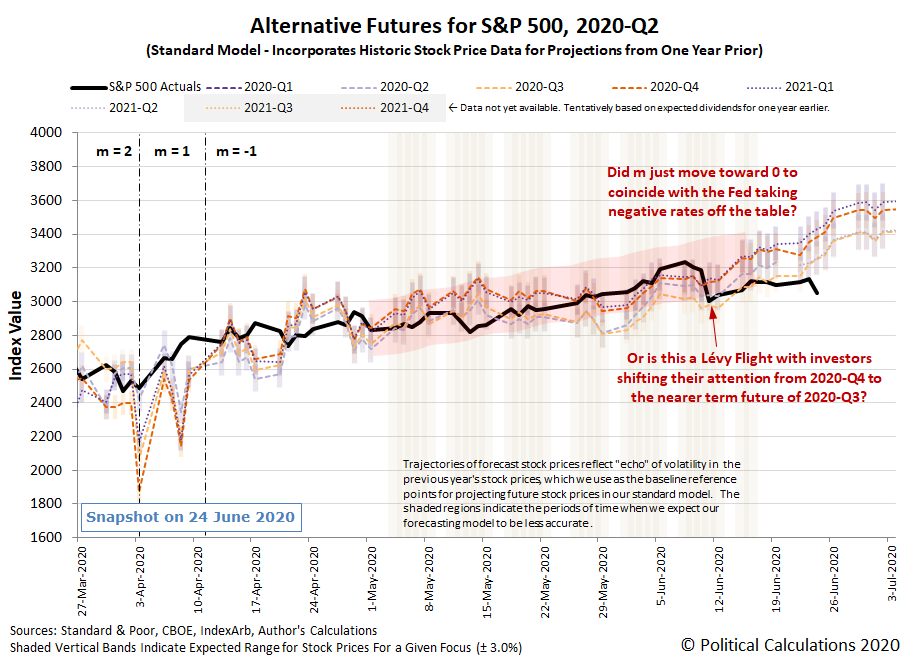

Coming into the third week of June 2020, we introduced two hypotheses for what caused the sharp, sudden, and now sustained deviation in the trajectory of the S&P 500 (Index: SPX), which rose on the week, but not by anywhere near enough to recover to its previous trajectory.

The two hypotheses for what caused the S&P 500 to plunge by 5.9% on Thursday, 11 June 2020 can be summarized as follows:

- The S&P 500 experienced a new Lévy Flight event, in which, investors suddenly shifted their forward looking focus from 2020-Q4, where it appears to have been since about 1 May 2020, to instead focus on the nearer term future of 2020-Q3.

- Investors adjusted their expectations for the future of the Federal Reserve's monetary policies, going from the anticipation of more expansionary policies to less expansionary ones.

Through the close of trading on Friday, 21 June 2020, we find the level of the S&P 500 is still consistent with what a dividend futures-based model would predict for both hypotheses, but that state of affairs will almost certainly change in the week ahead.

As shown in the alternative futures forecast chart above, the model anticipates the level of the S&P 500 will rise significantly in the week ahead to follow the trajectory associated with investors fixing their attention on the near-term future of 2020-Q3 if the Lévy Flight hypothesis holds, assuming they have not changed their expectations for how expansionary the Fed's monetary policies will be going forward following the end of its last meeting on 10 June 2020.But, if the shift that occurred on 11 June 2020 was the result of a change in expectations for the Fed's monetary policies, where the amplification factor in the dividend futures-based model suddenly changed to become less negative than it has been, we will see the trajectory of the S&P 500 start to consistently underrun the levels projected by the model as shown on the alternative futures chart above, which currently assumes no change in the amplification factor since 12 April 2020.

There's also the possibility that both things we've hypothesized could have happened, but here, we would still see the trajectory of the S&P 500 underrun the model's projections as currently shown on the chart above, which would allow us to reject the first hypothesis because of its assumption that there was no change in investor expectations for how expansionary the Fed's monetary policies will be.

With the stock market's behavior so interesting, this is definitely a fun time for us. Perhaps not as much fun as the first time we took advantage of a natural experiment with the S&P 500, but we're learning quite a lot in near real time!

