The S&P 500 (Index: SPX) had one of its best weeks of 2023. The index closed the trading week ending on 1 September 2023 at 4515.77, which was up 2.5% from the previous week's close.

The reason why stock prices rose however is because of negative changes in the outlook for jobs in the U.S. The biggest driver was a large reduction in the number of job openings, which dropped to their lowest level since March 2021.

That assessment of a softening job market was reinforced with 1 September 2023's employment situation report, which showed an increase in the unemployment rate.

For the stock market however, these negative developments produced a positive result, as investors bet on the bad jobs news taking any additional interest rate hikes in 2023 off the table. Prior to the week's jobs-related news, investors were giving a greater than 50% probability of at least one more quarter point rate hike in 2023. The elimination of that probability is positive for stocks, especially for those firms that rely heavily on debt financing, who investors believe will benefit from having higher profits from lower-than-previously-expected interest costs. It's the proverbial silver lining on a dark cloud.

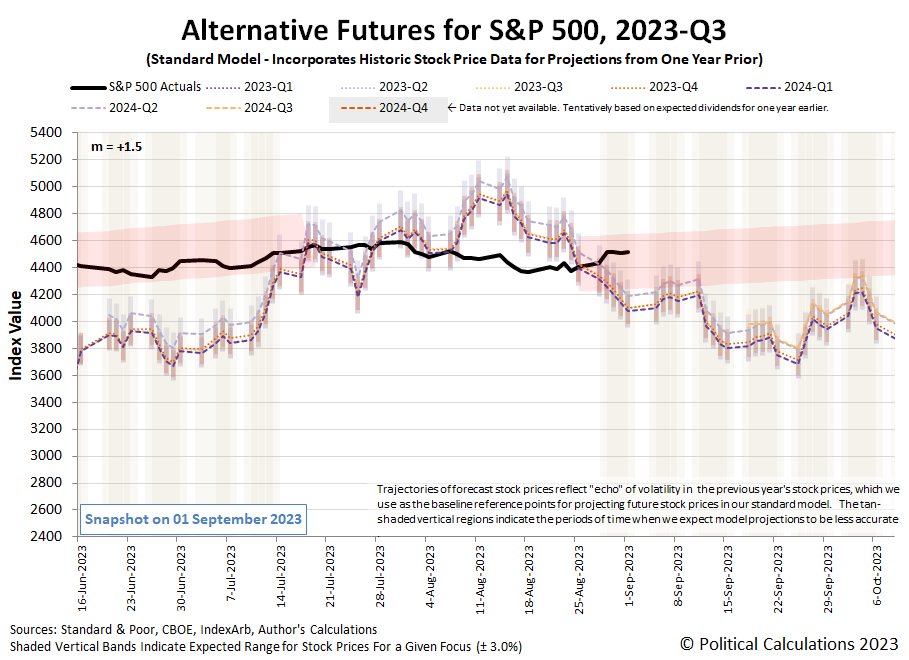

The S&P 500 moved up into the upper portion of the newly added redzone forecast range in the latest update of the dividend futures-based model's alternative futures chart.

Overall, stock prices are behaving as expected with investors continuing to focus their attention on the final quarter of 2023 in setting current day stock prices.

Here's our summary of the week's market moving headlines:

- Monday, 28 August 2023

-

- Signs and portents for the U.S. economy:

- Bigger trouble developing in Canada?

- Bigger trouble, stimulus developing in China:

- China new home prices growth likely flat in 2023, dragging on economy - Reuters poll

- China's industrial profits extend slump into seventh month

- Factbox-How China is trying to boost its stock market

- China halves stamp duty on stock trades to boost flagging market

- China approves 37 retail funds to help revive market

- Marketmind: Beijing tries new ways to lift moribund markets

- Case builds for China's banks to cut deposit rates

- BOJ minions wonder if they can blame China, want reasons to keep never-ending stimulus alive:

- BOJ Ueda says China's slowdown adds to economic uncertainty

- BOJ's Ueda: Underlying inflation still a bit below target

- ECB minions getting the results they wanted, think pausing rate hikes might be mistake:

- Euro zone lending growth slows further as rate hikes bite

- ECB rate pause now may be too early: policymaker

- Nasdaq, S&P 500, Dow kick off final week of August with gains, helped by 3M

- Tuesday, 29 August 2023

-

- Signs and portents for the U.S. economy:

