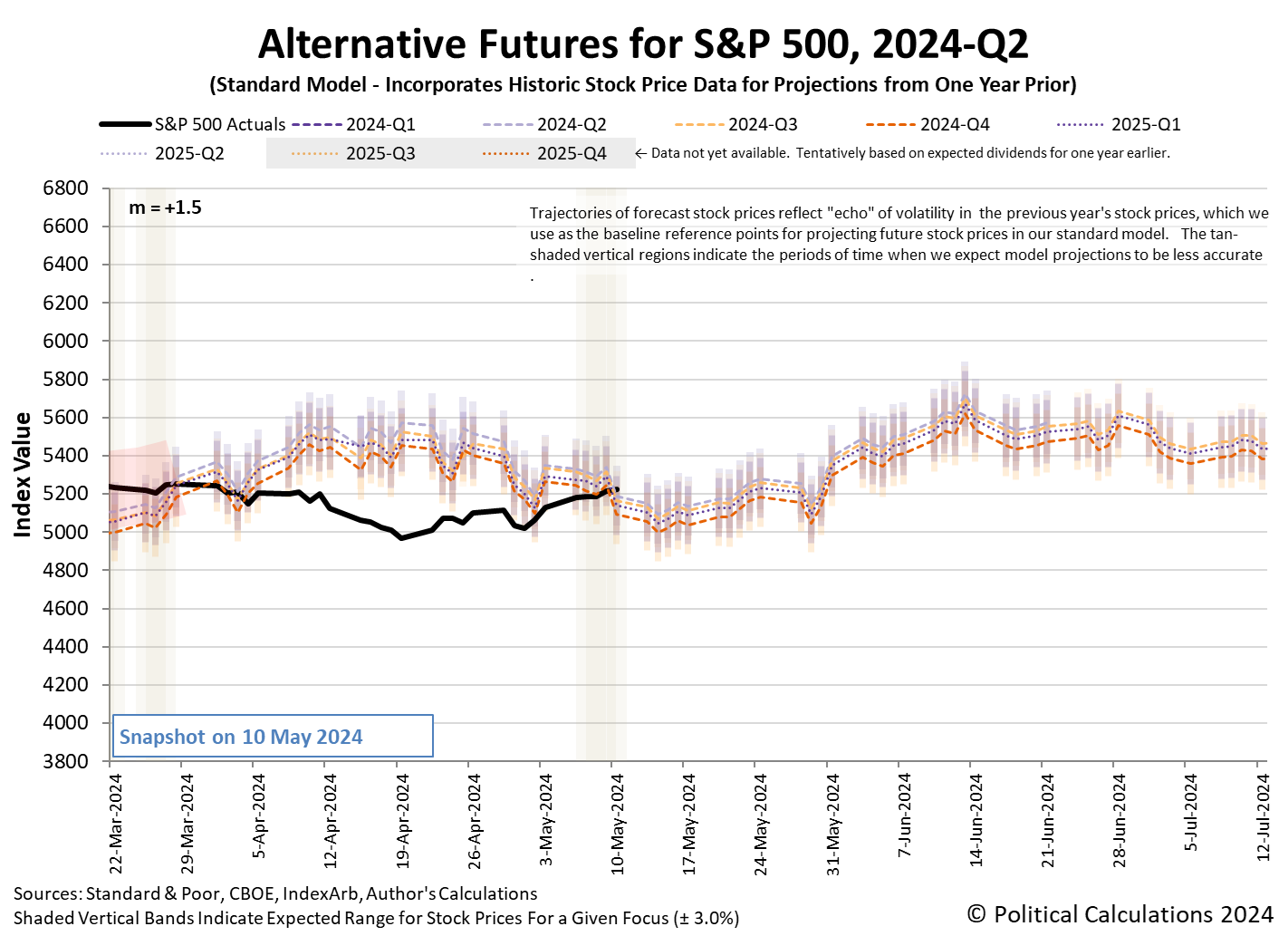

The latest update for the alternative futures chart shows the trajectory rejoining the dividend futures-based model's projections as expected, with investors focusing their foward-looking attention on 2024-Q3.

The market-moving headlines document the Fed officials' various statements and provide more context for the information investors absorbed during the week that was.