- Monday, 15 June 2020

- Daily signs and portents for the U.S. economy:

- Oil prices rise 2% on optimism around OPEC+ output pact

- Fed launches long-awaited Main Street lending program

- Fed minions unleash more stimulus and share thoughts:

- Fed will begin purchasing corporate bonds on Tuesday

- Systemic racism slows economic growth: Dallas Fed chief Kaplan

- Fed's Daly says yield curve control could be 'little helper'

- Wall Street closes higher as Fed soothes recovery worries

- Tuesday, 16 June 2020

- Daily signs and portents for the U.S. economy:

- Oil prices rise 3% on signs of U.S. economic recovery

- U.S. economy starts long recovery as retail sales post record jump

- Bigger stimulus developing in the U.S. and Canada:

- Trump team prepares $1 trillion infrastructure plan to spur economy

- Fed corporate bond move relieves potential stigma for companies, say investors

- Bank of Canada focused on stimulus, low rates to support economy

- Fed minions consider coronavirus recession recovery path:

- Green shoots welcome but recovery still a long road, Fed's Powell says

- Instant View: Powell: No U.S. growth recovery until epidemic controlled

- Fed Chair Powell says strong job market can reduce U.S. racial inequality

- As 'ground zero' for crisis, Nevada shows need for fiscal aid: Fed's Powell

- Fed officials' GDP forecasts not likely factoring second COVID wave: Powell

- Fed has lots of 'dry powder,' Kaplan tells Bloomberg Radio

- Fed's Harker says he expects 'sharp recession' in 2020 with growth next year

- China says economy will grow in 2020, wants to buy up distressed U.S. businesses

- China's economy may grow 3% in 2020, government researcher says

- China keen to seek benefits from pandemic, distressed U.S. assets: report

- Wall Street closes higher on signs of economic recovery

- Wednesday, 17 June 2020

- Daily signs and portents for the U.S. economy:

- Oil slides on fresh COVID-19 outbreaks, bump in crude stocks

- Americans face new coronavirus challenge: a shortage of coins

- U.S. homebuilding rises moderately; jump in permits hints at green shoots

- U.S. mortgage rates hit record low, purchase applications at 11-year high

- Fed minions looking for a fiscal boost and consider coronavirus impacts

- Fed's Powell beats drum for more government aid to bolster economy

- Fed's Mester says rebound from likely record economic decline depends on containing coronavirus

- Fed's Bostic says pandemic exacerbated structural inequalities

- The world turned tospy turvy....

- Odds and ends for U.S. trade:

- China bought about $1 billion of U.S. cotton: Lighthizer

- U.S. trade chief vows to push for 'broad reset' at WTO

- Japan's exports fall most since 2009 as U.S. demand slumps

- S&P closes lower as new COVID-19 cases surge

- Thursday, 18 June 2020

- Daily signs and portents for the U.S. economy:

- Oil edges up on OPEC output cut compliance; pandemic still weighs

- U.S. retail foot traffic rebounds, more staff at work, as lockdowns ease

- McDonald's to hire 260,000 staff this summer as restaurants reopen

- Bigger trouble expected to continue in bellwether countries Switzerland, Taiwan:

- Swiss National Bank signals need to maintain negative rates

- Taiwan central bank holds fire on rates, cuts growth outlook again

- Bigger stimulus developing in U.S., but not so much in China:

- U.S. House Democrats unveil $1.5 trillion infrastructure plan

- China won't adopt 'flood-like' stimulus nor negative rates: regulator

- China pledges continued economic support but warns of liquidity hangover

- Fed minions share outlooks:

- Fed's Bullard says U.S. economy not out of the woods yet

- Fed's Mester says it could take two years for economy to return to pre-Covid levels

- Fed's Kaplan: Systemic racism is 'all of our problem' - MarketPlace

- S&P 500 closes nominally higher amid COVID-19 spikes, muted data

- Friday, 19 June 2020

- Daily signs and portents for the U.S. economy:

- Oil boosted by OPEC+ cuts even as virus weighs on market

- Running on 'hopium': Explaining the market rally in Wall Street's terms

- Trump renews threat to cut ties with Beijing, a day after high-level U.S.-China talks

- EU bosses seek greater power through stimulus in Eurozone:

- EU stimulus designed to support single market: executive chief

- EU parliament wants new EU taxes to finance recovery fund, EU budget

- EU leaders still split on recovery fund design, Commission says

- ECB's Lagarde urges quick EU recovery plan as economy in 'dramatic fall'

- Fed officials signal rising caution on U.S. economic recovery amid virus spread

- Fed's Clarida says there is more the central bank can do for U.S. economy

- Fed's Kashkari says U.S. economic recovery could take longer than hoped

- U.S. economy will likely need more support, Fed's Rosengren says

- How dismal has Japan's economy been for this state of affairs to be an improvement in its outlook?

- S&P 500 closes lower as COVID-19 resurgence casts a shadow on sentiment

Elsewhere, Barry Ritholtz presents a succinct summary of the positives and negatives he found in the week's markets and economy news.

Update 24 June 2020: It looks like we may be able to reject the first hypothesis. With the level of the S&P 500 clearly underrunning all of the dividend futures-based model's projections, as the index dropped 2.6% today to close at 3,050.33, it looks like we will be able to rule out this hypothesis because of its assumption that investors did not lower their expectations for how expansionary the Fed's monetary policies will be in the future.

Now the question is how much much of the change is Lévy Flight and how much is change in amplification factor? We'll need to develop two new hypothesis to sort out that question, but unlike this natural experiment, we suspect it will be much tougher to answer.