- Oil rises 1% on softer dollar, US braces for hurricane hit

- US labor market loses steam as job openings, resignations decline

- Former Fed minions say current Fed minions want to jerk investors around:

- Bigger trouble developing in China:

- China's factory activity likely extended declines in August - Reuters poll

- China companies' fundraising options narrow after IPO restrictions

- Analysis-Chinese investors rush to offshore funds to offset domestic risks

- BOJ minions get data that suggests it’s time to end never-ending stimulus:

- ECB minions getting results they wanted:

- S&P 500 ends sharply higher, jobs data fuels interest rate optimism

- Wednesday, 30 August 2023

-

- Signs and portents for the U.S. economy:

- US second-quarter economic growth revised lower as inventories drop

- Oil prices rise after U.S. data shows tighter crude supply

- Short U.S. housing correction likely over; tight supply to keep prices high: Reuters poll

- Fed minions worried about potential risk from more regional bank failures, hint they can stop hiking rates:

- US Fed ramps up demands for corrective actions by regional banks - Bloomberg News

- Fed can stop hiking rates if economy slows at current pace, Rosengren says

- Bigger trouble developing in China:

- South Korea exports to extend downturn amid worsening China outlook: Reuters poll

- Chinese banks post sluggish profit growth, warn of regional debt risks

- Factbox-What are global companies saying about China's economy?

- Bigger stimulus developing in China:

- BOJ minions says changes to never-ending stimulus may happen next year:

- Wall Street ends higher as economic data fuels rate-pause bets

- Thursday, 31 August 2023

-

- Signs and portents for the U.S. economy:

- Fed minions expected to hold interest rates steady at September meeting:

- Bigger trouble developing in China:

- BOJ minions get reason to continue never-ending stimulus:

- ECB minions getting results they wanted, still worried about inflation:

- German unemployment rises more than expected in August

- Stubborn euro zone inflation fails to settle ECB rate debate

- ECB's Holzmann leaning towards September rate hike

- Nasdaq, S&P, Dow end mixed a day ahead of jobs report; stocks close out August in the red

- Friday, 1 September 2023

-

- Signs and portents for the U.S. economy:

- Oil rises to highest in over seven months on supply worries

- US unemployment rate rises, wage growth cools as labor market slows

- Things Fed minions say:

- Full impact of Fed hikes still to be seen in real economy, ex-vice chair Blinder says

- Bigger stimulus developing in China:

- China to cut banks' FX reserve ratio to rein in yuan weakness

- Major Chinese banks cut deposit rates as efforts to prop the economy grow

- China's Beijing, Shanghai ease mortgage rules for first-time home buyers

- Bigger trouble spreading out from China:

- Bigger trouble still developing in China:

- 'Too afraid to buy': China's slowing economy overshadows property easing moves

- China new home prices fall for fourth month, sales slump - survey

- Explainer-Why is China's economy slowing down and could it get worse?

- BOJ minions getting mixed signals on whether to keep never-ending stimulus alive:

- Japan capex growth weakens with companies wary about China slowdown

- Japan's factory activity shrinks, squeezed by costs - PMI

- Japan's economic output runs above capacity for first time in nearly 4 years

- Eurozone economy sees some signs of life, ECB minions play coy about their plans for future rate hikes:

- Euro zone August factory activity showed signs of recovery -PMI

- ECB's Villeroy: options open at upcoming rate meetings

- Stocks start September mixed; S&P posts best week since June, Dow, Nasdaq also up

The CME Group's FedWatch Tool continues to show no rate hike in September (2023-Q3). The big change from last week came as investors stopped betting one last quarter point rate hike later in 2023 following the past week's jobs report and downward revisions in previous months' employment numbers. Now investors expect the Fed will hold rates steady until 1 May 2024, when they anticipated the Fed will start a series of quarter point rate cuts that will continue at six-to-twelve-week intervals through the end of 2024.

The Atlanta Fed's GDPNow tool predicts an annualized real growth rate of +5.6% during 2023-Q3, down from the previous week's estimate of +5.9% growth.

Image credit: Every Cloud Has a Silver Lining photo by Colin Smith via Geograph Britain and Ireland. Creative Commons. Attribution-ShareAlike 2.0 Generic (CC BY-SA 2.0).