Do you remember 3 January 2022? On the first trading day of the year, the S&P 500 (Index: SPX) closed at an all-time record high of 4,796.56.

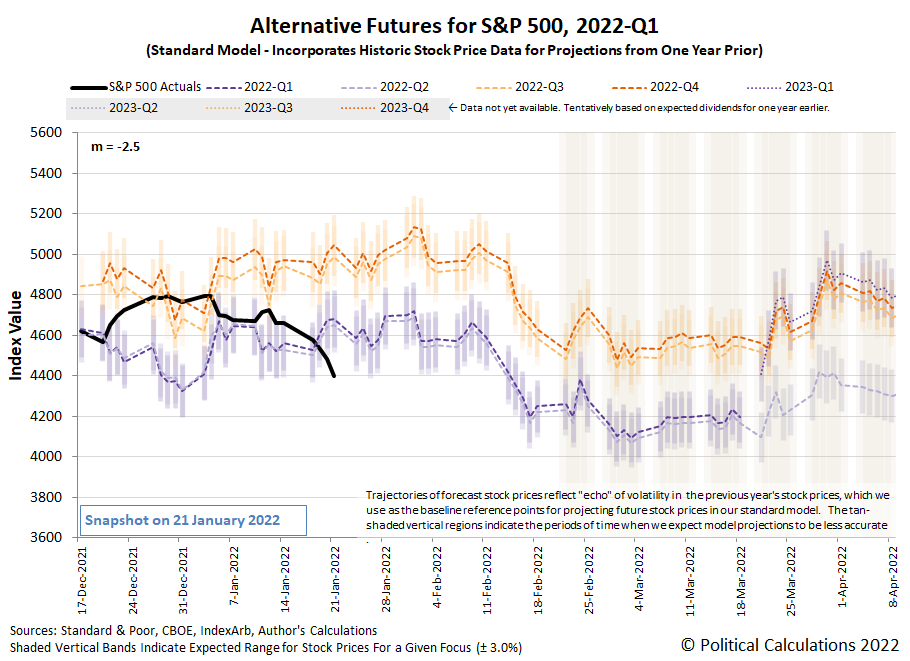

Since then, the index has fallen by 398.62 points (or 8.3%), with two-thirds of that decline in the past week. On the alternative futures chart, that drop during the past week looks like bottom dropping out with the trajectory of the S&P 500 shooting below the dividend futures-based model's lowest projections for this period.

On a side note, it's not just this chart showing the bottom dropping out of the S&P 500. We have another chart that will better drive that point home, which we'll present in a separate analysis.

Since Friday, 21 January 2022 saw atypically large values of options expiring, the jury is still out on how much noise that contributed to the market's action, so we're paying especially close attention to the new week's trading activity. With that event in the past, we should get a clearer signal on where stock prices are heading in short order.

We're also paying attention to how we might need to reset the level of the dividend future model's multiplier, which is something we've anticipated since December 2021 might become necessary with the Federal Reserve altering its monetary policies. That's in addition to paying attention to the market-moving headlines as they hit the newstreams, where we noted the following stories in the past week.

- Tuesday, 18 January 2022

- Signs and portents for the U.S. economy:

- Oil prices hit 7-year highs; Mideast unrest stokes supply jitters

- New York state factory activity slumps in January amid Omicron surge

- Bigger trouble developing in Australia, Eurozone, Canada, Mexico:

- Australian consumers shellshocked as Omicron hits spending, growth

- Euro zone consumers in for a shock as power bills soar

- Even as Omicron slams Canada, bets on January rate hike rise

- Mexico economy slips in December, hinting at weak close to 2021

- Bigger stimulus developing in China, Germany:

- China cuts rates on policy loans, analysts point to more easing ahead

- China has plenty policy tools in reserve to cope with slowing economy - state planner

- China cenbank to roll out more policy moves to stabilise growth

- Germany to help companies shoulder higher power costs

- BOJ minions on board with inflation, ECB minions standing by to someday leap into action:

- BOJ raises inflation forecasts but rules out policy tightening

- ECB can adapt policy faster if high inflation persists - Villeroy

- Wall St sinks as yields spike, financials fall after Goldman miss

- Wednesday, 19 January 2022

- Signs and portents for the U.S. economy:

- U.S. mortgage interest rates climb for 4th straight week

- Oil highest since 2014 as Turkey outage adds to tight supply outlook

- Big U.S. banks see higher expenses from workers' rising wages

- Bigger inflation developing in France, UK, Japan, Canada, Russia:

- "Good" French economic growth not hit by Omicron but inflation too high - Villeroy

- UK inflation hits near 30-year high, pressuring BoE and households

- Japan govt panel member joins BOJ in highlighting inflation risk

- Canada's annual inflation rate hits 4.8% in Dec to three-decade high

- Russia working on financial stability as Kremlin decries 'unacceptable' inflation

- Bigger stimulus developing in China:

- Wall Street sell-off deepens, Nasdaq confirms correction

- President Biden's press conference goes very badly, in a way that might lead oil prices to spike and hurt the economy:

- Thursday, 20 January 2022

- Signs and portents for the U.S. economy:

- As inflation breaks records, $100 oil is also looming

- Oil prices slip from 2014 highs, supply concerns limit losses

- U.S. existing home sales tumble in December

- U.S. weekly jobless claims at three-month high; seen trending down as Omicron subsides

- Fed minions thinking about tomorrow:

- Fed kicks off debate on issuing its own digital currency with new white paper

- Fed may run fast on long road to normal balance sheet

- Bigger stimulus developing in China:

- China says will roll out more steps to boost effective demand - state media

- China cuts key rates, steps up monetary stimulus to boost economy

- ECB minions counting on inflation going away on its own:

- Wall Street drops as bargain-hunting tapers off

- Friday, 21 January 2022

- Signs and portents for the U.S. economy:

- U.S. crude exports ramp up as global demand recovers

- Aluminum cans to jet fuel: inflation dominates U.S. corporate earnings

- Treasury Secretary tries gaslighting to save failing Biden policy proposals:

- Bigger stimulus developing in China:

- China will appropriately step up policy support for economy -premier

- China caps weekly policy easing blitz with fresh rate cuts

- BOJ minions notice inflation, will think about stuff they can do about it:

- Japan's inflation hovers around 2-year high, BOJ flags price pressure

- Japan's Kishida says up to BOJ to decide on exit from easy money policy

- S&P 500, Nasdaq post worst weeks since pandemic start as Netflix woes deepen slide

As of 21 January 2022, the CME Group's FedWatch Tool projects quarter point rate hikes in March 2022 (2022-Q1), June (2022-Q2), July (2022-Q3), and December (2022-Q4).