- Monday, 6 May 2024

-

- Signs and portents for the U.S. economy:

- Oil climbs as Gaza tensions rise, Saudi Arabia hikes prices

- US banks report weaker loan demand, Fed survey says

- Fed minions signal rate cuts are more likely than not, thinking a recession might help them end inflation:

- Fed's Williams says next Fed move likely to be lower rates

- Fed's Barkin: Ending inflation likely to require a hit to demand

- Bigger trouble developing in China:

- China home sales slump 47% over May Day holiday vs 2023

- China's services activity eases in April but still solid

- ECB minions say they're going to confidently cut Eurozone interest rates:

- ECB grows more confident about cutting rates, policymakers say

- ECB's Simkus expects June rate cut to be followed by others

- Nasdaq, S&P, and Dow ended higher as investors hope for rate cuts

- Tuesday, 7 May 2024

-

- Signs and portents for the U.S. economy:

- Fed minions say they won't hike rates, but maybe won't cut them either:

- Fed may need to hold rates steady all year, Kashkari says

- Inflation "settling" high could pose new risks for the Fed, economy

- BOJ minions see growth signs, threaten to intervene to prop up yen again:

- Japan's service activity extends gains on solid demand, PMI shows

- Japan warns of action over rapid currency moves

- ECB minions say they won't be "lenient" with Eurozone inflation:

- S&P, Dow end slightly up, extend closing streaks despite Disney drag

- Wednesday, 8 May 2024

-

- Signs and portents for the U.S. economy:

- Fed minions say they know how to measure market liquidity, think they might need a recession to contain inflation, say all is well:

- NY Fed's Perli offers guideposts to measure market liquidity levels

- Fed's Collins says economy may need to weaken to get 2% inflation

- Fed's Cook says households, banks, firms largely in solid financial shape

- BOJ minions keep threatening to do more interventions to prop up yen:

- ECB minions gives green light to Eurozone interest rate cuts, wants to think about monetary policy:

- Dow notches best daily win streak since December; S&P ends flat, while Nasdaq slips

- Thursday, 9 May 2024

-

- Signs and portents for the U.S. economy:

- US weekly jobless claims highest in more than eight months as labor market eases

- US 30-year fixed-rate mortgage falls to 7.09%, still too high to boost housing

- Oil edges up to one-week high on rising demand hopes after China, US data

- Fed minions falling behind for cutting interest rates:

- Growth signs, bigger stimulus developing in China:

- China's exports and imports return to growth, signalling demand recovery

- China April crude oil imports rise 5.45% on previous year

- Two Chinese megacities lift home purchase curbs to attract buyers

- BOJ minions saying they're really going to hike rates if they have to fight inflation:

- BOJ's board turned hawkish in April, steady rate hikes now in view

- Japan real wages fall in March, marking 2 years of decline

- BOE planning rate cut in June 2024:

- Dow posts seven-day win streak, Nasdaq and S&P 500 also rise on rate cut bets

- Friday, 10 May 2024

-

- Signs and portents for the U.S. economy:

- Oil benchmark Brent above $84 on perky demand signals

- New Biden tariffs on China's EVs, solar, medical supplies due Tuesday

- Fed minions think U.S. economic growth is sliding, wonder if U.S. interest rates are high enough to fight jump in inflation expectations:

- Fed's Bostic says economy likely slowing, though rate-cut timing uncertain

- Fed officials mull whether rates high enough as inflation expectations jump

- US monetary policy may not be tight enough, Fed's Logan says

- Mixed growth signs developing in China:

- China's car exports hit record high in April, as domestic sales fall

- China's green aluminium ambitions hit by erratic rains, power cuts

- BOJ minions see signs of recession in Japan, might use to avoid rate hikes:

- Japan economy expected to shrink in Q1 due to weak consumption: Reuters poll

- Japan's consumer spending extends declines, clouding outlook for BOJ rate hikes

- ECB minions gearing up for rate cut in June 2024:

- Nasdaq, S&P, Dow end solidly higher for the week as investors eye CPI data

The Atlanta Fed's GDPNow tool is projecting an annualized real GDP growth rate of +4.2% in 2024-Q2, sharply up from the previous week’s forecast for 3.3% growth.

Image credit: Microsoft Bing Image Creator. Prompt: "An editorial cartoon of a Wall Street bull riding a bicycle looking backwards at a bear chasing him".